Smart Coatings Market Size, Share, Trends and Forecast by Layer Type, Function, End Use Industry, and Region, 2025-2033

Smart Coatings Market Size and Share:

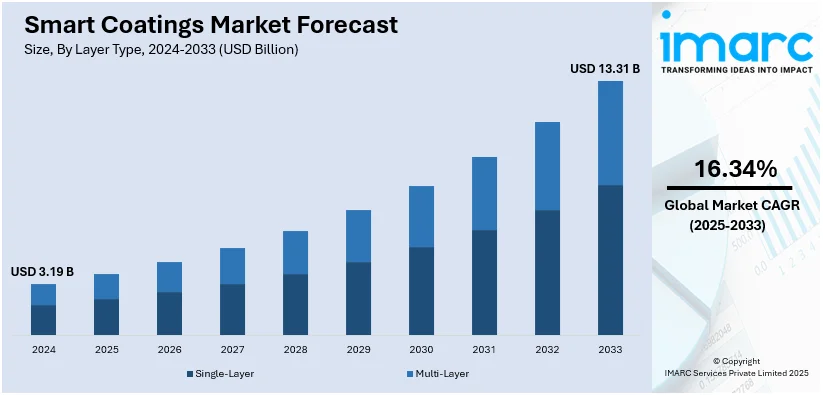

The global smart coatings market size was valued at USD 3.19 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.31 Billion by 2033, exhibiting a CAGR of 16.34% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of 36.5% in 2024. Increasing demand for corrosion-resistant coatings across industries and rising environmental awareness favoring eco-friendly coatings is propelling the market growth. Besides this, the smart coatings market share is driven by the expansion of the healthcare sector with a focus on antimicrobial coatings and growing investments in research and development (R&D) for innovative technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.19 Billion |

|

Market Forecast in 2033

|

USD 13.31 Billion |

| Market Growth Rate (2025-2033) | 16.34% |

Smart coatings represent a groundbreaking advancement in material science designed to provide diverse advantages in multiple sectors. They are crafted to adjust and react thoughtfully to changes in the environment and external factors. They are commonly utilized for corrosion protection in the automotive and aerospace industries, for self-cleaning features on architectural surfaces, and also in healthcare for antimicrobial coatings on medical equipment. They offer improved durability, since they can repair small damages, lowering maintenance expenses. Furthermore, their self-cleaning features lessen the requirement for chemical cleaners, rendering them eco-friendly. In the automotive sector, they can alter their color or transparency when exposed to variations in temperature or light, improving both vehicle appearance and safety. There are different kinds of smart coatings including self-repairing coatings, photo responsive coatings, and water-repellent coatings, each designed for particular uses.

Energy infrastructure is expanding the United States smart coatings market demand through increased investments. Rising renewable energy projects require durable coatings for solar panels, wind turbines, and transmission infrastructure protection. Smart coatings enhance efficiency by providing self-cleaning, anti-corrosion, and anti-reflective properties in energy generation systems. Government initiatives promoting clean energy adoption accelerate the demand for advanced protective coatings across power plants. Oil and gas infrastructure upgrades drive the need for corrosion-resistant coatings in pipelines, tanks, and offshore platforms. Increased construction of smart grids and energy storage facilities strengthens demand for conductive and insulating smart coatings. Extreme weather conditions necessitate temperature-responsive coatings for energy equipment, ensuring operational efficiency and longevity. To cater these demands, in November 2024, Perma-Pipe International Holdings secured $15 million in contracts across the Americas and MENA regions, expanding its district energy infrastructure presence. The projects use anti-corrosion coatings and XTRU-THERM® insulation for pipeline protection. With a backlog exceeding $100 million, the company strengthens its market position through strategic expansion and advanced coating solutions for industrial applications. Moreover, research and development (R&D) in nanotechnology improve the performance of smart coatings in high-stress energy environments. Infrastructure modernization efforts encourage utility companies to adopt smart coatings for improved maintenance and energy efficiency.

Smart Coatings Market Trends:

Increasing demand for corrosion-resistant coatings

The market is experiencing substantial growth driven by the increasing need for corrosion-resistant coatings in various sectors. Industries, such as automotive, aerospace, and construction rely on these coatings to protect materials from deterioration and increase their lifespan. The use of smart coatings is rising because of their self-repairing traits and real-time corrosion detection features, rendering them extremely useful in industrial settings. In car manufacturing, smart coatings extend vehicle longevity and lower maintenance costs, guaranteeing improved performance across different conditions. The aerospace sector, functioning in harsh conditions, depends on these coatings to safeguard essential parts from corrosion and deterioration. Likewise, in construction, intelligent coatings are utilized to enhance the durability of infrastructure and its resistance to environmental harm. Businesses are putting money into creative solutions, like AkzoNobel’s self-healing anti-corrosion coating, introduced in November 2023 for wind turbines, which aids in fixing small damage, prolonging blade lifespan. The rising need for improved coatings underscores their importance in improving durability, efficiency, and cost-effectiveness in various sectors.

Growing awareness of environmental concerns

The increasing focus on sustainability is a key element catalyzing the demand for smart coatings in various sectors. These coatings promote environmentally friendly options by decreasing the frequency of reapplications and upkeep, thereby reducing waste and chemical usage. Self-cleaning coatings enable surfaces to resist dirt and contaminants, resulting in cleaner surroundings and reduced dependence on harsh cleaning chemicals. In maritime uses, anti-fouling coatings stop the accumulation of biological organisms on vessels, minimizing the discharge of toxic substances into aquatic environments. Moreover, energy-saving coatings enhance the efficiency of solar panels and windows, leading to reduced energy usage in buildings and renewable energy systems. The G7 Partnership for Global Infrastructure and Investment seeks to raise $600 billion by 2027 for sustainable infrastructure while supporting green innovations such as smart coatings. With the transition of industries to green technologies, the need for long-lasting, energy-efficient, and environmentally friendly coatings will keep rising, reinforcing their importance in sustainable growth.

Expansion of the healthcare sector

The rapid growth of the healthcare sector is significantly driving demand for antimicrobial smart coatings, which play a crucial role in infection control. These coatings are designed to prevent bacterial and pathogen growth on surfaces, making them essential for medical equipment, hospital infrastructure, and high-touch areas. As concerns over healthcare-associated infections (HAIs) increase, hospitals and clinics are adopting advanced coatings to maintain hygienic environments and reduce cross-contamination risks. India’s hospital market, valued at $98.98 billion in 2023, is expected to grow at an 8.0% CAGR, reaching $193.59 billion by 2032 (IBEF). This expansion is driving demand for infection-resistant materials, strengthening the smart coatings market growth. As hospitals and healthcare facilities modernize and expand, antimicrobial coatings remain essential in enhancing patient safety and reducing maintenance costs. This growing sector offers lucrative opportunities for smart coatings manufacturers to develop innovative solutions tailored to the healthcare industry's needs.

Smart Coatings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart coatings market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on layer type, function, and end use industry.

Analysis by Layer Type:

- Single-Layer

- Multi-Layer

Multi-layer leads the market with 52.7% of market share in 2024. The growth of the multi-layer segment in the coatings industry is primarily driven by the increasing demand for advanced protection and performance in various applications. Multi-layer coatings offer a versatile solution by combining different layers with specific functionalities, such as corrosion resistance, ultraviolet (UV) protection, and adhesion enhancement, meeting the diverse requirements of industries like automotive, aerospace, and electronics. Moreover, the ever-evolving regulatory landscape and stringent environmental standards are catalyzing the need for coatings with reduced volatile organic compounds (VOCs) and enhanced durability, making multi-layer coatings an attractive choice. In line with this, technological advancements are enabling the development of complex multi-layer systems with superior properties, catering to specialized markets. The rising trend of customization and tailored solutions has bolstered the adoption of multi-layer coatings to meet specific performance criteria. Additionally, the increasing focus on sustainability and energy efficiency in construction and infrastructure projects is leading to the incorporation of multi-layer coatings for thermal insulation and weather resistance.

Analysis by Function:

- Anti-Microbial

- Anti-Corrosion

- Anti-Fouling

- Anti-Icing

- Self-Cleaning

- Self-Healing

- Others

The growth of the anti-corrosion segment within the global smart coatings market is primarily driven by the increasing need for durable and long-lasting protection against corrosion across various industries including automotive, aerospace, and infrastructure. Smart coatings in this segment offer real-time corrosion monitoring and self-healing properties, enhancing the lifespan of critical assets and reducing maintenance costs. Moreover, environmental concerns are encouraging industries to seek eco-friendly alternatives, and anti-corrosion smart coatings align with this demand by minimizing the need for frequent recoating and reducing the environmental impact of corrosion-related maintenance. In line with this, stringent regulations and quality standards in sectors, such as aerospace and automotive, are compelling manufacturers to adopt advanced corrosion-resistant solutions, driving the adoption of smart coatings. Technological advancements in smart coatings improve corrosion resistance by incorporating nanotechnology and self-healing properties. Manufacturers are developing eco-friendly anti-corrosion coatings to comply with sustainability regulations and environmental concerns.

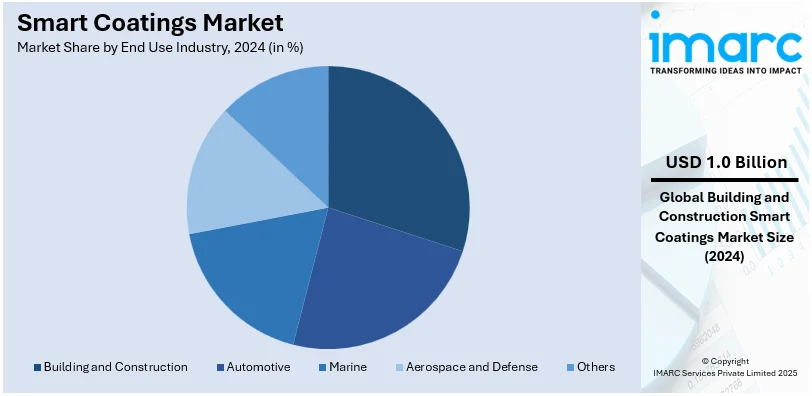

Analysis by End Use Industry:

- Building and Construction

- Automotive

- Marine

- Aerospace and Defense

- Others

Building and construction leads the market with 25.6% of market share in 2024. The growth of the building and construction segment is primarily driven by rapid urbanization and expansion of residential, commercial, and infrastructure projects. This rapid urbanization necessitates the construction of new buildings, roads, bridges, and other structures, fueling the market’s growth. Moreover, the emphasis on sustainable and energy-efficient construction practices is compelling the adoption of innovative materials and technologies including smart coatings, which enhance energy efficiency, durability, and aesthetics. In line with this, the need for improved infrastructure, especially in emerging economies, is driving significant investments in construction projects. Additionally, government initiatives, such as infrastructure development programs and affordable housing schemes, further stimulate the building and construction sector. Furthermore, the ongoing trend of urban renewal and renovation projects in developed regions contributes to sustained growth across the globe.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific held the largest market share of 36.5% in 2024. The market for smart coatings in the region is growing at a fast pace due to rapid industrialization and infrastructure development in China and India, creating huge demand for smart coatings across sectors like construction, automotive, and electronics. To assist these sectors, grow, in November 2024, the NIPSEA Group, represented by Nippon Paint announced its expansion operations in China into urban development and smart transportation. It displayed the Smart Road Marking Paint and Photocatalytic Coating at CIIE 2024. With its 74 plants and 10 R&D facilities, company is fueling research and development (R&D) in automotive paints, further intensifying its long-term commitment in China's evolving market and investment in innovation. Besides this, awareness about the requirement for sustainable and eco-friendly solutions aligns with the adoption of smart coatings, which are energy-efficient and environmentally conscious. The growth in the automotive industry in the region seeks smart coatings to improve energy efficiency and aesthetics in vehicles, further propelling the market growth. In addition, R&D investments in countries, such as South Korea and Japan are yielding technological advancements and innovative smart coating solutions. In addition, Asia-Pacific's role as a leading electronics manufacturing hub is increasing the demand for coatings to protect sensitive electronic components.

Key Regional Takeaways:

United States Smart Coatings Market Analysis

The United States hold 85.50% of the market share in North America. The US automotive industry is experiencing strong growth, positioning itself as a key driver of the market. In 2022, US light vehicle sales reached 11.5 million units, making it the world’s second-largest light-vehicle market after China, as reported by the International Trade Administration (ITA). With automakers prioritizing vehicle longevity and efficiency, the demand for smart coatings is rising rapidly. These advanced coatings offer self-healing, anti-scratch, anti-corrosion, and hydrophobic properties, which help extend vehicle lifespan and reduce maintenance costs. The increasing adoption of electric vehicles (EVs) is further driving demand, as smart coatings improve battery performance, thermal management, and overall energy efficiency. Additionally, strict environmental regulations are mandating manufacturers to adopt sustainable, high-performance coatings that comply with emission and durability standards. As the industry shifts toward more efficient and eco-friendly solutions, the market in US is expected to see significant expansion, with automakers increasingly integrating innovative coating technologies into next-generation vehicles.

Europe Smart Coatings Market Analysis

The expansion of the aerospace and defense sector is a key factor fueling the market in Europe. In 2023, the industry witnessed a 10.1% annual increase, reaching €290.4 billion ($301.05 billion), according to ASD Europe. This consistent growth reflects rising investments in advanced materials and protective technologies, including smart coatings. In aerospace, smart coatings provide self-healing, anti-corrosion, and thermal-resistant properties, which enhance aircraft durability and efficiency. These coatings protect aircraft structures from wear, extreme temperatures, and environmental exposure, reducing maintenance costs. In defense applications, they contribute to stealth capabilities, radar absorption, and environmental resistance, improving military vehicle performance. With European Union policies and defense contractors emphasizing innovation and sustainability, demand is increasing for lightweight, high-performance coatings. The incorporation of nanotechnology and eco-friendly formulations is further influencing market expansion. As investment in aerospace and defense rises, the adoption of smart coatings in these industries is expected to grow substantially.

Latin America Smart Coatings Market Analysis

Rising infrastructure investments across Latin America are catalyzing demand for smart coatings, particularly in energy and construction projects. In Chile, the government has introduced an extensive infrastructure plan, featuring 48 grid projects worth $1.45 billion. Among them, the largest transmission line project, valued at $345 million, is set to begin in 2025. These large-scale developments require durable and high-performance materials to enhance longevity, efficiency, and sustainability. Smart coatings, known for their corrosion resistance, self-healing capabilities, and thermal regulation, provide essential protection for power grids, bridges, and commercial buildings. As Latin American nations focus on modernizing infrastructure, the demand for low-maintenance, long-lasting coatings continues to rise. Additionally, the growing emphasis on energy efficiency and environmental sustainability is accelerating the adoption of smart coatings. These advanced materials are becoming an integral part of the region’s construction and energy sectors, supporting sustainable infrastructure development.

Middle East and Africa Smart Coatings Market Analysis

The Middle East and Africa region is undergoing a major infrastructure expansion, creating a growing need for smart coatings. The UAE has a strong pipeline of transportation and road projects, including the $11 billion Etihad Rail project, a proposed $5.9 billion hyperloop between Dubai and Abu Dhabi, and the $2.7 billion Sheikh Zayed double-deck road. Large-scale infrastructure projects require high-performance materials that enhance durability, efficiency, and longevity. Smart coatings, known for their corrosion resistance, self-cleaning properties, and thermal regulation, provide essential protection against harsh climates, lower maintenance costs, and support sustainability goals. With continuous investments in urban development, transportation, and energy sectors, demand for innovative coatings is rising. The focus on infrastructure resilience and energy efficiency is accelerating smart coatings adoption, making them a crucial element in the MEA region’s long-term development strategy.

Competitive Landscape:

The market is extremely competitive, with major industry competitors aiming to grow their market presence through innovation and technological progress. Businesses emphasize research and development (R&D) to create innovative coating solutions designed for the automotive, aerospace, healthcare, and construction sectors. To achieve a competitive advantage, manufacturers emphasize product differentiation by providing unique coatings that feature corrosion resistance, self-cleaning abilities, and antimicrobial properties. Quality, longevity, and performance are vital in achieving market dominance. Moreover, key players are forming strategic alliances with suppliers, distributors, and end-users, which enhance market access and fortifies supply chain networks. The rising demand for sustainable and eco-friendly coatings is prompting companies to create environmentally considerate solutions, heightening competition. For example, in September 2024, BASF SE Coatings introduced automotive refinish clearcoats that utilized ChemCycling technology to transform waste tires into recycled raw materials for high-performance coatings. Launched under Glasurit Eco Balance and R-M eSense, these coatings enhance body shop productivity while promoting sustainability. Their quick-drying characteristics aid in reducing energy use and cutting CO₂ emissions, aligning with environmentally friendly refinishing options. With the increasing worldwide acceptance of smart coatings, businesses persist in promoting technological innovation, keeping the market vibrant and centered on performance-oriented improvements.

The report provides a comprehensive analysis of the competitive landscape in the smart coatings market with detailed profiles of all major companies, including:

- 3M Company

- A&K Painting Company

- Ancatt Inc

- BASF SE

- Dupont De Nemours Inc.

- Jotun A/S

- NEI Corporation

- PPG Industries

- RPM International Inc.

- Tesla NanoCoatings Inc.

- The Lubrizol Corporation (Berkshire Hathaway Inc)

- The Sherwin-Williams Company

Latest News and Developments:

- July 2024: Smart Planet Technologies launched an innovative coating specifically developed for paper-based flexible packaging solutions.

- September 2023: D.C. United formed a partnership with Sherwin-Williams to strengthen its association with a leading paint manufacturer.

- June 2023: Lubrizol Corporation revealed plans to invest approximately $150 million in multiple projects across India, including a CPVC resin plant in Gujarat and a grease lab in Navi Mumbai.

Smart Coatings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Layer Types Covered | Single-Layer, Multi-Layer |

| Functions Covered | Anti-Microbial, Anti-Corrosion, Anti-Fouling, Anti-Icing, Self-Cleaning, Self-Healing, Others |

| End Use Industries Covered | Building and Construction, Automotive, Marine, Aerospace and Defense, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | 3M Company, A&K Painting Company, Ancatt Inc, BASF SE, Dupont De Nemours Inc., Jotun A/S, NEI Corporation, PPG Industries, RPM International Inc., Tesla NanoCoatings Inc., The Lubrizol Corporation (Berkshire Hathaway Inc.) The Sherwin-Williams Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, smart coatings market outlook, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global smart coatings market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart coatings industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart coatings market was valued at USD 3.19 Billion in 2024.

The smart coatings market is projected to exhibit a CAGR of 16.34% during 2025-2033, reaching a value of USD 13.31 Billion by 2033.

The smart coatings market growth is driven by rising demand for durable, high-performance materials across automotive, aerospace, healthcare, and construction industries. Increasing investments in infrastructure, energy efficiency, and sustainable technologies catalyze adoption. Self-healing, anti-corrosion, and antimicrobial properties enhance product lifespan, reducing maintenance costs. Stringent environmental regulations encourage eco-friendly coatings. Growth in electric vehicles (EVs), renewable energy, and military applications further drives demand for smart coatings.

Asia Pacific currently dominates the smart coatings market, accounting for a share of 36.5% in 2024. Countries like China, India, Japan, and South Korea lead in automotive, aerospace, electronics, and construction industries, driving demand for advanced coatings. Increasing government investments in sustainable infrastructure and smart city projects further fuel market growth. Additionally, rising awareness about eco-friendly coatings and stringent environmental regulations contribute to the sector’s expansion in the region.

Some of the major players in the smart coatings market include 3M Company, A&K Painting Company, Ancatt Inc, BASF SE, Dupont De Nemours Inc., Jotun A/S, NEI Corporation, PPG Industries, RPM International Inc., Tesla NanoCoatings Inc., The Lubrizol Corporation (Berkshire Hathaway Inc.) The Sherwin-Williams Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)