Serum-Free Media Market Size, Share, Trends and Forecast by Media Type, End Uses, and Region, 2025-2033

Serum-Free Media Market Size and Trends:

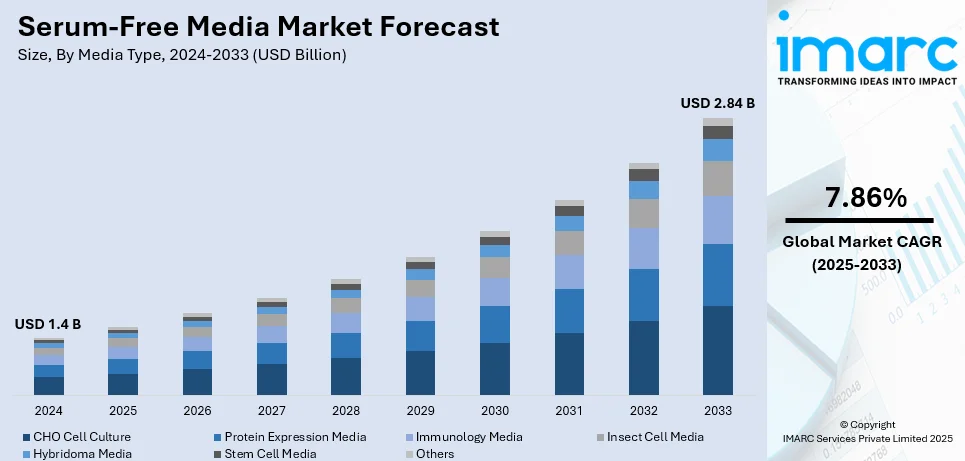

The global serum-free media market size was valued at USD 1.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.84 Billion by 2033, exhibiting a CAGR of 7.86% from 2025-2033. North America currently dominates the market, holding a serum-free media market share of over 38.7% in 2024. The rising instances of infectious and chronic diseases, increasing product adoption across the biotechnology and pharmaceutical sectors, and the escalating awareness about products’ multifarious benefits represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 2.84 Billion |

| Market Growth Rate (2025-2033) | 7.86% |

The global market is majorly driven by the widespread adoption of advanced cell culture technologies in drug discovery and development. Notably, on April 11, 2024, Thermo Fisher Scientific introduced Gibco CTS OpTmizer One Serum-Free Medium, an animal origin-free formulation designed to enhance T cell expansion with scalability, high cell viability, and reduced contamination risk. It supports autologous and allogeneic workflows, accelerating CAR-T therapy production and improving therapeutic efficacy. Furthermore, rising demand for biologics, including monoclonal antibodies, vaccines, and gene therapies, drives the need for optimized serum-free formulations. Ethical concerns regarding animal-derived components further promote this transition. Moreover, continual advancements in recombinant protein production and bioprocess optimization enhance cost efficiency and scalability. Besides this, increasing investments in pharmaceutical research and development (R&D), precision medicine, regenerative therapies, and new biomanufacturing facilities in emerging markets contribute to serum-free media market growth.

The United States is a key regional market, which is growing due to reduced reliance on animal-derived components, driven by ethical considerations and stringent regulatory standards. Similarly, growing investments in biopharmaceutical R&D are advancing the development of monoclonal antibodies, vaccines, and cell therapies. For instance, on December 17, 2024, Merck reveled that the FDA had accepted its Biologics License Application for clesrovimab (MK-1654), a long-acting monoclonal antibody intended to safeguard infants from respiratory syncytial virus (RSV) during their first RSV season. Clesrovimab could be available by June 10, 2025, offering infants a single-dose RSV immunization. Moreover, the increasing prevalence of chronic and rare diseases, combined with significant government funding, are key factors driving the serum-free media market demand. Ongoing advancements in automation technologies and a highly skilled workforce are also fostering innovation and enabling the development of more effective healthcare solutions.

Serum-Free Media Market Trends:

Growing Adoption of Cell-Based Therapies

The serum-free media market is being driven significantly by the expanding field of cell-based therapies, including regenerative medicine, cancer immunotherapy, and stem cell therapies. According to an industrial report, the cell therapy technologies market worldwide is expected to grow at a CAGR of 11.0% from 2023 to 2029. These therapies depend on the efficient growth and differentiation of cells, which is critical for their therapeutic efficacy. Serum-free media provide a defined, controlled environment, eliminating the variability that animal-derived components like serum introduce, thus ensuring reproducibility and consistency in cell cultures. This trend is likely to accelerate the demand for serum-free alternatives due to the increased regulation of using animal products in therapeutic applications. The media are also helpful for the optimization of cell production to clinical applications that have reduced the risk of contamination and adverse reactions resulting from animal serum. The trend is for an increase in demand for optimized, serum-free solutions with the ever-growing cell-based therapies on the cusp of entering the commercial markets.

Advancements in Bioprocessing Technologies

Advances in bioprocessing technologies have an impact on the serum-free media market due to the growing demand for biologics and biosimilars. According to the U.S. Department of Health and Human Services (HHS), biologics represent a significant portion of Medicare Part B drug spending, comprising 78.9% of total spending in 2021. Continuous cell culture systems, perfusion technology, and automated bioreactors help augment biologics' large-scale manufacturing process as the scale of manufacturing continues to increase by the biomanufacturers. Media formulation should also meet the expectations in these modern advanced technologies regarding stable performance in the extended period of culture. Serum-free media play a critical role in supporting the growth of cells in these advanced systems while maintaining the desired yield and quality of the product. The integration of automation in manufacturing also demands media that provide precise control over the culture environment to improve efficiency and reduce costs. Additionally, these technologies enhance productivity and decrease manufacturing costs since they do not require serum, a very expensive and variable component. This is also expected to be on the rise as the advances in bioprocessing continue.

Shift Toward Animal-Free and Ethical Production

The demand for ethical and sustainable production methods is growing, which is driving the shift toward animal-free and serum-free media in biotechnology and pharmaceutical research. The USDA and the FDA's Center for Veterinary Medicine (CVM) primarily focus on ensuring the safety and efficacy of animal-derived materials used in medical products. For instance, the FDA has issued guidelines on the use of materials derived from cattle in medical products intended for human use, emphasizing the need to prevent contamination and ensure safety. Increasing concerns about animal welfare, along with the need to adhere to regulatory guidelines that limit animal testing, are pushing researchers and manufacturers to seek alternatives to traditional animal serum. Serum-free media have ethical as well as several benefits from the reduction in risk of contamination by animal component sources that would otherwise produce erratic results. Moreover, production costs regarding obtaining and processing serum from animals would be significantly minimized by these media. The increase in adoption is predicted since more biopharmaceutical companies and research institutes wish to adopt ethically acceptable methods of production. This trend is further supported by the ongoing efforts to develop more affordable and effective serum-free formulations, making them increasingly accessible for both research and commercial-scale production.

Serum-Free Media Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global serum-free media market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on media type and end uses.

Analysis by Media Type:

- CHO Cell Culture

- Protein Expression Media

- Immunology Media

- Insect Cell Media

- Hybridoma Media

- Stem Cell Media

- Others

Based on the serum-free media market forecast, CHO cell culture leads the market with around 31.9% of market share in 2024 due to its widespread application in biologics production. These cells are well-suited for manufacturing monoclonal antibodies, vaccines, and therapeutic proteins. Their adaptability to grow in serum-free conditions reduces the risk of contamination, ensures batch consistency, and aligns with regulatory requirements for animal-free components. The ability to achieve high protein yields and scalability in bioreactors further enhances their appeal. CHO cells' genetic stability and compatibility with various media formulations render them a preferred choice for pharmaceutical companies. The market benefits from established protocols, extensive research, and robust supply chains supporting CHO cell culture in serum-free environments, driving its leadership position.

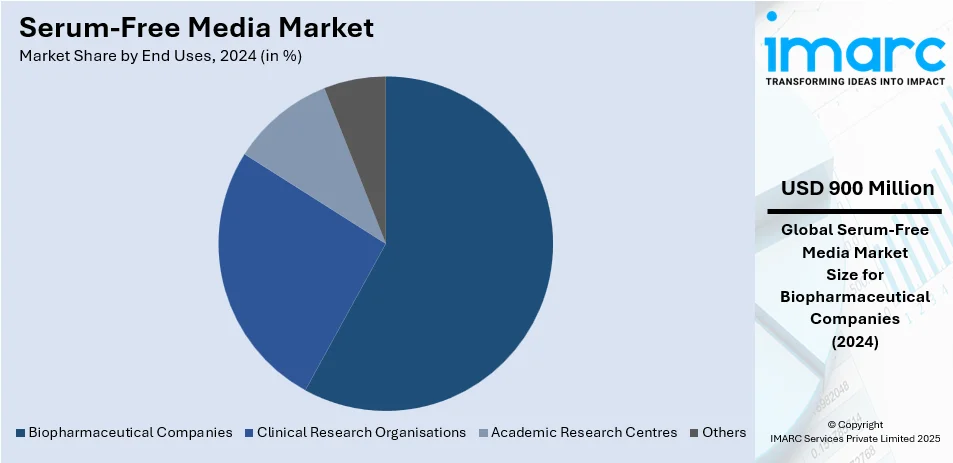

Analysis by End Uses:

- Biopharmaceutical Companies

- Clinical Research Organisations

- Academic Research Centres

- Others

Biopharmaceutical companies leads the market with around 58.7% of the market share in 2024 driven by their pivotal role in advancing innovative therapies and addressing global healthcare needs. Their focus on research and development (R&D) drives breakthroughs in biologics, including monoclonal antibodies, vaccines, and cell and gene therapies. These firms leverage advanced technologies such as recombinant DNA and cell culture systems to produce high-value products. Strong regulatory compliance, robust clinical pipelines, and strategic partnerships enhance their market dominance. The rising prevalence of chronic diseases and demand for personalized medicine further expand their influence in the serum-free media market outlook. With significant investment capacity, established expertise, and global distribution networks, biopharmaceutical companies are well-positioned to meet industry demands and maintain leadership in the healthcare and life sciences sectors.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest serum-free media market share of over 38.7%. Some of the factors driving the market include the growing prevalence of life-threatening diseases, rising demand for regenerative and personalized medicines, and the increasing product utilization in biomanufacturing processes. The expanding adoption of advanced cell culture technologies in research and development accelerates innovation in biologics. Favorable government initiatives and funding for biopharmaceutical research further support the market growth. Additionally, the push for ethical practices and regulatory compliance encourages the transition to serum-free formulations, reducing dependence on animal-derived components. The region benefits from a strong presence of major market players, well-established healthcare infrastructure, and advancements in therapeutic production, fostering sustained growth and competitiveness in the serum-free media market.

Key Regional Takeaways:

United States Serum-Free Media Market Analysis

The augmenting demand for biopharmaceutical production and cell culture applications are bolstering the market. According to an industrial report, the United States was leading the world in biotech funding with an investment of more than USD 56 Billion in 2023. This investment wa mainly allocated for serum-free media development. Such factors as this latest trend in custom medicine and gene therapy for developing medications propelled serum-free media solutions at R&D and manufacturing levels in the industry. Prominent companies like Thermo Fisher Scientific and Lonza were at the top of this business, with cutting-edge technologies for cell culture without the use of any animal serum. The ongoing regulatory impetus for animal-free products pushes the market forward. The U.S. government's focus on advancing healthcare infrastructure and expanding biopharmaceutical capabilities ensures a strong, sustained demand for serum-free media in the region.

Europe Serum-Free Media Market Analysis

In the European region, serum-free media market is growing gradually. This advancement is essentially linked with cell therapy and biopharmaceutical production. As per European Federation of Pharmaceutical Industries and Associations, the market revenues for 2023 stood at USD 480.2 Billion in Europe biotechnology-based market, and one of the main shares goes to the improvement of cell culture technologies. In December 2023, Eligo Bioscience, a French company, received USD 30 Million in a Series B round of investment, highlighting the growing interest in biotech innovations. The rising demand for vaccines and biologics further drives the use of serum-free media. Moreover, the biotech industry in Europe and the U.S. raised around USD 81 Billion in capital in 2023, signaling robust investment in the sector. The increasing demand for a reduction in animal testing by EU regulations is accelerating the shift toward animal-free media solutions. Continued innovation in the serum-free media market is assured by collaboration between European biotech and pharmaceutical companies.

Asia Pacific Serum-Free Media Market Analysis

The Asia Pacific market is expanding at a rapid pace due to the increased focus on biomanufacturing and healthcare requirements. In Japan, the government agency METI discussed its investment plan of USD 3 Billion to develop the biotech ecosystem and strengthen collaboration with the U.S. Some of these include the Drug Discovery Venture Ecosystem Enhancement Project to support Japanese startups in the field of drug discovery. Keidanren (Japan Business Federation), LINK-J, and local governments simultaneously launched their biotech initiatives. Moreover, 11 Japanese startup companies with state-of-the-art technologies presented pitches to further enhance innovation in the region. Local companies, including Wuxi AppTec and Samsung Biologics, are investing heavily in R&D to enhance their production processes. The growth of the market in this region is also further supported by government-backed initiatives in countries such as Japan and South Korea, where innovation and collaboration are promoted in the serum-free media landscape.

Latin America Serum-Free Media Market Analysis

Latin America's serum-free media market is moving steadily in the right direction, as influenced by the growth in demand for biologics and vaccines within the region. According to an industrial report, in 2023, the biotechnology market in Latin America generated USD 84,697.7 Million in revenue, with growing investment in serum-free media for vaccine production and cell therapy applications. Biotechnology is an industry in Brazil in which the government is involved through various initiatives. It has, therefore, ensured that its pharmaceutical industry grows continuously. Another critical market for cell culture solutions comes from Mexico as investment in more advanced biotechnology solutions is underway. There has been a rising demand for biologics and biosimilars, with more cases of chronic diseases being recorded. Additionally, better infrastructures for the healthcare industry and increased collaboration between international companies like Merck and Sartorius are likely to pave the way for greater usage of serum-free media in this region.

Middle East and Africa Serum-Free Media Market Analysis

The market in Middle East and Africa is growing which can be attributed to the increased healthcare and biotechnology investments. The Dubai Chamber of Commerce estimates that by 2028, the market of biotechnology would expand up to USD 2.6 Million. The region would be headed by the UAE and Saudi Arabia as markets. In the 2023 federal budget, USD 1.3 Billion was allocated by the UAE for healthcare as well as community protection, showing strong government support for the life sciences sector. Saudi Arabia's Vision 2030 initiative continues to drive demand for biotech solutions, such as serum-free media, in support of the kingdom's biotechnology and pharmaceutical industries. These emerging hotspots are slowly surfaced in Middle East and Africa, where with increasing healthcare needs and medical research breakthroughs, investment in R&D and infrastructure fuels it.

Competitive Landscape:

The serum-free media market's competitive landscape is marked by significant rivalry between established players and emerging companies. Key participants employ strategies, such as mergers, acquisitions, partnerships, and collaborations, to expand their market presence. For instance, on January 22, 2025, Leica Biosystems and Molecular Instruments announced a partnership to integrate HCR™ Pro RNA-ISH with BOND RX systems, enabling simultaneous RNA and protein target detection on tissue samples. This development enhances protein expression analysis, offering scalability and automation for cancer research. Innovation remains a core focus, with customized media formulations and improved production efficiency providing a competitive edge. Companies capitalize on strong distribution networks and advanced manufacturing facilities, while startups drive differentiation through niche solutions. The market develops with ongoing R&D, regulatory changes, and sustainability efforts.

The report provides a comprehensive analysis of the competitive landscape in the serum-free media market with detailed profiles of all major companies, including:

- Athena Environmental Sciences Inc.

- Corning Incorporated

- FUJIFILM Irvine Scientific Inc. (FUJIFILM Holdings Corporation)

- Himedia Laboratories Private Limited

- Lonza Group AG

- Merck KGaA

- MP Biomedicals (Valiant Co. Ltd.)

- PAN-Biotech GmbH

- PromoCell GmbH

- Sino Biological Inc.

- STEMCELL Technologies Inc.

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- November 2024: Sartorius Stedim Biotech inaugurated a new Center for Bioprocess Innovation in Massachusetts. This center fosters joint research and process development that further the development of bioprocessing technologies for the life sciences industry.

- In October 2024, The Competition Commission of India (CCI) approved Mankind Pharma’s ₹13,630 crore acquisition of Bharat Serums and Vaccines. This deal strengthens Mankind’s presence in India’s women’s health and fertility drug market. Both companies specialize in pharmaceutical formulations and healthcare products, enhancing Mankind’s portfolio. The acquisition aligns with its growth strategy, expanding its footprint in critical therapeutic areas.

- In April 2024, Expression Systems and Thomson partnered to showcase the effectiveness of ESF AdvanCD™ cell culture medium with Thomson Optimum Growth® flasks for scaling protein production in baculovirus and insect cell systems. The combination delivers consistent cell growth and high expression levels across flask sizes and volumes, ensuring a robust, scalable platform. Learn more in their latest application note on cultivating Sf9 suspension cells with ESF AdvanCD chemically defined media.

- April 2024: Thermo Fisher Scientific launched Gibco CTS OpTmizer One Serum-Free Medium. The product, designed for the manufacture of cell therapy, has improved scalability to ensure the efficient and consistent production of advanced therapies.

- November 2023: Thermo Fisher Scientific launched a serum-free medium for cell culture applications. This innovation improves cell growth and productivity, enabling efficient large-scale vaccine and biologic production, meeting the increasing industry demand for high-quality bioprocessing solutions.

- October 2023: Lonza launched a customized serum-free medium for gene therapy applications. This product supports the growth of viral vectors, thereby addressing critical needs in gene therapy manufacturing and advancing solutions for scalable therapeutic production.

- May 2023: Lonza launched TheraPEAK T-VIVO Cell Culture Medium in May 2023 for use in CAR T-cell manufacturing. This medium promotes the growth and maintenance of immune cells with an emphasis on reliability and quality in immunotherapy production.

Serum-Free Media Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Media Types Covered | CHO Cell Culture, Protein Expression Media, Immunology Media, Insect Cell Media, Hybridoma Media, Stem Cell Media, Others |

| End Uses Covered | Biopharmaceutical Companies, Clinical Research Organisations, Academic Research Centres, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Athena Environmental Sciences Inc., Corning Incorporated, FUJIFILM Irvine Scientific Inc. (FUJIFILM Holdings Corporation), Himedia Laboratories Private Limited, Lonza Group AG, Merck KGaA, MP Biomedicals (Valiant Co. Ltd.), PAN-Biotech GmbH, PromoCell GmbH, Sino Biological Inc., STEMCELL Technologies Inc., Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the serum-free media market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global serum-free media market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the serum-free media industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The serum-free media market was valued at USD 1.4 Billion in 2024.

The serum free media market is projected to exhibit a CAGR of 7.86% during 2025-2033.

The market is largely driven by the increasing adoption of cell-based therapies, demand for biologics, advancements in bioprocessing technologies, ethical concerns regarding animal-derived components, and growing investments in biopharmaceutical R&D. Additionally, the shift towards animal-free production methods and rising awareness of serum-free media's benefits are key contributors.

North America currently dominates the serum-free media market, accounting for a share exceeding 38.7%. This dominance is fueled by growing demand for personalized medicine, increasing investments in biotech, regulatory support, and ethical shifts toward serum-free media.

Some of the major players in the serum-free media market include Athena Environmental Sciences Inc., Corning Incorporated, FUJIFILM Irvine Scientific Inc. (FUJIFILM Holdings Corporation), Himedia Laboratories Private Limited, Lonza Group AG, Merck KGaA, MP Biomedicals (Valiant Co. Ltd.), PAN-Biotech GmbH, PromoCell GmbH, Sino Biological Inc., STEMCELL Technologies Inc., and Thermo Fisher Scientific Inc. among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)