Smart Contracts Market Size, Share, Trends and Forecast by Platform, Blockchain Type, Contract Type, Enterprise Size, End Use, and Region, 2025-2033

Smart Contracts Market Size and Share:

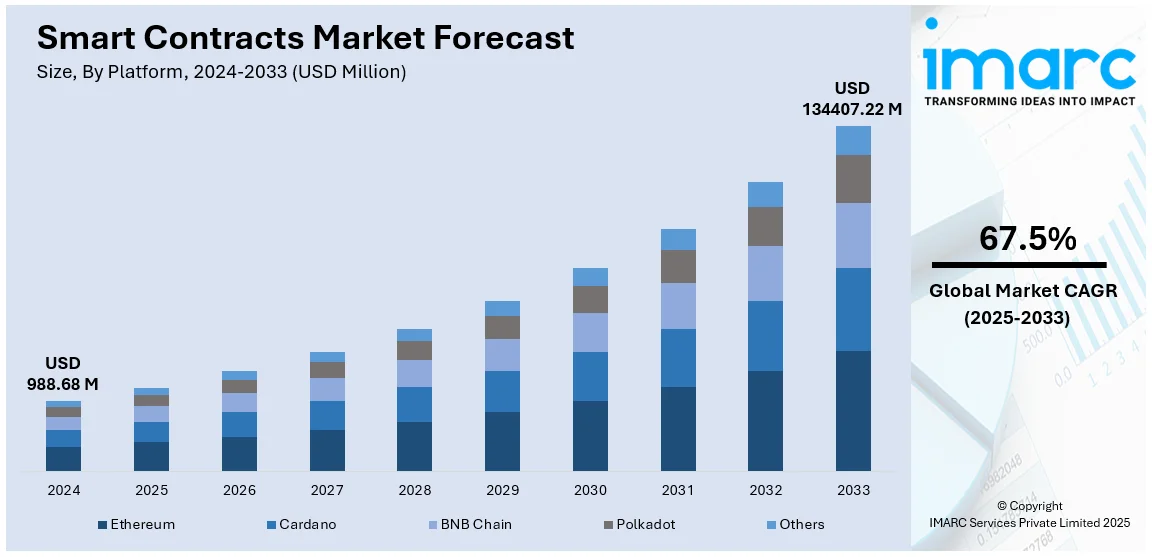

The global smart contracts market size was valued at USD 988.68 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 134407.22 Million by 2033, exhibiting a CAGR of 67.5% from 2025-2033. North America currently dominates the market, holding a market share of over 33.2% in 2024. The market is driven by its strong technological infrastructure, increasing blockchain adoption across industries, and favorable regulatory environment for digital innovations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 988.68 Million |

| Market Forecast in 2033 | USD 134407.22 Million |

| Market Growth Rate (2025-2033) | 67.5% |

Smart contracts market share is gaining traction due to the growing acceptance and adoption of blockchain technology across various industries. Self-executing contracts are directly written into lines of code, which are self-executing contracts which promote openness, security, and efficiency. The decentralized characteristic of blockchain reduces mediation, eliminating the risks of intermediaries and lowers transaction costs. There has been an amplified need in recent times to implement the uses of blockchain due to the growth of decentralized finance (DeFi) platforms and blockchain applications across finance, healthcare, and supply chain management. Moreover, the non-repudiation nature of blockchain's distributed ledger ensures transactions are immutable in nature, giving smart contracts significant appeal for streamlining processes involved in payment settlement, legal contracts, and assets transfer. In line with this, there will be significant demand for the use of smart contracts as different industries continue with digitization in order to carry out operations and boosted trustworthiness in these automated processes efficiently and securely. For instance, in August 2024, EvaCodes introduced innovative DePIN solutions, merging blockchain with infrastructure systems to enhance scalability, transparency, and sustainability while tackling inefficiencies in traditional centralized models.

The supportive regulatory environment in the United States has been a key driver for smart contracts market growth. Over the past few years, U.S. authorities have shown increasing interest in regulating blockchain technology and smart contracts. For example, in December 2024, 8Cell Tech specializes in smart contract development to automate business processes, reduce costs, and enhance security using blockchain technologies like Ethereum, offering tailored solutions for businesses. Moreover, multiple states, such as Wyoming and Arizona, have developed their legal framework for recognizing the legal status of blockchain-based records and smart contracts, further promoting a business-friendly environment for innovation. Additonally, the SEC and other similar regulatory bodies within the United States are making guidelines on the application of smart contracts more explicit and clearer, with specific guidelines applied in the finance sector. These steps have been a security boost to businesses and developers in the general, giving a motivation to invest more and commit to blockchain-based solutions. As the US government continues to clarify its stance on blockchain technology, smart contracts are becoming a viable and legal solution for industries to modernize their operations and efficiency in transactions.

Smart Contracts Market Trends:

Integration with Internet of Things

Integration of the Internet of Things (IoT) with smart contracts is becoming one of the prominent trends in the smart contract market. Increasing the usage of IoT devices generates more opportunities to automate using smart contracts. Devices can be designed to trigger smart contracts based on real-time data, such as adjusting payments based on delivery completion or temperature change as detected by a sensor. Businesses can benefit from higher efficiency and precision due to the lack of human interference in transactions between IoT devices. This integration proves to be helpful in logistics, manufacturing, and smart homes as it deals with real-time processing of data and execution of contracts. As more IoT devices appear, demand for secure and automated systems also amplifies as there will be greater integration of smart contracts in all sectors. The growth of IoT and its fusion with blockchain-powered smart contracts will revolutionize automation and bring about greater operational efficiency across industries.

Growth of Decentralized Autonomous Organizations (DAOs)

The growth trend of decentralized autonomous organizations (DAOs), powered by blockchain technology is the most notable within this space. DAOs rely on smart contracts for decision-making, governance, and fund allocation without centralized control. This decentralized model allows stakeholders to participate in the organization's decision-making, usually by means of voting mechanisms encoded in smart contracts. As more businesses and projects embrace decentralized governance models, DAOs are gaining acceptance in finance, entertainment, and charity sectors. The implementation of transparent and automated decision-making processes with the risk of corruption and inefficiency that is intrinsic to traditional organizations is reduced. The emergence of DAOs signifies moving toward high comprehensive and transparent types of organization as their use in smart contracts, bolstered further due to the rapidly increasing popularity and adoption of decentralised business models.

Smart Contract Security Improvements

As the adoption of smart contracts increases, there is a growing emphasis on improving their security. With the rise of smart contract hacks and exploits, organizations are placing more focus on creating secure and reliable smart contracts. To address vulnerabilities, developers are employing advanced tools and techniques, such as formal verification and security auditing, to ensure the code functions as intended. Formal verification methods help prove the correctness of smart contracts mathematically, reducing errors and potential exploits. For example, in December 2024, Nadcab Labs highlighted its innovative blockchain solutions, including advancements in smart contract security (addressing vulnerabilities), crypto token ecosystems (enabling token creation), decentralized exchanges (creating secure platforms), and automated systems (streamlining operations). Furthermore, the development of secure coding practices and the integration of security-focused platforms is ensuring that smart contracts are resilient to attacks. As more businesses implement smart contracts for critical processes, security will remain a primary concern. Continuous improvement in smart contract security will drive trust and adoption, ensuring that blockchain applications are safe and reliable for use across a variety of industries.

Smart Contracts Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart contracts market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on platform, blockchain type, contract type, enterprise size, and end use.

Analysis by Platform:

- Ethereum

- Cardano

- BNB Chain

- Polkadot

- Others

Ethereum, holding a dominant share of 48.3% in the smart contracts market, owes its leadership to its pioneering status in blockchain technology and its robust ecosystem. Its versatile platform supports decentralized applications (dApps) and offers an advanced smart contract infrastructure powered by its Ethereum Virtual Machine (EVM). Ethereum’s first-mover advantage, combined with continuous upgrades, such as Ethereum 2.0, enhances scalability, security, and energy efficiency, solidifying its position. Furthermore, its widespread adoption across industries such as finance, healthcare, and supply chain management reflects its reliability and effectiveness in automating processes. The platform's vibrant developer community contributes to innovative solutions, further boosting its appeal. Strategic partnerships and the integration of Ethereum in enterprise solutions enhance its usability, making it the most preferred platform for executing smart contracts. The platform’s adaptability and industry penetration underscore its leadership in the smart contracts domain.

Analysis by Blockchain Type:

- Public

- Private

- Hybrid

Public, with a commanding market share of 56.7%, dominate the smart contracts market due to their transparent and decentralized nature. They allow unrestricted participation and foster trust by offering immutable and verifiable transactions, crucial for smart contracts' functionality. This openness makes them ideal for various use cases, including decentralized finance (DeFi), supply chain transparency, and peer-to-peer networks. Key public blockchains like Ethereum and Binance Smart Chain offer robust frameworks for deploying smart contracts, further driving adoption. The growing popularity of public blockchains is also attributed to their ability to eliminate intermediaries, reduce costs, and enhance operational efficiency. Their expansive global network of nodes ensures data security and accessibility. Increasing use cases in voting systems, identity verification, and crowdfunding highlight their versatility. Continuous innovations and scalability enhancements position public blockchains as integral to the future growth of smart contracts across diverse industries.

Analysis by Contract Type:

- Smart Legal Contracts

- Decentralized Autonomous Organizations (DAO)

- Application Logic Contracts

Decentralized Autonomous Organizations (DAO), capturing 36.6% of the market, represent a significant segment in smart contracts. DAOs leverage smart contracts to automate governance processes, enabling decentralized decision-making. Their rising popularity stems from their ability to eliminate the need for traditional hierarchical structures, promoting transparency and inclusivity. DAOs are increasingly employed in crowdfunding, investment platforms, and community-driven projects, demonstrating their versatility. Their reliance on blockchain technology ensures immutability and trust in decision-making processes. The ease of tokenized voting and seamless execution of governance policies through smart contracts further enhances their appeal. The expansion of decentralized finance (DeFi) applications and the growing adoption of blockchain-based governance systems propel the growth of this segment. DAOs’ potential to disrupt traditional organizational structures and drive innovation across industries underscores their significant market share. Enhanced regulatory clarity and technological advancements are expected to further strengthen their role in the smart contracts’ ecosystem.

Analysis by Enterprise Size:

- Small and Medium Enterprises

- Large Enterprises

Large enterprises, accounting for a dominant 65% of the market, are key drivers of smart contract adoption. These organizations leverage smart contracts to streamline complex operations, enhance efficiency, and reduce costs. By automating processes like procurement, compliance, and supply chain management, large enterprises achieve significant operational improvements. Their robust IT infrastructure and higher investment capacity enable them to integrate advanced blockchain solutions effectively. Industries such as banking, manufacturing, and healthcare are increasingly utilizing smart contracts to ensure data integrity and secure transactions. Large enterprises also benefit from reduced risk of fraud and enhanced transparency, making smart contracts indispensable. The growing need for scalable solutions and global compliance further accelerates adoption in this segment. Partnerships with blockchain developers and active participation in pilot programs reflect their proactive approach to innovation. As industry leaders, large enterprises play a pivotal role in driving market growth and setting benchmarks for smaller entities.

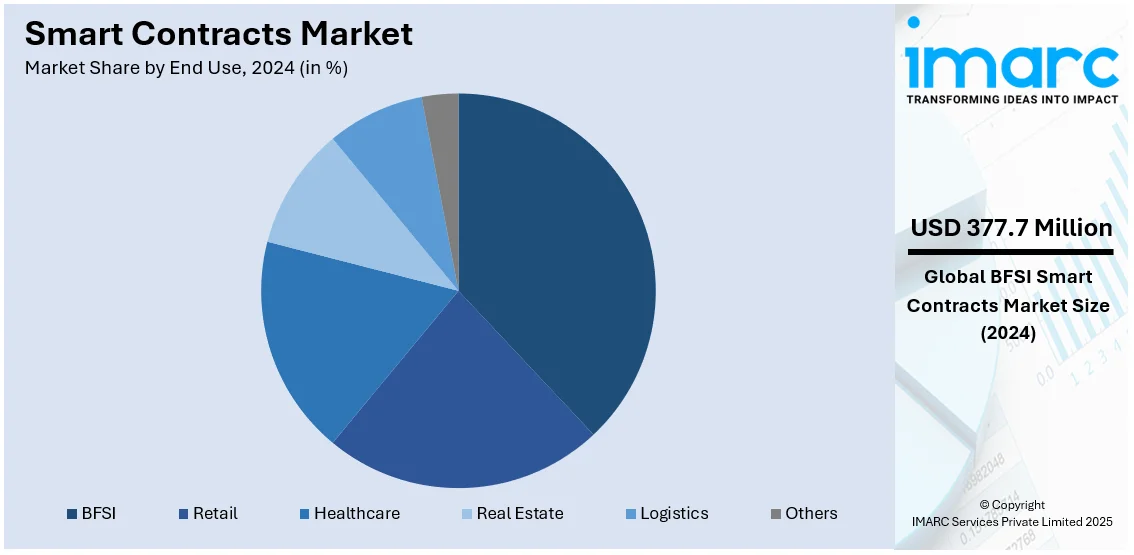

Analysis by End Use:

- BFSI

- Retail

- Healthcare

- Real Estate

- Logistics

- Others

The BFSI sector, with a significant 38.2% market share, is the leading end-use industry for smart contracts. Financial institutions utilize smart contracts to automate processes like loan disbursement, insurance claims, and trade settlements, ensuring faster and error-free transactions. Their ability to enhance transparency, reduce fraud, and minimize operational costs makes them invaluable in this sector. Blockchain-based smart contracts offer unparalleled data security and compliance, addressing critical concerns in BFSI operations. The growing adoption of decentralized finance (DeFi) solutions further underscores the importance of smart contracts in revolutionizing financial services. Their application in creating secure digital identities, automating audits, and facilitating cross-border transactions demonstrates their transformative potential. Increasing demand for real-time processing and customer-centric solutions propels growth in the BFSI segment. Strategic collaborations between financial institutions and blockchain technology providers are driving innovation, making smart contracts an integral part of the BFSI landscape.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

North America, holding a commanding 33.2% share, leads the global smart contracts market due to the early adoption of blockchain solutions and advanced technological infrastructure. The region is home to leading blockchain developers and numerous enterprises investing in smart contract implementation. Robust regulatory support and the presence of established players such as Ethereum further bolster market growth. Industries like finance, healthcare, and retail are leveraging smart contracts to improve operational efficiency and secure transactions. The growing popularity of decentralized finance (DeFi) and tokenized assets underscores the demand for smart contracts in the region. The United States, being a major hub for technological innovation, contributes significantly to North America’s dominance. Educational initiatives, government-backed projects, and increased venture capital investments in blockchain technologies highlight the region’s proactive approach to adoption. This strong ecosystem of innovation, coupled with supportive policies, positions North America as a leader in smart contract deployment.

Key Regional Takeaways:

United States Smart Contracts Market Analysis

The United States holds a significant share in the smart contracts market, driven by a robust technological infrastructure and early adoption of blockchain technologies. The nation’s extensive presence of blockchain developers, coupled with strong venture capital investments, fosters innovation and the development of advanced smart contract solutions. Key industries such as banking, healthcare, and supply chain management are actively integrating smart contracts to streamline operations, enhance transparency, and reduce costs. The growing popularity of decentralized finance (DeFi) and non-fungible tokens (NFTs) further propels market demand. Regulatory clarity surrounding blockchain applications strengthens market confidence, encouraging enterprise-level adoption. Collaborations between technology providers and large enterprises are accelerating advancements in smart contract platforms. Educational initiatives and government-backed blockchain projects are also contributing to growth. The United States’ leadership in blockchain research and development positions it as a pivotal player in the global smart contracts landscape.

Europe Smart Contracts Market Analysis

Europe is turning into an important geographic location for smart contracts. Growing blockchain adoption as well as lenient regulatory structures have provided immense opportunities in Europe. Smart contract integration has found strong leadership by some of Europe's major economies, including Germany, the UK, and France, within these industries, among others like banking, insurance, and logistics. A proactive approach from the European Union on blockchain regulation ensures a stable environment for innovation and encourages business use of smart contract solutions. Increasing digital transformation initiatives and stronger collaborations between technology companies and businesses contribute to growth in the market. Decentralized finance (DeFi) applications and tokenization projects are picking up and boosting adoption further. Both public and private resources of the region amplify educational programs and funding for research in blockchain technologies. Europe is focused on sustainability and efficiency, which is exactly what smart contracts provide, promoting their use across industries.

Asia Pacific Smart Contracts Market Analysis

Rapid growth is observed in the smart contracts market of the Asia Pacific with technology and higher adoption rates within the industry. Investments are witnessed by China, India, and Japan into infrastructure with regard to blockchain. With finance, supply chain, and healthcare sectors underpinning deployment of smart contracts, growth in government-backed initiatives are motivating this pace ahead. Innovation is boosted by the emergence of a region-wide startup ecosystem and strong venture capital investments in blockchain projects. The demand for cost-effective and efficient solutions converges with what smart contracts provide are supporting wide-scale adoption. The expanding penetration of DeFi and digital asset platforms underscores the growing importance of smart contracts for Asia Pacific. Educational and research collaborations are enhancing expertise in blockchain technologies, strengthening the market. The region’s large population and expanding digital economy present immense opportunities for smart contract applications in various sectors.

Latin America Smart Contracts Market Analysis

Latin America is highly embracing smart contracts, fueled by growing awareness about blockchain technologies and their ability to solve regional problems. Brazil, Mexico, and Argentina are evaluating smart contracts to be used for finance, agriculture, and supply chain management, among other sectors. DeFi platforms and tokenized assets continue to attract widespread attention, revealing the adaptability of smart contracts. Startups and small businesses are using smart contracts to cut costs and increase operational efficiency, thereby boosting market growth. Governments are starting to use blockchain for the transparency and efficiency of public services, which also boost adoption. Local and international technology firms are working together to introduce high advanced smart contract solutions to the region. Despite infrastructural challenges, growing digital transformation initiatives and increasing mobile connectivity in Latin America are creating opportunities for smart contract implementation across sectors.

Middle East and Africa Smart Contracts Market Analysis

The Middle East and Africa steadily adopt smart contracts, which utilizes blockchain technology for regional needs to be fulfilled across sectors like finance, logistics, and real estate. Adoption is highly led by United Arab Emirates, Saudi Arabia, and South Africa, influenced, and encouraged forward due to government programs and investments made in blockchain infrastructures. In this respect, both public services and private enterprise increase transparency and effectiveness with the usage of smart contracts. The focus of the region on digital transformation creates an ideal opportunity for the application of smart contracts which is spurring growth. Financial inclusion projects and increasing DeFi solutions promote adoption. Integration with global blockchain companies brings superior solutions suited for regional markets. Training programs and pilots are enhancing understanding and knowledge in blockchain technologies. In line with this where many challenges remain the same, such as regulatory uncertainty, infrastructure, this region will be observed as an emerging market within the smart contract market.

Competitive Landscape:

It can be characterized that the global competitive landscape is diverse and continuously changing. Competitors are already working on a variety of emergent technologies to leverage innovation so as not to lose their share in the marketplace. Product development, strategic partnerships, and mergers and acquisitions are key business strategies of such players in market share expansion as well as improvements in offerings. Companies are investing heavily in research and development to meet the accelerating demand for advanced and efficient solutions. Targeting new geographical markets, focusing on niche segments, and improving customer engagement through customized solutions form part of competitive strategies. Industry leaders are being partnered with companies to strengthen capabilities and boost market penetration. The dynamic nature of the market with companies that adapt to technological changes, regulatory change, and the shifting preferences of customers are expected to be winners in the long run, while creating a competitive yet collaborative atmosphere among industry participants.

The report provides a comprehensive analysis of the competitive landscape in the smart contracts market with detailed profiles of all major companies, including:

- 4soft

- Algorand

- Innowise

- ScienceSoft USA Corporation

- Stratis Group Ltd

- TATA Consultancy Services Limited

- Vention

Latest News and Developments:

- In July 2024, Stratis Group Ltd launched smart contracts on Microsoft’s .NET framework, becoming the first blockchain to enable auditable C# smart contracts, driving innovation and enterprise adoption in blockchain technology.

- In March 2024, Algorand made waves in the blockchain space with the release of AlgoKit 2.0, supporting Python for smart contract development. The platform also implemented protocol upgrades to improve performance and cost efficiency, solidifying its position as a leading choice for fast, secure, and affordable smart contract solutions.

Smart Contracts Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platform Covered | Ethereum, Cardano, BNB Chain, Polkadot, Others |

| Blockchain Type Covered | Public, Private, Hybrid |

| Contract Type Covered | Smart Legal Contracts, Decentralized Autonomous Organizations (DAO), Application Logic Contracts |

| Enterprise Size Covered | Small and Medium Enterprises, Large Enterprises |

| End Use Covered | BFSI, Retail, Healthcare, Real Estate, Logistics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 4soft, Algorand, Innowise, ScienceSoft USA Corporation, Stratis Group Ltd, TATA Consultancy Services Limited, Vention, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart contracts market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart contracts market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart contracts industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global smart contracts market was valued at USD 988.68 Million in 2024.

The global smart contracts market is estimated to reach USD 134407.22 Million by 2033, exhibiting a CAGR of 67.5% from 2025-2033.

The global smart contracts market is driven by increasing adoption of blockchain technology, growing demand for secure and transparent digital transactions, and the rising need to automate business processes. Enhanced data integrity reduced operational costs, and the expansion of decentralized finance (DeFi) applications further propel the market's growth, alongside rising investments in innovative smart contract development.

North America currently dominates the market, holding a market share of over 33.2% in 2024. The dominance is driven by a strong technological infrastructure, increasing blockchain adoption across industries, and a favorable regulatory environment for digital innovations.

Some of the major players in the global smart contracts market include 4soft, Algorand, Innowise, ScienceSoft USA Corporation, Stratis Group Ltd, TATA Consultancy Services Limited, Vention, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)