Sexually Transmitted Disease (STD) Diagnostics Market Size, Share, Trends and Forecast by Type, Device Type, End User, and Region, 2025-2033

Sexually Transmitted Disease (STD) Diagnostics Market Size and Share:

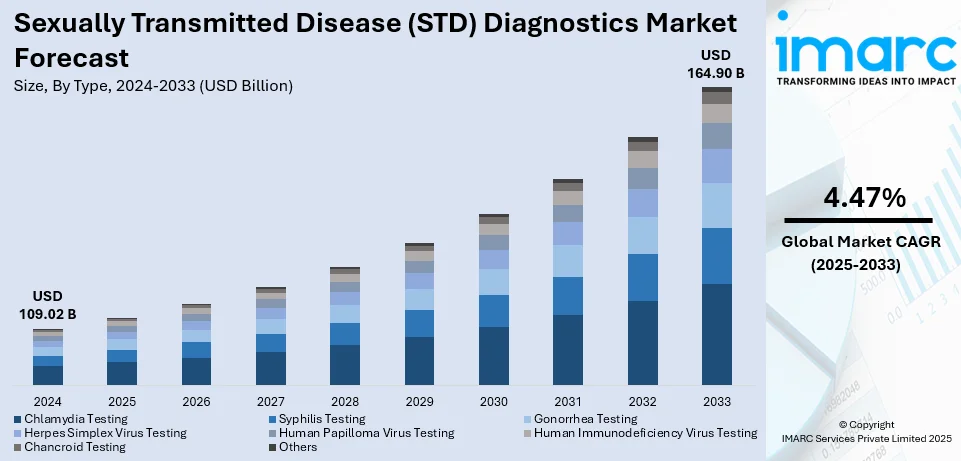

The global sexually transmitted disease (STD) diagnostics market size was valued at USD 109.02 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 164.90 Billion by 2033, exhibiting a CAGR of 4.47% from 2025-2033. North America currently dominates the market, holding a market share of over 36.8% in 2024. The sexually transmitted disease (STD) diagnostics market share is increasing due to rising prevalence of STDs, increasing awareness among the masses regarding early diagnosis, and the introduction of at-home STD testing kits.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 109.02 Billion |

|

Market Forecast in 2033

|

USD 164.90 Billion |

| Market Growth Rate (2025-2033) | 4.47% |

The sexually transmitted disease (STD) diagnostics market growth is expanding due to rising infection rates, adding mindfulness, and advancements in individual technologies. The growing frequence of chlamydia, gonorrhea, syphilis, HPV, and HIV has led to an advanced demand for early and accurate discovery methods. Governments and health associations are laboriously promoting screening programs and mindfulness campaigns, encouraging routine testing and reducing stigma. Technological advancements, similar as rapid point- of- care (POC) testing, molecular diagnostics, and AI- driven diagnostic tools, are perfecting the exactness and speed of STD finding. The shift toward home- grounded testing kits has also enhanced availability, feeding privacy-conscious individualities. Also, the expansion of telemedicine services is making STD diagnosis more accessible, allowing patients to consult doctors and take test results remotely. With adding backing for exploration and development, and growing public health initiatives, the STD diagnostics market is anticipated to witness sustained growth in the coming times.

The sexually transmitted disease (STD) diagnostics demand in the U.S. is expanding due to rising infection rates, increased mindfulness, and advancements in individual technology. The growing frequence of chlamydia, gonorrhea, syphilis, and HPV has led to advanced demand for early discovery and screening programs. Government initiatives and public health campaigns promoting routine STD testing have further fueled demand growth. Advancements in rapid-fire testing, PCR- grounded diagnostics, and at- home STD test kits are making screening more accessible and accessible. Telehealth services have also contributed to increased testing, allowing patients to take consultations and prescriptions remotely. Also, increased backing for sexual health clinics and research is driving invention in point- of- care diagnostics and AI- grounded testing results. With a shift toward preventative healthcare and bettered availability of testing services, the U.S. STD diagnostics market is anticipated to grow steadily, addressing the rising public health concerns and perfecting early discovery rates.

Sexually Transmitted Disease (STD) Diagnostics Market Trends:

Rising prevalence of STDs

The growing rate of sexually transmitted infections (STIs) worldwide is one of the major drivers for the demand of advanced diagnostic testing. The reasons include unprotected sexual activity, multiple sexual partners, and lack of awareness about preventive measures, which contribute to the rising infection rates. According to the World Health Organization, about 1 million people contract a STI daily. Every year, roughly 500 million people become infected with one of the four major STIs: chlamydia, gonorrhea, syphilis, or trichomoniasis. The increasing burden of these infections emphasizes the necessity for early and accurate diagnostic solutions. Governments and healthcare organizations are also encouraging STI screening programs, which are expected to further drive the demand for rapid and reliable diagnostic technologies, as reported by industry reports. Advances in molecular diagnostics, point-of-care testing, and self-testing kits have significantly boosted the market growth. Healthcare providers have been pushing hard to enhance early detection, treatment outcomes, and infection control measures.

Technological advancements in diagnostic methods

Innovations in diagnostic technologies have significantly improved the speed, accuracy, and accessibility of sexually transmitted disease (STD) detection, fueling market expansion. The development of nucleic acid amplification tests (NAATs), rapid diagnostic tests (RDTs), and at-home testing kits has revolutionized STD diagnostics by providing convenient and efficient testing solutions. These advancements are beneficial in underserved or remote areas where access to healthcare facilities is restricted. According to industry reports, the rising demand for early and reliable detection methods has accelerated investments in cutting-edge diagnostic solutions. According to the National Institute for Health and Care Research (NIHR) in the UK, in June 2023, Linear Diagnostics, a spinout from the University of Birmingham, secured funding to develop a rapid STI test. The company is working on a 20-minute test for diagnosing gonorrhea and chlamydia, addressing the urgent need for faster and more accessible STI diagnostics. Such technological breakthroughs are enhancing early detection efforts and improving patient outcomes, thereby driving market growth.

Increasing awareness and government initiatives

Increasing awareness and government initiatives are the main drivers of growth in the STD diagnostics market. Recent data indicates that STIs are on the rise in numerous areas. In 2022, WHO Member States announced an aim of reducing the annual number of syphilis cases by tenfold by 2030, from 7.1 million to 0.71 million. However, new syphilis cases in individuals aged 15 to 49 years increased by more than 1 million in 2022, reaching 8 million. The Americas and Africa experienced the most substantial increases. The initiative to reduce STI rates globally, ensuring universal access to prevention, care, and treatment, has greatly amplified the need for more efficient and accessible diagnostic tools. Further, the CDC's "Get Yourself Tested" campaign has played a very important role in encouraging regular STD testing, targeting high-risk populations, and spreading awareness about the importance of early detection. With more and more campaigns backed by governments to create a better-informed public that's demanding STD diagnosis services, these markets are being fueled. Rising focus on prevention and treatment coupled with regular testing will propel this market.

Sexually Transmitted Disease (STD) Diagnostics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sexually transmitted disease (STD) diagnostics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, device type, and end user.

Analysis by Type:

- Chlamydia Testing

- Syphilis Testing

- Gonorrhea Testing

- Herpes Simplex Virus Testing

- Human Papilloma Virus Testing

- Human Immunodeficiency Virus Testing

- Chancroid Testing

- Others

Chlamydia testing represented the largest segment due to the high frequence of the infection, wide screening programs, and asymptomatic nature of the complaint. Chlamydia is one of the most generally reported STDs globally, particularly among young grown-ups and sexually active beings, making routine screening essential. Unlike other STDs, chlamydia frequently presents no conspicuous symptoms, leading to delayed opinion and increased transmission rates. To combat this, health authorities similar as the CDC and WHO recommend regular chlamydia screening, especially for high- threat populations like sexually active women under 25.

Analysis by Device Type:

- Laboratory Devices

- Thermal Cycler – PCR

- Lateral Flow Readers

- Flow Cytometers

- Absorbance Microplate Reader – Enzyme Linked Immunosorbent Assay (ELISA)

- Others

- Point of Care (PoC) Devices

- Phone Chips (Microfluidics + ICT)

- Portable/Bench Top/Rapid Diagnostic Kits

Laboratory devices accounted for the largest market share due to their high accurateness, reliability, and capability to process large sample volumes. Unlike rapid-fire or at- home test kits, laboratory- grounded diagnostic systems similar as polymerase chain reaction (PCR), nucleic acid amplification tests (NAATs), and immunoassays offer superior perceptivity and particularity, assuring precise discovery of various STDs, including HIV, chlamydia, gonorrhea, and syphilis. Hospitals, individual centers, and public health laboratories count on these advanced technologies to give comprehensive screening, confirmational testing, and disease monitoring. also, ongoing advancements in automated testing systems, AI- powered diagnostics, and multiplex assays have further bettered laboratory effectiveness and turnaround time.

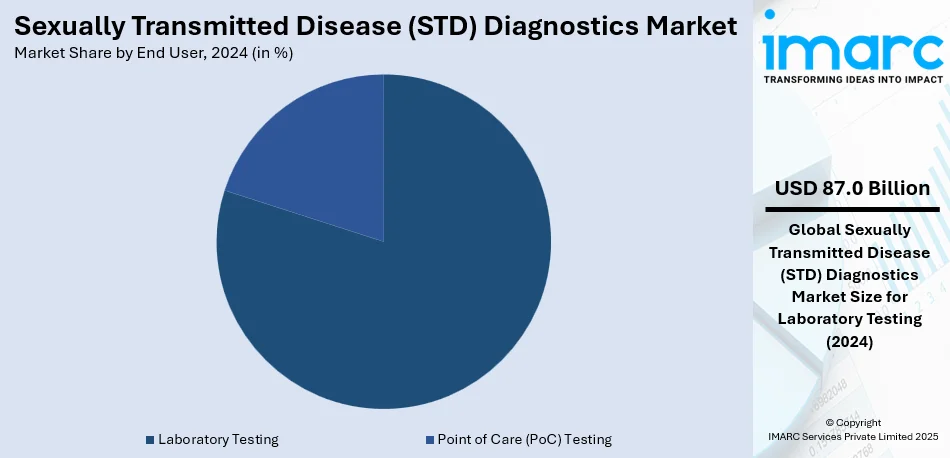

Analysis by End User:

- Laboratory Testing

- Point of Care (PoC) Testing

Laboratory testing dominates the sexually transmitted disease (STD) diagnostics market with a share of 79.8% due to its high accuracy, comprehensive testing capabilities, and ability to handle large sample volumes. Unlike rapid or at-home tests, lab-based diagnostics utilize advanced techniques such as PCR (Polymerase Chain Reaction), nucleic acid amplification tests (NAATs), and enzyme immunoassays (EIAs), ensuring greater sensitivity and specificity in detecting infections. Healthcare providers and public health agencies prefer laboratory testing for confirmatory diagnoses, particularly for asymptomatic cases, where accurate detection is critical. Moreover, laboratory facilities can test for multiple STDs simultaneously, making them the preferred choice for screening programs, hospitals, and sexual health clinics.

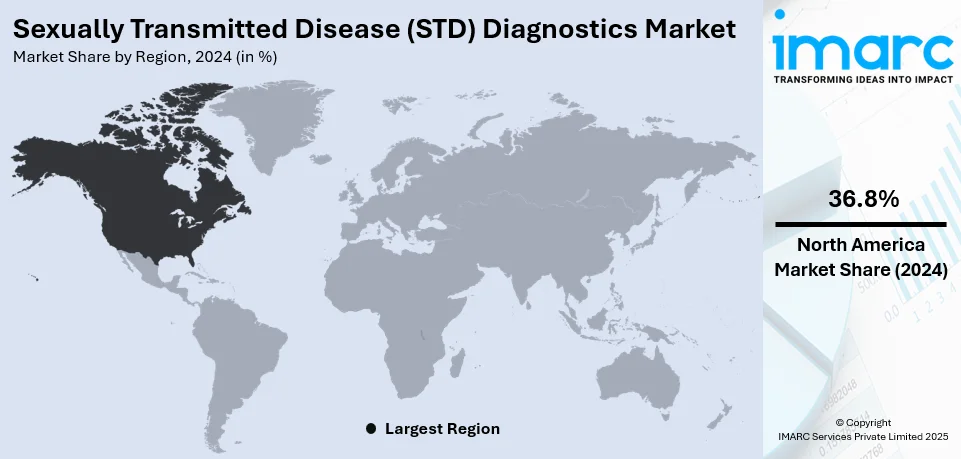

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.8% due to high infection rates, advanced healthcare infrastructure, and widespread awareness initiatives. The region has a significant burden of chlamydia, gonorrhea, syphilis, and HIV infections, driving the need for early diagnosis and routine screening programs. The U.S. and Canada have well-established public health initiatives promoting regular STD testing, supported by government funding and non-profit organizations. Programs by the Public Health Agency of Canada and the Centers for Disease Control and Prevention (CDC) ensure access to low-cost or free STD testing, increasing patient participation. Technological advancements, including PCR-based diagnostics, AI-driven screening, and at-home STD test kits, further contribute to market expansion.

Key Regional Takeaways:

United States Sexually Transmitted Disease (STD) Diagnostics Market Analysis

In 2024, the United States accounted for 94.3% of the sexually transmitted diseases (STDs) diagnostics market in North America. The rising cases of sexually transmitted diseases (STDs) in the United States are emerging as a growth factor for the STD diagnostics market. The Centers for Disease Control and Prevention (CDC) announced that recorded cases of gonorrhea, primary and secondary syphilis in the United States climbed by 10% and 7%, respectively, in 2020 compared to 2019, while congenital syphilis cases increased by over 15%. This alarming increase in infections has heightened the demand for more sophisticated diagnostic solutions, leading to investment in better testing technologies. In August 2020, the U.S. Food and Drug Administration (FDA) granted 510(k) approval to DiaSorin, Inc. for the LIAISON XL MUREX anti-HBe assay, which is a diagnostic test for the detection of HBV infections. The regulatory approvals for such innovative diagnostic tools have increased the access to high-precision testing that helps in the early detection of diseases and improves their management. The increasing STD burden, along with technological progress and regulatory assistance, is fueling the growth of the U.S. market.

Europe Sexually Transmitted Disease (STD) Diagnostics Market Analysis

An increasing number of tests for sexually transmitted infections (STIs) conducted across Europe is an important factor in the growth of the STD diagnostics market. According to a Public Health England report, the overall number of tests performed in 2020 in Sexual Health Services and other community-based settings to diagnose serious STIs was quite high. Chlamydia accounted for the bulk of the tests (161.67 thousand), followed by gonorrhea (57.08 thousand), first-episode genital warts (27.47 thousand), and first-episode genital herpes (20.53 thousand). Rising awareness of STI prevention, government initiatives for early detection, and the increased penetration of testing facilities throughout health care institutions are accelerating the growth rate of the market. On top of that, rapid advancements of digital health care and the availability of at-home STI testing have increased accessibility in distant areas. As investments in diagnostic technology and public health initiatives continue to intensify, reliance on effective and fast STD testing technologies will increase in Europe.

Asia Pacific Sexually Transmitted Disease (STD) Diagnostics Market Analysis

The Asia Pacific region is contributing a lot to the growth of the sexually transmitted disease diagnostics market, mainly because of the high incidence of Hepatitis C Virus infections. The Institute for New Era Strategy projects that around 641,000 people in Japan will be diagnosed with HCV by 2020. More than 530,000 of them were under the age of 80, with 157,000 under the age of 60. The high load of HCV cases, augmented awareness, and the government-sponsored initiative for detection of the diseases in the earliest stage have caused the demand to pick up. Additionally, increases in access, enhancement in test infrastructure, and uptake of nucleic acid amplification tests drive growth in this market. As countries in the region continue to strengthen public health policies and invest in cutting-edge STD diagnostic technologies, the Asia Pacific market is expected to witness substantial expansion in the coming years.

Latin America Sexually Transmitted Disease (STD) Diagnostics Market Analysis

The strengthening of sexually transmitted disease (STD) diagnostics market in Latin America is largely contributed by new diagnostic technologies. In 2022, the country of Brazil developed a new syphilis test in collaboration with Johns Hopkins University, Baltimore, U.S., and the University of Coimbra, Portugal. The new test diagnostic tool is expected to be more effective while relatively saving costs and will thereby receive widespread usage within the primary healthcare network. This test is fully integrated into the technological ecosystem of Brazil's Ministry of Health, ensuring seamless implementation and accessibility.

Cost-effective, high-speed diagnostic solutions are important in Latin America because high rates of syphilis prevalence and limited health resources demand efficient screening programs. With continued government and research institution investment in cutting-edge diagnostic technologies, governments continue to develop the region's diagnosis and disease management capabilities, creating significant expansion opportunities for the STD diagnostics market.

Middle East and Africa Sexually Transmitted Disease (STD) Diagnostics Market Analysis

A growing rate of sexually transmitted infections (STIs) in the Middle East and Africa is highly contributing to an increase in the demand for better diagnostic solutions. According to the National Institutes of Health, the three most frequent sexually transmitted infections in North Africa are bacterial vaginosis (31%), human papillomavirus (23%), and Candida spp. (15%). The high prevalence of these infections emphasizes the urgent need for enhanced screening and early detection methods in order to enhance the management of diseases and lower transmission rates.

Historically, limited healthcare infrastructure and social stigma surrounding STIs in some of the regions pose challenges in terms of diagnosis and treatment. Improved awareness programs and government health-care initiatives along with rapid diagnostic advancements are gradually overcoming the problems for access to the detection services. Continued investment into diagnostic technologies along with public health interventions would place the Middle East and Africa STD diagnostics market among the significant areas of growth toward addressing the emerging burden of the region.

Competitive Landscape:

Leading players in the STD diagnostics market are adopting several strategies to maintain and strengthen their market positions. Technological innovation is at the forefront, with companies focusing on rapid testing solutions, point-of-care diagnostics, and AI-based diagnostic tools that enhance accuracy and speed. These advancements are designed to meet the increasing demand for convenient and accessible testing options. Key players are also expanding their product portfolios to offer a wider range of STD diagnostic kits and services, catering to different segments like home testing, clinics, and hospitals. By improving ease of use and affordability, companies are targeting high-risk populations and underserved areas. Strategic partnerships with healthcare organizations, government health programs, and research institutions further help expand their market reach. These efforts are creating a favorable sexually transmitted disease (STD) diagnostics market outlook.

The report provides a comprehensive analysis of the competitive landscape in the sexually transmitted disease (STD) diagnostics market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Becton Dickinson and Company

- BioMérieux SA

- Bio-Rad Laboratories Inc.

- Cepheid (Danaher Corporation)

- F. Hoffmann-La Roche AG

- Hologic Inc.

- Qiagen N.V.

- Quidel Corporation

- Siemens Healthineers AG (Siemens AG)

Latest News and Developments:

- February 2023: F. Hoffmann-La Roche Ltd. has formed a public-private partnership (PPP) named Lab Networks for Health in collaboration with the Centers for Disease Control and Prevention (CDC). This new program aims to improve HIV and tuberculosis (TB) testing, prevention, and treatment in high-burden countries around the world, including Africa, Eastern Europe, Latin America, Central Asia, and the Caribbean.

- February 2023: Mylab has developed a variety of STD-specific point-of-care testing. This contains a reagent-free component that does not require refrigeration; these tests will be applicable in many POC facilities with limited resources. Aside from the product's applications, implementing TTI surveillance in donated blood banks could help to reduce such illnesses among recipients.

- January 2023: Molbio Diagnostics expanded its STD diagnostics offering with the Truenat HSV 1/2, a herpes simplex virus test that provides results in less than an hour - it represents a significant step forward in point-of-care STD detection.

Sexually Transmitted Disease (STD) Diagnostics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chlamydia Testing, Syphilis Testing, Gonorrhea Testing, Herpes Simplex Virus Testing, Human Papilloma Virus Testing, Human Immunodeficiency Virus Testing, Chancroid Testing, Others |

| Device Types Covered |

|

| End Users Covered | Laboratory Testing, Point of Care (PoC) Testing |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Becton Dickinson and Company, BioMérieux SA, Bio-Rad Laboratories Inc., Cepheid (Danaher Corporation), F. Hoffmann-La Roche AG, Hologic Inc., Qiagen N.V., Quidel Corporation, Siemens Healthineers AG (Siemens AG), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sexually transmitted disease (STD) diagnostics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sexually transmitted disease (STD) diagnostics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sexually transmitted disease (STD) diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sexually transmitted disease (STD) diagnostics market was valued at USD 109.02 Billion in 2024.

The sexually transmitted disease (STD) diagnostics market is estimated to exhibit a CAGR of 4.47% during 2025-2033.

The rising prevalence of STDs, increasing awareness among the masses regarding early diagnosis, and the introduction of at-home STD testing kits represent some of the key factors driving the market.

North America currently dominates the market due to the high infection rates, advanced healthcare infrastructure, and widespread awareness initiatives.

Some of the major players in the sexually transmitted disease (STD) diagnostics market include Abbott Laboratories, Becton Dickinson and Company, BioMérieux SA, Bio-Rad Laboratories Inc., Cepheid (Danaher Corporation), F. Hoffmann-La Roche AG, Hologic Inc., Qiagen N.V., Quidel Corporation, Siemens Healthineers AG (Siemens AG), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)