Smart Energy Market Size, Share, Trends and Forecast by Component, Product, End Use Sector, and Region, 2025-2033

Smart Energy Market Size and Share:

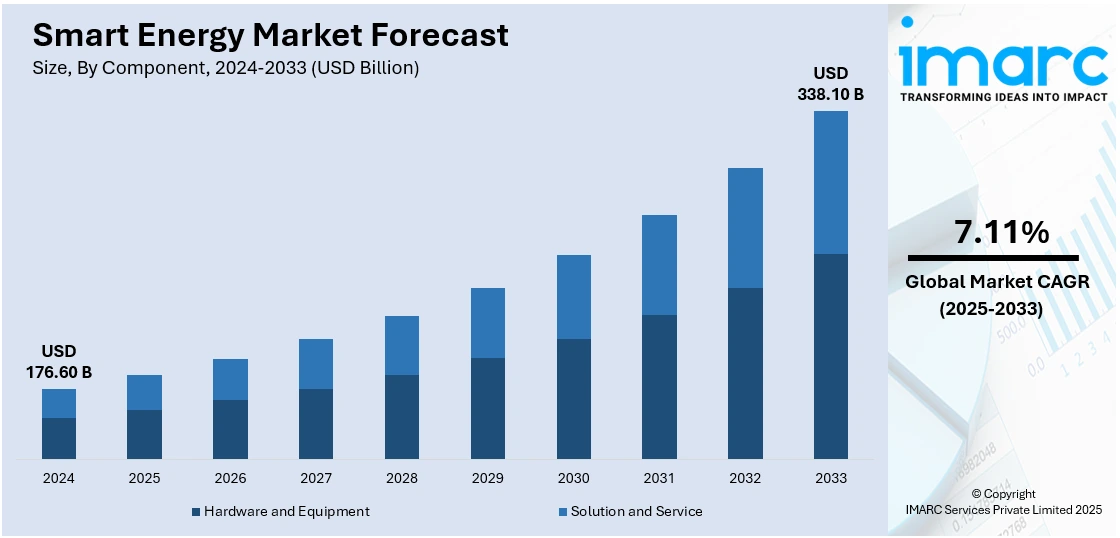

The global smart energy market size was valued at USD 176.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 338.10 Billion by 2033, exhibiting a CAGR of 7.11% from 2025-2033. North America currently dominates the market, holding a market share of over 39.8% in 2024. The smart energy market share is expanding, driven by the worldwide need for enhanced energy efficiency, rising focus on sustainable operations and innovations in digital technologies, and adoption of policies that are supporting energy transition, including renewable energy project subsidies, smart meter installation mandates, and smart grid infrastructure investment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 176.60 Billion |

|

Market Forecast in 2033

|

USD 338.10 Billion |

| Market Growth Rate 2025-2033 | 7.11% |

Smart energy industry is experiencing strong growth owing to the rising focus on sustainability, energy efficiency, and decarbonization. Regulatory authorities and governments are coming up with stringent policies that are promoting renewable energy deployment and minimizing the level of greenhouse gases, in turn, increasing the adoption rate of smart energy solutions. Enhanced rollout of energy storage systems, smart meters, and smart grids is reorienting traditional power infrastructure into a sophisticated, data-centric network increasing the distribution of energy, monitoring, and optimizing. Technological innovations like the Internet of Things (IoT), artificial intelligence (AI), and blockchain are additionally accelerating the market evolution by providing real-time data analytics, predictive maintenance, and decentralized energy management.

The United States market is experiencing progression owing to several smart energy market growth factors. Policy initiatives like tax credits for solar installation and investments by the federal government in clean infrastructure are promoting utilities and people to shift towards intelligent energy systems. Smart grid innovation, along with the integration of distributed energy resources, is facilitating more efficient and resilient power management throughout the nation. In addition, improvements in digital technologies like AI, IoT, and cloud computing are increasing the ability of energy management platforms to support real-time monitoring, predictive maintenance, and demand-response programs. The growing emphasis on decarbonization and energy independence, particularly in the face of climate concerns and geopolitical factors, is also facilitating innovation and investment in smart energy solutions. A new record $71 billion was poured into US clean transportation and energy in the third quarter of 2024, according to a Thursday report by research company Rhodium Group. This was a 12% year-over-year increase, and a 2% improvement from Q2 of 2024.

Smart Energy Market Trends:

Rising Demand for Energy Efficiency and Sustainability

The worldwide need for enhanced energy efficiency and sustainable operations is impelling the growth of the market. The World Meteorological Organization (WMO) stated that the year 2024 was considered the hottest in history, marking the end of a decade of unparalleled warmth driven by human activities. The level of greenhouse gases keeps on increasing to all-time high observations, committing more heat for the future. With the growing concerns regarding climate change, carbon emissions, and dwindling fossil fuel reserves, governments, industries, and consumers are increasingly focusing on the shift to cleaner and more efficient energy solutions. Smart energy technologies, including smart grids, advanced metering infrastructure (AMI), and intelligent energy management systems, are vital in maximizing energy consumption. These technologies offer real-time information that aids in the identification of inefficiencies, minimizes wastage of energy, and minimizes operational costs.

Technological Advancements in Smart Energy Systems

As per the smart energy market analysis, heightened innovations in digital technologies are advancing the smart energy industry immensely. Developments in the IoT, AI, machine learning (ML), and blockchain are reshaping the way energy is produced, transmitted, and consumed. IoT-based sensors and intelligent devices allow real-time monitoring of energy consumption in various sectors, ranging from residential to industrial. AI software predicts energy demand from massive datasets, optimizes load balancing, and improves fault detection. Blockchain provides secure, open platforms for peer-to-peer energy trading, enhancing trust and efficiency in peer-to-peer energy markets. In addition to enhancing operational performance, these technologies also lower energy-related expenses by facilitating predictive maintenance and energy optimization automation. Additionally, cloud-based platforms provide scalable and accessible energy management solutions for end-users and utilities. The IMARC Group predicts that the global cloud storage market size is expected to reach USD 490.56 Billion by 2033.

Government Policies and Regulatory Support

Government policies and regulation schemes are essential in driving the market. Most nations have adopted policies supporting energy transition, including renewable energy project subsidies, smart meter installation mandates, and smart grid infrastructure investment. For example, the European Union's Clean Energy Package include significant policy and funding support for upgrading energy infrastructure. These frameworks are usually tied to wider climate objectives, such as greenhouse gas emissions reductions and net-zero targets. Regulators are also facilitating the liberalization of energy markets, promoting competition and innovation. Time-of-use pricing models and demand-response programs also incentivize consumers to use smart energy technologies. The coordination of public and private sector objectives through policy mechanisms, public-private partnerships, and performance-based incentives is key to speeding up the development and deployment of smart energy solutions. In 2024, India achieved major milestones in solar and wind installations, policy development, and infrastructure development, paving the way for ambitious goals in 2025. With a vision to reach 500 GW of non-fossil fuel-based energy capacity by 2030, India is becoming a clean energy leader in the world. As on Jan 20, 2025, India's cumulative non-fossil fuel based energy capacity has reached 217.62 GW.

Smart Energy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart energy market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, product, and end use sector.

Analysis by Component:

- Hardware and Equipment

- Solution and Service

Solution and service stand as the largest component in 2024, holding 78.6% of the market. Smart energy solutions are technologies and systems that aim to maximize the generation, transmission, and consumption of energy, promoting efficiency and sustainability. Smart energy solutions usually consist of energy storage systems, smart grids, advanced metering infrastructure (AMI), and distributed energy resources (DERs) such as solar panels and wind turbines. Smart energy solutions are integrated suites of products involving technology, software, and analytics to assist both businesses and individuals in becoming more energy efficient and sustainable. Common features of the services are energy management platforms, demand-side management (DSM) initiatives, and energy optimization consulting. IoT- and AI-driven energy management platforms give timely feedback on power usage, and users can keep track of how power is consumed, where areas of inefficiency lie, and take remedial measures.

Analysis by Product:

- Smart Grid

- Digital Oilfield

- Smart Solar

- Home Energy Management System

Smart grid leads the market with 41.7% of market share in 2024. A smart grid is an advanced, digitalized electricity network that utilizes communication technologies and real-time data analytics to monitor, control, and optimize the flow of electricity. By providing real-time insights into energy consumption and grid performance, a smart grid helps utilities prevent outages and respond faster to disruptions. It also empowers consumers with data to optimize their energy usage, reducing costs and minimizing waste. Additionally, smart grids enable the integration of distributed energy resources (DERs), such as home solar installations, into the broader grid, supporting the transition to cleaner, renewable energy sources. By enhancing efficiency, reducing transmission losses, and supporting a more resilient infrastructure, smart grids are a critical component of modernizing energy systems worldwide.

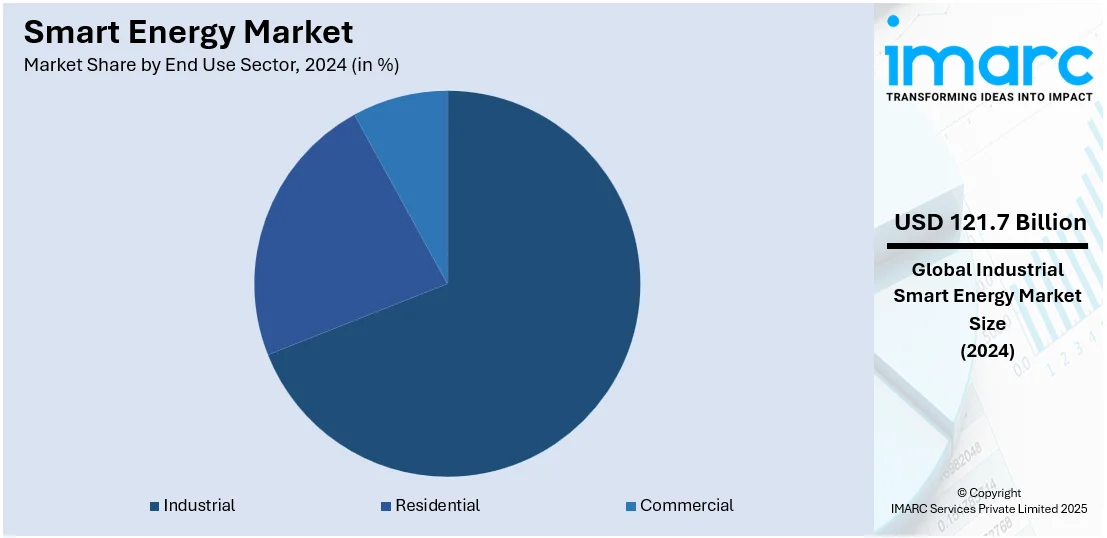

Analysis by End Use Sector:

- Residential

- Industrial

- Commercial

Industrial leads the market with 68.9% of market share in 2024. In the industrial sector, manufacturing and production facilities are major end-users of smart energy solutions. These industries often have high energy demands and require optimized energy management to maintain operational efficiency while reducing costs. Smart energy systems, such as energy management software, automated systems, and predictive maintenance technologies, help these industries reduce energy consumption, improve equipment longevity, and ensure minimal downtime. The integration of smart meters and real-time monitoring systems allows manufacturers to track energy usage patterns, identify incompetence, and execute energy-saving measures. Moreover, the ability to integrate renewable energy sources like solar and wind into production facilities supports sustainability efforts while mitigating the impact of rising energy costs.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the 39.8% share of the market. The region is growing rapidly due to a high drive for energy efficiency, sustainability, and upgrade of current infrastructure. Governments in United States and Canada are introducing policies and regulations to curtail carbon emissions and enhance renewable energy integration. Smart energy technologies are being promoted by schemes like tax credits for installation of renewable energy equipment and investment in smart grid initiatives. Moreover, states and provinces are implementing next-generation energy management systems to minimize energy usage, enable integration of distributed energy resources (DERs), and enhance grid resilience. Advances in IoT, AI, and machine learning are further driving the market, allowing real-time monitoring, predictive analytics, and automation. These technologies assist utilities and consumers in improving energy efficiency and lowering operational expenses. Demand from people for smart home solutions and renewable energy sources is also on the rise, resulting in increased adoption of smart meters, energy storage systems, and solar technologies. The IMARC Group predicts that the North America smart home automation systems market size is expected to reach USD 66.80 Billion by 2033.

Key Regional Takeaways:

United States Smart Energy Market Analysis

The United States hold 83.06% share of the North American region. The United States is witnessing increased smart energy adoption due to the growing deployment of smart grid technologies. The US electric grid is an engineering marvel with more than 9,200 electric generating units having more than 1 million megawatts of generating capacity connected to more than 600,000 miles of transmission lines. Rising efforts to modernize energy infrastructure are prompting utilities to integrate smart meters, real-time monitoring systems, and automated distribution solutions. This deployment of smart grid technologies enhances operational efficiency, reduces energy losses, and supports better demand response capabilities. In addition, utilities are leveraging data analytics and intelligent energy management platforms to optimize energy usage. Consumer interest in dynamic pricing models and energy-saving programs further accelerates smart grid integration. Energy providers are also investing in digital infrastructure to support decentralized energy systems. These advancements are promoting interoperability across energy networks. As smart grid technologies continue to expand, the overall energy ecosystem in the US is becoming more resilient, efficient, and sustainable.

Asia Pacific Smart Energy Market Analysis

Asia-Pacific is seeing rising smart energy adoption due to the growing power outage cases across the region. For instance, as temperatures rise across India, 38% of households surveyed confirm experiencing daily power outages. Frequent disruptions in power supply are prompting a shift toward smart energy systems that ensure greater reliability and control. Utilities are deploying advanced metering infrastructure and grid automation technologies to detect faults quickly and minimize downtime. With growing urban populations and increasing energy demand, the ability to handle power outages efficiently becomes critical. Energy providers are adopting predictive maintenance and remote monitoring to pre-emptively address system failures. Investment in microgrid solutions and backup energy systems is also increasing to support energy resilience. Government initiatives are also emphasizing reliable power delivery through digital infrastructure upgrades. The growing urgency to mitigate the impact of power outages is driving Asia-Pacific’s momentum toward more robust smart energy systems.

Europe Smart Energy Market Analysis

Europe is expanding its smart energy landscape due to the growing utilization of renewable energy resources. For instance, renewable energy sources represented 24.5% of the European Union’s final energy use in 2023. As wind, solar, and hydro energy become more integrated into power systems, there is a heightened need for intelligent energy management to address intermittency and load balancing. Smart energy technologies are enabling real-time monitoring, storage optimization, and dynamic grid adjustments to align with variable renewable energy outputs. Utilities are deploying distributed energy resource management systems to handle decentralized generation efficiently. The need to ensure grid stability while increasing the share of renewables is encouraging adoption of advanced analytics, forecasting tools, and responsive grid frameworks. Energy storage and flexible demand management are also being prioritized. With renewable energy resources playing a central role in the energy transition, Europe continues to lead in adopting smart energy solutions for a cleaner and more stable power grid.

Latin America Smart Energy Market Analysis

Latin America is experiencing rising smart energy adoption driven by the emergence of advanced technologies. By 2023, approximately 14 million smart meters were installed in the area, but by 2029, this figure is expected to climb to nearly 43 million units, raising the penetration from 6.5% to more than 18%. Energy providers are modernizing outdated infrastructure by integrating intelligent grid systems that support real-time monitoring and automated fault detection. This shift helps improve energy efficiency, reduce operational costs, and support the integration of distributed energy sources. As energy demand increases, smart grid adoption is enabling more reliable and adaptive power delivery across urban and remote regions.

Middle East and Africa Smart Energy Market Analysis

Middle East and Africa are seeing increased smart energy adoption due to growing investment in the commercial sector. For instance, in 2023, foreign investors accounted for 45% of total commercial property transactions in Dubai. Businesses are prioritizing energy efficiency and sustainability through intelligent power management systems and smart building solutions. With greater focus on cost optimization and operational resilience, commercial facilities are adopting smart technologies to monitor usage, reduce waste, and optimize energy distribution. Investment in the commercial sector is accelerating the shift toward digital energy solutions across diverse commercial applications.

Competitive Landscape:

Market players in the smart energy sector are actively driving innovation through the development and deployment of advanced technologies aimed at improving energy efficiency and sustainability. Key players, including utility companies, energy technology providers, and infrastructure developers, are focused on expanding smart grid systems, integrating renewable energy solutions, and enhancing energy storage capabilities. They are also investing in IoT and AI-driven platforms to enable real-time energy management, predictive maintenance, and demand-response programs. Strategic partnerships and acquisitions are prevalent as companies seek to strengthen their market position, broaden their product offerings, and improve customer experience. Furthermore, players are working closely with governments to align with regulatory frameworks and benefit from incentives that promote cleaner, more efficient energy solutions across residential, commercial, and industrial sectors.

The report provides a comprehensive analysis of the competitive landscape in the smart energy market with detailed profiles of all major companies, including:

- ABB Ltd.

- General Electric Company

- Honeywell International Inc.

- International Business Machines Corporation

- Itron Inc.

- Landis+Gyr AG

- Larsen & Toubro Limited

- Robert Bosch GmbH

- S&T AG

- Schneider Electric SE

- Sensus (Xylem Inc.)

- Siemens AG

Latest News and Developments:

- April 2025: LONGi, in collaboration with Raystech, launched the Hi-MO X10 solar module at the 2025 Smart Energy Council Conference and Exhibition in Sydney. Featuring advanced HPBC 2.0 cell technology and TaiRay wafers, the Hi-MO X10 offers high-power efficiency and resilience against extreme Australian weather.

- March 2025: PG&E launched a virtual power plant, SAVE, aimed at reducing local grid constraints by utilizing residential distributed energy resources. The demonstration program involved 1,500 electric customers with battery storage and 400 customers with smart panels, providing support during peak demand periods. PG&E also collaborated with aggregators like Sunrun and SPAN to optimize energy usage based on real-time grid signals.

- February 2025: Smart Metering Systems (SMS) completed its merger with Horizon Energy Infrastructure (HEI) and Smart Meter Assets (SMA), forming a leading UK smart metering provider. This move, initially announced in November 2024, positions the Group to accelerate smart energy and water solutions in the UK and expand into Germany. The merger also boosts SMS’s management of over 6 million meters.

- December 2024: The Dubai Electricity and Water Authority (DEWA) announced that it would launch a USD 1.9 billion smart grid initiative to boost sustainability and operational efficiency, in partnership with Microsoft Copilot. The project aims to integrate generative AI across DEWA’s operations to enhance customer satisfaction and technological leadership.

Smart Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware and Equipment, Solution and Service |

| Products Covered | Smart Grid, Digital Oilfield, Smart Solar, Home Energy Management System |

| End Use Sectors Covered | Residential, Industrial, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., General Electric Company, Honeywell International Inc., International Business Machines Corporation, Itron Inc., Landis+Gyr AG, Larsen & Toubro Limited, Robert Bosch GmbH, S&T AG, Schneider Electric SE, Sensus (Xylem Inc.), Siemens AG., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, smart energy market forecasts, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart energy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart energy market was valued at USD 176.60 Billion in 2024.

The smart energy market is projected to exhibit a CAGR of 7.11% during 2025-2033, reaching a value of USD 338.10 Billion by 2033.

Key factors driving the market include rising global focus on sustainability, energy efficiency, and decarbonization. Policy initiatives, technological advancements in AI, IoT, and blockchain, and increased adoption of smart grids and renewable energy solutions are further accelerating growth.

North America currently dominates the smart energy market, accounting for a share of over 39.8% in 2024. This is driven by policies supporting renewable energy and infrastructure modernization.

Some of the major players in the smart energy market include ABB Ltd., General Electric Company, Honeywell International Inc., International Business Machines Corporation, Itron Inc., Landis+Gyr AG, Larsen & Toubro Limited, Robert Bosch GmbH, S&T AG, Schneider Electric SE, Sensus (Xylem Inc.), Siemens AG., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)