Singapore Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2026-2034

Singapore Logistics Market Overview:

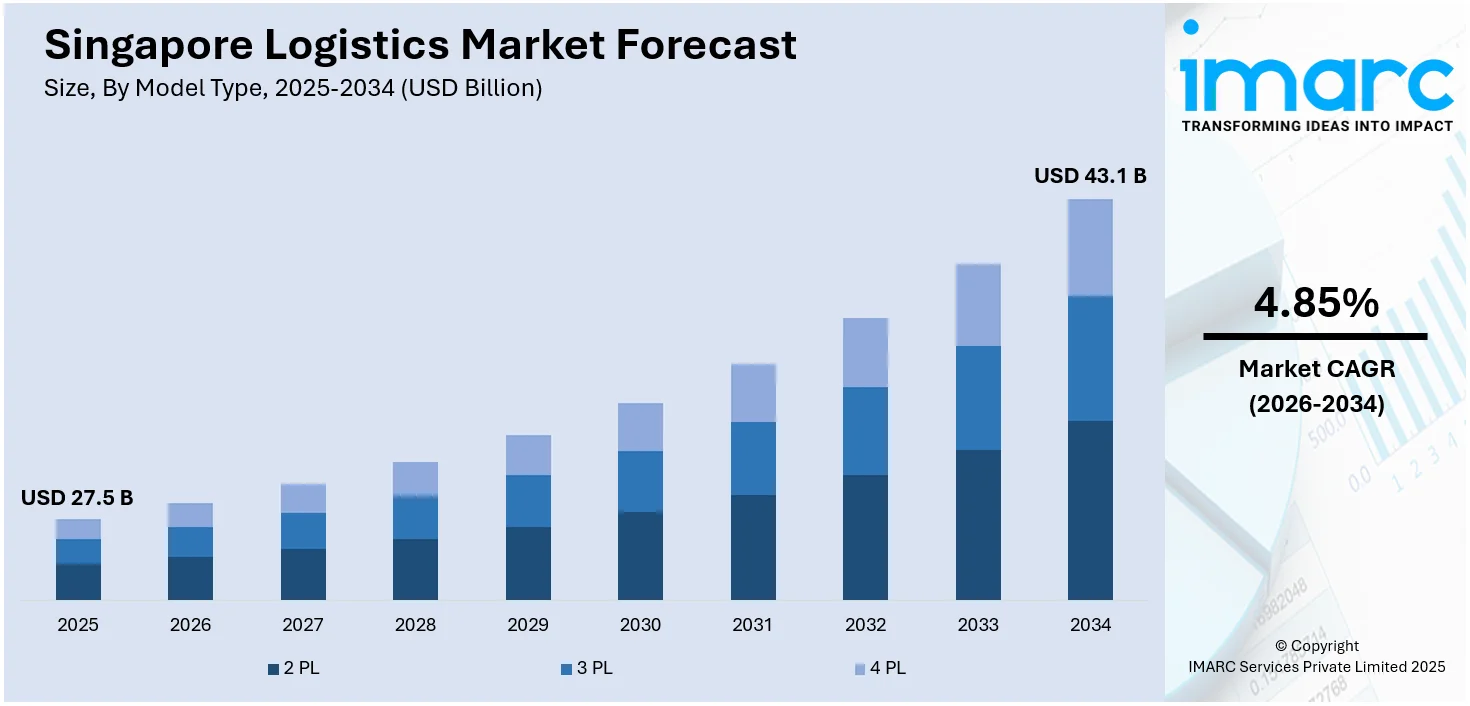

The Singapore logistics market size reached USD 27.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 43.1 Billion by 2034, exhibiting a growth rate (CAGR) of 4.85% during 2026-2034. The market is driven by the increasing number of pharmaceutical and medical device manufacturing plants, along with the thriving food and beverage (F&B) industry that needs efficient and trustworthy supply systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 27.5 Billion |

| Market Forecast in 2034 | USD 43.1 Billion |

| Market Growth Rate (2026-2034) | 4.85% |

Singapore Logistics Market Trends:

Rising Number of Pharmaceutical and Medical Device Manufacturing Plants

According to an article published in 2023 on the website of the Singapore Economic Development Board (EDB), Singapore has more than 80 pharmaceutical and medical device manufacturing plants. Pharmaceuticals and medical devices frequently require specialist logistics solutions, such as temperature-controlled transit and storage, to maintain product integrity and comply with regulatory requirements. The manufacture of temperature-sensitive pharmaceuticals and biologics increases the demand for dependable cold chain logistics, prompting increased investments in refrigerated warehouses, transportation vehicles, and monitoring technology. The stringent regulatory requirements for pharmaceutical and medical device logistics are catalyzing the demand for logistics providers who specialize in compliance and quality assurance, ensuring that items are handled in accordance with good distribution practices (GDP).

To get more information on this market Request Sample

The expansion of manufacturing plants necessitates increased investment in logistical infrastructure, such as warehouses, distribution centers, and transportation networks, to support effective supply chain operations. The logistics market benefits from the use of sophisticated technologies, such as IoT for real-time monitoring, blockchain for secure and transparent supply chains, and AI for improving logistics operations and assuring on-time delivery. The growth of the pharmaceutical and medical device industries generates additional positions in logistics and supply chain management, necessitating the creation of specific skills and training programs to fulfill industry expectations.

Thriving Food and Beverage (F&B) Industry

As per an article published in 2024 on the website of the Singapore Department of Statistics, the total sales value of F&B services in April 2024 was estimated at $931 million. To ensure timely delivery of perishable items, the food and beverage (F&B) industry requires efficient and trustworthy supply systems. This need motivates advances in logistical operations, such as transportation, warehousing, and inventory management. The requirement to maintain the quality and safety of perishable items including fresh produce, dairy products, and meats drives greater investments in cold chain logistics. This includes refrigerated transportation and temperature-controlled storage areas.

The rise of e-commerce platforms for food delivery and grocery shopping is boosting the demand for sophisticated logistical solutions, such as last-mile delivery services, to match consumer expectations for quick and dependable delivery. Compliance with severe food safety and hygiene laws involves the use of specialized logistics services capable of handling food goods that meet these standards. This creates a demand for logistics companies who specialize in food safety and quality management. The F&B sector promotes innovations in packaging and handling solutions to maintain the freshness and quality of food goods during transportation and storage, resulting in advances in logistics technology and practices. As a worldwide trading hub, Singapore imports and exports a large volume of food goods. This trade activity increases the demand for effective logistics services for customs clearance, warehousing, and delivery.

Singapore Logistics Market News:

- March 2024: PSA Singapore (PSA) has announced a strategic expansion of its Jurong Island Terminal (JIT) to meet the growing demand for sustainable, efficient and resilient supply chain solutions from industries based on Jurong Island.

- June 2024: GEODIS and L-Acoustics opened their new regional distribution center in Singapore. The distribution center is a testament to the manufacturer's commitment to this strategic and growing market.

Singapore Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2 PL, 3 PL, and 4 PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes roadways, seaways, railways, and airways.

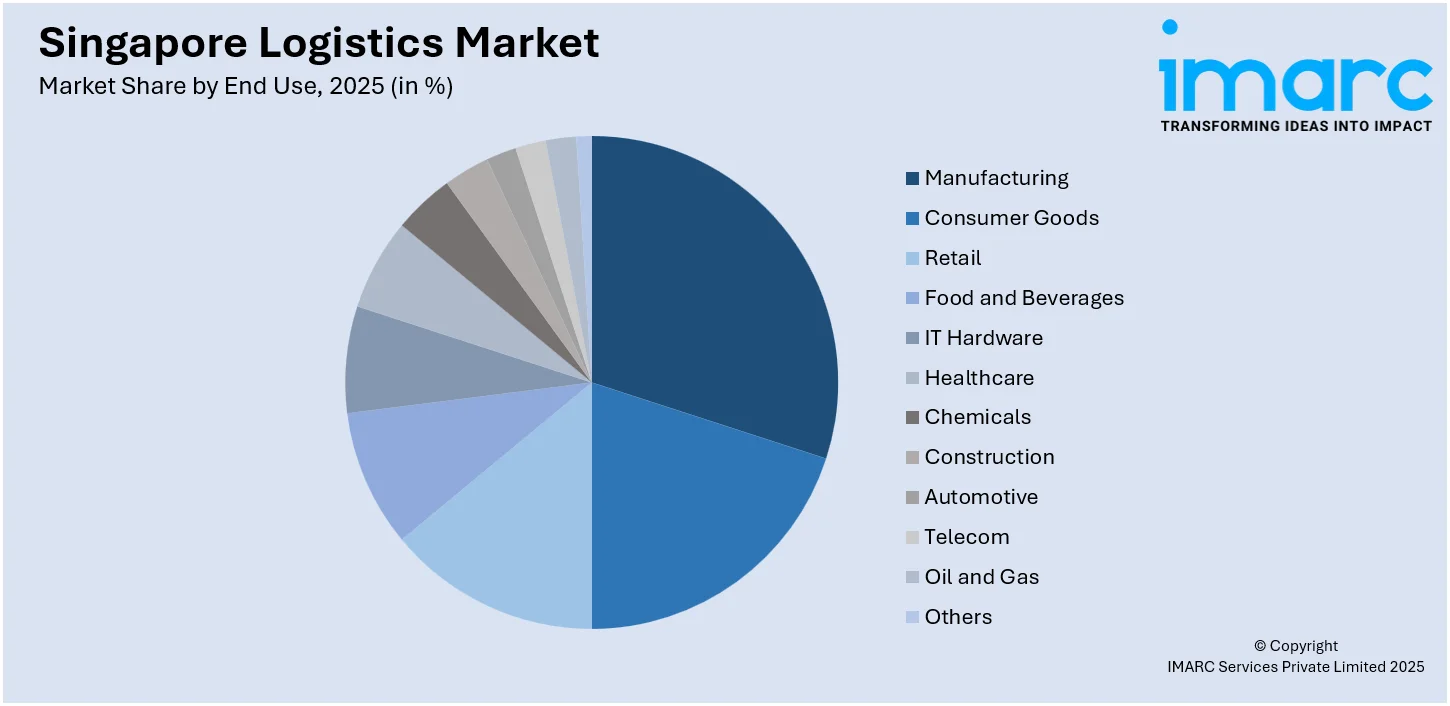

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Singapore logistics market was valued at USD 27.5 Billion in 2025.

The Singapore logistics market is projected to exhibit a CAGR of 4.85% during 2026-2034, reaching a value of USD 43.1 Billion by 2034.

The Singapore logistics market is propelled by its strategic location, world-class port and airport facilities, and pro-business government policies. Growing e-commerce demand, regional distribution needs, and investment in automation further enhance Singapore’s role as a logistics hub.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)