Smart Antenna Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2025-2033

Smart Antenna Market Size and Share:

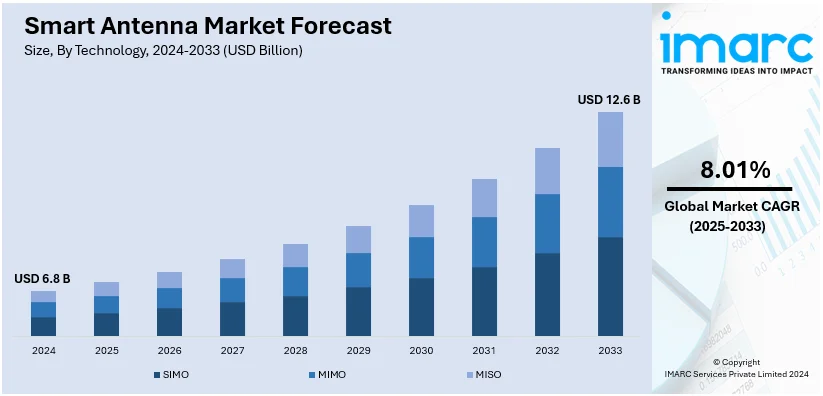

The global smart antenna market size was valued at USD 6.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.6 Billion by 2033, exhibiting a CAGR of 8.01% from 2025-2033. North America currently dominates the market, holding a market share of over 34.7% in 2024. The smart antenna market is primarily driven by the rising proliferation of the internet, the growing number of mobile devices, the development of new 5G technologies, the increasing investment on telecommunication infrastructures, and the widespread adoption of the Internet of thing (IoT) devices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Market Growth Rate (2025-2033) | 8.01% |

The market of smart antennas continues to expand as there is a growing demand for high-speed wireless communication and constantly evolving 5G technology. Smart antennas work with multiple input multiple output (MIMO) and beamforming facilities that increase data transfer rates, reduce interferences, and expand the area of signal coverage. Rising trends like IoT integration, smart cities, and autonomous cars also push the market forward, while adaptive antenna systems are implemented in defense for quality. Furthermore, global enterprises are dedicating significant funds in research & development to upgrade the dual-purpose antennas as per the changing market trends, to increase bandwidth, and to ensure effective communication.

In the United States, the smart antenna market is expanding steadily, supported by accelerated 5G network rollouts and the growing demand for low-latency communication across sectors like telecommunications, automotive, and public safety. The U.S. government's initiatives to strengthen communication infrastructure, coupled with rising investments in AI and IoT technologies, are key drivers for market growth. For instance, in December 2024, Washington secured $15.9 million from the NTIA to implement its Digital Equity Plan, helping residents access affordable Internet, improve digital skills, and enhance online privacy through outreach, training, and partnerships. Smart antennas are playing a crucial role in supporting the development of smart cities, autonomous vehicles, and defense systems by providing robust connectivity and real-time communication. Leading U.S. companies are focusing on technological advancements, including adaptive antenna designs, to address increasing data demands and ensure high performance in complex network environments.

Smart Antenna Market Trends:

Rising Deployment of 5G Technology

5G technology has become a worldwide phenomenon, which in turn, has augmented the demand for smart antenna. As the Federal Communications Commission (FCC) stated in 2022 already, the USA experiences the widespread rollout of 5G networks (92% of the population), which is compared with previous years. Such spread is increasing the consumption of smart antennas, which are currently developed in high frequencies and data rate to sustain the 5G network generation, therefore, market growth and innovation opportunities in the antenna technology are experienced. With 5G now spreading across the globe, smart antennas will become real cornerstones of network improvement as they result in better and more spaced-out connections.

Rapid Expansion of Internet of Things (IoT)

One of the key trends influencing the smart antenna market share is massive IoT devices growth. As per the forecasts by the U.S. Department of Commerce, the connected IoT devices figure to be more than 75 billion by the year 2025. The IoT is gaining traction and foothold across all applications and this growth of IoT devices has escalated the demand for smart antenna communication systems that can support the exploding traffic and connectivity needs of IoT devices which further stimulates the market demand. Intelligent antennas ensure the reliability of communications and the timely exchange of IoT objects data, thus increasing their battery life and making them part of the connected ecosystems of the Internet of Things.

Wireless Connectivity Demand

The continuous rise of the requirement for speedy wi-fi connectivity is the key driver for smart antenna market growth. The increasing usage of mobile data and the current trend of people consuming bandwidth-hungry content like video streaming or online gaming has escalated the need for advanced antenna platforms to better the capacity of the network and increase the performance of the system. According to the International Telecommunication Union (ITU), international data traffic will grow 31% per year implying smart antennas critically important in meeting the annual mounted demands of wireless communication. With wireless networks becoming the new norm in the consumer and corporate arena for routine tasks, manufacturers of smart antennas are needed to maintain the same standard of seamless and dependable wireless connection, thereby creating a positive smart antenna market outlook.

Smart Antenna Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart antenna market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology and application.

Analysis by Technology:

- SIMO

- MIMO

- MISO

MIMO leads the market with around 57.8% of market share in 2024. The demand for MIMO technology in the smart antenna market is significantly driven by its ability for multiplying the transmission data rates and upgrading network capacity. For instance, the Federal Communications Commission (FCC) reported evidence that the Multi-Input Multi-Output (MIMO) adoption is experiencing growth with a yearly growth rate on average of 12% between 2020 and 2025. Economic efficiency in controlling signaling interference and enhancing the spectrum is one of the major reasons for its popularity. As governments worldwide adopt modern communication technologies, MIMO system has become valuable in respect to fulfilling the increasing desire for high-speed data transfer. Therefore, it remains a strategic area for research and development (R&D) and implementation of smart antennas across the globe.

Analysis by Application:

- Wi-Fi Systems

- WiMAX Systems

- Cellular Systems

- RADAR Systems

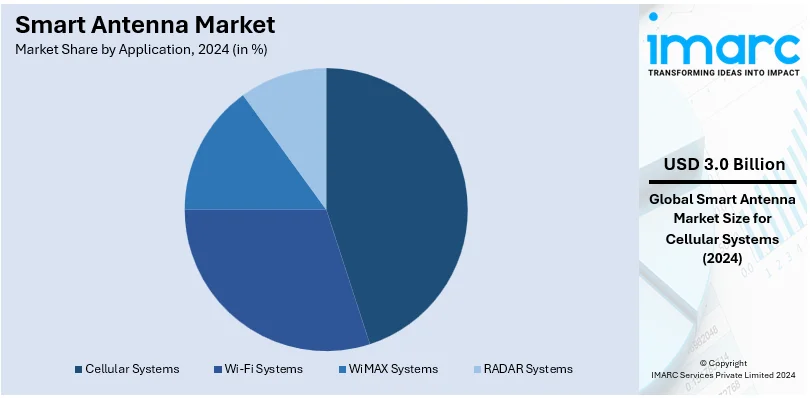

Cellular systems lead the market with around 43.5% of market share in 2024. The smart antenna market research report indicates that cellular systems dominate the market as they register increasing demand for mobile data and the rapid rise of the and the ever-growing need for reliable connectivity. As per the reports of International Telecommunication Union, mobile data traffic in the world is expected to show 30% per year increases. This growth is aggravated by the fact that tech boom, which is caused by proliferation of smartphones, IoT devices, and bandwidth-intensive applications. Intelligent antenna systems are crucial parts of cellular network designs, improving signal strength and system coverage area while lowering interference risk and network efficiency. With the growth of modern cellular technology, the smart antennas market demand is constantly increasing.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34.7%. In North America, the smart antenna market growth is primarily propelled by the rising demand for faster internet connectivity and the higher rate of support for cutting edge wireless communications technologies. As per the U.S. Census Bureau's data, the internet adoption in the United States witnessed a 20 percent increase in the past year, verifying the rising trend of digital connectivity among individuals. Additionally, 40% increase of 5G deployments by FCC in the United States during the last year was the reason of further market development of the 5G technology. Complementarily, these features comprise the smart antenna market development in North America promoting innovation and improving technical advancements.

Key Regional Takeaways:

United States Smart Antenna Market Analysis

In 2024, United States accounted for 75.00% of the market share in North America. The quick development of 5G technology and rising investments in wireless communication infrastructure are driving the smart antenna market in the US. Due to significant investments made in network expansion by telecom behemoths like Verizon, AT&T, and T-Mobile, the United States is leading the way in the rollout of 5G. To achieve the fast speeds and low latency promised by 5G networks, smart antennas—which enhance signal quality and data throughput—are essential.

The aerospace and defense industries also significantly contribute to market expansion. Unmanned aerial vehicles (UAVs), radar systems, and military communication systems all use smart antennas to improve connectivity and guarantee safe data transfer. Furthermore, the need for sophisticated antenna systems that can handle several connections at once is being driven by the growing use of Internet of Things (IoT) devices in sectors including healthcare, smart homes, and the automotive industry. Market expansion is further supported using beamforming technology in smart antennas to increase spectral efficiency and lower interference. Furthermore, the growing adoption of Wi-Fi 6 and Wi-Fi 7 protocols in consumer goods, along with government programs encouraging broadband access in rural regions, are significantly expanding the U.S. market. According to the Wi-Fi Alliance, a global network of Wi-Fi providers, more than 5.2 Billion Wi-Fi 6 and Wi-Fi 6E devices will be shipped by 2025. Demand for sophisticated connectivity in smart homes, workplaces, and industrial settings is rising, which is fueling this expansion.

Europe Smart Antenna Market Analysis

The extensive deployment of 5G networks and the expansion of Industry 4.0 applications are driving the smart antenna market in Europe. Smart manufacturing, which depends on strong wireless communication networks backed by intelligent antennas, is being prioritized by nations like Germany, the UK, and France. High-speed connectivity is emphasized by the European Union's Digital Agenda and programs like "Gigabit Society," which increases demand. Under the Euro 7.5 Billion (USD 7.9 Billion) Digital Europe program, the first EU program exclusively devoted to the EU's digital transformation, the European Commission is accelerating the digital transformation by co-financing the research, development, and deployment of cutting-edge technologies in 2021–2027, given its significance for EU competitiveness. Additionally, each EU nation should allocate at least 20% of the cash it receives from the EU Recovery and Resilience Facility to the digital transition.

As smart antennas are crucial for connected cars, automated driving systems, and Vehicle-to-Everything (V2X) connectivity, the automobile industry is heavily involved. Investments in smart grid systems, where smart antennas optimize data transmission for real-time monitoring, are another result of Europe's strong emphasis on sustainability and energy efficiency. Furthermore, Europe's leadership in space technology and communication technologies is being strengthened by the growing use of smart antennas in sophisticated satellite communication systems for uses like remote monitoring and maritime navigation.

Asia Pacific Smart Antenna Market Analysis

The market for smart antennas is expanding at an exponential rate in the Asia-Pacific area because of rising mobile device adoption, 5G network expansion, and fast urbanization. Leading the way in the region's telecommunications infrastructure developments are China, Japan, and South Korea. The rollout of 5G and the increasing use of IoT devices in sectors including manufacturing, healthcare, and transportation depend heavily on smart antennas. The need for smart antennas in urban planning and public safety applications is being further fueled by India's Digital India initiative and rising investments in smart city initiatives. More than 90% of the INR 46,787 crore (USD 5.5 Billion) that the Central Government of India has already disbursed to 100 Smart Cities under the Smart Cities Mission has been used. Significant Initiatives Under the Smart City Mission’s Integrated Command and Control Centres (ICCC) have made significant progress. There are operating ICCCs in each of the 100 Smart Cities, which use data to make well-informed decisions using cutting-edge technology like artificial intelligence, the Internet of Things, and data analytics. Furthermore, the region's thriving entertainment and e-commerce industries are driving up demand for dependable high-speed internet, which smart antennas provide. These antennas' incorporation into cutting-edge technology like virtual reality (VR) and augmented reality (AR) is also contributing to market expansion.

Latin America Smart Antenna Market Analysis

The market for smart antennas in Latin America is being driven by the rising need for better wireless connectivity and communication in both urban and rural areas. Countries like Mexico and Brazil are making significant investments in the rollout of 5G and extending connectivity to underdeveloped areas. Nearly two thirds of Latin American customers plan to upgrade to 5G, per the GSMA Intelligence customers in Focus Survey 2020. Over the past five years, Latin American operators have spent USD 54 Billion on mobile capital expenditures, primarily for the deployment and growth of 4G networks. It is anticipated that the region's implementation of 5G networks will result in a modest rise in capital expenditures. Strong communication networks backed by intelligent antenna systems are essential given the region's growing use of IoT in smart city initiatives and agriculture. Smart antennas are also becoming essential in the media and entertainment industries, where customers want top-notch streaming services. Additionally supporting market expansion in Latin America are improvements in LTE networks and the growing usage of Wi-Fi 6.

Middle East and Africa Smart Antenna Market Analysis

Investments in telecommunications and the expanding use of IoT in industries like energy, healthcare, and agriculture are driving the market for smart antennas in the Middle East and Africa. The UAE and Saudi Arabia are among the Gulf Cooperation Council (GCC) nations spearheading the rollout of 5G networks and smart city initiatives, which is driving up demand for smart antennas. The commercial rollout of 5.5G in the Middle East was initiated by six operators during the 2023 Global Mobile Broadband Forum (MBBF). Shortly after, those same carriers successfully finished over 20 scenario-specific pilots of 5.5G technologies, including RedCap, Passive IoT, and glasses-free 3D, as well as 10-Gbps testing. Strong wireless communication infrastructure is essential for projects in Africa that aim to increase rural access and improve education using digital technologies. The market expansion is further supported by the usage of smart antennas in energy management and satellite communication systems.

Competitive Landscape:

Key players in the smart antenna market are developing new products fitting the changing scenarios of wireless communication solutions. Organizations like Qualcomm Incorporated and Intel Corporation are concentrating on the development of beamforming technology to reinforce the transmission and reception of signals, this will improve the network performance and reliability. Also, Sierra Wireless in collaboration with Airgain Inc. are pursuing the integration of smart antennas in IoT devices to provide effortless connectivity in varied applications. In addition to this, Telstra Corporations Limited and Motorola Solutions Inc. are investing in smart antenna systems in a bid to ensure that 5G networks are deployed and existing coverage and capacity are improved. For instance, In April 2021, ADTRAN Inc introduced its OSA 5405-MB as the first ultra-compact outdoor PTP grandmaster clock with multi-band GNSS receiver implemented with integrated antenna to the market. It provides communication service providers (CSPs) and enterprises with the desired nanosecond-level accuracy required by 5G fronthaul and other emerging bidirectional low-latency applications.

The report provides a comprehensive analysis of the competitive landscape in the smart antenna market with detailed profiles of all major companies, including:

- ADTRAN Inc.

- Airgain Inc.

- AirNet Communications Corporation

- Arraycom LLc

- Intel Corporation

- Linx Technologies

- Motorola Solutions Inc.

- Qualcomm Incorporated

- Sierra Wireless

- Telstra Corporation Limited

- Texas Instruments Incorporated

- Trimble Inc.

Latest News and Developments:

- April 2025: Ericsson announced its plan to expand Ericsson Antenna System (EAS) manufacturing in India, localizing 100% of passive antenna production by June 2025 through a partnership with VVDN Technologies. This positions India as a strategic innovation and export hub within Ericsson’s global supply chain (including Mexico, Romania, China), accelerating 5G deployment and digital transformation.

- March 2025: Anritsu Corporation and MediaTek jointly verified MediaTek’s Smart AI Antenna Technology in the M90 5G Modem using Anritsu’s MT8821C Radio Communication Analyzer. This advanced antenna supports body proximity sensing, AI gesture detection, and delivers 24% faster low-band uplink throughput via optimized power and antenna tuning. The MT8821C enables comprehensive testing across all mobile technologies, aiding R&D for smartphones and IoT devices. The technology will be showcased at MWC2025, highlighting its role in advancing 5G and 6G innovations.

- March 2025: Zyxel Networks showcased its latest fiber access solutions at WISPAMERICA 2025, including the flagship CX4800-56F aggregation switch with 48 x 10/25GbE ports and 8 x 100GbE uplinks, designed for high-density enterprise networks. New XGS-PON line cards support smooth transitions from GPON to XGS-PON, enabling flexible service deployment. Zyxel’s upcoming WiFi 7 access points feature Smart Antenna and Multi-Link Operation (MLO) technologies, enhancing speed, reliability, and coverage in dense wireless environments. Attendees can preview Zyxel’s FWA WiFi 7 solution by appointment.

- February 2025: Zetifi developed an innovative two-in-one UHF and cellular combo antenna that significantly enhances connectivity for off-roaders and farmers. This breakthrough device integrates UHF radio and LTE cellular signals, improving communication reliability in remote and challenging environments. Recently, Zetifi raised $12 million in a Series A funding round to accelerate the mass-market launch of its on-farm and remote area connectivity solutions. The company is actively inviting New York farmers and machinery dealers to trial these revolutionary location-aware smart antennas, aiming to transform vehicle and equipment connectivity.

Smart Antenna Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | SIMO, MIMO, MISO |

| Applications Covered | Wi-Fi Systems, WiMAX Systems, Cellular Systems, RADAR Systems |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ADTRAN Inc, Airgain Inc., AirNet Communications Corporation, Arraycom LLc, Intel Corporation, Linx Technologies, Motorola Solutions Inc, Qualcomm Incorporated, Sierra Wireless, Telstra Corporation Limited, Texas Instruments Incorporated, Trimble Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart antenna market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global smart antenna market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart antenna industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

A smart antenna is an advanced antenna system that uses signal processing techniques to enhance wireless communication by improving signal quality, minimizing interference, and optimizing coverage. Applications include telecommunications, IoT, autonomous vehicles, and defense systems, enabling faster data transmission, reliable connectivity, and efficient communication across complex network environments.

The smart antenna market was valued at USD 6.8 Billion in 2024.

IMARC estimates the global smart antenna market to exhibit a CAGR of 8.01% during 2025-2033.

The global smart antenna market is driven by rising demand for high-speed wireless communication, rapid 5G deployment, and growing IoT adoption. Increased reliance on adaptive antennas for defense, smart cities, and autonomous vehicles, along with advancements in MIMO technology, further boosts market growth and enhances connectivity solutions.

According to the report, MIMO represented the largest segment by technology, driven by enhancing data transmission speeds, improving signal quality, and optimizing network coverage. Widely adopted in 5G networks, IoT applications, and smart devices, MIMO supports seamless connectivity, reduces interference, and meets the increasing demand for high-performance wireless communication across industries.

Cellular systems lead the market by application, supporting advanced wireless communication technologies like 4G and 5G. Smart antennas enhance network capacity, reduce signal interference, and ensure seamless connectivity for mobile users. Their integration in cellular systems enables high-speed data transmission, meeting the growing demand for reliable, low-latency communication across expanding global networks.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global smart antenna market include ADTRAN Inc, Airgain Inc., AirNet Communications Corporation, Arraycom LLc, Intel Corporation, Linx Technologies, Motorola Solutions Inc, Qualcomm Incorporated, Sierra Wireless, Telstra Corporation Limited, Texas Instruments Incorporated, Trimble Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)