Smart Implants Market Size, Share, Trends and Forecast by Product Type, Material, End User, and Region, 2026-2034

Smart Implants Market Size and Share:

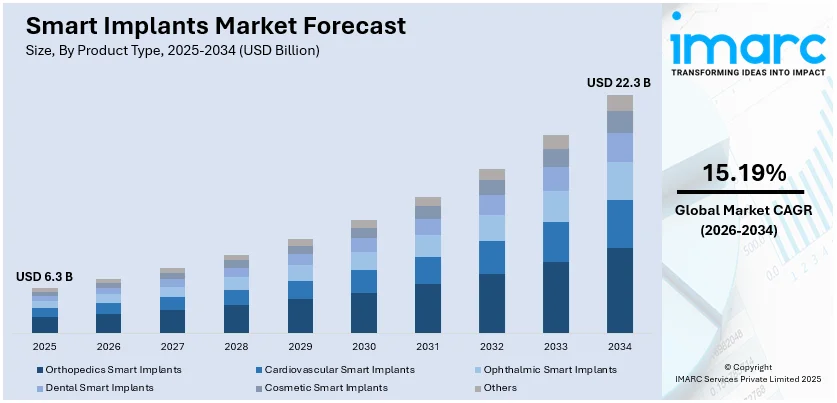

The global smart implants market size was valued at USD 6.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 22.3 Billion by 2034, exhibiting a CAGR of 15.19% during 2026-2034. North America currently dominates the market, holding a significant market share of over 40.2% in 2025. The increasing prevalence of chronic diseases, rising cases of heart failure, and the growing preference for minimally invasive surgeries (MIS) represent some of the key factors driving the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.3 Billion |

| Market Forecast in 2034 | USD 22.3 Billion |

| Market Growth Rate (2026-2034) | 15.19% |

The global smart implants market is driven by advancements in healthcare technologies and the growing demand for personalized medical solutions. These implants, integrated with sensors and IoT connectivity, enable real-time monitoring and data collection, improving patient outcomes. The increasing prevalence of chronic conditions, such as osteoporosis and cardiovascular diseases, boosts the adoption of smart implants for precise treatment and rehabilitation. This awareness about minimally invasive procedures further supports market growth. According to the IMARC Group, the minimally invasive surgery market size is forecasted to reach USD 91.0 Billion by 2032, exhibiting a CAGR of 6% during 2024-2032. Government initiatives also support healthcare infrastructure and encourage widespread adoption of smart implants throughout the world, thus driving the market further.

To get more information on this market Request Sample

The United States has emerged as a key regional market for smart implants, driven by the increasing prevalence of chronic diseases, such as osteoporosis, arthritis, and cardiovascular conditions, requiring advanced treatment solutions. The rising adoption of minimally invasive surgeries enhances the demand for smart implants due to their precision and improved recovery outcomes. As per a report published by the IMARC Group, the United States minimally invasive surgery market is expected to reach USD 35.3 Billion by 2032, exhibiting a CAGR of 3.93% during 2024-2032. In addition, technological advancements, including IoT integration and AI-driven analytics, enable real-time monitoring, boosting patient care. Besides this, growing awareness about personalized healthcare solutions and the availability of biocompatible materials support adoption.

Smart Implants Market Trends:

Increasing prevalence of chronic diseases

One of the main drivers in the smart implants market is the rising prevalence of chronic conditions such as osteoporosis, arthritis, diabetes, and cardiovascular diseases. According to IDF Diabetes Atlas (2021) reports, the global diabetes burden is rising, with 10.5% of adults affected in 2021, projected to rise to 783 Million by 2045, fuelling demand for smart implants to enhance disease management and improve outcomes. Examples of such smart implants would include orthopedic ones fitted with sensors that track healing, thereby alerting doctors about possible complications. This enables better patient outcomes and lesser reoperation requirements. Besides this, the increasing healthcare needs of the geriatric population and increased willingness to embrace new technological advancements in medicine are further increasing the requirement for smart implants.

Advancements in healthcare technologies

Technological innovations in sensor technology, the Internet of Things (IoT), and artificial intelligence (AI) are driving the smart implants market. According to the IMARC Group, the global artificial intelligence market is projected to reach USD 854.5 Billion by 2033, exhibiting a CAGR of 23.64% during 2025-2033. These developments allow implants to collect and transmit real-time data, enabling remote monitoring and personalized treatment plans. Predictions of complications, optimization of therapies, and improvement of the decision-making process by healthcare providers can also be done through the analytics developed by AI. Notable improvements have also been associated with a move toward more biocompatible materials, along with innovations brought through 3D printing regarding the strength, safety, and individualization of implants. These have both advanced the functionality of smart implants and opened fields for use in orthopedics, cardiology, and neurology.

Growing demand for minimally invasive procedures

Patients and healthcare providers are increasingly opting for minimally invasive surgeries because of their numerous advantages, such as less pain, faster recovery, and a lower risk of complications. Smart implants are well-suited to these procedures, as they can be precisely positioned and monitored without the need for extensive surgical intervention. For instance, smart stents and pacemakers used in cardiovascular procedures can provide real-time feedback on their performance, ensuring optimal placement and functionality. This compatibility with minimally invasive techniques drives their adoption in modern healthcare settings. In addition, increasing awareness about these advanced, patient-friendly solutions contributes to the growth of the smart implants market globally.

Smart Implants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart implants market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, material, and end user.

Analysis by Product Type:

- Orthopedics Smart Implants

- Knee Arthroplasty

- Hip Arthroplasty

- Spine Fusion

- Fracture Fixation

- Others

- Cardiovascular Smart Implants

- Pacing Devices

- Stents

- Structural Cardiac Implants

- Ophthalmic Smart Implants

- Intraocular Lens

- Glaucoma Implants

- Dental Smart Implants

- Cosmetic Smart Implants

- Others

Orthopedics smart implants stand as the largest component in 2025, holding around 46.0% of the market. These implants lead the market due to the tremendous progress they have made in improving patient outcomes and managing healthcare. Such implants are designed with sensor-embedded technology that continuously monitors the healing process, follows the movement of the patient, and detects complications, such as infections or implant failure, in real-time. They provide exact data to healthcare professionals, thus enabling them to make better decisions, adjust treatments, and intervene early when necessary. Orthopedic smart implants will also enhance the recovery process of patients by promoting more personal, data-driven care. Their ability to seamlessly integrate with other medical devices and technologies also solidifies their position in the market, making them an important innovation in modern orthopedic treatments.

Analysis by Material:

- Bone Cement

- Metal

- Cobalt

- Alloy

- Titanium

- Others

Metal represents the leading market segment in 2025. This dominance is due to its robust strength, toughness, and biocompatibility, ideal for long-term medical devices. Titanium and stainless steel are used the most in orthopedic, dental, and cardiovascular devices, as they have a large tolerance for the mechanical effects of the human body in addition to their resistance toward corrosion. These materials also support the integration of advanced technologies, such as sensors and wireless communication systems, which are essential for smart implants. Moreover, metal implants can be precisely engineered for various applications, ensuring better functionality and performance. Their well-established use in healthcare, along with the ability to incorporate cutting-edge technology, makes metal the dominant material in the smart implants market.

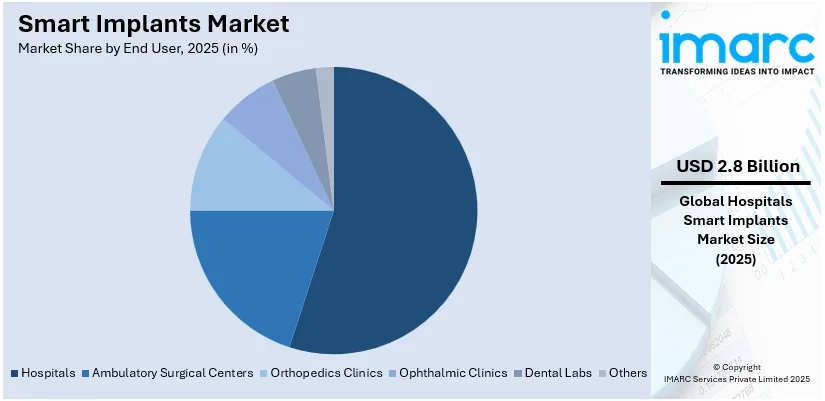

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Ambulatory Surgical Centers

- Orthopedics Clinics

- Ophthalmic Clinics

- Dental Labs

- Others

Hospitals lead the market with around 52.2% of smart implants market share in 2025. This is due to their vital role in the care of patients and working with modern medical treatments. As the primary service providers of healthcare, hospitals are well-equipped to provide the infrastructure, expertise, and personnel to implement and monitor these implants as expected. These implants often require precise surgical placement, followed by continuous post-operative monitoring, which is offered by the controlled, medically supervised environment of a hospital. Hospitals also have access to sophisticated diagnostic equipment and utilize data from smart implants in all comprehensive patient care systems for management. The increasing requirement for personalized treatment and effective outcomes also strengthens the leadership of hospitals in smart implant technology adoption.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 40.2%. The leading reason North America dominates the smart implants market is that this region is well advanced with regard to healthcare infrastructure and possesses a strong research and development (R&D) ability. Such an environment, rich in innovation and comprising high levels of investment for advancements in healthcare, helps facilitate rapid development, testing, and adoption of smart implants. The North American healthcare system is also highly developed to facilitate the availability of resources needed in hospitals and clinics to utilize advanced technologies. The regulatory climate in this region, besides positive reimbursement policies, also stimulates the utilization of smart implants. Moreover, in comparison to other regions, advanced treatments are more accessible in North America to consumers.

Key Regional Takeaways:

United States Smart Implants Market Analysis

In 2025, the United States accounts for over 88.2% of the smart implants market in North America. The adoption of advanced medical technologies, particularly in urban settings, is elevating the prominence of smart implants in the United States. Growing populations in metropolitan areas are leading to a rise in demand for efficient healthcare solutions, such as dental implants, creating opportunities for innovative implant technologies that cater to a tech-savvy populace. According to reports, the United States is witnessing rapid growth in dental implant adoption, with over 3 Million recipients and 500,000 added annually, driven by their superior benefits and rising interest in smart implant technology. Concurrently, the increase in healthcare-related investments is enabling hospitals to adopt cutting-edge solutions for patient care. The integration of these implants with healthcare monitoring systems is a key advantage, allowing seamless data collection and personalized care. Enhanced recovery times, minimally invasive procedures, and improved surgical outcomes further contribute to their appeal. In densely populated regions, infrastructure upgrades, including modernized clinics, support their deployment. With an increasing geriatric population seeking better mobility and health, smart implants are addressing chronic conditions efficiently while supporting lifestyle improvements, driving their widespread adoption.

Asia Pacific Smart Implants Market Analysis

The rising prevalence of degenerative conditions such as osteoarthritis and injuries linked to a growing geriatric population are key drivers of the Asia Pacific smart implants market. According to industry reports, knee osteoarthritis affects 22-39% of Indians over 60, driving a 13.22% rise in total knee replacement (TKR) procedures from 25,215 in 2014-15 to 43,905 in 2018-19. This growth is propelling the adoption of smart knee implants for better patient outcomes. Smart knee implants offer significant advantages, such as precise data collection, patient-specific adjustments, and long-lasting durability. These features help individuals regain mobility and experience an improved quality of life. Emerging economies are also expanding medical device production to cater to increasing surgical volumes, aligning with advancements in orthopedic care. Additionally, the adoption of minimally invasive techniques expedites the integration of implants into standard procedures, particularly in regions with evolving healthcare infrastructure. Smart implants equipped with AI-driven analytics optimize post-operative rehabilitation. For instance, smart knee systems that track movement provide personalized therapy insights, supporting recovery and minimizing complications.

Europe Smart Implants Market Analysis

The Europe smart implants market is primarily driven by the growing prevalence of vision impairments, which is boosting interest in advanced ophthalmic solutions. Smart implants tailored for eye care, such as retinal prostheses and intraocular devices, address complex visual disorders. For instance, dry eye disease prevalence in Europe has risen, with recent studies highlighting a 15% increase over a decade. This rise is driving the adoption of smart eye implants to combat growing vision-related challenges. These implants improve patient outcomes through enhanced precision and long-term effectiveness, making them vital in addressing chronic eye diseases. Developments in surgical techniques and diagnostics further foster the adoption of smart implants in specialized treatments. As a result, healthcare providers are increasingly incorporating these technologies for early intervention and continuous monitoring. Patients benefit from innovative devices that integrate seamlessly into therapeutic regimens, reducing the need for repetitive procedures. For instance, smart retinal devices equipped with data transmission capabilities provide enhanced visual performance and feedback, reflecting their value in managing progressive disorders.

Latin America Smart Implants Market Analysis

The growing Latin America smart implants market is being led by multiple factors. The rising healthcare awareness and prevalence of diseases, such as arthritis, cardiovascular disorders, and diabetes, among others, is leading to increased demands for advanced implant solutions. A growing geriatric population in this region has also led to greater demand for orthopedic and dental implants, particularly those enabling real-time monitoring and, as such, better outcomes. In addition, improvements in medical technology combined with infrastructural advancement of healthcare systems are helping promote smart implants. The increasing disposable income and easy accessibility to proper health care enable patients to embrace these modern treatment options. As per industry reports, total disposable income in Latin America is projected to grow by 60% by 2040. Besides this, governmental efforts in improving the health care sector, along with additional allocations for research in medicine, further facilitate industry expansion.

Middle East and Africa Smart Implants Market Analysis

The expansion of healthcare facilities, in line with growing urban developments, is propelling the adoption of smart implants in the Middle East and Africa. Investments in hospital infrastructure support the integration of technologically advanced devices into surgical and therapeutic protocols. According to a Dubai Healthcare City Authority report, the number of private medical facilities in Dubai reached 4,482 in 2022, with 56 hospitals and over 55,208 licensed professionals. As healthcare infrastructure grows, the adoption of smart implants is increasing to meet rising patient needs. Advantages such as seamless compatibility with advanced diagnostic tools and extended operational lifespans make smart implants ideal for modernized healthcare systems. For instance, orthopedic implants designed for continuous monitoring contribute to faster recovery rates, enhancing their utility in hospital-based treatments.

Competitive Landscape:

The key players in the smart implants market are catalyzing its growth through various strategic actions. The leading firms are investing heavily in research and development (R&D), creating advanced, innovative products that integrate smart sensors and wireless technologies for real-time monitoring of patient health. Various collaborations and partnerships with hospitals and healthcare providers are creating more opportunities for the adoption of smart implants, as patients enjoy better outcomes and specific treatment. Additionally, the focus on increasing the biocompatibility, durability, and functionality of implants is ensuring their successful long-term stay in the market. Improvements in the production capacity, along with processes to make regulatory approvals easy, have increased availability and accessibility, which is propelling smart implants market growth.

The report provides a comprehensive analysis of the competitive landscape in the smart implants market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Biotronik

- Boston Scientific Corporation

- Cochlear Limited

- CONMED Corporation

- Intelligent Implants

- IQ Implants USA

- Medronic plc

- Smart Implant Solutions USA

- Stryker Corporation

- Zimmer Biomet

Latest News and Developments:

- December 2024: OSSIO, Inc. secured USD 27.6 Million in funding to expand its innovative OSSIOfiber Smart Implants, designed for bio-integrative orthopedic fixation. These metal-free implants offer strong surgical solutions while fully integrating with natural bone, reducing post-surgical complications. The funds will drive product development, U.S. manufacturing, and global market expansion. Questa Capital led the investment to support OSSIO's disruptive technology in the USD 16 Billion orthopedic market.

- December 2024: North Oaks Orthopaedic Specialty Center has introduced the ROSA Knee System, leveraging robotic technology for precision in total knee arthroplasty. This advanced system assists surgeons in resurfacing damaged cartilage and replacing it with metal implants and medical-grade plastic. Designed to enhance patient outcomes, it ensures smoother knee motion and improved mobility. The innovative approach highlights a step forward in smart implant technology and surgical care.

- December 2024: Researchers at Scripps Health received a $317,000 NIH grant to develop the world's first smart shoulder replacement implant. The device will monitor and transmit data on shoulder mechanics post-surgery. The project, conducted over 2 years, aims to create a prototype and validate its functionality through cadaver testing.

- November 2024: Zimmer Biomet has received FDA approval for its Oxford Cementless Partial Knee Implant, marking its U.S. debut. Widely used in Europe since 2004, the implant commands a 60% market share there. This smart implant technology enhances orthopedic options for patients and will launch in the U.S. by early 2025.

- November 2024: Exactech has achieved a major milestone with its first surgical case using its new Equinoxe® Central Screw Baseplate implant for shoulder care. This innovative smart implant leverages over two decades of clinical expertise, offering advanced glenoid options and enhanced fixation. Designed for both primary and revision cases, it features a curved anatomic shape for bone preservation. Exactech continues to expand its global presence in orthopedic solutions.

Smart Implants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Materials Covered |

|

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Orthopedics Clinics, Opthalmic Clinics, Dental Labs, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Biotronik, Boston Scientific Corporation, Cochlear Limited, CONMED Corporation, Intelligent Implants, IQ Implants USA, Medronic plc, Smart Implant Solutions USA, Stryker Corporation, Zimmer Biomet, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart implants market from 2020-2034.

- The smart implants market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Smart implants are advanced medical devices embedded with sensors and wireless technology to monitor and transmit real-time data about the condition of the patient. These implants can track factors such as healing progress, infection risk, or implant performance, allowing for personalized care. They enhance treatment outcomes by enabling early detection of complications and facilitating data-driven medical decisions.

The smart implants market was valued at USD 6.3 Billion in 2025.

IMARC estimates the global smart implants market to exhibit a CAGR of 15.19% during 2026-2034.

The increasing demand for personalized healthcare, advancements in sensor technology and wireless communication, rising prevalence of chronic diseases and orthopedic conditions, growing adoption of minimally invasive surgeries, and expanding healthcare infrastructure and technological investments are the primary factors driving the global smart implants market.

According to the report, orthopedics smart implants represented the largest segment by product type due to their ability to enhance patient recovery through real-time monitoring of healing and implant performance.

Metal leads the market by material due to its strength, durability, and biocompatibility, making it ideal for long-lasting implants.

Hospitals account for the largest market share by end user due to their advanced infrastructure and expertise in surgical procedures and post-operative care.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global smart implants market include Abbott Laboratories, Biotronik, Boston Scientific Corporation, Cochlear Limited, CONMED Corporation, Intelligent Implants, IQ Implants USA, Medronic plc, Smart Implant Solutions USA, Stryker Corporation, Zimmer Biomet, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)