Silicon Wafer Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue

Silicon Wafer Manufacturing Plant Project Report (DPR) Summary:

IMARC Group's comprehensive DPR report, titled "Silicon Wafer Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," provides a complete roadmap for setting up a silicon wafer manufacturing unit. The silicon wafer market is driven by the increasing demand for semiconductors in various industries, particularly in consumer electronics, automotive, telecommunications, and renewable energy. The global silicon wafer market size was valued at USD 27.80 Billion in 2025. According to IMARC Group estimates, the market is expected to reach USD 46.71 Billion by 2034, exhibiting a CAGR of 5.64% from 2026 to 2034.

This feasibility report covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc.

The silicon wafer manufacturing plant setup cost is provided in detail covering project economics, capital investments (CapEx), project funding, operating expenses (OpEx), income and expenditure projections, fixed costs vs. variable costs, direct and indirect costs, expected ROI and net present value (NPV), profit and loss account, financial analysis, etc.

![]()

Access the Detailed Feasibility Analysis, Request Sample

What is Silicon Wafer?

A silicon wafer refers to a thin, highly pure, and circular slice of single-crystal silicon that constitutes the basic substrate material from which integrated circuits, microprocessors, and solar cells are made. Silicon constitutes an important substance used in the making of semi-conductors, where the conductivity can be intentionally enhanced by introducing certain impurities into the substance through a process known as doping. This makes it possible to etch billions of microscopic transistors on the surface of the silicon wafers through a variety of processes involving photolithography, etching, and deposition, among others.

Key Investment Highlights

- Process Used: Crystal growth, slicing, polishing and cleaning.

- End-use Industries: Semiconductor manufacturing, electronics, photovoltaics, MEMS, telecommunications.

- Applications: Used for integrated circuit substrates, microchip fabrication, solar cells, sensors, and RF device components.

Silicon Wafer Plant Capacity:

The proposed manufacturing facility is designed with an annual production capacity ranging between 3–5 million wafers, enabling economies of scale while maintaining operational flexibility.

Silicon Wafer Plant Profit Margins:

The project demonstrates healthy profitability potential under normal operating conditions. Gross profit margins typically range between 45-55%, supported by stable demand and value-added applications.

- Gross Profit: 45-55%

- Net Profit: 20-25%

Silicon Wafer Plant Cost Analysis:

The operating cost structure of a silicon wafer manufacturing plant is primarily driven by raw material consumption, particularly polysilicon, which accounts for approximately 40-50% of total operating expenses (OpEx).

- Raw Materials: 40-50% of OpEx

- Utilities: 30-35% of OpEx

Financial Projection:

The financial projections for the proposed project have been developed based on realistic assumptions related to capital investment, operating costs, production capacity utilization, pricing trends, and demand outlook. These projections provide a comprehensive view of the project’s financial viability, ROI, profitability, and long-term sustainability.

Major Applications:

- Semiconductor Fabrication (wafer handling, cleaning, and polishing systems)

- Photolithography (mask aligners, resist coating, and exposure equipment)

- Etching & Deposition (chemical vapor deposition, plasma etching, and thin-film coatings)

- Testing & Packaging (inspection tools, probe stations, and die packaging equipment)

Why Silicon Wafer Manufacturing?

✓ Core Enabler of the Semiconductor Ecosystem: Silicon wafers are a key building block in the production of integrated circuits, power devices, sensors, and memory. As such, silicon wafers are essential in electronics, auto semiconductors, renewable energy-related semiconductors, data centers, and industrial automation.

✓ High but Defensible Entry Barriers: Manufacturing silicon wafers requires huge capital investment and needs clean environments, crystal growth with accuracy, state-of-the-art slice processing, polishing, and high quality. Qualification cycles, besides certification, ensure high barriers that block less capable manufacturers.

✓ Strong Alignment with Global Megatrends: Rapid boost in electric cars, renewable energy sources, development of 5G & AI infra, automation, IoT, etc., is increasing steady demand for semiconductors, thereby creating a prolonged demand for high-quality silicon wafers. Power electronics, advanced nodes, are registering strong double-digit growth.

✓ Policy & Strategic Manufacturing Support: Government policies for the development of the regional ecosystems for semiconductors through the likes of semiconductor incentive programs, fabrication facility subsidization, or regionalized policies (Make in India or CHIPS Act) are enhancing the downstream demand for wafers.

✓ Supply Chain Localization & Strategic Security: For semiconductor companies, this means that a resilient and geographically diversified wafer supply chain is important for mitigating geopolitical risks, shortening lead times, and ensuring continuity of supplies. This could provide an opportunity for regional wafer producers with strong process control and scalable operations.

Transforming Vision into Reality:

This report provides the comprehensive blueprint needed to transform your silicon wafer manufacturing vision into a technologically advanced and highly profitable reality.

Silicon Wafer Industry Outlook 2026:

The market for silicon wafers is experiencing sustained growth, driven by the expanding demand for semiconductors across industries such as electronics, automotive, renewable energy, and data infrastructure. The rising need for high-performance, reliable, and miniaturized electronic components—particularly for integrated circuits, power devices, and sensors—is accelerating the adoption of advanced silicon wafers. The rapid proliferation of electric vehicles, renewable energy systems, data centers, artificial intelligence, and automation-intensive manufacturing is further boosting demand, as these applications rely on semiconductors that deliver high efficiency, thermal stability, and precision. Based on recent data from the International Energy Agency (IEA), annual global EV sales are projected to exceed 20 million units in 2025 alone. The Asia-Pacific region, led by China, Taiwan, South Korea, and India, is expected to remain the fastest-growing market due to expanding semiconductor fabrication capacity and strong government support, while North America and Europe continue to benefit from investments in domestic chip manufacturing, technology upgrades, and stringent quality standards.

Leading Silicon Wafer Manufacturers:

Leading manufacturers in the global silicon wafer industry include several multinational companies with extensive production capacities and diverse application portfolios. Key players include:

- Shin-Etsu Chemical

- SUMCO

- GlobalWafers

- Siltronic

- SK Siltron

all of which serve end-use sectors such as semiconductor manufacturing, electronics, photovoltaics, MEMS, telecommunications.

How to Setup a Silicon Wafer Manufacturing Plant?

Setting up a silicon wafer manufacturing plant requires evaluating several key factors, including technological requirements and quality assurance.

Some of the critical considerations include:

- Detailed Process Flow: The manufacturing process is a multi-step operation that involves several unit operations, material handling, and quality checks. Below are the main stages involved in the silicon wafer manufacturing process flow:

- Unit Operations Involved

- Mass Balance and Raw Material Requirements

- Quality Assurance Criteria

- Technical Tests

- Site Selection: The location must offer easy access to key raw materials such as polysilicon. Proximity to target markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

- Plant Layout Optimization: The layout should be optimized to enhance workflow efficiency, safety, and minimize material handling. Separate areas for raw material storage, production, quality control, and finished goods storage must be designated. Space for future expansion should be incorporated to accommodate business growth.

- Equipment Selection: High-quality, corrosion-resistant machinery tailored for silicon wafer production must be selected. Essential equipment includes crystal growth furnaces (Czochralski or float zone), wafer saws, edge grinders, lapping and polishing machines, chemical etching baths, cleaning stations (including megasonic or RCA cleaners), inspection systems, and packaging automation. All machinery must comply with industry standards for safety, efficiency, and reliability.

- Raw Material Sourcing: Reliable suppliers must be secured for raw materials like polysilicon to ensure consistent production quality. Minimizing transportation costs by selecting nearby suppliers is essential. Sustainability and supply chain risks must be assessed, and long-term contracts should be negotiated to stabilize pricing and ensure a steady supply.

- Safety and Environmental Compliance: Safety protocols must be implemented throughout the manufacturing process of silicon wafer. Advanced monitoring systems should be installed to detect leaks or deviations in the process. Effluent treatment systems are necessary to minimize environmental impact and ensure compliance with emission standards.

- Quality Assurance Systems: A comprehensive quality control system should be established throughout production. Analytical instruments must be used to monitor product concentration, purity, and stability. Documentation for traceability and regulatory compliance must be maintained.

Project Economics:

Establishing and operating a silicon wafer manufacturing plant involves various cost components, including:

- Capital Investment: The total capital investment depends on plant capacity, technology, and location. This investment covers land acquisition, site preparation, and necessary infrastructure.

- Equipment Costs: Equipment costs, such as those for crystal growth furnaces (Czochralski or float zone), wafer saws, edge grinders, lapping and polishing machines, chemical etching baths, cleaning stations (including megasonic or RCA cleaners), inspection systems, and packaging automation, represent a significant portion of capital expenditure. The scale of production and automation level will determine the total cost of machinery.

- Raw Material Expenses: Raw materials, including polysilicon, are a major part of operating costs. Long-term contracts with reliable suppliers will help mitigate price volatility and ensure a consistent supply of materials.

- Infrastructure and Utilities: Costs associated with land acquisition, construction, and utilities (electricity, water, steam) must be considered in the financial plan.

- Operational Costs: Ongoing expenses for labor, maintenance, quality control, and environmental compliance must be accounted for. Optimizing processes and providing staff training can help control these operational costs.

- Financial Planning: A detailed financial analysis, including income projections, expenditures, and break-even points, must be conducted. This analysis aids in securing funding and formulating a clear financial strategy.

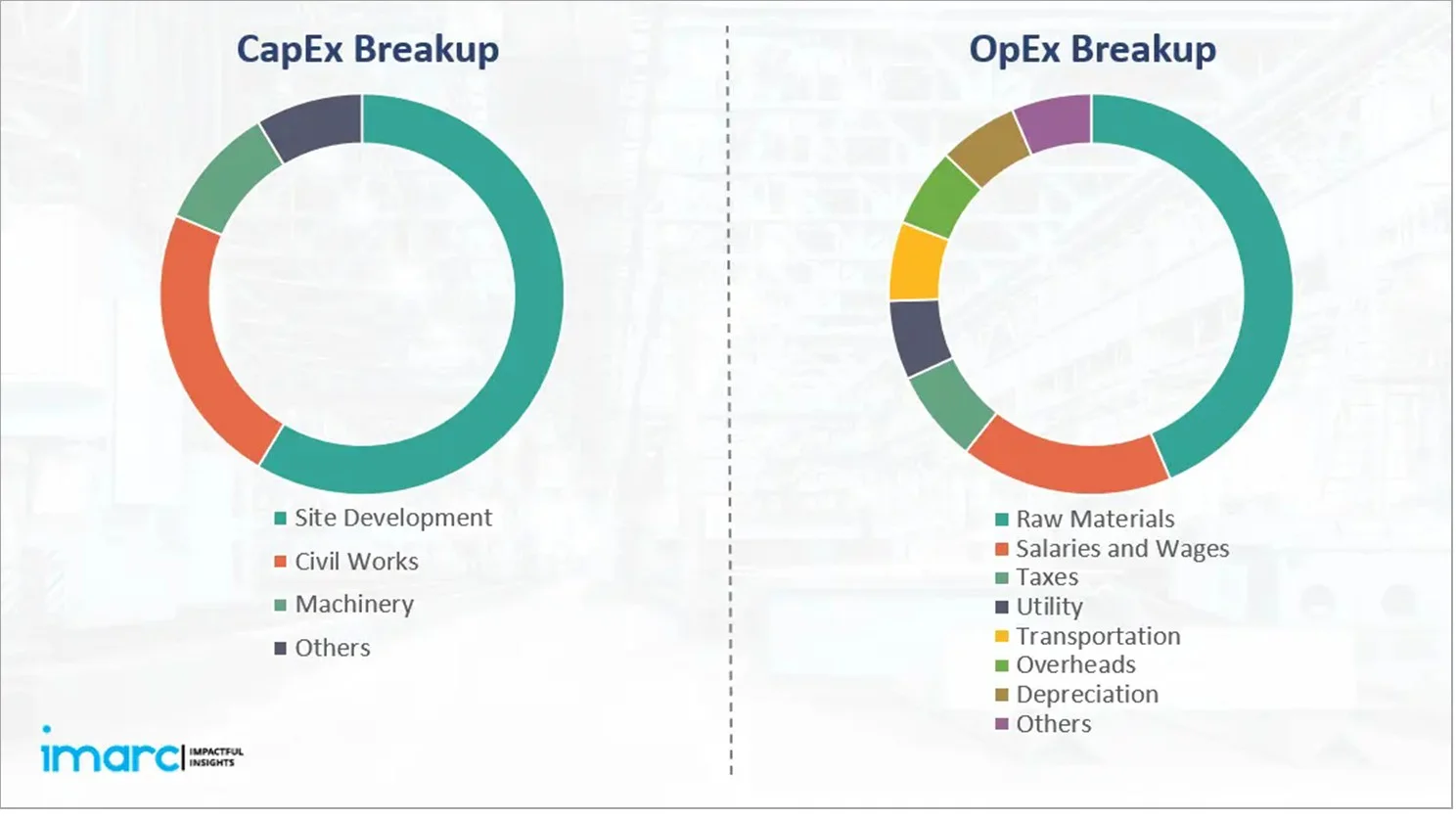

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Capital Investment (CapEx): Machinery costs account for the largest portion of the total capital expenditure. The cost of land and site development, including charges for land registration, boundary development, and other related expenses, forms a substantial part of the overall investment. This allocation ensures a solid foundation for safe and efficient plant operations.

Operating Expenditure (OpEx): In the first year of operations, the operating cost for the silicon wafer manufacturing plant is projected to be significant, covering raw materials, utilities, depreciation, taxes, packing, transportation, and repairs and maintenance. By the fifth year, the total operational cost is expected to increase substantially due to factors such as inflation, market fluctuations, and potential rises in the cost of key materials. Additional factors, including supply chain disruptions, rising consumer demand, and shifts in the global economy, are expected to contribute to this increase.

Capital Expenditure Breakdown:

| Particulars | Cost (in US$) |

|---|---|

| Land and Site Development Costs | XX |

| Civil Works Costs | XX |

| Machinery Costs | XX |

| Other Capital Costs | XX |

To access CapEx Details, Request Sample

Operational Expenditure Breakdown:

| Particulars | In % |

|---|---|

| Raw Material Cost | 40-50% |

| Utility Cost | 30-35% |

| Transportation Cost | XX |

| Packaging Cost | XX |

| Salaries and Wages | XX |

| Depreciation | XX |

| Taxes | XX |

| Other Expenses | XX |

To access OpEx Details, Request Sample

Profitability Analysis:

| Particulars | Unit | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Average |

|---|---|---|---|---|---|---|---|

| Total Income | US$ | XX | XX | XX | XX | XX | XX |

| Total Expenditure | US$ | XX | XX | XX | XX | XX | XX |

| Gross Profit | US$ | XX | XX | XX | XX | XX | XX |

| Gross Margin | % | XX | XX | XX | XX | XX | 45-55% |

| Net Profit | US$ | XX | XX | XX | XX | XX | XX |

| Net Margin | % | XX | XX | XX | XX | XX | 20-25% |

To access Financial Analysis, Request Sample

Latest Industry Developments:

- May 2025: GlobalWafers launched its USD 3.5 billion silicon wafer manufacturing facility in Sherman, Texas, marking the first fully integrated 12-inch wafer production line built in the United States in over two decades.

Report Coverage:

| Report Features | Details |

|---|---|

| Product Name | Silicon Wafer |

| Report Coverage | Detailed Process Flow: Unit Operations Involved, Quality Assurance Criteria, Technical Tests, Mass Balance, and Raw Material Requirements Land, Location and Site Development: Selection Criteria and Significance, Location Analysis, Project Planning and Phasing of Development, Environmental Impact, Land Requirement and Costs Plant Layout: Importance and Essentials, Layout, Factors Influencing Layout Plant Machinery: Machinery Requirements, Machinery Costs, Machinery Suppliers (Provided on Request) Raw Materials: Raw Material Requirements, Raw Material Details and Procurement, Raw Material Costs, Raw Material Suppliers (Provided on Request) Packaging: Packaging Requirements, Packaging Material Details and Procurement, Packaging Costs, Packaging Material Suppliers (Provided on Request) Other Requirements and Costs: Transportation Requirements and Costs, Utility Requirements and Costs, Energy Requirements and Costs, Water Requirements and Costs, Human Resource Requirements and Costs Project Economics: Capital Costs, Techno-Economic Parameters, Income Projections, Expenditure Projections, Product Pricing and Margins, Taxation, Depreciation Financial Analysis: Liquidity Analysis, Profitability Analysis, Payback Period, Net Present Value, Internal Rate of Return, Profit and Loss Account, Uncertainty Analysis, Sensitivity Analysis, Economic Analysis Other Analysis Covered in The Report: Market Trends and Analysis, Market Segmentation, Market Breakup by Region, Price Trends, Competitive Landscape, Regulatory Landscape, Strategic Recommendations, Case Study of a Successful Venture |

| Currency | US$ (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customized based on the requirement of the customer |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Report Customization

While we have aimed to create an all-encompassing silicon wafer plant project report, we acknowledge that individual stakeholders may have unique demands. Thus, we offer customized report options that cater to your specific requirements. Our consultants are available to discuss your business requirements, and we can tailor the report's scope accordingly. Some of the common customizations that we are frequently requested to make by our clients include:

- The report can be customized based on the location (country/region) of your plant.

- The plant’s capacity can be customized based on your requirements.

- Plant machinery and costs can be customized based on your requirements.

- Any additions to the current scope can also be provided based on your requirements.

Why Buy IMARC Reports?

- The insights provided in our reports enable stakeholders to make informed business decisions by assessing the feasibility of a business venture.

- Our extensive network of consultants, raw material suppliers, machinery suppliers and subject matter experts spans over 100+ countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- Our cost modeling team can assist you in understanding the most complex materials. With domain experts across numerous categories, we can assist you in determining how sensitive each component of the cost model is and how it can affect the final cost and prices.

- We keep a constant track of land costs, construction costs, utility costs, and labor costs across 100+ countries and update them regularly.

- Our client base consists of over 3000 organizations, including prominent corporations, governments, and institutions, who rely on us as their trusted business partners. Our clientele varies from small and start-up businesses to Fortune 500 companies.

- Our strong in-house team of engineers, statisticians, modeling experts, chartered accountants, architects, etc. has played a crucial role in constructing, expanding, and optimizing sustainable manufacturing plants worldwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Frequently Asked Questions

Capital requirements generally include land acquisition, construction, equipment procurement, installation, pre-operative expenses, and initial working capital. The total amount varies with capacity, technology, and location.

To start a silicon wafer manufacturing business, one needs to conduct a market feasibility study, secure required licenses, arrange funding, select suitable land, procure equipment, recruit skilled labor, and establish a supply chain and distribution network.

Silicon wafer manufacturing requires raw materials such as high-purity quartz sand (silicon dioxide). This is refined into polysilicon and then grown into a single crystal ingot, which is sliced into wafers. During the process, dopants such as boron or phosphorus are added to alter the silicon's electrical properties.

A silicon wafer factory typically requires Czochralski crystal pullers for creating silicon ingots, multi-wire saws for slicing, and a variety of lapping, polishing, and etching machines to achieve the required surface finish. A modern factory also needs a cleanroom environment with systems to prevent particle contamination and advanced handling equipment, including robotic arms and automated carriers.

The main steps generally include:

-

Purify silicon feedstock to electronic grade

-

Grow single crystal ingot using Czochralski method

-

Slice ingot into thin wafer discs

-

Grind and lap wafers for flatness

-

Polish surfaces to mirror-level finish

-

Clean wafers to remove contaminants

-

Inspect wafers for defects and quality

-

Packaging, storage, and distribution

Usually, the timeline can range from 24 to 48 months to start a silicon wafer manufacturing plant, depending on factors like site development, machinery installation, environmental clearances, safety measures, and trial runs.

Challenges may include high capital requirements, securing regulatory approvals, ensuring raw material supply, competition, skilled manpower availability, and managing operational risks.

Typical requirements include business registration, environmental clearances, factory licenses, fire safety certifications, and industry-specific permits. Local/state/national regulations may apply depending on the location.

The top silicon wafer manufacturers are:

-

SUMCO Corporation

-

GlobalWafers Co., Ltd.

-

Siltronic AG

-

Wafer Works Corporation

-

Okmetic Oy

Profitability depends on several factors including market demand, manufacturing efficiency, pricing strategy, raw material cost management, and operational scale. Profit margins usually improve with capacity expansion and increased capacity utilization rates.

Cost components typically include:

-

Land and Infrastructure

-

Machinery and Equipment

-

Building and Civil Construction

-

Utilities and Installation

-

Working Capital

Break even in a silicon wafer manufacturing business typically range from 5 to 8 years, depending on scale, regulatory compliance costs, raw material pricing, and market demand. Efficient manufacturing and export opportunities can help accelerate returns.

Governments may offer incentives such as capital subsidies, tax exemptions, reduced utility tariffs, export benefits, or interest subsidies to promote manufacturing under various national or regional industrial policies.

Financing can be arranged through term loans, government-backed schemes, private equity, venture capital, equipment leasing, or strategic partnerships. Financial viability assessments help identify optimal funding routes.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization