Smart Factory Market Size, Share, Trends and Forecast by Field Devices, Technology, End Use Industry, and Region, 2025-2033

Smart Factory Market Size and Share:

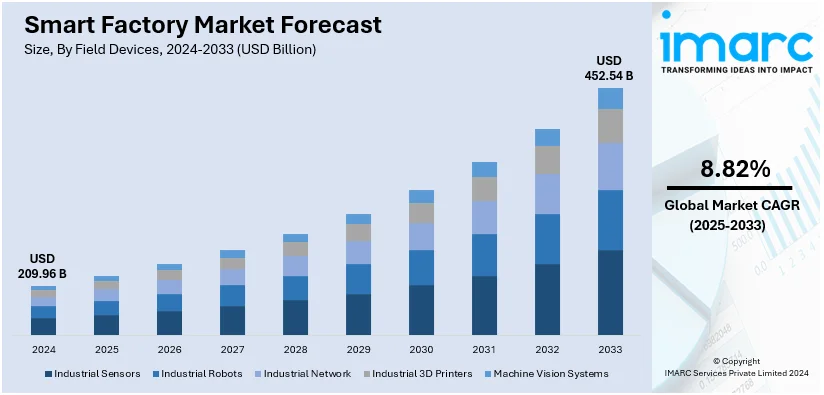

The global smart factory market size was valued at USD 209.96 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 452.54 Billion by 2033, exhibiting a CAGR of 8.82% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 45.5% in 2024. The increasing demand for industrial automation, the rising adoption of refurbished industrial robots and radio frequency identification (RFID) systems, and the growing integration of connected devices with cloud computing, artificial intelligence (AI), and the Internet of Things (IoT) are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 209.96 Billion |

|

Market Forecast in 2033

|

USD 452.54 Billion |

| Market Growth Rate 2025-2033 | 8.82% |

The global market is propelled by the rising need for operational efficiency and cost reduction in manufacturing. Similarly, the growing adoption of Industrial Internet of Things (IIoT) technologies enabling real-time monitoring, data-driven decision-making, and predictive maintenance, is providing an impetus to the market. For instance, on July 18, 2024, LG Electronics accelerated its smart factory business by integrating AI with 66 years of manufacturing expertise. Through its Production Engineering Research Institute (PRI), LG offers solutions such as Digital Twin technology, autonomous robots, and generative AI, targeting industries like semiconductors and pharmaceuticals with ambitious multi-trillion KRW growth goals by 2030. Additionally, the demand for sustainable, energy-efficient manufacturing solutions and scalable robotics integration continues to drive market expansion.

The United States is a key regional market and is growing due to the need for resilient supply chains and agile manufacturing to optimize production and respond to market shifts. An industry report highlights that 86% of U.S. manufacturers consider smart factories as key to competition by 2025, although only 16% currently have real-time visibility into operations. Smart factories enhance asset efficiency by 20%, improve product quality by 30%, and reduce costs by 30%. Furthermore, the steady adoption of real-time data analytics, cloud computing, and Industry 4.0 technologies is driving better decision-making and operational transparency. Government support for advanced manufacturing and the demand for customized products further propel growth in the market. Additionally, the growing focus on workforce safety, skill development, and cybersecurity integration ensures reliable operations and accelerates smart factory adoption across industries.

Smart Factory Market Trends:

Widespread Acceptance of the Industrial Internet of Things (IIoT)

The advent of the Industrial Internet of Things (IIoT) is a significant driver for the growth of the smart factory market. IIoT refers to the network of interconnected devices, sensors, and machines within the industrial setting, enabling data collection, analysis, and sharing in real-time. This connectivity and data exchange revolutionize traditional manufacturing processes and contribute to the development of smart factories. By leveraging IIoT, smart factories can achieve enhanced visibility, control, and optimization of their operations. Connecting and monitoring various devices and equipment in real-time allows for improved efficiency, predictive maintenance, and reduced downtime. According to Huawei Technologies, 5G wireless technology could revolutionize manufacturing, driving growth valued at over USD 740 billion by 2030, approximately 4% of global manufacturing GDP. Its advanced real-time connectivity and data communication capabilities are critical for enabling Industrial Internet of Things (IIoT) applications and smart factories. IIoT enables seamless data integration from different systems, providing valuable insights for better decision-making and process optimization. Moreover, the adoption of IIoT in smart factories also enables the integration of cyber-physical systems, creating a seamless connection between the physical production environment and the digital world. This integration facilitates better coordination, collaboration, and synchronization of processes, leading to increased agility, flexibility, and responsiveness to changing market demands.

Rising Adoption of Smart Factory Solutions

The growing adoption of smart factory solutions for manufacturing intricate automotive and medical components is a majorly contributing to the smart factory market. These industries have complex production requirements, demanding high precision, quality, and efficiency, which smart factory technologies can effectively address. In the automotive sector, smart factories enable seamless integration of automation, robotics, and advanced analytics to optimize manufacturing. This integration enhances productivity, reduces errors, and ensures consistent quality in producing intricate automotive components. In fact, the automotive industry has aggressive plans to convert an additional 44% of its factories into smart facilities over the next five years, according to industry reports. Smart factories also facilitate real-time monitoring of equipment, inventory management, and supply chain optimization, enabling automotive manufacturers to meet the growing demands of the industry efficiently. Similarly, the medical industry requires precise manufacturing processes for intricate components such as medical devices, implants, and instruments. Smart factory solutions offer advanced automation, intelligent quality control, and real-time analytics, ensuring the highest standards of precision and quality. Moreover, integrating advanced traceability and serialization systems in smart factories helps meet regulatory compliance requirements in the medical field. Additionally, adopting smart factory solutions in these industries improves production efficiency and enables manufacturers to meet stringent quality standards and regulatory requirements. As a result, the demand for smart factory technologies is growing rapidly, thereby driving the overall market.

Growing Focus on Sustainability and Environmental Responsibility

As industries all around the world aim at reducing carbon footprints and opting for environmentally friendly practices, smart factories bring innovations that promote sustainability. They use technologies like IoT, AI, and data analytics to improve energy efficiency while minimizing waste and optimizing resources. Smart factories have the potential to monitor and analyze the real-time consumption of energy so that it becomes easier to point out where exactly the energy-saving measures should be implemented. This reduces the cost of operation and contributes to environmental sustainability through the reduction of greenhouse gas emissions. Moreover, smart factories promote efficient waste management through the application of intelligent systems that monitor and optimize material usage. By minimizing material waste and recycling or reusing materials wherever possible, smart factories reduce environmental impact and contribute to a circular economy. Following this, in February 2023, Emerson combined its power expertise with renewable energy capabilities into the OvationTM Green portfolio, assisting power generation companies in their transition to green energy generation and storage. This expansion includes the integration of Mita-Teknik software with Emerson's Ovation automation platform, enhancing capabilities in renewable energy, cybersecurity, and remote management. In addition, through the adoption of smart factory technology, predictive maintenance is ensured by finding out that machinery and equipment are working efficiently. This pre-emptive approach reduces unprogrammed time, minimizes emergency repairs, and increases equipment life. Reduction of equipment waste and longevity also supports sustainable practices within smart factories

Smart Factory Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart factory market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on field devices, technology, and end use industry.

Analysis by Field Devices:

- Industrial Sensors

- Industrial Robots

- Industrial Network

- Industrial 3D Printers

- Machine Vision Systems

Industrial robots lead the market with around 35.3% of market share in 2024. This is due to the changes they bring in the manufacturing industry through the integration of automation, connectivity, and artificial intelligence. Industrial robots provide various advantages, including increased productivity, enhanced precision, cost savings, and safety. Companies can simplify production processes, optimize workflows, and attain higher efficiency by integrating intelligent robotics into their operations. Industrial robots can carry out repetitive and labor-intensive tasks with consistent accuracy and speed, avoiding human errors and minimizing production downtime. Their ability to work collaboratively with human workers increases productivity. The increasing adoption of industrial robots in smart factories is driving the market by transforming traditional manufacturing processes into agile, intelligent, and interconnected systems. As companies realize that they can gain more productivity and save costs, the demand for industrial robots is expected to increase.

Analysis by Technology:

- Product Lifecycle Management (PLM)

- Human Machine Interface (HMI)

- Enterprise Resource Planning (ERP)

- Manufacturing Execution Systems (MES)

- Distributed Control Systems (DCS)

- Industrial Control System

- Others

Distributed Control Systems (DCS) hold the leading position in the market with around 23.8% of market share in 2024 as DCS provides precise decentralized control and automation of complex manufacturing processes. It improves operational efficiency by integrating the real-time monitoring and control of various production units to enable efficient communication between the machinery, sensors, and human operators. Its modular design ensures scalability, as manufacturers can change their production to meet the changes in demand without having to overhaul systems already in place. DCS also enables sophisticated data analytics and predictive maintenance, which minimizes downtime and optimizes resource usage. As efficiency, safety, and agility take center stage in smart factories, DCS boasts robustness and reliability in the handling of high-volume, intricate operations. Compatibility with emerging technologies such as IoT, AI, and cloud computing further strengthens the system's position in the smart factory ecosystem.

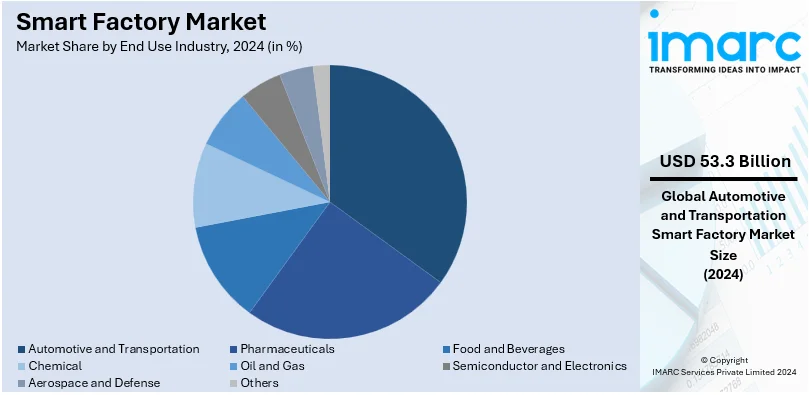

Analysis by End Use Industry:

- Pharmaceuticals

- Food and Beverages

- Chemical

- Oil and Gas

- Automotive and Transportation

- Semiconductor and Electronics

- Aerospace and Defense

- Others

Automotive and transportation lead the market with around 25.4% of market share in 2024. This is as they increasingly embrace smart factory technologies in an effort to make their productions more efficient, reduce costs, and increase product quality. Smart factories help automobile manufacturers render the production processes streamlined and optimize the management of supply chains. Advanced automation, robotics, and data analytics allow seamless operations on the assembly line with increased precision, faster production cycles, and better overall productivity. Smart factories further provide real-time monitoring and predictive maintenance, resulting in reduced time out and the optimal utilization of equipment. There is a fast-growing demand in the automotive and transportation sectors, with electric and autonomous vehicles, for smart factory technology. These are further contributing factors in the development of the efficient production of the EV components and battery systems of the autonomous vehicle, hence the whole market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 45.5% due to the presence of a strong manufacturing base. It has well-established industries, such as automotive, electronics, and consumer goods, actively adopting smart factory technologies. The governments in the region are also actively promoting initiatives to drive industrial automation and digital transformation. They are investing in research and development (R&D), offering subsidies, and implementing supportive policies to encourage the adoption of smart factory technologies. This favorable regulatory environment attracts domestic and foreign investments, further propelling the growth of the market. Furthermore, the region has a strong technological infrastructure and skilled workforce, facilitating the implementation and operation of smart factories. The availability of advanced technologies, such as artificial intelligence (AI), robotics, and the Internet of Things (IoT), also contributes to the growth of the market in Asia Pacific.

Key Regional Takeaways:

United States Smart Factory Market Analysis

In 2024, the United States accounted for 81.70% of the North America smart factory market. The expansion in semiconductor research and development (R&D) is an important catalyst for the United States smart factory market, as these innovations directly enable the integration of advanced technologies such as artificial intelligence, robotics, and IoT in manufacturing. In 2023, in the United States, the semiconductor industry proved its commitment to innovation through a record investment of USD 59.3 Billion into R&D. According to the Semiconductor Industry Association, this allocation shows an increase of only 0.9% compared with 2022. Thus, it marks strategic emphasis on advancing leading-edge technologies.

Semiconductors are the spine of smart factory systems; they power sensors, automation platforms, and real-time data analytics. Consistent investment in R&D develops faster, more efficient, and reliable semiconductor solutions, hence improving the capacity of intelligent factories. The synergy between the advancements in semiconductors and digitalization in manufacturing is pushing smart factory solutions across industries, hence promoting operational efficiencies and innovation in the U.S. industrial framework.

Europe Smart Factory Market Analysis

According to an industry report, the European manufacturing sector is an important entity in the region's economy, incorporating 2.1 million enterprises that employed 30 million people in 2021. With the European Commission now pushing for the adoption of Industry 4.0, demand for smart factory solutions is growing rapidly. Integration of advanced technologies such as robotics, IoT, and AI in production processes are transforming the efficiency, flexibility, and sustainability features.

The shift towards automation will be further sped up by the post-COVID-19 recovery efforts, given that manufacturers prioritize resilience and productivity to mitigate any future disruptions. Recognizing this potential, the major global vendors are expanding their product portfolios in order to address the growing demand for robotic and digital solutions across Europe. The European Commission has been implementing many initiatives to promote digital innovation and energy-efficient manufacturing practices. In this context, smart factory systems are increasingly gaining popularity, cementing Europe's position as the leader in the world's industrial transformation. This should set the basis for robust growth in the market for smart factory systems.

Asia Pacific Smart Factory Market Analysis

The Asia-Pacific region is growing rapidly in the smart factory market, due to rapid industrialization, increased adoption of automation, and supportive government initiatives. India, with an installed power capacity of 442.85 GW as of April 30, 2024, is a key contributor to this growth, according to reports. As per IBEF, the Indian government's push for Industry 4.0 is accelerating the adoption of smart factory technologies. The National Manufacturing Policy, which seeks to increase the share of the manufacturing sector in GDP to 25% by 2025, is setting a favorable environment for the deployment of advanced manufacturing solutions.

In addition, the Production Linked Incentive scheme rolled out in 2022 will take India's core manufacturing sector to global levels. These are pushing digital transformation and adoption of automation technologies across sectors. Efforts from India, coupled with the increasing focus on efficiency and sustainability in the region, are expected to drive overall growth in the Asia-Pacific smart factory market, as per IBEF.

Latin America Smart Factory Market Analysis

Brazil stands out as a key disruptor of the Latin American smart factory market, since the country has major contributions to oil and gas production in the region. The International Trade Association observes that Brazil has the world's largest recoverable ultra-deep oil reserves and that 97.6% of its oil is produced offshore. The country's industrial sector is expected to grow further with the new industrial policy launched in January 2024. The policy sets development goals up to 2033, focusing on developing a sustainable industrial ecosystem through measures such as new financing instruments, including a development credit line for the industrial sector.

Adoption of smart factory technologies is envisaged in these efforts to drive more efficiency, sustainability, and competitiveness. For this reason, modernization of the industrial sector in Brazil is on track to significantly contribute to the expansion of the Latin American smart factory market.

Middle East and Africa Smart Factory Market Analysis

The Middle East and Africa region is likely to grow at a significant pace in the market with rapid industrialization, high demand for automation, and government-supported initiatives. Most of the countries in this region are emphasizing manufacturing sector changeover through digitalization and adoption of advanced technologies. Key players, such as the UAE, Saudi Arabia, and South Africa, are setting an example with their strategic plans in enhancing manufacturing efficiency, sustainability, and innovation.

The United Arab Emirates, for instance, looks at the adoption of smart factory solutions as enhancing industrial output and diversification in the economy as part of the "UAE Vision 2021" goals. Similar ambitions are targeted at Saudi Arabia under "Vision 2030", which strives to modernize the industrial sector with investments into automation and AI technologies. These efforts, combined with the growing need for more sustainable production methods, are creating a favorable environment for the growth of the smart factory market across the Middle East and Africa. As the region moves toward greater digital transformation, it is set to become a key player in the global smart factory landscape.

Competitive Landscape:

The top companies are the leading forces in market growth, based on their innovative solutions and high level of expertise. They are in the lead of developing and implementing advanced technologies in manufacturing processes to revolutionize manufacturing and improve the efficiency of operation. They heavily invest in research and development (R&D) for cutting-edge technology designed specifically for smart manufacturing. Furthermore, they also offer all-round end-to-end solutions involving hardware, software, and services to meet the different requirements of the manufacturing industry. They are customizable and scalable to the particular requirements of each solution so that manufacturers can adapt to the operation of their choice to fulfill their unique workflow and production requirements. Also, leading smart factory companies are globally based and thus partner with other organizations operating in any other type of industry. They develop industry-specific solutions by understanding different specific needs and challenges of different sectors and provide customized support to their clients. Furthermore, these companies contribute to the market growth through strategic partnerships and acquisitions. They seek out opportunities to enhance their product portfolios, technological capabilities, and expand into new markets. These strategic moves strengthen their market position and foster the adoption of smart factory solutions worldwide.

The report provides a comprehensive analysis of the competitive landscape in the smart factory market with detailed profiles of all major companies, including:

- ABB Ltd

- Dassault Systèmes

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- Johnson Controls International

- Microsoft Corporation

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Schneider Electric SE

- Siemens AG

Latest News and Developments:

- November 2024: Schneider Electric officially launched its new smart factory in Dunavecse, Hungary, covering 28,000 m². Here, it will employ up to 500 workers, whose work will contribute to raising the production capabilities by 90% of the new engineering-to-order (ETO) solutions, which will be exported throughout Europe.

- October 2024: ABB Ltd. launched a renewed brand positioning and tagline, "Engineered to Outrun," emphasizing its focus on the pursuit of accelerating electrification and automation in industry. The refreshed branding is to position ABB for leadership in digital transformation, where it would concentrate on developing solutions that can bring about innovation and efficiency and improve sustainability.

- October 2024: Mitsubishi Electric Corporation plans to invest about USD 86 Billion in its U.S.-based subsidiary Mitsubishi Electric Power Products, based in Pittsburgh, Pennsylvania. The investment is expected to enhance the group's capabilities in advanced switchgear production and power electronics to meet the increasing demand for transmission and distribution grid products, driven by the focus in renewable energy and decarbonization in the United States.

- In 2021: Dassault Systèmes announced a collaboration with Capgemini, a leading consulting and technology services company, to accelerate the digital transformation of manufacturing industries. The partnership aimed to combine Dassault Systèmes' 3DEXPERIENCE platform with Capgemini's expertise in digital manufacturing to provide end-to-end solutions for smart factories.

- In 2021: Emerson Electric Co. launched the Plantweb Optics platform. This platform combines advanced analytics, digital twin technology, and the Industrial Internet of Things (IIoT) connectivity to enable real-time monitoring and optimization of industrial processes. The Plantweb Optics platform provides actionable insights and predictive analytics to enhance the operational efficiency, asset performance, and maintenance strategies of smart factories.

- In 2019: ABB Ltd. collaborated with Ericsson to create flexible wireless automation solutions for smart factories. This collaboration combined ABB's industry-leading automation expertise with Ericsson's 5G wireless technology to enable reliable and efficient wireless communication in industrial settings.

Smart Factory Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Field Devices Covered | Industrial Sensors, Industrial Robots, Industrial Network, Industrial 3D Printers, Machine Vision Systems |

| Technologies Covered | Product Lifecycle Management (PLM), Human Machine Interface (HMI), Enterprise Resource Planning (ERP), Manufacturing Execution Systems (MES), Distributed Control Systems (DCS), Industrial Control System, Others |

| End Use Industries Covered | Pharmaceuticals, Food and Beverages, Chemical, Oil and Gas, Automotive and Transportation, Semiconductor and Electronics, Aerospace and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, Dassault Systèmes, Emerson Electric Co., General Electric Company, Honeywell International Inc., Johnson Controls International, Microsoft Corporation, Mitsubishi Electric Corporation, Robert Bosch GmbH, Schneider Electric SE, Siemens AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart factory market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart factory market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart factory industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart factory market was valued at USD 209.96 Billion in 2024.

The smart factory market is projected to exhibit a CAGR of 8.82% during 2025-2033, reaching a value of USD 452.54 Billion by 2033.

The market is driven by increasing demand for industrial automation, increasing adoption of Industrial Internet of Things (IIoT) technologies, significant advancements in artificial intelligence (AI) and machine learning, rising need for operational efficiency, and growing integration of connected devices with cloud computing and internet of things (IoT).

Asia Pacific currently dominates the smart factory market, accounting for a share of 45.5% in 2024. The dominance is fueled by rapid industrial automation, strong government initiatives for digital transformation, expanding manufacturing sector, and increasing adoption of advanced technologies.

Some of the major players in the smart factory market include ABB Ltd, Dassault Systèmes, Emerson Electric Co., General Electric Company, Honeywell International Inc., Johnson Controls International, Microsoft Corporation, Mitsubishi Electric Corporation, Robert Bosch GmbH, Schneider Electric SE, and Siemens AG, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)