Small Drones Market Size, Share, Trends and Forecast by Size, Type, Application, and Region, 2025-2033

Small Drones Market Size and Share:

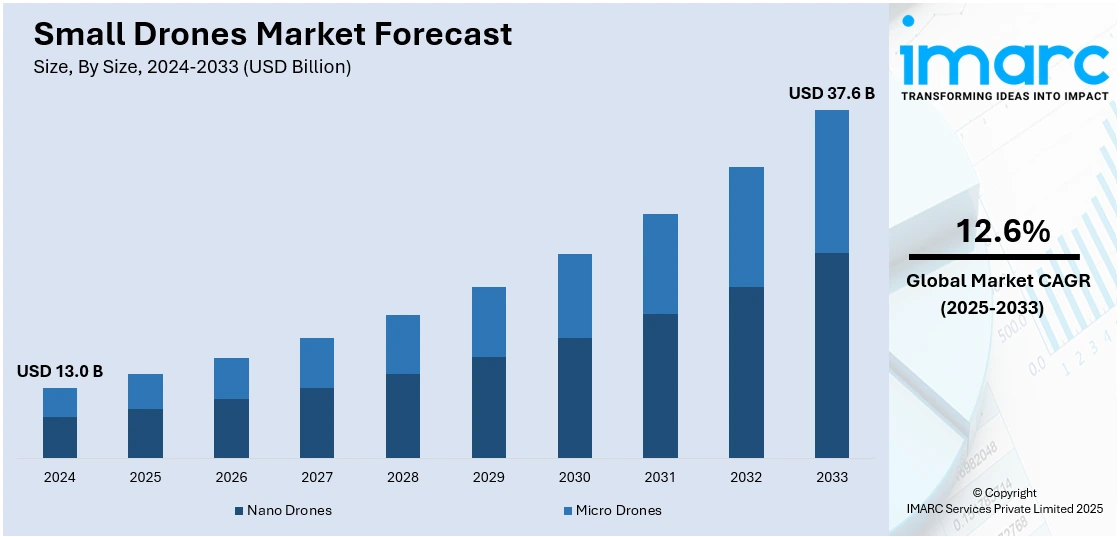

The global small drones market size was valued at USD 13.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 37.6 Billion by 2033, exhibiting a CAGR of 12.6% from 2025-2033. North America currently dominates the market, holding a market share of over 32.4% in 2024. The rapid technological advancements, cost-efficiency and product accessibility, rising diverse applications, establishment of regulatory frameworks for drone operations, rapid expansion in precision agriculture, increasing product effectiveness in emergency response and disaster management are some of the major factors expanding the small drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.0 Billion |

| Market Forecast in 2033 | USD 37.6 Billion |

| Market Growth Rate (2025-2033) | 12.6% |

The market for small drones is on an upward trajectory due to advances in drone technology and expanding demand for drones across various industries. Besides, the adoption of drones in commercial applications like agriculture, construction, logistics, and surveillance is also propelling the market. For example, in agriculture, small drones are used in monitoring the growth of crops and precision farming. In construction, drones are used for site mapping and inspection. Increased use of UAVs in the defense sector for ISR purposes also boosts the growth of the market. Technological developments-including improvements in battery life, lightweight materials, and better sensors-make small drones efficient and versatile and increase their adoption. The commercial sector application of legal reforms concerning the use of drones and the growing interest in many drone-based services like aerial photography and deliveries continue pushing the market segment.

The United States has emerged as a key regional market for small drones due to advances in drone technology, increasing commercial applications for drones, and an enhanced level of government support for drone developments. Automated flight, greater efficiency in battery, and higher payloads have improved several folds advantages, thus propelling the market. Rising demand for drone-based services, such as aerial imaging, mapping, and inspections, is another critical driver, offering cost-effective and efficient solutions as compared to traditional methods. Growth rates in e-commerce and last-mile delivery have increased the usage of drones for logistics. Additionally, increasing military investments in surveillance and reconnaissance applications contribute to market growth. These factors collectively underscore the expanding role of small drones in diverse sectors across the U.S.

Small Drones Market Trends:

Technological advancements

Micro-components, more efficient batteries, and processing power advancements have led to some most compact drones being able to pack more power. They can now carry the most sophisticated sensors, cameras, and communications while retaining some measure of their flight duration and maneuverability. New innovations in artificial intelligence and machine learning have made it possible for drones to become autonomous and navigate through complicated spaces to complete missions without human intervention. As per reports, the AI in drone technology market is set to reach USD 84 Billion by 2030. As technology continues to advance, the power of miniaturization and advanced features will change the definition of small drones within specific industries.

Cost-Efficiency and accessibility

Small drones save time and costs as compared to traditional methods for use in surveillance, mapping and data gathering. Due to their compact size, they can be carried almost anywhere and deployed in remote or difficult locations. Reduced acquisition costs and the minimal amount of training needed have contributed democratization of drone acquisition and usage in companies, including small businesses. Reports indicate that the construction industry might consider the introduction of a small drone for a 52% reduction in data collection time, 5 to 20% savings in costs, and a measured accuracy of 61 %. This accessibility merges with innovation that propels industries to find new applications, hence making drones essential in program innovations to increase operational efficiency and decision-making.

Diverse applications

Agricultural drones with multispectral cameras, can analyze crops to determine health levels and to optimize irrigation controls before harvesting, resulting in enhanced yields. In the construction and infrastructure sectors, drones allow for accurate surveys of sites, as well as progress monitoring, thus leading to better management of projects. In the energy sector, drones inspect pipelines, power lines, and wind turbines making the performance of maintenance much more efficient, reducing parlays. Access to hazardous environments, such as those affected by some disasters or in confined locations, makes drones indispensable to emergency response and search and rescue operations. The total integration of small drones among those sectors demonstrates their versatility and emphasizes their important role in changing industries and processes.

Small Drones Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global small drones market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on size, type, and application.

Analysis by Size:

- Nano Drones

- Micro Drones

Micro drones stand as the largest segment in 2024, holding around 65.0% of the market. One of the primary reasons is their compact size, which grants them exceptional agility and maneuverability, enabling them to navigate intricate environments with precision. This attribute is particularly advantageous for applications that require close-quarter inspections, such as indoor monitoring or confined spaces. Additionally, micro drones offer an accessible entry point into the drone market for both consumers and businesses due to their relatively lower cost compared to larger counterparts. This affordability appeals to a broader demographic, fostering wider adoption across various industries, from hobbyists and enthusiasts to professionals in fields like photography, videography, and surveillance. Furthermore, other small drones market trends include advancements in miniaturization and technology that have led to a convergence of capabilities within micro drones, allowing them to integrate high-quality cameras, sensors, and communication systems. This convergence expands their utility across diverse sectors including real estate, entertainment, agriculture, and more.

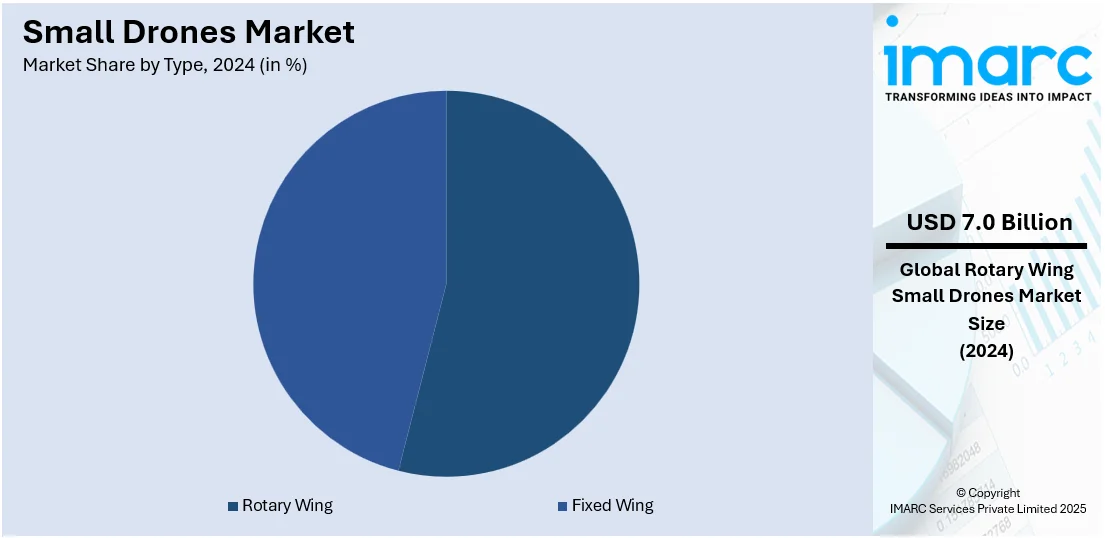

Analysis by Type:

- Fixed Wing

- Rotary Wing

Rotary wing leads the market with around 53.8% of market share in 2024. Rotary wing drones, which include quadcopters and other multirotor configurations, offer exceptional stability, maneuverability, and hover capability. This makes them suitable for tasks that demand precise aerial control, such as aerial photography, videography, surveying, and inspections. The simplicity of design and operation of rotary wing drones contributes to their popularity. With vertical takeoff and landing capabilities, they require minimal infrastructure, enabling deployment in various environments, both indoors and outdoors. Their ease of use appeals to a diverse user base, ranging from recreational users to professionals in industries like agriculture, real estate, and emergency response. Moreover, the ongoing advancements in propulsion systems, materials, and control technologies have led to improved flight times and payload capacities for rotary wing drones, enhancing their viability for more complex tasks. Given these factors, the rotary wing segment is expected to retain its prominence, driven by its versatility and continuous innovations that cater to the evolving demands of industries seeking efficient and agile aerial solutions.

Analysis by Application:

- Military and Defense

- Consumer

- Consumer and Civil

Military and defense lead the market in 2024. Drones provide a transformative advantage in surveillance, reconnaissance, and intelligence gathering. Their ability to access challenging or dangerous environments while minimizing human risk is a strategic asset for defense forces. Unmanned aerial vehicles (UAVs) offer real-time situational awareness, enabling military personnel to make informed decisions swiftly. Additionally, armed drones, or unmanned combat aerial vehicles (UCAVs), have gained prominence for their precision strike capabilities, reducing collateral damage and enhancing operational effectiveness. The constant technological innovation in drone capabilities, including longer flight endurance, enhanced sensors, and improved communication systems, further solidifies their significance in defense applications. Drones serve as force multipliers, extending the reach and capabilities of military units, and they are essential for monitoring borders, tracking threats, and supporting counter-terrorism efforts. As militaries worldwide continue to recognize the advantages of drone technology, the military and defense segment is anticipated to remain the largest driver of growth within the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America accounted for the largest market share of over 32.4%. North America possesses a well-established technological ecosystem with robust research and development capabilities, which has led to the creation of cutting-edge drone technologies and solutions. Furthermore, favorable regulatory frameworks, such as the Federal Aviation Administration's (FAA) progressive approach to integrating drones into airspace, have paved the way for diverse commercial applications. This has spurred innovation and investment in the drone industry, attracting both startups and established players to develop and deploy small drones across sectors including agriculture, infrastructure, and logistics. The region's strong emphasis on defense and security has driven significant demand for drones in military applications, contributing to the overall small drones market growth. Moreover, the high consumer adoption of recreational drones and the strong presence of tech giants specializing in drone manufacturing have bolstered the market's expansion.

Key Regional Takeaways:

United States Small Drones Market Analysis

The United States accounts for 84.80% of the small drones market in North America due to multiple factors, reflecting advancements in technology and evolving applications across industries. Small drones are becoming integral to industries, such as agriculture, construction, real estate, and delivery services. For instance, in agriculture, drones equipped with high-resolution cameras and sensors are used for crop monitoring, pest control, and irrigation management, enhancing efficiency and reducing costs. According to reports, there were 1.89 Million U.S. farms in 2023. In addition, the growing demand for drone-based delivery services is offering a favorable small drones market outlook. Besides this, innovations in drone technology, such as enhanced battery life, improved payload capacity, advanced sensors, and autonomous flight capabilities, are significantly expanding their usability. The development of artificial intelligence (AI) and machine learning (ML) for drones enables tasks like obstacle detection, data analysis, and precision navigation, making them more effective for both commercial and recreational purposes. Moreover, governing agencies in the country are implementing regulations to promote safe drone operations. Initiatives like the FAA’s UAS Integration Pilot Program aim to facilitate drone adoption by addressing safety and airspace integration challenges, encouraging commercial deployment. Furthermore, drones are increasingly used by law enforcement, firefighters, and emergency services for surveillance, search and rescue operations, and disaster response. Additionally, the defense sector utilizes small drones for reconnaissance, intelligence gathering, and tactical missions, driven by their portability and cost-effectiveness.

Asia Pacific Small Drones Market Analysis

The increasing small drones demand across commercial, industrial, and governmental sectors is propelling the market growth in the region. Agriculture dominates many economies in the region, and small drones are being used extensively for precision farming, crop health monitoring, and pesticide spraying. Countries like India and China are adopting drone technology to enhance agricultural productivity and reduce resource wastage. Similarly, rising infrastructure projects in nations, such as Indian, Japan, and South Korea, is impelling the market growth. According to CRISIL’s Infrastructure yearbook 2023, India will spend nearly USD 1,727.05 Billion on infrastructure in seven fiscals through 2030. The construction sector is leveraging drones for site mapping, progress tracking, and inspection tasks, ensuring efficiency and safety. Apart from this, governing agencies in the region are actively promoting drone adoption through favorable policies and financial incentives. Indian government is implementing supportive measures, such as the liberalized Drone Rules 2021 and the Production-Linked Incentive (PLI) scheme for drone manufacturing, fostering a conducive environment for market growth. Furthermore, the region is a hub for drone innovation, with countries like China leading global manufacturing. Advances in battery efficiency, lightweight materials, and AI-driven navigation systems are making drones more versatile and affordable. Local production capabilities, combined with reduced hardware costs, are fueling accessibility for various industries.

Europe Small Drones Market Analysis

Small drones are gaining traction in industries like agriculture, energy, and construction. In agriculture, drones are used for precision farming, monitoring crop health, and managing resources efficiently. The construction and energy sectors deploy drones for site surveys, infrastructure inspections, and maintenance, reducing operational costs and improving safety. Countries, such as Germany and France, are also leveraging drones for urban planning and renewable energy projects. Renewable energy sources represented an estimated 24.1% of the European Union’s final energy use in 2023, as per the European Environment Agency. In line with this, the European Union (EU) is fostering drone adoption through unified regulations and financial incentives. The European Union Aviation Safety Agency (EASA) is introducing standardized rules across member states to ensure safety and integration into airspace. Additionally, the European Commission’s funding under the Horizon Europe program supports drone innovation and development, enabling startups and established players to expand their capabilities. Apart from this, advancements in AI, machine learning, and robotics, are enhancing drone capabilities, such as autonomous navigation, obstacle avoidance, and data analytics. Companies in the region are focusing on developing lightweight, energy-efficient drones with longer flight times and advanced sensors, making them suitable for complex tasks. These innovations are key drivers for industries, such as logistics, where drones are being tested for last-mile delivery. Additionally, drones are increasingly used in public safety and security applications, including surveillance, crowd monitoring, and disaster response.

Latin America Small Drones Market Analysis

The small drones market in Latin America is expanding due to their versatile applications across industries and increasing government support. With agriculture being a major economic activity, drones are widely used for crop monitoring, irrigation management, and pest control. Countries like Brazil and Argentina leverage drones to improve yield and resource efficiency, addressing regional food security challenges. Moreover, rapid urbanization and large-scale infrastructure projects drive the adoption of drones for site surveys, construction monitoring, and inspections, ensuring cost savings and enhanced safety. According to the CIA, the urban population in Mexico was 81.6% of total population in 2023. Furthermore, governing agencies and private sectors are using drones for border security, crime monitoring, and disaster response. For instance, Mexico and Colombia deploy drones for surveillance in challenging terrains.

Middle East and Africa Small Drones Market Analysis

The small drones market in the Middle East and Africa is driven by diverse applications and increasing investment in drone technology. In regions facing water scarcity and arid conditions, drones are pivotal for precision agriculture, irrigation optimization, and crop monitoring. As per reports ‘Economics of Water Scarcity in MENA: Institutional Solutions’ by the end of this decade, the amount of water available per capita annually will fall below the absolute water scarcity threshold of 500 cubic meters per person, per year. Countries like South Africa and Kenya are adopting drones to improve agricultural productivity and resource management. In addition, the Middle East’s large-scale construction projects, such as Saudi Arabia’s NEOM city, and Africa’s expanding energy sector use drones for mapping, inspections, and monitoring, ensuring efficiency and safety in challenging environments. Furthermore, rising geopolitical tensions in the Middle East is increasing the demand for security solutions.

Competitive Landscape:

Companies are heavily investing in research and development to enhance drone capabilities, such as improving flight endurance, autonomous navigation, and sensor integration. For example, advancements in AI and machine learning enable drones to perform complex tasks like object recognition and dynamic obstacle avoidance, broadening their applications. Partnerships with technology firms, government agencies, and commercial enterprises are common. These collaborations allow companies to access new markets, develop tailored solutions, and improve regulatory compliance. Moreover, many players are diversifying their offerings to cater to specific industries, such as agriculture, logistics, or defense. This approach helps in tapping niche markets and meeting specialized customer needs.

The report provides a comprehensive analysis of the competitive landscape in the small drones market with detailed profiles of all major companies, including:

- Aerovironment Inc.

- Autel Robotics

- Delair

- Elbit Systems Ltd

- Israel Aerospace Industries

- Lockheed Martin Corporation

- Microdrones GmbH

- Raytheon Technologies Corporation

- SZ DJI Technology Co. Ltd.

- Teledyne FLIR LLC

- Textron Inc.

- Thales Group

Latest News and Developments:

- July 2024: Canberra signed more than USD 67.6 Million in contracts to procure small unmanned aerial systems (sUAS) for the army and air force. The expenditure is part of a larger effort to enhance the services' tactical autonomous fleets in order to improve warfighter safety and increase observation, reconnaissance, and multiple-payload logistical capabilities in land, littoral, small marine craft, and urban missions.

- September 2023: The Indian Army devised a pioneering strategy to equip its Main Battle Tanks (MBTs) with micro-drones. By leveraging autonomous aerial technology and artificial intelligence (AI), the initiative seeks to significantly boost the Army’s operational effectiveness in combat scenarios.

- July 2023: Russia's Design Bureau of Unmanned Aircraft-Building developed a mufti-rotor micro-drone dubbed Vektor Kh-120 with a dry weight of 38 grams to strike sheltered enemy manpower. The company told government-owned TASS that Vektor Kh-120 is a disposable kamikaze drone that can fire 5.45x39mm (10.2g) and 9x19mm Luger (7.45 g) rounds to carry out missions that a rifleman cannot perform.

Small Drones Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sizes Covered | Nano drones, Micro Drones |

| Types Covered | Fixed Wing, Rotary Wing |

| Applications Covered | Military and Defense, Consumer, and Consumer and Civil |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aerovironment Inc., Autel Robotics, Delair, Elbit Systems Ltd., Israel Aerospace Industries, Lockheed Martin Corporation, Microdrones GmbH, Raytheon Technologies Corporation, SZ DJI Technology Co. Ltd., Teledyne FLIR LLC, Textron Inc., Thales Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the small drones market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global small drones market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the small drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The small drones market was valued at USD 13.0 Billion in 2024.

IMARC estimates the small drones market to exhibit a CAGR of 12.6% during 2025-2033.

The rapid technological advancements, cost-efficiency and product accessibility, rising diverse applications, establishment of regulatory frameworks for drone operations, rapid expansion in precision agriculture, increasing product effectiveness in emergency response and disaster management are some of the major factors propelling the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the small drones market include Aerovironment Inc., Autel Robotics, Delair, Elbit Systems Ltd., Israel Aerospace Industries, Lockheed Martin Corporation, Microdrones GmbH, Raytheon Technologies Corporation, SZ DJI Technology Co. Ltd., Teledyne FLIR LLC, Textron Inc., Thales Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)