Smart Container Market Size, Share, Trends and Forecast by Offering, Technology, Vertical, and Region, 2025-2033

Smart Container Market Size and Share:

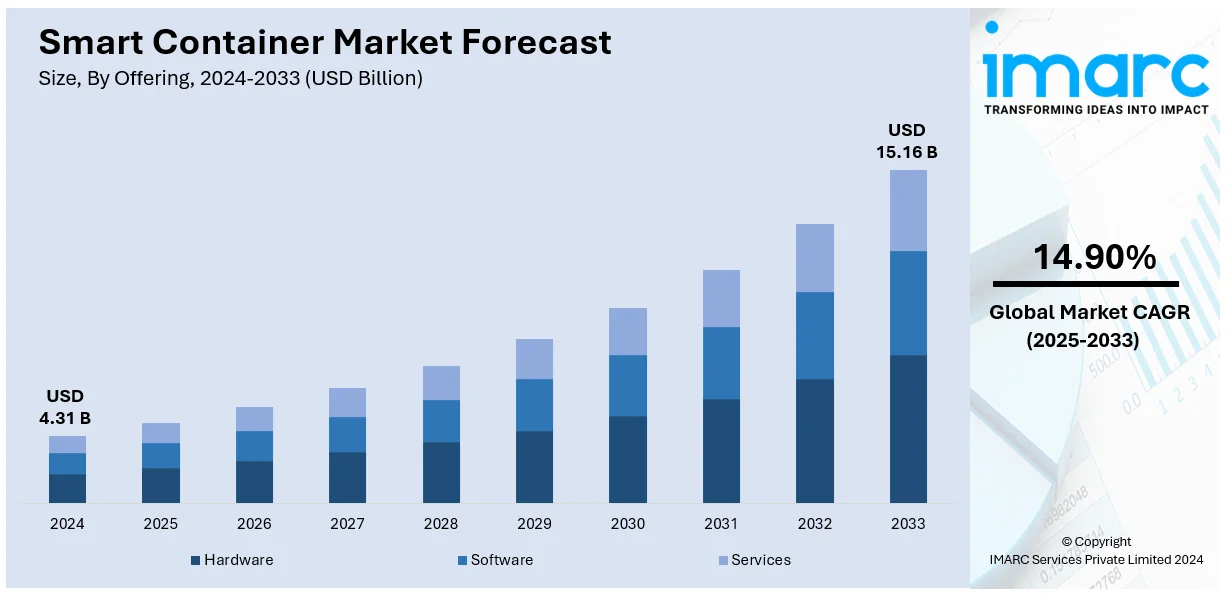

The global smart container market size was valued at USD 4.31 Billion in 2024. The market is projected to reach USD 15.16 Billion by 2033, exhibiting a CAGR of 14.90% from 2025-2033. Europe currently dominates the market in 2024. The market is fueled by the growing demand for real-time temperature monitoring, increasing adoption of predictive analytics, advancements in telematics solutions, rising focus on reducing food and pharmaceutical waste, supportive government initiatives for digital transformation, and expanding investments in smart logistics infrastructure. The global smart container market is expected to expand rapidly over the next few years, fueled by rising demand for full supply chain transparency and greater use of IoT solutions. Despite slight variations in projections across different analyses, there is broad agreement that the market will grow at a strong pace.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.31 Billion |

| Market Forecast in 2033 | USD 15.16 Billion |

| Market Growth Rate 2025-2033 | 14.90% |

The growth of the smart container market is driven by the integration of ongoing technological advancements on the Internet of Things (IoT), artificial intelligence (AI), and sensor technologies, as they enable real-time tracking and monitoring to optimize supply chain efficiency. In addition to this, stringent regulatory compliance in industries like food and pharmaceuticals is significantly contributing to the market expansion, ensuring product safety. Furthermore, the rapid growth of e-commerce amplifies the need for effective logistics solutions, aiding the market growth. Moreover, sustainability initiatives promote waste reduction and environment-friendly practices, providing an impetus to the market. Apart from this, the integration of blockchain ensures data security and transparency, which is catalyzing the market growth. For instance, Busan tested "smart" containers, installed with blockchain systems, specially designed to detect and prevent lithium-ion battery fires, improving safety measures and enhancing reliability in the shipping market. Concurrently, the need for reliable cold chain monitoring enhances product adoption in temperature-sensitive sectors, thereby propelling the market forward.

The smart container market growth in the United States (US) is driven by the increasing need for supply chain digitization and automation to improve operational efficiency. In line with this, the rapid expansion of the pharmaceutical and food sectors demands robust temperature and condition monitoring to maintain product integrity, which is fueling the market demand. Additionally, the growing focus on reducing logistics costs, enhancing traceability, and minimizing human errors supports the adoption of smart containers, strengthening the market share. In confluence with this, the surge in demand for personalized customer experiences in e-commerce encourages real-time tracking, which is aiding the market growth. For instance, initiatives such as the formation of the Smart Container Consortium by WISeKey and CASPIAN CONTAINER COMPANY aim to revolutionize container logistics through IoT-enabled devices and sensors, further advancing the adoption of smart container technologies. Apart from this, continuous innovations in wireless communication and sensor technologies facilitate smarter innovations, enhancing the efficiency of container management systems, and thereby impelling the market growth.

Smart Container Market Trends:

Significant Technological Advancements

Ongoing technological advancements, especially in the realms of the IoT and AI, are crucial in driving the global smart container market. IoT technology equips containers with advanced sensors that continuously monitor critical parameters such as temperature, humidity, shock, and location in real time. This comprehensive monitoring ensures the safety and integrity of the cargo, which is essential for industries handling sensitive items such as pharmaceuticals and perishable goods. The integration of AI further enhances these capabilities by analyzing the collected data to predict potential issues before they arise, optimize transportation routes for efficiency, and minimize downtime due to unforeseen problems. This synergistic use of IoT and AI improves the reliability and efficiency of the supply chain, significantly reducing operational costs by preventing cargo spoilage and ensuring timely deliveries. Such technological innovations make smart containers indispensable in modern logistics, promoting their widespread adoption across various sectors, thereby creating a positive smart container market outlook. As per reports, smart technology is currently installed in about 40% of dry containers and a third of reefer containers, demonstrating its broad use in the shipping sector.

Supply Chain Efficiency

Efficiency in the supply chain is another significant factor propelling the smart container market. According to the IMARC GROUP, the global supply chain analytics market reached USD 8.1 Billion in 2023 and is expected to reach USD 30.6 Billion by 2032, exhibiting a CAGR of 15.5% during 2024-2032. Smart containers provide real-time tracking and monitoring capabilities that greatly enhance visibility across the entire supply chain, leading to the robust growth of the smart container market. This transparency empowers businesses to make swift and informed decisions, thereby reducing delays and ensuring timely delivery of goods. By offering precise data on the status and location of shipments, smart containers help prevent common logistical issues such as misrouting or prolonged storage times. Additionally, these containers optimize internal conditions such as temperature and humidity, which is crucial for minimizing spoilage and waste, especially in industries dealing with perishable goods such as food and pharmaceuticals. This optimization ensures the quality and safety of the cargo further leading to significant cost savings by reducing the loss of goods.

Regulatory Compliance

Regulatory compliance is one of the most pivotal smart container market drivers, especially in sectors handling food, pharmaceuticals, and hazardous materials. Governments and regulatory bodies across the globe enforce stringent regulations to guarantee the safe and secure transport of sensitive goods. Failure to comply can lead to severe penalties, product recalls, and reputational damage. According to a survey report, 70% of customers reported shipment delays, with a large percentage attributable to problems with documentation. By guaranteeing that the necessary documentation is submitted on time, smart containers can reduce these interruptions. Smart containers, equipped with advanced monitoring and reporting capabilities, are designed to meet these rigorous standards efficiently. They provide precise, real-time data on various parameters such as temperature, humidity, and location, ensuring that the cargo remains within prescribed safety limits throughout its journey. This continuous monitoring and transparent reporting enable companies to demonstrate compliance with regulatory requirements effectively. Additionally, the ability to promptly identify and address any deviations from set conditions helps prevent potential breaches of safety standards, thereby safeguarding both the products and the public. The smart container industry overview highlights significant growth driven by technological advancements, regulatory compliance, and the increasing need for efficient supply chain solutions.

Growing Influence of IoT and Global Trade

The market is shaped by rapid IoT adoption and the continued growth of international trade. Companies are embedding sensors, RFID tags, and communication modules into containers to enable real-time tracking and environmental monitoring. This allows logistics providers to monitor temperature, humidity, and cargo status remotely, reducing spoilage and enhancing accountability across supply chains. With increasing reliance on predictive analytics and automation, the use of connected containers has shifted from optional to essential for high-value or sensitive goods. Simultaneously, global trade expansion is increasing the complexity and volume of cross-border shipments. As per industry reports, global trade attained a record of USD 33 Trillion in 2024, marking a 3.7% growth compared to 2023. As ports become more congested and regulatory requirements tighten, the demand for transparent, efficient cargo handling is growing. Smart containers support these needs by improving route optimization, minimizing delays, and providing accurate, real-time data for customs and compliance processes. This integration of connected technology with rising trade flows is reinforcing the role of smart containers in modern freight operations.

Challenges and Opportunities:

The market for smart containers witnesses a combination of operational challenges and potential opportunities. Among the major challenges is the upfront high cost of sensor-enabled containers, data infrastructure, and connectivity solutions that may keep away small and mid-sized logistics companies. Interoperability challenges between various systems and platforms add to the complexities of adoption, especially across global supply chains with multiple stakeholders. Data privacy and security issues also rises as sensitive shipping data are digitally transmitted and stored. In contrast, the market presents substantial opportunities fueled by growing demand for real-time visibility and automation within logistics. The growth of temperature-sensitive freight, especially in pharmaceuticals and food, is building strong demand for condition-monitoring functionality. Regulatory advances that require international trade to be transparent and traceable are also compelling businesses towards digitalization. With 5G and satellite communications technologies enhancing connectivity, the prospects for wider deployment and cost effectiveness enhance. These factors collectively position smart containers as a valuable asset in modernizing global freight logistics.

Smart Container Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart container market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on offering, technology, and vertical.

Analysis by Offering:

- Hardware

- Software

- Services

According to the report, hardware represented the largest segment in 2024. One of the primary reasons hardware holds the largest market share is the high demand for advanced sensor technology. Sensors are integral components of smart containers, as they provide the real-time data that is necessary for monitoring and maintaining the optimal conditions of the cargo. These sensors track various parameters such as temperature, humidity, shock, and location, ensuring the safety and integrity of the goods. Industries such as pharmaceuticals, food, and chemicals heavily rely on precise environmental control during transport, making robust sensor technology indispensable. The growth of the IoT sector further fuels the demand for sophisticated sensors, as they become more capable and affordable, leading to widespread adoption.

Analysis by Technology:

- GPS (Global Positioning System)

- Cellular

- LoRa WAN (Long Range Wide Area Network)

- Bluetooth Low Energy (BLE)

- Others

GPS technology is a critical segment in the smart container market, offering precise location tracking and real-time data on the movement of goods. GPS-enabled smart containers provide accurate, continuous monitoring of the location of a container, which is essential for efficient logistics management. This technology helps in route optimization, reducing transit times, and ensuring timely delivery of goods. It also plays a crucial role in security, allowing companies to track stolen or misplaced containers swiftly. The ability to monitor containers globally without relying on local infrastructure makes GPS highly valuable for international shipping and cross-border logistics. The widespread availability and reliability of GPS technology have made it a standard in the industry.

Cellular technology is another vital segment in the smart container market, providing robust connectivity for data transmission. Cellular networks enable real-time communication between smart containers and central monitoring systems, facilitating constant data exchange. This technology supports high data transfer rates, making it suitable for transmitting detailed sensor data, including temperature, humidity, and shock information. Cellular networks are widely available and offer extensive coverage in urban and suburban areas, making them ideal for land-based logistics.

LoRa WAN technology is a segment that focuses on long-range, low-power communication for smart containers. This technology is particularly suited for applications requiring extended battery life and wide coverage areas, such as remote or rural locations. LoRa WAN enables the transmission of small data packets over long distances, making it ideal for periodic updates on container status without draining the battery quickly. This capability is crucial for monitoring containers in areas where cellular and other connectivity options are limited or unavailable. LoRa WAN networks are cost-effective and scalable, allowing for the deployment of large numbers of smart containers with minimal infrastructure investment.

Bluetooth Low Energy (BLE) technology is an important segment in the smart container market, known for its low power consumption and short-range communication capabilities. BLE is particularly useful for monitoring containers in localized environments, such as warehouses, ports, and distribution centers. This technology allows for the efficient transfer of data from sensors to nearby gateways and mobile devices, providing real-time updates on the condition of the cargo. The low energy consumption of BLE ensures prolonged battery life for sensors, reducing maintenance and operational costs. Additionally, BLE technology supports mesh networking, enabling multiple devices to communicate with each other and extend coverage within confined areas.

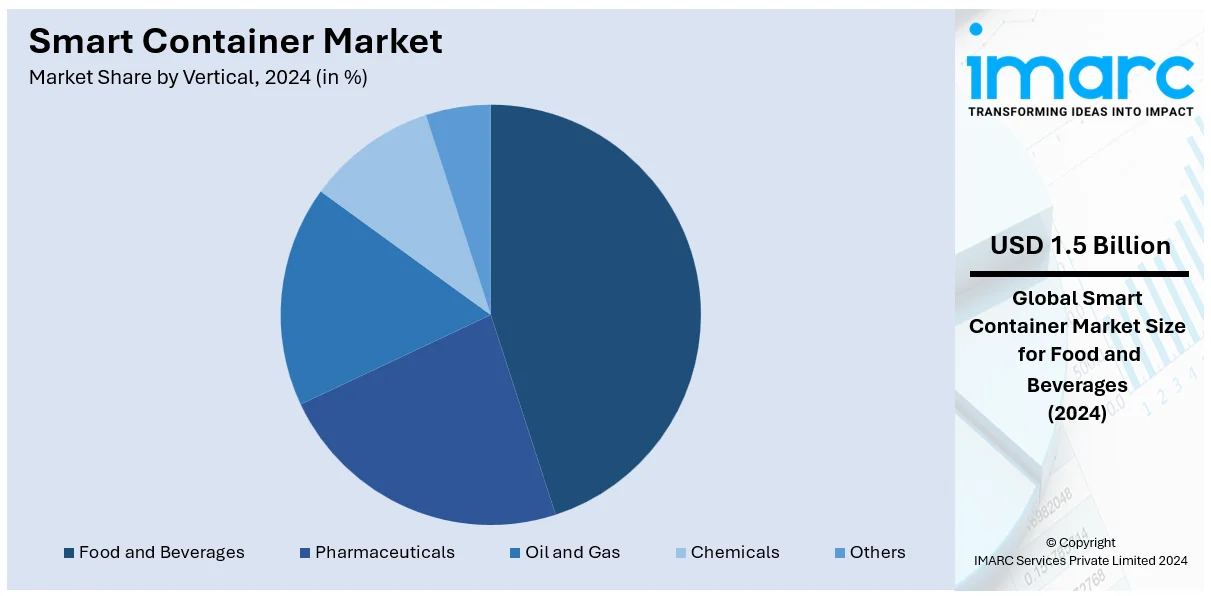

Analysis by Vertical:

- Food and Beverages

- Pharmaceuticals

- Oil and Gas

- Chemicals

- Others

According to the report, food and beverages (F&B) represented the largest segment in 2024. The F&B industry is the largest segment in the market breakup by vertical for smart containers due to the highly perishable nature of its products. Perishable goods such as fruits, vegetables, dairy products, and meats require strict temperature control throughout the supply chain to maintain their quality and safety. Any deviation in temperature can lead to spoilage, resulting in significant financial losses and health risks for consumers. Smart containers, equipped with advanced IoT sensors, continuously monitor, and adjust internal conditions to ensure optimal storage environments. Real-time data on temperature, humidity, and other critical parameters allows for immediate corrective actions if any anomalies are detected. This capability is crucial for preventing spoilage and maintaining the freshness of food products, thereby minimizing waste, and ensuring consumer safety.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the report, Europe was the largest market for smart containers in 2024. The prominence of Europe as the largest segment in the smart container market by region can be attributed to several key factors. The stringent regulatory environment of the region plays a significant role. European regulations for the transportation of goods, particularly food, pharmaceuticals, and hazardous materials, are among the strictest in the world. These regulations mandate comprehensive monitoring and reporting, which smart containers are uniquely equipped to provide. This regulatory pressure drives the adoption of smart container technologies to ensure compliance and avoid penalties. Additionally, Europe boasts a highly developed infrastructure that supports advanced logistics solutions. The extensive network of the continent of ports, railways, and highways is well-suited to integrate with smart container systems, facilitating seamless real-time tracking and monitoring across various transportation modes. This infrastructure is complemented by strong investment in digitalization and innovation, fostering an environment where smart technologies can thrive.

Key Regional Takeaways:

North America Smart Container Market Analysis

The growth of smart containers in North America is significantly driven by the expansion in the logistics and the e-commerce market, as industries such as pharmaceuticals, automotive, and food require real-time tracking and monitoring of their shipments. United States (US) and Canada rank highly in the adoption of smart container technologies which contributes to the IoT and sensor changes in logistics and supply chain visibility. Additionally, trade agreements such as the newly ratified United States-Mexico-Canada Agreement (USMCA) have continued to boost cross-border business which makes the use of smart containers imperative due to the increased scrutiny of the shipments. According to reports, about USD 1.3 trillion worth of goods are traded between the United States and its northern and southern neighbors annually, and exports to Mexico and Canada are said to help sustain nearly three million Americans in their employment.

United States Smart Container Market Analysis

The necessity for real-time supply chain monitoring, the country's robust logistics industry, and developments in IoT technology are driving the smart container market in the United States. There is a great need for effective cargo tracking and management systems because the U.S. logistics sector generates over USD 2 Trillion yearly, as per an industry report. Real-time temperature, humidity, and location monitoring have become easier with the growth in the use of IoT-enabled systems. This is crucial for industries like F&B and pharmaceuticals. For instance, nearly half of pharmaceutical products are sensitive to temperature and hence require advanced smart container solutions. Also, the food industry benefits significantly because the United States exports USD 11,793 Million in February from USD 10,494 Million in January of 2024 (as per an industrial report), thus requiring containers that are compliant with the Food and Drug Association (FDA) regulations and maintain freshness. The increased concern about cargo security is driving smart containers with tamper-detection technologies. The growing SMART (Strengthening Mobility and Revolutionising Transportation) program by the U.S. government contributes to the expansion of this market. As more people adopt sustainability, where the carbon emission in the transport sector has decreased significantly, the demand for energy-saving, reusable smart containers also increases.

Europe Smart Container Market Analysis

The smart containers market in Europe is fuelled by the strong regulatory environment, the strong urge for sustainability, and innovative technology. The highly advanced logistics infrastructure in Europe widely accepts IoT-enabled smart containers, especially in the domain of cold chain logistics. Close to 50% of pharmaceutical goods transported in Europe have specific temperature requirements, thus, they carry huge volumes of pharmaceutical commodities. Europe is also at the top in renewable energy, and smart containers facilitate streamlined supply chains for batteries and solar panels. Leading countries including Germany, France, and the Netherlands, make wide use of smart containers to export food, chemicals, and auto parts. The European Union's Green Deal, with its aspiration to achieve climate neutrality by 2050, promotes smart containers and other energy-efficient logistics solutions. While tamper-detection systems are meeting Europe's strict customs and border security regulations, the real-time monitoring and predictive analytics of smart containers are improving operational efficiency. Businesses in the region have been continuously introducing smart containers. For instance, Hapag Lloyd, the fifth-largest container shipping company in the world, is headquartered in Germany and has recently celebrated passing 700,000 smart containers within its 1.6 million-strong fleet.

Asia Pacific Smart Container Market Analysis

As per the smart container market statistics, Asia-Pacific’s dominant role in global manufacturing and exports is fueling demand for smart containers, as companies in the region seek to enhance supply chain efficiency and visibility. According to an industrial report, in 2023, the world's largest exporter, China, shipped over USD 3 Trillion in products, many of which required smart container solutions. Similarly, India's USD 200 Billion logistics sector is gradually implementing IoT-enabled containers for perishables and medicines. South Korea and Japan, are the major electronics exporters and use smart containers to ensure the quality and safety of their shipments. In the region, businesses are continually introducing smart containers. In May 2024, for example, China Mobile assists in deploying the first "Silk Road Maritime" smart containers. The first batch of 625 smart containers, recently launched, besides promoting the rapid development of new high-caliber productive forces in port and shipping logistics, it provides more effective information services for developing trade, including supply chain logistics and cross-border e-commerce. In addition, regional trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), encourage cross-border trade and require the application of smart containers to optimize operational efficiency.

Latin America Smart Container Market Analysis

The smart container market in Latin America is driven by the growth of the pharmaceutical sector, agricultural exports, and the adoption of modern logistics technologies in the region. Smart containers are utilized by Brazil and Argentina, the world's biggest exporters of beef and soybeans, to monitor the humidity and temperature during transportation. As per industry data, January-March 2024 experienced a strong surge in Brazilian container activity, with exports growing 22.5% year-over-year over the same period in 2023, adding more steam to market growth. In fact, the IoT is becoming more popular in logistics by the minute, especially as Brazil puts significant investments in modernizing its ports and supply chain. Smart container demand surges due to the effects of the signing of a free trade agreement such as the USMCA, which encourages cross-border trade.

Middle East and Africa Smart Container Market Analysis

The expansion of oil exports, agricultural commerce, and infrastructural development all affect the Middle East and Africa's smart container business. Smart containers are used in the oil and gas industry of the Middle East, which is responsible for producing more than 33% of the world's oil. They transport petrochemicals and other chemicals safely. As per an International Energy Agency (IEA) report, energy investment in the Middle East is projected to hit around USD 175 Billion in 2024, with clean energy representing about 15% of the overall investment. There are more and more applications of IoT-enabled containers in the agricultural exports of African coffee and cocoa, especially to ensure product quality. The updating of the logistical infrastructure of the region with a focus on smart containers helps improve their adoption, especially in South Africa and the United Arab Emirates. Moreover, smart containers ensure global competitiveness by supporting international trade rules.

Competitive Landscape:

Key players in the smart container market are driving significant market growth through a variety of strategic efforts. Companies such as Maersk, Traxens, and Orbcomm are at the forefront, leveraging technological advancements to enhance their offerings. Maersk, for instance, has invested heavily in its Remote Container Management (RCM) system, which allows consumers to monitor the conditions of their cargo in real time, ensuring optimal conditions throughout the shipping process. Traxens, another major player, collaborates with shipping giants such as CMA CGM and MSC to provide advanced tracking solutions that integrate IoT and big data analytics, enabling precise monitoring and predictive maintenance. Orbcomm focuses on comprehensive IoT solutions that track and monitor containers and also offer detailed analytics to optimize routes and improve operational efficiency. These businesses are also establishing strategic alliances and acquisitions to broaden their technological prowess and market penetration, per the smart container market prediction. For instance, the collaboration between Traxens and COSCO Shipping Lines aims to enhance digital shipping solutions across their fleets. Additionally, companies are investing in research and development (R&D) to develop next-generation smart container technologies that incorporate AI and machine learning for better predictive analytics and automation.

The report provides a comprehensive analysis of the competitive landscape in the smart container market with detailed profiles of all major companies, including:

- Ambrosus

- Globe Tracker ApS

- Nexiot AG

- Orbcomm Inc.

- Phillips Connect Technologies LLC (R.A. Phillips Industries Inc.)

- Robert Bosch Manufacturing Solutions GmbH

- Smart Containers Group AG

- SeaLand (Maersk Group)

- Traxens

- Zillionsource Technologies Co. Ltd.

Latest News and Developments:

- June 2025: ORBCOMM introduced CrewView, a new onboard visibility tool that enables vessel crews to monitor smart refrigerated and dry containers in real time while at sea, eliminating the remaining gap in end-to-end supply chain visibility. CrewView provides SMS alerts without requiring satellite connectivity, supports vessel-to-shore data sharing, and integrates interactive container maps and APIs for third-party systems. The solution, built on technology acquired from Vobal Technologies in May 2025, has been piloted with several global shipping lines and is now part of ORBCOMM’s broader mission to digitalize container tracking across sea, port, and land.

- May 2025: Maersk has begun deploying its OneWireless digital connectivity platform across 450 vessels to enhance smart container and cargo tracking. The platform upgrades onboard infrastructure from 2G to 4G, improving data granularity and enabling real-time monitoring for reefer and dry containers. Supported by partners including ZEDEDA, Nokia, and Onomondo, the unified network integrates multiple wireless technologies and allows centralized control of onboard applications, even in remote or low-connectivity environments.

- March 2025: Several major technology firms launched the Smart Container Alliance. The initiative aims to improve global cargo traceability, support customs modernization, and strengthen enforcement against illicit trade by advancing smart container technologies. It aligns with ongoing EU Customs Union reforms and promotes public-private cooperation to standardize digital customs practices.

- November 2024: ZIM Integrated Shipping Services is using Hoopos' cutting-edge fleet intelligence technologies to further its global deployment of smart containers. The objectives of this effort are to give clients real-time shipment information, increase operational efficiency, and improve container tracking.

- March 2024: Silk Road Shipping has launched its first smart containers, reflecting the growing demand for e-commerce-driven logistics solutions. Advanced tracking and monitoring technology included in these smart containers allow for real-time data on the movements and conditions of the cargo. This project is in line with the growing demand for more effective and transparent supply chain systems due to the growth of global e-commerce.

- November 2023: WISeKey and CASPIAN CONTAINER COMPANY have formed the Smart Container Consortium, dedicated to revolutionizing container logistics through IoT-enabled devices and sensors.

- April 2023: At Singapore Maritime Week, the logtech company AELER unveiled "Unit One," a new generation container. The container was unveiled on April 25 during Sea Asia, Singapore's premier nautical exhibition. As the first composite-made transportation container, Unit One is "stronger, better insulated, and smarter.

Smart Container Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | Hardware, Software, Services |

| Technologies Covered | GPS (Global Positioning System), Cellular, LoRa WAN (Long Range Wide Area Network), Bluetooth Low Energy (BLE), Others |

| Verticals Covered | Food and Beverages, Pharmaceuticals, Oil and Gas, Chemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ambrosus, Globe Tracker, ApS., Nexiot AG, Orbcomm Inc., Phillips Connect Technologies LLC (R. A. Phillips Industries Inc.), Robert Bosch Manufacturing Solutions GmbH, Smart Containers Group AG, SeaLand (Maersk Group), Traxens, Zillionsource Technologies Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart containers market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart container market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart containers industry and its attractiveness.

Key Questions Answered in This Report

The global smart container market was valued at USD 4.31 Billion in 2024.

IMARC Group estimates the market to reach USD 15.16 Billion by 2033, exhibiting a CAGR of 14.90% from 2025-2033.

Key factor like increasing demand for efficient supply chain management, advancements in IoT and AI technologies, rising focus on reducing cargo theft and damage, stringent regulatory requirements for food and pharmaceutical transport, and the growing need for real-time monitoring in logistics operations are driving the market demand.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global smart container market include Ambrosus, Globe Tracker, ApS., Nexiot AG, Orbcomm Inc., Phillips Connect Technologies LLC (R. A. Phillips Industries Inc.), Robert Bosch Manufacturing Solutions GmbH, Smart Containers Group AG, SeaLand (Maersk Group), Traxens, Zillionsource Technologies Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)