Secondary Battery Market Size, Share, Trends and Forecast by Type, Application, Industry Vertical, and Region, 2025-2033

Secondary Battery Market Size and Share:

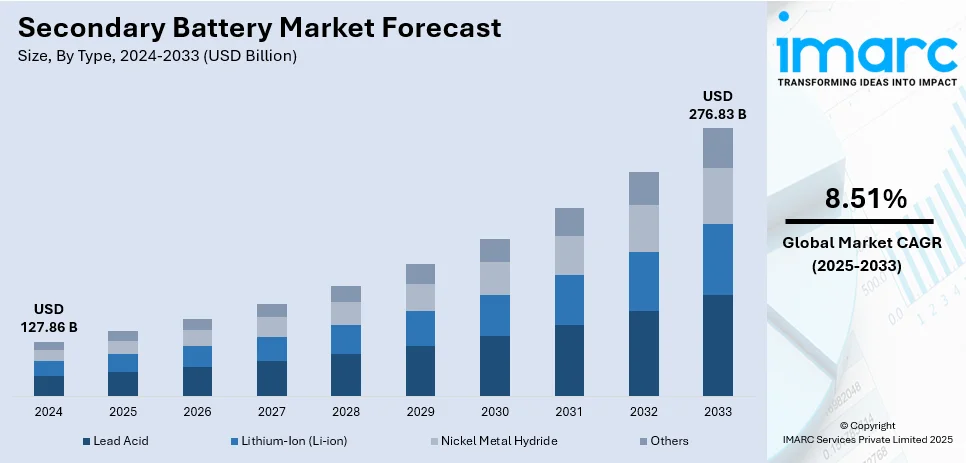

The global secondary battery market size was valued at USD 127.86 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 276.83 Billion by 2033, exhibiting a CAGR of 8.51% from 2025-2033. Asia Pacific currently dominates the market, holding a secondary battery market share of over 46.8% in 2024. The secondary battery market is expanding due to the growing adoption of electric vehicles (EVs), energy storage solutions for renewable energy integration, and consumer electronics. Innovations in battery technology, increasing environmental awareness, and favorable government policies are also key drivers of market growth. Expanding industrial applications and grid modernization also contribute significantly to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 127.86 Billion |

|

Market Forecast in 2033

|

USD 276.83 Billion |

| Market Growth Rate (2025-2033) | 8.51% |

One major driver in the secondary battery market is the growing demand for EVs. As governments worldwide enforce stricter regulations on carbon emissions and provide incentives for EV adoption, the need for efficient energy storage systems has surged. Lithium-ion secondary batteries are essential for powering EVs, offering high energy density, long lifespan, and fast charging capabilities. Innovations like solid-state batteries are further improving performance, contributing to the secondary battery market growth. The rising consumer preference for eco-friendly transportation solutions continues to bolster the adoption of secondary batteries in the automotive sector.

In the United States, the market for secondary batteries is highly upgrowing primarily with the rising usage of EV along with incentives and a tightening noose of emissions control policies from both the federal and state levels. The government incentive to adopt EVs through the provision of up to $7,500 in tax credits on purchase is mainly helping people change their conventional driving modes. Such incentives in combination with other grants promoting infrastructural growth encourage demand for Li-ion batteries. The U.S. push towards renewable energy integration and grid modernization is further increasing the need for energy storage systems where secondary batteries hold a critical role in the stabilization of grids. The growth in consumer electronics, led by improving technology, also supports the expansion. Investment in battery manufacturing and recycling continues to improve the growth of the secondary battery market trends.

Secondary Battery Market Trends:

Increasing Adoption of Electric Vehicles (EVs)

The growing transition to electric mobility is a major driver of the secondary battery market. In 2023, electric vehicles accounted for nearly one in five cars sold worldwide, with sales nearing 14 million units. EV adoption is rising globally due to government subsidies, emission regulations, and consumer awareness about sustainability. Lithium-ion batteries dominate the EV segment because of their high energy density, longer lifecycle, and improved safety features. Additionally, advancements in battery technology, such as fast charging and enhanced storage capacity, are addressing consumer concerns like range anxiety. Automakers are partnering with battery manufacturers to secure supply chains, while significant investments are being made in developing solid-state batteries for next-generation EVs. This trend positions secondary batteries as critical components in transitioning to cleaner transportation solutions.

Renewable Energy Integration and Grid Storage

The increasing focus on renewable energy sources, including solar and wind power, has generated an enormous demand for efficient energy storage systems, leading to the growth of the secondary battery market. In 2023, the world added a record 473 GW of renewable energy capacity, increasing the stock of renewable power by 13.9%. The need for secondary batteries, especially lithium-ion and flow batteries, in balancing power grids is becoming a requirement with fluctuating renewable energy generation. The government and utility providers are spending significantly on large-scale battery storage projects to stabilize grid operations and ensure a reliable supply of energy during peak demand in the secondary battery market outlook. These technologies are also making them more efficient and scalable. This trend fits in with the overall decarbonization of the world, making secondary batteries all the more viable for renewable energy infrastructure.

Expansion of Consumer Electronics

The increasing demand for portable consumer electronics, including smartphones, laptops, and wearable devices, is a key factor driving the growth of the secondary battery market. Lithium-ion batteries are favored in these applications for their lightweight design, high energy density, and quick charging capabilities. Innovations in battery chemistry and form factors are addressing the growing need for longer-lasting and safer batteries. Moreover, the rise of Internet of Things (IoT) devices and smart home technologies has boosted the demand for efficient secondary batteries. In 2023, the number of connected IoT devices increased by 16%, reaching 16.7 billion active endpoints. Manufacturers are also exploring sustainable battery production and recycling solutions to meet both environmental regulations and consumer expectations.

Secondary Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global secondary battery market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and industry vertical.

Analysis by Type:

- Lead Acid

- Lithium-Ion (Li-ion)

- Nickel Metal Hydride

- Others

Lead acid battery majorly rules the secondary battery market because they are affordable, reliable, and are largely used in many applications. Such batteries are broadly utilized in automotive, industrial, and backup power systems by their more powerful design and capability to produce a high surge current. The automobile industry, comprising conventional vehicles and electric two-wheelers, is mainly demanding lead acid batteries for use in starting, lighting, and ignition (SLI). Industrial uses like forklifts, backup power supplies using UPS, and renewable energy storage applications give support to their increasing use. Despite competition from lithium-ion batteries, developments in lead-acid battery technology in such areas as efficiency improvement and increasing lifespan provide favorable circumstances for maintaining their secondary battery market share. Their cost-effectiveness and established recycling infrastructure make them an environmentally sustainable choice for many applications.

Analysis by Application:

- Electronics

- Motor Vehicles

- Industrial Batteries

- Portables Devices

- Others

Secondary batteries power a wide range of electronic devices, including smartphones, laptops, and wearables. Their high energy density, compact size, and long lifecycle make lithium-ion batteries the preferred choice. As the demand for advanced consumer electronics grows, secondary batteries are integral to supporting portability and energy-efficient device performance.

Moreover, the motor vehicle sector relies on secondary batteries for traditional vehicles’ SLI functions and electric vehicle propulsion. Lead-acid batteries dominate conventional cars, while lithium-ion batteries power electric and hybrid models. The increasing shift to electric mobility continues to drive innovation and demand for advanced battery technologies in this application.

Except for this, forklifts, UPS systems, and other renewable energy sources require industrial batteries. Lead acid batteries are very much in favor because of economy and durability but lithium-ion are gaining popularity lately due to better efficiency and life. Increasing industrialization and industrial automation in each sector are putting a demand in terms of reliable energy storage solutions in industries.

Furthermore, portable devices, including power tools, cameras, and medical equipment, heavily depend on lightweight, high-performance secondary batteries. Lithium-ion technology leads this segment due to its superior energy density and rechargeability. Growing consumer preference for compact, long-lasting devices continues to fuel advancements in secondary battery technology for portable applications.

Also, the others category includes secondary battery applications in aerospace, marine, and grid energy storage systems. Demand is driven by the need for reliable and durable energy solutions in these specialized sectors. Innovations in battery chemistry, focusing on performance under extreme conditions, are expanding the adoption of secondary batteries in diverse niche markets.

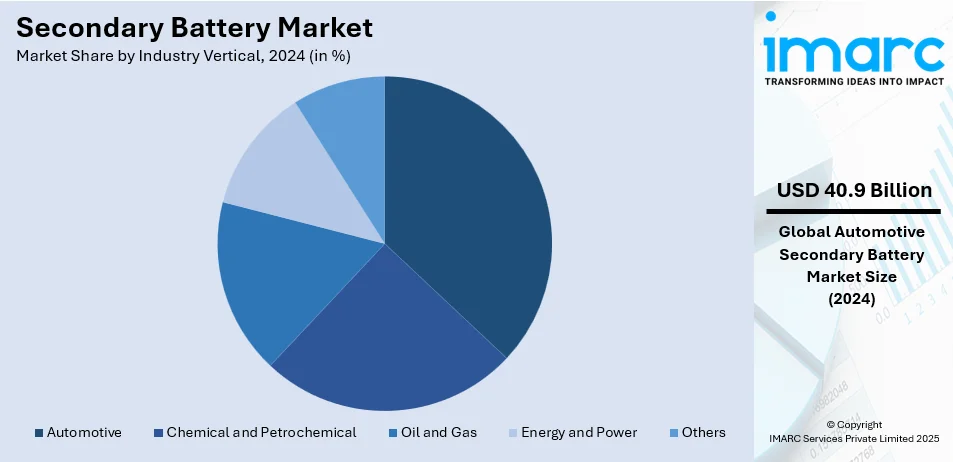

Analysis by Industry Vertical:

- Chemical and Petrochemical

- Oil and Gas

- Energy and Power

- Automotive

- Others

The automotive sector accounts for the largest market share in the secondary battery market, at 32.0%, as it is a critical component of both traditional and electric vehicles (EVs). Lead-acid batteries are the most commonly used in conventional vehicles for SLI functions, driven by their cost-effectiveness and reliability. With a rapidly growing EV market, demand for lithium-ion batteries is now higher due to their high energy density, long life, and faster charging capability. The support from governments and advances in battery technology have enhanced the secondary battery market demand. Moreover, hybrid vehicles and electric two-wheelers have augmented the market's growth under the automotive segment. The dependency on secondary batteries ensures that the sector remains as market leaders.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the secondary battery market forecast, Asia Pacific dominates the market with a significant 46.8% market share, driven by robust manufacturing capabilities, high demand across various industries, and supportive government policies. The region is home to leading battery producers and raw material suppliers, creating a strong ecosystem for battery production. Rapid urbanization, industrialization, and the increasing adoption of electric vehicles (EVs) in countries such as China, Japan, and South Korea are driving the growth of the market. Additionally, the increasing use of secondary batteries in renewable energy storage, consumer electronics, and industrial applications further drives demand. Government incentives promoting EVs and clean energy, combined with technological advancements and cost-effective production, solidify Asia Pacific’s dominance in the global secondary battery market.

Key Regional Takeaways:

North America Secondary Battery Market Analysis

The North American secondary battery market is growing at a rapid pace with the fast-growing adoption of EVs, renewable energy initiatives, and consumer electronics. Government policies through tax incentives and grants have accelerated the electric mobility transition. This has caused an increased demand for lithium-ion batteries, as they dominate the EV segment, with higher energy density and a longer lifespan. The region is experiencing a boom in renewable energy, where secondary batteries take a significant part in energy storage systems, help stabilize power grids and enable the storage of surplus energy coming from solar and wind. In addition, the increasing popularity of portable consumer electronics, like smartphones, laptops, and wearables, have increased the need for efficient, long-lasting, and reliable power sources. North America is placing emphasis on battery recycling technologies, as well as sustainable energy solutions, further paving the way for the development of the secondary battery market-the key player in this global energy transformation.

United States Secondary Battery Market Analysis

The U.S. secondary battery market is fueled by the rising adoption of electric vehicles (EVs) and strict government regulations focused on reducing carbon emissions, driven by high pollution levels. According to the Nature Conservancy, the average carbon footprint per person in the U.S. is 16 tons, one of the highest in the world. Federal incentives for purchases of electric vehicles through tax credits and subsidization of manufacturing battery production facilities boost demand. On top of that, renewable sources, in particular solar and wind energy, deployment will necessitate further the application of efficient systems in batteries. Apart from this, advanced technology for the production of lithium-ion batteries is greatly improving energy density, lifecycle, and economy of the performance, thereby increasing their use in various industries such as consumer electronics, healthcare, and aerospace. In addition, a growing need for portable electronics, including smartphones, laptops, and wearable devices, is advancing the market growth. In this respect, significant private investments, as well as public funds, for research and recycling infrastructure for batteries, are emerging in efforts to push the sustainability agenda. The presence of major market players and extensive R&D capabilities in the U.S. further position that country as one global leader in secondary battery innovation.

Asia Pacific Secondary Battery Market Analysis

The Asia Pacific secondary battery market is thriving due to rapid industrialization and urbanization in major economies like China, India, Japan, and South Korea. The region's leadership in global electronics manufacturing drives the demand for rechargeable batteries in consumer devices such as smartphones, tablets, and cameras. India ranked second with 659 Million smartphone users in 2024, according to reports. Apart from this, China, being the world's largest EV market, heavily influences battery demand with its aggressive push for green energy vehicles and substantial investments in lithium-ion battery production. In China, the governing agencies are introducing very stringent environmental rules to check pollution and decrease the usage of fossil fuel, thereby encouraging the use of EVs. For example, to purchase an electric car, people get incentives like subsidies on EVs, low tax, and reduced license plates in large cities compared to other cars. South Korea and Japan host key battery manufacturers that are the technology leaders with sizeable quantities exported abroad. Additionally, government policies aimed at promoting the grid integration of renewable energy and energy storage systems play a crucial role. For example, India is working towards its 450 GW renewable capacity by 2030, which requires scaleable battery storage solutions. Industrial use of secondary batteries in applications like backup power systems and grid stabilization will also further enhance market growth.

Europe Secondary Battery Market Analysis

Stringent environmental policies and the European Union’s ambitious climate goals, such as achieving carbon neutrality by 2050, is impelling the market growth. These policies are intensifying the adoption of electric vehicles and renewable energy systems across the continent, significantly boosting battery demand. Leading automotive manufacturers in countries like Germany, France, and Sweden are heavily investing in battery technology to cater to the growing EV market. Reports indicate that new electric car registrations in Europe reached nearly 3.2 million in 2023, marking an increase of almost 20% compared to 2022. Concurrently, the European Battery Alliance supports the development of a sustainable battery ecosystem, including raw material sourcing, production, and recycling processes. Additionally, the growing adoption of smart grid technologies and the demand for efficient energy storage systems to support renewable energy grids are driving market growth. Lithium-ion batteries, in particular, are widely used in smart grid applications because of their high energy density, long cycle life, and quick response times. They enable utilities to manage peak demand, reduce reliance on fossil fuel-based backup systems, and support load leveling. Additionally, the rise in demand for portable electronics and industrial backup solutions underlines the importance of robust secondary battery infrastructure across the region.

Latin America Secondary Battery Market Analysis

The secondary battery market in the Latin America region is witnessing growth due to increasing urbanization, investments in renewable energy projects, and the growing use of electric vehicles in countries like Brazil and Chile. In 2023, the Brazilian government unveiled a new "growth acceleration" plan, which allocated USD 12.5 billion to finance new renewable energy projects, according to reports. Moreover, governments in the region are investing in clean energy initiatives, particularly solar and wind projects, which require efficient battery storage systems for grid stability. Furthermore, the burgeoning demand for portable electronic devices and backup power solutions in industries also drives battery adoption. Additionally, the region's efforts to reduce dependency on fossil fuels by promoting EVs are contributing to secondary battery market expansion.

Middle East and Africa Secondary Battery Market Analysis

In the Middle East and Africa, the secondary battery market is driven by the increasing focus on renewable energy and the need for reliable energy storage solutions in remote and off-grid areas. Countries like the UAE and Saudi Arabia are heavily investing in solar power projects, which depend on secondary batteries for energy storage and grid management. According to industry reports, by the end of 2023, Saudi Arabia's installed solar capacity (2.3 GW) accounted for 2.5% of its total capacity and less than 1% of its power generation. The country aims to achieve 50% renewable energy in its power mix by 2030 and reach net-zero emissions by 2060. Additionally, the rising adoption of electric and hybrid vehicles, especially in Gulf Cooperation Council (GCC) countries, is driving the demand for advanced batteries. Furthermore, the expansion of the consumer electronics market across Africa contributes to the need for rechargeable batteries in smartphones and other portable devices.

Competitive Landscape:

The competitive landscape of the secondary battery market is characterized by rapid technological advancements, innovation, and strategic collaborations. Key players focus on enhancing battery performance, including energy density, lifecycle, and charging speed, to meet diverse end-user demands across automotive, consumer electronics, and energy storage sectors. Manufacturers are investing in research and development to pioneer next-generation technologies, such as solid-state and silicon-anode batteries. Regional production capabilities and raw material sourcing strategies significantly impact market positioning, with companies competing to secure a reliable supply chain for critical materials like lithium, cobalt, and nickel. Additionally, firms emphasize sustainable practices, including recycling and eco-friendly manufacturing, to align with regulatory frameworks and growing consumer preferences for environmentally conscious products.

The report provides a comprehensive analysis of the competitive landscape in the secondary battery market with detailed profiles of all major companies, including:

- Amperex Technology Limited (TDK Corporation)

- Byd Company Limited

- Duracell Inc. (Berkshire Hathaway Inc.)

- Energizer Holdings Inc.

- EnerSys

- LG Chem Ltd.

- Panasonic Corporation

- Saft (TotalEnergies SE)

- Samsung SDI Co. Ltd.

- Showa Denko K. K.

- Sony Group Corporation

- Tianjin Lishen Battery Joint-Stock Co. Ltd.

Latest News and Developments:

- January 2025: The Ministry of Electronics and Information Technology (MeitY) is focused on fostering innovation in rechargeable battery technology (RBT) to strengthen manufacturing in India. To support this, MeitY established the "Centre of Excellence (COE) on Rechargeable Battery Technology (Pre-cell)" at CMET, Pune.

- November 2024: Amara Raja Energy & Mobility Ltd planned to invest over USD 120 Million in its New Energy Business during the financial year 2026, as it continues to prioritize research and development, and manufacturing of lithium-ion (Li-ion) cells.

- August 2022: Contemporary Amperex Technology Co., Limited (CATL) announced an investment of USD 8,074 million to build a 100 GWh battery plant in Debrecen, eastern Hungary. This will be CATL's second battery plant in Europe, following its facility in Germany.

Secondary Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lead Acid, Lithium-Ion (Li-ion), Nickel Metal Hydride, Others |

| Applications Covered | Electronics, Motor Vehicles, Industrial Batteries, Portables Devices, Others |

| Industry Verticals Covered | Chemical and Petrochemical, Oil and Gas, Energy and Power, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amperex Technology Limited (TDK Corporation), Byd Company Limited, Duracell Inc. (Berkshire Hathaway Inc.), Energizer Holdings Inc., EnerSys, LG Chem Ltd., Panasonic Corporation, Saft (TotalEnergies SE), Samsung SDI Co. Ltd., Showa Denko K. K., Sony Group Corporation and Tianjin Lishen Battery Joint-Stock Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the secondary battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global secondary battery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the secondary battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The secondary battery market was valued at USD 127.86 Billion in 2024.

IMARC estimates the secondary battery market to reach at USD 276.83 Billion in 2033 exhibiting a CAGR of 8.51% during 2025-2033.

Key factors driving the secondary battery market include the rising adoption of electric vehicles (EVs), government incentives for clean energy solutions, advancements in battery technology, growing demand for renewable energy storage, increased use of portable electronics, and the push for sustainable battery production and recycling solutions.

Asia Pacific currently dominates the market fueled by strong manufacturing capabilities, high demand across diverse industries, and favorable government policies, the region boasts a thriving ecosystem for battery production, supported by leading battery manufacturers and raw material suppliers.

Some of the major players in the secondary battery market include Amperex Technology Limited (TDK Corporation), Byd Company Limited, Duracell Inc. (Berkshire Hathaway Inc.), Energizer Holdings Inc., EnerSys, LG Chem Ltd., Panasonic Corporation, Saft (TotalEnergies SE), Samsung SDI Co. Ltd., Showa Denko K. K., Sony Group Corporation and Tianjin Lishen Battery Joint-Stock Co. Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)