Sequencing Reagents Market Size, Share, Trends and Forecast by Technology, Type, Application, End Use, and Region, 2025-2033

Sequencing Reagents Market Size and Share:

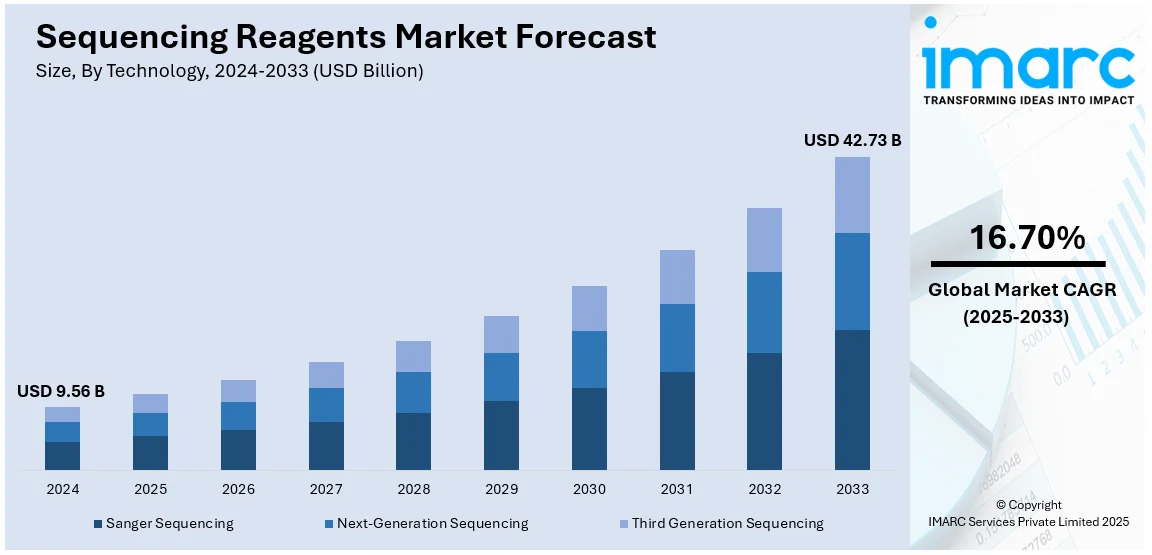

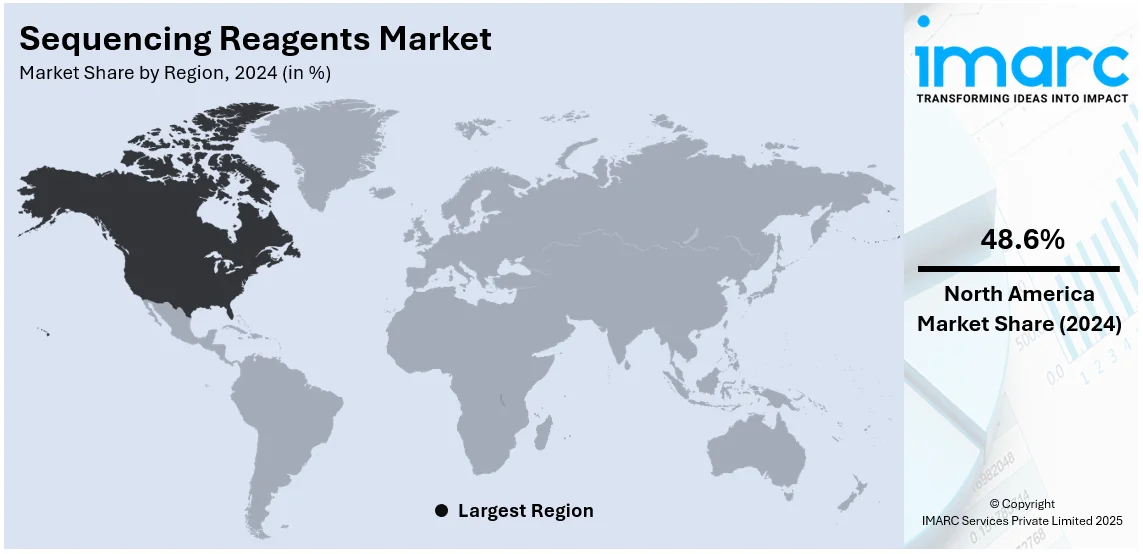

The global sequencing reagents market size was valued at USD 9.56 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 42.73 Billion by 2033, exhibiting a CAGR of 16.70% from 2025-2033. North America currently dominates the market, holding a market share of over 48.6% in 2024. The market is primarily driven by the rising use of single-cell sequencing technologies, the broadening applications of sequencing in agriculture and environmental monitoring, and the growing prevalence of liquid biopsy in oncology, enhancing the need for advanced and efficient reagents.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.56 Billion |

| Market Forecast in 2033 | USD 42.73 Billion |

| Market Growth Rate (2025-2033) | 16.70% |

The global market is primarily driven by significant advancements in genomic research and the increasing demand for personalized medicine. In line with this, rising genetic disorders and cancer prevalence have accelerated the adoption of next-generation sequencing (NGS) technologies, which require high-quality reagents to ensure accuracy. Additionally, ongoing research in oncology, microbiome studies, and rare genetic diseases is further stimulating market appeal. Furthermore, the heightened focus on precision medicine and the need for customized treatment plans are driving investments in sequencing technologies. This rise in innovation is amplifying the demand for specialized reagents. A notable example is QIAGEN’s expanded collaboration with AstraZeneca, announced on August 28, 2024, to creäte companion diagnostics for chronic diseases using QIAGEN’s QIAstat-Dx platform. This collaboration showcases QIAGEN’s expertise in leveraging sequencing reagents for precision medicine and targeted therapies.

The United States is a key regional market and is experiencing robust growth, propelled by the rising demand for advanced genomic diagnostics, bolstered by innovations in precision medicine and personalized healthcare. In addition to this, the widespread prevalence of chronic diseases, such as cancer, cardiovascular conditions, and genetic disorders, is intensifying the need for genetic testing and next-generation sequencing (NGS). Besides this, increasing government investments in healthcare infrastructure and genomic research further support the market expansion. A significant example is the NIH’s USD 27 Million investment on September 23, 2024, to establish genomics-enabled learning health systems (gLHS) that integrate genomic data into patient care. This initiative aims to enhance medical practices in underserved areas. As research institutions and biotech companies increasingly adopt NGS for drug development and biomarker discovery, improved sequencing reagents' quality and affordability also fuel the market growth across various diagnostic and therapeutic applications.

Sequencing Reagents Market Trends:

Growing Adoption of Single-Cell Sequencing Technologies

A significant trend in the global sequencing reagents market is the growing adoption of single cell sequencing technologies, which offer researchers the ability to analyze the genetic composition of individual cells. This enables a more detailed understanding of cellular functions and gene expression, particularly in complex diseases like cancer and neurological disorders. For instance, on October 29, 2024, Parse Biosciences launched the Parse GigaLab™, a platform capable of scaling single-cell sequencing to billions of cells per year. Using Parse’s Evercode™ technology, GigaLab supports large-scale projects, such as drug screens and AI model datasets. As single cell sequencing gains momentum in research areas like immunology and oncology, the demand for specialized sequencing reagents increases to ensure accurate, efficient analysis. This is expected to drive growth in the market, as it plays a key role in advancing personalized medicine and disease research.

Rapid Expansion of Sequencing Applications

The expansion of sequencing applications in agriculture and environmental monitoring is significantly driving the sequencing reagents market. Advanced sequencing technologies are increasingly used to study plant genomes, improve crop yield, monitor soil health, and track biodiversity. Notably, on June 6, 2024, MGI Tech Co., Ltd. launched an efficient Low-pass whole genome sequencing (WGS) solution for agricultural large-scale molecular breeding genotyping. This includes the MGIEasy PCR-Free FS Library Prep Set and DNBSEQ sequencers, designed to enhance throughput, reduce costs, and improve genomic analysis. Additionally, sequencing is playing a vital role in environmental DNA (eDNA) analysis to monitor species diversity, contributing to biodiversity conservation efforts. The demand for reagents tailored to these applications, offering higher sensitivity and robustness, is accelerating, expanding market reach in non-clinical and environmental fields.

Growth of Liquid Biopsy in Oncology

The increasing adoption of liquid biopsy is a key trend driving the market. Liquid biopsy, which analyzes genetic material from blood or other bodily fluids, offers a non-invasive alternative to traditional biopsies and significant potential in early cancer detection, monitoring disease progression, and assessing treatment responses. For example, on August 5, 2024, Illumina introduced new oncology assays, TruSight Oncology 500 (TSO 500 HT) and TruSight Oncology 500 ctDNA v2, for its NovaSeq X Series, advancing liquid biopsy applications. These assays provide faster sequencing, broader batch sizes, and lower costs, enhancing precision oncology research. Sequencing reagents capable of accurately analyzing cell-free DNA (cfDNA) or circulating tumor DNA (ctDNA) are essential for liquid biopsy. As liquid biopsy applications, particularly in oncology, continue to grow, the demand for specialized reagents supporting sensitive, high-throughput sequencing is accelerating market expansion.

Sequencing Reagents Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sequencing reagents market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, type, application, and end use.

Analysis by Technology:

- Sanger Sequencing

- Next-Generation Sequencing

- Third Generation Sequencing

Next-Generation Sequencing (NGS) dominates the market, holding 90.6% of the share in 2024 due to its unmatched capabilities in speed, accuracy, and scalability. NGS enables high-throughput sequencing, allowing researchers to sequence entire genomes in a fraction of the time compared to traditional methods. This efficiency, coupled with reduced costs, has made NGS the preferred choice for a variety of applications, including genomics, oncology, and personalized medicine. Additionally, significant advancements in NGS technology have enhanced sensitivity, precision, and throughput, further driving its adoption. The growing demand for genomic data in clinical research, diagnostics, and drug development is contributing to NGS’s strong market presence and rapid growth.

Analysis by Type:

- Library Kits

- Template Kits

- Control Kits

- Sequencing Kits

- Others

Sequencing kits represent 36.5% of the market share in 2024 due to their essential role in facilitating DNA/RNA sequencing processes. These kits provide all necessary reagents, enzymes, and tools required for sample preparation, ensuring standardization, reliability, and efficiency in sequencing workflows. The convenience of ready-to-use kits reduces complexities for researchers, streamlining protocols and ensuring consistent, high-quality results. With the rise in applications like genomic research, clinical diagnostics, and personalized medicine, sequencing kits are in high demand for a broad range of applications. Their scalability and ability to integrate with next-generation sequencing (NGS) platforms further bolster their market share, driving growth across research and healthcare sectors.

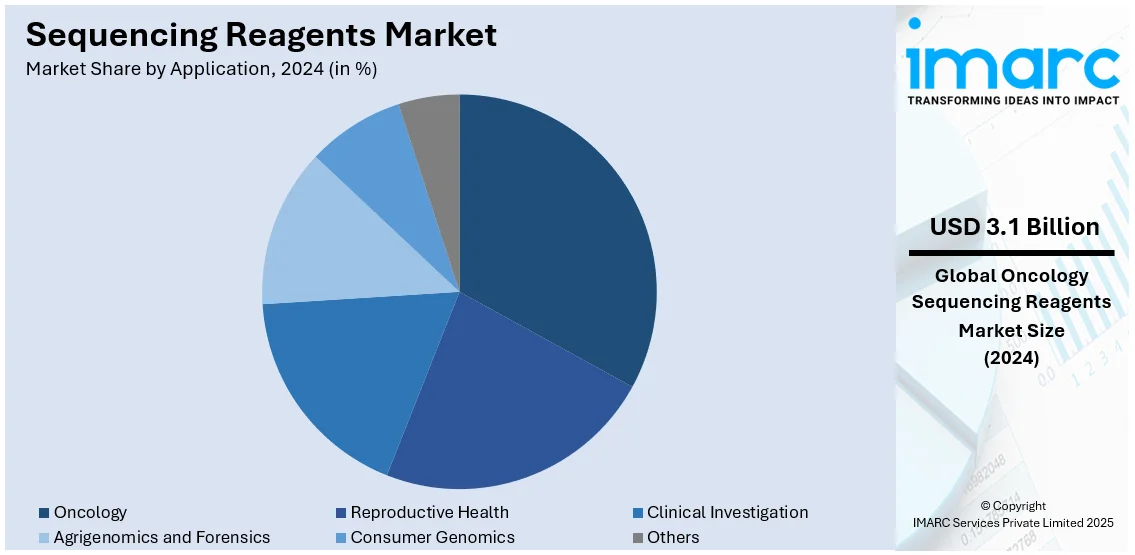

Analysis by Application:

- Oncology

- Reproductive Health

- Clinical Investigation

- Agrigenomics and Forensics

- Consumer Genomics

- Others

Oncology leads the market with a 32.6% share in 2024 attributed to the increasing demand for genomic-based cancer diagnostics and treatments. The techniques of sequencing facilitate the discovery of genetic mutations, biomarkers, and tumor heterogeneity that would be useful for personalized cancer treatment. With precision medicine and targeted therapy on the increase, oncology applications of next-generation sequencing, therefore, will play a huge role in further improving the efficacy of treatments in cancer patients. The possibility to analyze complex data of genetics in relation to mutation detection for accuracy at cancer-related changes supports early diagnosis, prognosis, and monitoring responses. Besides, a continually ongoing investigation on the uses of liquid biopsy and tumor profiling coupled with an ever-growing application drive the need for sequencing reagents in oncology.

Analysis by End Use:

- Academic Research

- Clinical Research

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Others

Academic research dominates the market with a 51.7% share in 2024 propelled by its central role in advancing genomics, molecular biology, and biotechnology. Academic institutions are the primary drivers of scientific discoveries, utilizing sequencing technologies for diverse applications such as gene expression analysis, mutation detection, and understanding genetic variations. These institutions generate a significant portion of the demand for sequencing reagents, as they are involved in both basic and applied research. Additionally, collaborations between universities, research centers, and biotech firms further fuel this demand. With increasing investments in genomic research, the growing emphasis on personalized medicine, and the push for innovative treatments, academic research continues to be a leading consumer of sequencing reagents.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounts for 48.6% share of the market due to its strong healthcare infrastructure, advanced research capabilities, and high adoption of cutting-edge technologies. The region is home to numerous leading academic institutions, research centers, and biotechnology firms that drive significant demand for sequencing reagents, particularly in genomics, oncology, and personalized medicine. Additionally, North America has high prevalence of substantial government funding and investment in life sciences and healthcare innovation. The presence of major companies further propels the market growth. The region’s early adoption of next-generation sequencing technologies and a growing emphasis on precision medicine continue to fuel the demand for sequencing reagents.

Key Regional Takeaways:

United States Sequencing Reagents Market Analysis

In 2024, the United States represents 87.50% of the North America sequencing reagents market, driven by advancements in genomic research and personalized medicine. As per CDC, an estimated 129 million Americans are affected by chronic diseases like heart disease, cancer, and diabetes, which, in turn, is increasing the adoption of next-generation sequencing (NGS) technologies. Chronic diseases account for 90% of the country’s annual USD 4.1 Trillion healthcare expenditure. The U.S. government’s significant investments in healthcare infrastructure and genomics research further fuel the market growth. The shifting focus on precision medicine and companion diagnostics boosts the demand for high-quality sequencing reagents. The U.S. is home to many top biotech and pharmaceutical companies, enhancing its market dominance. Notably, on January 13, 2025, Illumina and NVIDIA announced a collaboration to enhance clinical research, drug discovery, and genomics AI development. This partnership combines Illumina's sequencing technology with NVIDIA's AI platforms to improve multiomic data analysis and drug target identification, advancing precision health.

Europe Sequencing Reagents Market Analysis

Europe's market is witnessing steady growth driven by advanced genomic research, healthcare investments, and public health initiatives. The European Union’s emphasis on precision medicine and major genomic initiatives, such as the Horizon 2020 program, is fostering market expansion. Leading countries like the United Kingdom, Germany, and France are at the forefront of adopting genomic technologies and driving sequencing research. For instance, on January 9, 2025, Ultima Genomics' UG 100 platform was selected for the UK Biobank’s Pharma Proteomics Project, marking it as the world’s largest proteomics study. The UG 100 platform will analyze over 5,400 protein markers across 600,000 samples, in collaboration with Thermo Fisher Scientific’s Olink Explore HT platform, advancing personalized medicine and disease progression studies. Additionally, the rising incidences of genetic disorders and the augmenting demand for tailored healthcare solutions in Europe further contribute to market growth. Collaborative research and funding initiatives are strengthening Europe’s global position in the sequencing reagents market.

Asia Pacific Sequencing Reagents Market Analysis

Sequencing reagents is experiencing stable growth in the Asia Pacific region. The market has witnessed a growing investment in healthcare, along with increasing research initiatives and advancements in genomics in countries like China, Japan, and India. It is worth noting that China has made considerable investments in genomics research and biotechnology, placing it as one of the leading countries in the market. There is an increasing use of genomic testing, particularly in cancer, rare diseases, and infectious diseases. Sequencing reagents are expected to gain momentum. For example, on January 8, 2025, PacBio delivered Vega systems to Berry Genomics in order to enable the development of clinical assays for the Chinese and other market players. Through Vega's long-read sequencing, this partnership helps deliver high-quality genomics services for carrier, prenatal, and newborn screening to clinical labs across China. With rising chronic diseases and genetic disorders and the increased acceptance of next-generation sequencing technologies, demand for personalized medicine is increasingly being supported by the growing Asia Pacific market.

Latin America Sequencing Reagents Market Analysis

Latin America's market for sequencing reagents is likely to grow, due to the rising healthcare investment and expanding genomics research. Brazil, Mexico, and Argentina are also building more research facilities in oncology, infectious diseases, and agriculture areas. Despite the adoption of sequencing technologies falling behind many other regions, the growing prevalence of chronic diseases and increasing awareness of personalized medicine are augmenting market demand. Furthermore, interlocal government collaborations, universities, and international organization research capacity strengthens in the region. With developing regulatory frameworks, as well as health care accessibility, Latin America is expected to witness a faster growth of market expansion. Genomic testing with advanced next-generation sequencing technologies further supports the expectation for an even greater increase in demand for sequencing reagents within the region.

Middle East and Africa Sequencing Reagents Market Analysis

The Middle East and Africa (MEA) market is growing due to increased investments in healthcare infrastructure, biotechnology, and genomic research. For example, on January 21, 2025, Sanabil Investments partnered with Redesign Health to foster healthcare innovation in Saudi Arabia, aiming to launch 20 healthcare companies. Countries like Saudi Arabia, UAE, and South Africa are adopting genomic technologies for disease research and diagnostics. The market is driven by rising genetic disorders, cancer, infectious diseases, and the demand for personalized medicine. However, challenges like high costs and limited access to advanced technologies may hinder broader adoption, though growth is expected with continued investments.

Competitive Landscape:

The competitive landscape of the sequencing reagents market comprises several leading companies that offer a wide range of sequencing reagents, systems, and software. The competition is fueled by continual technological advancements, product innovation, as well as strategic partnerships. Companies are increasingly focused on next-generation sequencing (NGS) technologies with an aim to enhance sensitivity, accuracy, and throughput. For instance, Illumina's October 9, 2024, launch of the MiSeq i100 Series provides faster, easier benchtop sequencing solutions, which have room-temperature storage and shipping, reducing delay times and environmental impact. These systems support applications in microbiology, oncology, and infectious diseases. Additionally, collaboration with academic and biotech institutions is expanding market reach. With the increasing demand for personalized medicine and advancements in artificial intelligence and genomic data analytics, companies are investing heavily in R&D to maintain their competitive edge and meet changing market needs.

The report provides a comprehensive analysis of the competitive landscape in the sequencing reagents market with detailed profiles of all major companies, including:

- Agilent Technologies, Inc.

- F. Hoffmann-La Roche Ltd

- Illumina, Inc

- Integrated DNA Technologies, Inc.

- Meridian Bioscience Inc.

- PacBio

- QIAGEN

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- October 16, 2024: Element Biosciences launched Trinity, a target capture sequencing solution that simplifies exome sequencing, reducing time and costs. Integrated with the AVITI System, Trinity eliminates complex steps, saving up to 5 hours of manual work. It includes a fast hybridization option for same-day results and supports custom panels for applications like cancer and MRD.

- October 9, 2024: MagBio Genomics launched its patent-pending Short Fragment Depletor - 10 High Throughput kit (SFD-10HT), designed to enhance DNA sample quality for long-read sequencing. The SFD-10HT efficiently removes DNA fragments smaller than 10 kb, improving DNA preparation for third-generation sequencing platforms like Pacific Biosciences. This advancement enhances genome assembly and structural variant identification.

- July 9, 2024: Illumina acquired Fluent BioSciences, a developer of innovative single-cell analysis technology. Fluent's accessible, scalable method eliminates the need for expensive instrumentation, enabling broader customer adoption. Integrated with Illumina's sequencing and informatics solutions, this acquisition enhances multiomics capabilities and accelerates discovery in single-cell research, offering comprehensive solutions for a wide range of applications.

- March 12, 2024: Curio Bioscience launched Curio Trekker, the world's first technology to spatially contextualize single cell sequencing data. Developed with the Broad Institute, this product provides single-cell spatial resolution, enhancing single-cell and single-nuclei analyses. Curio Trekker enables researchers to capture spatial data easily, revolutionizing research in fields like cancer biology and neuroscience.

- February 7, 2024: Sysmex and Hitachi High-Tech announced a collaboration to develop new genetic testing systems enabled with capillary electrophoresis sequencers, or CE sequencers. The partnership focuses on improving efficiency, reducing cost, and shortening measurement times for clinical genetic testing, primarily in oncology and other diseases. The companies plan regulatory approval for devices and reagents.

Sequencing Reagents Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Sanger Sequencing, Next-Generation Sequencing, Third Generation Sequencing |

| Types Covered | Library Kits, Template Kits, Control Kits, Sequencing Kits, Others |

| Applications Covered | Oncology, Reproductive Health, Clinical Investigation, Agrigenomics and Forensics, Consumer Genomics, Others |

| End Uses Covered | Academic Research, Clinical Research, Hospitals and Clinics, Pharmaceutical and Biotechnology Companies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd, Illumina, Inc., Integrated DNA Technologies, Inc., Meridian Bioscience Inc., PacBio, QIAGEN, Takara Bio Inc., Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sequencing reagents market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sequencing reagents market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sequencing reagents industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sequencing reagents market was valued at USD 9.56 Billion in 2024.

The sequencing reagents market is projected to exhibit a CAGR of 16.70% during 2025-2033, reaching a value of USD 42.73 Billion by 2033.

Key factors driving the market include continual advancements in genomic research, growing demand for personalized medicine, rising genetic disorders, increasing oncology applications, and innovations in sequencing technologies like NGS. Additionally, continual government investments in healthcare and genomics are contributing to the market growth.

North America presently dominates the sequencing reagents market, accounting for a share exceeding 48.6%. This dominance is fueled by advanced healthcare infrastructure, robust research capabilities, and high adoption of next-generation sequencing technologies.

Some of the major players in the sequencing reagents market include Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd, Illumina, Inc., Integrated DNA Technologies, Inc., Meridian Bioscience Inc., PacBio, QIAGEN, Takara Bio Inc., and Thermo Fisher Scientific Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)