Smart Food Packaging Market Size, Share, Trends and Forecast by Packaging Type, Material, Functionality, Technology, Application, and Region, 2025-2033

Smart Food Packaging Market Size and Share:

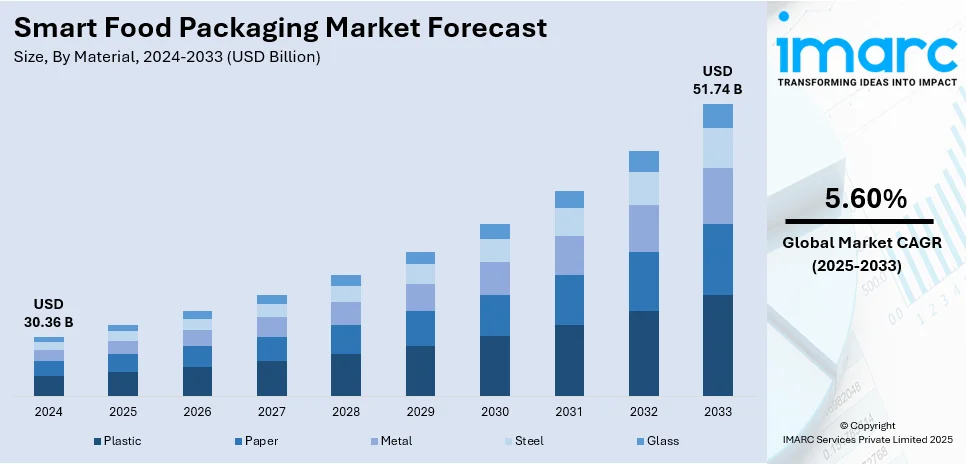

The global smart food packaging market size was valued at USD 30.36 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 51.74 Billion by 2033, exhibiting a CAGR of 5.60% from 2025-2033. North America currently dominates the market, holding a market share of over 37.5% in 2024. The market is propelled by strict food safety regulations and boosting consumer demand for fresh and sustainable packaging solutions, and rapid advancements in IoT-enabled and intelligent packaging technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 30.36 Billion |

| Market Forecast in 2033 | USD 51.74 Billion |

| Market Growth Rate (2025-2033) | 5.60% |

The global smart food packaging market has been witnessing substantial growth based on several key driving factors. Enhanced consumer demand related to food safety and quality is amongst the primary influencing factors because of help from smart technologies in packaging while monitoring and freshening the food products. Heightened awareness regarding keeping food fresh or maintaining product integrity through packaging has set the pace on the consumers' side. The need for convenience propels packaging solutions that provide instant information on the product, such as temperature, humidity, and freshness. Technological innovations in sensor capabilities, RFID tags, and QR codes ensure efficient tracking of an item, which leads to greater food traceability and transparency. Regulatory pressure around food safety and sustainability further drives the market due to boosted demands from manufacturers looking for ecofriendly alternatives. For example, in November 2024, Berry Global introduced a non-carbon black packaging solution for Diplom-Is’s Royal ice cream brand. This innovation improves recyclability by making containers detectable by NIR scanners, reducing plastic waste and enhancing production efficiency. Moreover, the preference for packaged food products is increasing among emerging economies. The demand for smart packaging solutions that help in extending shelf life, reducing waste, and providing an overall consumer experience is therefore, high.

The market in the United States holds a share of 81.7% and is primarily driven by growing consumer demand for enhanced food safety and transparency. People have become highly aware of the risks associated with foodborne illnesses, and consumers are thus seeking packaging that provides real-time monitoring of food conditions, whether it is temperature and freshness. New innovations in packaging technologies like smart labels, sensors, and time-temperature indicators enable better quality control of foods, lessening spoilage and waste. For instance, in November 2024, Amcor presented its smart food packaging innovations, highlighting solutions like AmPrima® films and Liquiflex® technology, which focus on sustainability, carbon footprint reduction, and improving food product preservation and shelf life. Moreover, e-commerce, and the accompanying rise in online grocery shopping, has also fuelled demand for packaging that assures safe delivery over long distances of food products. The concern for environmental factors has triggered a call for sustainable packaging. There is also an increased call by many US-based companies to eliminate plastic waste while embracing recyclable or biodegradable materials in packaging. Other regulations and consumer pressures are forcing the US food manufacturer to adopt smart packaging technologies for food safety in line with new U.S. regulations and demand by consumers to track their products from farm to table.

Smart Food Packaging Market Trends:

Advancements in Sustainable Smart Packaging

Global trend towards sustainability is remolding the smart food packaging market. Growing awareness towards environmental concerns are compelling the manufacturer to produce less plastic packaging with reduced waste generation that is recyclable or biodegradable. Edible packaging, plant-based materials, and compostable films are being promoted. For example, in January 2024, Sealed Air launched a biobased, industrial compostable protein packaging tray made from 54% renewable wood cellulose, offering an eco-friendly alternative to traditional trays and supporting sustainability goals. Furthermore, ecofriendly production practices of brands to capture the minds of eco-friendly customers and abide by the severe environment law are the other key trends. Alongside the growing needs for sustainable choices, companies continue to invest immensely in research and development to create packaging which balance functionality as well as environmental influence. This global shift aligns with sustainability goals, and most companies are considering green intelligent packing to be a differentiator in terms of competition within the market.

Integration of IoT and Digital Technologies

This combination of IoT and digital technology in food packaging is shifting the way food products are being tracked, monitored, and managed. Realtime monitoring of food conditions like temperature, humidity, and expiration dates has been made possible by smart packaging solutions enabled by IoT. This improves efficiency for supply chain, safety for a product, and reduces food waste. It offers a trail of origin and journey for consumers to know everything about their food. Improved inventory management by brands due to digital streamlining is one of the advantages of these innovations. As the world continues to get more digital, IoT-enabled smart packaging of food products promises to revamp this space globally.

Growth in Demand for Personalized Packaging Solutions

Accelerating demand for customized packaging solutions is a leading global trend in the smart food packaging market. Food companies have been motivated to innovate by consumer needs and preferences to tailor their products for health, individualized, or special goals. These companies use technologies like QR codes, personalized labels, and interactive packaging to deliver more personal experiences. These innovations allow the consumer to get targeted information, recipes, and promotional content as well, thus creating a better brand experience altogether. Personalized packaging also opens avenues for greater consumer engagement and loyalty. The heightening adoption of personalized smart packaging with health-conscious consumers demanding more product information continues to empower brands to connect with their audience at a much deeper level, thus creating a powerful platform for boosting the differentiation quotient of the product.

Smart Food Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart food packaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on packaging type, material, functionality, technology, and application.

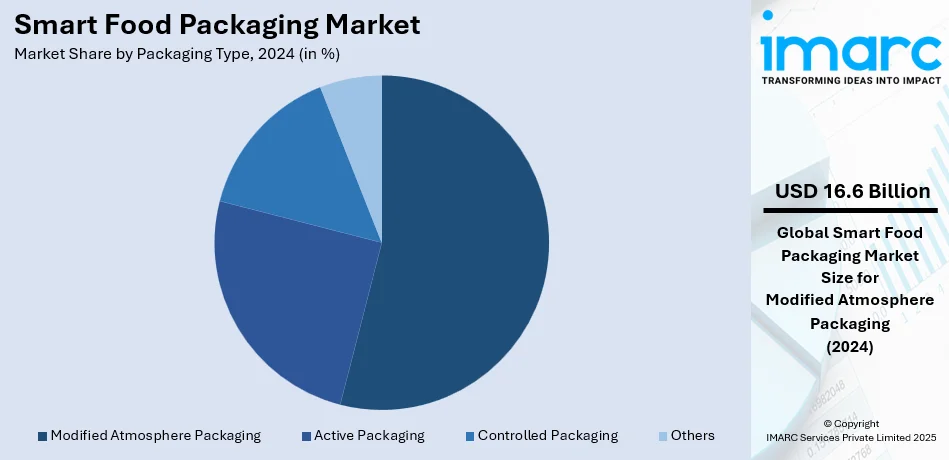

Analysis by Packaging Type:

- Active Packaging

- Controlled Packaging

- Modified Atmosphere Packaging

- Others

Modified Atmosphere Packaging (MAP) dominates the smart food packaging market, holding a 54.7% share. It extends shelf life by altering the composition of gases within the packaging, reducing oxidation and microbial growth. This technology is widely used in perishable products, maintaining freshness without preservatives. The demand is growing due to consumer preference for natural and minimally processed food. Advances in gas flushing techniques and high-barrier films enhance the effectiveness of MAP. Retailers and manufacturers benefit from reduced food waste and improved product presentation. Stringent food safety regulations and the rising e-commerce food sector are further fueling adoption. The meat, poultry, seafood, dairy, and fresh produce industries are the primary users. Innovations in biodegradable films and intelligent sensors are improving MAP efficiency, making it an essential solution for enhancing food quality and safety.

Analysis by Material:

- Plastic

- Paper

- Metal

- Steel

- Glass

Plastic remains the dominant material in smart food packaging, accounting for 42.5% of the market share in 2024. Its widespread use is due to durability, lightweight properties, cost efficiency, and superior barrier protection. High-performance polymers, such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), enhance moisture, oxygen, and light resistance, ensuring extended shelf life. Flexible and rigid plastics support active and intelligent packaging innovations, such as time-temperature indicators and oxygen scavengers. Sustainability concerns are driving the development of recyclable, biodegradable, and bio-based plastics. Regulatory policies and consumer demand for eco-friendly solutions are prompting shifts toward compostable alternatives. Despite environmental concerns, plastic remains a preferred choice due to cost-effectiveness and versatility in applications across frozen foods, snacks, dairy, and ready-to-eat (RTE) meals.

Analysis by Functionality:

- Barrier Protection

- Moisture & Gas Control

- Temperature Regulation

- Food Safety Monitoring

- Shelf-Life Extension

- Product Authentication

- Others

Barrier protection plays an important role in preventing the invasion of food with external contaminants like bacteria, moisture, and UV light, affecting the quality of food. Modern materials include multi-layer films and nanocoatings, providing extra durability, allowing for a longer shelf life, and thereby enabling freshness retention while reducing food waste and regulatory requirements for food safety and hygiene.

Moisture and gas control technologies regulate internal packaging conditions to prevent spoilage and maintain product integrity. Solutions such as modified atmosphere packaging (MAP) and desiccants help control oxygen and humidity levels, extending freshness. These technologies are widely used in perishable food products like dairy, meat, and snacks to enhance storage stability.

It maintains food products at optimal thermal conditions during transportation and storage. With smart packaging materials like phase-change materials and insulated layers, temperature fluctuation is avoided, making it essential for cold-chain logistics, allowing items that are sensitive to temperature to be safely transported and ensuring their quality-both food items like frozen foods and medicines.

Food safety monitoring is the instant detection of contaminates, growth of microorganism, and spoilage-related indicators in packs. Biosensors and chemical indicator technologies alert both consumers and the retailer about actual food hazards from an early period. Such food safety solutions contribute to better adherence to regulations; they also win consumer confidence by reducing the chance of food poisoning and product withdrawal.

Shelf-life extension technologies preserve food freshness by slowing the rate of oxidation, microbial growth, and enzymatic reactions. Vacuum packaging, oxygen scavengers, and antimicrobial films delay early spoilage. Such technologies are also conducive to sustainability in terms of lower food waste, higher storage capacity, and greater time before foods become unsafe to consume.

Product authentication technologies involve various counterfeiting neutralizing and brand-protection through implementing seals, RFID tags, and blockchain traceability. Such solutions make the supply chain transparent; verify the legitimacy of items and thereby offer consumers the comfort that the source of food is authentic and of good quality, which ultimately safeguards the business from fraudulent activities and offers regulatory compliance.

Other smart packaging functionalities include interactive packaging, biodegradable materials, and energy-efficient solutions. Interactive elements like NFC tags engage consumers with digital experiences, while eco-friendly packaging reduces environmental impact. Energy-efficient materials, such as self-cooling or heating elements, provide added convenience, catering to evolving consumer preferences and regulatory sustainability initiatives in the food industry.

Analysis by Technology:

- Time Temperature Indicators (TTI)

- Freshness Indicators

- Oxygen & Carbon Dioxide Indicators

- Barcode Labels

- RFID Tags

- QR Code Labels

Time Temperature Indicators (TTI) are an essential tool for food freshness tracking since they follow the temperature variations within the supply chain. It indicates spoilage or improper exposure, thus providing assurance of safety with visual signs of exposure to unfavorable conditions. The use of TTI is popular in transporting perishable goods, pharmaceuticals, and in the cold-chain logistics industry.

Freshness indicators identify the biochemical alteration within food products as spoilage signals before signs appear. Sensors sense microbial action, gas production, or pH alteration, hence making it easier for real-time evaluation of food safety. In modern times, packaging is used extensively to cut food waste and win consumer trust with sustainability practices among retailers and logistic companies.

Oxygen and carbon dioxide indicators ensure the optimal atmospheric conditions inside packaging by detecting gas imbalances that can accelerate spoilage. Sensors are crucial in MAP, thus enabling extended shelf life for perishable products. These sensors are commonly used in the dairy, meat, and seafood industries to maintain freshness and prevent contamination.

Barcode labels are one of the best ways to manage inventory because they allow for tracking in real-time. They provide information such as expiration dates, batch numbers, and handling instructions, which amplify the efficiency of the supply chain. Barcode labels are commonly used in supermarkets and logistics to comply with food safety regulations and facilitate stock management in retail and manufacturing.

Advanced tracking and authentication capabilities through RFID tags help increase supply chain transparency and efficiency. Compared to barcodes, RFID technology enables the contactless scanning of food products, thus allowing for real-time monitoring. Most of these tags are widely used in logistics, warehousing, and retail sectors to improve their management of inventory, reduce food waste, and ensure safety through automated data collection and analytics.

QR code labels provide interactive and data-rich solutions for smart packaging. Consumers can scan QR codes to access detailed product information, traceability data, and usage instructions. They support transparency in food sourcing, enhance brand engagement, and promote regulatory compliance by linking to digital content, improving consumer confidence and decision-making processes.

Analysis by Application:

- Meat, Poultry & Seafood

- Fruits & Vegetables

- Dairy Materials

- Bakery & Confectionery

- Sauces & Condiments

- Jams & Jellies

- Snacks

- Edible Oil

- Processed Food Materials

The meat, poultry, and seafood sector is the largest application area for smart food packaging, driven by stringent food safety regulations and the need for extended shelf life. This segment benefits from technologies such as Modified Atmosphere Packaging (MAP), vacuum packaging, and antimicrobial coatings, ensuring freshness and reducing spoilage risks. Smart sensors and indicators provide real-time tracking of temperature and spoilage levels, crucial for maintaining cold chain integrity. Rising demand for protein-rich diets and growing e-commerce food sales are accelerating adoption. Consumer concerns about contamination and transparency in supply chains further boost demand for intelligent labeling and traceability solutions. The expansion of processed and frozen meat products, coupled with sustainability efforts in packaging, is reshaping market dynamics in this category.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the smart food packaging market with a 37.5% share in 2024, driven by advanced technological adoption, strict food safety regulations, and consumer demand for convenience and sustainability. The region's food industry is highly developed, with major investments in active and intelligent packaging solutions, including RFID tracking, smart labels, and antimicrobial coatings. The region dominates due to strong retail infrastructure, e-commerce growth, and heightening consumer awareness regarding food quality and waste reduction. Canada and Mexico are also witnessing significant growth due to expanding food exports and regulatory compliance. Rising concerns over plastic waste are pushing innovation in biodegradable and recyclable materials. The region's leadership in IoT and cloud-based food monitoring systems further strengthens its position in the global smart food packaging market.

Key Regional Takeaways:

United States Smart Food Packaging Market Analysis

The U.S. smart food packaging market is highly in demand as technology and the consumer are continually advancing. Increasingly, consumers want packaging that not only offers convenience but also extends the shelf life of products and provides instantaneous information about product quality. Freshness indicators, time-temperature indicators, and RFID tags have become indispensable to ensure safety for perishable goods. The US food market is shifting its preference towards Smart packaging for very strict safety levels on foods due to government rulings. Boosting advocacy towards sustainability where the focus on developing sustainable packing ideas and consumer willingness towards adopting these environmentally friendly packs into the consumer end have gained emphasis. Further amplified online commerce also propelled needs of durable robust secure packages ensuring deliveries to reach consignee with wholesome foods. The United States will continue to be a leading market for innovative smart food packaging, largely due to consumer preference for quality, convenience, and sustainability.

Europe Smart Food Packaging Market Analysis

Europe is one of the leading regions globally in smart food packaging owing to increased regulation concerning food safety, growing concern for sustainability by consumers, and technological advancements. Consumers from Europe are especially concerned about food quality, and packaging solutions that offer monitoring of fresh servings, temperature, and shelf life in real time are gaining popularity. The region's escalated focus on sustainability has also inspired the use of biodegradable films and recycling-friendly packaging, among others. The European region is also expected to grow based on the rising trends of IoT enabled packaging for more transparent supply chains as well as better traceability in products. A high standard for safe food packaging safety has been required by regulatory authorities such as the EFSA. Europe is apt to continue its powerful growth in smart food packaging following the rise in online food retail and changing consumer habits.

Asia Pacific Smart Food Packaging Market Analysis

The Asia Pacific region is expected to see significant growth in the smart food packaging market due to rapid urbanization, changing lifestyles, and an increasing demand for packaged food products. The rise of e-commerce and modern retail channels has boosted the need for secure, convenient packaging that maintains food quality during transportation. Manufacturers from China, India, and Japan are major leaders of the market in these regions, opting for smart packaging solutions for ensuring improved safety and quality, better shelf life, and minimized waste. Regional food safety concerns, coupled with traceability demands, drive RFID and QR codes with time-temperature indicators in various markets. This trend has led to greater consciousness among the environment towards a reduction in greenhouse emissions. The Asia Pacific market is also registering a high demand for ready-to-eat and processed foods, propelling the demand for advanced packaging technologies ensuring freshness and quality.

Latin America Smart Food Packaging Market Analysis

The Latin American market for smart food packaging is currently growing steadily on account of surging consumer demands for food safety, convenience, and quality preservation. With growth in disposable income and urbanization, consumers will highly opt for packaged and processed foods, propelling the requirement for innovative solutions in packaging. Packers in Brazil, Mexico, etc. are focusing on smart packages, which feature freshness indicators and RFID tags plus temperature-sensitive labeling, to avoid deterioration of packed products and therefore enhance shelf-life. E-commerce business, food-delivery services too are adding force to the ever-growing demand of guaranteeing secure conveyance and preservation of food packs. This, on the other hand, Latin American consumers are now becoming environmentally conscious, making them encourage the adoption of sustainable packaging by manufacturers, thus using biodegradable and recyclable materials. Therefore, with continued growth in the Latin American economy, the demand for advanced functional solutions in food packaging is going to impel.

Middle East and Africa Smart Food Packaging Market Analysis

In the Middle East and Africa, growth is seen to be quite large for the smart food packaging market due to rapid urbanization, growing disposable incomes, and shifting consumer preferences. Rapid population growth along with a shift towards modern retail have led to the increasing demand for packaged foods in countries like the UAE, Saudi Arabia, and South Africa. Heightened awareness among the consumers regarding food safety, demand for smart packaging technologies offering real-time monitoring, temperature control, and extended shelf life, emphasis on sustainability across the region and utilization of environment-friendly materials with recyclable packaging, and new food safety regulations driving the application of smarter safer packaging solutions for the manufacturers contribute to the market in the Middle East and Africa. As e-commerce is on the rise in the region, the need for packaging that would ensure product quality during transit is on the rise, further fueling the growth of the smart food packaging market in the MEA region.

Competitive Landscape:

Smart food packaging is continuously innovated upon by the newness of technology emerging in this area. The smart food packaging market focuses on providing advanced solutions regarding safety, extended shelf life, and lesser food waste. The competition here is quite dynamic as well as aggressive as participants invest a significant amount in R&D in relation to including emergent technologies, like RFID, time-temperature indicators, and sensors in packaging material. These innovations help monitor food quality and ensure the integrity of products through the supply chain. Besides technology, sustainability is a key driver, with companies intensely adopting eco-friendly materials such as biodegradable films and recyclable packaging. The market also witnesses strategic collaborations between packaging companies, food manufacturers, and technology providers to deliver integrated solutions that meet the growing demand for smarter, safer packaging. As competition increases, companies are focusing on improving operational efficiencies and expanding their product offerings to cater to the diverse needs of the food industry.

The report provides a comprehensive analysis of the competitive landscape in the smart food packaging market with detailed profiles of all major companies, including:

- Amcor plc

- Sealed Air

- Berry Global Inc.

- THE TETRA LAVAL GROUP

- Mondi Group

- Toyo Seikan Group Holdings, Ltd.

- Crown

- 3M

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Multisorb

- Huhtamäki Oyj

- Checkpoint Systems, Inc.

Latest News and Developments:

- In November 2024, Sealed Air and Bradbury’s Cheese unveiled the CRYOVAC AutoWrap Lite, a groundbreaking packaging system that reduces plastic use by 65%. The innovative solution extends product shelf life to nearly 100 days, enhances productivity, and eliminates the need for costly gases, marking a significant advancement in sustainable packaging.

- In May 2024, Amcor introduced its "Bottles of the Year" program, recognizing innovative, sustainable packaging designs across beverage, food, and healthcare sectors. The initiative highlights consumer trends such as sustainability, convenience, and personalization, further solidifying Amcor's leadership in packaging innovation and responsible design.

- In March 2024, Berry Global and Mitsubishi Gas Chemical Company, Inc. launched a new recyclable barrier solution using MXD6 resin for food packaging. This innovation, recognized by the Association of Plastics Recyclers (APR), offers improved recyclability, extends shelf life, and reduces food and plastic waste, aligning with sustainability goals.

Smart Food Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Active Packaging, Controlled Packaging, Modified Atmosphere Packaging, Others |

| Materials Covered | Plastic, Paper, Metal (Steel), Glass |

| Functionalities Covered | Barrier Protection, Moisture & Gas Control, Temperature Regulation, Food Safety Monitoring, Shelf Life Extension, Product Authentication, Others |

| Technologies Covered | Time Temperature Indicators (TTI), Freshness Indicators, Oxygen & Carbon Dioxide Indicators, Barcode Labels, RFID Tags, QR Code Labels |

| Applications Covered | Meat, Poultry & Seafood, Fruits & Vegetables, Dairy Materials, Bakery & Confectionery, Sauces & Condiments, Jams & Jellies, Snacks, Edible Oil, Processed Food Materials |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Brazil, Mexico |

| Companies Covered | Amcor plc, Sealed Air, Berry Global Inc., THE TETRA LAVAL GROUP, Mondi Group, Toyo Seikan Group Holdings, Ltd., Crown, 3M, MITSUBISHI GAS CHEMICAL COMPANY, INC., Multisorb, Huhtamäki Oyj, Checkpoint Systems, Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart food packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart food packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart food packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart food packaging market was valued at USD 30.36 Billion in 2024.

IMARC Group estimates the market to reach USD 51.74 Billion by 2033, exhibiting a CAGR of 5.60% from 2025-2033.

The smart food packaging market is driven by increasing demand for food safety, extended shelf life, and real-time quality monitoring. Rising consumer awareness, stringent food regulations, and advancements in active and intelligent packaging technologies further boost growth. The adoption of IoT, RFID, and QR code labels enhances traceability, while sustainability concerns drive innovation in eco-friendly packaging solutions.

North America currently dominates the market fueled by the adoption of advanced technologies, stringent food safety regulations, and growing consumer demand for convenience and sustainability.

Some of the major players in the smart food packaging market include Amcor plc, Sealed Air, Berry Global Inc., THE TETRA LAVAL GROUP, Mondi Group, Toyo Seikan Group Holdings, Ltd., Crown, 3M, MITSUBISHI GAS CHEMICAL COMPANY, INC., Multisorb, Huhtamäki Oyj, Checkpoint Systems, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)