Singapore Data Center Market Size, Share, Trends and Forecast by Component, Type, Enterprise Size, End User, and Region, 2026-2034

Singapore Data Center Market Size and Share:

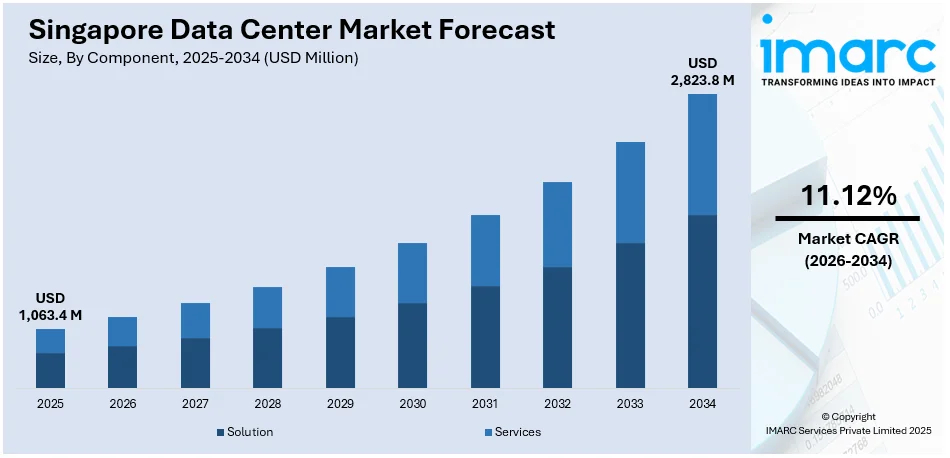

The Singapore data center market size was valued at USD 1,063.4 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 2,823.8 Million by 2034, exhibiting a CAGR of 11.12% during 2026-2034. Central Singapore leads the market, holding a market share of over 40.0% in 2025. This is due to its proximity to central business districts, good connectivity, and sophisticated infrastructure. It has a strategic position that attracts major players and sustains the high demand for data-intensive services to make it a potential location for data center concentration and expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,063.4 Million |

| Market Forecast in 2034 | USD 2,823.8 Million |

| Market Growth Rate 2026-2034 | 11.12% |

The strategic geographical position of the country in Southeast Asia is one of the principal drivers of the Singapore data center market share as it makes the country a prime gateway for international companies to grow their businesses within the Asia-Pacific region. The advanced infrastructure, stable politics, and highly mature IT ecosystem of Singapore form a good base for data center development. The country's low latency and high-speed connectivity to other key Asian markets increase its attractiveness, especially for companies that need real-time processing and transfer of their data. Moreover, Singapore's positioning as a technology and financial hub draws multinational businesses and service providers who require secure, scalable, and stable data storage capabilities. The strong regulatory environment of the country also ensures international standard compliance, developing confidence and growth among investors in the data center industry.

To get more information on this market Request Sample

In addition, the growing demand for cloud computing, big data analysis, and the emergence of new technologies such as AI, IoT, and 5G are propelling the requirement for greater data processing capacity. With companies increasingly digitizing and embracing these technologies, the amount of data produced is growing, pushing the need for high-capacity data centers. The growth of submarine cable networks in Singapore has also further heightened connectivity, lowering latency and enhancing global data transfer efficiency. The proactive approach of the government towards digital transformation and environmental initiatives also contributes significantly to the sector's advancement. Focusing on sustainability, Singapore's data center industry is turning green to become energy-efficient and environmentally friendly, inviting foreign players to invest and address the region's changing data demands while reducing environmental footprints. For instance, as per industry reports, Singapore is currently leading the data center boom in Asia-Pacific, attracting significant investments. In 2024, the region attracted USD 15.5 Billion in cross-border data center investments, making it the global leader. This surge is part of a broader recovery in the global market, with a 118% rise in transaction volumes, driven by acquisitions, redevelopment, and new developments in the sector.

Singapore Data Center Market Trends:

Growing Adoption of 5G Network

5G networks provide significantly faster data transmission and lower latency than previous generations, driving a surge in data traffic. This, in turn, boosts demand for data storage and processing, prompting the expansion of data centers. 5G also enhances edge computing by shifting processing closer to the data source, increasing the need for smaller, decentralized data centers across the network. The growth of IoT devices and advanced technologies like AR, VR, autonomous vehicles, and smart cities further intensifies the need for powerful, low-latency data centers. Additionally, 5G supports broader adoption of cloud services, requiring more robust infrastructure and denser data center networks. According to the International Trade Administration (IEA), around 55% of people in Singapore are expected to use 5G networks by 2025.

Rising Number of Submarine Cables

An article published on the website of the International Trade Administration (IEA) in 2024 shows that Singapore has approximately 30 international submarine cables that provide an aggregate 44.8Tbit/s capacity. Submarine cables provide high-speed, high-capacity links between nations, and Singapore’s growing number of undersea connections is enhancing its global network access. This makes it an attractive site for data center operations. These cables reduce latency by enabling faster, more direct data routes—essential for real-time data processing needs. Greater cable density also improves redundancy, minimizing disruptions and boosting data transfer reliability. The enhanced bandwidth supports rising demands from cloud services, streaming, and digital applications. As a key hub in global data exchange, Singapore’s robust submarine cable infrastructure draws multinational companies to establish data centers for efficient data management and distribution worldwide.

Singapore Data Center Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Singapore data center market, along with forecast at the country and regional levels from 2026-2034. The market has been categorized based on component, type, enterprise size, and end user.

Analysis by Component:

- Solution

- Services

Solution stands as the largest component in 2025, holding around 65.8% of the market. This dominance is due to the country's position as a leading digital hub in Southeast Asia. With increasing demand for cloud services, AI, and digital transformation, enterprises seek end-to-end solutions that encompass infrastructure, security, and managed services. Singapore’s strategic location, robust connectivity, and pro-tech policies attract global hyperscalers and enterprises needing comprehensive solutions. Additionally, the shift toward hybrid and multi-cloud environments boosts demand for integrated services rather than just hardware. As organizations prioritize operational efficiency, scalability, and compliance, solution-based offerings provide tailored, value-added services that align with evolving digital needs, making it the largest market component.

Analysis by Type:

- Colocation

- Hyperscale

- Edge

- Others

Colocation leads the market with around 50.6% of market share in 2025. Colocation leads the Singapore data center market due to its strategic benefits and cost-efficiency for businesses. Singapore’s limited land availability and high real estate costs make in-house data center development expensive and space-constrained. Colocation offers a scalable, secure alternative by providing shared facilities with advanced infrastructure, power, and cooling systems. It appeals to enterprises, cloud providers, and hyperscalers seeking to reduce capital expenditure while maintaining control over their hardware. Additionally, Singapore’s strong connectivity, political stability, and data sovereignty laws attract multinational companies needing reliable regional hubs. The rise of digital transformation, edge computing, and data-intensive applications further fuels demand for colocation, making it a practical, scalable, and high-performance solution in the country’s thriving digital ecosystem.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises leads the market with around 60.2% of market share in 2025, driven by their extensive digital infrastructure needs, global operations, and high data processing demands. These organizations rely heavily on data centers to support cloud computing, big data analytics, AI applications, and mission-critical workloads. Singapore’s strategic location, robust regulatory framework, and advanced connectivity make it an ideal regional hub for large multinational corporations. Moreover, large enterprises often require high levels of security, compliance, and scalability—features best delivered through enterprise-grade data center services. With increasing focus on digital transformation and business continuity, these companies invest significantly in colocation, managed services, and cloud integration. Their size, resources, and need for reliability position them as the primary drivers of data center growth in Singapore.

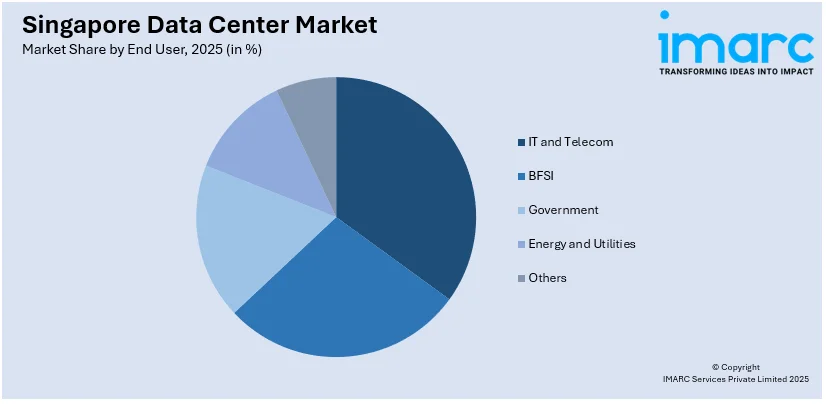

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecom

- Government

- Energy and Utilities

- Others

IT and telecom leads the market with around 35.0% of market share in 2025. The IT and telecom sector leads Singapore’s data center market due to its critical role in powering digital infrastructure and connectivity. As demand for cloud computing, 5G, IoT, and AI accelerates, IT and telecom companies require robust, high-performance data centers to manage vast amounts of data and ensure low-latency services. Singapore’s strategic location as a digital gateway to Asia, combined with its reliable power supply, political stability, and advanced connectivity, makes it a prime base for regional operations. These companies are also at the forefront of digital transformation, driving demand for colocation, cloud services, and managed solutions. Their continuous need for scalability, data security, and high uptime positions the IT and telecom sector as the dominant force in the market.

Regional Analysis:

- North-East

- Central

- West

- East

- North

In 2025, Central Singapore accounted for the largest market share of over 40.0%. This is due to its strategic location, superior infrastructure, and proximity to key business districts. This area offers excellent connectivity through dense fiber networks and easy access to financial institutions, tech hubs, and multinational headquarters, making it ideal for latency-sensitive operations. Central Singapore also benefits from well-developed power and cooling infrastructure, crucial for high-performance data centers. The presence of major commercial zones attracts colocation providers and cloud service operators seeking to serve enterprise clients efficiently. Additionally, the government's supportive policies and urban planning make Central Singapore a preferred location for high-density, scalable data center developments, reinforcing its dominance in the nation’s growing digital economy.

Competitive Landscape:

The Singapore data center market is highly competitive, driven by the country’s strategic location, advanced infrastructure, and strong connectivity. With increasing demand for cloud services, data processing, and storage, many global and regional providers are expanding their presence. The market benefits from Singapore’s robust telecommunications network, low latency, and proximity to key Asian markets, making it a preferred hub for businesses. Providers are focusing on offering high-density, scalable, and energy-efficient solutions to meet growing data traffic needs. The rise in digital services, such as IoT, AI, and big data, further intensifies competition as companies strive to offer more reliable, cost-effective, and secure data storage and processing solutions. The market is also influenced by government policies that support digital transformation and data center development. For instance, in March 2025, Singapore's Defense Science and Technology Agency (DSTA) partnered with Oracle to create a sovereign, air-gapped Oracle Cloud Isolated Region. This will support the Ministry of Defense and Singapore Armed Forces, enhancing their Command, Control, Communications, and Computers (C4) functions with high-performance, secure cloud services. The region will leverage Oracle's cloud and AI technologies, bolstering scalability and security for defense operations. This collaboration underscores the growing importance of secure, scalable data center infrastructure in government and military sectors.

The report provides a comprehensive analysis of the competitive landscape in the Singapore data center market with detailed profiles of all major companies

Latest News and Developments:

- February 2025: Singtel’s regional data center arm, Nxera DCT, secured an SGD 643 Million (USD 476 Million) green loan to fund the development of DC Tuas, a 58MW data center in Singapore. The project will feature sustainable design, next-gen cooling, and support for AI workloads, with a target for net-zero emissions by 2028.

- November 2024: Equinix announced a USD 260 million investment in SG6, its sixth data center in Singapore. Opening in Q1 2027 with 20MW capacity, SG6 is expected to support AI workloads with advanced liquid cooling and green features.

- November 2024: China’s Kingdee International Software Group launched a data center and office in Singapore to support Chinese companies expanding overseas, in a partnership with iSoftStone.

- October 2024: Proofpoint announced plans to launch a data center in Singapore in 2025 to support data residency compliance and address rising cyber threats. This would be the company’s 28th global facility.

- June 2024: Singapore unveiled a Green Data Centre Roadmap, releasing 300MW for sustainable data center growth. Operators using green energy can access an additional 200MW. The initiative aims to balance digital expansion with environmental goals, targeting a PUE of 1.3, amid regional competition and limited local energy resources.

- June 2024: Google completed a major expansion of its data center and cloud region campus in Singapore, raising its total infrastructure investment in the region to USD 5 Billion.

Singapore Data Center Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Types Covered | Colocation, Hyperscale, Edge, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Users Covered | BFSI, IT and Telecom, Government, Energy and Utilities, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore data center market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Singapore data center market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore data center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The data center market in Singapore was valued at USD 1,063.4 Million in 2025.

The Singapore data center market is projected to exhibit a CAGR of 11.12% during 2026-2034, reaching a value of USD 2,823.8 Million by 2034.

Key factors driving the Singapore data center market include rising demand for cloud services, digital transformation, data sovereignty laws, and strong connectivity infrastructure. Strategic location, government support, and the presence of global tech firms also fuel growth, along with increasing adoption of AI, IoT, and 5G technologies across industries.

In 2025, Central Singapore dominated the Singapore data center market, accounting for the largest market share of 40.0%, driven by high demand from financial services, cloud providers, and tech firms. Its strategic location, robust infrastructure, superior connectivity, and proximity to business hubs made it ideal for low-latency operations and enterprise-level data center deployments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)