Smart Home Security Camera Market Size, Share, Trends, and Forecast by Technology, Application, Distribution Channel, and Region, 2025-2033

Smart Home Security Camera Market Size and Share:

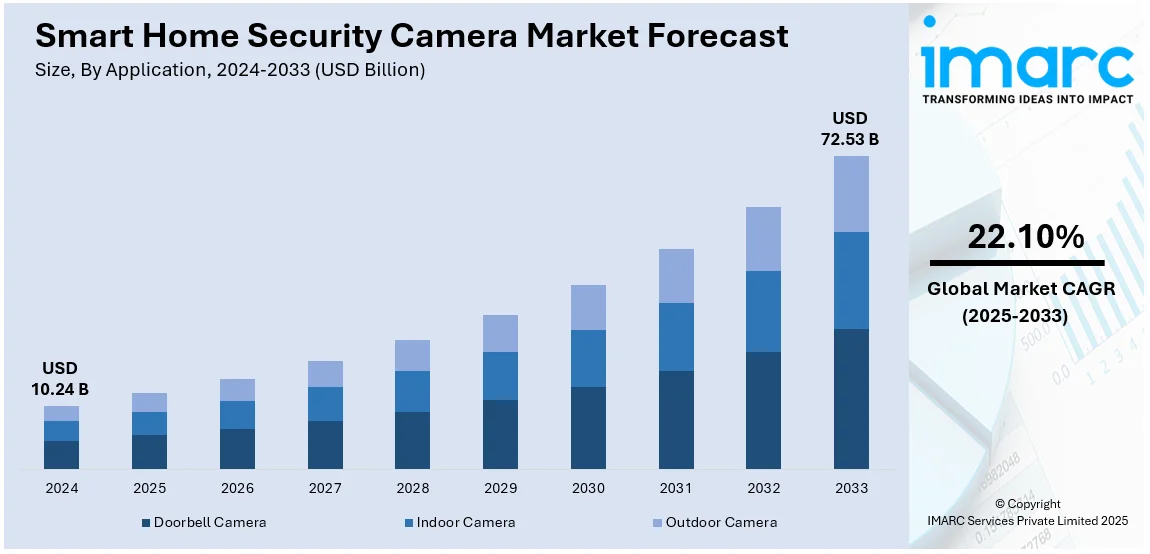

The global smart home security camera market size was valued at USD 10.24 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 72.53 Billion by 2033, exhibiting a CAGR of 22.10% from 2025-2033. North America currently dominates the market, holding a market share of over 42.5% in 2024. The growth of the North American region is driven by increasing smart home adoption, advanced technology infrastructure, consumer awareness of security, and high disposable income levels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.24 Billion |

| Market Forecast in 2033 | USD 72.53 Billion |

| Market Growth Rate (2025-2033) | 22.10% |

The rising concerns about home security, particularly due to incidents of burglary and vandalism, are encouraging more people to adopt smart home security solutions. Smart security cameras offer real-time monitoring, remote access, and better overall security, making them an attractive option for homeowners. Additionally, smart security cameras allow homeowners to monitor their property from anywhere in the world via smartphones or computers. This remote accessibility is a significant advantage over traditional security systems, providing peace of mind and flexibility. Besides this, advancements in artificial intelligence (AI), machine learning (ML), and cloud computing are enhancing the functionality of smart home security cameras. Features like facial recognition, motion detection, night vision, and two-way audio are increasingly integrated, improving the overall user experience.

The United States plays a crucial role in the market, driven by the increasing concerns over property crimes and break-ins. The perception of safety is a major priority, especially in areas with higher crime rates. Smart home security cameras provide a proactive approach, enabling users to monitor their homes in real time and receive instant alerts about suspicious activities. Moreover, the growing demand for discreet and multifunctional home security solutions is driving innovation, with a focus on devices that integrate seamlessly into everyday environments while offering advanced features such as high-resolution video and remote connectivity. For example, in 2024, Deluxe CCTV Inc. launched the "Secure Your Home" series, which includes hidden security cameras embedded in everyday objects such as air purifiers and smoke detectors. These intelligent devices provide Wi-Fi access, remote observation, and 4K video resolution in certain models. The launch responds to the increasing need for subtle, efficient home security as burglary rates continue to be elevated in the USA.

Smart Home Security Camera Market Trends:

Growing Demand for Enhanced Home Security

With an increasing number of burglaries, property crimes, and home invasions, people are seeking smart solutions that offer real-time monitoring and instant alerts. Smart cameras offer advanced features such as motion detection, two-way audio, night vision, and cloud storage for video recordings, all of which contribute to enhanced security. Additionally, integration with other smart home devices like alarms, lights, and locks makes these systems even more effective in protecting homes. The ability to monitor homes remotely via smartphones and smart assistants, such as Alexa and Google Assistant, is appealing to homeowners seeking both convenience and peace of mind. As safety concerns grow, people are more inclined to invest in these high-tech security solutions, further driving the demand for smart home security cameras. In 2024, Xiaomi introduced the 360 Home Security Camera 2K, which includes AI Human Detection, 2K resolution, and complete 360-degree coverage. It provides full-color night vision, two-way audio communication, and works with Alexa and Google Assistant.

Advancements in AI and ML Technologies

Technological advancements in AI and ML are significantly influencing the smart home security camera market. AI enables cameras to identify and distinguish between different types of movements, reducing false alarms triggered by pets, wind, or passing cars. These intelligent systems can recognize familiar faces, alert homeowners to unfamiliar individuals, and even analyze behavioral patterns to detect unusual activity. Moreover, the incorporation of voice recognition, object tracking, and predictive analytics is making security cameras smarter and more intuitive. ML algorithms improve the performance of these devices over time by learning from past data, enhancing their ability to predict security breaches. The combination of AI with high-definition video quality and real-time data processing makes smart home cameras a valuable tool for users. In 2024, SimpliSafe launched its Outdoor Security Camera Series 2 alongside the AI-powered Active Guard Outdoor Protection system. This system uses AI to detect and identify human movement, escalate unknown visitors to professional monitoring, and prevent crimes before they occur. The camera, priced at $200, includes advanced features like HD video, night vision, and a 90dB siren.

Integration with Smart Home Ecosystems

With the rise of connected devices, such as smart thermostats, lights, locks, and voice assistants, security cameras are becoming an integral part of the broader home automation system. Homeowners prefer cameras that seamlessly integrate with their existing smart devices, allowing for centralized control via mobile apps or voice commands. Additionally, cameras integrated with home security systems can provide enhanced monitoring capabilities and even trigger emergency responses automatically. The convenience of managing multiple smart devices from one platform is boosting the adoption of smart security cameras, positioning them as essential components of modern, connected homes. In 2024, Anona introduced its Aurora security camera and Holo WiFi smart lock, broadening its smart home security offerings. The Aurora boasts 4K resolution, AI detection, color night vision, and a 10,000mAh battery, whereas the Holo smart lock provides auto-lock, anti-peeping features, and works with Alexa and Google Assistant.

Smart Home Security Camera Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart home security camera market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, application, and distribution channel.

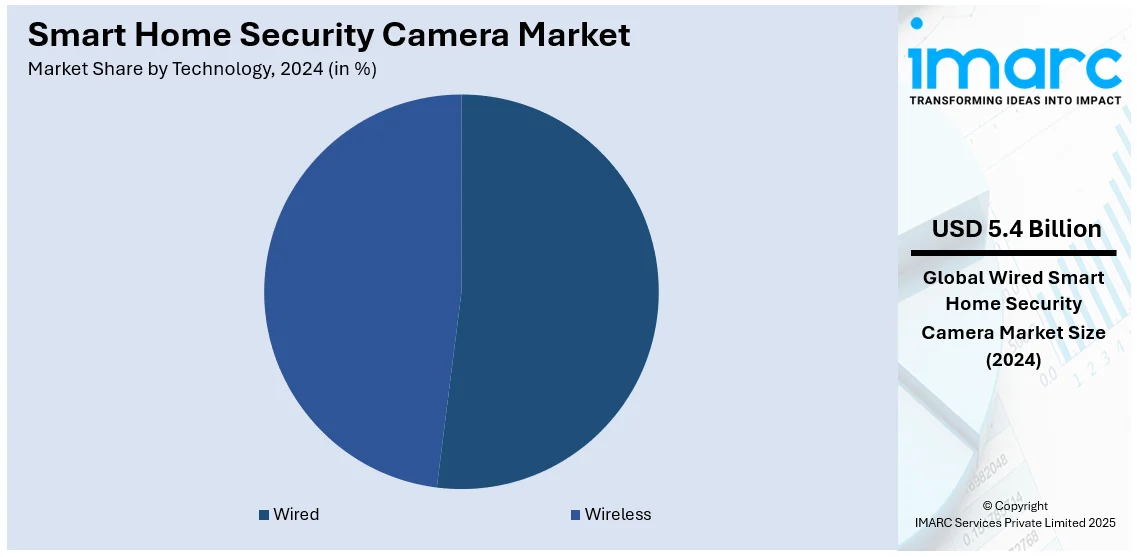

Analysis by Technology:

- Wired

- Wireless

Wired stands as the largest component in 2024, holding 52.2% of the market share. Wired dominates the market due to its reliability, superior performance, and suitability for critical surveillance needs. It provides consistent power and uninterrupted connectivity, eliminating concerns about battery life or signal interference often associated with wireless options. This ensures stable, high-resolution video quality, making it a preferred choice for users prioritizing image clarity and security. Wired system is particularly ideal for large properties, businesses, or long-term installations, where comprehensive coverage and dependable operation are essential. Advances in wired technology are making installation more flexible, enabling seamless integration into existing setups. Additionally, wired cameras are often perceived as more secure against cyber threats, as they do not rely on Wi-Fi signals susceptible to hacking. Its ability to function independently of internet connectivity also makes it suitable for areas with unstable networks.

Analysis by Application:

- Doorbell Camera

- Indoor Camera

- Outdoor Camera

Indoor camera represents the largest segment with 38.2% of market share in 2024. Indoor camera holds the largest market share due to its widespread adoption for home monitoring and personal security. Its compact design and ease of installation make it suitable for a variety of indoor settings, ranging from residential to commercial spaces. It caters to the growing demand for features like motion detection, two-way audio, and integration with smart home systems, providing convenience and peace of mind to users. Indoor camera is often more affordable than outdoor models, further driving its popularity among cost-conscious buyers. It is used for diverse applications, including monitoring children, pets, and elderly family members, as well as safeguarding valuables. Technological advancements such as AI-driven alerts and high-definition video are enhancing its appeal, offering smarter and more efficient security solutions. Additionally, its ability to connect seamlessly to mobile apps allows users to monitor their homes remotely, contributing to its significant share in the market.

Analysis by Distribution Channel:

- Online

- Offline

Offline represents the largest segment due to the trust and convenience it offers to buyers. Physical retail store allows shoppers to see and test products before purchasing, providing a hands-on experience that online platforms cannot replicate. Many buyers prefer in-person interactions to gain expert guidance, resolve doubts, and ensure they are choosing the right product for their needs. Additionally, offline store often provides an immediate product availability, eliminating the waiting times associated with online shipping. For security devices, individuals value the assurance of after-sales service and in-store support, which physical retailers readily offer. Moreover, established retail networks and local vendors create accessibility in regions with limited online penetration. Offline channel is especially popular for high-value items, as it enables buyers to assess product quality directly.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest market share of 42.5%. North America dominates the market because of its advanced technological infrastructure, significant individual purchasing power, and a strong emphasis on personal and property safety. The area's inhabitants show a notable enthusiasm for embracing cutting-edge technologies, especially those that improve convenience and security. The established network of producers, distributors, and sellers facilitates the broad accessibility of advanced security solutions. Furthermore, the area gains from substantial funding in research activities, resulting in ongoing advancements in security technology. In 2024, Reolink introduced the Altas PT Ultra, a security camera powered by batteries that records in 4K with 12 hours of continuous video, ColorX night vision, and 355° pan along with AI tracking. The Reolink Altas PT Ultra can now be bought in North America for a retail price of $209.99 USD on Reolink.com and Amazon. The camera garnered 17 "Best of IFA 2024" accolades for its creativity.

Key Regional Takeaways:

United States Smart Home Security Camera Market Analysis

In North America, the United States accounted for 81.60% of the total market share. The United States is a crucial segment in the market, driven by its advanced technological infrastructure, high user awareness, and strong demand for home automation. With a large population embracing smart home solutions, the US is becoming a hub for innovation and adoption of security technologies. Increasing concerns about home safety and property crime are leading to a growing preference for smart security systems that offer remote monitoring, motion detection, and real-time alerts. The country’s well-established infrastructure for research and development (R&D) fosters continuous advancements, ensuring access to cutting-edge products tailored to user needs. Additionally, the presence of major manufacturers and tech companies in the US allows for widespread product availability and promotional efforts. Retail and distribution networks, both offline and online, ensure easy access to these devices. E-commerce plays a significant role in supporting the market growth, providing buyers with the convenience of browsing, comparing, and purchasing security cameras online. This platform enables quick access to a variety of options, along with competitive pricing. The IMARC Group anticipates that the e-commerce sector in the United States will attain a value of US$ 2,083.97 Billion by 2032, demonstrating a compound annual growth rate (CAGR) of 6.80% between 2024 and 2032.

Europe Smart Home Security Camera Market Analysis

Europe’s smart home security camera market is flourishing, driven by increasing interest in home automation and smart technology. The market also benefits from the strong regulatory framework that encourages the use of advanced security technologies, further promoting the demand for smart home security cameras. Additionally, the region has a high adoption rate of connected devices, including security cameras, with countries like the UK, Germany, and France leading the way. Technological advancements in video quality, data encryption, and AI-powered features, such as facial recognition and motion tracking, are attracting individuals seeking reliable and user-friendly security solutions. In 2024, Xiaomi introduced the Smart Camera C500 Pro in Europe, equipped with a 5MP camera that offers 3K resolution and HDR mode for superior video quality. It provides 360° rotation, motion sensing, and privacy options such as a physical lens cover. Available for €69.99 in certain European nations, it works with Alexa and Google Assistant for voice command functionalities.

Asia Pacific Smart Home Security Camera Market Analysis

The Asia Pacific region is experiencing rapid growth in the market, largely due to the increasing awareness about home security solutions. Countries like China, Japan, South Korea, and India are becoming key players, driven by advancements in technology and high rates of smartphone penetration. Additionally, the region is seeing widespread adoption of IoT and cloud-based solutions, making it easier for users to monitor and manage security remotely. The growing presence of international and regional technology players, who are showcasing cutting-edge innovations tailored to local market needs is also helping the region establish itself as a strong market for smart home security cameras. For instance, during the Smart Home Expo taking place from May 2-4, 2024, Hikvision India presented its newest smart home innovations, featuring cutting-edge facial recognition Video Door Phones (VDP), smart home cameras, and AX PRO wireless intrusion alarms. The firm emphasized advancements designed to improve home security, concentrating on scalable and flexible options.

Latin America Smart Home Security Camera Market Analysis

In Latin America, the market for smart home security cameras is growing consistently as people increasingly prioritize security and the integration of technology in their residences. Nations such as Brazil, Mexico, and Argentina are demonstrating heightened interest in connected security devices, supported by the rising accessibility of budget-friendly solutions that provide advanced functionalities like real-time notifications and cloud storage. The area's adoption of mobile technology and its expanding internet infrastructure bolster the need for remote monitoring features, making smart cameras a crucial component of contemporary home security systems. For example, in 2024, Viasat worked together with Altan to enhance mobile service in Mexico by combining satellite with LTE technologies. This collaboration aims to provide broadband and mobile connectivity to remote areas, assisting over 150,000 people.

Middle East and Africa Smart Home Security Camera Market Analysis

The Middle East and Africa region is witnessing a gradual rise in the adoption of smart home security cameras, driven by increasing concerns about home security and the growing interest in home automation. In the Middle East, high-income individuals are more likely to invest in luxury smart home solutions, including advanced security systems that offer features like facial recognition and real-time alerts. Meanwhile, in Africa, the focus is on affordable and easy-to-use security solutions, with a rising number of users embracing mobile-based monitoring. The region's growing interest in digital transformation and connected homes is contributing to the increasing demand for smart security cameras. In 2024, the UNDP and cBrain partnered to accelerate Africa's digital transformation.

Competitive Landscape:

Main market participants are emphasizing innovation, forming strategic alliances, and broadening their product ranges to address increasing consumer needs. They are also highlighting smooth compatibility with other smart home gadgets and virtual assistants, improving user comfort. Sustainable methods and energy-saving designs are increasingly being recognized as stakeholders respond to the rising consumer consciousness regarding environmental effects. Businesses are incorporating cutting-edge technologies like AI, ML, and IoT to improve functionalities such as motion detection, facial recognition, and intelligent alerts. Initiatives involve enhancing cloud storage solutions, guaranteeing data protection, and providing varied subscription plans to appeal to a broad range of users. In 2024, Vantiva introduced the Vantiva Peek™, which is a smart security camera made for self-storage units. The camera integrates motion, humidity, and temperature sensors, providing real-time monitoring and alerts via a mobile app. It offers long battery life, easy installation, and rugged design for storage environments, with a subscription service for renters.

The report provides a comprehensive analysis of the competitive landscape in the smart home security camera market with detailed profiles of all major companies, including:

- Arlo Technologies

- Blink (Amazon.com, Inc.)

- Brinks Home

- Eufy

- Frontpoint Security

- Ring LLC

- Samsung Electronics Co, Ltd

- SimpliSafe, Inc.

- Skylinkhome

- Vivint, Inc

- Wyze Labs Inc

- Xiaomi Inc.

Latest News and Developments:

- October 2024: Amazon launched its Blink range of smart home security cameras in Australia and New Zealand. The affordable Blink Outdoor 4 and Mini 2 models offer 1080p HD video, two-way audio, and motion detection. With prices starting at AU$69/NZ$79, they provide accessible home security options with easy setup and integration with Alexa.

- August 2024: Wyze Labs launched an AI-powered video search feature for its $9.99/month Cam Unlimited plan, allowing users to search security footage via text for specific objects, actions, or attributes like colors and shapes. The feature leverages a proprietary vision language model for faster performance. Wyze continues enhancing security following past data breaches.

- March 2024: Xiaomi unveiled the Xiaomi Outdoor Camera CW500 with dual 4MP cameras offering a 2.5K resolution and a wide field of view for enhanced security. Compatible with Xiaomi HyperOS and controllable via the MIJIA app, it features IP66 water resistance, night vision, and smart alerts.

Smart Home Security Camera Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Wired, Wireless |

| Applications Covered | Doorbell Camera, Indoor Camera, Outdoor Camera |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arlo Technologies, Blink (Amazon.com, Inc.), Brinks Home, Eufy, Frontpoint Security, Ring LLC, Samsung Electronics Co, Ltd, SimpliSafe, Inc., Skylinkhome, Vivint, Inc, Wyze Labs Inc, and Xiaomi Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart home security camera market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart home security camera market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart home security camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global smart home security camera market was valued at USD 10.24 Billion in 2024.

The global smart home security camera market is estimated to reach USD 72.53 Billion by 2033, exhibiting a CAGR of 22.10% from 2025-2033.

The global smart home security camera market is driven by rising demand for home automation, increasing security concerns, and advancements in IoT technology. Growing smartphone penetration and better internet connectivity boost adoption. Features like remote access, cloud storage, and AI-powered analytics appeal to users.

North America currently dominates the global market. growth of the North American region is driven by increasing smart home adoption, advanced technology infrastructure, consumer awareness of security, and high disposable income levels.

Some of the major players in the global smart home security camera market include Arlo Technologies, Blink (Amazon.com, Inc.), Brinks Home, Eufy, Frontpoint Security, Ring LLC, Samsung Electronics Co, Ltd, SimpliSafe, Inc., Skylinkhome, Vivint, Inc, Wyze Labs Inc, and Xiaomi Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)