Seasonal Influenza Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

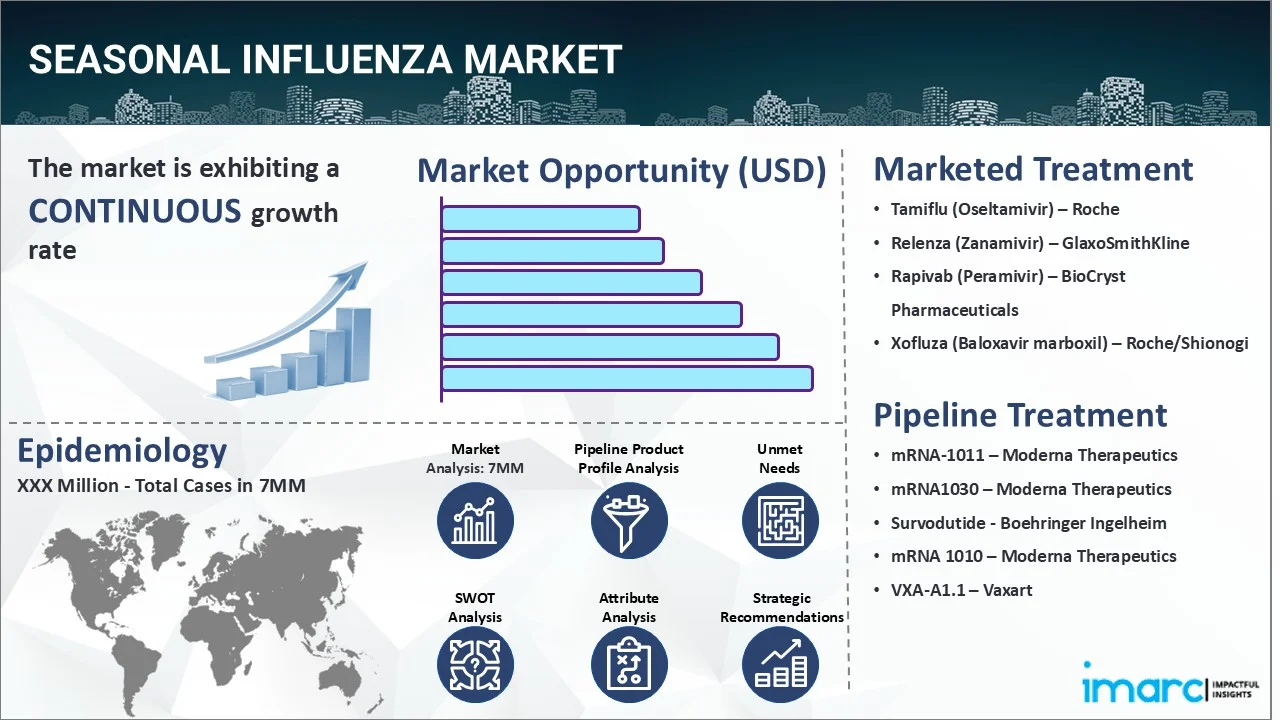

The seasonal influenza market reached a value of USD 10.2 Billion across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 48.4 Billion by 2035, exhibiting a growth rate (CAGR) of 15.18% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year | 2024 |

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 10.2 Billion

|

|

Market Forecast in 2035

|

USD 48.4 Billion

|

| Market Growth Rate 2025-2035 | 15.18% |

The seasonal influenza market has been comprehensively analyzed in IMARC's new report titled "Seasonal Influenza Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Seasonal influenza, commonly referred to as flu, is a contagious respiratory disorder caused by the influenza viruses. It typically occurs in seasonal outbreaks, mainly during the fall and winter months in temperate regions. This condition spreads through respiratory droplets when an infected person coughs, sneezes, or talks. It can also be transmitted by coming into contact with contaminated surfaces and then touching the mouth, nose, or eyes. The common symptoms of this ailment include fever, body aches, runny or stuffy nose, fatigue, cough, loss of appetite, weakness, diarrhea, sore throat, vomiting, nausea, chills, headaches, etc. The diagnosis of seasonal influenza typically involves a combination of a medical history review, clinical feature assessment, and laboratory procedures. During an initial exam, the healthcare provider may evaluate lung function and check for other physical indicators of respiratory illness. Additionally, rapid influenza diagnostic tests (RIDTs) are recommended to validate the presence of viral antigens in patients. Numerous molecular techniques, such as reverse transcription-polymerase chain reaction and nucleic acid amplification tests, are further utilized to obtain details about viral load and strain characterization.

To get more information on this market, Request Sample

The increasing cases of airborne diseases due to various factors, including cold weather, dry air, enhanced crowding in enclosed spaces, etc., are primarily driving the seasonal influenza market. In addition to this, the rising prevalence of weakened immunity that can impair the respiratory tract's natural defense mechanisms, making individuals more susceptible to viral infections, is also creating a positive outlook for the market. Moreover, the widespread adoption of effective antiviral drugs, like oseltamivir, zanamivir, peramivir, etc., to reduce the severity and duration of flu symptoms among patients is further bolstering the market growth. Apart from this, the inflating application of saline nasal spray, which works by flushing out mucus and irritants from the nasal passages to relieve congestion, minimize post-nasal drip, and alleviate sinus discomfort, is acting as another significant growth-inducing factor. Additionally, the emerging popularity of chemoprophylaxis techniques, since they can effectively reduce the risk of acquiring viral infections, thereby slowing down the spread of the disease, is expected to drive the seasonal influenza market during the forecast period.

IMARC Group's new report provides an exhaustive analysis of the seasonal influenza market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for seasonal influenza and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those with a stake in or planning to enter the seasonal influenza market in any capacity.

Recent Developments:

- In June 2025, Moderna announced positive results from a Phase 3 efficacy study (P304) evaluating the relative vaccine efficacy (rVE) against influenza illness of mRNA-1010, the Company's seasonal influenza vaccine candidate, compared to a licensed standard-dose seasonal influenza vaccine in adults aged 50 years and older. mRNA-1010 achieved the most stringent superiority criterion prespecified in the protocol, with an rVE of 26.6% in the overall study population.

- In April 2025, Roche announced that the New England Journal of Medicine (NEJM) had published a detailed analysis of the phase III CENTERSTONE trial of Xofluza (baloxavir marboxil). The trial met its primary endpoint, demonstrating that a single oral dose of Xofluza administered to individuals infected with influenza reduced the odds of untreated household members contracting the virus by 32%.

- In September 2024, BioCryst Pharmaceuticals, Inc. stated that the U.S. Department of Health and Human Services (HHS) had awarded BioCryst up to a $69 million contract for the procurement of up to 95,625 doses over five years of RAPIVAB (peramivir injection) for the treatment of influenza.

Key Highlights:

- Seasonal influenza is an acute viral infection that affects 5-10% of adults and 20-30% of children each year.

- Every year, over a billion instances of seasonal influenza are reported, with 3-5 million cases resulting in severe disease.

- It causes between 290,000 and 650,000 respiratory deaths each year.

- Developing countries account for 99 percent of mortality among children under the age of five due to influenza-related lower respiratory tract infections.

- Annual influenza epidemics often occur in the United States during winter and the fall.

Drugs:

Tamiflu (oseltamivir) is an antiviral medication that works by inhibiting the influenza virus's neuraminidase enzyme. This enzyme is crucial for the virus to replicate and spread within the body. By blocking neuraminidase, Tamiflu prevents the virus from leaving infected cells and infecting new cells, thus reducing the severity and duration of flu symptoms.

mRNA-1011 is under clinical development by Moderna for the prevention of seasonal influenza, including influenza A H1N1, H3N2, and influenza B yamagata and victoria strains. It is a pentavalent vaccination that contains mRNA encoding hemagglutinin (HA) glycoproteins from five flu strains (influenza A H1N1, H3N2, and influenza B Yamagata, Victoria strains, as well as one additional HA strain).

VXA-A1.1 is an oral influenza vaccination tablet created by Vaxart, Inc. It is a replication-defective adenovirus type-5 vaccine expressing influenza hemagglutinin. It appears to protect against influenza through a combination of B cell and T cell responses, specifically with the induction of antibody-secreting cells producing hemagglutinin (HA)-specific IgA.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the seasonal influenza market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the seasonal influenza market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current seasonal influenza marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Tamiflu (Oseltamivir) | Roche |

| Relenza (Zanamivir) | GlaxoSmithKline |

| Rapivab (Peramivir) | BioCryst Pharmaceuticals |

| Xofluza (Baloxavir marboxil) | Roche/Shionogi |

| mRNA-1011 | Moderna Therapeutics |

| mRNA1030 | Moderna Therapeutics |

| mRNA 1010 | Moderna Therapeutics |

| VXA-A1.1 | Vaxart |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the seasonal influenza market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the seasonal influenza across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the seasonal influenza across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of incident cases (2019-2035) of seasonal influenza across the seven major markets?

- What is the number of incident cases (2019-2035) of seasonal influenza by age across the seven major markets?

- What is the number of incident cases (2019-2035) of seasonal influenza by gender across the seven major markets?

- What is the number of incident cases (2019-2035) of seasonal influenza by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with seasonal influenza across the seven major markets?

- What is the size of the seasonal influenza patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend seasonal influenza of?

- What will be the growth rate of patients across the seven major markets?

Seasonal Influenza: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for seasonal influenza drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the seasonal influenza market?

- What are the key regulatory events related to the seasonal influenza market?

- What is the structure of clinical trial landscape by status related to the seasonal influenza market?

- What is the structure of clinical trial landscape by phase related to the seasonal influenza market?

- What is the structure of clinical trial landscape by route of administration related to the seasonal influenza market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)