Skimmed Milk Powder Market in India Size, Share, Trends and Forecast by Sector, and Region, 2025-2033

Market Overview:

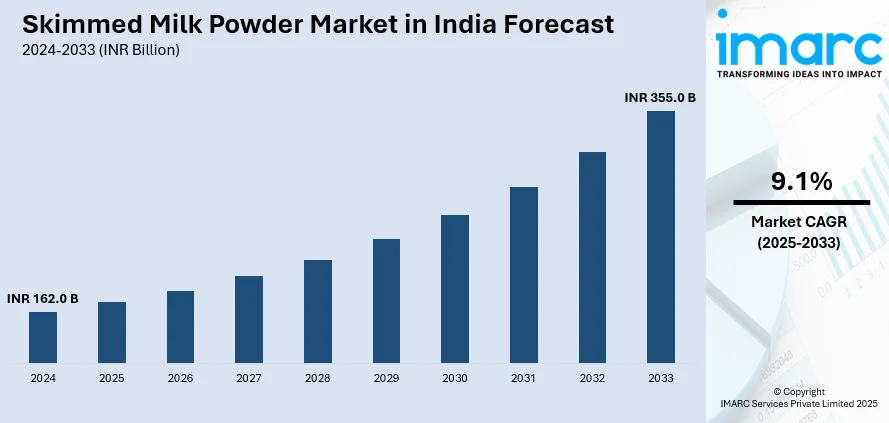

The skimmed milk powder market in India size reached INR 162.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach INR 355.0 Billion by 2033, exhibiting a growth rate (CAGR) of 9.1% during 2025-2033. Increasing health consciousness, rising inclination towards a nutritious diet, and the growing reliance on e-commerce websites represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 162.0 Billion |

|

Market Forecast in 2033

|

INR 355.0 Billion |

| Market Growth Rate 2025-2033 | 9.1% |

Skimmed milk powder is produced by removing the fat from fresh pasteurized milk and evaporating the remaining liquid until it becomes a dry powder. It offers a longer shelf life and can be reconstituted with water to create a liquid milk product. It is rich in protein, calcium, vitamins, potassium, phosphorus, magnesium, minerals, and other essential nutrients. It aids in supporting muscle growth and repair, improving bone health, promoting weight management, enhancing heart health, and boosting the immune system. It also enhances brain function, promotes healthy skin, reduces inflammation, and minimizes the risk of developing irritable bowel syndrome (IBS) and diabetes. At present, product manufacturers operating in India are introducing organic, and sugar and lactose-free product variants to expand their product portfolio. They are also focusing on launching skimmed milk powder in different flavors like chocolate, hazelnut, caramel, vanilla, strawberry, and blueberries.

To get more information of this market, Request Sample

Skimmed Milk Powder Market in India Trends:

The increasing health consciousness and the rising awareness among the masses about the health benefits of skimmed milk powder represent one of the major factors facilitating the market growth in India. Moreover, skimmed milk powder is used in the preparation of numerous bakery goods, dairy products, and beverages, including bread, cakes, chocolates, candies, ice cream, cheese, yogurt, hot chocolate, soups, and shakes, which are served across restaurants and other commercial food outlets. This, coupled with the burgeoning food and beverage (F&B) industry, is contributing to the market growth in the country. In addition, rapid urbanization, expanding purchasing power of the consumer, and the growing inclination of individuals towards a healthy and nutritious diet is driving the demand for skimmed milk powder based ready to eat (RTE) food products in the country. Apart from this, there is an increase in the use of skimmed milk powder in the manufacturing of baby food and infant formula to improve digestion. This, along with the rising concerns of parents about the balanced nutrition of their children, is favoring the growth of the market. furthermore, the growing reliance on e-commerce websites due to the advantages offered by these websites, such as easy availability, cashback, discounted prices, secure payment, and cash-on-delivery (COD), is creating a positive outlook for the market in the country.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the skimmed milk powder market in India, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on sector.

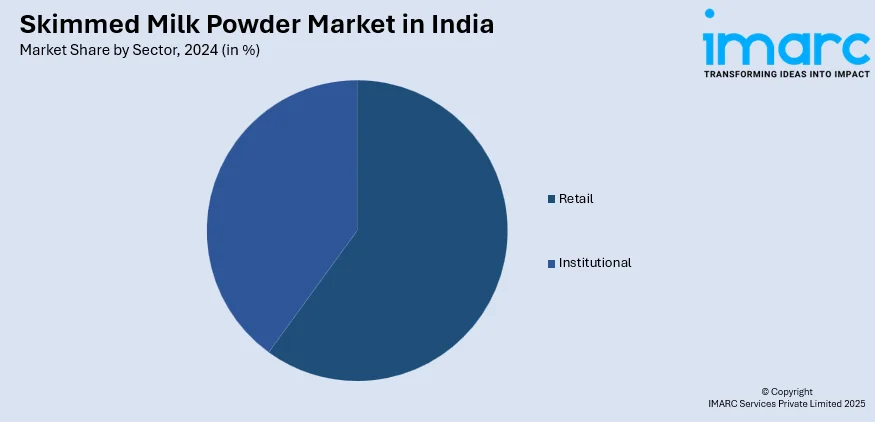

Sector Insights:

- Retail

- Institutional

The report has provided a detailed breakup and analysis of the skimmed milk powder market in India based on the sector. This includes retail and institutional. According to the report, institutional represented the largest segment.

States Insights:

- Karnataka

- Maharashtra

- Tamil Nadu

- Delhi

- Gujarat

- Andhra Pradesh and Telangana

- Uttar Pradesh

- West Bengal

- Kerala

- Haryana

- Punjab

- Rajasthan

- Madhya Pradesh

- Bihar

- Orissa

The report has also provided a comprehensive analysis of all the major states markets, which include Karnataka, Maharashtra, Tamil Nadu, Delhi, Gujrat, Andhra Pradesh And Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar, and Orissa. According to the report, West Bengal was the largest market for skimmed milk powder in India. Some of the factors driving the West Bengal skimmed milk powder market in India included the rising consumption of RTE food products, easy availability, product innovations, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the skimmed milk powder market in India. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include GCMMF, KMF, Mother Dairy, TN Cooperative and RCDF. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the skimmed milk powder market in India from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the skimmed milk powder market in India.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the skimmed milk powder market in India industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The skimmed milk powder market in India was valued at INR 162.0 Billion in 2024.

We expect the skimmed milk powder market in India to exhibit a CAGR of 9.1% during 2025-2033.

The rising adoption of skimmed milk in infant formulations, as it is a rich source of essential nutrients for the overall growth and development, is currently driving the skimmed milk powder market in India.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase skimmed milk powder.

On a regional level, the market has been classified into Maharashtra, Uttar Pradesh, Andhra Pradesh, Tamil Nadu, Gujarat, Rajasthan, Karnataka, Madhya Pradesh, West Bengal, Bihar, Delhi, Kerala, Punjab, Orissa, and Haryana, where West Bengal currently dominates the market.

Some of the major players in the skimmed milk powder market in India include GCMMF, KMF, Mother Dairy, TN Cooperative, and RCDF.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)