Singapore Soft Drinks Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Singapore Soft Drinks Market Overview:

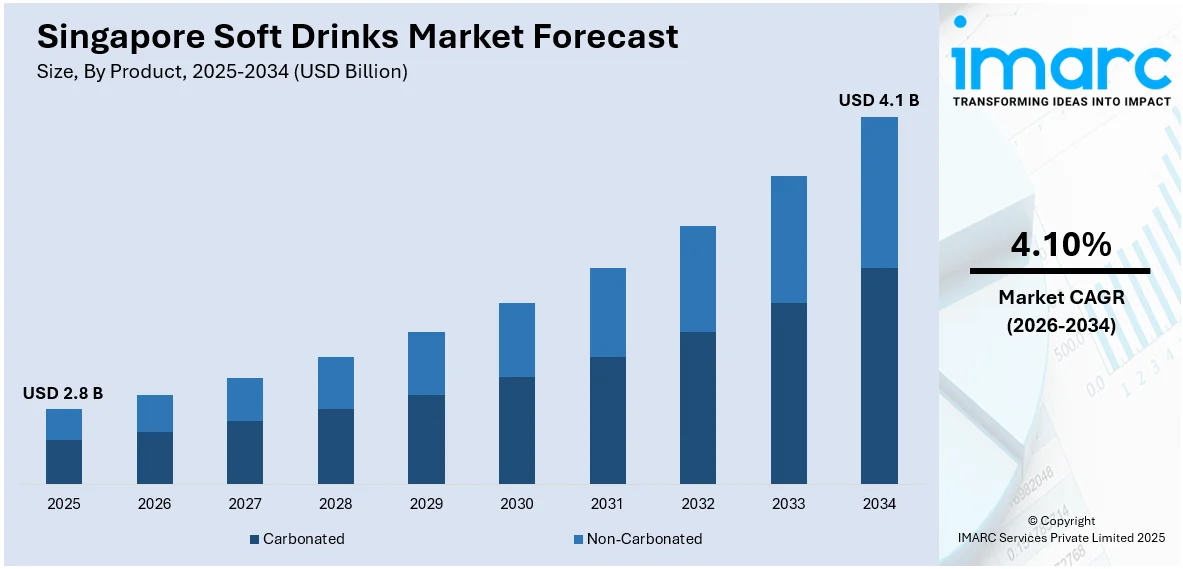

The Singapore soft drinks market size reached USD 2.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.1 Billion by 2034, exhibiting a growth rate (CAGR) of 4.10% during 2026-2034. The rising consumer health consciousness, the increasing demand for low-sugar and functional beverages, innovative product offerings, aggressive marketing campaigns, and a growing preference for convenient, on-the-go consumption options are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.8 Billion |

|

Market Forecast in 2034

|

USD 4.1 Billion |

| Market Growth Rate 2026-2034 | 4.10% |

Singapore Soft Drinks Market Trends:

Rising Health Consciousness

The increasing consumer demand for low-sugar, functional, and healthier beverage options is acting as a major growth-inducing factor. For instance, in 2022, Singapore's upcoming implementation of its sugar-sweetened beverage (SSB) labeling system Nutri-Grade is driving local beverage firms to reformulate and create low-sugar product options to avoid potential repercussions, including upcycled drinks firm Imperfect Drinks. The Singapore government introduced the Nutri-Grade concept as far back as 2020, and after several pushbacks due to the COVID-19 pandemic, it was slated for implementation in December 2022. The Nutri-Grade scheme will involve nutrient labels with four different grades: 'A' (dark green), 'B' (light green), C (yellow), and D' (red), going from lowest to highest sugar and saturated fat content. The use of this front-of-pack label (FoPL) will be mandatory for Grade C and Grade D beverages. Many beverage firms producing drinks that fall in the Grade C and Grade D categories such as fruit juices and soft drinks have had to make changes to adapt to this upcoming system via either reformulation or new product innovation, especially due to fears that having C or D labels on their products will negatively impact consumer perceptions of these.

To get more information on this market Request Sample

Increasing Product Innovation

Continuous product launches in new and unique flavors, ingredients, and the advent of functional drinks to attract diverse consumer preferences. For instance, in 2023, Singapore introduced 88 new brands and sub-brands in the soft drinks space, while accounting for nearly 10% of all new brand launches in the beverages industry globally, Euromonitor reported. With its share, Singapore also emerged as one of the top three countries for product innovation and brand launches in the beverages industry, which includes soft drinks, hot drinks, and Alcoholic Ready-To-Drinks (RTDs) Singapore is also second to the United States in product innovation in the soft drinks space with 88 new brands and sub-brands launched since January 2023.

Singapore Soft Drinks Market News:

In April 2024, Coca-Cola launched the newest addition to the Coca-Cola Creations line-up with Coca-Cola K-Wave Zero Sugar in Singapore. First released in South Korea in February and now launching across the region, Coca-Cola K-Wave Zero Sugar celebrates fans of K-Pop through the limited-edition flavor and a suite of music-focused digital and IRL experiences featuring some of the genre’s biggest stars.

In September 2023, IncreBio (formerly known as JuiceInnov8), a Bangkok-based food biotech company that marries the power of nature and twists of science on a mission to create truly healthier foods & beverages—starting with juice, announced the inaugural launch of INCREDIBLE Juice, a Near Zero Sugar™ juice. The company promises to revolutionize juice—a $150Bn market and the world's third largest drink—a category lacking no/low sugar alternatives until now.

Singapore Soft Drinks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Carbonated

- Non-Carbonated

The report has provided a detailed breakup and analysis of the market based on the product. This includes carbonated and non-carbonated.

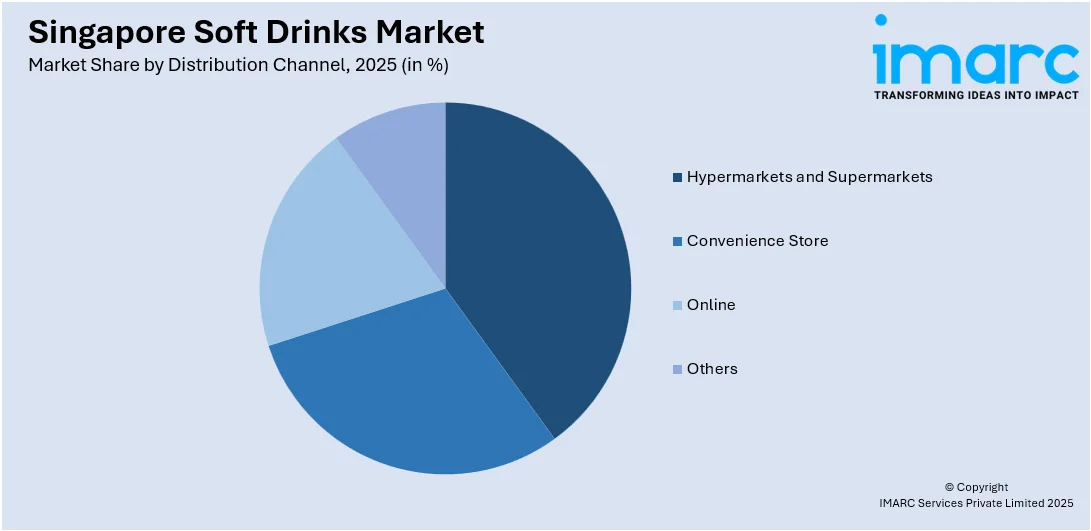

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hypermarkets and Supermarkets

- Convenience Store

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, convenience store, online, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Soft Drinks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Carbonated, Non-Carbonated |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Store, Online, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Singapore soft drinks market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Singapore soft drinks market?

- What is the breakup of the Singapore soft drinks market on the basis of product?

- What is the breakup of the Singapore soft drinks market on the basis of distribution channel?

- What are the various stages in the value chain of the Singapore soft drinks market?

- What are the key driving factors and challenges in the Singapore soft drinks?

- What is the structure of the Singapore soft drinks market and who are the key players?

- What is the degree of competition in the Singapore soft drinks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore soft drinks market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore Soft Drinks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore soft drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)