Singapore Cards and Payments Market Size, Share, Trends and Forecast by Cards, Payment Terminals, Payment Instruments, and Region, 2026-2034

Singapore Cards and Payments Market Overview:

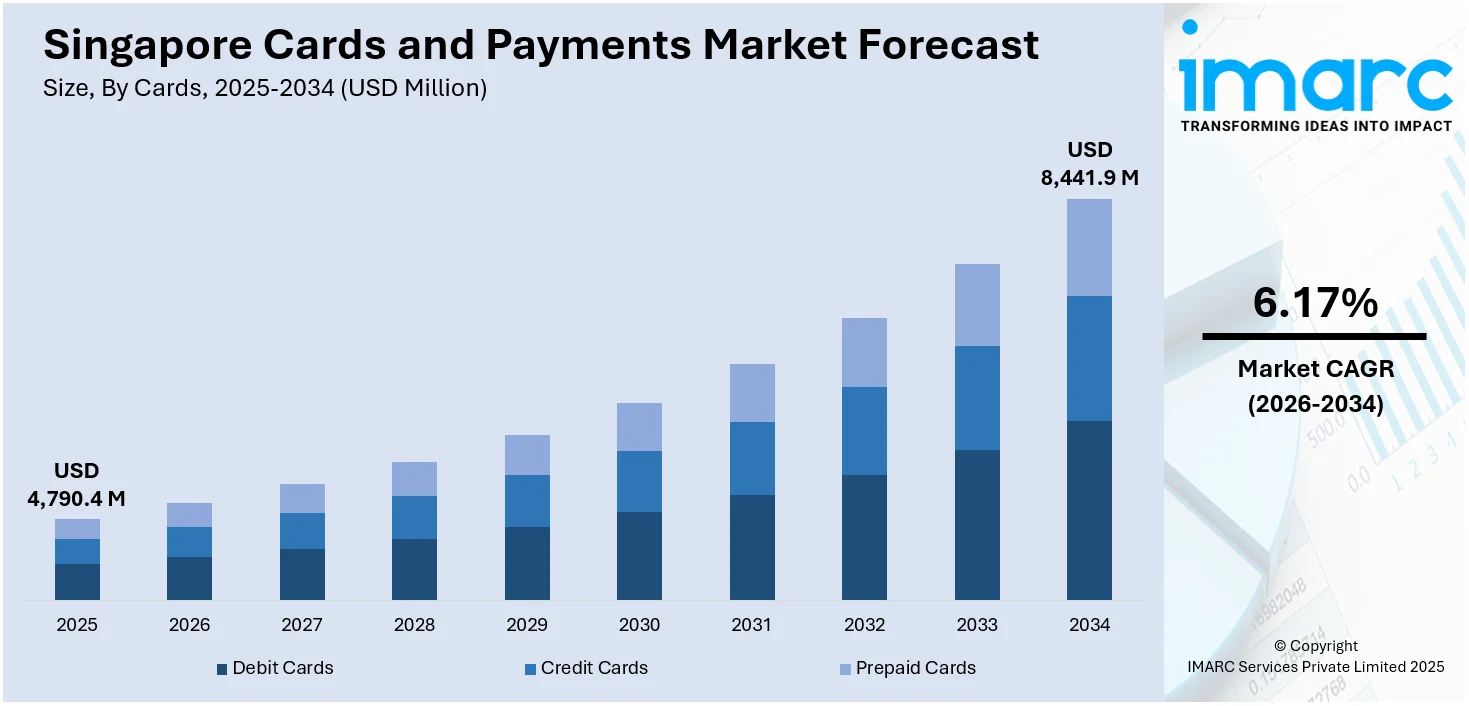

The Singapore cards and payments market size reached USD 4,790.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 8,441.9 Million by 2034, exhibiting a growth rate (CAGR) of 6.17% during 2026-2034. The market is experiencing significant growth driven by heightening digital payment adoption and rapid expansion of e-commerce, favorable government initiatives promoting a cashless society, and expanding merchant acceptance of digital payments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4,790.4 Million |

| Market Forecast in 2034 | USD 8,441.9 Million |

| Market Growth Rate (2026-2034) | 6.17% |

Singapore Cards and Payments Market Trends:

Rapid Digitalization and E-commerce Growth

Singapore cards and payments market is evolving primarily driven by digitalization and e-commerce development. For instance, data from the Monetary Authority of Singapore (MAS) reveals that e-commerce transactions recorded a remarkable increase to SGD 11. And with global transactions reaching $2 Billion in the first quarter of 2022, a 12% increase compared to the previous year, the need for a secure and effective form of digital payment method has risen. This rise in e-commerce traffic is in line with the changes witnessed in Singaporean society over recent years as the population increasingly turns to the Internet for most of their purchases. Since consumer options shift towards buying products through the internet, companies are forced to provide users with smooth payment services. Thus, to satisfy this need, existing and emerging players in the Singaporean financial market including financial institutions and payment service providers have developed a plethora of digital payment products that reflect the changing needs of consumers in Singapore. Further, this trend vindicates the significance of digitalization and e-commerce in charting the course for the Singaporean cards and payments market.

To get more information on this market Request Sample

Rising Adoption of Contactless Payments

Mobile payment and cashless payment continue to gain popularity, especially through the deployment of Near Field Communication (NFC) payments and QR code payments in Singapore. According to the Singaporean government's Infocomm Media Development Authority (IMDA), QR code payments in the country surged by 42% in 2021, reaching SGD 8.8 Billion in transaction value. This growth trend further reflects why the contactless form of payment is preferred now more than ever due to the benefits it offers as well as rising cases of the coronavirus (COVID-19) pandemic. To reduce physical touch with products, consumers are using cashless options as a way of carrying out their transactions in the current market different merchants offering contactless payment systems. The on-face, convenience, and efficiency of these payment procedures elevate the general transactional process and at the same time accredit towards nurturing the cashless society. While Singapore slowly adapts to the digital era of the payment system, the control and facilitation of contactless payment innovations are set to transform the payment industry in Singapore dramatically.

Favorable Government Initiatives

Government policies and approvals are central in shaping cards and payments in Singapore. For instance, the Monetary Authority of Singapore (MAS) has recently introduced measures aimed at strengthening innovation and competition within the monetary sphere. Among these efforts, the Payment Services Act (PSA) and the Singapore Quick Response Code (SGQR) deserve special attention. Its role is to give a wide and reliable legal framework of payment services to protect consumers and develop innovation. At the same time, the SGQR initiative simplifies payments by using a QR code on a national level for both merchants and consumers in the country. Combined, these efforts seek to strengthen payment system integrity, spur the development of fintech products and services, and protect the reliability of payments. Therefore, Singapore remains at the forefront of exploring advanced payment systems to advance the nation’s economy and expand the opportunities for financial accessibility.

Singapore Cards and Payments Market News:

- In January 2023, Samsung announced its plans to expand the availability of the Samsung Wallet app to eight additional countries, with Singapore being among them. This versatile wallet application was introduced as a unified platform, offering users a secure storage solution for their digital keys, boarding passes, identification cards, and various other documents on their mobile devices.

Singapore Cards And Payments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on cards, payment terminals, and payment instruments.

Cards Insights:

- Debit Cards

- Credit Cards

- Prepaid Cards

The report has provided a detailed breakup and analysis of the market based on the cards. This includes debit cards, credit cards, and prepaid cards.

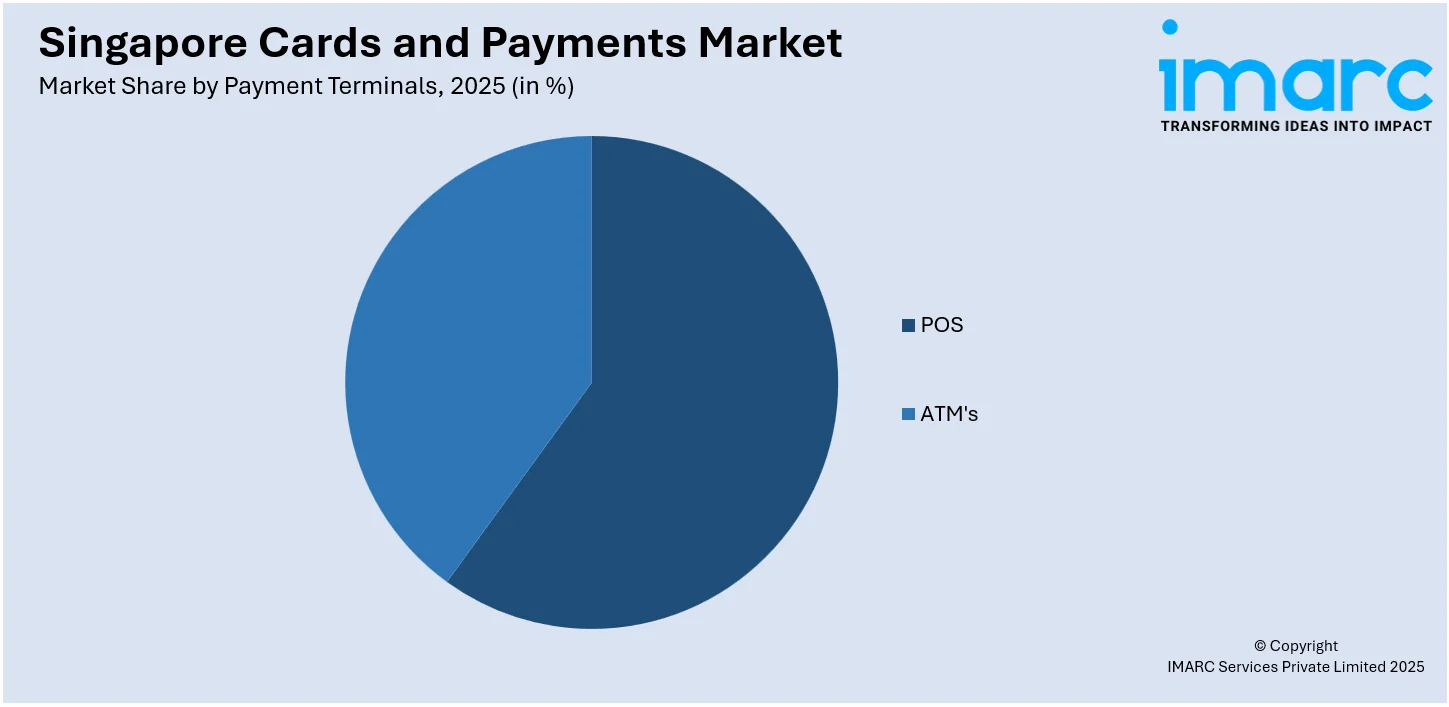

Payment Terminals Insights:

Access the comprehensive market breakdown Request Sample

- POS

- ATM's

A detailed breakup and analysis of the market based on the payment terminals have also been provided in the report. This includes POS and ATM's.

Payment Instruments Insights:

- Credit Transfers

- Direct Debit

- Cheques

- Payment Cards

A detailed breakup and analysis of the market based on the payment instruments have also been provided in the report. This includes credit transfers, direct debit, cheques, and payment cards.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Cards And Payments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cards Covered | Debit Cards, Credit Cards, Prepaid Cards |

| Payment Terminals Covered | POS, ATM's |

| Payment Instruments Covered | Credit Transfers, Direct Debit, Cheques, Payment Cards |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore cards and payments market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore cards and payments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore cards and payments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in Singapore was valued at USD 4,790.4 Million in 2025.

The cards and payments market in Singapore is projected to exhibit a CAGR of 6.17% during 2026-2034, reaching a value of USD 8,441.9 Million by 2034.

Heightening digital payment adoption, rapid expansion of e-commerce, favorable government initiatives promoting a cashless society, and expanding merchant acceptance of digital payments are driving the Singapore cards and payments market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)