Smart Helmet Market Size, Share, Trends and Forecast by Component, Type, Technology, End User, and Region, 2025-2033

Smart Helmet Market 2024, Size and Share:

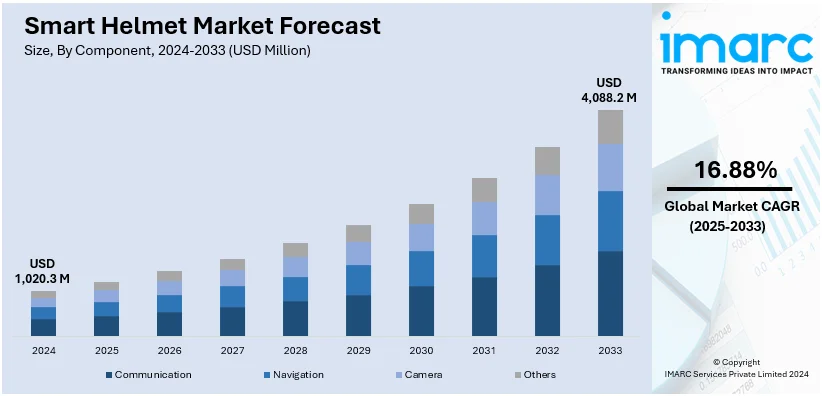

The global smart helmet market size was valued at USD 1,020.3 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 4,088.2 Million by 2033, exhibiting a CAGR of 16.68% from 2025-2033. North America currently dominates the market, holding a market share of over 42.2% in 2024. The growth of the North American region is driven by rising safety regulations, technological advancements in smart helmets, increasing road accident awareness, and the adoption of connected devices in various applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,020.3 Million |

|

Market Forecast in 2033

|

USD 4,088.2 Million |

| Market Growth Rate 2025-2033 | 16.68% |

The growing number of road accidents and workplace hazards is driving the demand for smart helmets equipped with features like crash detection, impact sensors, and emergency alert systems to enhance safety for users in transportation and industrial sectors. Furthermore, innovations in the Internet of Things (IoT), augmented reality (AR), and wearable technology are enabling the integration of advanced features such as heads-up displays, noise-canceling microphones, and real-time navigation, making smart helmets highly functional and appealing. Apart from this, governing bodies across the globe are enforcing stringent safety regulations for motorcycling, construction, and other hazardous industries, encouraging the adoption of helmets with advanced protective features. Additionally, manufacturers are exploring eco-friendly materials and energy-efficient components in smart helmets, aligning with sustainability goals and attracting environmentally conscious individuals.

The United States is a key region in the market, driven by the increasing popularity of biking, skiing, and other adventure sports, which require smart helmets that provide safety along with features like performance tracking, communication, and live recording. Besides this, the integration of advanced safety technologies, such as light-emitting diode (LED) lighting and Bluetooth connectivity in smart helmets to enhance functionality is propelling the smart helmet market growth. These features enhance visibility and facilitate seamless communication, addressing critical safety concerns and appealing to safety-conscious users. In 2024, VATA7 introduced the X1 Smart LED Helmet, enhancing nighttime safety for motorcyclists in North America and beyond. The X1-DOT model, tailored for North American consumers, integrates 360-degree LED lighting and Bluetooth connectivity, improving visibility and connectivity. This innovation aims to reduce accidents and set new safety standards in motorcycle gear.

Smart Helmet Market Trends:

Rising Focus on Maintaining Rider Safety

The increasing awareness among riders and regulatory authorities about the importance of road safety is bolstering the market size. Smart helmets not only provide enhanced safety features but also cater to the tech-savvy preferences of modern riders. Riders are increasingly expecting innovative features in their safety gear, including helmets. In addition, key players are focusing on unveiling helmets that offer enhanced safety features to individuals. For instance, on 10 April 2024, Ather Energy launched its new series of helmets called the Ather Halo smart helmet series, which is a complete game-changer that offers more than just protection. The helmet prioritizes safety with top certifications, a protective shell, and internal padding. It also offers Bluetooth connectivity for automatic pairing, music or call management, and rider-pillion intercom.

Increasing Need for Hands-Free Communication Options

Steelbird Helmets launched their innovative Fighter line of helmets on May 20, 2024, offering advanced features like a Pin Lock-70 anti-fog shield, integrated Bluetooth, and enhanced safety capabilities. These helmets are equipped with a 5.2 smart Bluetooth headset that provides 48 hours of talk time and 110 hours of standby, ensuring reliable connectivity for extended use. The voice-activated navigation system and LED light blinker enhance safety and convenience, especially during night rides or poor visibility conditions. Hands-free communication allows riders to stay connected without the need to manually operate devices, reducing distractions and maintaining focus on the road. This feature is particularly beneficial for group rides, enabling seamless communication between riders to coordinate routes and share information without compromising safety. Additionally, the helmets' anti-fog shield ensures clear vision in varying weather conditions, while the Bluetooth functionality enhances the overall riding experience, making the Fighter line a comprehensive solution for tech-savvy motorcyclists.

Growing Cases of Road Accidents

Road accidents, especially those involving motorcycles and bicycles, usually result in serious injuries or fatalities on account of vulnerability of riders. According to Department of Transportation, in 2023, the United States saw an estimated 40,990 road accidents. Modern safety features included in smart helmets are impact sensors, airbags, and enhanced visibility tools like light-emitting diode (LED) lights and reflective materials. These features improve rider visibility, provide early warning systems, and can lessen the severity of injuries or completely eliminate accidents. There is a rise in the demand for safety solutions that offer proactive accident prevention and protection features is providing a positive smart helmet market outlook. Furthermore, top market players are launching smart helmets that are beneficial in preventing accidents. For example, on 26 September 2023, Patna-based startup Takeward innovation introduced a range of smart helmets to prevent accidents and theft of bikes. The bike will not move unless an individual wear this smart helmet.

Smart Helmet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart helmet market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, type, technology, and end user.

Analysis by Component:

- Communication

- Navigation

- Camera

- Others

Communication leads the market with 34.5% of smart helmet market share in 2024. The communication segment dominates the market, driven by its critical role in enhancing user safety and convenience. Integrated communication systems enable seamless hands-free interactions through Bluetooth and Wi-Fi connectivity, facilitating real-time communication without compromising safety. This feature is particularly beneficial for motorcyclists, construction workers, and outdoor sports enthusiasts, who require efficient communication in dynamic environments. The integration of advanced microphones and noise-canceling speakers ensures clarity, even in high-noise settings. Additionally, communication-enabled helmets support connectivity with mobile devices, enabling access to navigation, music, and emergency services. The growing preference for smart helmets in professional and recreational activities underscores the demand for reliable and efficient communication features. Furthermore, these systems enhance workplace safety by allowing instant alerts and coordination in critical situations. As manufacturers continue to innovate by adding multi-device pairing and voice-command capabilities, the communication segment remains pivotal to the growth and adoption of smart helmets globally.

Analysis by Type:

- Full Face

- Half Face

- Hard Hat

Full face dominates the market with 58.6% of market share in 2024. The full-face segment leads the market due to its superior safety and functionality. Full-face smart helmet provides comprehensive head and face protection, making it highly favored by motorcyclists, sports enthusiasts, and professionals in hazardous environments. It is often incorporate advanced features such as crash detection, built-in cameras, heads-up displays, and communication systems, enhancing its appeal and utility. Its enclosed design ensures better integration of technology, like noise reduction for clear communication and optimal positioning for augmented reality displays. Full-face helmet is also designed to improve aerodynamics and reduce wind resistance, which is particularly advantageous for motorcyclists. Furthermore, its ability to shield users from adverse weather conditions and debris adds to their practicality. Manufacturers are focusing on lightweight materials and ergonomic designs to enhance comfort without compromising safety, driving the adoption of full-face smart helmet across various applications and solidifying its dominance in the market.

Analysis by Technology:

- Integrated Communication System

- Integrated Video Camera

- Contactless Temperature Measurement

- Bluetooth Connectivity

- Signal Indicator and Brake Function

- Others

Based on the smart helmet market forecast, integrated communication system dominates the market due to its critical role in ensuring seamless connectivity and enhanced functionality. This system enables real-time communication through Bluetooth and Wi-Fi, providing users with the ability to stay connected without compromising safety. Particularly popular among motorcyclists, construction workers, and adventure enthusiasts, integrated communication system allows for hands-free calls, coordination, and instant messaging, enhancing efficiency and convenience in various scenarios. Noise-canceling microphones and high-quality speakers ensure clarity even in noisy environments, while multi-device pairing capabilities allow users to connect to smartphones, GPS devices, and other gadgets simultaneously. The ability to interact with navigation tools, music, and voice assistants further enhances the user experience, making integrated communication system indispensable in both professional and recreational settings. Continuous advancements in communication technology, including extended battery life and improved range, reinforce the dominance of this segment, driving its widespread adoption in the market.

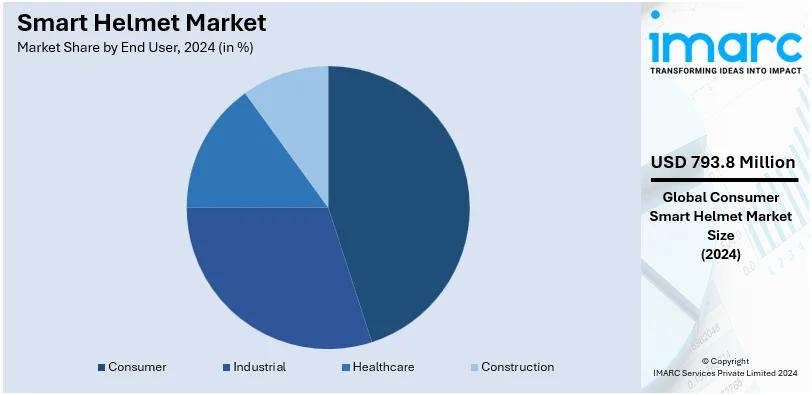

Analysis by End User:

- Consumer

- Industrial

- Healthcare

- Construction

Consumer leads the market with 77.8% of market share in 2024. The consumer segment holds the largest share in the market due to its widespread application in recreational activities such as motorcycling, cycling, and sports. Smart helmets designed for this segment integrate features like Bluetooth connectivity, built-in cameras, heads-up displays, and crash detection systems, offering safety and convenience. Motorcyclists and cyclists benefit from features, including navigation assistance, hands-free communication, and music streaming, which enhance their riding experience while maintaining safety. For adventure sports enthusiasts, the inclusion of impact sensors and real-time activity tracking adds significant value. Additionally, the growing adoption of smart helmets for fitness tracking, enabled by integrated sensors that monitor metrics such as heart rate and speed, is broadened their appeal. Consumer-focused designs prioritize comfort, lightweight materials, and stylish aesthetics, further driving the demand. With manufacturers continuously innovating to offer enhanced functionalities such as AR displays and voice command integration, the consumer segment is expected to maintain its dominant position in the market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 42.2%, driven by rising awareness about road safety and the increasing prevalence of advanced technology adoption. As per Forbes, more than 44,000 lives were lost in traffic accidents across the United States (US) in 2023, which is enhancing the urgency of strengthening safety measures. The rising number of road accidents in the region is significantly driving the demand for smart helmets, which integrate advanced communication systems, crash detection sensors, and navigation assistance. These features appeal to tech-savvy users seeking enhanced safety and convenience. Moreover, stringent safety regulations in North America, particularly regarding motorcycle and bicycle safety, encourage the adoption of helmets that comply with or exceed traditional standards. The ability of smart helmets to provide real-time alerts, track performance metrics, and enhance protection is further increasing their popularity.

Key Regional Takeaways:

United States Smart Helmet Market Analysis

United States accounted for 83.60% of the total North American market share. US smart helmet is considered a significant market for its fast-growing development. Regulations about safety and rules set by governments highly drive demand for them. Lumos has sold over 300,000 smart helmets worldwide, with a large portion of them sold in the US through Amazon Global Selling. Specialized in making smart helmets that come with an attached LED light system that may facilitate communication as well as improved visibility while riders ride the roads. The US market is mature in comparison, and consumers within the country are early adopters of new technologies, which further fuels market expansion. With growing safety awareness and regulations regarding road safety, demand for innovative products like smart helmets will rise. This places the US firmly in the position of leading the worldwide market for smart helmets, in which both old-established and new players utilized the growing trend.

Europe Smart Helmet Market Analysis

Europe's market is growing rapidly, with industrial, military, and sports applications driving this growth. The European Commission has outlined that the EU invests in advanced technologies for workplace safety, making its region grow at 12% year on year. In the defense sector, the UK and France are also boosting their budgets to include more advanced equipment, and smart helmets have played a great role in soldier safety. On the industrial side, Germany leads in the development of smart helmets with an augmented reality interface and real-time communication for workers. Regulatory bodies also enforce higher standards of safety, further stimulating market growth. This makes Europe a global leader in the market, with companies like BAE Systems and Bosch taking the lead in their commitment to technological innovation and R&D in workplace safety.

Asia Pacific Smart Helmet Market Analysis

The Asia Pacific market for the smart helmet sector is undergoing rapid growth by rising industrial activity, increasing constructions, and a growing consciousness for ensuring worker safety. As quoted by the Chinese Ministry of Defense, during recent times, the People's Liberation Army military spend has passed USD 250 Billion where smart helmets play a big role in advanced soldier systems. Similarly, Japan and South Korea among other countries also make prominent contributions as the smart helmet develops new technological innovations to provide worker productivity and safety that enhance worker performance in construction and manufacturing industries. Late 2024: Royal Enfield and SENA teamed up to launch the joint-marketed 50S Mesh Communicator to provide enhanced riding connectivity with Bluetooth 5, 9 channels of Wave tech. The INR 35,990 (USD 424.62) helmet is capable of seamless retrofitting and can integrate with smartphones, a very important step in the consumer sector. Industry reports show that the market in this region is likely to grow at a CAGR of 15% with increasing demand in the military and civilian sectors. Local manufacturers partnering with global technology firms have been the source of much innovation, and the focus has been on augmented reality and health monitoring. The Asia Pacific region will continue to witness growth because of escalating knowledge about smart technologies and workplace safety.

Latin America Smart Helmet Market Analysis

The market is slowly growing in Latin America, primarily as a result of industrialization, construction, and growing safety regulations. As of 2023, according to an industrial report, Brazil's construction sector stands at approximately USD 125 Billion, where the sector will drive smart helmet adoption through greater demand for safety technologies protecting workers from hazardous environments. Growing awareness of occupational health and safety risks in countries such as Mexico and Argentina are also supporting the market growth. Key players like Grupo Protech and others are leading in Brazil, providing smart helmet solutions with GPS tracking and integrated communication systems. As smart technologies become more popular and safety regulations continue to tighten across the region, the demand for smart helmets in Latin America is likely to grow, especially in the construction and mining sectors.

Middle East and Africa Smart Helmet Market Analysis

The market in the Middle East and Africa is growing steadily, pushed by technological advancement, increased security concerns, and safety at work. According to the International Trade Administration, the construction sector in Saudi Arabia is booming, and investment in high-tech equipment for safety purposes, which includes smart helmets, will rise dramatically in the next few years. Africa also has such countries as South Africa who are integrating the smart helmet into their industries to heighten the level of security. The increase in military personnel demand for smart helmets, especially in the United Arab Emirates and Egypt, is also another factor strengthening the market growth. Goaded by government-led efforts focused on safety in hazardous working environments and military modernization initiatives, the adoption of smart helmets in the Middle East and Africa is projected to surge, which makes the region an emerging player in the market globally.

Competitive Landscape:

Top players in the market are investing heavily in research operations activities to innovate new technologies for smart helmets. This includes advancements in integrated communication systems, AR, and virtual reality (VR) features, sensor technologies for safety monitoring, and enhanced comfort and usability. They are focusing on improving the materials used in helmets to enhance safety without compromising comfort. They are also engaging in collaboration with technology firms, communication companies, and software developers to integrate cutting-edge technologies into smart helmets. For example, in 2024, GoPro, Inc. revealed a deal to purchase Forcite Helmet Systems, a leader in integrating technology into helmets. GoPro aims to fast-track Forcite's goal of delivering a safer and more dynamic motorcycling experience via tech-enhanced motorcycle helmets, with the ultimate objective of tech-enabling additional helmet categories in the future.

The report provides a comprehensive analysis of the competitive landscape in the smart helmet market with detailed profiles of all major companies, including:

- Babaali

- Forcite Helmet System Pty Ltd.

- Jarvish Inc.

- Livall Tech Co Ltd.

- Lumos Helmet

- Nexsys. Co., Ltd.

- Sena Technologies Inc

Latest News and Developments:

- October 2024: Royal Enfield and SENA launched the co-branded 50S Mesh Communicator, enhancing rider connectivity with Bluetooth 5, 9 channels, and Wave tech. Priced INR 35,990 (USD 425.01), it supports seamless helmet retrofitting and smartphone integration.

- March 2024: Mod Bikes has partnered with Lumos to enhance rider safety with smart helmets featuring synchronized turn signals, brake lights, and auto-off functionality, seamlessly integrated into the 2024 Mod Bikes lineup. Accessories are now available in stores.

- January 2024: GoPro announced its acquisition of Forcite Helmet Systems, aiming to enhance motorcycling safety through tech-enabled helmets. The deal is expected to close in Q1 2024, advancing GoPro’s long-term growth strategy.

Smart Helmet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Communication, Navigation, Camera, Others |

| Types Covered | Full Face, Half Face, Hard Hat |

| Technologies Covered | Integrated Communication System, Integrated Video Camera, Contactless Temperature Measurement, Bluetooth Connectivity, Signal Indicator and Brake Function, Others |

| End Users Covered | Consumer, Industrial, Healthcare, Construction |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Babaali, Forcite Helmet System Pty Ltd., Jarvish Inc., Livall Tech Co Ltd., Lumos Helmet, Nexsys. Co., Ltd., Sena Technologies Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart helmet market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart helmet market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart helmet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A smart helmet is a technologically advanced headgear designed to enhance safety and functionality. It is equipped with features like Bluetooth connectivity, GPS navigation, crash sensors, and heads-up displays, and ensures convenience and protection for users. It is used in sectors like construction, sports, military, and motorcycling.

The smart helmet market was valued at USD 1,020.3 Million in 2024.

IMARC estimates the global smart helmet market to exhibit a CAGR of 16.68% during 2025-2033.

The global smart helmet market is driven by rising safety concerns, advancements in IoT and wearable technology, and increasing adoption across industries like construction, sports, and motorcycling. Features such as crash detection, GPS navigation, and real-time communication enhance usability, while government regulations promoting workplace safety and the growing trend of connected devices further drive the market demand.

In 2024, communication represented the largest segment by component attributed to the rising demand for hands-free interaction, real-time connectivity, and integrated Bluetooth systems for enhanced safety and convenience across applications.

Full face leads the market by type owing to its superior safety, comprehensive head protection, and integration of advanced features like crash detection, noise reduction, and enhanced visibility for motorcyclists and sports enthusiasts.

Integrated communication system is the leading segment by technology due to the growing need for hands-free connectivity, seamless communication, and real-time navigation among motorcyclists, industrial workers, and adventure enthusiasts.

Consumer is the leading segment by end user, driven by the increasing demand for advanced safety features, connectivity options, and convenience among motorcyclists, cyclists, and adventure enthusiasts seeking enhanced riding experiences.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global smart helmet market include Babaali, Forcite Helmet System Pty Ltd., Jarvish Inc., Livall Tech Co Ltd., Lumos Helmet, Nexsys. Co., Ltd., Sena Technologies Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)