Singapore Autonomous Cars Market Size, Share, Trends and Forecast by Level of Autonomy, Type, Vehicle Type, and Region, 2026-2034

Singapore Autonomous Cars Market Overview:

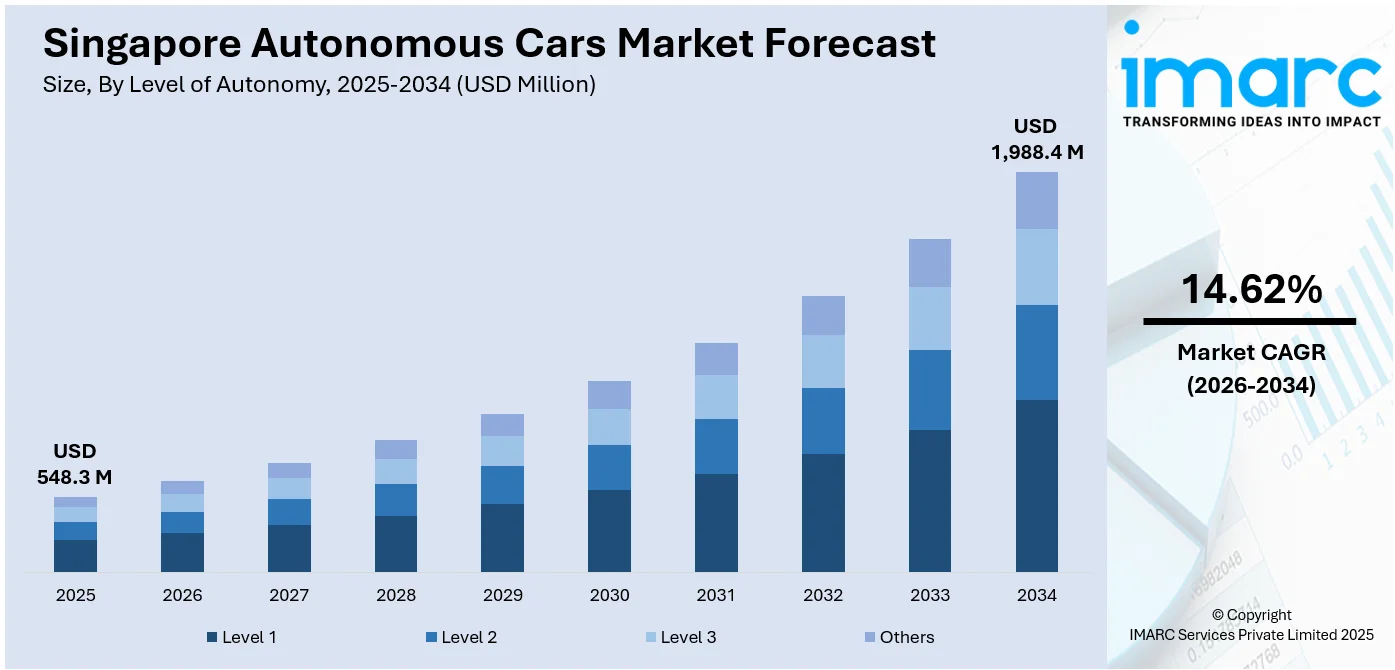

The Singapore autonomous cars market size reached USD 548.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,988.4 Million by 2034, exhibiting a growth rate (CAGR) of 14.62% during 2026-2034. The market is propelled by the government’s support in adopting new technologies, advanced technological infrastructure, which is crucial for the operation of autonomous vehicles, and significant urban mobility challenges due to dense population.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 548.3 Million |

| Market Forecast in 2034 | USD 1,988.4 Million |

| Market Growth Rate (2026-2034) | 14.62% |

Singapore Autonomous Cars Market Trends:

Urban Mobility Challenges

Singapore has considerable urban mobility issues due to its dense population and limited land. As per Traffic Index, with an average TCI of 13 in the previous 30 days, Singapore is currently sitting on position 68 in Global Traffic Congestion Rankings. Besides, the heaviest traffic congestion in Singapore is usually observed around 08:00 and 18:00, a period characterized as rush hour, resulting in prolonged and widespread traffic delays throughout the city. Autonomous vehicles have the ability to address these issues by improving traffic management, reducing congestion, and enhancing transportation efficiency. The capacity of AVs to communicate with one another and with traffic control systems may result in a more coordinated flow of traffic. Furthermore, autonomous vehicles could have a big impact on public transit systems by connecting with current networks to deliver "last-mile" solutions that improve accessibility and convenience for all residents.

To get more information on this market Request Sample

Economic and Environmental Goals

Singapore is also motivated by economic and environmental considerations. Autonomous vehicles are seen as a key component in reducing carbon emissions and traffic accidents, aligning with Singapore’s sustainability goals. According to the National Environment Agency (NEA), transportation is responsible for around 15% of Singapore’s greenhouse gas emissions, and the majority of that comes from cars and taxis. Furthermore, the push toward AV technology is seen as a way to strengthen the country’s position as a leader in high-tech industries, attracting investments and creating jobs in the emerging tech sector. Hence, since 2017, autonomous vehicles (AVs) are being integrated into Singapore’s public transportation system to help make commutes more seamless. In addition to matching demand with supply, another compelling reason to use AVs is that they lower the likelihood of accidents due to human error. According to a McKinsey report, traffic accidents could be reduced by 90% when AVs become the primary means of transport.

Singapore Autonomous Cars Market News:

- In November 2023, Hyundai Motor Group and Motional, the Aptiv-Hyundai joint venture aimed at commercializing autonomous vehicles, announced to co-develop production-ready versions of the all-electric IONIQ 5 robotaxi at the automaker’s new innovation center in Singapore, the Hyundai Motor Group Innovation Center Singapore (HMGICS). Hyundai and Motional’s jointly developed all-electric IONIQ 5 robotaxi will be manufactured at HMGICS.

- In December 2023, WeRide, a leading global Level 4 autonomous driving technology company, officially announced that it has successfully obtained the Singapore Milestone Testing Regime Level 1 License for Autonomous Vehicles (AV) on Public Roads (referred to as "M1 License") and the T1 Assessment License for AVs on Public Paths (referred to as "T1 License") from the Land Transport Authority (LTA) of Singapore. With these licenses, WeRide's Robobus will be able to conduct tests on a larger scale on public roads in Singapore, covering important areas such as One North and the National University of Singapore.

Singapore Autonomous Cars Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on level of autonomy, type, and vehicle type.

Level of Autonomy Insights:

- Level 1

- Level 2

- Level 3

- Others

The report has provided a detailed breakup and analysis of the market based on the level of autonomy. This includes level 1, level 2, level 3, and others.

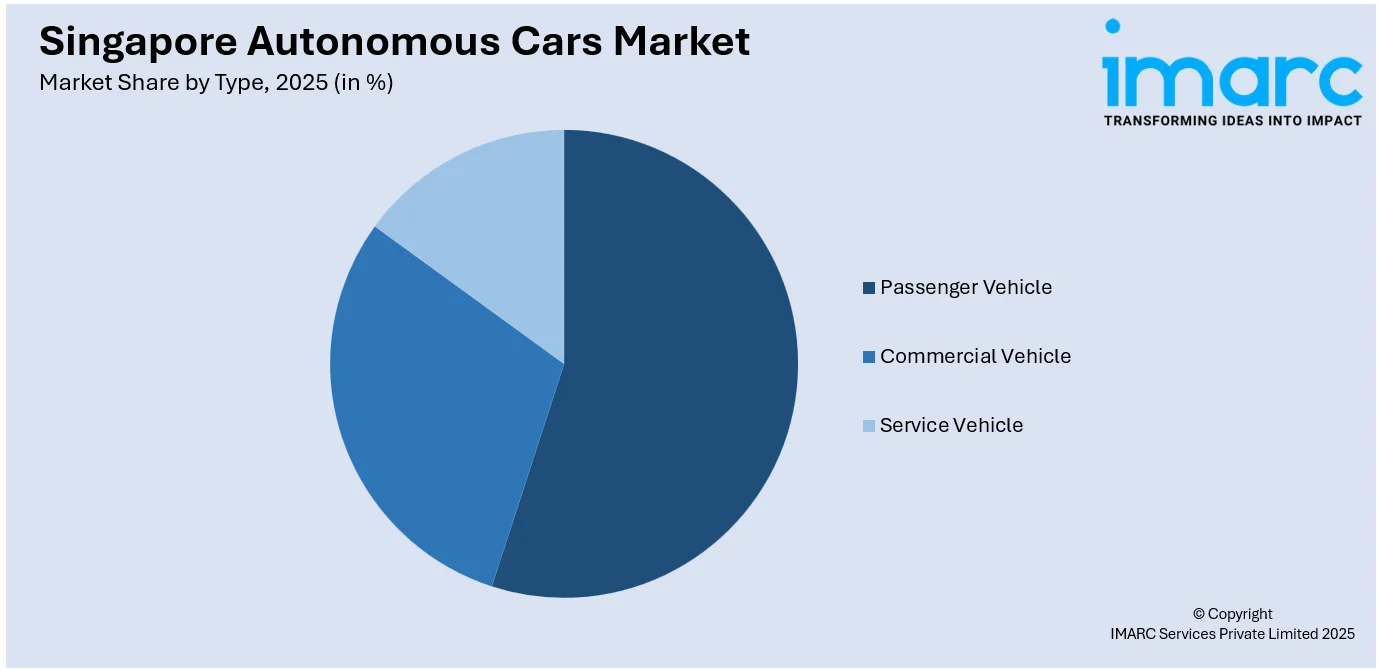

Type Insights:

Access the comprehensive market breakdown Request Sample

- Passenger Vehicle

- Commercial Vehicle

- Service Vehicle

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes passenger vehicle, commercial vehicle, and service vehicle.

Vehicle Type Insights:

- Hatchback

- Sedan

- SUV

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes hatchback, sedan, and SUV.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Autonomous Cars Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Level of Autonomies Covered | Level 1, Level 2, Level 3, Others |

| Types Covered | Passenger Vehicle, Commercial Vehicle, Service Vehicle |

| Vehicle Types Covered | Hatchback, Sedan, SUV |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore autonomous cars market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore autonomous cars market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore autonomous cars industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Singapore autonomous cars market was valued at USD 548.3 Million in 2025.

The Singapore autonomous cars market is projected to exhibit a CAGR of 14.62% during 2026-2034, reaching a value of USD 1,988.4 Million by 2034.

The Singapore autonomous cars market is driven by strong government support, smart city initiatives, and advanced infrastructure. High technology adoption, investments in research and development, and a focus on reducing traffic congestion also boost growth. Favorable regulations and collaborations between public and private sectors further accelerate market expansion and innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)