Smart Indoor Gardens Market Size, Share, Trends and Forecast by Type, Technology, End Use, and Region, 2025-2033

Smart Indoor Gardens Market Size and Share:

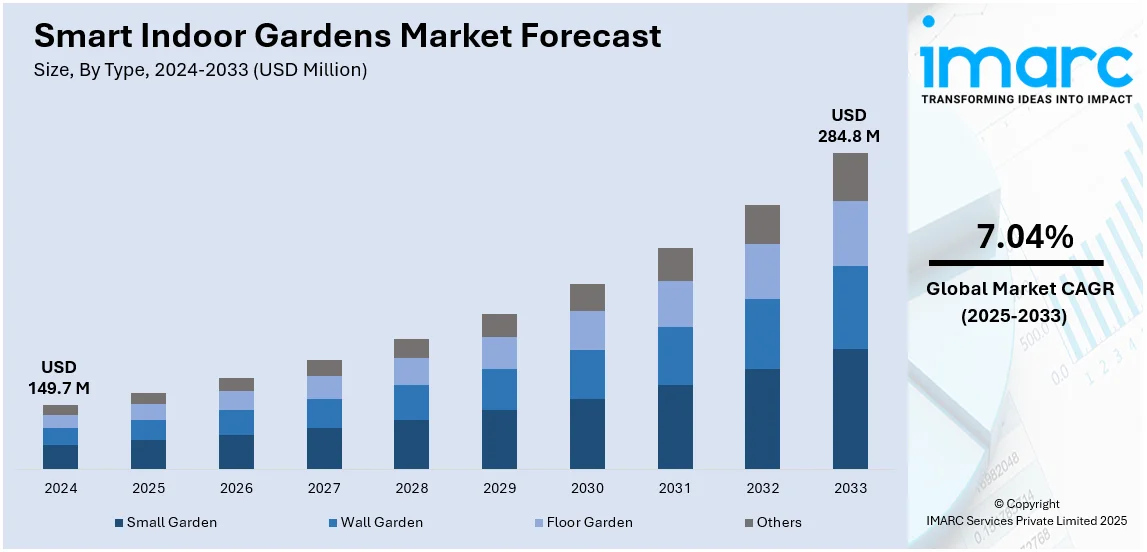

The global smart indoor gardens market size was valued at USD 149.7 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 284.8 Million by 2033, exhibiting a CAGR of 7.04% from 2025-2033. North America currently dominates the market, holding a market share of over 40.1% in 2024. The smart indoor gardens market share is driven by rising urbanization, increasing consumer interest in home gardening, and growing demand for fresh, organic produce. Advancements in IoT, automated hydroponic systems, and smart sensors further enhance convenience, fueling market expansion globally.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 149.7 Million |

|

Market Forecast in 2033

|

USD 284.8 Million |

| Market Growth Rate (2025-2033) | 7.04% |

The smart indoor gardens demand is expanding fleetly, driven by adding urbanization, growing interest in home gardening, and advancements in smart technology. As further people live in apartments and civic settings with limited out-of-door space, demand for automated indoor gardening solutions is rising. These systems enable users to grow herbs, vegetables, and flowers easily, making gardening more accessible to individuals with busy cultures. Technological inventions, including AI- powered factory monitoring, automated watering, and LED grow lights, have enhanced effectiveness and ease of use. Consumers are progressively drawn to sustainable living and organic food product, boosting acceptance of smart gardens that allow homegrown, pesticide-free yield. also, the rising popularity of IoT- enabled home automation integrates smart gardens with existing smart home ecosystems, further driving market growth. As mindfulness of health and environmental sustainability grows, and as technology continues to evolve, the smart indoor gardens market is anticipated to see sustained expansion in the coming times.

The smart indoor gardens market in the United States is witnessing significant growth due to adding consumer interest in home gardening, technological advancements, and a rising focus on health and sustainability. As urbanization leads to lower living spaces, consumers are turning to smart gardening solutions that enable year- round, soil-free cultivation using hydroponic and aeroponic systems. Advancements in IoT, AI, and automation have also enhanced the effectiveness of smart inner gardens, allowing users to cover and control plant growth remotely through smartphone apps. These inventions appeal to tech- expertise consumers seeking convenience and perfection in inner gardening. Also, the growing demand for organic and fungicide-free food has driven consumers to embrace homegrown alternatives. With adding mindfulness of environmental sustainability, smart auditoriums help reduce food waste and carbon traces. As further people seek self- adequacy and healthier lifestyles, the U.S. demand for smart inner gardens is anticipated to expand further.

Smart Indoor Gardens Market Trends:

Technological advancements in garden automation

The advanced technology innovations, especially automation systems, are changing the smart indoor garden market. More than 30% of American households garden at home, and more are implementing automated methods to make plant care easier, according to the NIH. Consumers want effortless solutions that make plant care easier with lesser manual effort. These smart indoor gardens are basically installed with automated irrigation and LED grow lights with climate control systems. More importantly, it now offers solutions that make use of AI to track the health of the plant and consequently make real-time changes in the environmental variables like temperature, humidity, and light intensity. This minimizes interference while perfecting optimal growing conditions to grow different types of plants. Even the more advanced systems are capacitated with sensors that can detect soil moisture and thus automatically adjust the watering schedule and give alerts when plant care is required. It increased its dependency on automation to allow a considerable difference to benefit consumers: with guaranteed correct care given to the plant regardless of experience level. This results in higher adoption rates of smart indoor gardens.

Rise in consumer demand for home-grown food

As consumers continue to become aware of the global state of food sustainability and the impacts of the environment, people will resort to smart indoor gardens as perfect solutions for home-grown produce. Consumer demand for home-grown food has seen a notable increase, particularly in the U.S. In 2021, 41% of American households roughly 53.7 million households—took part in food gardening, according to the National Gardening Association (NGA). This eagerness for fresh, organic, and locally sourced food transcends the desire to cultivate herbs, vegetables, and fruits in their homes. This trend is especially pronounced in towns, where space for traditional gardening is scarce. Smart indoor gardens, on the other hand, provide a means of growing all different types of crops at any time of the year in places where it might not be practical to garden outdoors, either because of climate or space. Also, the perception and worry over food security and the increasing interest in a healthier lifestyle push people toward this type of shift. The consumers are now much better informed on the benefits of growing their own food as a means of having fresh, nutrient-dense options readily available while reducing their carbon footprint.

Integration with smart home ecosystems

The seamless integration of smart indoor gardens with broader smart home systems has been a key growth driver in the market. The increasing adoption of smart home technologies such as Amazon Alexa and Google Assistant, among others who go hand-in-hand with IoT-enabled devices, links smart indoor gardens with added convenience and functionality in the ecosystem. As of the second quarter of 2023, 42% of internet-connected households in the United States had at least one smart home appliance, such as a robotic vacuum cleaner, smart door locks, smart lighting, smart thermostats, or video doorbells, according to an industry report. Users can see and manage their indoor gardening through their smartphone or tablet or even voice assistants, and thus, the display of each light and watering setting can be updated really conveniently. Some users may query Alexa to check the status of plants, water at specific times, or have the system alert them. This connectivity improves the user experience through personalized, automated care that allows easy maintenance of an indoor garden without constant monitoring. It also falls into the broader category of integration with smart homes, as more people embrace the inclusion of technology in their lives, thereby expanding the appeal of smart indoor gardens.

Smart Indoor Gardens Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart indoor gardens market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, and end use.

Analysis by Type:

- Small Garden

- Wall Garden

- Floor Garden

- Others

Floor gardens holds the largest market share with 72.0% as they can accommodate a greater number of plants, allowing users to grow a wider variety of herbs, vegetables, and fruits. Their spacious design supports deeper root growth and better nutrient absorption, making them ideal for both personal and commercial use. Many floor gardens integrate IoT-enabled features such as automated watering, LED grow lights, climate control, and nutrient monitoring. These technologies enhance efficiency, reduce maintenance, and ensure optimal plant growth, attracting tech-savvy consumers.

Analysis by Technology:

- Smart Sensing Technology

- Smart Pest Management Technology

- Self-Watering Technology

- Others

Smart sensing technology dominates the market due to its capability to enhance plant growth effectiveness, automate preservation, and enhance user convenience. These advanced detectors cover crucial environmental factors similar as temperature, moisture, light intensity, and soil humidity, ensuring optimal growing conditions with minimum human intervention. One of the primary drivers of this technology’s dominance is its integration with IoT and AI- based systems, allowing users to admit real- time updates and control their gardens remotely via smartphones. This appeals to busy urban consumers looking for a low- conservation gardening solution.

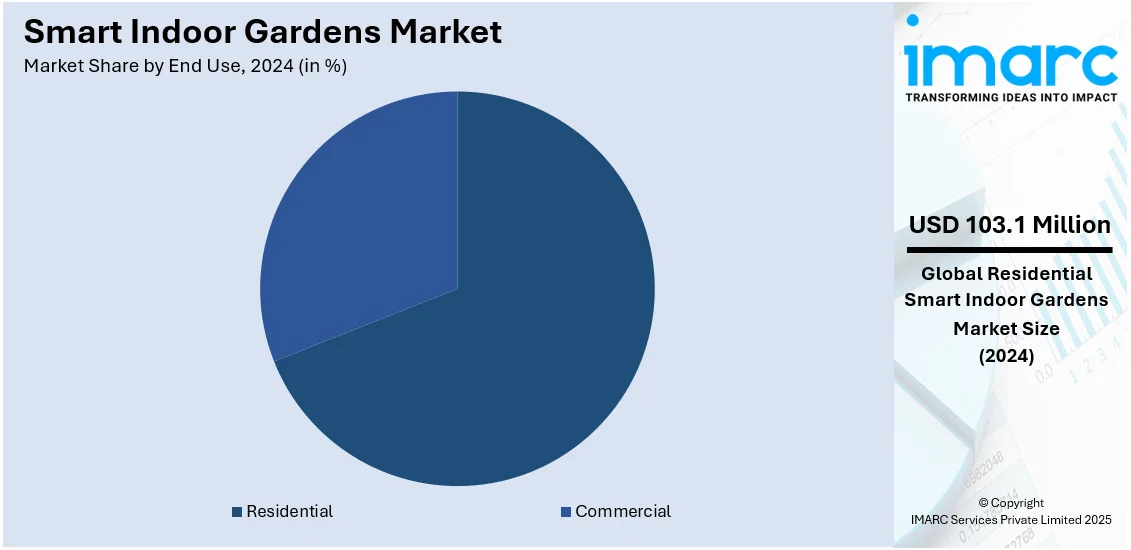

Analysis by End Use:

- Residential

- Commercial

Residential leads the market with 68.9% share due to increasing consumer interest in home gardening, healthy eating, and sustainable living. With urbanization leading to smaller living spaces and limited outdoor gardening options, smart indoor gardens provide a space-efficient solution for growing vegetables, fresh herbs, and flowers year-round. Technological advancements, including automated lighting, self-watering systems, and smartphone integration, make these gardens user-friendly, attracting busy professionals and novice gardeners. Additionally, the growing trend of organic and pesticide-free food consumption has encouraged homeowners to cultivate their own produce, ensuring freshness and quality.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- United Arab Emirates

- Others

In 2024, North America accounted for the largest market share of over 40.1% share due to its high consumer awareness, advanced technology adoption, and increasing preference for homegrown food. The region has a strong demand for automated gardening solutions, driven by urbanization and shrinking outdoor spaces, especially in cities like New York, Los Angeles, and Toronto. Consumers are increasingly turning to hydroponic and aeroponic systems to grow fresh produce indoors, regardless of seasonal changes. Additionally, North America has a well-established IoT and smart home ecosystem, enabling seamless integration of smart gardens with home automation systems. The presence of leading market players and frequent technological innovations further boost industry growth.

Key Regional Takeaways:

United States Smart Indoor Gardens Market Analysis

In 2024, the United States accounted for 83.20% of smart indoor gardens market share in North America and is blooming with more interest in home gardening, urban farming, and sustainable living. An industrial survey claims that the U.S. residential investment sector was expanding in 2023, with investors purchasing a record 29% of properties in December. Increased homeownership among the "techie population" and this shift in real estate market patterns both greatly support the expansion of the smart home technology sector. Since fewer foreign purchases were made for residential properties in the United States, cutting foreign direct investment also includes 21.2%. As a result, technology advancements in smart gardening may gain greater attention and priority. With the ever-growing awareness about the environment, companies such as AeroFarm and Click and Grow are leading the way in providing user-friendly and sustainable solutions to consumers looking for fresh produce year-round.

Europe Smart Indoor Gardens Market Analysis

The smart indoor garden market in Europe is growing by leaps and bounds due to an increase in the concern for environment and urbanization. An industry estimate states that the first half of 2023 saw €1.3 billion (about USD 1.42 billion) in investment in residential markets, indicating growing interest in home applications of innovation, including sustainable living solutions. The Digital Economy and Society Index of European Commission shows that the region is strongly focused on green technologies, thus expanding smart indoor gardening. The countries that have adopted these technologies include Germany, the UK, and France, which are all focused on urban agriculture and sustainability. Government policies and benefits that promote eco-friendly production further drive this smart indoor garden market growth, mainly in the regions where consumer demand for organic and locally produced food is relatively high. Features such as integrated lighting systems and self-watering mechanisms are becoming normal to integrate into a smart indoor garden, which will continue to see consumption levels across the region.

Asia Pacific Smart Indoor Gardens Market Analysis

The Asia Pacific region is rapidly growing in terms of demand in the market for the smart indoor garden, by the factor of urbanization and increasing disposable incomes. The rising demand for sustainable and cutting-edge home technologies is demonstrated by the fact that Chinese real estate developers invested over 11.21 trillion yuan (USD 1.57 trillion) on residential properties in 2023, according to an industry report. Cities within the region are to undergo immense development, mainly urban growth, which will present these with a need for space-efficient solutions like smart indoor gardens. The same demand is thus witnessed on the shores of China, Japan, and South Korea, as technological developments in hydroponic and aeroponic systems establish demand from the consumer side for sustainable food production methods. Government support for these initiatives and food security programs continues to propel this market forward. Companies like Xiaomi and T3 Vertical Farm are benefiting from the new trend of seeking smart solutions for maximum utilization of space and least possible use of water.

Latin America Smart Indoor Gardens Market Analysis

Latin America's smart indoor garden market is growing as the demand for sustainable living solutions increases. According to Abrainc, the Brazilian Association of Real Estate Developers, sales of residential real estate in Brazil have soared by 32.6% in 2023, driven by both the Minha Casa Minha Vida housing program and high-end segments. Both a thriving market and predictions of declining interest rates are indicated by an increase in residential sales. In light of this, additional growth is anticipated due to the possibility of the Selic rate declining from 11.25% to 9%, and increased consumer confidence would undoubtedly spur more home innovations, such as smart indoor gardens. This smart indoor garden market trend, combined with increased regional attention to environmental issues, points to Latin America as an area where the global smart indoor garden market will see a large stakeholder.

Middle East and Africa Smart Indoor Gardens Market Analysis

In the Middle East and Africa region, the smart indoor gardens are being adopted due to innovation in technology and a high demand for sustainable living solutions. An industry report claims that Dubai's real estate market had a notable uptick in 2023, with real estate transactions totaling USD 173 billion. This indicates both economic activity and the significant consumer demand for smart home technologies. The acceleration of urbanization, mostly in the UAE and Saudi Arabia, is making the demand for smart indoor gardening solutions in residential properties increase steadily. Rising investments in green technologies and government incentives are aiding to promote sustainability and place the region well on the path to expanding smart indoor gardens, which can feed into the demand for efficient and space-saving food production methods.

Competitive Landscape:

Companies are integrating AI, IoT, and automation to enhance the efficiency of smart indoor gardens. Features such as automated watering, climate control, and app-based monitoring are improving the user experience, making indoor gardening more accessible to tech-savvy consumers. Smart sensors and LED grow lights are also being optimized to improve plant growth while reducing energy consumption. Besides, market leaders are launching modular, customizable gardening solutions to cater to various consumer needs, from small countertop herb gardens to large, fully automated indoor farms. They are also incorporating sustainable and eco-friendly materials into their products to attract environmentally conscious buyers. Moreover, companies are forming alliances with retailers, e-commerce platforms, and smart home ecosystem providers to enhance distribution and accessibility. Collaborations with grocery stores and wellness brands are also emerging, promoting smart indoor gardens as a sustainable food solution. These efforts are creating a favorable smart indoor market outlook.

The report provides a comprehensive analysis of the competitive landscape in the smart indoor gardens market with detailed profiles of all major companies, including:

- AeroFarms

- Agrilution GmbH

- AVA Technologies Inc.

- BSH Hausgeräte GmbH (Robert Bosch Stiftung GmbH)

- CityCrop Automated Indoor Farming Ltd

- Click & Grow LLC, EDN Inc.

- Grobo Inc.

- Plantui Oy,

- SproutsIO Inc.

Latest News and Developments:

- January 2025: Plantaform debuted their Smart Indoor Garden with award-winning Fogponics technology at CES 2025. The U.S. debut features year-round sustainable domestic produce and sleek, functional design. Plantaform, which won the CES Innovation Award in Food and AgTech, improves modern living by fusing elegance and innovation.

- December 2024: Prior to CES 2025, LG Electronics unveiled their new indoor gardening tool. This sleek, contemporary device offers a small yet roomy option for cultivating a variety of plants by combining cutting-edge illumination with a system for quick plant growth. It has remote control through the LG ThinQTM app, automatic watering, and fertilizer dispensing.

- January 2023: Rise Gardens, a CES Innovation Award Honoree, debuted a new modular indoor garden at CES 2023. With its intelligent hydroponic technology, Wi-Fi connectivity, and app management, the system can accommodate up to 108 plants. It has an elegant design, a number of accessories, and voice control integration with Alexa.

Smart Indoor Gardens Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Small Garden, Wall Garden, Others |

| Technologies Covered | Smart Sensing Technology, Smart Pest Management Technology, Self-Watering Technology, Others |

| End Uses Covered | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Turkey, Saudi Arabia, United Arab Emirates |

| Companies Covered | AeroFarms, Agrilution GmbH, AVA Technologies Inc., BSH Hausgeräte GmbH (Robert Bosch Stiftung GmbH), CityCrop Automated Indoor Farming Ltd, Click & Grow LLC, EDN Inc., Grobo Inc., Plantui Oy, and SproutsIO Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart indoor gardens market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart indoor gardens market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart indoor gardens industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart indoor gardens market was valued at USD 149.7 Million in 2024.

IMARC estimates the smart indoor gardens market to exhibit a CAGR of 7.04% during 2025-2033.

The smart indoor gardens market is driven by rising urbanization, increasing consumer interest in home gardening, and growing demand for fresh, organic produce. Advancements in IoT, automated hydroponic systems, and smart sensors further enhance convenience, fueling market expansion globally.

North America currently dominates the market due to the increasing focus on indoor aesthetics and rising urbanization.

Some of the major players in the smart indoor gardens market include AeroFarms, Agrilution GmbH, AVA Technologies Inc., BSH Hausgeräte GmbH (Robert Bosch Stiftung GmbH), CityCrop Automated Indoor Farming Ltd, Click & Grow LLC, EDN Inc., Grobo Inc., Plantui Oy, and SproutsIO Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)