Singapore Construction Market Size, Share, Trends and Forecast by Sector, and Region, 2026-2034

Singapore Construction Market Overview:

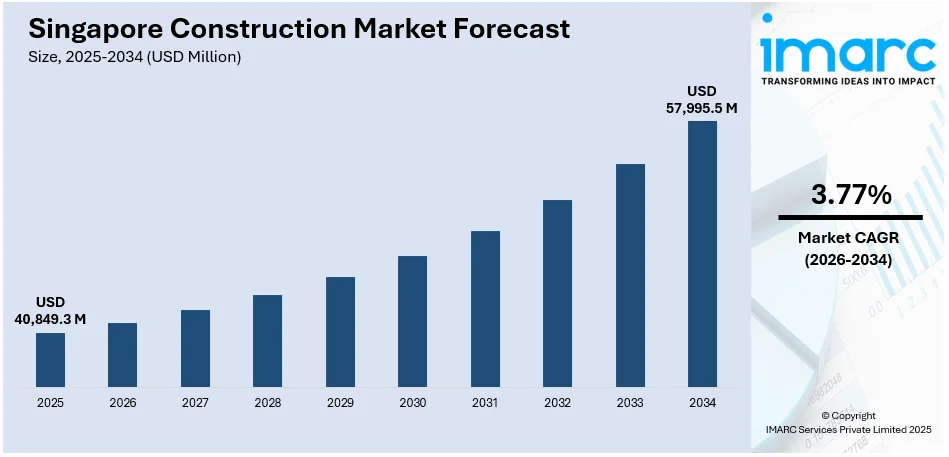

The Singapore construction market size reached USD 40,849.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 57,995.5 Million by 2034, exhibiting a growth rate (CAGR) of 3.77% during 2026-2034. The rising government infrastructure projects, growing urban redevelopment, sustainable building initiatives, increasing foreign investment, significant technological advancements, and growing focus on smart city development are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 40,849.3 Million |

| Market Forecast in 2034 | USD 57,995.5 Million |

| Market Growth Rate (2026-2034) | 3.77% |

Singapore Construction Market Trends:

Rising Government Infrastructure Projects

Significant investment in public infrastructure, such as transportation networks, public housing, and healthcare facilities. According to a report by AECOM, in collaboration with Longitude — a Financial Times Company, AECOM’s Future of Infrastructure research harnesses survey data and opinions from over 10,000 infrastructure users in 10 major global cities, including Singapore, to ask how satisfied, safe, inspired and engaged people feel with their roads and bridges, rail services and utilities. Some 62% of respondents felt that the private sector should take a greater role in infrastructure development. Singaporeans were generally displeased with the reliability of the current public transportation system, with 58% finding it increasingly stressful to travel via public transportation and 59% saying that they would not be willing to pay higher fares for public transportation. High fares and delays could play a role in people’s dissatisfaction. A total of 22% rated overall public transportation as unaffordable, while 20% rated public transportation reliability as ‘poor’. Around 18% of the respondents are willing to pay higher fares for public transportation. Some 22% are also willing to pay higher taxes to fund infrastructure improvements.

To get more information on this market Request Sample

Urban Redevelopment

Ongoing urban renewal projects aimed at enhancing city landscapes and increasing land use efficiency. For instance, in May 2024, ahead of the redevelopment of Singapore’s city ports as part of the Greater Southern Waterfront, the authorities are studying the area’s structures and buildings to see if they can be used to enhance the future development’s character. Urban Redevelopment Authority (URA) chief executive Lim Eng Hwee told The Straits Times in an interview that “the old port and some of the infrastructures do bring some value to the area”, adding that structures are being studied to see if “one or more can be retained, integrated and made very interesting”. While Mr Lim did not name the buildings under study, heritage experts have said that these could include Prima Flour Mills – Singapore’s first flour mill, which commenced operations in 1963.

Singapore Construction Market News:

In April 2024, Keppel achieved its first close for the Keppel Sustainable Urban Renewal Fund after securing “Korean institutional capital”. The global asset manager and operator said this brings total funds under management in its sustainable urban renewal (SUR) strategy to more than US$1.7 billion (S$2.3 billion). The flagship fund invests in real estate and platform opportunities to create sustainable assets across real estate segments including commercial, living, life sciences, hospitality, and logistics in Singapore, South Korea, Japan, Australia, and first-tier cities in China.

In April 2024, the Building and Construction Authority (BCA) announced the launch of the NEC4 contract for construction and engineering projects in Singapore at the BuildSG Leadership Engagement and Development (LEAD) Summit 2024 at the Sands Expo & Convention Centre, Marina Bay Sands.

Singapore Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on sector.

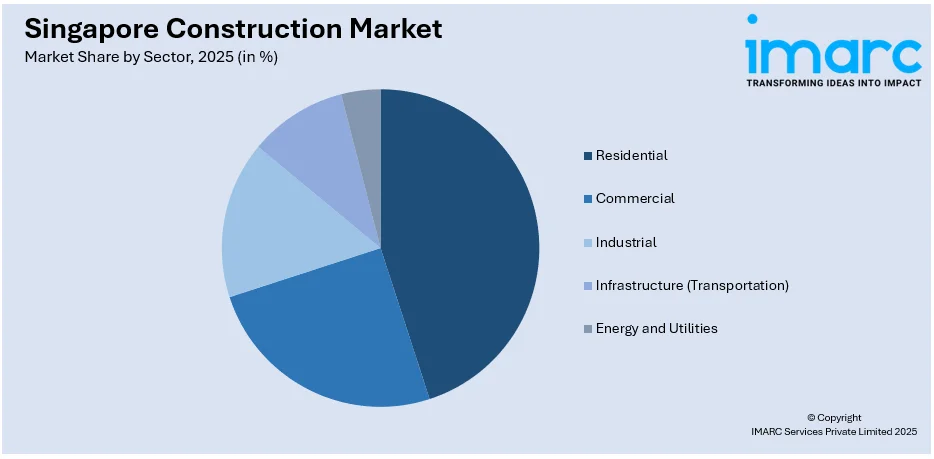

Sector Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

- Infrastructure (Transportation)

- Energy and Utilities

The report has provided a detailed breakup and analysis of the market based on the sector. This includes residential, commercial, industrial, infrastructure (transportation), and energy and utilities.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore construction market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The construction market in Singapore was valued at USD 40,849.3 Million in 2025.

The Singapore construction market is projected to exhibit a CAGR of 3.77% during 2026-2034, reaching a value of USD 57,995.5 Million by 2034.

The growth of the Singapore construction market is driven by sustained government infrastructure spending, strong demand for residential and commercial redevelopment, and investments in green buildings. Moreover, urban renewal projects, smart city initiatives, and transport network expansions support steady activity. Additionally, foreign investment, advanced construction technologies, and workforce upskilling contribute to higher productivity and long-term sector resilience.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)