Singapore Dairy Market Size, Share, Trends and Forecast by Product Type and Region, 2026-2034

Singapore Dairy Market Summary:

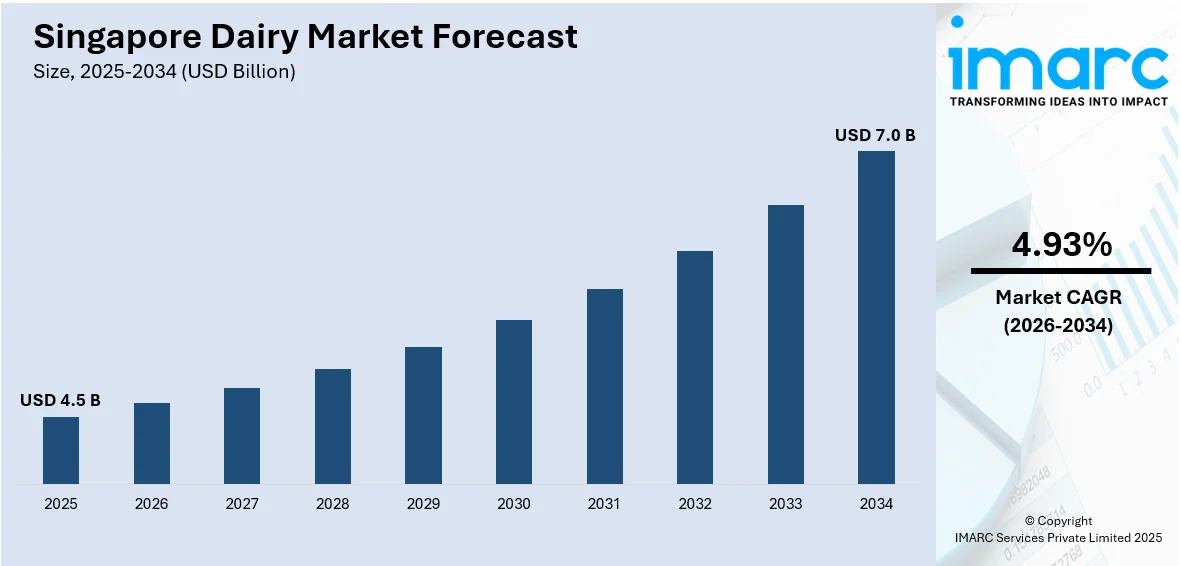

The Singapore dairy market size was valued at USD 4.5 Billion in 2025 and is projected to reach USD 7.0 Billion by 2034, growing at a compound annual growth rate of 4.93% from 2026-2034.

The Singapore dairy market is experiencing robust growth, driven by evolving consumer preferences towards health-conscious food choices and increasing awareness about nutritional benefits offered by dairy products. Rapid urbanization and westernization of dietary patterns are reshaping consumption habits, with people increasingly integrating dairy into daily meals. The market benefits from sophisticated retail infrastructure, extensive distribution networks, and rising disposable incomes that enable premium product purchases across the urban population seeking quality dairy options.

Key Takeaways and Insights:

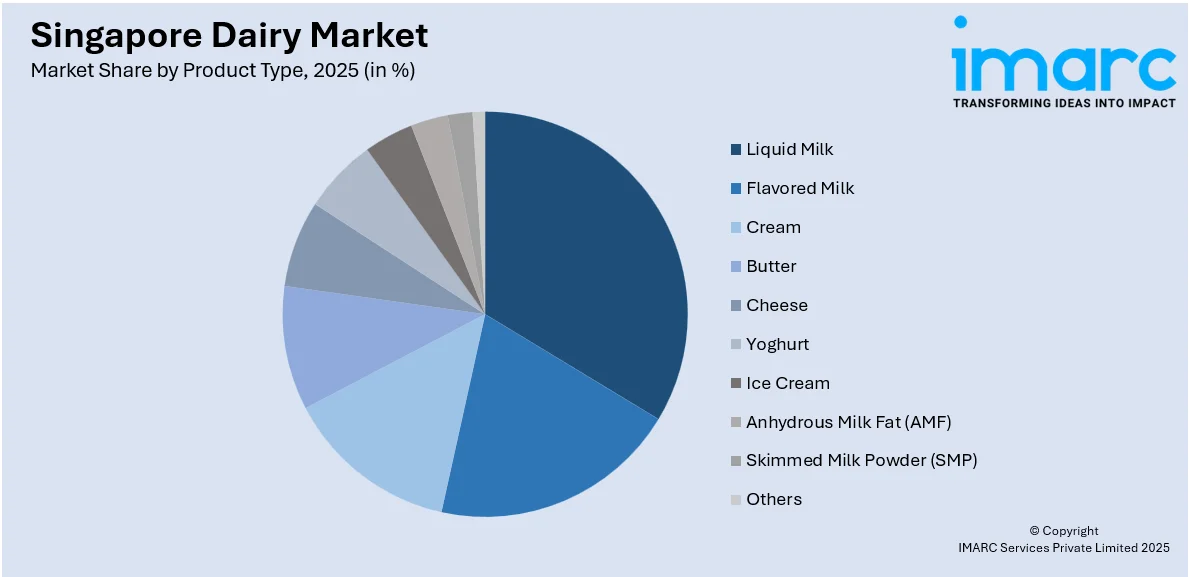

- By Product Type: Liquid milk dominates the market with a share of 18% in 2025, owing to its essential role in daily nutrition, widespread availability across retail channels, and growing consumer preference for calcium-rich beverages supporting bone health and overall wellness.

- By Region: Central comprises the largest region with 30% share in 2025, driven by Singapore's highest population density, concentration of premium retail outlets, tourist influx in commercial districts, and presence of high-income consumers seeking diverse dairy offerings.

- Key Players: Key players drive the Singapore dairy market by expanding product portfolios, enhancing distribution networks, and investing in fortified and functional dairy innovations. Their strategic partnerships with retailers and focus on health-oriented marketing accelerate market penetration across diverse consumer segments.

To get more information on this market Request Sample

The Singapore dairy industry continues to transform through strategic innovations and evolving consumer demands for healthier food options. The market landscape reflects a sophisticated blend of traditional dairy products and emerging functional variants designed to address specific nutritional needs across different demographic segments. Health-conscious consumers increasingly seek dairy products enriched with probiotics, omega-3 fatty acids, and essential vitamins that support digestive health, cardiovascular wellness, and cognitive function. The proliferation of modern retail channels, including supermarkets, hypermarkets, and e-commerce platforms, ensures broad product accessibility throughout the island nation. Premium and artisanal dairy products command growing shelf space as affluent consumers demonstrate willingness to pay higher prices for superior quality and transparent sourcing. Singapore's strict food safety regulations and quality standards create a trusted marketplace that attracts international dairy brands while supporting established local players. According to the Singapore Food Agency, the country imported over 90% of its food requirements between 2022 and 2024, positioning it as a significant destination for global dairy exporters seeking access to affluent Asian consumers.

Singapore Dairy Market Trends:

Rising Demand for Fortified and Functional Dairy Products

Singaporean consumers increasingly prioritize dairy products enriched with essential vitamins, minerals, and bioactive compounds that address specific health concerns. Manufacturers respond by developing innovative formulations incorporating vitamin D, calcium, and probiotics targeting bone health and immune support. This wellness-driven trend reflects broader regional health consciousness amplified by aging population demographics. According to the Singapore Department of Statistics, the median monthly household income increased by 3.9% from USD 10,869 in 2023 to USD 11,297 in 2024, enabling consumers to afford premium fortified dairy products.

Growth of Plant-Based Dairy Alternatives

The Singapore dairy market is witnessing substantial expansion of plant-based alternatives, driven by lactose intolerance concerns, environmental sustainability awareness, and vegan lifestyle adoption. Retailers allocate increasing shelf space to soy, oat, and almond-based products catering to health-conscious consumers seeking dairy-free options. Local and international brands compete intensively through flavor innovations and nutritional fortification strategies. In May 2024, Nestlé Singapore introduced Goodnes, a new line of dairy-free oat milk to meet growing demand for plant-based alternatives, reflecting manufacturers' commitment to product diversification.

Westernization of Dietary Patterns

Changing lifestyle patterns and exposure to international cuisine through travel and media drive increased dairy consumption among Singaporean consumers. Traditional Asian diets expand to incorporate cheese, butter, yogurt, and cream-based products previously uncommon in regional food culture. Young urban professionals particularly embrace Western breakfast and snacking habits, featuring dairy-rich foods. Singapore's diverse expatriate population is surging, significantly influencing demand patterns for international dairy products across premium retail segments.

Market Outlook 2026-2034:

The Singapore dairy market demonstrates favorable growth trajectory, supported by sustained consumer demand for nutritious and convenient food options. Product innovations, focusing on functional benefits, premium ingredients, and sustainable sourcing practices, position manufacturers to capture evolving consumer preferences. The market generated a revenue of USD 4.5 Billion in 2025 and is projected to reach a revenue of USD 7.0 Billion by 2034, growing at a compound annual growth rate of 4.93% from 2026-2034. Government initiatives promoting food security encourage local dairy production capabilities while maintaining access to quality imported products. E-commerce channel expansion and digital marketing strategies enable brands to reach broader consumer segments efficiently.

Singapore Dairy Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Liquid Milk |

18% |

|

Region |

Central |

30% |

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Liquid Milk

- Flavored Milk

- Cream

- Butter

- Cheese

- Yoghurt

- Ice Cream

- Anhydrous Milk Fat (AMF)

- Skimmed Milk Powder (SMP)

- Whole Milk Powder (WMP)

- Whey Protein

- Lactose Powder

- Curd

- Others

Liquid milk dominates with a market share of 18% of the total Singapore dairy market in 2025.

Liquid milk maintains its dominant position through fundamental dietary relevance and widespread household consumption patterns across Singapore's diverse population demographics. The segment benefits from established distribution infrastructure ensuring product freshness and consistent availability through modern retail channels, convenience stores, and emerging e-commerce platforms serving urban consumers. As per IMARC Group, the Singapore e-commerce market size reached USD 116.3 Billion in 2025 and is set to reach USD 332.0 Billion by 2034.

Consumer preference for liquid milk reflects growing awareness about its nutritional completeness as a convenient protein and calcium source supporting overall health maintenance. Manufacturers invest in product innovations through lactose-free variants, fortified formulations, and premium organic options addressing specific dietary requirements. Singapore's affluent consumer base demonstrates willingness to pay premium prices for quality-assured, sustainably sourced milk products. The segment continues to benefit from strategic marketing campaigns emphasizing dairy's role in bone health and childhood development, particularly resonating with health-conscious parents and aging population.

Regional Insights:

- North-East

- Central

- West

- East

- North

Central leads with a share of 30% of the total Singapore dairy market in 2025.

Central commands the largest market share through its concentration of commercial districts, premium retail establishments, and high population density driving substantial dairy consumption volumes. This area encompasses Singapore's primary business hub attracting office workers, tourists, and high-income residents who frequently purchase dairy products from upscale supermarkets, specialty stores, and food service outlets. Heavy pedestrian traffic in shopping and entertainment areas creates consistent demand across diverse dairy categories throughout the year.

The retail market in Central is characterized by the presence of flagship stores operated by major global and indigenous dairy companies with broad product lines to satisfy the complex demands of consumers. The geographic location is a testing ground for new and innovative premium dairy propositions and limited editions, mainly targeting high-end consumers to offer them a unique culinary experience. New products like organic, lactose-free, and unique cheese options are rolled out by various companies in this location first.

Market Dynamics:

Growth Drivers:

Why is the Singapore Dairy Market Growing?

Rising Health Consciousness and Nutritional Awareness

Singaporean consumers demonstrate increasing awareness regarding nutritional requirements and the role of dairy products in supporting overall health and wellness objectives. This trend reflects broader regional emphasis on preventive healthcare approaches addressing lifestyle-related conditions prevalent among urban populations. Consumers actively seek dairy products enriched with probiotics, vitamins, and minerals targeting specific health benefits, including digestive wellness, bone strength, and immune system support. Educational initiatives by health authorities and dairy manufacturers successfully communicate calcium and protein benefits, particularly relevant for aging demographics requiring enhanced nutritional intake. In 2024, cardiovascular disease was responsible for 30.5% of all fatalities in Singapore, equating to around 22 individuals dying from it daily. This concerning statistic indicated that almost one in three fatalities in Singapore was caused by heart disease or stroke, as reported by the Singapore Heart Foundation, driving awareness about nutrition's importance in promoting holistic health. The growing prevalence of lifestyle diseases motivates consumers to incorporate nutritious dairy products into daily dietary routines as accessible intervention strategies.

Product Diversification and Innovation

The Singapore dairy market benefits substantially from continuous product innovations and portfolio diversification strategies employed by domestic and international manufacturers. Companies invest significantly in research and development (R&D) capabilities to introduce novel formulations, addressing evolving consumer preferences for convenience, taste variety, and functional benefits. Innovation extends across traditional dairy categories with launches of flavored milk variants, premium cheese selections, probiotic yogurt lines, and lactose-free alternatives expanding consumer choice. Manufacturers respond to health trends by developing products with reduced sugar content, enhanced protein levels, and clean-label ingredients appealing to wellness-focused consumers. Strategic product launches targeting specific demographic segments, including children, athletes, and the elderly population, create differentiated value propositions capturing incremental market share. In November 2023, Nestlé launched N3 milk, leveraging its R&D capabilities in Switzerland and Singapore to deliver nutritious milk products with essential vitamins, proteins, and minerals addressing consumer nutritional needs.

Expanding Retail Infrastructure and E-Commerce Growth

Singapore's sophisticated retail ecosystem provides robust infrastructure supporting dairy product distribution and accessibility across diverse consumer segments and geographic locations. Modern trade channels, including supermarkets, hypermarkets, and convenience stores, maintain comprehensive dairy sections featuring domestic and imported products meeting varied taste preferences and price expectations. Digital platforms enable efficient product discovery, comparison shopping, and subscription services ensuring consistent dairy supply for household consumption. Major retailers invest in cold chain logistics capabilities maintaining product freshness and quality throughout distribution networks reaching consumers island-wide. In January 2024, Singapore's 7-Eleven opened its first automated self-service store at Esplanade MRT station using smart cameras and deep learning technology, demonstrating advanced retail innovation enhancing consumer convenience and accessibility across food categories, including dairy products.

Market Restraints:

What Challenges the Singapore Dairy Market is Facing?

High Import Dependency and Supply Chain Vulnerabilities

The high dependency on imported dairy products makes the market in Singapore inherently vulnerable to global disruptions to the supply chain. The country does not have well-established dairy production infrastructure, which means it has to import high amounts from global sources. Global geopolitics or weather-related issues disrupt their sources periodically, creating market volatility pertaining to prices.

Prevalence of Lactose Intolerance Among Asian Populations

Lactose intolerance is a common characteristic in large portion of Singapore's predominantly Asian population, which leads to a natural limitation in consumption of traditional dairy products. It is a natural trait of their physiology that limits their willingness to consume traditional milk products, shifting their demand to lactose-free products and plant-based products instead. Therefore, dairy companies are compelled to innovate their products in order to gain relevance in the changing consumer diet preferences.

Intensifying Competition from Plant-Based Alternatives

Traditional dairy products face escalating competitive pressure from plant-based alternatives capturing market share among health-conscious, environmentally aware, and ethically motivated consumers. Soy, oat, almond, and coconut-based products achieve improved taste profiles and nutritional fortification approaching dairy equivalence, reducing switching costs for consumers exploring alternatives. Premium pricing of plant-based options creates attractive margin opportunities attracting investment and innovation attention from major food manufacturers expanding non-dairy portfolios.

Competitive Landscape:

The Singapore dairy market features a moderately concentrated competitive landscape, characterized by established multinational corporations operating alongside regional players and specialized domestic brands. Major participants leverage extensive distribution networks, brand recognition, and diversified product portfolios to maintain market positions across multiple dairy categories. Competition intensifies through product innovations, promotional campaigns, and strategic partnerships with retail chains securing premium shelf placement. Companies differentiate through quality assurance certifications, sustainability initiatives, and targeted marketing addressing specific consumer segments. The market structure encourages continuous improvements in product offerings and customer service standards benefiting end consumers through enhanced choice and value propositions.

Singapore Dairy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Liquid Milk, Flavored Milk, Cream, Butter, Cheese, Yoghurt, Ice Cream, Anhydrous Milk Fat (AMF), Skimmed Milk Powder (SMP), Whole Milk Powder (WMP), Whey Protein, Lactose Powder, Curd, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Singapore dairy market size was valued at USD 4.5 Billion in 2025.

The Singapore dairy market is expected to grow at a compound annual growth rate of 4.93% from 2026-2034 to reach USD 7.0 Billion by 2034.

Liquid milk dominated the market with a share of 18%, driven by its essential role in daily nutrition, widespread retail availability, and growing consumer awareness about calcium and protein benefits supporting bone health and overall wellness.

Key factors driving the Singapore dairy market include rising health consciousness among consumers, continuous product diversification and innovations by manufacturers, expanding retail infrastructure, including e-commerce channels, and increasing disposable incomes enabling premium product purchases.

Major challenges include high import dependency creating supply chain vulnerabilities, lactose intolerance prevalence among Asian populations limiting consumption, intensifying competition from plant-based alternatives, price volatility from global market fluctuations, and maintaining cold chain integrity across distribution networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)