Singapore Online Gaming Market Size, Share, Trends and Forecast by Device Type, Gaming Type, Age Group, Gender Demographics, Model, and Region, 2026-2034

Singapore Online Gaming Market Summary:

The Singapore online gaming market size was valued at USD 712.80 Billion in 2025 and is projected to reach USD 1,387.34 Billion by 2034, growing at a compound annual growth rate of 7.60% from 2026-2034.

As the city-state solidifies its status as Southeast Asia's leading center for digital entertainment, the online gaming business in Singapore is expanding rapidly. User involvement in casual, competitive, and social gaming forms is increasing due to widespread smartphone adoption, top-notch 5G infrastructure, and a tech-savvy populace. Deeper market penetration is being fostered by government-backed initiatives that assist the creation of interactive media, a flourishing esports environment, and rising investments in cloud gaming and immersive technologies. The Singapore online gaming market share is being further strengthened by burgeoning digital payment networks, rising disposable incomes, and a growing preference for free-to-play monetization schemes.

Key Takeaways and Insights:

- By Device Type: Mobile devices dominate the market with a share of 56% in 2025, driven by Singapore's exceptionally high smartphone penetration, affordable mobile data plans, and the convenience of on-the-go gaming experiences across all demographics.

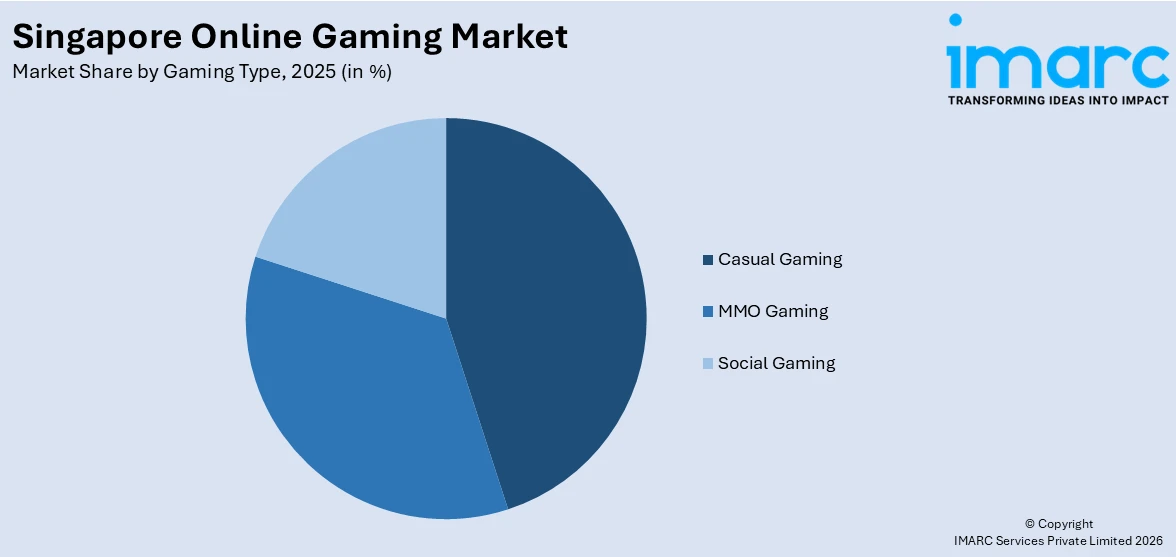

- By Gaming Type: Casual gaming leads the market with a share of 40% in 2025, owing to its accessibility, short session formats, and broad appeal among both younger and older population segments seeking quick entertainment options.

- By Age Group: 19-25 years represent the largest segment with a share of 32% in 2025, reflecting this cohort's deep digital fluency, high engagement with competitive and social gaming platforms, and strong in-app spending behavior.

- By Gender Demographics: Male account for the biggest share of 60% in 2025, attributed to higher participation rates in competitive esports, massively multiplayer online titles, and action-oriented gaming genres.

- By Model: Free-to-play games exhibit a clear dominance with a share of 67% in 2025, reflecting the widespread adoption of freemium monetization strategies that lower entry barriers while generating revenue through in-app purchases and microtransactions.

- Key Players: In order to boost user engagement, increase market reach, and take advantage of the region's growing demand for interactive digital entertainment, major players in the online gaming industry in Singapore expand digital content libraries, invest in esports infrastructure, improve mobile gaming experiences, and establish strategic alliances.

.webp)

To get more information on this market Request Sample

As consumers, producers, and politicians all embrace interactive digital entertainment as a cornerstone of the country's digital economy, the Singaporean online gaming sector is growing. The nation's world-class connectivity infrastructure, which facilitates smooth cross-platform gaming and real-time competitive experiences, is a key factor influencing this advancement. For both casual mobile users and professional esports athletes, the country's early attainment of nationwide standalone 5G coverage offers an ultra-low latency network that enables lag-free gaming sessions. A more favorable environment for long-term market expansion across all user segments and device categories is being created by policy encouragement through government-backed grants for game development, increasing interest in cloud gaming and augmented reality experiences, as well as organizing esports events.

Singapore Online Gaming Market Trends:

Rapid Growth of Competitive Esports Ecosystem

Singapore is rapidly emerging as Southeast Asia's premier esports destination, attracting major international tournaments and fostering local competitive talent. For instance, the BLAST Slam IV Dota 2 tournament held at the Singapore Indoor Stadium in November 2025 featured a USD 1 Million prize pool and drew over 5,000 fans, with broadcasts reaching 50 territories in 15 official languages. Government partnerships with tournament organizers and rising spectator engagement are strengthening Singapore's online gaming market growth.

Increasing Adoption of Cloud Gaming and Immersive Technologies

Among Singapore's digitally connected populace, cloud gaming, augmented reality, and virtual reality technologies are gaining popularity because they provide high-end gaming experiences without requiring costly gear. High-fidelity game content can be streamed smoothly because to the nation's sophisticated 5G infrastructure, which has average download speeds of over 376 Mbps. In order to provide engaging experiences across mobile, console, and computer devices, developers and platform operators are investing in immersive formats that take advantage of low-latency connectivity.

Rising Influence of Gaming Content Creators and Streaming Culture

The creator economy surrounding gaming is expanding rapidly in Singapore, with local streamers and gaming influencers flourishing on prominent platforms such as Twitch, YouTube, and TikTok. These content creators play a pivotal role in game marketing, community building, and player retention across Southeast Asia, shaping consumer preferences and driving engagement with new releases. Businesses are increasingly viewing this growing ecosystem as a strategic channel for branded partnerships, data-driven audience engagement, and promotional campaigns that effectively connect gaming audiences with new titles, in-game experiences, and interactive entertainment offerings.

Market Outlook 2026-2034:

Singapore's online gaming market is poised for sustained advancement, supported by continued infrastructure investment, policy encouragement, and deepening consumer engagement across multiple gaming formats. The market generated a revenue of USD 712.80 Billion in 2025 and is projected to reach a revenue of USD 1,387.34 Billion by 2034, growing at a compound annual growth rate of 7.60% from 2026-2034. Higher revenue streams are anticipated as a result of the rising esports ecosystem, the growing desire for mobile-first gaming experiences, and the growing use of free-to-play monetization models. It is also expected that developments in cloud gaming, augmented reality integration, and artificial intelligence-powered game design will transform user experiences and draw in new audiences. The country's standing as a major center for digital entertainment in the Asia-Pacific area will be further strengthened by government support through programs like the Singapore Tourism Board's multi-year esports partnership with international tournament organizers and IMDA's grants for game development prototypes.

Singapore Online Gaming Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Device Type |

Mobile Devices |

56% |

|

Gaming Type |

Casual Gaming |

40% |

|

Age Group |

19-25 Years |

32% |

|

Gender Demographics |

Male |

60% |

|

Model |

Free-to-play Games |

67% |

Device Type Insights:

- Mobile Devices

- Digital Console

- Computer

Mobile devices dominate with a market share of 56% of the total Singapore online gaming market in 2025.

Due to the country's remarkably high smartphone adoption and extensive mobile connectivity, mobile devices are the backbone of Singapore's online gaming industry. Mobile gaming's portability and ease of use fit in perfectly with Singaporean customers' urban lifestyle, allowing them quick casual play during breaks, commutes, and free time. Mobile gaming is now available to people of all ages and income levels nationwide because to the widespread availability of reasonably priced, high-performance smartphones and aggressive mobile data deals from major carriers.

The strength of Singapore's mobile gaming segment is further reinforced by the country's world-class 5G connectivity, which enables lag-free multiplayer experiences and seamless cloud gaming on handheld devices. For instance, according to IMDA's Digital Society report, 99% of resident homes in Singapore have internet access, creating a deeply connected user base. Major titles such as Mobile Legends, Free Fire, and Candy Crush Saga maintain strong download rankings, while regional publishers like Garena continue to expand their mobile-first content offerings to serve the growing demand for accessible, high-quality gaming experiences.

Gaming Type Insights:

Access the comprehensive market breakdown Request Sample

- Casual Gaming

- MMO Gaming

- Social Gaming

Casual gaming leads with a share of 40% of the total Singapore online gaming market in 2025.

In Singapore's online gaming market, casual gaming has the most share because to its wide accessibility and minimal commitment requirements, which appeal to a diverse range of demographics. These games are well-liked by both casual users looking for quick enjoyment and devoted gamers due to their simple principles, brief play sessions, and low learning curves. While in-app purchases and reward-based advertising create steady revenue streams for developers and publishers working in the nation's cutthroat digital entertainment market, the freemium model common in casual games facilitates seamless onboarding.

Singapore's mobile-first gaming culture, where puzzle, simulation, and hyper-casual games often rank among the most downloaded apps on major app stores, further reinforces the dominance of casual gaming. Strong download numbers and consistent engagement rates are still driven by consumers' persistent desire for conveniently available and digestible entertainment formats. Casual gaming continues to be the most popular style of gaming in the nation thanks to increased social integration features, competitive leaderboards, and seasonal event-driven content releases that boost user engagement and retention.

Age Group Insights:

- Below 18 Years

- 19-25 Years

- 26-35 Years

- 36-45 Years

- Over 46 Years

19-25 years is the largest segment, accounting for 32% of the total Singapore online gaming market in 2025.

The largest consumer cohort in Singapore's online gaming market is the 19–25 age group, which is distinguished by strong involvement with competitive multiplayer games, high digital fluency, and active participation in esports communities. This group enjoys widespread access to high-speed internet and high-end mobile devices, which allow for multi-platform immersive gaming sessions. Their propensity to spend money on cosmetic improvements, seasonal battle passes, and in-app purchases makes them a vital force behind long-term commercial growth in all gaming genres.

The flourishing esports culture in Singapore and the increasing impact of gaming content providers on streaming and social media platforms further influence the gaming habits of this age group. Young adults are actively involved in both recreational and professional gaming activities through university-level competitive gaming tournaments and organized esports career development programs. In the nation's changing digital entertainment landscape, social media, live streaming platforms, and interactive gaming experiences come together to form a highly engaged ecosystem that sustains long-term user retention, community loyalty, and spending patterns among young adult gamers.

Gender Demographics Insights:

- Male

- Female

Male gamers hold the largest share at 60% of the total Singapore online gaming market in 2025.

Male gamers constitute the dominant demographic in Singapore's online gaming market, reflecting their higher participation rates in competitive multiplayer titles, action-oriented genres, and organized esports activities. This segment demonstrates strong engagement with massively multiplayer online games, first-person shooters, and battle royale titles that require sustained time investment and strategic team coordination. Male gamers in Singapore also exhibit higher average spending on premium subscriptions, in-game currencies, and competitive gaming peripherals, reinforcing their significant contribution to the overall revenue generation within the country's online gaming ecosystem.

The prevalence of male gamers is further reinforced by Singapore's established esports infrastructure, which attracts predominantly male audiences to competitive tournaments, live gaming events, and professional league viewing experiences. However, the gender gap within the gaming community is gradually narrowing as casual and social gaming genres attract an increasing number of female players, driving broader demographic diversification across the online gaming landscape. Developers and publishers are increasingly designing inclusive content and marketing strategies that cater to a wider audience base, fostering a more balanced and representative gaming community throughout Singapore.

Model Insights:

- Free-to-play Games

- Pay-to-Play Games

Free-to-play games represent the leading segment with a 67% share of the total Singapore online gaming market in 2025.

Free-to-play games command the largest revenue share in Singapore's online gaming market, leveraging monetization strategies centered on microtransactions, seasonal content passes, and cosmetic item sales. This model eliminates upfront purchase barriers, enabling rapid user acquisition and high installation volumes across mobile, console, and computer platforms. The accessibility of free-to-play titles has been instrumental in expanding the overall gaming population, particularly among casual users and younger demographics who prioritize low-cost entry points when exploring new gaming experiences and interactive entertainment options.

The dominance of free-to-play models in Singapore is bolstered by advanced digital payment infrastructure, including widespread adoption of digital wallets and seamless in-app purchase systems that reduce transaction friction for consumers. Publishers continue to refine engagement mechanics through live service updates, limited-time events, and reward-based loyalty systems that sustain monetization over extended player lifecycles. The strong consumer willingness to spend within freemium ecosystems, supported by high disposable incomes and a digitally mature population, ensures that free-to-play remains the preferred monetization framework for both global publishers and regional developers operating in Singapore.

Regional Insights:

- North-East

- Central

- West

- East

- North

The North-East region of Singapore contributes to the online gaming market through its dense residential population base, including areas such as Hougang, Sengkang, and Punggol. High broadband penetration rates and strong mobile connectivity support widespread casual and competitive gaming activities among residents. The presence of community esports venues and gaming cafes encourages social gaming interaction, while young family demographics in newer townships drive demand for accessible mobile gaming entertainment options.

The Central region serves as the primary hub for Singapore's online gaming ecosystem, housing major technology companies, esports venues, and digital entertainment infrastructure. Areas such as the Central Business District, Kallang, and Toa Payoh host gaming events and esports experience centers that attract both local and international audiences. The concentration of young professionals, students, and high-income residents in this region drives premium gaming consumption, including pay-to-play titles and competitive esports participation.

The West region of Singapore, encompassing Jurong, Clementi, and Bukit Batok, contributes significantly to the online gaming market through its mix of residential communities and educational institutions. The proximity of universities and polytechnics fosters a young, digitally active population engaged in competitive and social gaming activities. Expanding digital infrastructure in the Jurong innovation district and growing adoption of high-speed broadband services support seamless gaming experiences across multiple device categories.

The East region, including Tampines, Bedok, and Pasir Ris, represents a growing contributor to Singapore's online gaming landscape through its large residential population base and strong digital connectivity. Young families and millennial residents in these townships demonstrate high mobile gaming engagement, particularly in casual and social gaming categories. Community-level gaming events and retail outlets specializing in gaming peripherals further stimulate consumer interest and spending in the online gaming market.

The North region of Singapore, covering Woodlands, Yishun, and Sembawang, supports online gaming market growth through expanding residential developments and improving broadband accessibility. The increasing adoption of smartphones and high-speed mobile internet among residents facilitates widespread participation in online gaming activities across age groups. Government-led smart township initiatives and community engagement programs that incorporate gaming elements are gradually driving digital entertainment adoption in this region.

Market Dynamics:

Growth Drivers:

Why is the Singapore Online Gaming Market Growing?

World-Class Digital Infrastructure and 5G Connectivity

Singapore's position as a global leader in digital infrastructure is a fundamental catalyst for online gaming market expansion. The country's nationwide standalone 5G coverage provides ultra-low latency and high-speed connectivity essential for seamless multiplayer gaming, cloud-based game streaming, and real-time competitive esports experiences. This advanced network backbone enables gamers to access high-fidelity content across mobile devices without performance degradation, effectively removing technical barriers that constrain gaming adoption in less connected markets. The strength of Singapore's digital foundation extends beyond mobile networks, with virtually universal broadband access supporting fixed-line gaming on consoles and computers. This comprehensive connectivity ecosystem supports cross-platform gameplay, enables cloud gaming services, and provides the infrastructure necessary for developers and publishers to deliver increasingly sophisticated interactive entertainment experiences to a highly connected gaming population.

Government Support for Digital Entertainment and Esports

Singapore's government has established a proactive policy framework that actively fosters growth in the gaming and esports sectors through targeted funding, institutional support, and international event hosting partnerships. Key government agencies, in collaboration with industry development bodies and tourism authorities, have implemented multiple initiatives to strengthen the domestic gaming ecosystem, including prototype development grants and talent development programs designed to nurture locally created gaming content. Multi-year partnerships with international esports tournament organizers further strengthen the country's reputation as a premier destination for competitive gaming entertainment, attracting global audiences and investment to the domestic market. These coordinated efforts are creating a supportive environment that encourages innovation, entrepreneurship, and professional career development within the interactive entertainment industry, positioning Singapore as a regional hub for gaming excellence.

High Spending Power and Digitally Native Consumer Base

Singapore's affluent, tech-savvy population provides a uniquely favorable consumer environment for online gaming market expansion. The city-state's high per capita income and strong disposable income levels translate directly into elevated gaming expenditure, with Singaporean gamers demonstrating a significantly higher average revenue per user compared to regional counterparts. This spending power supports premium content consumption, subscription-based gaming services, and substantial in-app purchase activity across free-to-play and pay-to-play models. The country's deeply penetrated gamer base reflects the positioning of gaming as a mainstream entertainment activity rather than a niche hobby. Young adults and working professionals constitute the core spending demographic, with strong willingness to invest in gaming peripherals, esports event attendance, and digital content purchases. This combination of high consumer spending power and broad gaming adoption creates a robust revenue foundation that continues to attract global publishers, developers, and investors to the Singapore market.

Market Restraints:

What Challenges the Singapore Online Gaming Market is Facing?

Regulatory Concerns Around Gaming Addiction and Youth Protection

Singapore's government has implemented increasingly stringent regulatory measures to address gaming addiction and protect younger populations from excessive screen time. Age verification requirements, content classification standards, and potential restrictions on loot box mechanics create compliance burdens for developers and publishers. These regulatory interventions, while socially beneficial, may constrain monetization strategies, limit certain game features, and slow the introduction of new content formats that rely on engagement-maximizing mechanics.

Market Saturation and Intense Competition

Singapore's relatively small population base of approximately six million residents constrains the total addressable market, creating saturation challenges as gamer penetration approaches its natural ceiling. Intense competition among global publishers, regional platforms, and local developers for a limited audience drives up user acquisition costs and compresses profit margins. The abundance of free-to-play alternatives and low switching costs further intensify competitive pressures, making sustained user retention and monetization increasingly difficult.

Rising User Acquisition and Content Development Costs

The cost of acquiring new users and developing high-quality gaming content continues to escalate in Singapore's mature digital market. Premium advertising inventory, influencer marketing partnerships, and targeted digital campaigns require substantial marketing budgets that challenge smaller studios and independent developers. Simultaneously, rising expectations for graphical fidelity, immersive storytelling, and live service content updates demand significant ongoing investment in development resources, technology infrastructure, and creative talent retention.

Competitive Landscape:

The Singapore online gaming market is becoming increasingly competitive as global publishers, regional platforms, and local studios intensify their efforts to capture user attention and spending. Companies are focusing on diversifying content portfolios, enhancing mobile-first experiences, and investing in esports infrastructure to strengthen user engagement. Competition is further driven by advancements in cloud gaming technology, expansion of free-to-play monetization models, and strategic partnerships between gaming companies and telecommunications providers. Innovation in social gaming features, content creator ecosystems, and cross-platform compatibility is fostering differentiation among market participants seeking to establish long-term user loyalty and sustainable revenue growth.

Singapore Online Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Mobile Devices, Digital Console, Computer |

| Gaming Types Covered | Casual Gaming, MMO Gaming, Social Gaming |

| Age Groups Covered | Below 18 Years, 19-25 Years, 26-35 Years, 36-45 Years, Over 46 Years |

| Gender Demographics Covered | Male, Female |

| Models Covered | Free-to-play Games, Pay-to-Play Games |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Singapore online gaming market size was valued at USD 712.80 Billion in 2025.

The Singapore online gaming market is expected to grow at a compound annual growth rate of 7.60% from 2026-2034 to reach USD 1,387.34Billion by 2034.

Mobile devices dominated the market with a share of 56%, driven by Singapore's exceptionally high smartphone penetration, world-class 5G connectivity, and the convenience of on-the-go gaming experiences across all demographics.

Key factors driving the Singapore online gaming market include world-class digital infrastructure, nationwide 5G coverage, government support for gaming and esports, high consumer spending power, expanding mobile gaming adoption, and rising interest in competitive esports.

Major challenges include regulatory concerns around gaming addiction and youth protection, market saturation due to the small population base, intense competition among global and regional publishers, rising user acquisition costs, and escalating content development expenditures.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)