Singapore Carbon Dioxide Market Size, Share, Trends and Forecast by Source, Form, End Use Industry, and Region, 2025-2033

Singapore Carbon Dioxide Market Overview:

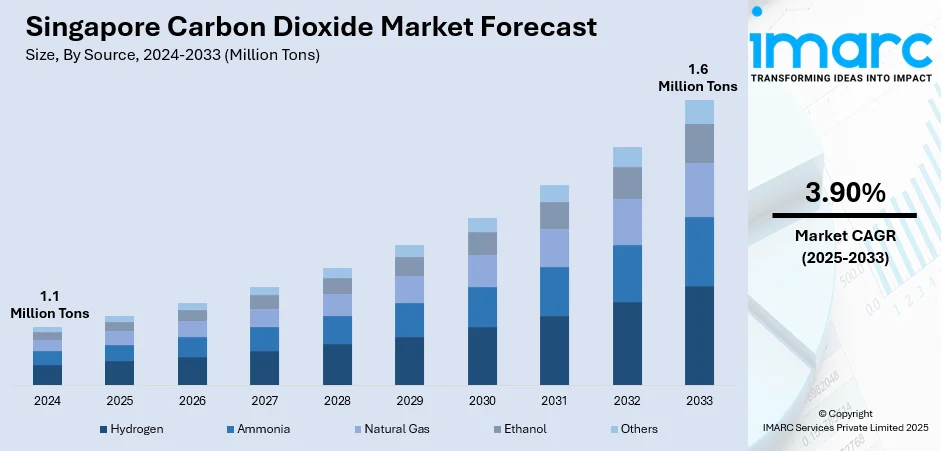

The Singapore carbon dioxide market size reached 1.1 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 1.6 Million Tons by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market is driven by its essential role in food and beverage carbonation, medical uses, and industrial applications, alongside growing demand in enhanced oil recovery and wastewater treatment, reflecting advancements in sustainable and efficient technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

1.1 Million Tons |

|

Market Forecast in 2033

|

1.6 Million Tons |

| Market Growth Rate 2025-2033 | 3.90% |

Singapore Carbon Dioxide Market Trends:

Increasing Demand in Food and Beverage Industry

One of the significant trends in the Singapore carbon dioxide market is the increasing demand in the food and beverage industry. The industry generated revenue of approximately SGD 13.5 Billion in 2023 and is projected to continue its growth trajectory. Carbon dioxide is crucial for carbonation in soft drinks, beer, and other beverages, giving them their characteristic fizz. Additionally, it is used in food preservation and packaging to extend the shelf life of products. With Singapore’s robust food and beverage sector and its reputation as a culinary hub, the demand for high-quality carbon dioxide is steadily rising. The trend is further supported by the growing consumer preference for convenience foods and ready-to-drink beverages, driving manufacturers to innovate and expand their product offerings. This trend underscores the importance of carbon dioxide in maintaining product quality and meeting consumer expectations, thereby boosting its market growth in the region.

To get more information on this market, Request Sample

Advancements in Carbon Capture and Utilization (CCU)

Advancements in Carbon Capture and Utilization (CCU) technologies are significantly impacting the Singapore carbon dioxide market. These technologies involve capturing CO2 emissions from industrial processes and repurposing them for various applications, including enhanced oil recovery, chemical production, and synthetic fuels. Singapore, committed to sustainable development and reducing its carbon footprint, is investing in CCU research and infrastructure. Companies are exploring innovative ways to convert captured CO2 into valuable products, thus turning waste into a resource. This trend is driven by stringent environmental regulations and the global push toward a circular economy. The successful implementation of CCU technologies in Singapore can lead to reduced greenhouse gas emissions and promote a sustainable supply of carbon dioxide for industrial uses, positioning the country as a leader in environmental innovation and green technology. For instance, several efforts were taken to convert captured CO2 into valuable products aligned with the global push toward a circular economy, highlighting Singapore's leadership in environmental innovation and green technology.

Growth in Medical and Pharmaceutical Applications

The growth in medical and pharmaceutical applications is another notable trend in the Singapore carbon dioxide market. CO2 is widely used in medical procedures, such as insufflation during laparoscopic surgeries, respiratory stimulation, and as a component in medical gas mixtures. The increasing healthcare demands, driven by an aging population and advancements in medical technologies, are boosting the use of carbon dioxide in the medical field. Furthermore, CO2's role in pharmaceutical manufacturing, particularly in the synthesis of active pharmaceutical ingredients (APIs) and as a solvent in supercritical fluid extraction, is gaining prominence. As Singapore continues to strengthen its position as a leading healthcare hub in Asia, the demand for high-purity carbon dioxide for medical and pharmaceutical applications is expected to rise, reflecting the broader trends of improving healthcare standards and the adoption of advanced medical technologies. For instance, Singapore's status as a leading healthcare hub in Asia underscores the growing importance of CO2 in these applications, driven by the need for advanced medical and pharmaceutical solutions.

Singapore Carbon Dioxide Market News:

- In 2023, ACE GASES MARKETING SDN BHD commenced constructing its second liquid CO2 plant in Terengganu, Malaysia. This was initiated to add a new facility to add a capacity of 70,000 tons per year, positioning the company as the largest liquid CO2 producer in Malaysia and aiding in its domestic market expansion.

- In 2023, Singapore-based carbon exchange Climate Impact X (CIX) launched its global spot trading platform, CIX Exchange, which aims to boost the liquidity of carbon offset trading and set a benchmark price for nature-based carbon credits. Seven transactions totaling 12,000 carbon credits were traded and cleared involving CIX's first standardized contract called CIX Nature X, or CNX.

Singapore Carbon Dioxide Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on source, form, and end use industry.

Source Insights:

- Hydrogen

- Ammonia

- Natural Gas

- Ethanol

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes hydrogen, ammonia, natural gas, ethanol, and others.

Form Insights:

- Solid

- Liquid

- Gas

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes solid, liquid, and gas.

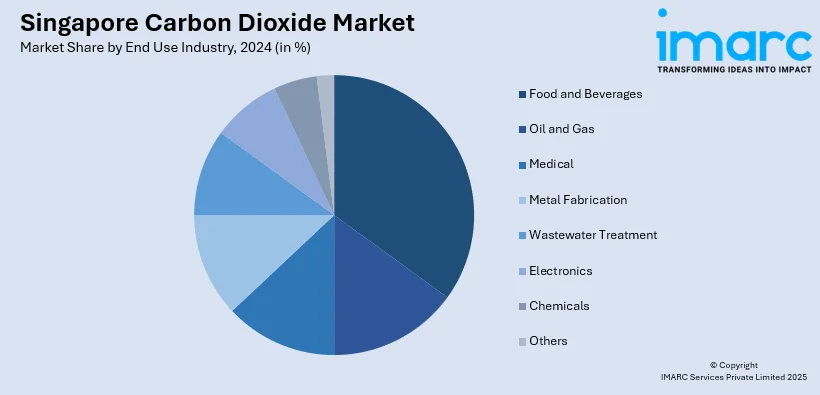

End Use Industry Insights:

- Food and Beverages

- Oil and Gas

- Medical

- Metal Fabrication

- Wastewater Treatment

- Electronics

- Chemicals

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes food and beverages, oil and gas, medical, metal fabrication, wastewater treatment, electronics, chemicals, and others.

Region Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Carbon Dioxide Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Hydrogen, Ammonia, Natural Gas, Ethanol, Others |

| Forms Covered | Solid, Liquid, Gas |

| End Use Industries Covered | Food and Beverages, Oil and Gas, Medical, Metal Fabrication, Wastewater Treatment, Electronics, Chemicals, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore carbon dioxide market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore carbon dioxide market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore carbon dioxide industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Singapore carbon dioxide market reached a value of 1.1 Million Tons in 2024.

The Singapore carbon dioxide market is projected to exhibit a CAGR of 3.90% during 2025-2033, reaching a value of 1.6 Million Tons by 2033.

The Singapore carbon dioxide market is driven by rising demand from the food and beverage, healthcare, and industrial sectors. Increased focus on carbon capture and utilization technologies, along with government initiatives supporting sustainability and emissions reduction, further boosts CO2 applications in green manufacturing, water treatment, and advanced energy solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)