Singapore Bakery Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Singapore Bakery Products Market Size and Share:

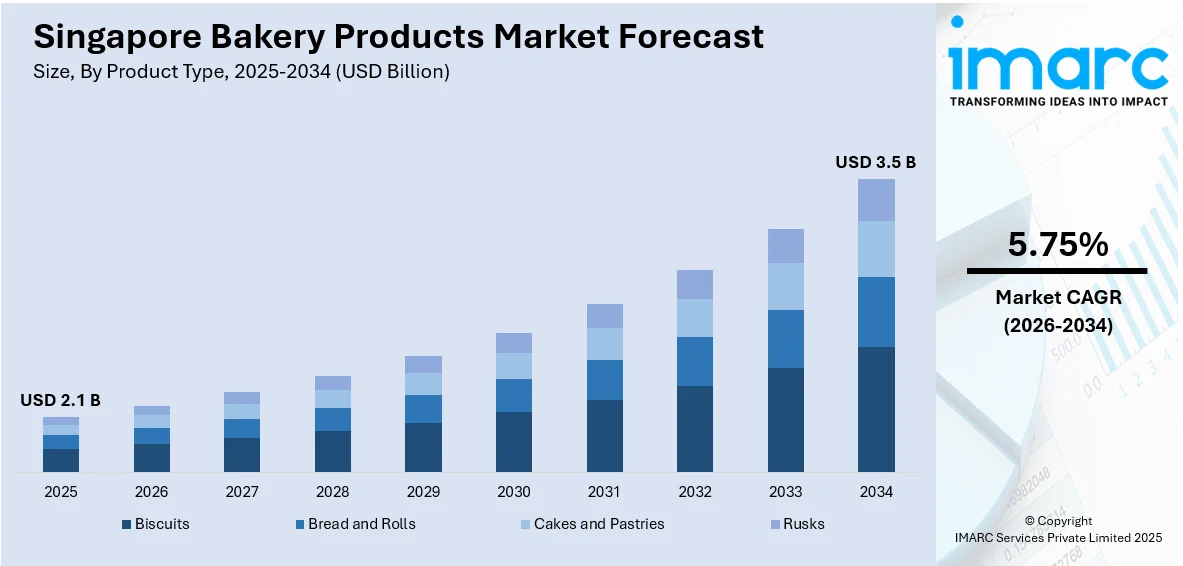

The Singapore bakery products market size was valued at USD 2.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 3.5 Billion by 2034, exhibiting a CAGR of 5.75% from 2026-2034. The market is witnessing significant growth due to the rising demand for healthier and functional bakery products and growth of premium and artisanal bakery offerings. Moreover, digitalization and e-commerce growth in bakery retail, the rising demand for Asian-inspired and fusion bakery products, and emphasis on clean-label and natural ingredients are expanding the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.1 Billion |

|

Market Forecast in 2034

|

USD 3.5 Billion |

| Market Growth Rate 2026-2034 | 5.75% |

The rising health consciousness among consumers in Singapore is spurring demand for bakery products containing functional ingredients, reduced sugar, and improved nutritional value. Consumers are looking for bakery products that fit with their dietary preferences like whole grain, gluten-free, and high-protein options. As more emphasis is given to wellness, such products as fortified bread, probiotic-enriched baked goods, and plant-based alternatives have been launched. Further, regulatory measures encouraging healthier eating, such as the Singapore Health Promotion Board's Healthier Choice Symbol (HCS) program, are pushing manufacturers to lower sugar and fat content in reformulating products. This is motivating bakery brands to innovate with superfoods, natural sweeteners, and high-fiber ingredients according to changing consumer preferences. For instance, in May 2024, Mondelez opened a new NPD hub in Singapore for biscuits and baked snacks, focusing on mindful snacking and portion balance. The facility, with over USD 5 Million in investment, will support regional development.

To get more information on this market Request Sample

The rising disposable income and evolving consumer preferences in Singapore are fueling demand for premium and artisanal bakery products. Consumers are increasingly willing to pay a premium for high-quality ingredients, unique flavors, and handcrafted baked goods. For instance, in September 2024, MILO® Singapore introduced limited-edition MILO® Cup Clips, featuring Singaporean MILO® lovers, further enhancing the cultural relevance of their offerings. Artisanal bakeries specializing in sourdough, specialty pastries, and gourmet bread are expanding, catering to a growing segment that values authenticity and craftsmanship. Additionally, the influence of international bakery trends, particularly from Japan and France, has heightened demand for innovative pastries and premium-quality baked products. The expansion of café culture and the popularity of social media-driven food trends further support the premiumization of the bakery sector, encouraging brands to focus on differentiation and quality.

Singapore Bakery Products Market Trends:

Digitalization and E-Commerce Growth in Bakery Retail

The rapid expansion of digital platforms is transforming the bakery sector in Singapore, with online bakeries, food delivery apps, and e-commerce platforms driving convenience-driven purchases. Consumers are increasingly ordering baked goods online, influenced by social media trends and digital marketing strategies. Bakeries are leveraging data analytics, artificial intelligence, and personalized recommendations to enhance customer engagement and optimize inventory management. For instance, in February 2025, Burnt Ends Bakery opened its second outlet at Audi House of Progress in Chinatown, offering classic doughnuts, sandwiches, and filter coffees, including the signature Slayer’s Blend for a perfect pairing. The rise of direct-to-consumer (DTC) models and cloud kitchens is further reshaping the competitive landscape, enabling bakeries to reach a wider audience without the need for physical storefronts.

Rising Demand for Asian-Inspired and Fusion Bakery Products

Singapore’s multicultural food landscape is influencing the bakery sector, with increasing demand for Asian-inspired and fusion baked goods. Consumers are showing a growing preference for traditional flavors such as matcha, pandan, taro, and black sesame, which are being incorporated into modern bakery products. For instance, in July 2024, Swee Heng expanded with Toast & Roll, offering over 50 items, including BBQ Chicken Floss and Taiwan Taro Rolls, targeting younger Singaporeans with affordable prices and fun packaging. Bakeries are also experimenting with cross-cultural influences, blending Western baking techniques with regional ingredients to create unique offerings. The popularity of mochi bread, Hokkaido milk buns, and durian-infused pastries reflects this evolving taste preference. Additionally, seasonal and limited-edition flavors inspired by Asian festivals and celebrations are driving excitement and consumer engagement in the market.

Emphasis on Clean Label and Natural Ingredients

Consumers in Singapore are increasingly prioritizing clean-label bakery products that contain natural, minimally processed ingredients. The demand for preservative-free, additive-free, and artificial flavor-free baked goods is rising, with shoppers favoring transparency in ingredient sourcing and manufacturing processes. Artisanal bakeries and premium brands are responding by offering organic, stone-milled, and non-GMO flour options, as well as natural sweeteners like honey, coconut sugar, and monk fruit extract. For instance, in February 2024, Swee Heng announced plans to open nine stores in 2024, investing S$13-15 million in a 40,000 sq ft facility. Eight will offer healthy sandwiches, stuffed croissants, and bagels, with one traditional bakery. This trend aligns with the broader movement toward mindful eating, where consumers seek simple, wholesome ingredients without compromising on taste or texture.

Singapore Bakery Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Singapore bakery products market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Biscuits

- Cookies

- Cream Biscuits

- Glucose Biscuits

- Marie Biscuits

- Non-Salt Cracker Biscuits

- Salt Cracker Biscuits

- Milk Biscuits

- Others

- Bread and Rolls

- Sandwich Breads

- Hamburgers

- Croissants

- Others

- Cakes and Pastries

- Packed Cupcakes

- Pastries

- Muffins

- Layer Cakes

- Donuts

- Swiss Roll

- Others

- Rusks

Biscuits, including cookies, cream biscuits, glucose biscuits, Marie biscuits, crackers, and milk biscuits, remain a staple in Singapore’s bakery market. They cater to diverse consumer preferences, from indulgent treats to health-conscious options. Premiumization, healthier formulations, and convenient packaging drive demand. Imported and locally produced biscuits benefit from strong retail distribution, e-commerce sales, and gifting trends.

Bread and rolls, including sandwich bread, hamburger buns, and croissants, form a crucial segment driven by demand for convenience and healthier alternatives. Whole grain, multigrain, and fortified bread varieties are gaining traction. The rise of artisanal bakeries and premium-quality baked goods has further diversified offerings, catering to consumers seeking freshness, nutrition, and premium ingredients.

Cakes and pastries, including packed cupcakes, muffins, layer cakes, donuts, and Swiss rolls, serve Singapore’s bakery market by fulfilling indulgence and gifting needs. The growing influence of international bakery trends and premiumization is driving demand for artisanal and fusion-inspired varieties. Specialty and café-style pastries, combined with social media-driven trends, are boosting market engagement and consumer interest.

Rusks are a niche but steady segment in Singapore’s bakery market, primarily catering to health-conscious consumers and traditional snack preferences. Often consumed with tea or coffee, they are valued for their crisp texture and extended shelf life. Manufacturers are introducing whole wheat, fiber-rich, and sugar-free variants to align with evolving dietary trends and health-conscious consumer demands.

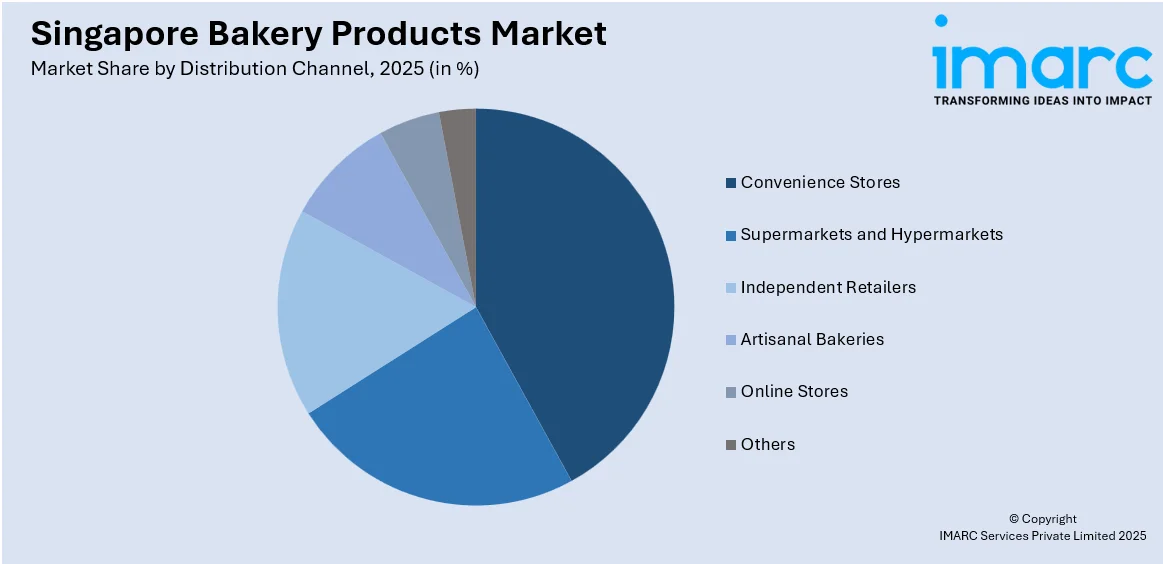

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Convenience Stores

- Supermarkets and Hypermarkets

- Independent Retailers

- Artisanal Bakeries

- Online Stores

- Others

Convenience stores play a crucial role in Singapore’s bakery market by offering quick access to packaged bread, biscuits, and ready-to-eat pastries. Their strategic locations in residential areas and transit hubs make them a go-to option for busy consumers. Brands leverage this channel for impulse purchases, limited-time offers, and small pack sizes catering to on-the-go consumption.

Supermarkets and hypermarkets dominate bakery product distribution in Singapore, providing a wide assortment of packaged and fresh bakery items. Consumers prefer this channel for bulk purchases, premium selections, and promotional discounts. Retailers partner with bakery brands to introduce healthier options, private-label products, and in-store bakeries, enhancing customer engagement and driving higher foot traffic.

Independent retailers, including traditional bakeries and small grocery stores, serve niche customer segments with specialized and locally preferred bakery products. These stores cater to neighborhood shoppers seeking freshly baked goods, ethnic flavors, and heritage brands. They play a significant role in distributing budget-friendly and single-serve bakery items, supporting the market’s diverse consumer base.

Artisanal bakeries are expanding in Singapore, catering to premium, health-conscious, and experience-driven consumers. Offering handcrafted, preservative-free, and fusion-inspired baked goods, these bakeries emphasize quality and exclusivity. Growing demand for sourdough bread, gourmet pastries, and personalized cakes is fueling their success. Artisanal brands benefit from word-of-mouth, social media marketing, and café-style retail experiences.

Online stores are revolutionizing Singapore’s bakery market by providing convenience, customization, and wider accessibility. E-commerce platforms, food delivery apps, and direct-to-consumer bakery websites enable consumers to purchase freshly baked or packaged products with doorstep delivery. Digital-first brands leverage social media, AI-driven personalization, and subscription models to attract customers, reshaping traditional bakery retail strategies.

Regional Analysis:

- North-East

- Central

- West

- East

- North

The North-East region, home to areas like Hougang and Punggol, is witnessing growing demand for bakery products due to its expanding residential developments. The rise of café culture and artisanal bakeries is driving interest in premium pastries and fresh bread. Supermarkets and convenience stores cater to busy families seeking ready-to-eat and healthier bakery options.

The Central region, including Orchard Road and CBD areas, serves as a hub for premium bakeries, international bakery chains, and café-style experiences. High-income professionals and expatriates drive demand for gourmet and artisanal baked goods. Luxury hotels, high-end supermarkets, and specialty stores play a key role in distributing premium pastries, customized cakes, and fusion bakery products.

The West, encompassing Jurong and Bukit Batok, supports strong supermarket and hypermarket bakery sales, catering to families and working professionals. The presence of large residential estates and business parks fuels demand for both everyday essentials like bread and indulgent treats from artisanal bakeries. Increasing footfall in shopping malls boosts the popularity of specialty bakery stores.

The East, with areas such as Tampines and Bedok, features a mix of traditional bakeries, modern café-style bakeries, and supermarkets stocking a variety of bakery goods. The region's strong food culture supports demand for both heritage and contemporary bakery products. Artisanal bakeries and international bakery franchises thrive, benefiting from high consumer engagement and social media exposure.

The North, covering areas like Woodlands and Yishun, is an emerging market for bakery expansion, driven by residential growth. Supermarkets and independent bakeries serve local demand for fresh bread, cookies, and traditional pastries. Increasing urbanization and improved retail infrastructure are supporting the rise of premium bakery outlets, catering to evolving tastes and healthier bakery preferences.

Competitive Landscape:

The Singapore bakery products market is highly competitive, with a mix of established international brands, local bakeries, and emerging artisanal players. Leading companies such as BreadTalk, Gardenia, and Bengawan Solo dominate through extensive distribution networks and strong brand recognition. For instance, in 2024, QAF Limited, maker of Gardenia, reported a 154% YoY increase in PATMI to $12.5m in H1 2024, driven by lower income tax expenses, with revenue rising 3.0% YoY to $309.2m. Artisanal and premium bakeries are gaining market share by offering handcrafted, preservative-free, and fusion-inspired products. The rise of e-commerce and food delivery platforms has intensified competition, with digital-first brands and cloud bakeries expanding their presence. Market players are focusing on innovation, premiumization, and healthier product offerings to differentiate themselves in an evolving consumer landscape driven by quality and convenience.

The report provides a comprehensive analysis of the competitive landscape in the Singapore bakery products market with detailed profiles of all major companies.

Latest News and Developments:

- In August 2024, Gardenia launched the new Pandan Coconut Loaf with Gula Melaka in Singapore, already popular in Malaysia. The loaf features pandan aroma, rich gula melaka flavor, and desiccated coconut. Additionally, Gardenia introduced the Pandan Gula Melaka cream roll and a premium cream roll gold edition in Black Forest, Chocolate Hazelnut, and Salted Caramel.

Singapore Bakery Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Convenience Stores, Supermarkets and Hypermarkets, Independent Retailers, Artisanal Bakeries, Online Stores, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore bakery products market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Singapore bakery products market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore bakery products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bakery products market in Singapore was valued at USD 2.1 Billion in 2025.

The growth of Singapore's bakery products market is driven by rising demand for convenient, affordable, and healthy options, along with increasing consumer preference for premium and innovative baked goods. The expansion of e-commerce, changing dietary habits, and a growing interest in plant-based and gluten-free offerings also contribute to market growth.

The Singapore bakery products market is projected to exhibit a CAGR of 5.75% during 2026-2034, reaching a value of USD 3.5 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)