Small Modular Reactor Market Report by Reactor Type (Heavy Water Reactor (HWR), Light Water Reactor (LWR), Fast Neutron Reactor (FNR), and Others), Deployment (Single-Module Power Plant, Multi-Module Power Plant), Application (Desalination, Power Generation, Process Heat), and Region 2025-2033

Market Overview:

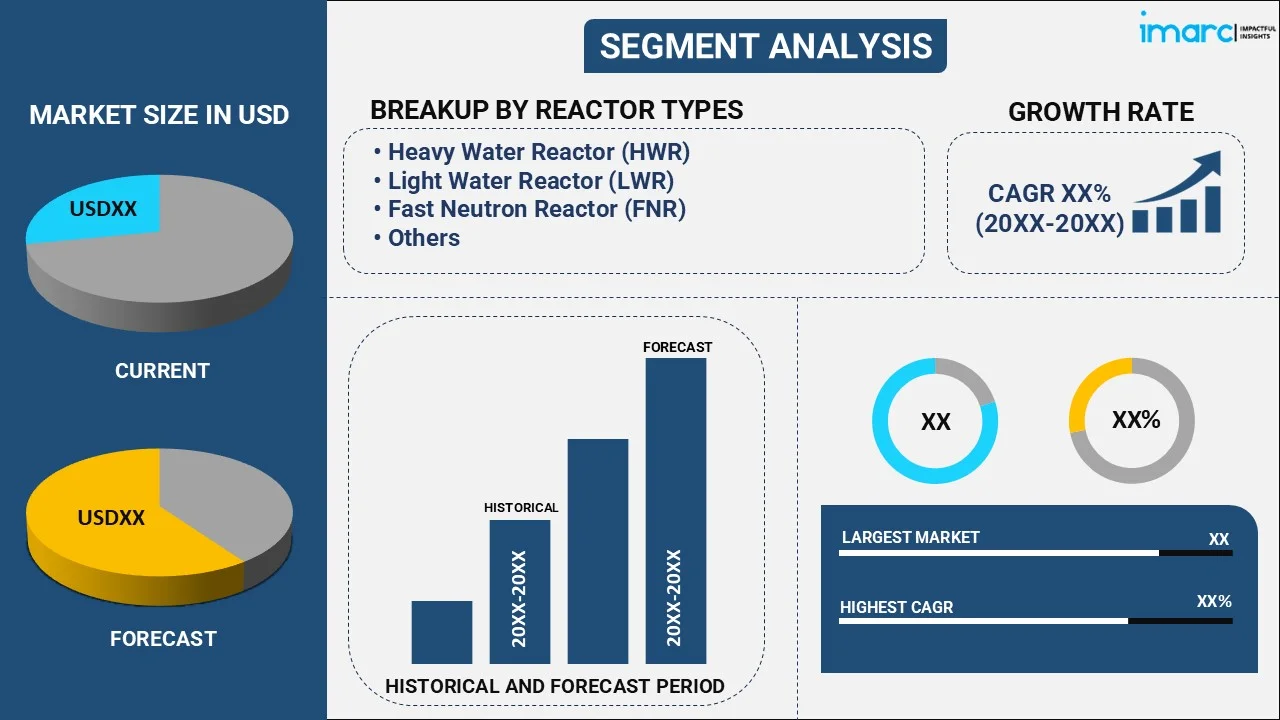

The global small modular reactor market size reached USD 6.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.19% during 2025-2033. The advancing technological innovation, the rapid nuclear industry growth, the increasing transition to a low-carbon energy future, the long-term fuel availability, and reduced dependency on fuel imports are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.0 Billion |

| Market Forecast in 2033 | USD 8.9 Billion |

| Market Growth Rate (2025-2033) | 4.19% |

A small modular reactor represents a cutting-edge advancement in nuclear power technology. These reactors are distinct from traditional, large-scale nuclear power plants in their compact size and modular design. Typically, they generate electrical power in tens to hundreds of megawatts, making them scalable and flexible to meet varying energy demands. The key advantages of SMRs lie in their enhanced safety features, reduced environmental impact, and ease of deployment in remote or constrained locations. Due to their smaller size, SMRs can be constructed in a factory-like setting, which reduces construction costs and accelerates deployment. Moreover, their inherent passive safety systems ensure they can effectively shut down and cool off without relying on active controls. It offers promise in diversifying energy portfolios and providing a reliable, carbon-free energy source. Their flexibility allows integration with grid systems and off-grid applications, such as providing power to remote communities or industrial facilities. As technology and regulatory frameworks continue to evolve, they hold the potential to play a crucial role in addressing global energy needs and combating climate change.

The global market is majorly driven by enhanced safety features and passive safety systems. In line with this, the reduced environmental impact with minimal greenhouse gas emissions is creating a positive outlook for the market. Furthermore, the versatility and scalability of diverse applications are significantly contributing to the market. Apart from this, the lower upfront capital costs compared to traditional nuclear plants offer numerous opportunities for the market. Moreover, the rising potential for standardization leading to economies of scale is catalyzing the market. Besides, improved energy accessibility in remote regions with limited infrastructure is propelling the product demand. Additionally, the escalating focus on sustainable and clean energy sources is providing a boost to the market.

Small Modular Reactor Market Trends/Drivers:

Increasing emphasis on enhanced safety features

The increasing emphasis on enhanced safety features is a crucial driver behind product demand in the global energy market. After past nuclear incidents, safety concerns have become paramount, leading to rigorous regulatory requirements and public scrutiny. SMRs have emerged as a promising solution due to their innovative safety designs, incorporating advanced passive safety systems. These systems enable the reactors to automatically shut down and cool off without relying on active human intervention or external power, enhancing their intrinsic safety. Investors, governments, and communities alike are increasingly recognizing the value of SMRs' enhanced safety features, which provide greater confidence in nuclear power as a reliable and secure energy source. This heightened safety focus fosters greater acceptance and support for SMR deployment, accelerating market growth. As technology continues to evolve, advancements in safety features further solidify the position of SMRs as a vital component of the future low-carbon energy landscape.

Rising demand for clean and low-carbon energy sources

The rising demand for clean and low-carbon energy sources is catalyzing the market. As global concerns about climate change intensify, there is a growing urgency to transition away from fossil fuels and reduce greenhouse gas emissions. SMRs offer a compelling solution, as they operate with a minimal carbon footprint compared to conventional fossil-fuel-based power generation. Its ability to produce electricity without emitting large amounts of greenhouse gases positions them as an attractive option to meet sustainability goals and support climate change mitigation efforts. Governments, corporations, and individuals seeking to reduce their environmental impact are increasingly turning to SMR as a viable alternative. Furthermore, as renewable energy sources like solar and wind face intermittency and grid integration challenges, the product provides a stable and reliable baseload power source. This reliability and lower carbon emissions make these reactors an appealing choice for complementing intermittent renewable energy sources and achieving a more sustainable energy mix. As a result, the rising demand for clean and low-carbon energy continues to propel the market.

Growing research and development in nuclear technology

The growing research and development (R&D) in nuclear technology is offering numerous opportunities for the market. As the demand for cleaner, safer, and more efficient energy sources increases, nuclear technology has seen renewed interest and investment in recent years. SMRs, being at the forefront of nuclear innovation, have captured the attention of researchers, governments, and private companies alike. Advancements in materials science, reactor design, and safety systems have been instrumental in making SMRs a viable and attractive option for meeting future energy demands. The ongoing R&D efforts aim to enhance the safety, efficiency, and cost-effectiveness of SMRs, paving the way for broader commercial deployment. Moreover, collaborations between governments, research institutions, and private companies have accelerated the pace of innovation in nuclear technology. These partnerships facilitate knowledge sharing and resource pooling, fostering breakthroughs that propel the growth and adoption of SMR in various regions and industries. The growing investment in nuclear R&D underscores the industry's commitment to continuously improve nuclear technology, making the reactor an increasingly compelling solution for sustainable, low-carbon energy generation in the years to come.

Small Modular Reactor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global small modular reactor market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on reactor type, deployment, and application.

Breakup by Reactor Type:

- Heavy Water Reactor (HWR)

- Light Water Reactor (LWR)

- Fast Neutron Reactor (FNR)

- Others

Heavy water reactor (HWR) dominates the market

The report has provided a detailed breakup and analysis of the market based on reactor type. This includes heavy water reactor (HWR), light water reactor (LWR), fast neutron reactor (FNR), and others. According to the report, heavy water reactor represented the largest segment.

Heavy Water Reactor (HWR) uses heavy water (deuterium oxide) as a neutron moderator, enabling them to sustain a nuclear chain reaction efficiently. These reactors are known for their high neutron economy, making them suitable for using natural uranium as fuel, which reduces the need for uranium enrichment.

Furthermore, the Light Water Reactor (LWR), the most prevalent type of nuclear reactor globally, uses ordinary water as both a coolant and a moderator. Pressurized Water Reactors (PWRs) and Boiling Water Reactors (BWRs) are two common subtypes. LWRs are known for their safety and reliability, providing a stable and cost-effective power generation option.

Moreover, Fast Neutron Reactor (FNR) utilizes fast neutrons to sustain a chain reaction. Unlike LWRs and HWRs, they do not require a moderator. Fast reactors can convert fertile material like depleted uranium and thorium into fissile fuel, enhancing resource utilization and reducing nuclear waste. Though still in the development stages, FNRs show promise for their potential to contribute to long-term sustainability and radioactive waste reduction.

Breakup by Deployment:

- Single-Module Power Plant

- Multi-Module Power Plant

Multi-module power plant dominates the market

The report has provided a detailed breakup and analysis of the market based on deployment. This includes single-module power plant and multi-module power plant. According to the report, multi-module power plant represented the largest segment.

In single-module power plant, individual SMRs are deployed as standalone units, each capable of generating electrical power independently. These power plants offer flexibility, allowing for incremental capacity additions as needed. They are well-suited for smaller energy demands, remote locations, or instances requiring a modular and scalable energy solution. The advantage of single-module power plants lies in their lower initial investment cost and ease of implementation, making them attractive options for regions with limited infrastructure or capital constraints.

On the contrary, multi-module power plants have multiple SMR units operating collectively as a single entity. These plants can be deployed to meet larger energy demands and provide a more continuous and stable power supply. Multi-module power plants benefit from economies of scale, as the shared infrastructure and operations reduce overall costs per unit of electricity generated. This approach is preferred in areas with higher energy consumption, where SMRs replace or supplement conventional large-scale nuclear power plants.

Breakup by Application:

- Desalination

- Power Generation

- Process Heat

Power generation dominates the market

The report has provided a detailed breakup and analysis of the market based on application. This includes desalination, power generation, and process heat. According to the report, power generation represented the largest segment.

SMRs can potentially drive advancements in desalination technologies by providing a reliable and sustainable energy source for the desalination process. The excess heat produced during electricity generation can be utilized in desalination plants, making them more energy-efficient and cost-effective. Integrating SMRs with desalination facilities offers a promising solution to address water scarcity challenges in regions facing water stress.

Furthermore, power generation remains the primary application for SMRs. These reactors produce electricity through nuclear fission, offering a stable and low-carbon energy supply. SMRs are increasingly considered for grid electricity generation, especially in regions where large-scale nuclear power plants may not be feasible due to infrastructure constraints or energy demand variations.

Moreover, these reactors can supply high-temperature process heat to various industrial applications, such as hydrogen production, district heating, or industrial processes like oil refining and chemical production. Utilizing the product in process heat applications contributes to decarbonization efforts across industries, reducing reliance on fossil fuels and decreasing greenhouse gas emissions.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

North America has emerged as a major driving force in the SMR market due to its significant investments in nuclear research and development. The United States, in particular, has shown keen interest in SMRs as a viable option to diversify its energy portfolio and reduce greenhouse gas emissions. Government support, including funding initiatives and regulatory frameworks that encourage SMR development, has fostered a favorable environment for industry growth. Additionally, collaboration between the public and private sectors has accelerated the commercialization of SMRs in North America, with potential applications in power generation, industrial processes, and remote communities.

On the other hand, Europe has actively pursued SMR technologies to achieve energy security and sustainability goals. Several European nations are investing in R&D projects to develop innovative SMR designs with enhanced safety features and improved resource utilization. Furthermore, the European Union's focus on carbon reduction and clean energy initiatives provides a conducive environment for SMR growth. Partnerships between European companies and international stakeholders have facilitated knowledge sharing and accelerated the progress of SMR deployment in Europe.

Competitive Landscape:

Top companies are crucial in bolstering market growth through innovative technologies, strategic partnerships, and comprehensive deployment strategies. These companies invest heavily in research and development to enhance reactor safety, efficiency, and cost-effectiveness. By continually improving their SMR designs, they instill confidence in potential investors and regulatory authorities, driving wider acceptance and adoption. Furthermore, these companies partner with governments, utilities, and other stakeholders to accelerate SMR deployment plans. Their collaboration and expertise in navigating regulatory processes help streamline the licensing and approval procedures, reducing barriers to market entry. Additionally, top companies showcase successful pilot projects and real-world applications, demonstrating the viability and reliability of their technologies. Such tangible examples create a positive market perception, attracting more customers and investors and further propelling the market.

The report has provided a comprehensive analysis of the competitive landscape in the small modular reactor market. Detailed profiles of all major companies have also been provided.

- ARC Clean Energy Inc.

- Brookfield Asset Management Inc

- Fluor Corporation

- General Electric Company

- Holtec International

- Leadcold Reactors

- Rolls-Royce Plc

- Terrestrial Energy Inc.

- X-Energy LLC

Small Modular Reactor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Reactor Types Covered | Heavy Water Reactor (HWR), Light Water Reactor (LWR), Fast Neutron Reactor (FNR), Others |

| Deployments Covered | Single-Module Power Plant, Multi-Module Power Plant |

| Applications Covered | Desalination, Power Generation, Process Heat |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ARC Clean Energy Inc., Brookfield Asset Management Inc, Fluor Corporation, General Electric Company, Holtec International, Leadcold Reactors, Rolls-Royce Plc, Terrestrial Energy Inc., X-Energy LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global small modular reactor market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global small modular reactor market?

- What is the impact of each driver, restraint, and opportunity on the global small modular reactor market?

- What are the key regional markets?

- Which countries represent the most attractive small modular reactor market?

- What is the breakup of the market based on the reactor type?

- Which is the most attractive reactor type in the global small modular reactor market?

- What is the breakup of the market based on the deployment?

- Which is the most attractive deployment in the global small modular reactor market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the global small modular reactor market?

- What is the competitive structure of the global small modular reactor market?

- Who are the key players/companies in the global small modular reactor market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the small modular reactor market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the small modular reactor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the global small modular reactor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)