Singapore Energy Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Singapore Energy Market Overview:

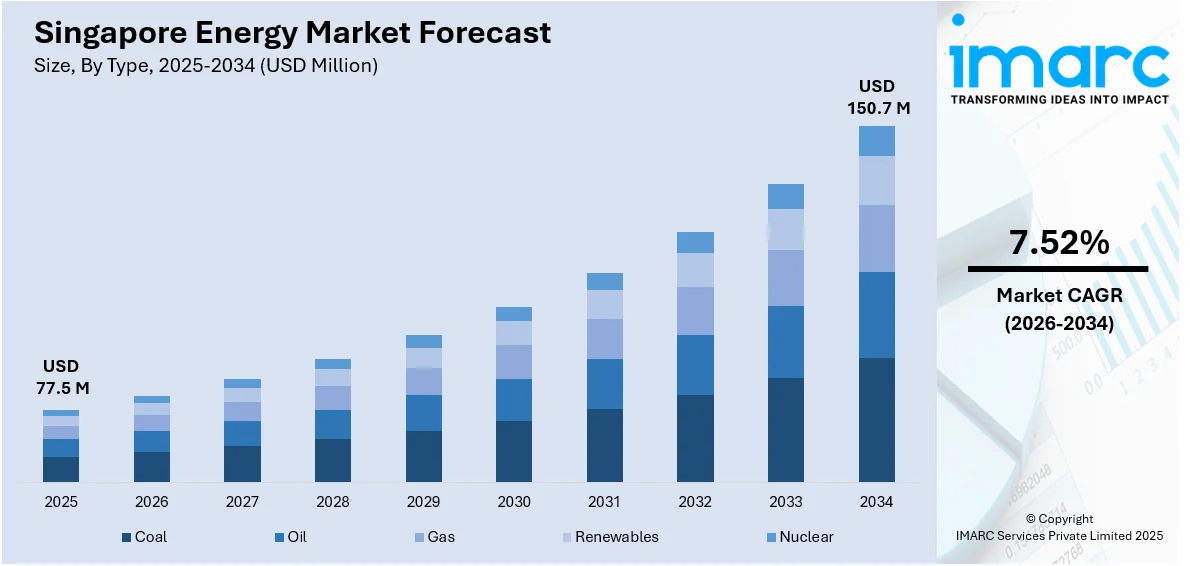

The Singapore energy market size reached USD 77.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 150.7 Million by 2034, exhibiting a growth rate (CAGR) of 7.52% during 2026-2034. Government policies ensure competition and reliability, diversification efforts focusing on renewable energy sources like solar and offshore wind, technological advancements, sustainability goals, collaboration and regional partnerships, and consumer demand for clean energy are some of the factors shaping the Singapore energy market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 77.5 Million |

| Market Forecast in 2034 | USD 150.7 Million |

| Market Growth Rate 2026-2034 | 7.52% |

Singapore Energy Market Trends:

Government Policies and Regulation

Singapore has an advanced energy market that is highly regulated by the Energy Market Authority (EMA). These policies are focused on creating competitive, reliable, and sustainable energy markets. EMA frames the rules for the market, which has compelled market players to understand the new tariff structures and license conditions and create a level playing field for all players. The government's Energy Story and the Singapore Green Plan 2030, which outline the government's long-term energy strategies, also offer an established direction for industry players to converge their investments and operations with national objectives pertaining to carbon reduction and environmental sustainability. The government will also consult and analyze how to best strike a balance on energy security, affordability and environmental considerations and create and promote a timely and predictable path for the transformation of the energy market through a series of market-wider proactive regulation and strategic planning.

To get more information on this market Request Sample

Diversification of Energy Sources

With natural gas being the primary source of energy in Singapore due to the lack of domestic energy resources, the need for diversification in the energy mix is emphasized in its energy policy. The government is promoting solar, offshore wind, and energy-storing technologies as ways to broaden the energy base beyond imported fossil fuels, which is further enhancing energy security, thereby fueling the Singapore energy market share. Projects like the SolarNova program and the Floating Solar Photovoltaic Systems are examples of its efforts to advance its renewable energy capabilities and environmentally friendly options. Implementing such projects will help Singapore hedge against supply risks, lower its greenhouse gas emissions, and develop a more durable energy system for coming generations.

Technological Advancements and Innovation

Technological innovation plays a crucial role in driving efficiency gains and advancing Singapore's energy market. Through research and development (R&D) initiatives and partnerships with industry stakeholders and research institutions, Singapore continually seeks to harness cutting-edge technologies to optimize energy production, transmission, and consumption. Smart grid solutions, digitalization, and data analytics enable real-time monitoring and control of energy systems, improving reliability and grid stability, thus creating a positive Singapore energy market outlook. Moreover, innovation in energy storage technologies enhances flexibility and resilience, enabling greater integration of intermittent renewable energy sources into the grid. By fostering a culture of innovation and investing in technological advancements, Singapore aims to stay at the forefront of the global energy transition while maintaining its position as a leading energy hub in the region.

Singapore Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Coal

- Oil

- Gas

- Renewables

- Nuclear

The report has provided a detailed breakup and analysis of the market based on the type. This includes coal, oil, gas, renewables, and nuclear.

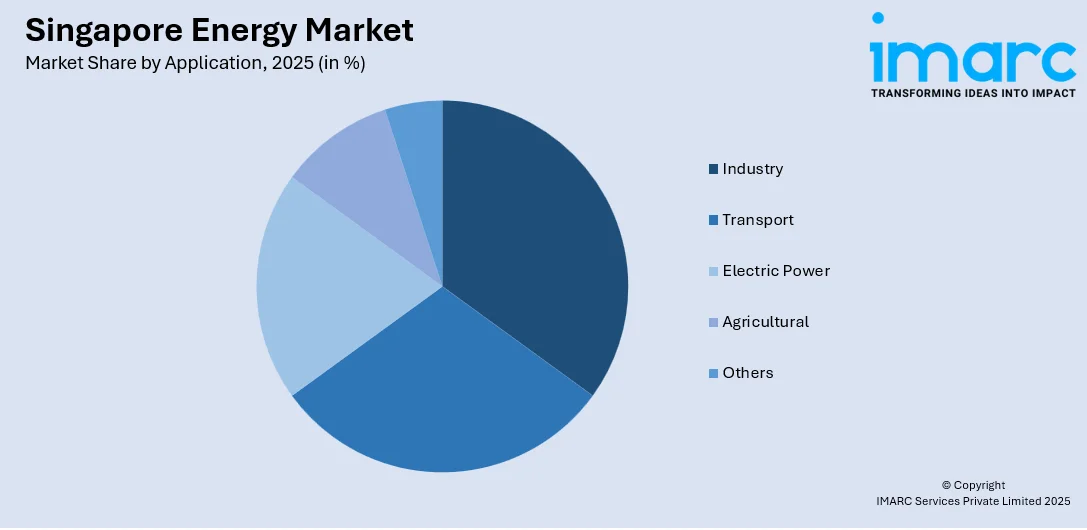

Application Insights:

Access the comprehensive market breakdown Request Sample

- Industry

- Transport

- Electric Power

- Agricultural

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industry, transport, electric power, agricultural, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Energy Market News:

- In 2024, SP Group (SP) declared that Bank of China, DBS Bank, Maybank Singapore, OCBC, and UOB had committed to a green lending facility of S$ 650 million. The Labrador Tower, a Green Mark Super Low Energy (GM SLE) skyscraper recognized by the skyscraper and Construction Authority (BCA), is the project for which this loan is intended. The Labrador Tower will feature advanced sustainable energy solutions such as Green Energy Technology (GET™), AI-driven energy management, sustainable cooling, thermal energy storage, solar panels, and EV charging facilities.

- In 2024, Sembcorp Development revealed the addition of three Vietnam Singapore Industrial Parks (VSIP) to its collection. The investment licenses for VSIP Thai Binh, VSIP Quang Ngai II, and Becamex-VSIP Binh Thuan were granted to firms owned by the Vietnam Singapore Industrial Park Joint Venture Company (VSIP JV Co), which is a partnership between Sembcorp and Becamex IDC Corporation, a state-owned enterprise in Vietnam. Sembcorp possesses a substantial stake between 24.6% and 49.3% in these recent initiatives.

Singapore Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Coal, Oil, Gas, Renewables, Nuclear |

| Applications Covered | Industry, Transport, Electric Power, Agricultural, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore energy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Singapore energy market was valued at USD 77.5 Million in 2025.

The Singapore energy market is projected to exhibit a CAGR of 7.52% during 2026-2034, reaching a value of USD 150.7 Million by 2034.

Singapore’s energy market is driven by reliance on imported natural gas, a strong push for renewable energy under the Green Plan, cross-border clean energy imports, and government investments in infrastructure. Innovations in energy storage, hydrogen technology, and strengthened carbon pricing further support the nation’s transition to a sustainable energy future.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)