Silver Nanoparticles Market Report by Synthesis Method (Wet Chemistry, Ion Implantation, Biological), Shape (Spheres, Platelets, Rods, Colloidal Silver Particles, and Others), End Use Industry (Electronics and IT, Healthcare and Lifesciences, Textiles, Food and Beverages, Pharmaceuticals, Cosmetics, Water Treatment, and Others), and Region 2026-2034

Silver Nanoparticles Market Size:

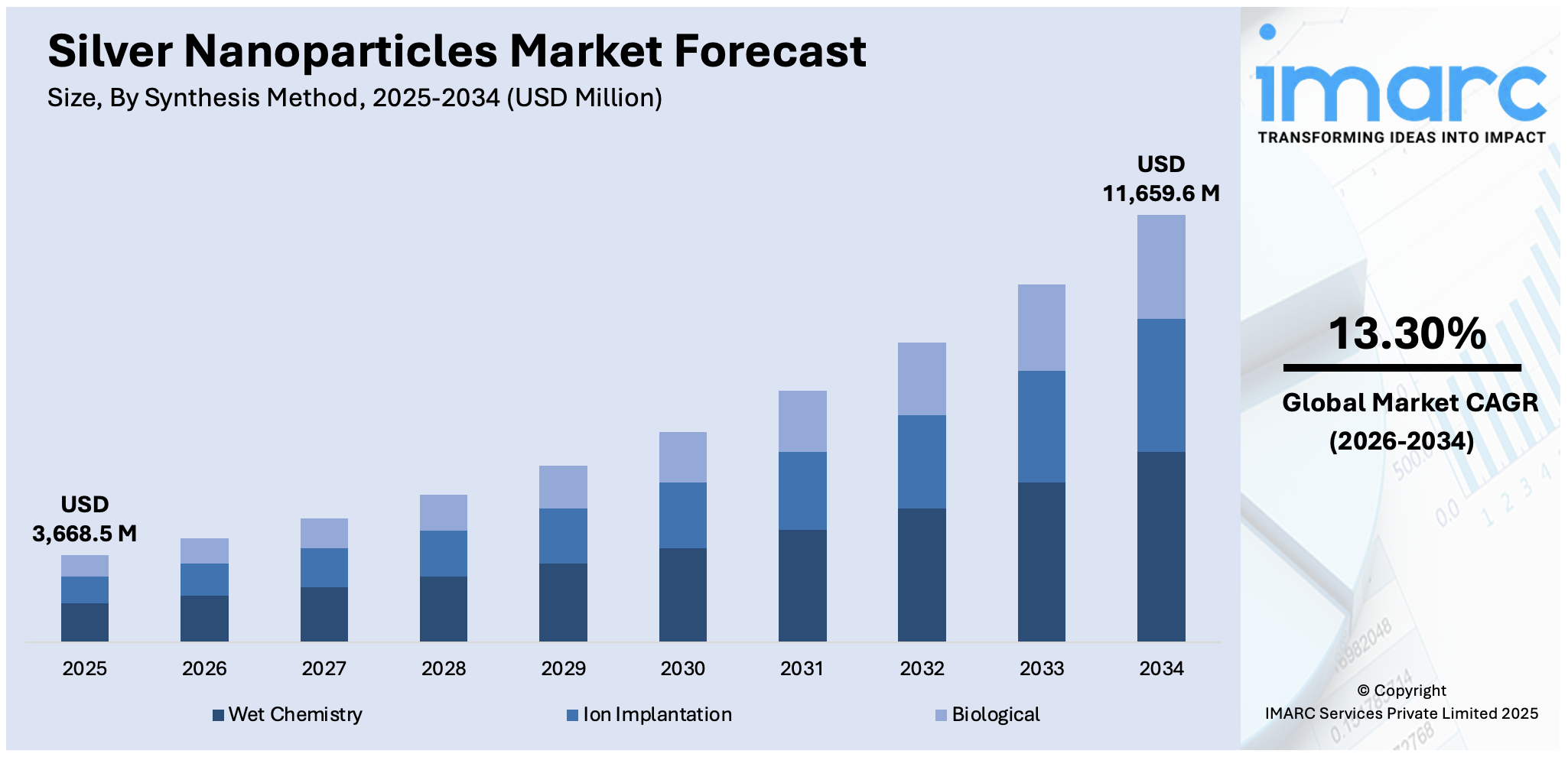

The global silver nanoparticles market size reached USD 3,668.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 11,659.6 Million by 2034, exhibiting a growth rate (CAGR) of 13.30% during 2026-2034. The global market is primarily driven by increasing demand for silver nanoparticles in the medical and healthcare sectors due to their antimicrobial properties, expanding applications in consumer electronics for high-performance components, and rising use in environmental and agricultural applications for water treatment and crop protection.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3,668.5 Million |

|

Market Forecast in 2034

|

USD 11,659.6 Million |

| Market Growth Rate 2026-2034 | 13.30% |

Silver Nanoparticles Market Analysis:

- Major Market Drivers: Silver nanoparticles are gaining attention due to the potent germicidal characteristics provided by the metal against microorganisms such as bacteria, viruses, fungi, and parasites, thereby adding to their commercial market growth. Moreover, augmenting consumer electronics applications such as conductive inks for flexible electronics are favoring silver nanoparticles market growth.

- Key Market Trends: The increasing trend of miniaturization in electronics and rising consumer demand for high-performing components are driving the growth of the silver nanoparticles market. Additionally, the attention to a sustainable and eco-friendly approach is propelling toward the utilization of silver nanoparticles in environmental and agricultural fields.

- Geographical Trends: North America and Europe are leaders in the market due to the well-established healthcare infrastructure and flourishing electronics industry. On the other hand, the Asia-Pacific region is witnessing accelerated growth due to rising industrialization and technological improvements in countries such as China and India.

- Competitive Landscape: According to the silver nanoparticles market analysis, the market is consolidated due to tough competition among leading players to launch new and innovative products to enhance their beneficial features. Growing research and development activities to improve the use of silver nanoparticles in different industrial applications enhance silver nanoparticle applications in numerous sectors.

- Challenges and Opportunities: Regulatory concerns and potential toxicity issues loom as major challenges for the market. Yet, continuous research and technological improvements could pave the way for making safer and more efficient nanoparticle-based solutions, providing double growth in sustainable development across a variety of applications.

To get more information on this market Request Sample

Silver Nanoparticles Market Trends:

Increasing silver nanoparticles demand in the medical and healthcare sector

The increasing deployment of silver nanoparticles in the medical and healthcare sectors brings about a rise in the global market. Silver nanoparticles have good antimicrobial effects, so they are widely utilized in wound dressings, medical equipment, and coating materials. This broad-spectrum combativeness, with equal effectiveness against bacteria, viruses, and fungi, is resulting in widespread use in hospital settings to preclude infections. In addition to this, the continuously increasing progress in the sphere of nanotechnology and biomedical research provides opportunities for silver nanoparticles in pharmaceutical delivery vehicles and diagnostic tools. Moreover, a rising emphasis on better patient care and safety, a turbulent increase in healthcare-associated infections (HAIs), and an ongoing need for novel medical solutions are creating a positive silver nanoparticles market outlook.

Expanding applications in consumer electronics

The demand for nano-based consumer electronics is leading to the development of the global silver nanoparticles market. Silver has excellent electrical conductivity and stability, making silver nanoparticles essential to producing different electronic components. Conductive inks are the key materials in flexible and printed electronics, such as printed sensors, solar panels, lighting, and RFID antennas. According to a market research report, the global flexible electronics market size reached US$ 30.5 Billion in 2023. IMARC Group expects the market to reach US$ 56.1 Billion by 2032, exhibiting a growth rate (CAGR) of 6.8% during 2024-2032. Thus, this is also positively influencing the silver nanoparticles market revenue. In addition, the electronic miniaturization trend, coupled with increased requirements for high performance, lower costs, and low-weight components, is providing an enhancement to the silver nanoparticles in the electronics industry. Furthermore, the increase in the penetration of wearable tech and Internet of Things (IoT) devices is driving the growing need for cutting-edge materials, according to the forecast. Therefore, the increasing use of silver nanoparticles in consumer electronics improves their market revenue due to the growing requirements of new technologies.

Rising environmental and agricultural applications

Amongst all global markets for silver nanoparticle use, the agricultural and environmental sectors are witnessing significant shares. According to the silver nanoparticles market report, silver nanoparticles have shown great antimicrobial and catalytic properties, making them the best candidate for water treatment processes in environmental applications for removing contaminants and pathogens from water sources. This is especially important in weather-stressed areas where water is running out or polluted. Silver nanoparticles are also found on agricultural products, being used as antimicrobial coatings and in the formulation of pesticides and fertilizers to enhance crop yield and provide stringent antimicrobial activity to protect crops from diseases. In addition, interest in environmentally sustainable technologies is stimulating the development of nanostructured materials to combat bacteria, presenting high efficiency at low dosages. According to the silver nanoparticles market forecast, this is a major proponent of the trend toward using nanotechnology in environmental and agricultural applications, emphasizing the role of silver nanoparticles in improving sustainability and expanding the market.

Silver Nanoparticles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on synthesis method, shape and end use industry.

Breakup by Synthesis Method:

- Wet Chemistry

- Ion Implantation

- Biological

Wet chemistry accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the synthesis method. This includes wet chemistry, ion implantation, and biological. According to the report, wet chemistry represented the largest segment.

Wet chemical routes, a classical and significant synthesis technique in the chemical industry, offer widespread applications in the market due to their flexibility and the production of high-quality materials. Along with this, the ability to employ liquid solvents to enable chemical reactions, such as making nanoparticles, catalysts, and advanced materials, is highly sought after due to the precise control of reaction conditions according to the silver nanoparticles market overview. This scalable architecture allows wet chemistry processes to be employed in laboratory settings as well as in high-volume industrial production to address various market needs. This represents a fundamental tool in pharmaceuticals, electronics, material sciences, and any industry concerned with the development of new products or the improvement of existing ones. Also, wet chemistry techniques are changing, making chemical synthesis ever more efficient and sustainable, meeting the increasing emphasis on greener practices within the market.

Breakup by Shape:

- Spheres

- Platelets

- Rods

- Colloidal Silver Particles

- Others

Spheres hold the largest share of the industry

A detailed breakup and analysis of the market based on the shape have also been provided in the report. This includes spheres, platelets, rods, colloidal silver particles, and others. According to the report, spheres accounted for the largest market share.

Spheres, as a dominant shape in the silver nanoparticles industry, hold significant importance due to their unique physical and chemical properties. In the realm of materials science and nanotechnology, spherical particles are favored for their uniformity and predictability in behavior, which are critical for applications such as drug delivery, catalysis, and photonics. Along with this, the isotropic nature of spheres ensures consistent interaction with external forces and fields, enhancing the performance and reliability of the materials. This geometric advantage extends to industries such as pharmaceuticals, where spherical nanoparticles are employed to optimize the delivery and efficacy of therapeutic agents. Additionally, in sectors such as manufacturing and electronics, spherical components are integral to the production of high-precision devices and coatings. The market's preference for spherical shapes is further driven by silver nanoparticles market recent developments, enabling the production of monodisperse spheres with tailored properties. Consequently, spheres continue to be a preferred shape, offering versatility and efficiency across diverse applications.

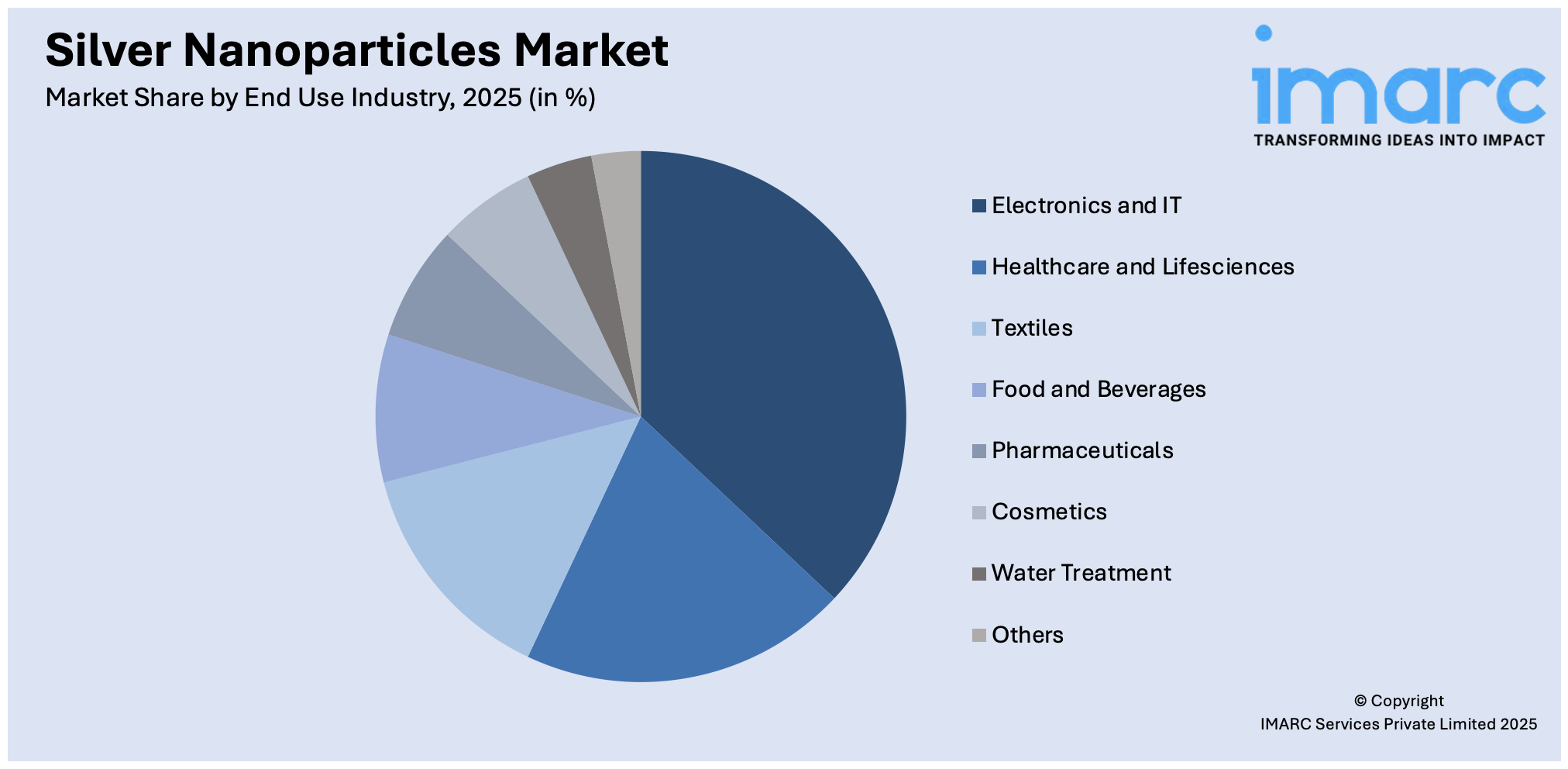

Breakup by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Electronics and IT

- Healthcare and Lifesciences

- Textiles

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Water Treatment

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes electronics and IT, healthcare and lifesciences, textiles, food and beverages, pharmaceuticals, cosmetics, water treatment, and others.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market accounting for the largest silver nanoparticles market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for silver nanoparticles.

North America holds a major silver nanoparticles market share of the global market on account of its technological advantages, economic structures, and major investments in research and development. The US and Canada display innovation, especially in pharmaceuticals, biotechnology, IT, and renewable energy. Together, a strong foundation in academia, a relatively business-friendly environment, and transformational science and technology combine to create a unique and fertile ecosystem. Moreover, North America has well-established supply chains and regulatory infrastructure for high-quality and safe production, enhancing its edge in global markets as well. It also increases the market growth due to the strong consumer base that seeks new-age solutions. Investment in sustainable practices and green technologies also aligns with silver nanoparticles market trends. Consequently, North America remains a pivotal region, influencing global market dynamics and setting benchmarks for innovation and quality.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the silver nanoparticles industry include

- American Elements

- Meliorum Technologies Inc.

- Merck KGaA

- nanoComposix

- Nanocs Inc.

- Nanoshel LLC

- Strem Chemicals Inc. (Ascensus Specialties LLC)

- ThermoFisher Scientific Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Major silver nanoparticles companies are also implementing strategic moves to sustain themselves in the market. Those efforts have taken the form of inorganic adjacencies, mostly through M&A transactions to broaden capabilities and market presence, R&D spending to power their innovation engine, and productization to make smart acquisitions, R&D investments, and product diversification to be more adaptable to changing consumer preferences. More importantly, they are operating in the digital era and using technologies such as artificial intelligence (AI) and data analytics to improve operations and understand markets better. This is rapidly being replaced by a focus on sustainability and corporate social responsibility, aligning themselves with environmental necessities across the globe and providing silver nanoparticles market recent opportunities.

Silver Nanoparticles Market News:

- May 22, 2024: Merck KGaA announced its plans to purchase US-based life science company Mirus Bio and will pay around $600 million (€550 million). The deal enhances Merck KGaA's position in the viral vector manufacturing space as Mirus Bio is focused on the discovery, development, and commercialization of transfection reagents.

- February 06, 2023: American Elements reveals the creation of the AE Fusion Energy division, expanding the public roster of newly minted factories to counter the increasing demand for advanced materials in Research & Development and scaled production at its fusion energy partner customers.

Silver Nanoparticles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Synthesis Methods Covered | Wet Chemistry, Ion Implantation, Biological |

| Shapes Covered | Spheres, Platelets, Rods, Colloidal Silver Particles, Others |

| End Use Industries Covered | Electronics and IT, Healthcare and Lifesciences, Textiles, Food and Beverages, Pharmaceuticals, Cosmetics, Water Treatment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Elements, Meliorum Technologies Inc., Merck KGaA, nanoComposix, Nanocs Inc., Nanoshel LLC, Strem Chemicals Inc. (Ascensus Specialties LLC), ThermoFisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the silver nanoparticles market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global silver nanoparticles market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the silver nanoparticles industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global silver nanoparticles market was valued at USD 3,668.5 Million in 2025.

We expect the global silver nanoparticles market to exhibit a CAGR of 13.30% during 2026-2034.

The rising application of silver nanoparticles across numerous end-use industries, such as

pharmaceuticals, healthcare, IT, etc., owing to their less energy-consumption, is primarily driving the global silver nanoparticles market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of various end-use industries for silver nanoparticles.

Based on the synthesis method, the global silver nanoparticles market has been segmented into wet chemistry, ion implantation, and biological. Among these, wet chemistry represents the largest market share.

Based on the shape, the global silver nanoparticles market can be bifurcated into spheres, platelets, rods, colloidal silver particles, and others. Currently, spheres account for the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America, where North America currently dominates the global market.

Some of the major players in the global silver nanoparticles market include American Elements, Meliorum Technologies Inc., Merck KGaA, nanoComposix, Nanocs Inc., Nanoshel LLC, Strem Chemicals Inc. (Ascensus Specialties LLC) and ThermoFisher Scientific Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)