Silane Market Size, Share, Trends and Forecast by Product, Application, End Use Industry, and Region, 2025-2033

Silane Market Size and Share:

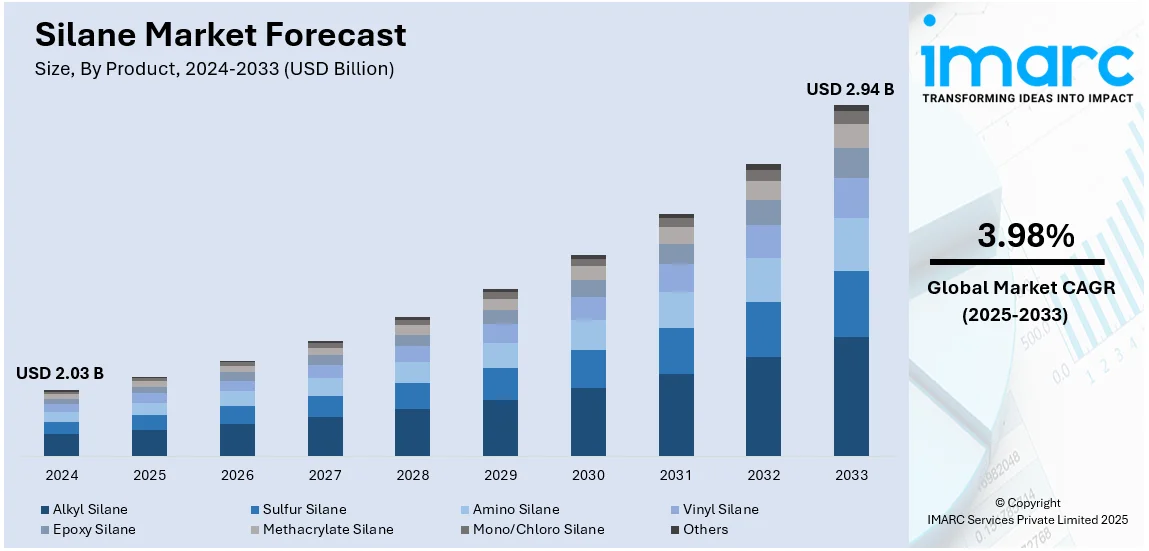

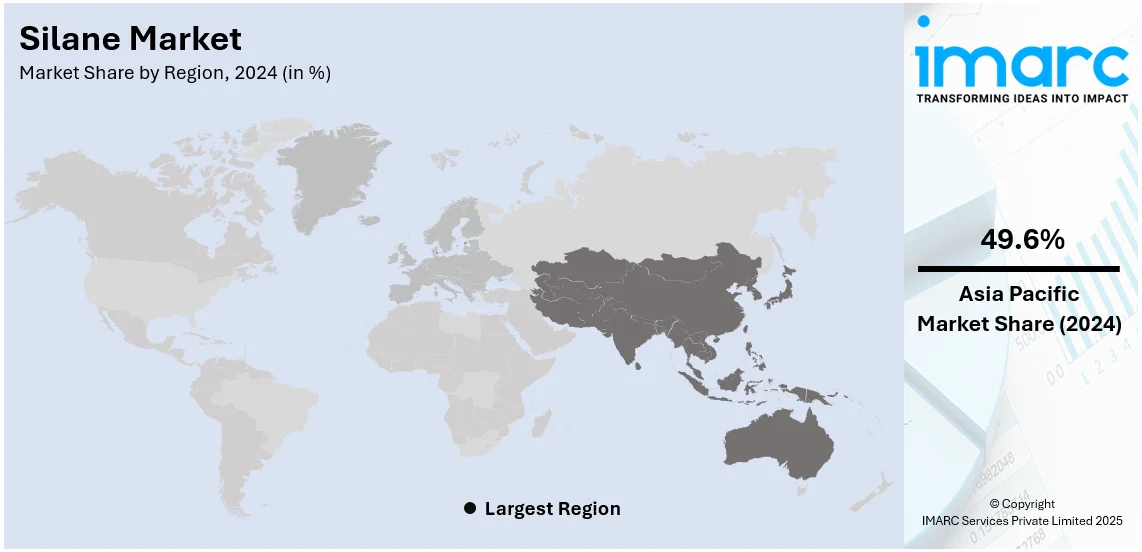

The global silane market size was valued at USD 2.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.94 Billion by 2033, exhibiting a CAGR of 3.98% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 49.6% in 2024. The market growth and forecast are primarily driven by the increasing demand for silane in semiconductor manufacturing, and the rising adoption of silane in solar energy for efficient photovoltaic cells. Additionally, its expanding use in automotive applications, where it enhances tire performance, fuel efficiency, and vehicle coatings for durability and protection, is favoring the silane market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.03 Billion |

| Market Forecast in 2033 | USD 2.94 Billion |

| Market Growth Rate (2025-2033) | 3.98% |

The global silane market is driven by increasing demand from key industries such as construction, automotive, and electronics. In construction, silanes are widely used in adhesives, sealants, and coatings to enhance durability and weather resistance. The automotive sector relies on silanes for tire manufacturing and surface treatment to improve fuel efficiency and performance. Additionally, the growing electronics industry utilizes silanes in semiconductor manufacturing and as coupling agents in advanced materials. Rising investments in infrastructure development, coupled with the shift toward sustainable and high-performance materials, further propel silane market growth. On 10th February 2025, The Mumbai Metropolitan Region Development Authority (MMRDA) entered into an agreement with Brookfield Corporation as part of the groundbreaking effort to enhance infrastructure in the region, which encompasses metro, roads, and logistics centers, in a move that could pave the way for USD 12 Billion investment under Mumbai 3.0. Formalized at the World Economic Forum in Davos, this agreement is significantly higher than other major investments and synonymous with Maharashtra’s target of achieving a USD 1 Trillion economy. Currently, MMRDA's estimated contribution stands at USD 300 Billion, which is likely to bolster urban connectivity further, catalyze industrial expansion, and positively impact sectors such as construction, logistics, and materials, including developments. Technological advancements and expanding applications in emerging economies are creating a positive silane market outlook.

The United States stands out as a key regional market, primarily driven by increasing demand from renewable energy sectors, particularly solar panel manufacturing, where silane is used in photovoltaic cell production. The growing emphasis on green energy solutions and federal incentives for clean energy adoption further enhance this demand. Additionally, the paints and coatings industry utilize silanes for water repellency and corrosion protection, driven by infrastructure upgrades and maintenance activities. The healthcare and personal care sectors also contribute to market growth, with silanes being used in medical devices and cosmetic formulations. Technological advancements and R&D investments in specialty chemicals further expand silane silane market demand. On 20th September 2024, the U.S. Department of Energy announced that Group14 Technologies was selected to enter into negotiations for a USD 200 Million award to develop a 7,200-metric-ton silane gas manufacturing facility in Moses Lake, Washington. The project, funded by the Bipartisan Infrastructure Law, aims to reduce reliance on China for silane, a key ingredient in next-generation silicon batteries. With a production capacity of more than 30 GWh, Group14 is well positioned to elevate the United States' standing in the silicon-based electric vehicle battery material marketplace.

Silane Market Trends:

Growing Demand for Electronics and Semiconductors

Rapid product utilization in the semiconductor and electronics industries is providing an impetus to the market. For processes such as chemical vapor deposition (CVD) and plasma-enhanced CVD, silane is essential as a raw ingredient used in the fabrication of integrated circuits and semiconductors (PECVD). The product use is driven by the rapid development of technologies such as artificial intelligence, the Internet of Things, and 5G, which rely on high-performance electronic components. According to reports, during the third quarter of 2024, 163 Million 5G subscriptions were added to reach a total of 2.1 Billion. Additionally, it is essential for the production of thin films and the improvement of component performance in semiconductor manufacturing, propelled by the increasing miniaturization of electronic devices.

Rising Use in Renewable Energy Technologies

The market is also expanding from the increasing use of the product in renewable energy technologies, especially in the solar (photovoltaic) industry. According to International Energy Association, global energy investment is set to exceed USD 3 Trillion for the first time in 2024. Thin-film solar cells, which are essential for creating more flexible and efficient solar panels, are made primarily of silane. The paper "Life cycle analysis of silane recycling in amorphous silicon-based solar photovoltaic manufacturing" emphasizes the benefits of recycling silane, which lowers silane loss from 85% to 17%, in terms of both cost and environmental impact. This procedure saves Millions of dollars a year in single-junction and tandem solar systems by reducing energy consumption, CO2 emissions, and raw silane costs by 68%. The demand for the product has increased due to increased investments in solar energy and the focus of governments and companies on sustainability and lowering carbon footprints.

Expanding Applications in Automotive Industry

Due to silane's performance-enhancing qualities, the automobile sector is using it in increasing quantities, particularly in the production of tires and vehicle coatings. Through its role as a coupling agent in silica-filled compounds during tire production, the product improves wet traction and lowers rolling resistance, both of which increase fuel efficiency and tire longevity. According to India Brand Equity Foundation, the automobile sector received a cumulative equity FDI inflow of about USD 35.65 Billion between April 2000 - December 2023. As automakers work towards increased sustainability and energy efficiency, these advantages are vital. It is also added to automotive coatings to ensure that vehicles last a long time by providing excellent protection against corrosion, wear, and environmental conditions. The requirement for lightweight, high-performance materials is increasing as the industry shifts towards electric vehicles (EVs). It is a crucial component in addressing the changing needs of contemporary automobile design and manufacture due to its capacity to improve durability and efficiency.

Silane Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global silane market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end use industry.

Analysis by Product:

- Alkyl Silane

- Sulfur Silane

- Amino Silane

- Vinyl Silane

- Epoxy Silane

- Methacrylate Silane

- Mono/Chloro Silane

- Others

Mono/chloro silane stand as the largest component in 2024, holding around 37.6% of the market due to their versatile applications across multiple industries. These compounds are widely used as precursors in the production of silicones, which are essential in manufacturing adhesives, sealants, and coatings for construction and automotive sectors. Their role in surface treatment and modification enhances material performance, making them indispensable in electronics and renewable energy applications, such as solar panel production. Additionally, mono and chloro silanes are critical in the synthesis of specialty chemicals and advanced materials. Their cost-effectiveness, coupled with superior properties such as water repellency and adhesion promotion, drives their widespread adoption, solidifying their position as the leading product segment in the global silane market.

Analysis by Application:

- Coupling Agents

- Adhesion Promoters

- Hydrophobing and Dispersing Agents

- Moisture Scavengers

- Silicate Stabilizers

- Others

Coupling agents leads the market in 2024, driven by their critical role in enhancing the performance of composite materials. These agents are widely used to improve adhesion between organic and inorganic materials, making them essential in industries such as construction, automotive, and electronics. In construction, they are integral to adhesives, sealants, and coatings, ensuring durability and weather resistance. The automotive sector relies on coupling agents for tire manufacturing and surface treatments to enhance strength and longevity. In electronics, they facilitate the production of advanced materials and semiconductors. Their ability to optimize material properties, such as mechanical strength and thermal stability, underscores their dominance in the market, supported by growing demand for high-performance and sustainable solutions.

Analysis by End Use Industry:

- Paints and Coatings

- Electronics and Semiconductors

- Rubber and Plastics

- Adhesives and Sealants

- Others

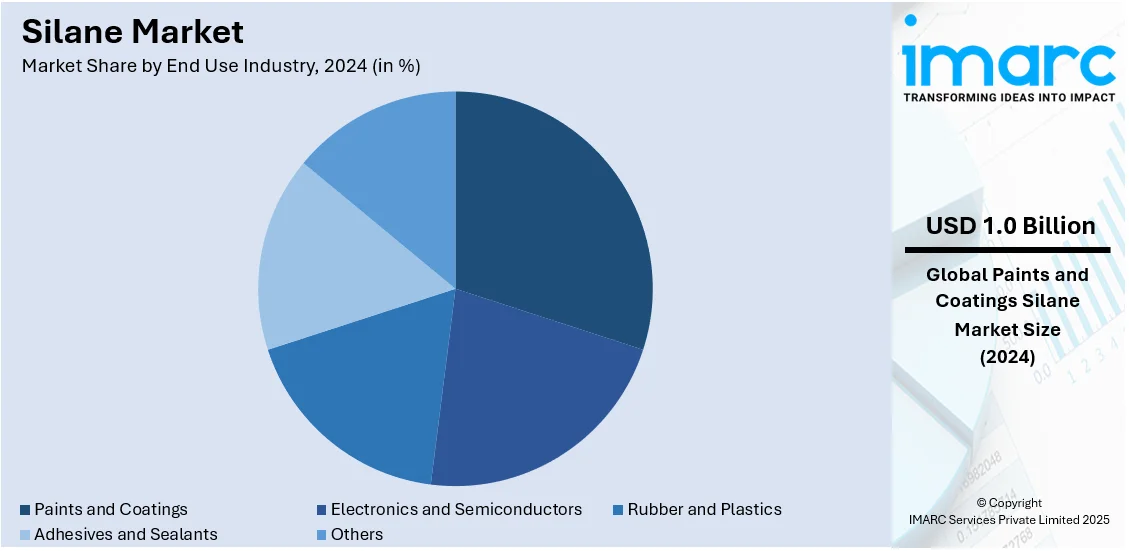

Paints and coatings lead the market with around 28.5% of market share in 2024, driven by the growing demand for high-performance and durable surface solutions. Silanes are extensively used in this sector to enhance properties such as adhesion, water repellency, and corrosion resistance, making them vital for both protective and decorative applications. The construction industry's need for weather-resistant coatings and the automotive sector's demand for durable finishes further fuel this growth. Additionally, rising infrastructure development, renovation activities, and the push for eco-friendly coatings contribute to the segment's expansion. Silanes' ability to improve product longevity and performance ensures their widespread adoption, solidifying paints and coatings as the dominant end-use industry in the silane market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 49.6%. This is due to the region's fast industrialization, rising building activity, and rising need for sophisticated materials in the electronics and automotive industries. Furthermore, the growth of their electronics and renewable energy sectors has made nations such as China, Japan, and South Korea prominent players. The usage of silane-based solutions is enhanced, for example, by China's extensive infrastructure initiatives and the need for long-lasting building materials. Moreover, the region's growing focus on electric vehicle production further supports the demand for silane in battery technologies.

Key Regional Takeaways:

United States Silane Market Analysis

The growing adoption of silane in the United States is largely driven by the expanding and growing investment in automotive sector, where silane is increasingly being used in the production of tires, adhesives, and coatings. For instance, since the start of 2021, auto manufacturers have announced investments of more than USD 75 Billion in the U.S. The automotive industry's focus on improving vehicle durability, fuel efficiency, and performance has led to a higher demand for silane-based solutions. Additionally, the push towards electric vehicles (EVs) has also resulted in a rise in demand for silane in various components including batteries and electronics. Silane's unique properties, including its ability to improve the bonding of materials such as rubber and plastics, have made it a crucial ingredient in meeting the automotive industry's stringent requirements. The need for high-quality, high-performance materials has therefore significantly increased the demand for silane in this sector, contributing to its increased adoption.

Asia Pacific Silane Market Analysis

In the Asia-Pacific region, the growing adoption of silane is closely linked to the rapid expansion of the electronics industry. According to India Brand Equity Foundation, India, considered a popular manufacturing hub, has grown its domestic electronics production from USD 29 Billion in 2014-15 to USD 101 Billion in 2022-23. As electronics continue to advance, there is an increasing demand for silane in the production of semiconductors, displays, and other electronic devices. Silane is crucial in ensuring the integrity and performance of these products due to its ability to enhance the bonding and insulating properties of materials. The rising demand for consumer electronics and the shift towards more efficient, compact devices are further fueling the growth of the silane market in the region. The strong presence of major electronics manufacturers and the continued push for technological innovations ensure that silane will play a vital role in supporting this industry's growth.

Europe Silane Market Analysis

In Europe, the rising adoption of silane is driven by the growing emphasis on solar energy for efficient photovoltaic cells. According to reports, 65.5 GW of solar has been installed in 2024, just beating the 2023 record of 62.8 GW of new solar. Silane plays a pivotal role in enhancing the performance and longevity of solar panels by improving the adhesion and stability of the materials used. With the increasing demand for renewable energy sources, European countries are investing heavily in the development of solar power, further improving the adoption of silane in the production of high-performance photovoltaic cells. The growing focus on reducing carbon footprints and transitioning to sustainable energy solutions is encouraging the use of silane in solar applications, as it helps in creating more efficient and durable solar technologies. As solar energy continues to gain traction in Europe, the demand for silane in the renewable energy sector is expected to rise, contributing to the growth of the market.

Latin America Silane Market Analysis

In Latin America, the growing investment in the semiconductor industry is driving the increased adoption of silane. For instance, US invested USD 500 Million Latin American semiconductor industry over five years, which is expected to enhance semiconductor ATP capabilities. The semiconductor industry relies on silane in the manufacturing of high-performance chips and electronic components, where it serves as a vital precursor in the production of integrated circuits. As Latin American countries focus on expanding their semiconductor manufacturing capabilities, there is a growing demand for silane to meet the needs of this technologically advanced industry. The investments aimed at bolstering the regional semiconductor market are likely to accelerate the adoption of silane, fostering the development of a robust electronic manufacturing ecosystem in the region.

Middle East and Africa Silane Market Analysis

In the Middle East and Africa, the growing construction sector is significantly driving the adoption of silane. According to reports, Saudi Arabia's construction sector is booming, with over 5,200 projects currently underway, valued at USD 819 Billion. Silane's properties make it ideal for use in the construction industry, particularly in applications such as concrete waterproofing, surface treatment, and coatings. As the construction industry experiences growth due to increased urbanization and infrastructure development, the demand for silane-based products is rising. Silane helps improve the durability and longevity of building materials, making it essential in creating structures that withstand harsh environmental conditions. The continued expansion of the construction sector in the region is therefore expected to further improve the adoption of silane in various applications.

Competitive Landscape:

The competitive landscape of the silane market is characterized by intense rivalry among key players striving to expand their market share through strategic initiatives. Companies are focusing on research and development to innovate advanced silane-based products tailored to diverse industrial applications. Strategic partnerships, mergers, and acquisitions are common as firms aim to enhance their production capabilities and geographic reach. Additionally, investments in sustainable and eco-friendly solutions are gaining traction to meet changing regulatory and consumer demands. Market players are also prioritizing capacity expansions and technological advancements to cater to growing demand from end-use industries such as construction, automotive, and electronics, ensuring a competitive edge in this dynamic market.

The report provides a comprehensive analysis of the competitive landscape in the silane market with detailed profiles of all major companies, including:

- Air Products Inc.

- Dow Inc.

- Evonik Industries AG

- Gelest Inc. (Mitsubishi Chemical Holdings Corporation)

- Momentive Performance Materials Inc.

- Nanjing Shuguang Chemical Group Co. Ltd.

- Power Chemical Corporation

- Rheinmetall AG

- Shin-Etsu Chemical Co. Ltd.

- Silar

- Tokyo Chemical Industry Co. Ltd.

- Wacker Chemie AG

Latest News and Developments:

- September 2024: A subsidiary of REC Silicon ASA and Sila Nanotechnologies signed a multi-year supply arrangement for premium US-produced silane. To fulfil their commitments to suppliers such as Mercedes-Benz and Panasonic, Sila will employ this silane to produce its Titan Silicon anode material. With its battery materials, Sila hopes to spearhead the global shift to renewable energy, while REC Silicon is a leading supplier of high-purity silicon materials.

- September 2024: Group14 Technologies secured a USD 200 Million grant to build a silane gas production plant in Moses Lake, Washington. The facility will produce 7,200 metric tons annually, supporting U.S. battery material manufacturing and reducing reliance on foreign silane sources.

- August 2023: Evonik expanded its rubber silanes production capacity at its joint venture plant, Evonik Lanxing (Rizhao) Chemical Industrial Co., Ltd. in China. This expansion aims to meet the growing demand for silane-based additives used in improving the performance and durability of rubber products in diverse sectors.

- March 2024: Cortec Europe launched MCI-2018 X, a 100% silane penetrating water repellent for concrete surfaces. This product enhances concrete durability by forming a hydrophobic layer, reducing moisture and chloride ingress, and is ideal for structures including parking garages, bridge decks, and historical restorations.

- May 2024: KCC Corporation acquired Momentive Performance Materials, a global leader in high-performance silicones and specialty solutions. The acquisition strengthens KCC’s portfolio in silane-based solutions, expanding their reach in high-tech applications, including coatings, adhesives, and automotive industries.

- April 2024: Shin-Etsu Chemical Co., Ltd. acquired Setex Technologies, Inc., which specializes in materials with strong friction and adhesion properties. This acquisition aims to enhance Shin-Etsu’s capabilities in producing advanced silane-based materials, improving performance across various industrial applications.

Silane Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Alkyl Silane, Sulfur Silane, Amino Silane, Vinyl Silane, Epoxy Silane, Methacrylate Silane, Mono/Chloro Silane, Others |

| Applications Covered | Coupling Agents, Adhesion Promoters, Hydrophobing and Dispersing Agents, Moisture Scavengers, Silicate Stabilizers, Others |

| End Use Industries Covered | Paints and Coatings, Electronics and Semiconductors, Rubber and Plastics, Adhesives and Sealants, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Products Inc., Dow Inc., Evonik Industries AG, Gelest Inc. (Mitsubishi Chemical Holdings Corporation), Momentive Performance Materials Inc., Nanjing Shuguang Chemical Group Co. Ltd., Power Chemical Corporation, Rheinmetall AG, Shin-Etsu Chemical Co. Ltd., Silar, Tokyo Chemical Industry Co. Ltd., Wacker Chemie AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the silane market from 2019-2033.

- The silane market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the silane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The silane market was valued at USD 2.03 Billion in 2024.

IMARC estimates the silane market to exhibit a CAGR of 3.98% during 2025-2033, reaching a value of USD 2.94 Billion by 2024.

The market is driven by growing demand in semiconductor manufacturing, increasing adoption in solar energy applications, and rising usage in automotive coatings and tire production. Additionally, infrastructure expansion, advancements in specialty chemicals, and the shift toward high-performance and sustainable materials are key growth factors.

Asia-Pacific currently dominates the silane market, accounting for a share exceeding 49.6% in 2024. This dominance is fueled by rapid industrialization, expanding construction activities, and high demand for advanced materials in the electronics and automotive sectors.

Some of the major players in the silane market include Air Products Inc., Dow Inc., Evonik Industries AG, Gelest Inc. (Mitsubishi Chemical Holdings Corporation), Momentive Performance Materials Inc., Nanjing Shuguang Chemical Group Co. Ltd., Power Chemical Corporation, Rheinmetall AG, Shin-Etsu Chemical Co. Ltd., Silar, Tokyo Chemical Industry Co. Ltd., and Wacker Chemie AG, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)