Signal Generator Market Size, Share, Trends and Forecast by Product, Technology, Application, End-Use, and Region, 2025-2033

Signal Generator Market Size and Share:

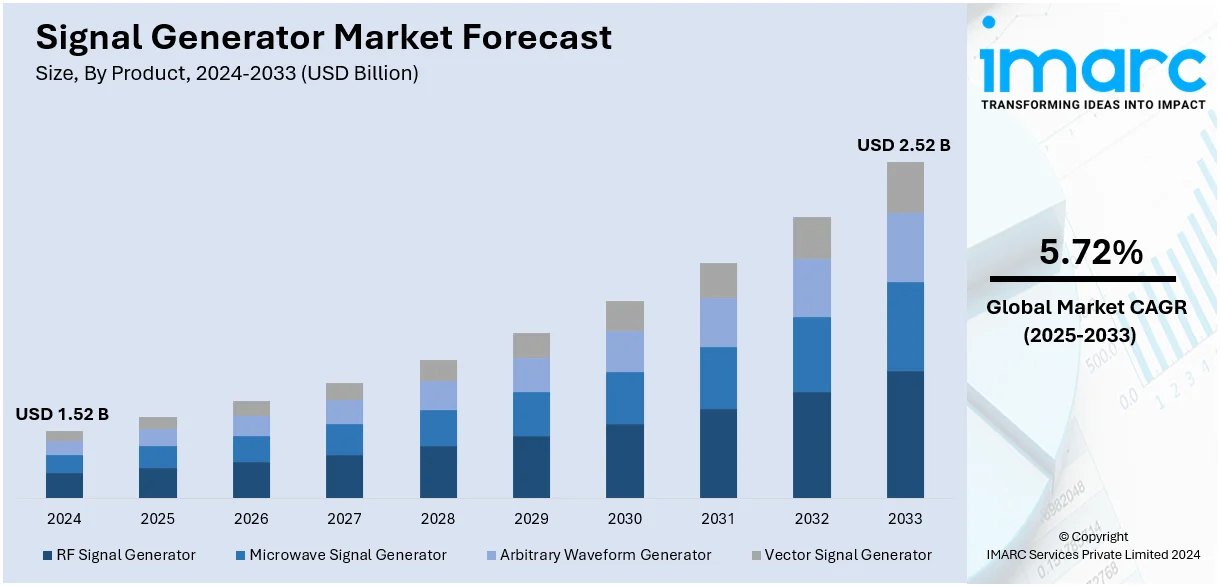

The global signal generator market size was valued at USD 1.52 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.52 Billion by 2033, exhibiting a CAGR of 5.72% from 2025-2033. North America currently dominates the market. The market is experiencing steady growth driven by the escalating demand for higher data rates and frequency bands, rising use in the aerospace and defense industries, and the increasing utilization of signal generators in academic institutions and research laboratories.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.52 Billion |

|

Market Forecast in 2033

|

USD 2.52 Billion |

| Market Growth Rate (2025-2033) | 5.72% |

The global market is experiencing significant growth primarily driven by growing demand for advanced testing solutions in telecommunications, electronics, and aerospace. The rise of wireless technologies like 5G and Internet of Things (IoT) increased the need for precise signal testing tools. On November 11, 2024, Keysight Technologies, in collaboration with Virginia Diodes Inc., announced the expansion of its FieldFox handheld signal analyzers to support mmWave frequencies up to 170 GHz. This lightweight, cost-efficient solution addresses the limitations of traditional desktop tools for 5G, 6G, aerospace, and automotive testing. Additionally, continual advancements in automotive technologies, such as ADAS and EVs, coupled with increased research and development (R&D) activities and multi-channel innovations, are fueling market growth.

The United States stands out as a key market and is experiencing significant growth due to continual advancements in wireless communication technologies, such as private 5G networks and satellite communication. The modernization of defense infrastructure has driven demand for radar, electronic warfare, and navigation testing solutions, which is creating lucrative opportunities in the market. On June 11, 2024, Tabor Electronics introduced the Proteus EW series Arbitrary Waveform Transceivers, featuring 10GHz signal generation, 4.5GHz transmission bandwidth, and real-time adaptability. This scalable, cost-effective solution enhances radar and electronic warfare applications. Federal initiatives boosting semiconductor manufacturing and the automotive sector's focus on autonomous vehicles and connected technologies are further propelling the market. Moreover, increased investments in renewable energy and innovations in healthcare imaging systems contribute to the expanding adoption of advanced signal testing tools.

Signal Generator Market Trends:

Technological Advancements

Continuous technological advancements and the development of Industry 4.0 represent one of the primary factors propelling the market growth. Additionally, the advent of software-defined signal generators and their expanding applications across various industries like telecommunications are offering a favorable market outlook. SDSGs leverage software algorithms to generate signals, enabling greater flexibility and adaptability. It allows users to customize signal parameters, such as frequency (ranging up to 100 GHz), amplitude, and modulation, through software interfaces. It also aids in reducing the need for complex hardware configurations and allows for easy updates and improvements. Along with this, the escalating demand for higher data rates and frequency bands is encouraging signal generators to offer extended frequency ranges. These generators can generate signals in the microwave and millimeter-wave frequencies for applications like fifth generation (5G) wireless communication and radar systems. Furthermore, the integration of signal generators with emerging technologies, such as Artificial Intelligence (AI) and the Internet of Things (IoT) is influencing the market growth. AI-driven signal generators can autonomously adjust signal parameters based on real-time feedback, optimizing test processes, and reducing human intervention. As per an industry report, the IOT market is expected to expand at a yearly growth rate of 10.49% from 2024 to 2029. IoT integration allows for remote monitoring and control of signal generators, enhancing efficiency in distributed testing scenarios.

Increasing Utilization in Aerospace and Defense and Automotive Industries

The rising use of signal generators in the aerospace and defense industries is offering a favorable market outlook. They are employed in radar testing, electronic warfare, and the development of communication systems for military applications. In addition, the increasing need for precise and reliable signal generators is influencing the market positively. Additionally, the constant advancements in military technology are driving the need for signal generators that can keep up with the changing requirements. In line with this, the rising reliance of the automotive industry on signal generators for testing and validating various electronic components, such as sensors, communication modules, and infotainment systems is supporting the growth of the market. Apart from this, the emergence of connected and autonomous vehicles is catalyzing the demand for signal generators capable of emulating complex automotive signals, like radar and LiDAR systems, which typically operate at frequencies between 76 and 81 GHz. Signal generators enable automakers and technology providers to test these systems rigorously under various conditions, including adverse weather and challenging road scenarios.

Expanding Applications in Research and Development

The expanding applications of signal generators in research and development (R&D) activities across various industries are creating a positive outlook for the market. In addition to this, the rising reliance of engineers and researchers on signal generators to prototype and test new concepts is contributing to the market growth. These generators provide adjustable signal parameters, including phase accuracy within ±0.5 degrees and modulation rates up to 100 Mbps, catering to varied experimental needs. Researchers can easily adjust signal parameters, such as frequency, amplitude, modulation, and phase, to match the requirements of their experiments. This adaptability enables them to explore a wide range of scenarios and test hypotheses effectively. Moreover, the digital transformation of industries like healthcare, manufacturing, and transportation relies heavily on R&D activities, which drives the demand for developing the electronic components and systems. Furthermore, the increasing utilization of signal generators in academic institutions and research laboratories to support scientific discoveries and innovation across a wide range of disciplines is favoring the market growth.

Signal Generator Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global signal generator market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product, technology, application, and end-use.

Analysis by Product:

- RF Signal Generator

- Microwave Signal Generator

- Arbitrary Waveform Generator

- Vector Signal Generator

RF signal generator leads the market with 36.9% of the market share in 2024. RF signal generators are widely used in generating radio frequency signals typically within the range of 9 kHz to several gigahertz (GHz). These generators are employed for various applications, including wireless communication, aerospace, and defense. RF signal generators offer enhanced precision in creating modulated and unmodulated signals, making them essential tools for testing RF devices, transceivers, and antennas.

Analysis by Technology:

- Global System for Mobile Phones (GSM)

- Code Division Multiple Access (CDMA)

- Wideband Code Division Multiple Access (WCDMA)

- Long Term Evolution (LTE)

- Others

Global System for Mobile Phones (GSM) dominated the market with 44.1% of the market share in 2024. GSM is one of the earliest and most widely adopted cellular communication standards. Signal generators catering to GSM technology generate signals conforming to the GSM standard, which operates in various frequency bands globally. These generators find applications in testing and validating GSM-based devices such as mobile phones, base stations, and IoT modules, ensuring their compatibility and performance within GSM networks.

Analysis by Application:

- Designing

- Testing

- Manufacturing

- Troubleshooting

- Repairing

- Others

Designing accounts for majority of the market with 36.0% of the market share in 2024. Designing accounts for the majority of the signal generator market as signal generators are essential tools in the development of electronic systems, circuit designs, and communications equipment. During the design phase, engineers use signal generators to simulate real-world signals, test components under varying conditions, and validate the performance of circuits and systems. These devices enable precise control over frequency, waveform, and amplitude, making them indispensable for accurate prototyping and product development. As such, the demand for signal generators in designing is higher compared to other applications like testing or troubleshooting.

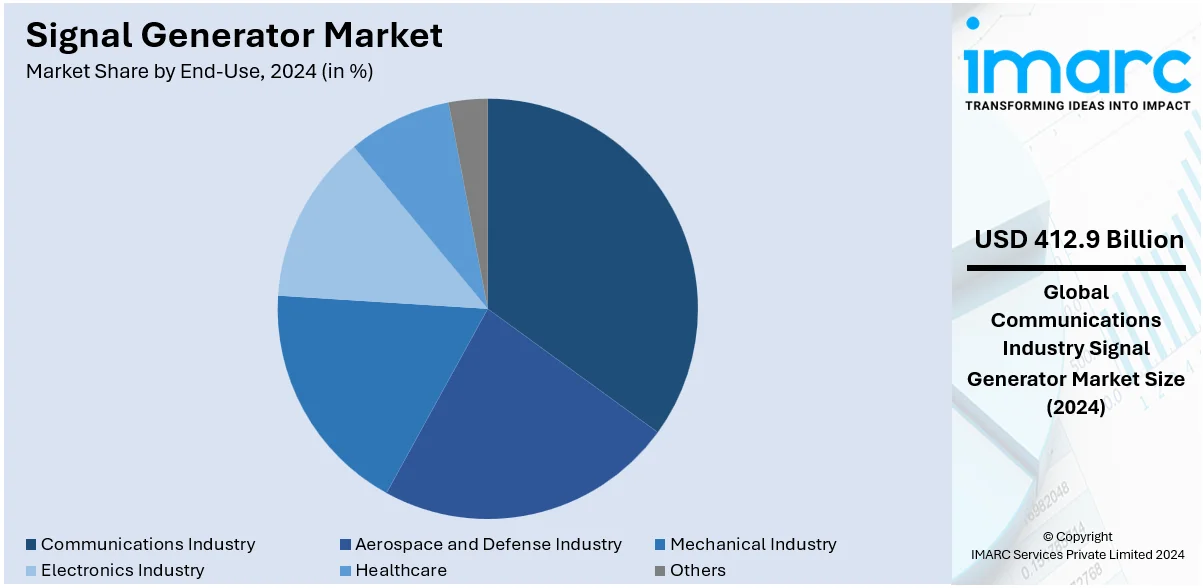

Analysis by End-Use:

- Communications Industry

- Aerospace and Defense Industry

- Mechanical Industry

- Electronics Industry

- Healthcare

- Others

Communications industry holds the highest market with 27.2% of the share in 2024. The communications industry relies on signal generators for testing and calibration of various devices. In addition to this, signal generators help ensure the reliability and performance of communication networks, including 5G, Wi-Fi, and optical fiber systems. They play a pivotal role in designing, troubleshooting, and maintaining these networks, making them indispensable tools for this sector.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share accounting for 37.1%. North America represents a significant portion of the signal generator market driven by the strong presence of technology-driven industries, including telecommunications, aerospace, and automotive. Signal generators in this region cater to advanced research and development (R&D), testing, and manufacturing needs. Additionally, the escalating demand for signal generators due to continuous technological advancements and focus on quality assurance is driving the market. Moreover, North America is a key hub for innovation, making it a prominent market for signal generator applications across various sectors.

Key Regional Takeaways:

United States Signal Generator Market Analysis

In 2024, the U.S. market holds 88.00% market share of the total North America signal generator market. The market in U.S. is growing with increasing technological innovations and demand from various industries such as telecommunication, defense, and electronics. According to the U.S. Department of Defense, the budget for the U.S. military in 2023 reached USD 820.3 Billion, which included an important amount towards communications and radar technologies that require advance signal generation equipment. Other big players in the industry, such as Keysight Technologies and Anritsu Corporation, help drive innovation with compact and efficient signal generators. Pushes in terms of 5G technologies from the U.S. government and focus on the aspects of cybersecurity are fueling the adoption of more complex signal generators, propelling the country to the top among global markets.

Europe Signal Generator Market Analysis

The signal generator market in Europe has been experiencing growth due to increased investments in the infrastructure and defense technology. According to a report by the European Commission, the defense budget in Europe was approximately at USD 318 Billion in 2023. Germany and France are at the top and are focusing more on radar and communications technology. The demand for high-performance signal generators is growing in the R&D application of the civilian sector. Advanced signal generators demand has been robust in Germany, as its robust manufacturing base is concerned, according to the German Electronics Association. Rohde & Schwarz and Thales are some of the leading players involved in innovations concerning software-defined radios and portable signal generation solutions. Moreover, the market is being augmented by the increasing adoption of 5G networks and the push towards autonomous systems, making it a very strong competitor on a global level.

Asia Pacific Signal Generator Market Analysis

The Asia Pacific signal generator market is growing rapidly with increasing demand from industries like telecommunications, electronics, and defense. According to China's defense budget for 2023, it was estimated at USD 224 Billion, with a significant portion allocated to the modernization of radar and communication technologies. The Indian defense budget for the financial year 2023-2024 was stated at USD 72.6 Billion. Most emphasis is on developing an advanced radar system, which is increasing signal generation tool demand in the market. The telecommunications market, with Japan and South Korea already setting the pace in developing the 5G networks, is expected to have an annual growth rate of 14% (as quoted in an industrial report). There have been significant inroads with companies like National Instruments and Keysight Technologies into this region, innovating their works in signal generation applications right from automotive to aerospace applications. The increasing investments in research and development and the associated government-backed infrastructure projects stimulate the growth of the market of signal generators in this region.

Latin America Signal Generator Market Analysis

The Latin America signal generator market is growing given the enhanced defense budgets and the implementation of the latest telecommunication technologies. According to an industrial report, Brazil's defense budget 2022 was USD 21.8 Billion; investments went into military modernization, which includes upgrading radar and communication systems. Civilian demand is also on the rise as countries such as Brazil and Mexico engage in expanding their telecommunication networks as well as building up 5G infrastructure. The growth of industries like automotive and electronics further strengthens the demand for signal generators. Local players such as Embraer and Siemens Brazil are contributing to market innovation, focusing on signal testing and research applications. The rise of smart cities and increased government investments in infrastructure development are expected to propel the signal generator market in Latin America.

Middle East and Africa Signal Generator Market Analysis

The Middle East and Africa regions are recording growth in the signal generator market due to regional defense spending and advancements in telecommunications. According to the International Trade Administration, the defense budget for Saudi Arabia in 2022 was projected to be USD 75.01 Billion. This is bound to inject investments into radar and communication systems. There is also a need for signal generators in the region due to rising technological infrastructure, particularly in the UAE and Qatar, which are currently developing 5G networks. Key players in this region are companies like Altran and Rohde & Schwarz, which offer cutting-edge signal generation solutions. The growth of military communications systems and growing demand for electronics and automotive testing in the Middle East and Africa will be the growth drivers.

Competitive Landscape:

The key players in the market are investing heavily in R&D activities to develop signal generators with higher frequency ranges, greater precision, and improved reliability. In addition to this, key players are expanding their global presence. They are establishing partnerships and distribution networks to reach new markets and customers. Along with this, several companies are offering customizable solutions to meet the specific needs of their clients. Additionally, they are enhancing their customer support services, providing training, and ensuring prompt technical assistance to maintain long-term relationships. Moreover, several market leaders are working on more energy-efficient signal generators and adopting eco-friendly manufacturing practices to align with global environmental concerns.

The report provides a comprehensive analysis of the competitive landscape in the signal generator market with detailed profiles of all major companies, including:

- Keysight Technologies Inc.

- Rohde & Schwarz Gmbh & Co Kg

- National Instruments Corporation

- Anritsu Corporation

- Tektronix Inc.

- Teledyne Technologies Incorporated

- B&K Precision Corporation

- Fluke Corporation

- Stanford Research Systems

- Good Will Instrument Co. Ltd

- Yokogawa Electric Corporation

Latest News and Developments:

- December 2024: GW Instek launched GSG-2000 Series RF Signal Generator on 9 December, which can generate frequencies from 9 kHz to 6 GHz, has phase noise at -117 dBc/Hz, and provides the facility of dual baseband generation. The device offers higher amplitude output, stability, and flexibility with options of OCXO for RF component testing and IoT applications.

- November 2024: Rohde & Schwarz and ETS-Lindgren are collaborating to bring enhanced OTA testing solutions for the next generation of wireless technologies by integrating the CMX500 and SMBV100B into EMQuest software. These CTIA-certified solutions support 5G FR1/FR2, Wi-Fi 7, A-GNSS, and more, supporting a full range of device testing and technology upgrade with readiness for new emerging wireless protocols.

- October 2024: Keysight Technologies, Inc. unveiled two handheld analog signal generators, RF and Microwave models, operating to 26 GHz. These lightweight tools have added depth to RF testing through their wide range of power (-120 dBm to +23 dBm), very low phase noise (-130 dBc/Hz), 20-µs switching speed, and complex modulation capabilities.

- September 2024: B&K Precision partnered with Gentek to represent its data acquisition recorders in the Southeast US, including Florida, Georgia, and other areas. The joint effort is geared toward comprehensive solutions for all data acquisition challenges, from sensor selection to complementary test products with end-to-end support.

- February 2021: Keysight Technologies, Inc., announced the acquisition of Sanjole, a leader in solutions for protocol decoding and interoperability of 4G, 5G and other wireless technologies.

Signal Generator Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | RF Signal Generator, Microwave Signal Generator, Arbitrary Waveform Generator, Vector Signal Generator |

| Technologies Covered | Global System for Mobile Phones (GSM), Code Division Multiple Access (CDMA), Wideband Code Division Multiple Access (WCDMA), Long Term Evolution (LTE), Others |

| Applications Covered | Designing, Testing, Manufacturing, Troubleshooting, Repairing, Others |

| End Uses Covered | Communications Industry, Aerospace and Defense Industry, Mechanical Industry, Electronics Industry, Healthcare, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Companies Covered | Keysight Technologies Inc., Rohde & Schwarz Gmbh & Co Kg, National Instruments Corporation, Anritsu Corporation, Tektronix Inc., Teledyne Technologies Incorporated, B&K Precision Corporation, Fluke Corporation, Stanford Research Systems, Good Will Instrument Co. Ltd, Yokogawa Electric Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the signal generator market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global signal generator market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the signal generator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The signal generator market was valued at USD 1.52 Billion in 2024.

IMARC estimates the signal generator market to exhibit a CAGR of 5.72% during 2025-2033, reaching USD 2.52 Billion by 2033.

The signal generator market is driven by growing demand for advanced testing solutions in telecommunications, aerospace, and automotive industries, and the rising adoption of wireless technologies such as 5G and IoT, which require precise signal testing. Additionally, increasing utilization in aerospace, defense, and academic research for radar, electronic warfare, and testing solutions is propelling the market.

North America currently dominates the signal generator market, accounting for a share exceeding 37.1%. This dominance is fueled by the region's advancements in telecommunications, aerospace, and defense industries, alongside significant investments in R&D and emerging technologies.

Some of the major players in the signal generator market include Keysight Technologies Inc., Rohde & Schwarz Gmbh & Co Kg, National Instruments Corporation, Anritsu Corporation, Tektronix Inc., Teledyne Technologies Incorporated, B&K Precision Corporation, Fluke Corporation, Stanford Research Systems, Good Will Instrument Co. Ltd, and Yokogawa Electric Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)