Secure Access Service Edge Market Size, Share, Trends and Forecast by Offerings, Application, and Region, 2025-2033

Secure Access Service Edge Market Size and Share:

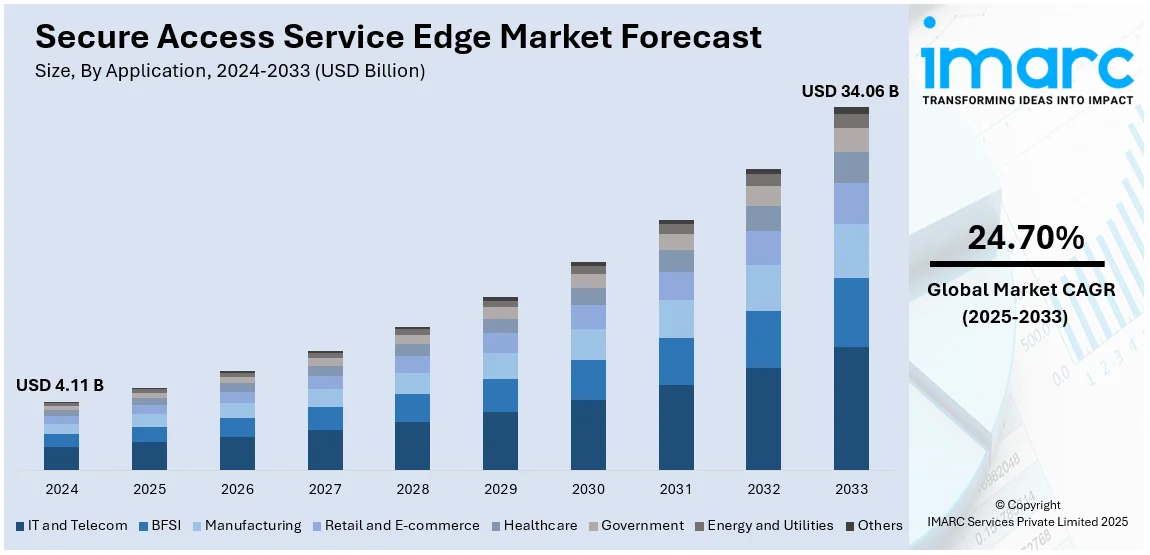

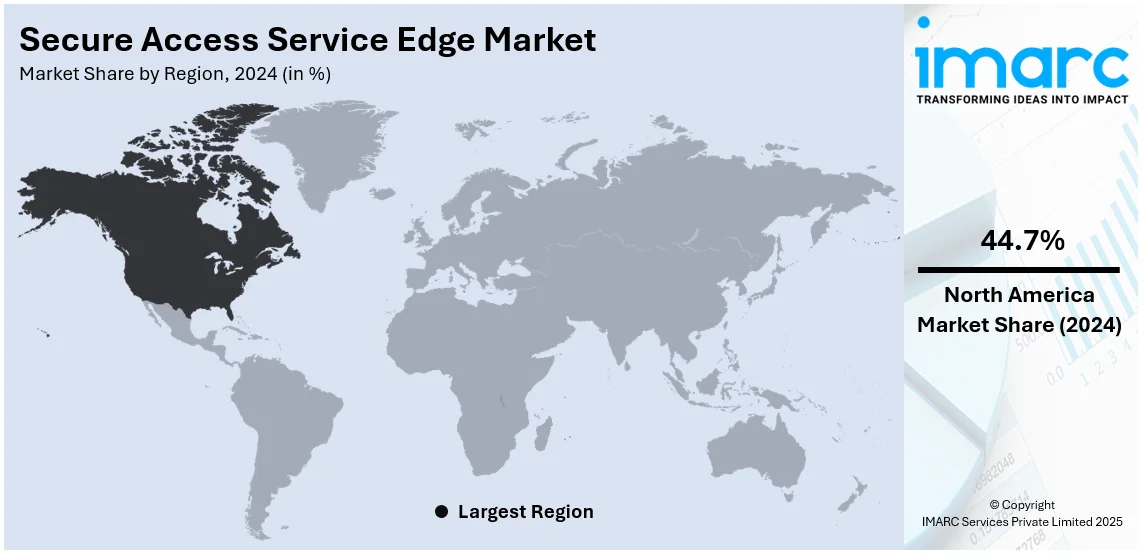

The global secure access service edge market size was valued at USD 4.11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.06 Billion by 2033, exhibiting a CAGR of 24.70% from 2025-2033. North America currently dominates the market, holding a market share of over 44.7% in 2024. The market is driven by increasing cloud adoption, the growth of remote and hybrid workforces, stringent regulatory compliance requirements, and escalating cybersecurity threats.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.11 Billion |

| Market Forecast in 2033 | USD 34.06 Billion |

| Market Growth Rate (2025-2033) | 24.70% |

The secure access service edge (SASE) market is significantly growing due to the rapid adoption of cloud services, as it is encouraging organizations to seek scalable and secure access solutions. For instance, there are 87% of enterprises are using multiple clouds therefore increasing the need for extensible and secure access solutions. In addition, the expansion of remote and hybrid workforces requires robust, seamless network access to maintain productivity and security, which is aiding the market growth. Moreover, the increasing cybersecurity threats demand advanced solutions to protect distributed networks and data, providing an impetus to the market. Besides this, strict regulatory requirements in industries like healthcare and finance require compliant security frameworks, thus contributing to the market expansion. Furthermore, digital transformation initiatives are fueling investments in modern and integrated security solutions, catalyzing the market growth.

The United States holds a share of 81.7% in the SASE market. The demand in the region is driven by the increasing reliance on edge computing to support data-intensive applications and real-time processing. In line with this, the rising investments in 5G infrastructure are enabling faster and more secure network connections, fostering the market expansion. Concurrently, the growth of Internet of Things (IoT) ecosystems across industries necessitates secure and scalable access solutions, which is impelling the market demand. Also, federal initiatives to strengthen cybersecurity resilience, including Cybersecurity and Infrastructure Security Agency (CISA) directives, are pushing organizations to adopt SASE, driving the market demand. Apart from this, the shift toward unified security and network management to reduce complexity and improve agility is thereby propelling the market forward.

Secure Access Service Edge Market Trends:

Integration of zero trust network access

The incorporation of Zero Trust Network Access (ZTNA) into SASE solutions is on the rise as organizations shift from conventional perimeter-based security models to more modern approaches. ZTNA provides an approach to control network access by offering proper authentication and authorization of the users or devices that wish to access an application or data in any location. The need for secure access to distributed resources is significant as a result of remote and hybrid work environments in the current world. For instance, in 2023 NIST published a Special Publication 800-207A, dedicated to access control of cloud-native applications in multi-cloud environments where ZTNA was considered an appropriate solution for complex network security. Besides this, the ZTNA implemented within SASE frameworks is efficient in minimizing the attack surfaces and counter-insider threats as it provides fine-tuned access policy controls. Additionally, with the growing amounts of data and applications that companies seek to protect, the incorporation of ZTNA into SASE architectures is considered best practice for the management of today’s networks, thus contributing to the market expansion.

Adoption of artificial intelligence and machine learning in SASE solutions

SASE platforms are increasingly leveraging artificial intelligence (AI) and machine learning (ML) to improve threat detection, streamline automated responses, and optimize overall network performance. In confluence with this, AI can detect suspicious behavior and possible threats, therefore, preventing them is much quicker and more efficient. For example, in early 2024, the National Institute of Standards and Technology (NIST) formed the United States AI Safety Institute Consortium comprising more than 280 organizations to work on the guidelines and standards of AI safety and security. Whereas, by using ML algorithms, the traffic of the network is better controlled and managed, prioritizing the necessary applications to provide the best experiences. This trend is relevant to the issues of the growing complexity of more advanced threats and distributed structures. Apart from this, with the adoption of AI and ML, SASE is turning into a more innovative and tactical approach to security and performance for businesses, as they look for preventive and wise solutions, thereby impelling the market growth.

Growing demand for multi-cloud support

The rise of multi-cloud strategies is driving the evolution of SASE solutions to provide consistent security and performance across diverse cloud environments. For instance, in 2023, 45.2% of the total European enterprises claimed to have implemented cloud computing services, while the large enterprises’ implementation index was 77.6%. Moreover, to ensure efficient operation, organizations that use multiple cloud providers need to have security policies and network access in a single management point. Additionally, SASE platforms have embedded multi-cloud features and, as a result, visibility and security can be implemented into different structures. This trend is coherent with simplification and general trends, as well as corresponding issues like data siloes, regulation, and connection of multiple clouds. Furthermore, as the adoption of multiple cloud solutions increases, the capacity of SASE to provide consistent protection and performance across the environments is emerging as a key differentiator, thus strengthening the market share.

Secure Access Service Edge Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global secure access service edge market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on offerings and application.

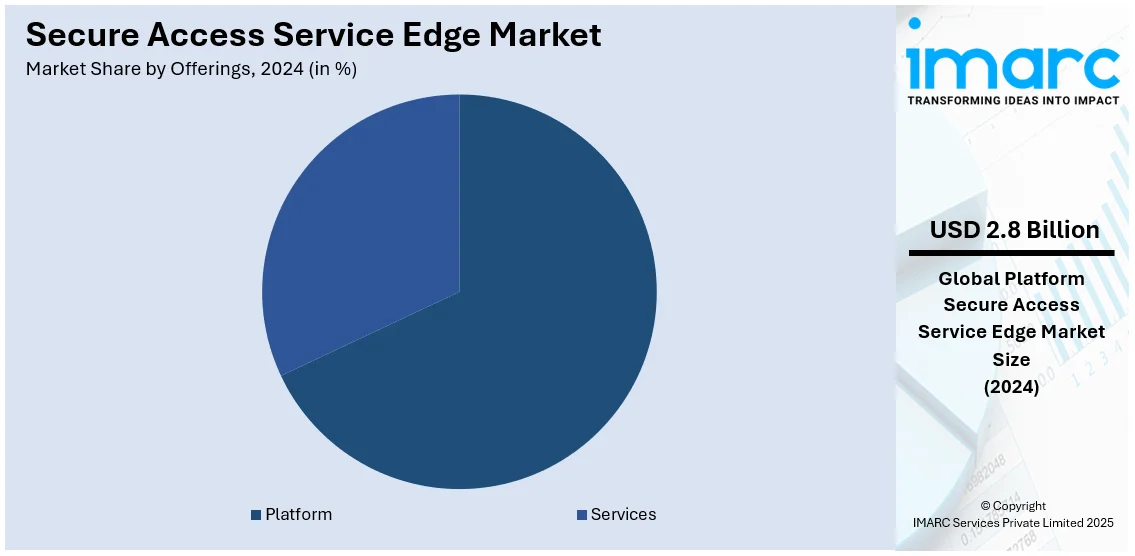

Analysis by Offerings:

- Platform

- Services

The platform leads with 67.6% of the market share. This segment is driven by its comprehensive approach to integrating network and security functions into a unified solution. They also decrease complexity by consolidating multiple services, including Secure Web Gateways (SWGs), Cloud Access Security Brokers (CASBs), and ZTNA committees under a single management entity known as platforms. These solutions are more effective and cost-saving than multiple-point solutions when combined in one platform. Besides this, the platform segment is expanding because of the need for expansion for cloud, remote workforce, and edge computing. Moreover, platform solutions are experiencing growth due to their high analytics, centralized policy control, and easy deployment, which make them the perfect solution for organizations that require complex security and network solutions, driving the market forward.

Analysis by Application:

- IT and Telecom

- BFSI

- Manufacturing

- Retail and E-commerce

- Healthcare

- Government

- Energy and Utilities

- Others

The IT and telecom sector dominates the market, driven by the sector's need for secure, high-performance connectivity in highly distributed environments. This segment is further growing due to the emerging cloud services that allow telecom providers and information technology (IT) organizations to offer more flexible solutions for a rising number of employees working remotely. Furthermore, real-time data processing and cross-platform and cross-technology coordination make SASE a necessity in the sector. Also, with the integration of SASE, telecom providers are expanding the portfolio of their services, like safe 5G connection and IoT support. Moreover, the increased instances of cyber threats against telecom and IT have boosted the uptake of SASE because organizations now need better security solutions to safeguard their structures and information, supporting the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

North America dominates the SASE market, accounting for a 44.7% share. The demand in the region is driven by rapid digital transformation and a strong focus on cybersecurity across industries. In line with this, the increased use of cloud services and shifting towards a higher level of hybrid and remote work in the region have led to the necessity of high-speed and safe access solutions. Moreover, the high adoption of IT services and solutions along with the rising integration of new-age technologies like edge computing and IoT fuels the demand for SASE in the region. The critical importance of security solutions, combined with the need to comply with regulations such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA), drives organizations to invest in advanced technologies. Furthermore, the surging rate and complexities of cyber threats in North America have led to the need for converged and zero-trust security architectures. Advancements in technologies like 5G and artificial intelligence (AI) are significantly driving the expansion of the security solutions market.

Key Regional Takeaways:

United States Secure Access Service Edge Market Analysis

The demand in the United States (US) SASE market is driven by the rapid adoption of cloud technologies, the rise of remote and hybrid workforces, and the increasing sophistication of cyber threats. Businesses in the US are increasingly investing in solid, flexible security solutions for critical information and optimal communication in decentralized settings. Moreover, federal trends include the Zero Trust Executive Order and cybersecurity directives from the CISA that are fueling the adoption of SASE across sectors including finance, healthcare, and critical infrastructure. For example, The CISA published the second edition of the Zero Trust Maturity Model in April of 2023, as a guide for organizations to evaluate and progress in their adoption of zero trust principles. This model suggests that ZTNA should be included as one of the constituent elements of modern-day secure networking architecture. Besides this, the increasing IoT devices, high adoption of 5G networks, and a developed IT environment create demand for strengthening integrated security and networking solutions. AI-integrated SASE solutions are also being implemented by enterprises to improve threat identification and network performance. Apart from this, compliance, performance, and network simplicity continue to be prioritized in the region, along with advancements, setting global standards and catalyzing the market growth.

Europe Secure Access Service Edge Market Analysis

The SASE market in Europe is witnessing substantial growth, fueled by a heightened emphasis on data privacy and the enforcement of strict regulations such as the GDPR. For instance, In 2023, e-mail services were established as the most popular cloud computing service, where 82.7% of enterprises resorted to this solution. Organizations across Europe are adopting SASE solutions to address the need for secure, compliant, and scalable access to cloud applications and data. The rapid shift to remote and hybrid work models, particularly in industries such as finance, healthcare, and manufacturing, has further fueled the demand for integrated security and networking frameworks. The region’s expanding adoption of edge computing and IoT technologies is also driving SASE deployment, as businesses seek to protect distributed networks and devices. European enterprises are leveraging SASE for its ability to simplify security management while providing advanced threat protection. Additionally, the growing concerns about ransomware and other cyber threats have heightened the urgency for implementing robust, zero-trust security solutions, bolstering the market demand.

Asia Pacific Secure Access Service Edge Market Analysis

The Asia Pacific SASE market is expanding because of the rising digitalization, cloud service adoption, and an extension of remote working. Chinese, Indians, and Japanese are driving appetite with investment in sophisticated IT structures and 5G networks. Recent incidents of cybercrimes in the area have caused the adoption of zero-trust security postures that form the foundation of SASE. For example, over 87,400 cybercrime reports were made in FY2023-24, averaging one report every six minutes. Also, the expansion of IoT environments and edge computing is driving the need for organizations to adopt integrated networking & security solutions. Industry vertical compliance needs on the regulatory front also help to strengthen SASE adoption in this broad and rapidly growing segment, thus aiding the market growth.

Latin America Secure Access Service Edge Market Analysis

The Latin America SASE market is growing as organizations adopt cloud technologies and remote work models. According to reports, approximately 68% of the world's population utilized the Internet in 2024, highlighting the region's increasing digital connectivity. The rising cybersecurity concerns in the region are driving demand for integrated solutions like SASE to protect distributed networks. Moreover, regulatory changes and data protection laws are prompting businesses to enhance security measures. Increasing investments in IT infrastructure and digital transformation in sectors like finance, healthcare, and manufacturing are further propelling market growth.

Middle East and Africa Secure Access Service Edge Market Analysis

In the Middle East and Africa, the SASE market is expanding due to the growing adoption of cloud services and widespread digital transformation initiatives across various industries. For instance, in 2024, around 200 women from the public sector across 45 countries, including West African countries, joined the program known as “Her CyberTracks” aiming to enhance the technical and soft skills of women in cybersecurity. The region's increasing cybersecurity threats and reliance on remote work models have created a demand for robust, integrated security solutions. Governments and enterprises are prioritizing zero-trust architectures to safeguard critical infrastructure. Additionally, growing investments in IT infrastructure and compliance with emerging data protection regulations are driving the adoption of SASE solutions and propelling the market forward.

Competitive Landscape:

The SASE market is highly competitive, with companies prioritizing innovation and the expansion of their service offerings. Notable trends include the incorporation of AI and ML to improve threat detection and response effectiveness. Providers are also prioritizing partnerships with cloud service platforms and telecom operators to strengthen their offerings and improve scalability. Mergers and acquisitions are becoming more frequent as companies seek to broaden their geographical reach and enhance their technological expertise. Additionally, there is a growing emphasis on offering customization and managed services to cater to the varied needs of enterprises. Additionally, vendors are focusing on zero-trust security enhancements and edge computing support to stay ahead in this fast-evolving market.

The report provides a comprehensive analysis of the competitive landscape in the secure access service edge market with detailed profiles of all major companies, including:

- Barracuda Networks, Inc.

- Broadcom Inc.

- Cato Networks

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Development LP

- Open Systems

- Palo Alto Networks

- Versa Networks, Inc.

Latest News and Developments:

- In August 2024, Palo Alto Networks hosted the virtual conference known as SASE Converge 2024, demonstrating the AI-operated Prisma SASE solutions for security optimization and IT optimization.

- In August 2024, Versa Networks announced the collaboration with Carahsoft to bring an AI-based SASE platform for the public sector specifically, to facilitate access to various SaaS and SD-WAN.

- In June 2024, Cato Networks released the Cato MSASE Partner Platform, enabling SASE providers to protect and manage their services with improved administrative capabilities.

Secure Access Service Edge Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | Platform, Services |

| Applications Covered | IT and Telecom, BFSI, Manufacturing, Retail and E-commerce, Healthcare, Government, Energy and Utilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Barracuda Networks, Broadcom, Cato Networks, Check Point Software Technologies, Cisco Systems, Hewlett Packard Enterprise, Open Systems, Palo Alto Networks, and Versa Networks, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the secure access service edge market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global secure access service edge market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the secure access service edge industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Secure Access Service Edge (SASE) is a cloud-native architecture that combines network and security services into a unified framework. It integrates technologies like Zero Trust Network Access (ZTNA), secure web gateways, and firewall-as-a-service to deliver scalable, secure access for users, devices, and applications across distributed environments.

The global secure access service edge market was valued at USD 4.11 Billion in 2024.

IMARC estimates the global secure access service edge market to exhibit a CAGR of 24.70% during 2025-2033.

Key factors driving the market are the rapid adoption of cloud services, increasing cybersecurity threats, the shift to remote work models, regulatory compliance demands, advancements in zero-trust security frameworks, and the growing need for integrated, scalable networking and security solutions.

In 2024, platform represented the largest segment by offerings, driven by its ability to provide unified security and networking functionalities in a single framework. Its scalability, ease of deployment, and efficient management of complex environments made it the preferred choice for organizations worldwide.

IT and Telecom leads the market by application owing to its critical need for secure and scalable network solutions to support cloud services, 5G, and IoT deployments. The sector's focus on mitigating sophisticated cyber threats and ensuring seamless connectivity.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global secure access service edge market include Barracuda Networks, Broadcom, Cato Networks, Check Point Software Technologies, Cisco Systems, Hewlett Packard Enterprise, Open Systems, Palo Alto Networks, Versa Networks, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)