Secure Logistics Market Size, Share, Trends and Forecast by Type, Service Type, Application, End User, and Region, 2025-2033

Secure Logistics Market Size and Share:

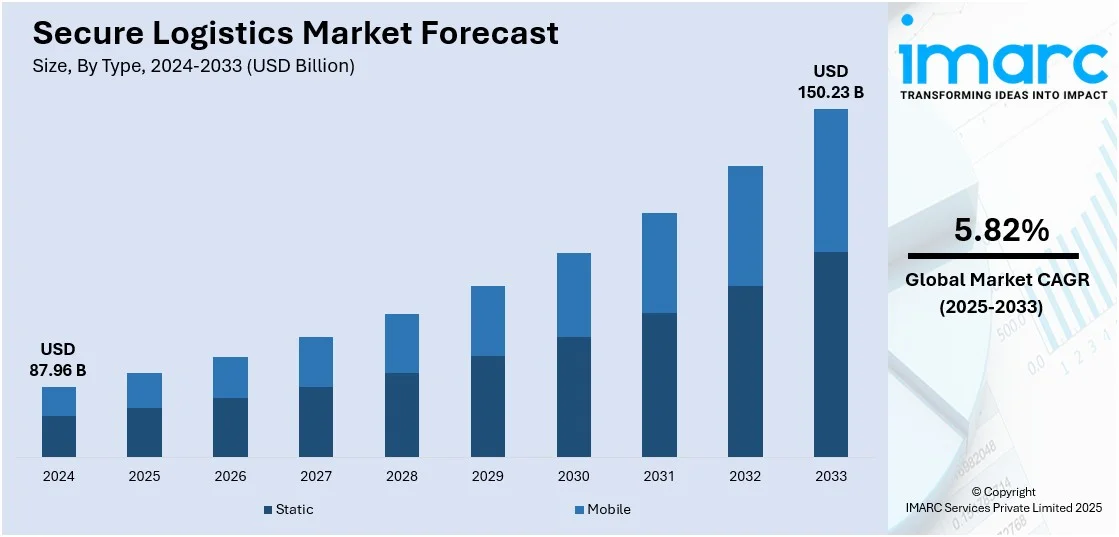

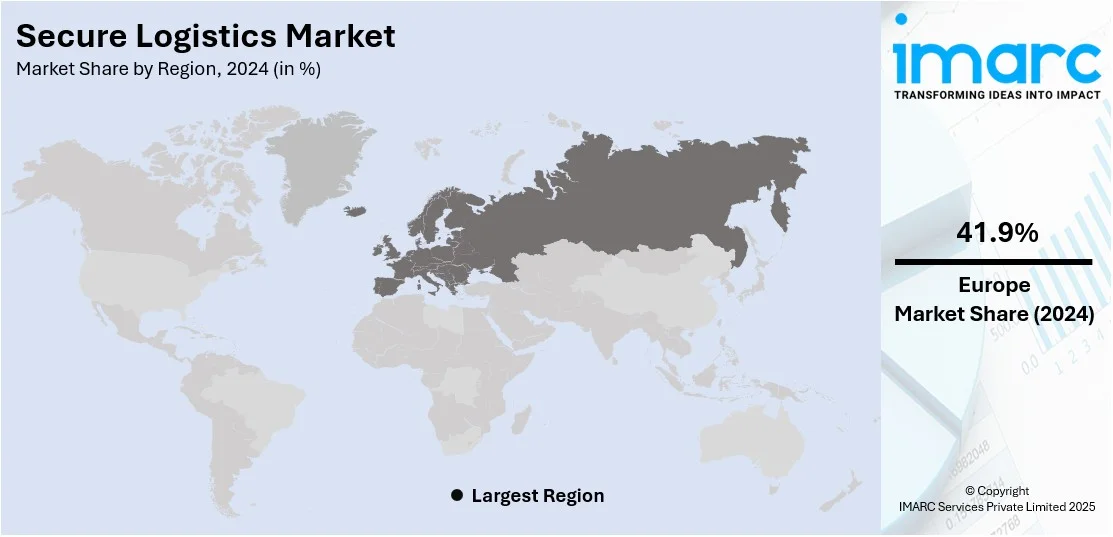

The global secure logistics market size was valued at USD 87.96 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 150.23 Billion by 2033, exhibiting a CAGR of 5.82% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 41.9% in 2024. The region’s well-established banking sector, organized retail, and emphasis on supply chain safety contribute to its leading role in the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 87.96 Billion |

|

Market Forecast in 2033

|

USD 150.23 Billion |

| Market Growth Rate 2025-2033 | 5.82% |

The secure logistics market is driven by a growing demand for safe transportation of valuable assets like cash, jewelry, and confidential documents. Rising crime rates, stricter regulatory standards, and the need for risk mitigation push banks, retailers, and government agencies to invest in secure transport solutions. The rapid expansion of e-commerce and international trade has added pressure to tamper-proof supply chains. Technological advancements, such as GPS tracking, smart locks, and real-time monitoring, have improved service reliability and customer trust. The rise of high-value pharmaceutical and electronics shipments also fuels market growth. Additionally, geopolitical tensions and global instability have increased the demand for armored transport and secure warehousing, especially in regions with weak infrastructure or security risks.

Pharmaceutical logistics in the US has increasingly focused on upgrading storage facilities to meet cGMP standards, with an emphasis on temperature control and enhanced security. This shift addresses the growing need for safe, compliant handling of high-value medical shipments, driven by stricter regulations, complex cold chain requirements, and rising demand for secure healthcare distribution. For instance, in September 2024, MD Logistics, a subsidiary of Nippon Express Holdings, converted 18,500 sq. meters of its Plainfield, Indiana, warehouse into a cGMP-compliant, temperature-controlled pharmaceutical facility with advanced security systems. The upgrade enhanced secure logistics capabilities for sensitive healthcare shipments in the US, meeting rising demand for compliant, high-security pharmaceutical distribution.

Secure Logistics Market Trends:

Growth of Secure Logistics with TMS, Precious Goods, and BFSI Sector

The increasing use of transportation management systems (TMS) is driving the secure logistics market, as these systems streamline shipment processes and improve operational transparency. The growing demand for precious metals and diamonds also fuels this trend, with secure logistics playing a key role in tracking, monitoring, and handling high-value consignments. Additionally, expansion in the banking, financial services, and insurance (BFSI) sector, alongside broader digitization across industries, is boosting market growth. Secure logistics supports the sector through regulated cash handling, wealth management, and the secure movement of sensitive financial assets. As per an industry report, by the end of 2024, digital banking users are expected to reach 3.6 billion, with the digital banking platform market projected to hit USD 13.9 Billion by 2026.

Impact of Digital Payments and Wallet Adoption

Secure logistics is also benefiting from the global shift toward digital payment methods. As more industries adopt cashless transactions, the backend infrastructure supporting these systems requires robust security, especially for high-value, real-time digital exchanges. The demand for outsourced security services and secure handling of transaction data continues to rise. According to reports, digital wallets handled USD 13.9 Trillion in global transaction value in 2023, accounting for half of all online transactions. This figure is expected to grow beyond USD 25 trillion by 2027, making up 49% of all online sales. The increased usage of digital wallets reinforces the need for secure logistics systems that can support this volume with minimal risk and high operational reliability.

Growth in Specialized Medical Device Logistics

Secure transport solutions for high-value medical devices are gaining ground across major European countries. With the rising demand for precision and compliance in the healthcare sector, logistics providers are introducing specialized road services that offer end-to-end visibility, trained personnel, and white-glove handling. Countries such as Germany, France, the UK, the Netherlands, Spain, and Italy are key markets adopting these solutions. As medical technology advances and delivery requirements become stricter, tailored logistics support is becoming essential for maintaining product integrity and meeting regulatory standards. For instance, in May 2024, Kuehne+Nagel launched specialized road logistics services for the MedTech industry in Europe, ensuring the secure handling of high-value medical devices. Available in Germany, France, the UK, the Netherlands, Spain, and Italy, it offers end-to-end visibility, trained experts, proactive monitoring, and white-glove deliveries, enhancing safety and reliability.

Secure Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global secure logistics market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, service type, application, and end user.

Analysis by Type:

- Static

- Mobile

Static stands as the largest component in 2024, holding around a 59.6% share of the market, owing to the demand from sectors that require consistent and high-value transport services. This includes banking, retail, pharmaceuticals, and government entities, all of which need regular, scheduled logistics support for cash, confidential documents, high-end electronics, or sensitive goods. These clients typically operate on fixed routes and predictable timelines, creating a stable revenue stream for logistics providers. The consistent volume and frequency of transport needs allow companies to optimize operations, invest in secure infrastructure, and scale efficiently. Since these sectors can’t afford disruption or risk, they rely heavily on secure logistics, reinforcing long-term contracts and driving steady growth across the market. This stability anchors the industry and attracts investment.

Analysis by Service Type:

- Cash Services

- Security Services

The secure logistics market is driven by strong demand across cash services and security services. Cash logistics remains essential in emerging economies where physical currency is widely used. Banks, ATMs, and retailers rely on regular cash-in-transit, ATM replenishment, and vault services, creating steady revenue and long-term contracts. To meet expectations around speed and safety, providers are investing in armored fleets, tracking, and digital tools.

At the same time, the need to transport high-value goods, like jewelry, pharmaceuticals, and confidential materials, is boosting demand for specialized security services. These include armed escorts, surveillance, and compliance-driven protocols. With rising risks and stricter regulations, companies are turning to experienced providers for secure, efficient transport, making both segments key growth drivers in the market.

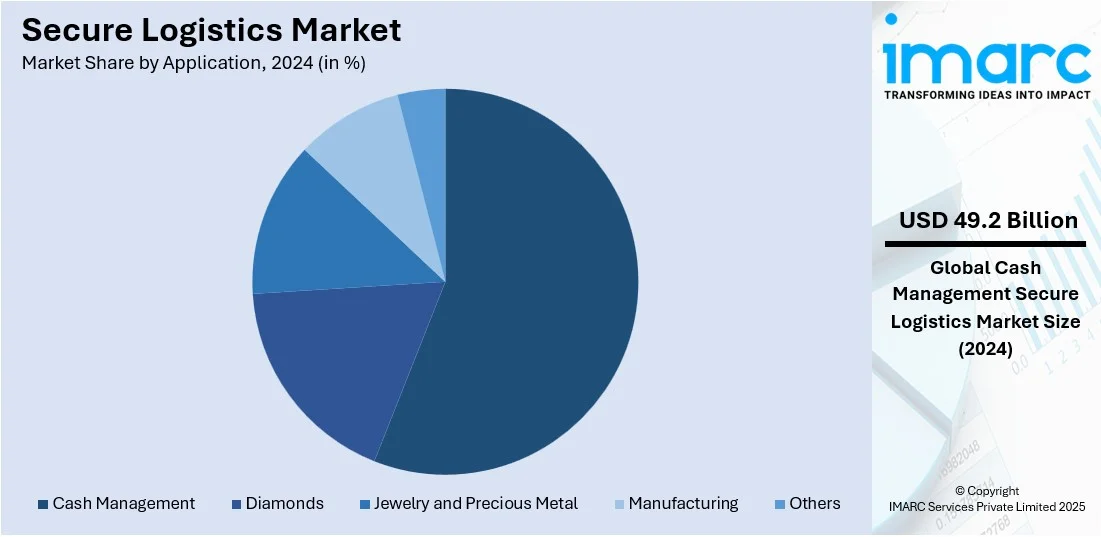

Analysis by Application:

- Cash Management

- Diamonds

- Jewelry and Precious Metal

- Manufacturing

- Others

Cash management leads the market with around 55.9% of market share in 2024 due to its essential role in supporting financial operations for banks, retailers, and other cash-intensive businesses. This segment includes cash collection, counting, sorting, vaulting, reconciliation, and real-time reporting. As businesses aim to reduce in-house handling risks and improve efficiency, they increasingly outsource cash management to specialized logistics providers. In many regions, especially in developing markets, cash remains a primary mode of transaction, making secure and timely handling critical. The need for accuracy, accountability, and compliance has pushed providers to adopt automated systems and integrated technology. The recurring nature of these services and their importance to daily operations make cash management a consistent revenue stream and a major contributor to market growth.

Analysis by End User:

- Financial Institutions

- Retailers

- Government

- Others

Financial institutions require regular cash-in-transit, ATM replenishment, and vault services to ensure uninterrupted cash availability and security. As financial networks expand, the demand for armored transport, real-time tracking, and regulatory compliance grows, making secure logistics essential to their operations.

Retailers depend heavily on secure logistics to manage daily cash flows. Large retail chains, supermarkets, and fuel stations need frequent cash pickups and deposits to reduce in-store risk and streamline operations. With high transaction volumes, they rely on providers for efficient cash handling, reconciliation, and secure delivery to financial institutions.

Government agencies use secure logistics for currency distribution, tax collection, confidential document transport, and movement of sensitive or high-value assets. These services must meet strict regulatory and security standards, driving demand for trusted logistics partners with specialized infrastructure and trained personnel.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 41.9%, driven by high demand from banking, retail, and government sectors. The region has a dense network of ATMs, a strong retail presence, and ongoing use of physical cash, especially in countries like Germany, Spain, and Italy. Strict regulatory frameworks and insurance standards push companies to invest in professional secure logistics services. Financial institutions require frequent cash replenishment and secure vaulting, while retailers depend on regular cash pickups to reduce in-store risk. Government contracts for the secure transport of currency, confidential documents, and sensitive materials further support market growth. Europe’s emphasis on compliance, risk management, and technological integration has positioned it as a stable, high-value market for secure logistics providers.

Key Regional Takeaways:

United States Secure Logistics Market Analysis

In 2024, the United States held a share of 88.9% in North America. The market is primarily driven by the increasing demand for secure transportation of high-value goods and sensitive information. In line with this, continuous technological advancements, such as real-time tracking systems and blockchain integration, enhancing transparency and security in operations, are propelling the market growth. Furthermore, heightened concerns about cybersecurity and data breaches are pushing companies to invest in more secure logistics solutions and fostering market expansion. The rise in e-commerce and the need for secure last-mile deliveries are also fueling market demand. The U.S. Census Bureau reported that U.S. retail e-commerce sales for the fourth quarter of 2024 reached USD 308.9 Billion, reflecting a 2.7% increase from the third quarter of 2024. E-commerce sales also accounted for 16.4% of total retail sales in Q4 2024, highlighting the continued shift toward online shopping. Additionally, the expansion of the pharmaceutical and healthcare sectors requiring secure transportation of sensitive products is encouraging higher product consumption. Moreover, the growing need for risk management and insurance solutions in logistics, as well as a rise in global trade and international shipments, are contributing to the market's expansion.

Europe Secure Logistics Market Analysis

The market in Europe is expanding due to rising security threats, prompting businesses to invest in advanced risk mitigation solutions. Similarly, the rise in high-value goods transportation, including luxury items and pharmaceuticals, is supporting the market demand for specialized services. Furthermore, growing regulatory compliance requirements, such as GDPR and AML directives, driving companies to implement enhanced security measures for logistics operations, are fostering market expansion. The rise of organized crime and cyber threats pushing logistics providers to integrate AI-driven surveillance, blockchain tracking, and biometric verification is further stimulating the market appeal. According to reports, in 2023, 8% of enterprises in the EU with 10 or more employees utilized AI technologies to enhance their business processes. Additionally, the expansion of e-commerce and digital payments heightening the need for fraud prevention and secure cash handling solutions is also impelling the market. Moreover, rapid urbanization and smart city initiatives accelerating the adoption of real-time tracking and security monitoring technologies are providing an impetus to the market.

Asia Pacific Secure Logistics Market Analysis

The secure logistics market in Asia-Pacific is being driven by the rising financial fraud and data breaches, pushing businesses to adopt advanced security measures. In accordance with this, the growth of cross-border trade has led to the increasing demand for secure transportation and real-time tracking solutions, thereby propelling the market growth. As per NITI Aayog, India's total trade during H1 2024 reached USD 576 Billion, marking a 5.45% year-on-year increase. Exports rose by 5.41% to USD 231 Billion, while imports grew by 5.48%, totaling USD 345 Billion. Furthermore, stringent government regulations on financial security and anti-money laundering (AML) compliance driving logistics firms to implement enhanced monitoring systems are encouraging higher product adoption. The rise of high-value asset transportation, including electronics and confidential documents, fueling the requirement for secure cash-in-transit and asset protection services is also bolstering market demand. Moreover, the rapid digitization of supply chains is increasing the need for blockchain-based logistics tracking and biometric authentication, ensuring greater transparency, security, and risk management across the region.

Latin America Secure Logistics Market Analysis

In Latin America, the secure logistics market is propelled by the region’s rising cargo thefts and organized crimes, thereby increasing the need for enhanced surveillance and GPS-enabled tracking. The Overhaul México Annual Cargo Theft Report 2024 reveals a significant year-over-year rise in cargo thefts. 80% of incidents involved violence, and 87% of thefts occurred in ten states. Puebla (23%) and Mexico State (22%) accounted for 45% of total cases nationwide. Similarly, the growth of the banking and financial sector requiring secure cash handling and armored transport services is impelling the market. Moreover, the increasing adoption of AI-powered risk assessment tools helping businesses prevent fraud and mitigate security threats efficiently is also bolstering the market development. Besides this, regulatory enforcement on supply chain security, prompting companies to invest in tamper-proof packaging and secure warehousing, is further fostering market expansion.

Middle East and Africa Secure Logistics Market Analysis

The Middle East and Africa market is expanding, attributed to heightened geopolitical instability, thereby increasing the need for secure transport and risk mitigation solutions. In line with this, the growth of critical infrastructure projects is driving demand for specialized security logistics for construction materials and high-value equipment. Furthermore, rising cyber threats in financial transactions prompting banks and fintech firms to adopt secure cash-in-transit and digital fraud prevention solutions, is propelling the market growth. The 2024 State of Cyber Security in MENA Report reveals a 68% rise in ransomware data leak site (DLS) victims, with 205 MEA companies affected. The GCC saw a 65% increase, from 32 cases in 2022 to 53 in 2023, highlighting growing cyber threats. Moreover, the expansion of luxury retail and precious metals trade fueling the need for high-security vaults and armored transport, is positively influencing the market.

Competitive Landscape:

The secure logistics market is witnessing increased partnerships and technology-driven collaborations, especially around real-time tracking, AI-based risk management, and blockchain for transparency. Governments are also pushing regulations for secure supply chains. While R&D and new product launches continue, partnerships and tech collaborations are currently the most common, enabling companies to scale services and strengthen security measures.

The report provides a comprehensive analysis of the competitive landscape in the secure logistics market with detailed profiles of all major companies, including:

- Allied Universal (Caisse de dépôt et placement du Québec)

- Brink's Company

- GardaWorld Corporation

- Lemuir Group

- Loomis

- Maltacourt Ltd

- PlanITROI Inc

- Prosegur Cash (Prosegur Compañía de Seguridad, S.A)

- Secure Logistics LLC.

- Securitas AB

- Serco Group plc

- SIS Group Enterprise

Latest News and Developments:

- February 2025: Shadowfax launched SF Shield, an AI-powered logistics security system integrating Track & Trace Solution and SF Eye. It enhances shipment visibility, fraud prevention, and gig workforce verification. With real-time tracking, AI-driven surveillance, and 20 million daily scans, it strengthens logistics security, minimizing discrepancies and improving supply chain integrity.

- February 2025: Elixia launched a cold chain logistics marketplace, offering on-demand, temperature-controlled transport for 2,000+ shippers and hundreds of transporters. The AI-powered platform ensures real-time tracking, automated temperature monitoring, and predictive analytics, enhancing security, efficiency, and transparency in pharmaceutical, dairy, and fresh produce logistics, reducing delays and wastage.

- December 2024: Arrive AI launched climate-assisted, secure delivery hubs for healthcare logistics, ensuring an unbroken chain of custody for lab samples, medications, and temperature-sensitive items. Integrated with robots, drones, and telemedicine systems, it reduces human error, enhances compliance, and lowers courier costs, optimizing medical deliveries and freeing staff for patient care.

- August 2024: FedEx launched FedEx Surround, an AI-powered logistics monitoring and intervention solution using SenseAware ID sensors for real-time tracking and predictive analytics. It enhances shipment security, proactive risk mitigation, and cold chain support. Initially available in Singapore and Hong Kong, expansion to China, Japan, and Australia is planned.

Secure Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Static, Mobile |

| Service Types Covered | Cash Services, Security Services |

| Applications Covered | Cash Management, Diamonds, Jewelry and Precious Metal, Manufacturing, Others |

| End Users Covered | Financial Institutions, Retailers, Government, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allied Universal (Caisse de dépôt et placement du Québec), Brink's Company, GardaWorld Corporation, Lemuir Group, Loomis, Maltacourt Ltd, PlanITROI Inc, Prosegur Cash (Prosegur Compañía de Seguridad, S.A), Secure Logistics LLC., Securitas AB, Serco Group plc, SIS Group Enterprise, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the secure logistics market from 2019-2033.

- The secure logistics market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the secure logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The secure logistics market was valued at USD 87.96 Billion in 2024

The secure logistics market is projected to exhibit a CAGR of 5.82% during 2025-2033, reaching a value of USD 150.23 Billion by 2033.

Key factors driving the secure logistics market include rising demand for safe transportation of high-value goods, growth in e-commerce, increased global trade, stricter regulations on cargo security, and advancements in tracking technologies. Sectors like banking, retail, and pharmaceuticals also fuel demand for secure transport and risk management services.

Europe dominated the secure logistics market, accounting for a share of 41.9% in 2024 due to strong regulatory frameworks, high demand for cash management and valuable goods transport, and advanced security infrastructure.

Some of the major players in the secure logistics market include Allied Universal (Caisse de dépôt et placement du Québec), Brink's Company, GardaWorld Corporation, Lemuir Group, Loomis, Maltacourt Ltd, PlanITROI Inc, Prosegur Cash (Prosegur Compañía de Seguridad, S.A), Secure Logistics LLC., Securitas AB, Serco Group plc, SIS Group Enterprise, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)