Singapore Cold Chain Market Size, Share, Trends and Forecast by Type, Temperature Range, Application, and Region, 2026-2034

Singapore Cold Chain Market Overview:

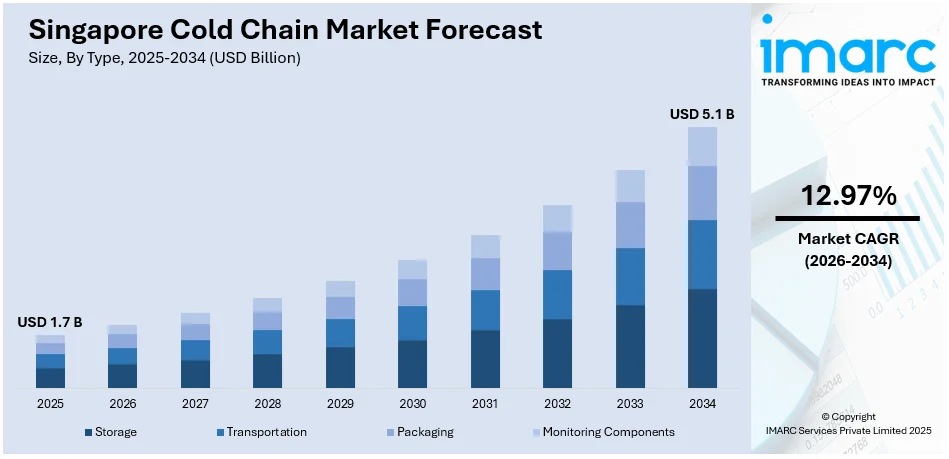

The Singapore cold chain market size reached USD 1.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.1 Billion by 2034, exhibiting a growth rate (CAGR) of 12.97% during 2026-2034. The increasing demand for perishable goods, advancements in refrigeration technology, a robust logistics infrastructure, the significant expansion in pharmaceutical and biotech industries, stringent food safety regulations, and growing e-commerce of temperature-sensitive products are some of the major factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.7 Billion |

| Market Forecast in 2034 | USD 5.1 Billion |

| Market Growth Rate (2026-2034) | 12.97% |

Singapore Cold Chain Market Trends:

Increasing Demand for Perishable Goods

Higher consumption of fresh food, dairy, and frozen products necessitates reliable cold chain solutions. According to OEC, Exports in 2022, Singapore exported $3.53M in Milk, making it the 69th largest exporter of Milk in the world. In the same year, Milk was the 730th most exported product in Singapore. The main destinations of Milk exports from Singapore are Malaysia ($1.06M), Vietnam ($701k), Brunei ($377k), Thailand ($332k), and Bangladesh ($239k). The fastest-growing export markets for Milk of Singapore between 2021 and 2022 were Vietnam ($572k), Thailand ($221k), and Cote d'Ivoire ($99k). According to food statistics 2022, SFA is committed to uplifting our agri-food sector to meet our 30 by 30 goal, which is to build the capability and capacity to sustainably produce 30% of Singapore’s nutritional needs by 2030. In 2022, hen shell eggs, seafood, and vegetable farms contributed around 29%, 8%, and 4% of our total food consumption respectively.

To get more information on this market Request Sample

Growth of Pharmaceutical and Biotech Industries

The rising need for temperature-controlled storage and transportation for sensitive medical products drives market expansion. According to the Singapore Economic Development Board (EBD), Singapore is a leading location for best-in-class manufacturing plants, where innovative products are launched and produced. Industry leaders like Pfizer, Novartis, MSD, Sanofi, AbbVie, and Amgen have global manufacturing hubs in Singapore for a wide range of products including Active Pharmaceutical Ingredients, drug products, and biologics drug substances. To enhance the competitiveness of the pharmaceutical manufacturing plants in Singapore, we have also partnered with the industry to develop training programs for both established drugs and new modalities, as well as establish the Pharma Innovation Programme Singapore (PIPS) consortium to push the envelope on new manufacturing technologies.

Advancements in Refrigeration Technology

Innovations in refrigeration and monitoring systems enhance efficiency and reliability, supporting market growth. For instance, conventional cooling devices account for as much as 10% of all global greenhouse gas emissions, according to the World Bank. It predicts that, if left unchecked, emissions from cooling will double by 2030. Cooling’s potential impact on the environment grows even starker over the longer term, as temperatures in cities that we currently regard as extreme potentially become the norm within 30 years. This will mean a global increase in demand, and regions not normally associated with air conditioning, such as northern Europe. However, the International Energy Agency (IEA) predicts that most demand growth will come from emerging economies, particularly in Southeast Asia. The region, where currently only 15% of the population has access to air conditioning, is predicted to see “skyrocketing” sales of units over the next 20 years.

Singapore Cold Chain Market News:

In April 2024, Courier and logistics company provider Ninja Van launched a cold chain delivery service, Ninja Cold. It is a part of its expansion plans beyond e-commerce and the company intends its launch in Singapore and Malaysia, along with Indonesia, the Philippines and Vietnam.

In January 2023, Tower Cold Chain a company that rents containers to the pharma industry for temperature-specific transport announced the opening of a new location in Tampines, Singapore, to support the company’s growth in the Asia Pacific (APAC) region.

Singapore Cold Chain Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, temperature range, and application.

Type Insights:

- Storage

- Facilities/Services

- Refrigerated Warehouse

- Cold Room

- Equipment

- Blast Freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Transportation

- By Mode

- Road

- Sea

- Rail

- Air

- By Offering

- Refrigerated Vehicles

- Refrigerated Containers

- By Mode

- Packaging

- Crates

- Insulated Containers and Boxes

- Large (32 to 66 liters)

- Medium (21 to 29 liters)

- Small (10 to 17 liters)

- X-small (3 to 8 liters)

- Petite (0.9 to 2.7 liters)

- Cold Chain Bags/Vaccine Bags

- Ice Packs

- Others

- Monitoring Components

- Hardware

- Sensors

- RFID Devices

- Telematics

- Networking Devices

- Others

- Software

- On-premises

- Cloud-based

- Hardware

The report has provided a detailed breakup and analysis of the market based on the type. This includes storage [facilities/services (refrigerated warehouse, cold room), equipment (blast freezer, walk-in cooler and freezer, deep freezer and others)], transportation [by mode (road, sea, rail, air), by offering (refrigerated vehicles, refrigerated containers)], packaging [crates, insulated containers and boxes {large (32 to 66 liters), medium (21 to 29 liters), small (10 to 17 liters), x-small (3 to 8 liters), petite (0.9 to 2.7 liters)}, cold chain bags/vaccine bags, ice packs, and others], monitoring components [hardware (sensors, RFID devices, telematics, networking devices, and others), software (on-premises and cloud-based)].

Temperature Range Insights:

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

A detailed breakup and analysis of the market based on the temperature range have also been provided in the report. This includes chilled (0°c to 15°c), frozen (-18°c to -25°c), and deep-frozen (below -25°c).

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Fruits and Vegetables

- Fruit Pulp and Concentrates

- Dairy Products

-

- Milk

- Butter

- Cheese

- Ice Cream

- Others

-

- Fish, Meat, and Seafood

- Processed Food

- Bakery and Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

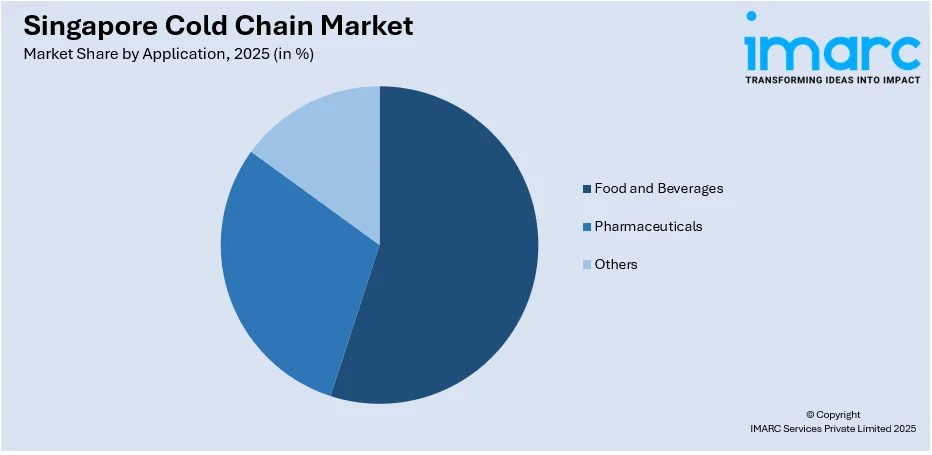

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverages [fruits and vegetables, fruit pulp and concentrates, dairy products (milk, butter, cheese, ice cream and others)], fish, meat and seafood, processed food, bakery and confectionary, and others, pharmaceuticals (vaccines, blood banking, and others), and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Cold Chain Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Temperature Ranges Covered | Chilled (0°C to 15°C), Frozen (-18°C to -25°C), Deep-frozen (Below -25°C) |

| Applications Covered |

|

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore cold chain market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore cold chain market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore cold chain industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold chain market in Singapore was valued at USD 1.7 Billion in 2025.

The Singapore cold chain market is projected to exhibit a CAGR of 12.97% during 2026-2034, reaching a value of USD 5.1 Billion by 2034.

The rise of e-commerce and online grocery platforms is catalyzing the demand for cold chain solutions, requiring reliable and timely delivery of perishable goods. In the healthcare sector, the storage and distribution of vaccines, biologics, and other temperature-sensitive medicines are further boosting the cold chain infrastructure. Singapore’s strategic position as a regional logistics hub is supporting investments in advanced cold chain systems to serve both domestic and regional markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)