Singapore Construction Equipment Market Size, Share, Trends and Forecast by Solution Type, Equipment Type, Type, Application, Industry, and Region, 2025-2033

Singapore Construction Equipment Market Overview:

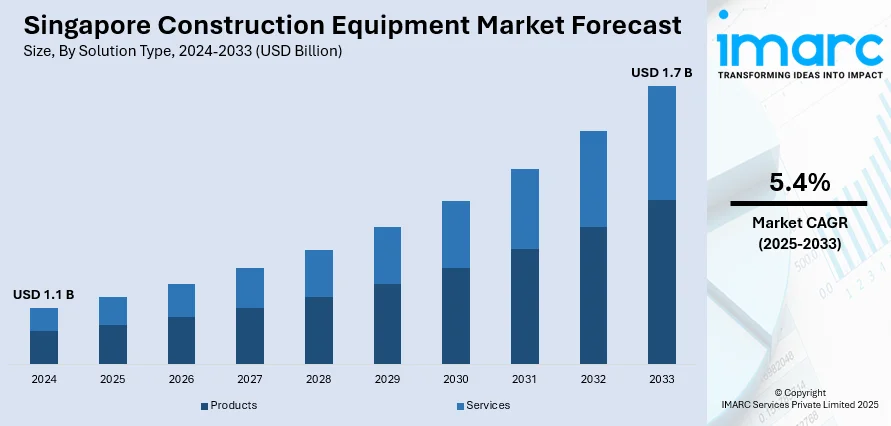

The Singapore construction equipment market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.4% during 2025-2033. Technological advancements and infrastructure development are key factors driving market growth by increasing demand for efficient, modern machinery in ongoing urbanization and large-scale projects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 1.7 Billion |

| Market Growth Rate (2025-2033) | 5.4% |

Singapore Construction Equipment Market Trends:

Incorporation of Technology and Use of Automated Construction Equipment

Singapore is witnessing rapid development and technological advancement in construction equipment applications, with a diversified use of sophisticated technologies and automation. Construction companies that invest in technology are 50% more likely to make a profit, if they have tools to collect and process the data. Construction machines are built with features like geographical position tracking and telecommunication in addition to new safety measures that increase the efficiency and safety of construction sites. Hence, these innovations not only reduce labor costs but also increase the value of projects by improving the timeliness and precision of construction work, making them highly beneficial for construction firms to adopt. Additionally, the availability of electric and hybrid machinery is advantageous for Singapore as it allows the state to utilize environmentally friendly equipment. The rapid advancement of construction technology, occurring more than once every few years, ensures that the equipment meets current market standards, thereby increasing its demand.

To get more information on this market, Request Sample

Infrastructural Developments and Urbanization Programs

Several factors contribute to Singapore's robust construction equipment market, including strong infrastructure development and ongoing urbanization activities. The continuous expansion of infrastructure projects, such as the extension of the public transport system, housing construction, and the development of smart city features, has led the government to consistently seek various types of construction machinery. The government of Singapore has identified infrastructure as a key pillar of national economic growth, announcing plans to issue up to SGD 90bn (USD 68bn) of new bonds to finance major infrastructure projects – notably the development of the island’s rail network, which is set to grow from its current 230km to about 360km, with several new lines and many new stations. The government also aims to issue green bonds worth SGD 19bn (USD 14bn) to support the development of projects such as Tuas Nexus, Singapore’s first integrated water and solid waste treatment facility. This reflects its broader ambition to make Singapore a leading centre for green finance and sustainable finance generally, as well as a hub for carbon services and trading. These projects require various construction needs to be met with specialized equipment designed for specific tasks. Additionally, plans to increase the share of new facility construction boost the use of high-performance construction equipment, supported by the modernization of existing structures. With Singapore's development emphasis on infrastructure, construction equipment is expected to continue experiencing modest growth.

Singapore Construction Equipment Market News:

- In June 2023, Volvo Construction Equipment Singapore (Volvo CE), which has its footprint in Singapore under the name Volvo Construction Equipment Singapore Pte. Ltd., introduced its first fully electric construction machines in Singapore, officially launching them for the Southeast Asia market at a gala event on Sentosa Island. Over 100 guests attended to celebrate this milestone and witness the exciting new technology firsthand.

- In November 2023, Kobelco Construction Machinery Co., Ltd. announced the launch of its new G-4 series hydraulic crawler cranes.

Singapore Construction Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on solution type, equipment type, type, application, and industry.

Solution Type Insights:

- Products

- Services

The report has provided a detailed breakup and analysis of the market based on the solution type. This includes products and services.

Equipment Type Insights:

- Heavy Construction Equipment

- Compact Construction Equipment

A detailed breakup and analysis of the market based on the equipment type have also been provided in the report. This includes heavy construction equipment and compact construction equipment.

Type Insights:

- Loader

- Cranes

- Forklift

- Excavator

- Dozers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes loader, cranes, forklift, excavator, dozers, and others.

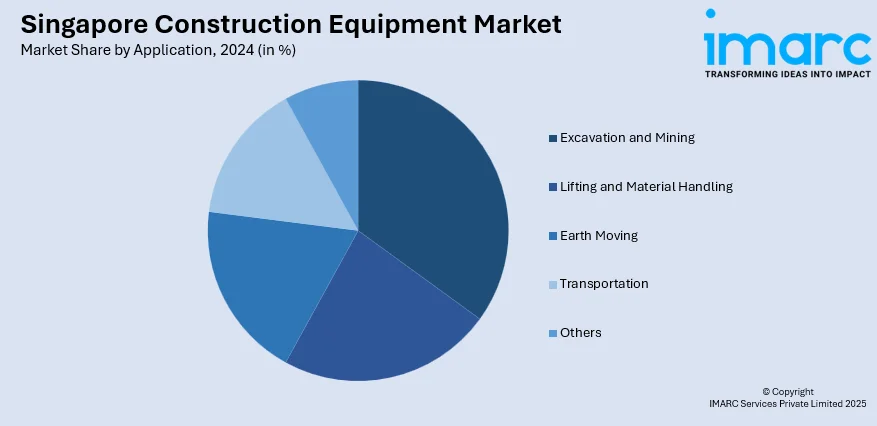

Application Insights:

- Excavation and Mining

- Lifting and Material Handling

- Earth Moving

- Transportation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes excavation and mining, lifting and material handling, earth moving, transportation, and others.

Industry Insights:

- Oil and Gas

- Construction and Infrastructure

- Manufacturing

- Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the industry. This includes oil and gas, construction and infrastructure, manufacturing, mining, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Construction Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solution Types Covered | Products, Services |

| Equipment Types Covered | Heavy Construction Equipment, Compact Construction Equipment |

| Types Covered | Loader, Cranes, Forklift, Excavator, Dozers, Others |

| Applications Covered | Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, Others |

| Industries Covered | Oil and Gas, Construction and Infrastructure, Manufacturing, Mining, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore construction equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore construction equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore construction equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The construction equipment market in Singapore was valued at USD 1.1 Billion in 2024.

The Singapore construction equipment market is projected to exhibit a CAGR of 5.4% during 2025-2033, reaching a value of USD 1.7 Billion by 2033.

The Singapore construction equipment market is driven by robust infrastructure and housing projects, government support, and a shift toward automation and electrification to address labor shortages. Additionally, the adoption of smart technologies like IoT and predictive analytics enhances efficiency, boosting demand for modern, eco-friendly, and connected machinery.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)