Singapore ERP Software Market Size, Share, Trends and Forecast by Function, Deployment, Enterprise Size, Vertical, and Region, 2026-2034

Singapore ERP Software Market Overview:

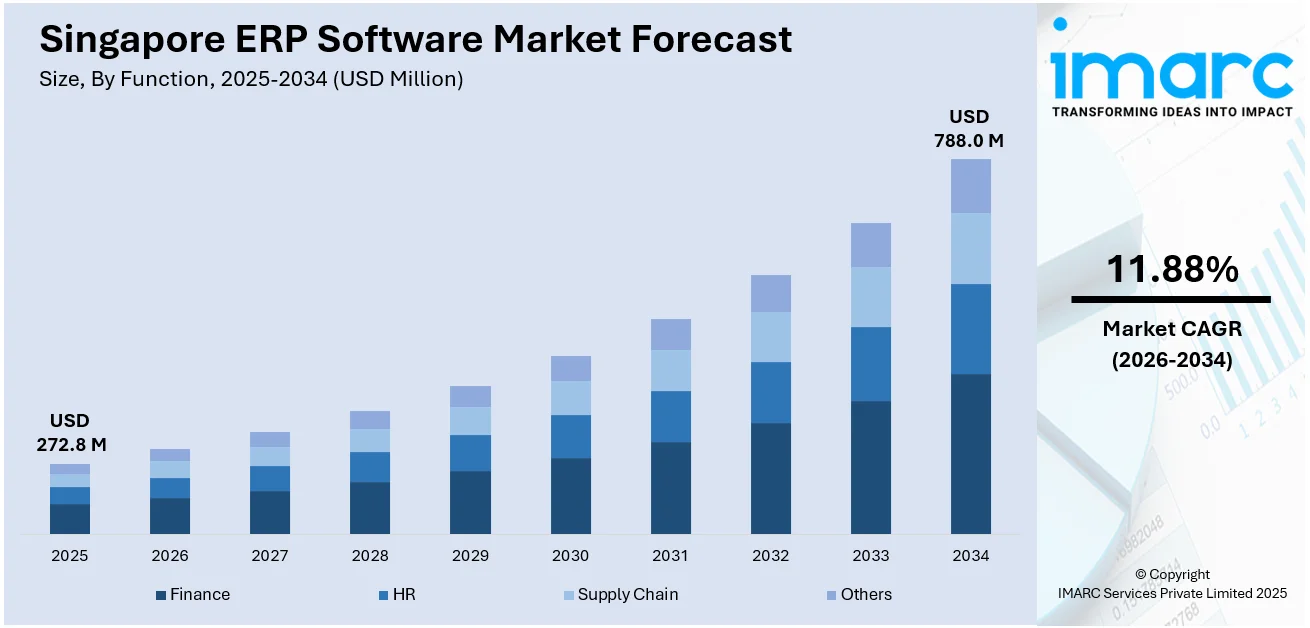

The Singapore ERP software market size reached USD 272.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 788.0 Million by 2034, exhibiting a growth rate (CAGR) of 11.88% during 2026-2034. The market in Singapore is primarily driven by the increasing adoption of cloud-based solutions by businesses to manage remote operations and ensure business continuity and an enhanced emphasis on data analytics as well as real-time reporting.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 272.8 Million |

| Market Forecast in 2034 | USD 788.0 Million |

| Market Growth Rate (2026-2034) | 11.88% |

Singapore ERP Software Market Trends:

Increasing Adoption of Cloud-Based Solutions

The Singapore ERP software market is significantly driven by the increasing adoption of cloud-based solutions, which offer unparalleled flexibility, cost efficiency, and accessibility crucial for modern business operations. As enterprises strive for higher efficiency and scalability, the demand for cloud ERP solutions has risen, eliminating the need for substantial upfront investments in IT infrastructure and providing seamless updates and maintenance. In Singapore, this trend is further amplified by the government's Smart Nation initiative, which encourages digital transformation across all sectors. This initiative aims to harness the power of digital technologies, including cloud computing, to enhance productivity and innovation across the economy. Furthermore, the COVID-19 pandemic has acted as a catalyst for this shift, with businesses increasingly adopting cloud-based ERP systems to manage remote operations and ensure business continuity. The agility provided by cloud ERP systems enables companies to adapt quickly to changing market conditions and customer needs, which is especially crucial in a dynamic and competitive market like Singapore.

To get more information on this market Request Sample

Increasing Emphasis on Data Analytics and Real-Time Reporting

Another critical driver of the Singapore ERP software market is the increasing emphasis on data analytics and real-time reporting. Modern ERP systems are equipped with advanced analytics tools that enable organizations to derive actionable insights from vast amounts of data, which is invaluable in a competitive market where timely and informed decision-making is crucial. The integration of artificial intelligence (AI) and machine learning (ML) within ERP systems enhances predictive analytics capabilities, allowing companies to forecast trends, manage risks, and optimize their supply chains more effectively. In Singapore, the regulatory environment also plays a pivotal role in this trend. With increasingly stringent compliance and regulatory requirements, businesses need robust reporting capabilities to adhere to local laws and regulations. ERP systems that offer comprehensive and real-time reporting help organizations mitigate the risk of non-compliance, thereby reducing potential legal and financial repercussions. Additionally, real-time data analytics provide businesses with a competitive edge by enabling them to respond swiftly to market changes, optimize operations, and improve customer satisfaction. As regulatory frameworks continue to change and the demand for data-driven decision-making grows, the adoption of ERP systems with advanced analytics and reporting capabilities is expected to rise, further propelling the growth of the ERP software market in Singapore.

Government Support and Initiatives

The Singaporean government's proactive stance in promoting digitalization and innovation significantly contributes to the ERP market's expansion. Various government initiatives and funding schemes, such as the Productivity Solutions Grant (PSG) and the Enterprise Development Grant (EDG), encourage businesses to adopt ERP systems. These programs offer financial support and resources for companies to invest in technology that enhances productivity and competitiveness. Additionally, the government's Smart Nation initiative aims to create a digitally integrated and data-driven economy, further propelling the adoption of ERP solutions across different sectors. By fostering an environment conducive to technological adoption, the government ensures that businesses are well-equipped to navigate the complexities of a rapidly changing market. Moreover, the government actively collaborates with private sector partners to develop innovative ERP solutions tailored to local business needs. The emphasis on public-private partnerships helps accelerate the deployment of advanced technologies, driving efficiency and growth. Educational programs and training sessions are also organized to equip the workforce with the necessary skills to manage and optimize ERP systems. As a result, businesses can leverage these systems more effectively, leading to improved operational performance. Additionally, regulatory frameworks and standards set by the government provide a structured approach for ERP implementation, ensuring consistency and quality. Finally, continuous investment in research and development by the government ensures that Singapore remains at the forefront of technological advancements, supporting the long-term growth of the ERP market.

Singapore ERP Software Market News:

- On 22nd May 2024, Epicor announced they are integrating generative AI with their new Epicor Prism ERP service, enhancing business decision-making capabilities, especially in manufacturing and retail sectors. This platform includes an automated code assistant for faster business processes and a conversational tool for production and purchasing insights, demonstrated effectively by dynamic users like the Visa Cash App RB Formula 1 team.

- On 22nd February 2024, Oracle ERP announced that they have been selected by Apollo Health & Lifestyle Limited to optimize financial operations, improve productivity, and eliminate manual processes, enabling the company to gain insights and drive better decision-making.

Singapore ERP Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on function, deployment, enterprise size, and vertical.

Function Insights:

- Finance

- HR

- Supply Chain

- Others

The report has provided a detailed breakup and analysis of the market based on the function. This includes finance, HR, supply chain, and others.

Deployment Insights:

- On-premises

- Cloud

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes on-premises and cloud.

Enterprise Size Insights:

- Large Enterprises

- Medium Enterprises

- Small Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises, medium enterprises, and small enterprises.

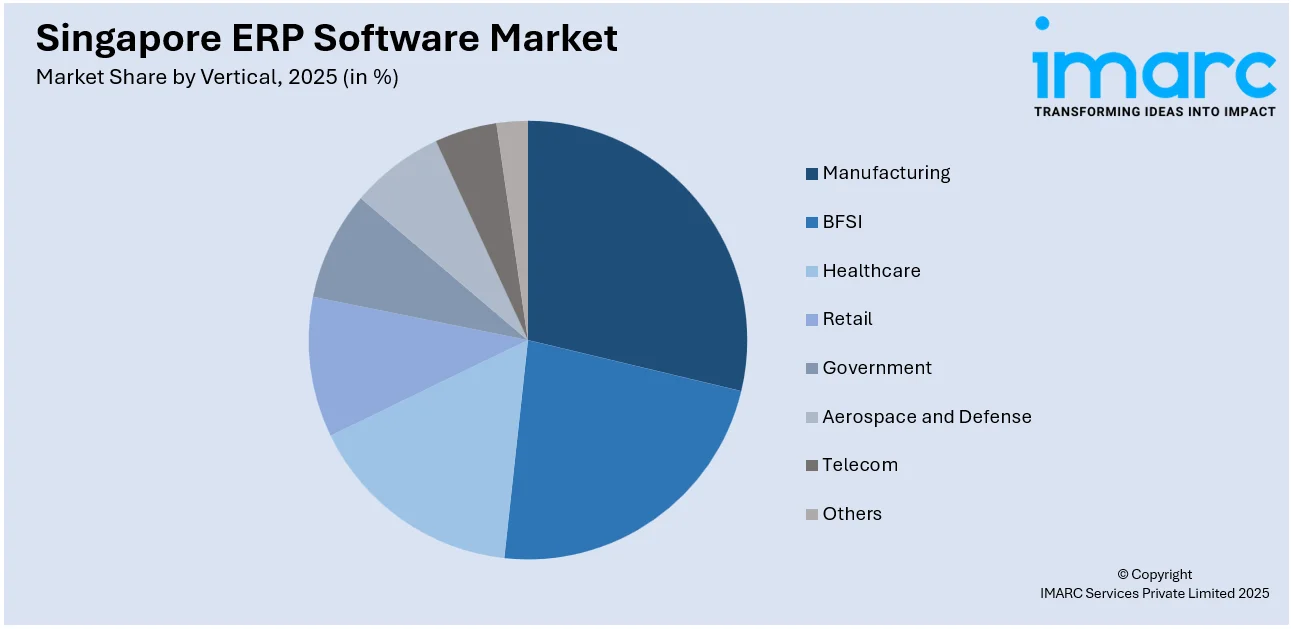

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- BFSI

- Healthcare

- Retail

- Government

- Aerospace and Defense

- Telecom

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes manufacturing, BFSI, healthcare, retail, government, aerospace and defense, telecom, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore ERP Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Finance, HR, Supply Chain, Others |

| Deployments Covered | On-premises, Cloud |

| Enterprise Sizes Covered | Large Enterprises, Medium Enterprises, Small Enterprises |

| Verticals Covered | Manufacturing, BFSI, Healthcare, Retail, Government, Aerospace and Defense, Telecom, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Singapore ERP software market performed so far and how will it perform in the coming years?

- What is the breakup of the Singapore ERP software market on the basis of function?

- What is the breakup of the Singapore ERP software market on the basis of deployment?

- What is the breakup of the Singapore ERP software market on the basis of enterprise size?

- What is the breakup of the Singapore ERP software market on the basis of vertical?

- What are the various stages in the value chain of the Singapore ERP software market?

- What are the key driving factors and challenges in the Singapore ERP software?

- What is the structure of the Singapore ERP Software market and who are the key players?

- What is the degree of competition in the Singapore ERP software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore ERP software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore ERP software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore ERP software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)