Seismic Services Market Size, Share, Trends and Forecast by Type, Technology, Location of Deployment, Application, and Region, 2025-2033

Seismic Services Market Size and Share:

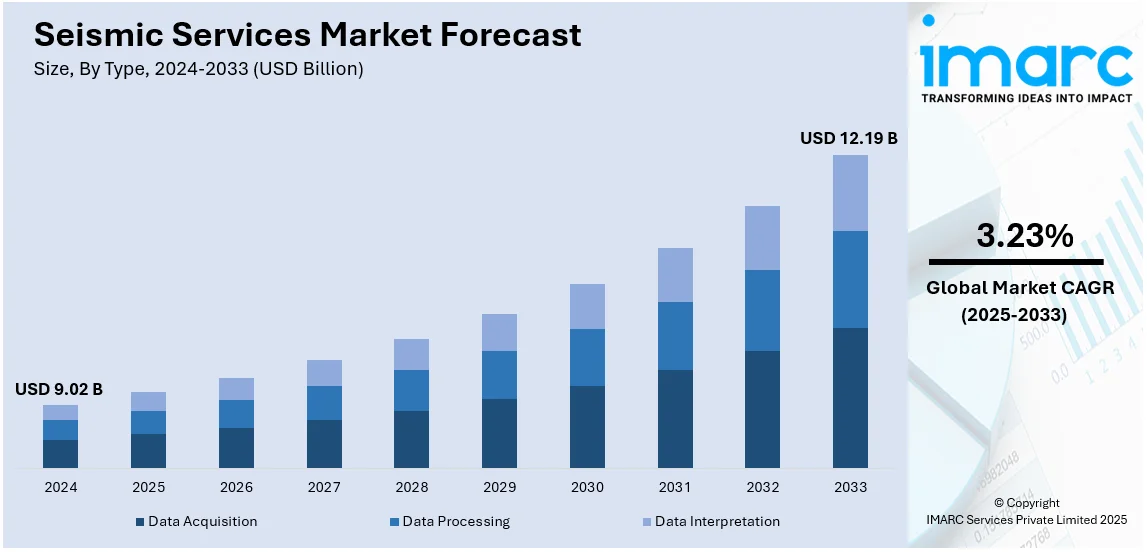

The global seismic services market size was valued at USD 9.02 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.19 Billion by 2033, exhibiting a CAGR of 3.23% during 2025-2033. North America currently dominates the market, holding a significant market share of over 39% in 2024. The is influenced by oil and gas exploration, technological advancements, earthquake risk assessments, and stricter safety regulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.02 Billion |

| Market Forecast in 2033 | USD 12.19 Billion |

| Market Growth Rate (2025-2033) | 3.23% |

The market for seismic services is driven by increasing oil & gas exploration, advancements in seismic imaging technology, rising infrastructure development, and growing geohazard assessments. The demand for energy resources fuels the need for seismic surveys to locate new reserves and optimize drilling operations. Innovations in 3D & 4D seismic imaging, AI, and IoT enhance data accuracy, improving exploration efficiency. Governments and industries require seismic data for construction safety, mining, and renewable energy projects. Increasing awareness of earthquakes, landslides, and subsurface risks is driving the demand for seismic surveys to mitigate potential hazards. The factors, collectively, are creating a seismic services market outlook outlook across the globe.

The United States seismic services market is driven by increasing oil & gas exploration, rising investments in renewable energy, infrastructure development, and geohazard risk assessment. According to industry reports, in the United States, the average annual cost to taxpayers for earthquake damage restorations is close to USD 15 Billion. Funding to stabilize or minimize damage is a wise and sensible move considering that. A recent geological assessment and the Federal Emergency Management Agency (FEMA) have found that the cost of post-earthquake rehabilitation can be up to three times higher than the cost of making investments in infrastructure modifications that are earthquake resilient. The shale revolution and offshore drilling projects in the Gulf of Mexico fuel demand for advanced seismic surveys. Technological advancements in 3D and 4D seismic imaging enhance exploration efficiency. Additionally, the expansion of wind and geothermal energy projects requires subsurface analysis. Growing concerns over earthquakes and natural disasters drive demand for seismic studies in construction and mining industries.

Seismic Services Market Trends:

Adoption of Advanced Seismic Technologies

Advanced technologies, such as 4D seismic imaging, AI, and machine learning, are now increasingly getting adopted and therefore the seismic services market is witnessing an essential shift. This is because seismic data collection and interpretation would drastically improve in terms of accuracy and speed due to these innovations. For example, it is possible to observe subsurface changes over time using 4D seismic imaging, hence obtaining more detailed insights into the behavior of a reservoir. AI and machine learning are being increasingly applied to process copious amounts of seismic data, enabling more accurate pattern identification and subsurface condition prediction. As per reports, machine learning algorithms have been shown to reduce data processing time by up to 60%, leading to faster and more efficient seismic data interpretation. These innovations are revolutionizing resource exploration and development by increasing the precision and accuracy of seismic data, enabling companies to reduce exploration costs by up to 30%. The companies in the oil, gas, and mineral sectors will be reaching out to these advanced seismic services more frequently as it cater to more sustainable and cost-effective alternatives. This change is going to make seismic services a critical enabler of performance and profitability improvement for resource development projects across all industry sectors.

Growing Demand for Renewable Energy Sources

Increased focus across the globe on transitioning to renewable sources of energy represents one of the key seismic services market trends. As industries begin to explore and tap into renewable energy sources, such as geothermal and offshore wind, site selection and resource evaluation rely heavily on seismic data. Seismic services help geothermal energy projects determine the appropriate sites for drilling to get good subsurface conditions, which are the right temperature and fluid flow to make sure energy production is optimized. Similarly, seismic services aid the development of offshore wind farms through seabed mapping and subsurface data, enabling the stability to be determined and minimizing risks. According to ThinkGeoEnergy, global geothermal power generation capacity stood at 16,127 MW at the end of 2022, with an increase of 286 MW over 2021. Additionally, the International Renewable Energy Agency (IRENA) reported that electricity generation from geothermal energy reached a total installed capacity of approximately 15.96 GW in 2021, growing at a modest rate of around 3.5% annually. This growth is expected to continue, with increasing investments in geothermal energy. This trend is fueled by government incentives, environmental regulations, and the growing demand for clean energy. These variables are driving investments in renewable energy infrastructure, which in turn is expanding the seismic services market, as the increase in demand for accurate subsurface data to support these renewable energy projects, therefore contributing to a more sustainable and diversified energy mix worldwide.

Focus on Environmental Sustainability and Risk Management

Environmental sustainability and risk management are emerging as major market drivers for seismic services, given the emphasis of various industries on reducing their environmental footprint and ensuring the safety of their activities. The oil, gas, and infrastructure sectors specifically rely on the availability of seismic data to evaluate the potential environmental risks connected to drilling, construction, or resource extraction. For instance, seismic surveys aid in fault lines detection, soil stability evaluation, and even predict earthquakes or landslides in areas of operation. Additionally, seismic monitoring systems for pipeline integrity have been shown to lower pipeline failures by up to 30%, an industrial report stated. Because regulations are strictly imposed, seismic services have become a corporate choice for full monitoring and risk assessment to comply with the environmental regulations. However, focusing on environmental issues and safety brings seismic services up to the frontline of risk management, and consequently, it finds its place to guarantee operations and also sustainability in whatever industry.

Seismic Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global seismic services market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on type, technology, location of deployment, and application.

Analysis by Type:

- Data Acquisition

- Data Processing

- Data Interpretation

Data acquisition dominates the seismic services market as it is the foundation of seismic exploration, providing critical subsurface data for industries like oil & gas, mining, and infrastructure development. Advanced 2D, 3D, and 4D seismic surveys help identify hydrocarbon reserves, assess geohazards, and support construction projects. With increasing demand for high-resolution imaging, companies invest heavily in cutting-edge sensors, geophones, and drones for accurate data collection. Additionally, technological advancements in wireless and nodal seismic systems enhance efficiency, driving further growth. As exploration and infrastructure projects expand, data acquisition remains the most vital and largest segment in seismic services.

Analysis by Technology:

- 2D Imaging

- 3D Imaging

- 4D Imaging

3D imaging leads the market with around 40.0% of the seismic services market share in 2024. 3D imaging dominates the market due to its ability to provide high-resolution subsurface mapping, essential for oil & gas exploration, geohazard assessment, and infrastructure development. Compared to traditional 2D surveys, 3D seismic imaging offers greater accuracy, depth perception, and data reliability, helping companies reduce drilling risks and optimize resource extraction. With increasing investments in advanced exploration technologies, industries prefer 3D seismic surveys to enhance reservoir characterization and earthquake hazard mitigation. Additionally, innovations in AI and machine learning further improve data processing and interpretation, solidifying 3D imaging as the most widely used seismic technology.

Analysis by Location of Deployment:

- Onshore

- Offshore

Onshore seismic services dominate due to high oil & gas exploration activity, infrastructure development, and geohazard assessments. Land-based seismic surveys are widely used for hydrocarbon exploration, mining, and construction projects. Governments and private companies invest in advanced seismic technologies to locate underground resources and assess earthquake risks. Additionally, advancements in nodal seismic systems, wireless sensors, and AI-driven data processing enhance efficiency and cost-effectiveness are intensifying the seismic services market demand. Expanding urbanization, renewable energy projects and underground storage facilities also drive demand. As a result, onshore seismic services continue to be crucial for industries requiring precise subsurface imaging and risk assessment.

Offshore seismic services lead due to rising deepwater and ultra-deepwater oil & gas exploration. Many energy companies invest in 3D and 4D seismic imaging to map undersea reservoirs and improve drilling accuracy. The demand for offshore wind farms and subsea infrastructure also boosts seismic surveys. Technological advancements like streamer-based surveys, ocean-bottom nodes (OBN), and autonomous underwater vehicles (AUVs) enhance data collection efficiency. With the global energy transition, offshore seismic services support carbon capture storage (CCS) projects and marine geohazard assessments. These factors make offshore seismic exploration a critical segment of the seismic services market.

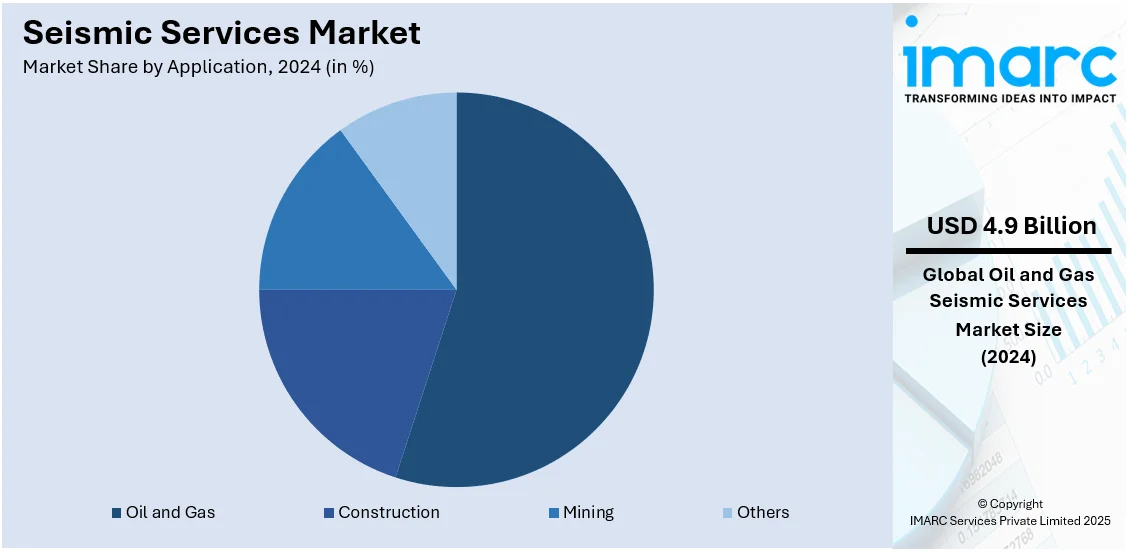

Analysis by Application:

- Oil and Gas

- Construction

- Mining

- Others

Oil and gas leads the market with around 54.7% of market share in 2024. The oil & gas industry dominates the seismic services market due to its reliance on seismic surveys for hydrocarbon exploration and reservoir management. 2D, 3D, and 4D seismic imaging help locate and evaluate underground oil and gas reserves, reducing drilling risks and improving extraction efficiency. With rising global energy demand, companies continue investing in offshore deepwater exploration and shale gas extraction, increasing the need for advanced seismic technologies. Additionally, seismic services support enhanced oil recovery (EOR) techniques and carbon capture storage (CCS), further driving the seismic services market growth. As a result, oil & gas remains the largest consumer of seismic services.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39%. The seismic services market in North America is driven by several factors. Increasing demand for oil and gas exploration and production has led to a rise in seismic surveys for resource identification and mapping. Advances in seismic technology, including 3D and 4D imaging, have improved the accuracy and efficiency of subsurface data collection, making it more attractive to industries. The growing emphasis on disaster risk mitigation, particularly in earthquake-prone areas like California, is fueling demand for seismic hazard assessments and monitoring services. Furthermore, stricter regulations and safety standards in construction require detailed seismic analysis to ensure structural integrity. The need for renewable energy exploration, such as geothermal resources, and the push for sustainable infrastructure also contribute to the growth of seismic services in the region.

Seismic Services Market Regional Takeaways:

United States Seismic Services Market Analysis

In 2024, the United States accounted for the largest market share of over 82.80% in North America. The U.S. seismic services market is developing with offshore oil and gas exploration, infrastructure, and renewable energy projects. The U.S. EIA estimates the crude oil production to be about 12.9 million barrels per day in 2023; for that reason, superior seismic technologies and practices for characterizing reservoirs are needed. Investments by the Federal Government in carbon capture and geothermal energy also contribute to the demand for seismic surveys. The main players are Schlumberger and CGG which lead the market with their superior products, 3D and 4D seismic imaging offerings. The Gulf of Mexico remains the epicenter of exploration, where drilling is taking place further offshore. Technological advances are inputting machine learning to enhance data interpretation. Government-backed geological surveys and increasing investment in offshore wind projects ensure growth in the market, making the U.S. a world leader in seismic services.

Europe Seismic Services Market Analysis

The European seismic services market is rising because of offshore oil and gas exploration, renewable energy projects, and government-backed geological studies. Major activity in seismic remains in the North Sea region, especially in Norway and the UK. According to an industrial report, the oil and gas investment in Norway in 2024 was estimated at USD 22.9 billion, which ensured a continued demand for seismic surveys for the optimization of resource extraction. The European Commission has allocated more than EUR 800 million (USD 884.71 million) for offshore wind farm development in 2023, which further increases the demand for seabed mapping and geophysical assessments. The UK and the Netherlands are focusing on carbon capture and geothermal energy, which is further increasing seismic service demand. Companies like PGS and TGS are leading the market with AI-driven seismic processing and 4D imaging. Moreover, the stringent EU environmental regulations encourage the development of low-impact seismic techniques. Europe will continue being the central market for seismic service providers, both fossil fuels and renewables.

Asia Pacific Seismic Services Market Analysis

The Asia Pacific seismic services market is growing rapidly in response to energy demand, increasing offshore exploration activities, and support from the government for domestic oil and gas production. According to recent reports, China's investment in oil and gas exploration has exceeded USD 20 billion during 2023, with investments in developing unconventional resources such as shale oil and gas to improve its domestic energy security and production, especially through offshore and unconventional reserves. India has committed around USD 8 billion in 2023 for its energy sector under the "Hydrocarbon Exploration and Licensing Policy," which has increased seismic survey activity. Australia, the world's largest LNG exporter, shipped around 80 million metric tons in 2023, relying on high-end seismic services for offshore gas field assessments, as per an industry report. Companies such as BGP Inc. and Shearwater GeoServices are using AI-driven seismic imaging for better accuracy. Southeast Asian expansion deepwater oil exploration in Southeast Asia and geothermal energy projects in Indonesia and the Philippines buttress further development of the markets. Energy security is a push for governments, and seismic services are essential for continued regional exploration efforts.

Latin America Seismic Services Market Analysis

The Latin American seismic services market is growing as the region continues to invest heavily in energy infrastructure and upgrade its oil refining capabilities. According to an industry report, the Mexican government recently presented an investment plan of USD 14 billion, of which USD 4.65 billion is targeted for energy projects to increase the refining capacity of Petróleos Mexicanos, or Pemex. Key projects are the completion of a coking plant at Pemex's Tula refinery and upgrading the Cadereyta refinery, which will help to process more heavy crudes into higher-value fuels. Furthermore, a natural gas liquefaction plant at the Salina Cruz port is under investment worth USD 25.2 billion. These projects are stimulating the demand for advanced seismic surveys for optimizing resource extraction and infrastructure development. Other companies operating here are CGG and Schlumberger, who perform state-of-art seismic data acquisitions and interpretations. With Latin America becoming increasingly involved in energy projects, the seismic services market is prepared for a sustainable growth profile, playing a vital role in the region's energy strategy.

Middle East and Africa Seismic Services Market Analysis

The Middle East and Africa seismic services market is expanding because of the extensive oil and gas exploration, rising offshore investments, and government-backed energy diversification initiatives. Saudi Arabia, a dominant oil producer, allocated over USD 50 billion for upstream oil and gas investments in 2023, sustaining demand for seismic surveys, according to the International Energy Agency (IEA). The UAE is investing in expanding the offshore reserves, ADNOC aims to invest 150 billion dollars in exploration and production in five years. Africa seismic services market picks up, particularly Namibia and Angola, turn into hot spots for new discoveries offshore, and companies PGS and Schlumberger dominate seismic exploration on the continent, and geothermal energy projects across Kenya and Ethiopia also boost the demand for seismic services onshore. Adoption of OBS technology and AI in seismic data interpretation is changing the way efficiency in exploration takes place and forms future market trends.

Top Seismic Services Companies:

The seismic services market is highly competitive, with key players including Schlumberger, Halliburton, and CGG, offering a wide range of geophysical and seismic survey solutions. These companies dominate through advanced technologies like 3D and 4D seismic imaging, providing accurate subsurface data for industries such as oil and gas, construction, and environmental monitoring. Smaller, regional players also contribute by offering specialized services in seismic hazard assessments, earthquake monitoring, and geotechnical investigations. Competition is driven by technological innovation, with a focus on improving seismic data quality, reducing costs, and enhancing efficiency. Additionally, demand for earthquake-resistant infrastructure in seismic-prone areas, particularly in North America, increases the need for reliable seismic service providers. Strategic partnerships and acquisitions are common as firms seek to expand their service offerings and geographic reach.

The report provides a comprehensive analysis of the competitive landscape in the seismic services market with detailed profiles of all major companies, including:

- Agile Seismic LLC

- Amerapex Corporation

- Asian Energy Services Ltd

- China National Petroleum Corporation

- China Oilfield Services Limited

- Echo Seismic Ltd.

- Halliburton Company

- PGS

- Pulse Seismic Inc.

- Schlumberger Limited

- SeaBird Exploration.

Latest News and Recent Developments:

- December 2024: Halliburton Labs welcomed five companies—360 Energy, Cella, Espiku, Mitico, and NuCube—into its collaborative ecosystem to advance energy solutions. The companies will focus on innovations in gas monetization, carbon storage, water recovery, carbon capture, and nuclear fission, with Halliburton’s support accelerating their commercialization efforts.

- November 2024: China Petroleum's BGP Inc., a subsidiary of CNPC, won a USD 490 million contract from ADNOC for a high-density 3D seismic survey of onshore oil fields. The project was announced at ADIPEC and expands ADNOC's 2018 initiative, using AI to speed up data interpretation and improve resource recovery across 85,000 square km.

- September 2024: Asian Energy Services secured a USD 9.47 million contract from Oil India for 2D seismic data acquisition of 4,300 LKM in Rajasthan Basin under Mission Anveshan. The 18-month project strengthens its order book to USD 115.5 million, supporting India’s energy exploration efforts and reinforcing the company’s industry presence.

- July 2024: PGS and TGS have finalized their full-service energy data company merger. With regulatory clearances, TGS has issued new shares and cash compensation to the former shareholders of PGS. Integration is going to help improve the efficiency of operation, innovation, and customer engagement. A strategic vision update will be provided on August 29.

- May 2024: SeaBird Exploration secured a six-month OBN source work contract for the Eagle Explorer in the Western Hemisphere, with potential extensions. Mobilization has begun, with operations starting in June 2024. The company’s backlog includes 33 months of OBN work, with additional opportunities in 2D seismic surveys under consideration.

Seismic Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Data Acquisition, Data Processing, Data Interpretation |

| Technologies Covered | 2D Imaging, 3D Imaging, 4D Imaging |

| Location of Deployments Covered | Onshore, Offshore |

| Applications Covered | Oil and Gas, Construction, Mining, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agile Seismic LLC, Amerapex Corporation, Asian Energy Services Ltd, China National Petroleum Corporation, China Oilfield Services Limited, Echo Seismic Ltd., Halliburton Company, PGS, Pulse Seismic Inc., Schlumberger Limited and SeaBird Exploration |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the seismic services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global seismic services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the seismic services industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The seismic services market was valued at USD 9.02 Billion in 2024.

The seismic services market is projected to exhibit a CAGR of 3.23% during 2025-2033, reaching a value of USD 12.19 Billion by 2033.

Key factors driving the seismic services market include increasing demand for oil and gas exploration, advancements in seismic technology (like 3D and 4D imaging), rising need for earthquake risk assessments, stricter construction safety regulations, and growing interest in renewable energy resources such as geothermal.

North America currently dominates the seismic services market, accounting for a share of 39%. Factors driving the North American seismic services market include oil and gas exploration, technological advancements, earthquake risk assessment, and safety regulations.

Some of the major players in the global seismic services market include Agile Seismic LLC, Amerapex Corporation, Asian Energy Services Ltd, China National Petroleum Corporation, China Oilfield Services Limited, Echo Seismic Ltd., Halliburton Company, PGS, Pulse Seismic Inc., Schlumberger Limited and SeaBird Exploration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)