Serious Games Market Size, Share, Trends and Forecast by Gaming Platform, Application, Industry Vertical, and Region, 2025-2033

Serious Games Market Size and Share:

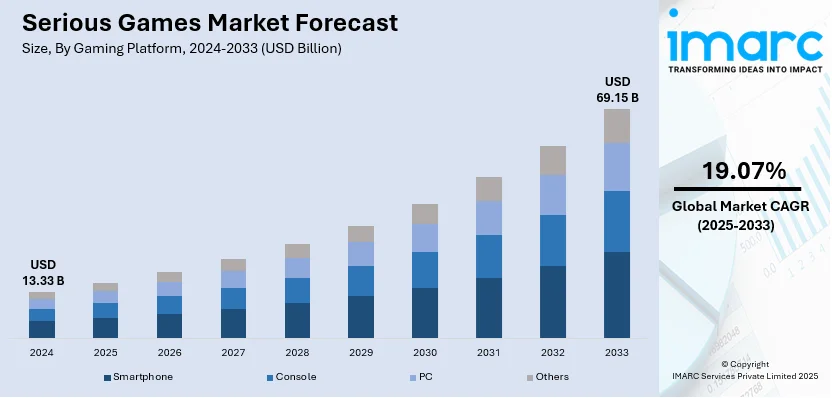

The global serious games market size was valued at USD 13.33 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 69.15 Billion by 2033, exhibiting a CAGR of 19.07% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 35.3% in 2024. The serious games market share is increasing due to the rising adoption in education and corporate training, advancements in augmented reality (AR) and virtual reality (VR), government support for gamification, and the growing demand for interactive learning.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.33 Billion |

| Market Forecast in 2033 | USD 69.15 Billion |

| Market Growth Rate (2025-2033) | 19.07% |

Educational institutions and businesses are utilizing serious games to improve engagement and retention. These games include interactive features that enhance the enjoyment of learning while boosting knowledge retention and skill development. Educational institutions, colleges, and online learning platforms employ serious games to instruct in areas such as mathematics, science, and language, whereas businesses apply them for workforce training, leadership growth, and compliance initiatives. Moreover, the incorporation of augmented reality (AR), virtual reality (VR), artificial intelligence (AI), and cloud computing is revolutionizing serious games by enhancing interactivity and authenticity. AI facilitates personalized learning experiences by tailoring content according to user advancement. AR and VR develop captivating training simulations, enhancing the learning experience. Cloud gaming enables users to play demanding games on various devices without the need for advanced hardware.

The United States is an essential part of the market, driven by leading gaming and technology firms that are creating cutting-edge serious gaming solutions. Moreover, top universities and research institutions play a vital role in the advancement of serious games by investigating their societal effects, advocating for game-based education, and fostering innovation in educational, cultural, and policy-related game design. For example, in 2023, MIT's Game Lab emphasized its contribution to enabling students to critically examine the societal effects of games. The lab promotes the creation of games with significant social themes while examining games as cultural and social artifacts. Game Lab Director T.L. Taylor highlights the significance of recognizing games as powerful media in cultural and political contexts.

Serious Games Market Trends:

Rising Demand for Effective Learning Solutions

There is a rise in demand for efficient learning solutions among people globally. Conventional teaching techniques fail to completely involve students or guarantee effective knowledge retention. Conversely, serious games offer engaging and immersive experiences that actively engage learners in their educational journey. They foster a fun and captivating atmosphere by integrating game mechanics, narratives, and interactive components, which encourage active involvement and improve learning results. Additionally, a report from WorldMetrics indicates that educational institutions are progressively integrating serious games, as 72% of teachers in the US state that digital learning resources enhance student involvement and comprehension. These games accommodate various learning styles, provide tailored learning experiences, and enable students to understand intricate concepts in a more approachable and interesting way.

Increasing Focus on Employee Training and Development

Organizations are placing greater emphasis on employee training and development to boost their involvement in business-related matters. They are concentrating on ongoing skill enhancement to boost productivity, employee involvement and retention, as well as overall business performance. Serious games offer an engaging and interactive platform for training, enabling employees to develop and enhance crucial skills in an encouraging setting. Moreover, they provide a practical learning experience by enabling employees to engage in tasks and situations pertinent to their positions. An industrial report states that serious games enhance learning retention by as much as 60% in comparison to conventional training approaches. Additionally, they help in mimicking intricate work scenarios, choices made, and engagements with customers. They also offer employees a secure environment to learn from their errors and acquire essential experience.

Technological Advancements in Serious Games

The incorporation of new technologies like virtual reality (VR) and augmented reality (AR) to deliver a more engaging and immersive experience for users is benefiting the market. VR technology offers users a virtual setting that mimics actual real-life scenarios. Students can acquire hands-on experience in a managed environment by using a VR headset. For example, research featured in the Journal of the American Academy of Orthopaedic Surgeons Global Research & Reviews indicated that medical students and resident surgeons who learned arthroplasty techniques via VR performed procedures faster than those taught with conventional methods. Moreover, VR technology is extensively utilized in the healthcare sector, enabling medical practitioners to rehearse intricate procedures or urgent scenarios. Conversely, AR improves the educational experience by superimposing digital components onto the physical world. Serious games utilize AR technology to enable learners to engage with virtual objects and information within their real-world surroundings.

Serious Games Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global serious games market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on gaming platform, application and industry vertical.

Analysis by Gaming Platform:

- Smartphone

- Console

- PC

- Others

Smartphones make up the biggest portion, representing 55.0% of the serious games market share in 2024. Their extensive usage is driven by ease, low cost, and growing global smartphone access. Users favor smartphones for intense gaming because of their portability, providing access to learning, training, and simulation applications at any time and place. The incorporation of high-resolution touchscreens, motion detectors, and AR features boosts interactivity, offering immersive experiences for users in education, healthcare, corporate training, and military uses. Moreover, progress in mobile processors, 5G connectivity, and cloud gaming facilitates smooth gameplay and immediate data processing, enhancing performance and accessibility. The presence of app-based serious games on platforms enhances market access, encouraging uptake among students, professionals, and trainees. The growing focus on mobile gamification approaches by educational institutions and businesses additionally boosts expansion, establishing smartphones as a leading platform for serious games globally.

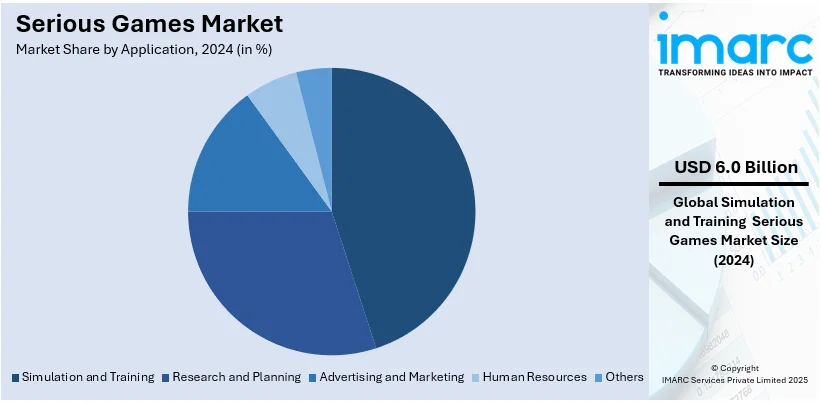

Analysis by Application:

- Simulation and Training

- Research and Planning

- Advertising and Marketing

- Human Resources

- Others

In 2024, simulation and training lead the serious games market with a 44.7% share due to their growing use in sectors like healthcare, aviation, defense, manufacturing, and emergency services. These games generate authentic, engaging settings that enable people to hone skills, improve decision-making, and cultivate critical thinking in safe, simulated situations. In healthcare, serious games are utilized for surgical training, patient diagnostics, and medical procedures, minimizing errors and enhancing efficiency. The aviation sector employs them for pilot instruction, flight simulations, and readiness for emergency situations. In defense, armed forces take part in mission-oriented training, combat drills, and strategic planning activities. Manufacturing firms utilize serious games for training in safety, optimizing processes, and handling equipment. Emergency services utilize them for disaster response, crisis handling, and rescue missions. Progress in AI, AR, and VR is increasingly improving realism, thus boosting the effectiveness of simulation-based training. The capacity to enhance skills, effectiveness, and awareness of situations is fueling the market growth.

Analysis by Industry Vertical:

- Education

- Healthcare

- Aerospace and Defense

- Government

- Retail

- Media and Entertainment

- Others

In 2024, education dominates the market, holding a 38.5% share, fueled by the growing incorporation of digital learning resources in schools, colleges, universities, and online platforms. These games encompass topics like mathematics, science, language acquisition, history, and skill growth, offering interactive experiences that boost student involvement, knowledge retention, and academic achievement. Organizations are utilizing serious games for customized learning, flexible evaluations, and teamwork problem-solving activities. The growing interest in game-based learning is additionally reinforced by progress in artificial intelligence, augmented reality, and virtual reality, which foster immersive and interactive learning experiences. Governments and educational institutions are advocating for gamified education to enhance student performance and close learning gaps. Furthermore, corporate training initiatives and professional growth courses are progressively integrating serious games to improve employee abilities, leadership development, and technical knowledge. The capacity to serve learners across all age ranges, from early childhood education to higher education and vocational training, is driving the demand for the serious games market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Asia Pacific region held the largest market share at 35.3%. The Asia Pacific region maintained the largest market share owing to the rising need for high-quality education and training. Moreover, the increasing use of smartphones and gaming consoles by people is driving the market expansion in the Asia Pacific area. In addition to this, the ongoing advancements in the gaming sector are driving market growth. Correspondingly, supportive governmental programs in educational technology and digital learning are enhancing the market's expansion in the area. In 2024, Mason Korea established the Korea Serious Game Institute (KSGI) to enhance the global footprint of George Mason University's Virginia Serious Game Institute (VSGI). KSGI strives to revolutionize Korea's gaming sector by advancing serious games for educational purposes, therapeutic applications, and social awareness. The inaugural ceremony showcased notable speakers, such as Rep. Ahn Cheol-soo and IFEZA Commissioner Yun Won-seok, who highlighted the institute's importance in promoting Korea's gaming sector and social programs.

Key Regional Takeaways:

United States Serious Games Market Analysis

The serious games market in the United States is growing with increasing adoption in education, defense, and healthcare. According to the Entertainment Software Association, 76 percent of children in 2023 regularly played video games, highlighting the lasting impact of interactive learning. The education sector is embedding serious games into digital learning environments to enhance engagement, improve knowledge retention, and support STEM education. In healthcare, serious games are widely used for surgical simulations, cognitive therapy, patient rehabilitation, and mental health treatment, improving medical training efficiency. The defense sector leverages serious games for combat simulations, mission planning, and crisis response training, reducing costs and enhancing strategic decision-making. Advancements in AI, VR, and AR are making training more immersive, realistic, and adaptive, increasing market demand. U.S.-based companies, along with government-backed research institutions, are driving innovations in serious gaming applications, expanding their role in corporate training, workforce development, and emergency preparedness.

Europe Serious Games Market Analysis

The significant growth of the European serious games market is gaining traction with rising use in various sectors including education, defense, and corporate training. The European EdTech Alliance values the European e-learning market at USD 50 billion in 2023, highlighting the importance of gamified education. Germany and France are at the forefront of implementing serious games for defense training through NATO-supported initiatives. According to Eurostat, over 80% of European businesses utilized digital tools for training purposes in 2023, which has impacted the corporate serious game industry. Fields like healthcare, particularly in cognitive therapy and rehabilitation, are seeing growth, with firms such as Virtualware and PlayGen leading innovations in this area. Funding from the European Union for digital transformation and innovation is propelling the serious gaming technology that is crucial for the future of the AR/VR industry.

Asia Pacific Serious Games Market Analysis

As investments in digital education, workforce training, and healthcare applications rise, the serious games market in the Asia Pacific region is growing. The Ministry of Education in China reported that by the end of 2023, the Smart Education of China platform was linked to 519,000 educational organizations, benefiting 18.8 million educators and 293 million students, showcasing the integration of digital technologies in education. India is advancing digital education as part of NEP 2020, with the government increasingly emphasizing e-learning platforms. Japan is investing in workforce training using AR/VR technology, while METI backs digital transformation in skill enhancement initiatives. South Korea's healthcare system is integrating gamified therapy options into a broader digital rehabilitation initiative. The area is emerging as a key center for serious games in multiple sectors, propelled by government-backed programs and major firms like NetDragon Websoft fostering advancements.

Latin America Serious Games Market Analysis

The serious games industry in Latin America, therefore, is expanding with significant potential due to substantial investments in digital education and workforce development. In Brazil, the government initiated the expansion of the new Growth Acceleration Program (PAC), allocating approximately USD 5.6 billion (BRL 28 billion) from 2023 to 2026 to promote digital inclusion and connectivity, with around USD 1.3 billion (BRL 6.5 billion) primarily designated for educational and health institutions. In 2023, according to industry reports, Mexico increased its budget for education, sports, science, and technology by 7.2% compared to 2022, reflecting a rising investment in digital learning resources. Although specific statistics on corporate training in Argentina and gamification of health in Chile are lacking, there is a broader trend across the region toward digital transformation in learning and skill development. Government-led technology-focused initiatives are pushing the integration of serious games into various sectors of education, workforce training, and healthcare.

Middle East and Africa Serious Games Market Analysis

An industry report indicates that the educational projects in the United Arab Emirates received AED 9.8 billion for 2023, equivalent to USD 2.67 billion, specifically aimed at enhancing the creation of digital learning tools in education. Saudi Arabia aims to prepare its workforce for 2030 with a strategy focused on training 2.31 million individuals in the private sector by 2025, investing in cutting-edge digital learning techniques. In Africa, Kenya has implemented digital education initiatives, although exact budget amounts for gamified learning resources are not provided. In South Africa, digital health projects are progressing well but still need official verification for the investment of ZAR 450 million (USD 24.30 million) in gamified rehabilitation, according to reports. The defense sector in the Middle East continues to invest in military training, although precise numbers for serious games implementations remain undisclosed.

Competitive Landscape:

Major participants in the sector are emphasizing the integration of gamification strategies, engaging narratives, authentic simulations, and advanced technologies to provide top-notch games. In this regard, they are hiring game designers, developers, and content creators to create and develop games tailored to specific industries and educational goals. In addition to this, businesses are collaborating with educational institutions, corporations, and government bodies to grasp their needs and create tailored games that align with their learning objectives, audience, and industry-related situations. Furthermore, leading producers are allocating resources to research and development (R&D) efforts aimed at enhancing game mechanics, visuals, user interfaces, and educational strategies, which is contributing to an optimistic serious games market forecast. In 2024, the Monterey Bay Aquarium Research Institute introduced the FathomVerse mobile game, an impactful game created to encourage ocean exploration. It enabled players to tag sea creatures from authentic underwater photos, aiding in the training of AI models for oceanographic studies. FathomVerse was a component of the Ocean Vision AI initiative, merging gaming with scientific exploration.

The report provides a comprehensive analysis of the competitive landscape in the serious games market with detailed profiles of all major companies, including:

- Applied Research Associate Inc.

- BreakAway Games

- Cisco Systems Inc.

- Designing Digitally Inc.

- Diginext SRL (CS Communication & Systèmes)

- Grendel Games

- LIB Businessgames B.V.

- MPS Interactive Systems Limited (MPS Ltd.)

- Serious Games Interactive

- Totem Learning

- YES!Delft

Latest News and Developments:

- December 2024: Buurtlab 070 together with Leiden University Green Office organized an event in The Hague, utilizing the serious game Sunjust to investigate energy justice. Created by Leiden University and TU Delft, the game emphasized disparities in solar park decision-making, raising awareness among students and community members.

- August 2024: ISR and CAPTRS introduced a no-cost digital game aimed at improving decision-making during public health emergencies. Gamers examine disease outbreaks, enhancing readiness for crises. The game promoted worldwide preparedness and scientific teamwork. ISR links its network of 10,000 members to enhance skills in managing rapid health threats.

- November 2023: Applied Research Associates (ARA) revealed that they will display their virtual reality-driven Chem/Bio Training and Assessment in Simulated Conditions (CB-TASC) and Virtual Reality Tactical Assault Kit (VR-TAK) at I/ITSEC 2023. Moreover, ARA showcased its Virtual Testbed, which combines BioGears and Unreal Engine, for DARPA’s Triage Challenge, improving casualty simulation.

Serious Games Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gaming Platforms Covered | Smartphone, Console, PC, Others |

| Applications Covered | Simulation and Training, Research and Planning, Advertising and Marketing, Human Resources, Others |

| Industry Verticals Covered | Education, Healthcare, Aerospace and Defense, Government, Retail, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Applied Research Associate Inc., BreakAway Games, Cisco Systems Inc., Designing Digitally Inc., Diginext SRL (CS Communication & Systèmes), Grendel Games, LIB Businessgames B.V., MPS Interactive Systems Limited (MPS Ltd.), Serious Games Interactive, Totem Learning, YES!Delft. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the serious games market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global serious games market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the serious games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The serious games market was valued at USD 13.33 Billion in 2024.

The serious games market is projected to exhibit a CAGR of 19.07% during 2025-2033, reaching a value of USD 69.15 Billion by 2033.

The market is expanding due to rising demand for immersive training solutions in education, healthcare, and corporate sectors. Advancements in AR, VR, and AI enhance engagement and learning outcomes. Government initiatives supporting gamification in education, coupled with increasing adoption in military and defense training, further support the market growth.

Asia Pacific currently dominates the serious games market, accounting for a share of 35.3%. The growth of the region is driven by expanding e-learning initiatives, government investments in digital education, continuous improvements in technology, increasing smartphone usage, and rising demand for gamified training solutions in corporate, healthcare, and military sectors.

Some of the major players in the serious games market include Applied Research Associate Inc., BreakAway Games, Cisco Systems Inc., Designing Digitally Inc., Diginext SRL (CS Communication & Systèmes), Grendel Games, LIB Businessgames B.V., MPS Interactive Systems Limited (MPS Ltd.), Serious Games Interactive, Totem Learning, YES!Delft. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)