Smart Farming Market Size, Share, Trends and Forecast by Agriculture Type, Software, Service, Solution, Application, and Region 2025-2033

Smart Farming Market Size and Share:

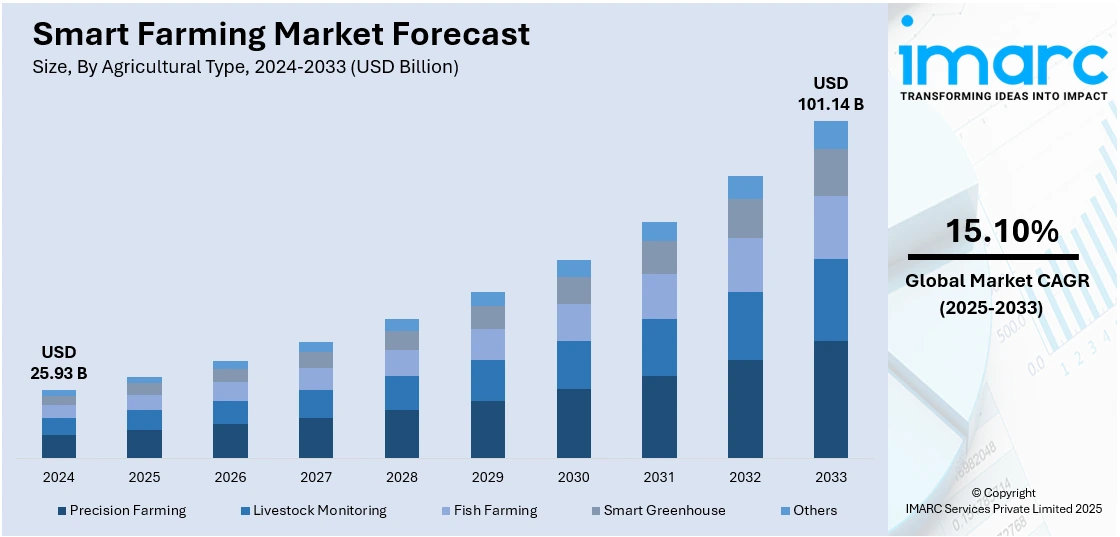

The global smart farming market size was valued at USD 25.93 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 101.14 Billion by 2033, exhibiting a CAGR of 15.10% during 2025-2033. North America currently dominates the market, holding a significant market share of over 43.7% in 2024. The market is expanding due to rising demand for precision agriculture, AI-based crop monitoring, and IoT-integrated systems. Moreover, labor shortages, sustainability goals, and growing investments in automation, and connected farm technologies across diverse agricultural landscapes are impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.93 Billion |

| Market Forecast in 2033 | USD 101.14 Billion |

| Market Growth Rate 2025-2033 | 15.10% |

The growing integration of artificial intelligence, Internet of Things (IoT), and sensor-based technologies is shaping the smart farming industry globally. Increasing concerns to enhance agricultural output while minimizing environmental impact is pushing farms to adopt automated systems for irrigation, fertilization, and crop monitoring. These systems enable real-time decision-making, improve input efficiency, and optimize labor management. For instance, in February 2025, Thailand launched the HandySense B-Farm platform, developed by NECTEC, integrating AI, IoT, and smart sensors to improve production accuracy, reduce waste, and raise incomes through digitized farm management. This development reflected a broader trend of digitization aimed at boosting sustainability and competitiveness, especially in high-value crop segments, further inducing the market growth.

The United States stands as a pivotal market for smart agriculture, with recent policy shifts expected to realign sector dynamics. The focus on farm-level productivity over abstract climate targets is expected to stimulate demand for data-driven platforms, precision equipment, and affordable automation. In April 2025, the USDA discontinued its USD 3.1 Billion Climate-Smart Commodities program due to inefficiencies and rebranded it as the Advancing Markets for Producers Program, mandating that at least 65% of funds reach farmers directly. This reorientation is poised to drive technology adoption by channeling resources into practical, market-oriented solutions. As U.S. farmers gain better access to funding for tangible improvements, the market is likely to see increased uptake of smart irrigation systems, GPS-guided machinery, and AI-supported crop management tools that deliver measurable returns. This shift supports a broader trend toward decentralizing innovation and empowering growers with technology that directly impacts profitability and sustainability.

Smart Farming Market Trends:

Integration of Advanced Connectivity Infrastructure

The expansion of high-speed, low-latency connectivity solutions is accelerating the adoption of digital tools in agriculture. 5G infrastructure, in particular, is enabling real-time data transmission and control of farming operations such as irrigation, fertilization, and crop monitoring. This has opened up new possibilities for automated field equipment and remote monitoring systems, offering farmers increased accuracy and reduced operational delays. Enhanced connectivity also facilitates large-scale data collection and remote support, leading to more precise decision-making. In December 2024, Turkey launched the 5G Smart Agriculture Project in Çorum, executed by Turk Telekom and ZTE, integrating drones and automated tools using a pilot 5G network. The initiative significantly improved spraying, irrigation, and fertilization tasks while reinforcing sustainability and digital transformation in farming practices. Such deployments demonstrate how high-speed networks can support smart agriculture by allowing devices and machines to operate in sync. As these technologies scale, they enable precision-based resource management, reducing input waste and increasing yield output, thereby promoting long-term cost savings and sustainability.

Collaborative Innovation in Cross-Border Ag-Tech

Cross-border research and collaboration are becoming key factors in accelerating smart farming development globally. Partnerships between academic institutions, agri-tech companies, and government agencies are allowing technology sharing, pilot deployments, and scaling of regional solutions. These collaborations foster innovation in weed control, crop monitoring, and smart machinery, aligning efforts toward improving food security and sustainability. This type of cooperation encourages interoperability and supports the development of adaptable tools for diverse farming environments. In June 2024, the Interreg Smart Farming & Food Processing program launched seven innovation projects in Flanders and the Netherlands, focusing on AI-based weed control, solar-powered farming tools, and robotics. These projects strengthened cross-border cooperation and promoted sustainable agri-tech adoption. The presence of shared goals and co-funded initiatives enhances the viability of advanced technologies that small- and mid-sized farms can adopt without bearing the full cost of innovation. As a result, innovation ecosystems are emerging across Europe and other regions, pushing the global smart farming market toward greater standardization, reduced implementation risk, and broader adoption of precision farming practices across regional boundaries.

AI-Driven Automation for Crop Efficiency

Artificial intelligence is playing an increasingly central role in automating core agricultural activities. By combining machine learning with real-time data from sensors and remote systems, AI platforms can optimize tasks such as irrigation, fertilization, pest control, and yield forecasting. This results in lower input use, better resource planning, and improved crop outcomes. AI-based automation also helps address labor shortages and improves operational scalability for both large farms and specialty crop producers. In May 2024, NEC X invested in Canadian tech startup Verdi to expand its AI-powered farm automation platform. Integrated with NEC’s CropScope initiative, the partnership enhanced smart irrigation and sustainable crop production while reducing technology adoption costs for farmers globally. This development reflects how AI-enabled tools are moving beyond pilot stages into mainstream use, supporting large-scale decision-making in agriculture. As AI algorithms improve and become more accessible through user-friendly platforms, they will further enable data-driven agriculture that adapts to specific field conditions.

Smart Farming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart farming market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on agriculture type, software, service, solution, and application.

Analysis by Agricultural Type:

- Precision Farming

- Livestock Monitoring

- Fish Farming

- Smart Greenhouse

- Others

In 2024, precision farming led the smart farming market, accounting for 40.6% of the total market share, driven by increased demand for optimized crop yields and efficient input use. Technologies like GPS-based guidance, variable rate application, and remote sensing enabled farmers to monitor field variability and apply resources only where needed. This not only minimized waste but also improved profitability and sustainability. Adoption surged in countries like the U.S., Germany, and Japan, where large-scale farms justified high-tech investments. Companies such as Trimble and Deere & Company expanded offerings like yield mapping and soil sampling tools, which accelerated market uptake. Government support programs and agricultural subsidies in North America and Europe further pushed farmers to adopt precision practices, making it the most dominant Segment.

Analysis by Software:

- Web Based

- Cloud Based

In 2024, web based segment led the smart farming market, accounting for 55.7% of the total market share, driven by ease of access, scalability, and real-time data availability. Farmers increasingly use cloud platforms for remote farm monitoring, predictive analytics, and decision-making. Web portals allowed seamless integration of sensor data, drone imagery, and farm machinery analytics on a single dashboard. Platforms like Climate FieldView and Ag Leader offered user-friendly interfaces that improved field operations management. Also, web-based systems reduced dependency on high-end local infrastructure, making them more cost-effective for small and mid-sized farms. With rising internet penetration across rural areas and growing smartphone use, particularly in Asia-Pacific and Latin America, web-based smart farming solutions gained rapid traction.

Analysis by Service:

- System Integration and Consulting

- Support and Maintenance

- Connectivity Services

- Managed Services

- Professional Services

In 2024, system integration and consulting led the smart farming market, fueled by the complexity of implementing multi-technology smart farming setups. Farmers and agribusinesses required guidance in aligning hardware like sensors, drones, and IoT devices with software platforms and data systems. Service providers like IBM, Accenture, and Bosch offered tailored solutions that combined farm management systems with automation, AI models, and cloud infrastructure. This support helped reduce setup errors and maximized ROI on tech investments. Additionally, consulting services played a key role in training end-users and ensuring smooth digital transitions. Demand is especially strong in high-value crop areas such as vineyards in California and greenhouses in the Netherlands, where precision was essential, and tech deployments were more advanced.

Analysis by Solution:

- Network Management

- Agriculture Asset Management

- Supervisory Control and Data Acquisition

- Logistics and Supply Chain Management

- Smart Water Management

- Others

Network management is a key driver in the smart farming sector, enabling seamless communication between devices, sensors, and farm equipment. As farms adopt IoT-based systems, managing data traffic and maintaining connectivity across large areas becomes critical. Technologies like LoRaWAN and NB-IoT help monitor soil, weather, and crop conditions in real-time. Also, broad-acre farms use advanced network management systems to integrate GPS-guided machinery with centralized data platforms, improving operational control and reducing downtime during critical farming operations.

Agriculture asset management supports the smart farming market by helping farmers track machinery, tools, and livestock digitally. Using RFID tags, GPS trackers, and mobile apps, farm owners can monitor equipment health, schedule maintenance, and manage resource allocation efficiently. This reduces unplanned breakdowns and increases the lifespan of assets. Dairy farms in New Zealand use asset management tools to monitor cow movements, feed schedules, and milking machinery.

SCADA systems drive smart farming by providing centralized monitoring and control over critical farm processes like irrigation, temperature regulation, and nutrient delivery. These systems collect real-time data from sensors and actuators, enabling timely interventions and automation. In greenhouse operations in the Netherlands, SCADA enables precision in climate control and fertigation, ensuring consistent crop growth. By minimizing manual errors and optimizing system performance, SCADA contributes to yield improvement and resource savings across diverse agricultural environments.

Logistics and supply chain management enhance farm-to-market efficiency by enabling real-time tracking of harvested crops, livestock, and inputs. Digital platforms integrate GPS, blockchain, and fleet tracking to reduce spoilage, theft, and delays. For example, cold chain logistics for perishable produce in India now use sensor-equipped containers that maintain temperature and humidity levels.

Smart water management systems support the smart farming market by optimizing irrigation through moisture sensors, automated valves, and weather forecasting tools. These systems help conserve water while ensuring crops receive precise hydration. In California, vineyards use smart drip irrigation networks controlled by IoT dashboards, adjusting flow based on soil moisture levels. By minimizing overwatering and improving plant health, these systems contribute to higher yields and reduced resource usage.

The others category includes innovations like crop spraying drones, autonomous harvesters, and weather prediction systems that don’t fall into standard classifications but play a growing role in smart farming. For instance, AI-powered pest detection systems in China use high-resolution imagery to spot infestations early, triggering alerts and treatment protocols. These technologies fill operational gaps, offering solutions for niche or emerging needs and expanding the overall capabilities of smart farming practices.

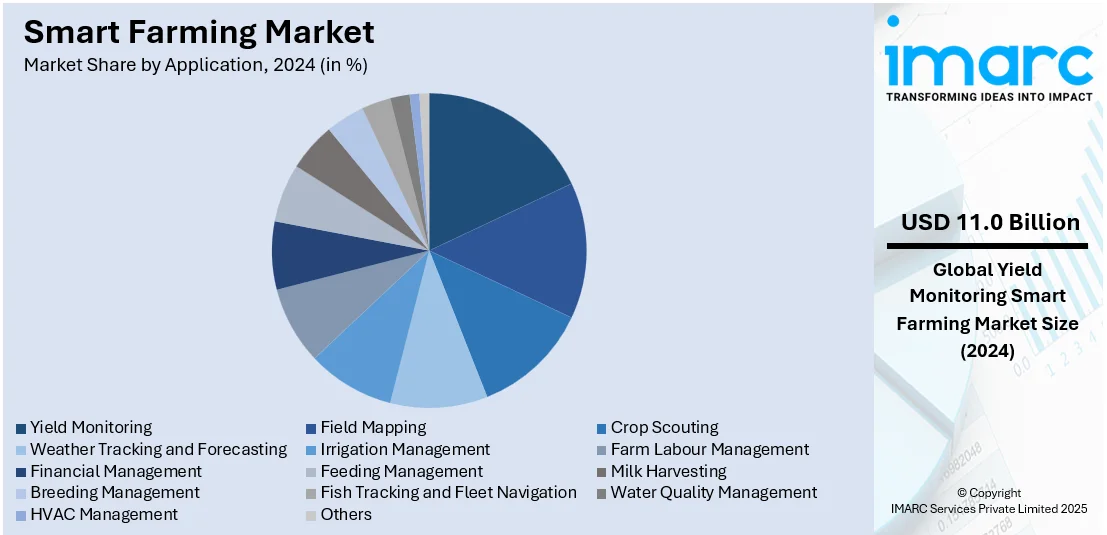

Analysis by Application:

- Yield Monitoring

- Field Mapping

- Crop Scouting

- Weather Tracking and Forecasting

- Irrigation Management

- Farm Labour Management

- Financial Management

- Feeding Management

- Milk Harvesting

- Breeding Management

- Fish Tracking and Fleet Navigation

- Water Quality Management

- HVAC Management

- Others

In 2024, yield monitoring led the smart farming market, accounting for 42.5% of the total share, supported by its critical role in data-driven agriculture. This technology enabled farmers to track crop output across fields using sensors, GPS, and combine harvesters equipped with onboard computers. The collected data allowed post-harvest analysis to identify productivity patterns and optimize planting strategies. High adoption was seen in North America and Europe, where companies like Ag Leader and CNH Industrial provided advanced yield sensors. The rise in demand for real-time harvest data in cereal and corn production areas further pushed growth.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America dominated the smart farming market with a 43.7% share, driven by large-scale mechanized agriculture, high technology penetration, and strong policy support. The U.S. and Canada led the adoption of GPS-based systems, autonomous tractors, and satellite-based field mapping. Major players like John Deere and Trimble launched integrated farm management solutions tailored for U.S. corn, soybean, and wheat growers. Government initiatives such as the USDA’s Precision Agriculture Loan Program also encouraged widespread deployment. Additionally, tech-savvy farmers embraced digital tools for livestock tracking, irrigation control, and yield forecasting. High investment capacity and well-established agricultural infrastructure supported pilot projects in AI and robotics, making the region a front-runner in deploying advanced smart farming models.

Key Regional Takeaways:

United States Smart Farming Market Analysis

In 2024, United States accounted for 81.50% of the market share in North America. The smart farming market in this region is gaining momentum due to the increasing demand for precision and efficiency in agriculture. Farmers are adopting technologies like AI, machine learning, autonomous machinery, and data-driven solutions to manage inputs and boost productivity. In August 2024, AGCO showcased advanced smart farming solutions at the Farm Progress Show in Iowa, introducing innovations such as Fendt's ErgoSteer and AutoDock, Precision Planting’s Radicle Agronomics, and PTx Trimble’s autonomous OutRun grain cart. These solutions enhanced the use of retrofit systems, enabling farmers to modernize existing equipment without complete replacements. Rising awareness of environmental sustainability is also encouraging the shift from traditional practices to smart methods that help reduce waste and resource use. Government incentives supporting digital agriculture tools and private investment in agri-tech startups further contribute to the sector's growth. Furthermore, the integration of real-time analytics and satellite monitoring is providing actionable insights for improving crop yield and minimizing loss.

Europe Smart Farming Market Analysis

Smart farming in Europe is evolving rapidly, backed by strong policy support, sustainability goals, and the need to address workforce shortages in agriculture. Farmers and agribusinesses are embracing automation, robotics, and digital platforms to meet the continent’s environmental targets and productivity expectations. In April 2025, the EU-funded AgRibot project advanced smart farming across Europe by introducing robotics, AR/XR, and 5G for tasks such as precision spraying and harvesting. These systems demonstrated their ability to reduce pesticide use by 85% and improve resource utilization, significantly reshaping how agriculture operates across diverse environments. The European Union’s Green Deal and Common Agricultural Policy reforms are acting as key drivers, pushing for eco-friendly solutions and digital integration on farms. The region is also seeing increased collaboration among universities, research institutes, and tech companies to develop scalable agri-tech solutions. There is a strong emphasis on reducing the carbon footprint and enhancing traceability of food products, making smart farming technologies essential.

Asia Pacific Smart Farming Market Analysis

The smart farming market in the Asia Pacific region is expanding steadily due to the need for higher productivity, efficient resource usage, and improved rural incomes. Many countries in the region are shifting from traditional farming methods to tech-enabled practices due to growing population pressure and limited arable land. In September 2024, India approved a INR 6,000 Crore investment under the MIDH scheme to promote precision farming using AI, drones, IoT, and data analytics. Covering 15,000 acres and involving 60,000 farmers, this initiative aimed to enhance yields, reduce environmental impact, and adapt innovations to local conditions. This reflects a wider regional focus on increasing food security and sustainability through the adoption of smart technologies. Governments across the Asia Pacific are actively promoting digital agriculture through funding, pilot programs, and public-private partnerships. The rise of agri-tech startups and increasing mobile internet penetration are also enabling smallholders to access real-time information, weather updates, and market trends. Precision irrigation, automated seeding, and pest control systems are becoming more common, especially in countries like Japan, China, and Australia.

Latin America Smart Farming Market Analysis

Latin America’s smart farming market is witnessing growth driven by the need to improve yields, manage large-scale farms efficiently, and reduce the environmental impact of agricultural activities. The region’s diverse climates and crop patterns demand adaptive and scalable technologies. In August 2024, Solinftec, a Brazil-based company, launched a solar-powered, autonomous docking station for its Solix Ag Robot at the Farm Progress Show in Iowa. This development enabled round-the-clock operations and cut herbicide use by up to 95%, showcasing the potential for tailored AI-driven field management. Countries like Brazil, Argentina, and Chile are investing in automation, drones, soil sensors, and farm management platforms to optimize operations. Moreover, integration of AI and machine learning in crop monitoring is helping farmers make timely decisions and improve output quality. Moreover, rising export demands and compliance requirements are prompting the use of traceability solutions across the value chain. Access to international funding and collaboration with global agri-tech firms is also helping Latin American producers modernize their agricultural systems.

Middle East Smart Farming Market Analysis

Smart farming is emerging as a key driver in the Middle East’s efforts to ensure food security, optimize water use, and overcome challenges posed by arid climates. The region is investing in advanced technologies like hydroponics, controlled environment agriculture, and AI-based crop management. In January 2025, Saudi agritech startup Arable secured USD 2.55 Million in Seed funding to expand hydroponic vegetable farming customized for desert conditions. The startup’s approach reduced setup costs, shortened deployment time, and lowered operational expenses, aligning with Saudi Arabia’s Vision 2030. Countries across the region are increasingly supporting innovation in agriculture to reduce dependence on food imports and strengthen local production. Government-led initiatives and favorable regulations are driving private sector interest in digital agriculture and sustainable farming systems. Water-saving irrigation, smart greenhouses, and climate-adaptive crop systems are gaining traction, especially in the UAE, Saudi Arabia, and Qatar.

Africa Smart Farming Market Analysis

Africa’s smart farming market is growing as governments and private players work to modernize agriculture, improve food security, and build climate resilience. The continent faces challenges such as low mechanization, unpredictable weather, and fragmented supply chains, which create opportunities for technology-driven solutions. In October 2024, AgraME in Dubai showcased smart farming innovations and regenerative agriculture practices, with strong participation from African stakeholders. The event highlighted Africa’s rising demand for animal products and emphasized regional collaboration to drive sustainable tech adoption. Many African countries are now prioritizing digital tools for soil health monitoring, pest control, and precision irrigation. The increased availability of affordable smartphones and internet connectivity is enabling farmers to access real-time data, financial services, and advisory support. Donor agencies and development partners are also funding pilot projects and scaling models that prove effective, positively influencing the market.

Competitive Landscape:

The market is experiencing rising competition as companies scale up technology deployment, enhance automation systems, and invest in climate-resilient practices to meet growing global agricultural demands. Businesses are prioritizing AI-powered platforms, data-driven decision tools, and precision farming solutions to support diverse applications in crop monitoring, irrigation, and resource optimization. Strategic partnerships, R&D in digital tools, and regional market expansion are also playing a key role in shaping industry progress.

The report provides a comprehensive analysis of the competitive landscape in the smart farming market with detailed profiles of all major companies, including:

- Grownetics, Inc.

- AG Leader Technology

- AGCO Corporation

- AgJunction Inc. (Kubota Corporation)

- Deere & Company

- Farmers Edge Inc.

- Trimble Inc.

- Granular Inc. (Corteva Inc.)

- Gamaya

- DICKEY-john

- CropMetrics LLC (CropX inc.)

- CLAAS KGaA mbH

- Raven Industries Inc. (CNH Industrial N.V.)

Latest News and Developments:

- April 2025: Europe advanced smart farming through the Euro 4.97 Million AgRibot initiative, joined by Denmark’s AgriRobot. The project deployed autonomous systems for weed control, spraying, harvesting and pruning, addressing labor shortages and safety concerns while boosting precision, sustainability, and automation in European agriculture.

- March 2025: Sri Lanka advanced climate-smart agriculture through the GeoGoviya platform. Integrating geospatial analytics, real-time climate data, and farmer registries, it improved crop management, reduced duplication in financial aid, and empowered 1.42 Million farmers with tailored insights for resilient, data-driven farming decisions.

- February 2025: Yamaha Motor launched Yamaha Agriculture Inc. to advance precision farming for specialty crops. By integrating AI, robotics, and real-time analytics, including technologies from Robotics Plus and The Yield, the initiative supported automation, efficiency, and sustainability across North America, Australia, and New Zealand.

- February 2025: South Korea launched its first five-year master plan (2025–2029) to scale smart farming nationwide. The plan targeted converting 35% of greenhouses into smart farms, boosting education, easing regulations, and creating innovation clusters, driving workforce resilience and technological competitiveness in agriculture.

- January 2025: Full Nature Farms launched the Rocket 2.0 Smart Irrigation Platform, integrating AI and sensors to cut water waste and boost yields. Awarded at CES 2025, the platform supported global expansion in Hong Kong, Saudi Arabia, the UK, and North America, advancing irrigation efficiency.

- August 2024: IMCD Malaysia and Urban Farm Tech launched the Smart Farm Project at JEPS, integrating IoT-based hydroponics into school education. Spanning 2,000 sq ft with 6,000 plants, the initiative promoted sustainability, entrepreneurship, and smart farming awareness among students and the local community.

- May 2024: New Holland showcased its TT3.50 tractor with integrated FieldOps farm management platform and advanced autosteer solutions at AGRITECHNICA ASIA in Bangkok. The launch supported precision agriculture adoption in Southeast Asia, boosting productivity, real-time data access, and sustainable farming practices.

Smart Farming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Agricultural Types Covered | Precision Farming, Livestock Monitoring, Fish Farming, Smart Greenhouse, Others |

| Softwares Covered | Web Based, Cloud Based |

| Services Covered | System Integration and Consulting, Support and Maintenance, Connectivity Services, Managed Services, Professional Services |

| Solutions Covered | Network Management, Agriculture Asset Management, Supervisory Control and Data Acquisition, Logistics and Supply Chain Management, Smart Water Management, Others |

| Applications Covered | Yield Monitoring, Field Mapping, Crop Scouting, Weather Tracking and Forecasting, Irrigation Management, Farm Labour Management, Financial Management, Feeding Management, Milk Harvesting, Breeding Management, Fish Tracking and Fleet Navigation, Water Quality Management, HVAC Management, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Grownetics, Inc., AG Leader Technology, AGCO Corporation, AgJunction Inc. (Kubota Corporation), Deere & Company, Farmers Edge Inc., Trimble Inc., Granular Inc. (Corteva Inc.), Gamaya, DICKEY-john, CropMetrics LLC (CropX inc.), CLAAS KGaA mbH, Raven Industries Inc. (CNH Industrial N.V.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart farming market from 2019-2033.

- The smart farming market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart farming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart farming market was valued at USD 25.93 Billion in 2024.

The smart farming market is projected to exhibit a CAGR of 15.10% during 2025-2033, reaching a value of USD 101.14 Billion by 2033.

Key factors driving the smart farming market include rising food demand, labor shortages, precision agriculture adoption, IoT integration, climate change adaptation, government support, data-driven decisions, and cost-efficient farming practices.

In 2024, North America dominated the smart farming market, accounting for the largest market share of 43.7%. The growth is driven by widespread adoption of precision farming technologies, strong government support, advanced infrastructure, high awareness among farmers, and significant investments in agri-tech startups focusing on automation, data analytics, and IoT solutions.

Some of the major players in the smart farming market include Grownetics, Inc., AG Leader Technology, AGCO Corporation, AgJunction Inc. (Kubota Corporation), Deere & Company, Farmers Edge Inc., Trimble Inc., Granular Inc. (Corteva Inc.), Gamaya, DICKEY-john, CropMetrics LLC (CropX inc.), CLAAS KGaA mbH, and Raven Industries Inc. (CNH Industrial N.V.).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)