Seaweed Market Size, Share, Trends and Forecast by Environment, Product, Application, and Region, 2025-2033

Seaweed Market Size, Share Analysis, Growth, Demand, and Forecast:

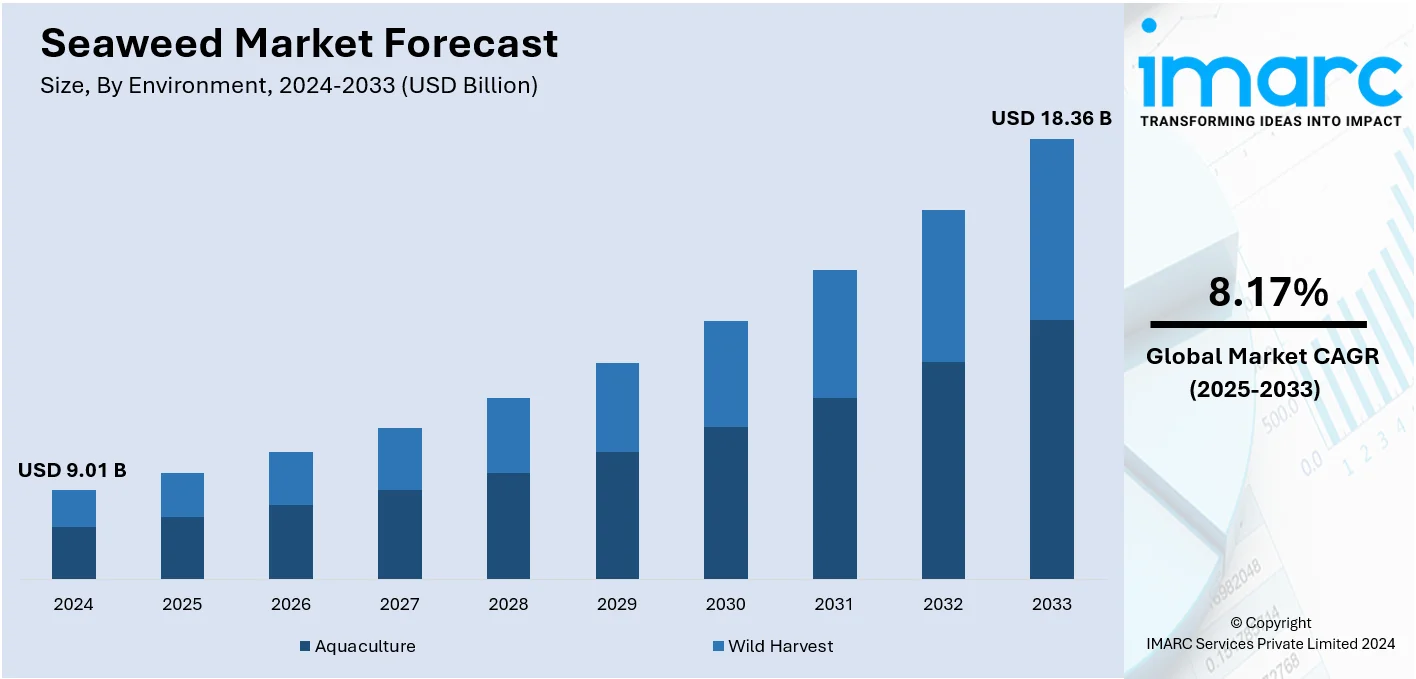

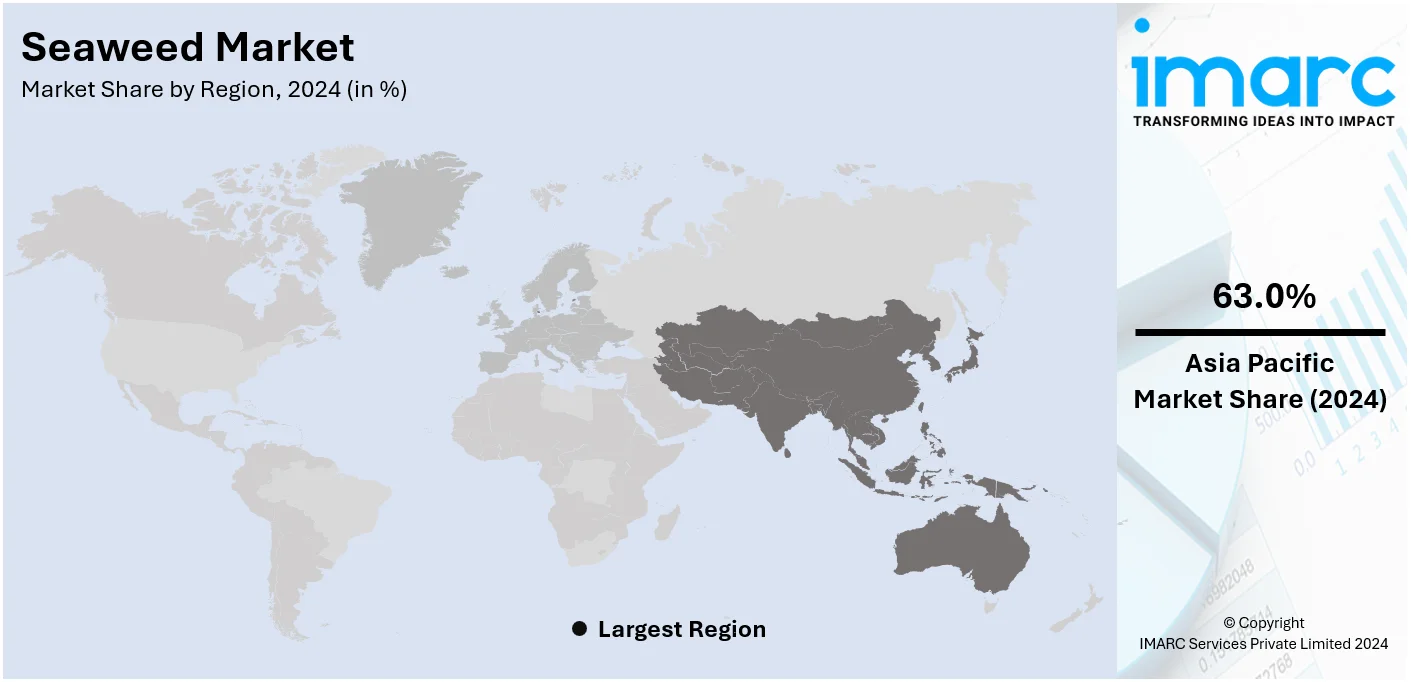

The global seaweed market size was valued at USD 9.01 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.36 Billion by 2033, exhibiting a CAGR of 8.17% from 2025-2033. At present, Asia Pacific holds the largest seaweed market share with 63.0%, driven by its long history of seaweed cultivation and consumption, abundant coastal resources and favorable climatic conditions, growing awareness about health benefits, technological advancements, and the region's government support.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.01 Billion |

| Market Forecast in 2033 | USD 18.36 Billion |

| Market Growth Rate 2025-2033 | 8.17% |

The global seaweed market is experiencing significant growth, largely due to the increasing consumer demand for plant-based products. The shift towards healthier and more sustainable food options, with seaweed being recognized for its rich nutrient profile and environmental benefits is accelerating the seaweed market demand. The World Bank's 2023 report highlights that seaweed farming can contribute to a sustainable future, identifying ten emerging markets with the potential to grow by an additional USD11.8 Billion by 2030. Furthermore, the global market for seaweed has tripled in size over the past two decades, growing from USD5 Billion in 2000 to USD17 Billion in 2021. Additionally, there is a notable increase in seaweed consumption in Western countries, driven by the rising popularity of plant-based diets and the incorporation of seaweed into various food products. The versatility of seaweed in culinary applications, along with its health benefits, continues to attract a broadening consumer base, further propelling market growth.

The United States seaweed market is experiencing significant growth, driven by several key factors. A notable increase in consumer demand for plant-based and sustainable food options has led to a surge in seaweed consumption. The versatility of seaweed in various culinary applications, coupled with its high nutritional value, has further boosted its popularity among health-conscious consumers. Additionally, the growing awareness of seaweed's environmental benefits, such as its role in carbon sequestration and minimal freshwater requirements for cultivation, aligns with the increasing consumer preference for eco-friendly products. This alignment has contributed to the market's upward trajectory. Moreover, advancements in seaweed farming and processing technologies have enhanced production efficiency and product quality, which is providing an impetus to seaweed market growth. The expanding applications of seaweed in industries beyond food, including cosmetics, pharmaceuticals, and agriculture, have also played a significant role in driving market growth.

Seaweed Market Trends:

Rising Demand in the Food and Beverage Industry

The rising demand for seaweed in the food and beverage industry is driven by health-conscious consumers seeking nutritious and sustainable food options. The versatility of seaweed allows it to be used as a flavor enhancer, texturizer, or even a standalone ingredient in snacks, condiments, and sushi, which is enhancing the seaweed market outlook. Apart from this, the rising application of seaweed seasonings to cure infections such as cough, fever, and fungal infections, as it works faster than the other antibiotics, is creating a positive impact on the overall market. Studies suggest that seaweed can increase the bioavailability of nutrients by up to 40% when incorporated into meals. Moreover, various key market players are extensively investing in seaweed cultivation technologies to offer high-quality seaweed products to consumers. For instance, WavePure is a seaweed powder range by Cargill, an American global food corporation, based on native seaweed obtained without any chemical modification. Cargill's WavePure ADG is based on a blend of Gracilaria seaweeds, which helps in maintaining stability and bringing great body and mouthfeel in dairy and plant-based dairy alternative applications.

Growing Awareness about Health Benefits

The increasing awareness regarding seaweed's nutritional profile, which is rich in vitamins, minerals, and antioxidants, is bolstering seaweed market share. Seaweed is recognized for its rich content of essential vitamins, minerals, dietary fiber, and bioactive compounds. Omega-3 (up to 40% by weight) and omega-6 (up to 10% by weight) fatty acids are among the polyunsaturated fatty acids found in seaweed in significant quantities. Additionally, it has a healthy amount of polyphenols, sterols, and pigments, including fucoxanthin, which has beneficial cholesterol-lowering properties. Studies have shown that seaweed consumption may have positive effects on immune function, gut health, cardiovascular health, and even cancer prevention. For instance, a new study conducted by researchers from the University of Coimbra and the University of Aveiro in Portugal indicated the promising role of seaweed-derived nutrients in drug discovery and innovative product development. The research describes the entire process that leads to a seaweed extract being recognized as a medicinal agent and becoming commercially accessible in the market.

Expanding Applications in Pharmaceuticals and Cosmetics

The emerging application of seaweed extracts in the pharmaceutical and cosmetic industries due to their beneficial properties is acting as another significant growth-inducing factor shaping the seaweed market outlook. Seaweed is rich in bioactive compounds like phlorotannins, fucoidan, and alginates, which possess antioxidant, anti-inflammatory, and moisturizing properties. Moreover, various pharmaceutical and nutraceutical companies are increasingly exploring the medicinal potential of seaweed to develop drugs and supplements. For instance, CadalminTM LivCure extract, a patent-protected nutraceutical product developed by the ICAR-Central Marine Fisheries Research Institute (CMFRI) from seaweeds to combat non-alcoholic fatty liver disease, will be available in the market soon. The product's bioactive components are derived from certain seaweeds and are entirely natural. The product is the ninth nutraceutical created by CMFRI and is designed with environmentally friendly green technology to enhance liver health. Besides this, various beneficial metabolites are obtained from seaweed, such as carotenoids, amino acids, pigments, polysaccharides, and Stoneman. These metabolites are widely employed in various skincare products, such as moisturizer, anti-wrinkle agent, texture-enhancing agents, or sunscreen.

Seaweed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global seaweed market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on environment, product, and application.

Analysis by Environment:

- Aquaculture

- Wild Harvest

Aquaculture is dominating the environment segment, holding 97.4% market share. It offers an environment in which aquatic organisms grow under controlled conditions and optimized ways of cultivating them, resulting in greater productivity and efficiency than its wild counterpart. According to IMARC, global aquaculture markets were valued at $79.3 Million Tons in 2023. I expect markets to reach 116.6 Million Tons by 2032, growing at 4.2% CAGR during the next 8 years (2024-2032). Other benefits of aquaculture are that it helps to solve the problems of overfishing as well as depletion in the wild fish stock. Since this is happening from the wild shores, aquaculture provides a better solution to the increasing demand for seafoods in a controlled and regulated environment of fish and shellfish farming.

Analysis by Product:

- Red

- Brown

- Green

Red seaweed dominates the market because of its wide range of use across areas such as food and beverages, pharmaceuticals, nutraceuticals, and others. It is increasingly being processed for the extraction of carrageenan, which is a natural polysaccharide that has gelling and stabilizing properties and propelling the growth of the segment. Additionally, the other applications, practice in the food and beverage industry as well as the emerging applications in agriculture, have been the assets that will be contributing to this section. For instance, in July 2022, it was reported that the carrageenans and oligo-carrageenans which are polysaccharides from red seaweeds enhance the growth of several plants by inducing alterations in important physiological and biochemical processes, in a review published in Wiley Open Library.

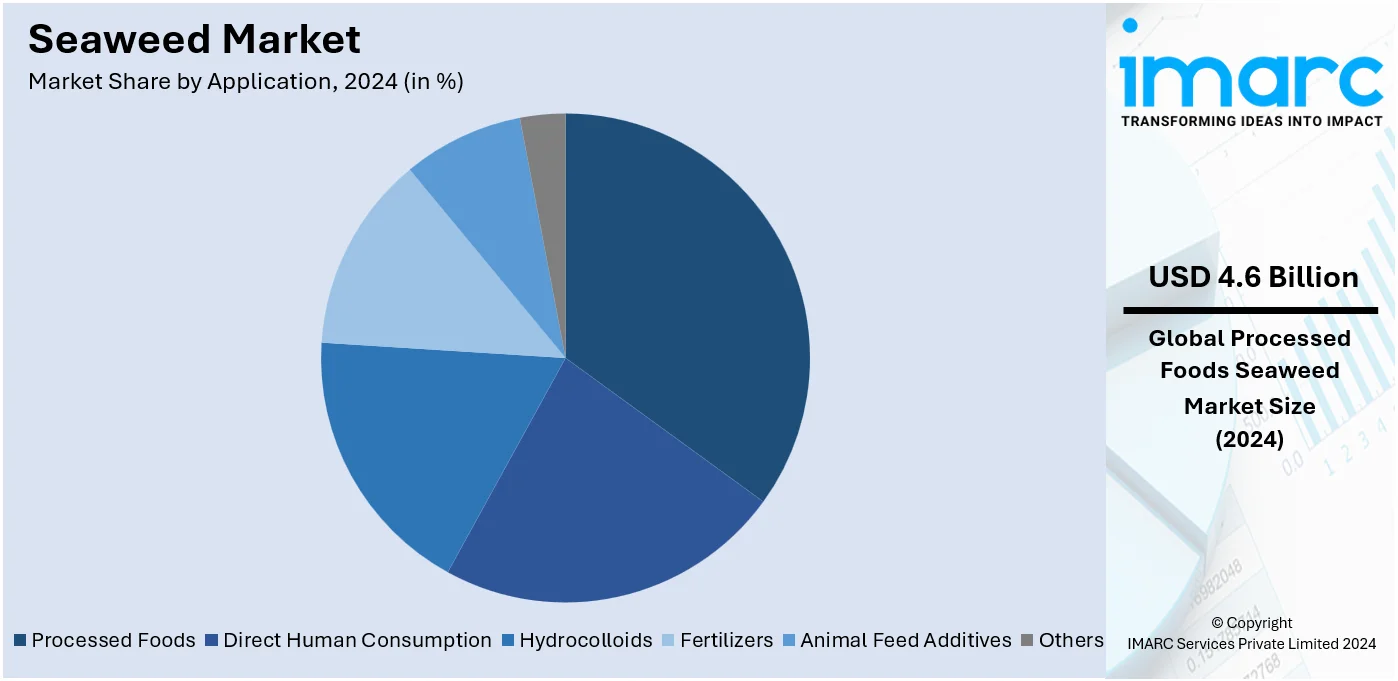

Analysis by Application:

- Processed Foods

- Direct Human Consumption

- Hydrocolloids

- Fertilizers

- Animal Feed Additives

- Others

Processed foods leads the market with 51.5% share due to the rising demand for seaweed-based snacks, seasonings, and food enhancers, particularly in regions embracing global cuisines. Direct human consumption also continues to grow, with products like nori, wakame, and kombu gaining traction in health-conscious markets for their nutritional benefits, including vitamins, minerals, and iodine. Hydrocolloids, including carrageenan, agar, and alginate, form a key segment in industrial applications. These substances are widely used as stabilizers, thickeners, and emulsifiers in food products like ice cream, dairy, and baked goods. Fertilizers derived from seaweed are becoming popular due to their organic nature and ability to enhance soil health and crop yield. In animal feed additives, seaweed is increasingly utilized for its nutritional content and role in reducing methane emissions in livestock, aligning with sustainability goals.

Regional Analysis:

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- North America

- United States

- Canada

- Europe

- France

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

- Peru

- Others

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Others

Asia Pacific is currently dominating the seaweed market share with 63.0% . The region has a long history of seaweed consumption, deeply rooted in its culinary traditions. By 2030, Asian nations are expected to consume 70% of the world's fish, according to a recent World Bank prediction. One of the fastest-growing economies, China is expected to supply 38% of the world's seafood. The aquaculture sector is being developed with investments from China and other Asian nations. Additionally, the region's vast coastline provides favorable conditions for seaweed cultivation. Moreover, seaweed extract biostimulants have the largest market share in the Indian biostimulants market. Recently, Corteva Agriscience signed an agreement to acquire Symborg, a biologicals-based company, as a part of its strategy to expand its biologicals portfolio. The action was taken to assist Corteva Agriscience in reaching their goal of dominating the agricultural biologicals industry on a global scale. Besides this, the region is a major producer of seaweed-derived hydrocolloids, such as carrageenan, agar, and alginate, which are widely used in the food, pharmaceutical, and cosmetic industries worldwide. This strong production base is further anticipated to strengthen the Asia Pacific in the global market.

Key Regional Takeaways:

North America Seaweed Market Analysis

The seaweed market in North America is growing rapidly due to several key factors. Rising consumer awareness about the nutritional and health benefits of seaweed has significantly increased its use in food products. The growing popularity of plant-based diets and functional foods, particularly in the United States and Canada, has further driven demand for seaweed as a rich source of iodine, vitamins, antioxidants, and dietary fiber. Additionally, seaweed is gaining attention for its role in gut health, weight management, and immune support, aligning with consumer preferences for natural and sustainable health solutions. The region has also seen a surge in culinary applications, with seaweed becoming a staple in sushi, snacks, and seasoning blends. This trend has been supported by the increasing influence of Asian cuisines and innovative product offerings by local and international brands. Beyond food, seaweed’s use in cosmetics, pharmaceuticals, and agriculture is expanding, with a growing interest in organic fertilizers and animal feed additives.

United States Seaweed Market Analysis

In recent times, seaweed farming in the U.S. has registered a massive boom, mostly in states such as New England, Pacific Northwest, and Alaska. According to industry reports, farms under these state headers grow these varieties in addition to a number of seaweed such as dulse, bull kelp, ribbon kelp, sugar kelp; used within foods such as sushi, salsas, sauces and seasonings among others, cosmetic, feedstock animal as well as fertilizer among many others. For instance, Alaska farmers harvested more than 112,000 pounds of seaweed in 2019, which was 200% more than the first commercial harvest back in 2017. North America's largest kelp farm is located off southeastern Alaska and uses vertical farming techniques to grow seaweed. Still, the industry remains in its developmental stage and is still under research, mainly on site requirements and sustainable farming practices. As this industry matures, seaweed farming is going to make major contributions to sustainable seafood, job creation in coastal economies, and environmental benefits through the improvement of water quality and buffering ocean acidification.

Europe Seaweed Market Analysis

Europe is also experiencing robust seaweed market trends, particularly in alternative proteins and sustainable food solutions. According to Ministry of Foreign Affairs, in Europe, seaweed consumption reportedly soared to the tune of a 147% increase in food and drinks products with or without containing seaweed or its flavor in 2011-2015. The UK has led the market by importing 6,271 tonnes worth of USD 12,846 worth of seaweed in 2019. France, Germany, and Spain among other European countries continue the trend in retail as well as foodservice segments. Popularity of seaweed in Asian cuisine, especially sushi and soups, has given seaweed a good level of recognition. Despite an increased production locally, Europe continues to import seaweed into the country, and out of the 25% that Europe imported in 2020, this was from developing countries. According to the seaweed market research report, with the increasing market, demand for innovative seaweed-based products, including plant-based alternatives, is expected to rise. In this context, exporters would be able to supply value-added products such as dried or powdered seaweed.

Asia Pacific Seaweed Market Analysis

According to a research article, China is the major player in the Asia-Pacific seaweed market, producing almost 58% of global seaweed production. The seaweed industry of China began in the 1950s and plays an essential role in the region's economy. This country alone produces around five million tons of edible seaweed a year, mainly from the variety called kombu. China's seaweed farmings are done by hung ropes in the sea, while introduced from Japan, the more economically important species being Saccharina japonica. Besides food production, other environmental benefits of seaweeds in China involve the sequestration of carbon, regulation of eutrophication, and remotion of heavy metals through the cultivation of seaweed thus improving the health status in marine ecosystems. Trading point: The main trading partners involve ASEAN countries, Chile and Peru. Given its established infrastructure and environmental benefits, China is at the forefront of regional and global markets for seaweed. This makes the Asia-Pacific region a major growth area in the industry.

Latin America Seaweed Market Analysis

Latin America's seaweed market forecast points to significant growth, with Brazil emerging as a key market. Brazil appears to offer more room for growth regarding Latin America's seaweed market, although there's great dependence on other parts of the world for imported materials; indeed, in 2023, Brazil alone imported from Indonesia 6,156 kg of carrageenan. According to an industrial report, carrageenan has largely been the product sourced, mainly from the species Kappaphycus alvarezii farmed in more than 30 nations. Since being first brought into Brazil in 1995, K. alvarezii is a species that has shown to be viable for cultivation because of its growth rates and market value. Its regions, such as Ilha Grande Bay and Santa Catarina, in Brazil have been showing potential with the possibility of yielding up to 730 tons of dry seaweed annually. Though there are some regulatory issues in certain areas, government support and continuous research are helping the industry expand. The potential for international trade in carrageenan, especially in the food and cosmetics sectors, further underscores the importance of this market for Brazil. The region focuses on sustainable agriculture and bioenergy, driving innovation in seaweed-based products. It is mainly in the cosmetics and energy sectors, with Latin American companies such as AlgaMar expanding production capacities to meet the demand for sustainable products. Going forward, continued government support for aquaculture and seaweed farming will likely propel further market growth in the region.

Middle East and Africa Seaweed Market Analysis

The Middle East seaweed market is on the bright side of growth, specially with Saudi Arabia's intent to increase its algae and seaweed industry. According to industry reports, Saudi Arabia has a vision toward 2030, the goal of which is that the investment into the sector of fisheries will be USD 4 Billion. KAUST was leading efforts in developing this biotechnology of algae and seaweed for pharmaceutical use, cosmetics, and the food industry. As part of its strategy, KAUST partners with private companies and trains Saudi nationals in marine farming. The Kingdom's Red Sea, with clean seawater and abundant sunlight, presents a promising environment for the cultivation of seaweed. In the coming years, Saudi Arabia is targeting becoming a leader in algae production, potentially positioning itself as a major competitor to China, the current market leader. One practice that will also feed the Kingdom's desire for sustainability is using wastewater and organic waste from date farming as part of creating a circular economy.

Competitive Landscape:

The seaweed industry insights highlight that leading players in the seaweed market are focusing on innovation, expansion, and sustainability to capitalize on the growing demand. They are investing heavily in research and development to create new products and improve the efficiency of seaweed farming and processing. For example, companies are developing innovative seaweed-based snacks, functional foods, and beverages to cater to health-conscious consumers. Others are working on high-quality hydrocolloids like carrageenan and alginate for industrial applications, including food processing, cosmetics, and pharmaceuticals. To meet the rising global demand, major players are expanding their production capabilities through partnerships and acquisitions. They are establishing farms in regions with ideal conditions for seaweed cultivation and working closely with local communities to ensure sustainable practices. Many are also adopting advanced technologies like automated farming systems and bioreactors to improve yield and reduce costs.

The report provides a comprehensive analysis of the competitive landscape in the seaweed market with detailed profiles of all major companies, including:

- Acadian Seaplants Limited

- Cargill Incorporated

- DuPont de Nemours Inc.

- Irish Seaweeds

- Leili

- Mara Seaweeds

- Qingdao Gather Great Ocean Algae Industry Group (GGOG)

Latest News and Developments:

- October 2024: BASF announced that it has partnered with Acadian Plant Health™ in order to expand its BioSolutions portfolio by introducing seaweed-based biostimulants. With the help of Acadian's Ascophyllum nodosum seaweed technology, crop resilience to climate stress is enhanced. BASF will globally distribute these products to help in climate-smart agriculture and sustainable crop production.

- October 2024: BASF announced that it has partnered with Acadian Plant Health™ in order to expand its BioSolutions portfolio by introducing seaweed-based biostimulants. With the help of Acadian's Ascophyllum nodosum seaweed technology, crop resilience to climate stress is enhanced. These products will be distributed internationally by BASF to support sustainable crop production and climate-smart agriculture.

- October 2024: India, says Central Marine Fisheries Research Institute, CMFRI, is capable of producing 9.7 million tonnes of seaweed in 342 locations. The new guidelines that the Union Government has framed aim at increasing the production of seaweed through imports of high-quality seed materials. It ensures that the same produces for the environment as well as for the coastal states economically.

- March 2024: Irish firm Simply Blue Group stamped its seal of approval to build the world's first commercial seaweed farm in the North Sea. The rough-and-tumble environment of an offshore wind array is not the easiest place to establish a new aquaculture venture, but the crowded North Sea provides seaweed farmers with few other options.

- March 2024: Sea6 Energy, a technology pioneer in the Blue Economy, recently launched the world's first large-scale mechanized tropical seaweed farm off Ekas, on the island of Lombok, Indonesia.

- October 2023: FlexSea, a startup with its roots at Imperial, announced the completion of a seed round worth Pound 3 Million (USD 3.77 Million) in equity and grants. The investment will help the company commercialize a range of sustainable packaging solutions that it has developed based on plastics derived from seaweed.

Seaweed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Aquaculture, Wild Harvest |

| Products Covered | Red, Brown, Green |

| Applications Covered | Processed Food, Direct Human Consumption, Hydrocolloids, Fertilizers, Animal Feed Fertilizers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | China, Indonesia, Philippines, South Korea, Malaysia, Vietnam, United States, Canada, France, Italy, Spain, Russia, Brazil, Mexico, Argentina, Chile, Peru, Saudi Arabia, United Arab Emirates, South Africa |

| Companies Covered | Acadian Seaplants Limited, Cargill Incorporated, DuPont de Nemours, Inc., Irish Seaweeds, Leili, Mara Seaweeds and Qingdao Gather Great Ocean Algae Industry Group (GGOG), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the seaweed market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global seaweed market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the seaweed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Seaweed is a general term for various types of marine algae that grow in oceans, seas, and other water bodies. It is a plant-like organism that belongs to different groups of algae, such as red algae (Rhodophyta), green algae (Chlorophyta), and brown algae (Phaeophyta). Seaweed lacks the complex structures found in land plants, like roots, stems, and leaves, but it often has similar functional parts, such as a holdfast (to anchor it), a stipe (stem-like structure), and blades (leaf-like parts).

The seaweed market was valued at USD 9.01 Billion in 2024.

IMARC estimates the global seaweed market to exhibit a CAGR of 8.17% during 2025-2033.

The expanding food and beverage industry, growing awareness about health benefits, increasing applications in pharmaceuticals and cosmetics, technological advancements, and government support are some of the major factors propelling the market.

In 2024, aquaculture represented the largest segment by environment, as it provides controlled and optimized conditions for the cultivation of aquatic organisms, allowing for higher productivity and efficiency compared to wild harvesting.

Red leads the market by product owing to its wide range of applications across various industries including food and beverages, pharmaceutical, and nutraceutical.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global seaweed market include Acadian Seaplants Limited, Cargill Incorporated, DuPont de Nemours, Inc., Irish Seaweeds, Leili, Mara Seaweeds and Qingdao Gather Great Ocean Algae Industry Group (GGOG), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)