Seasonal Allergic Rhinitis Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

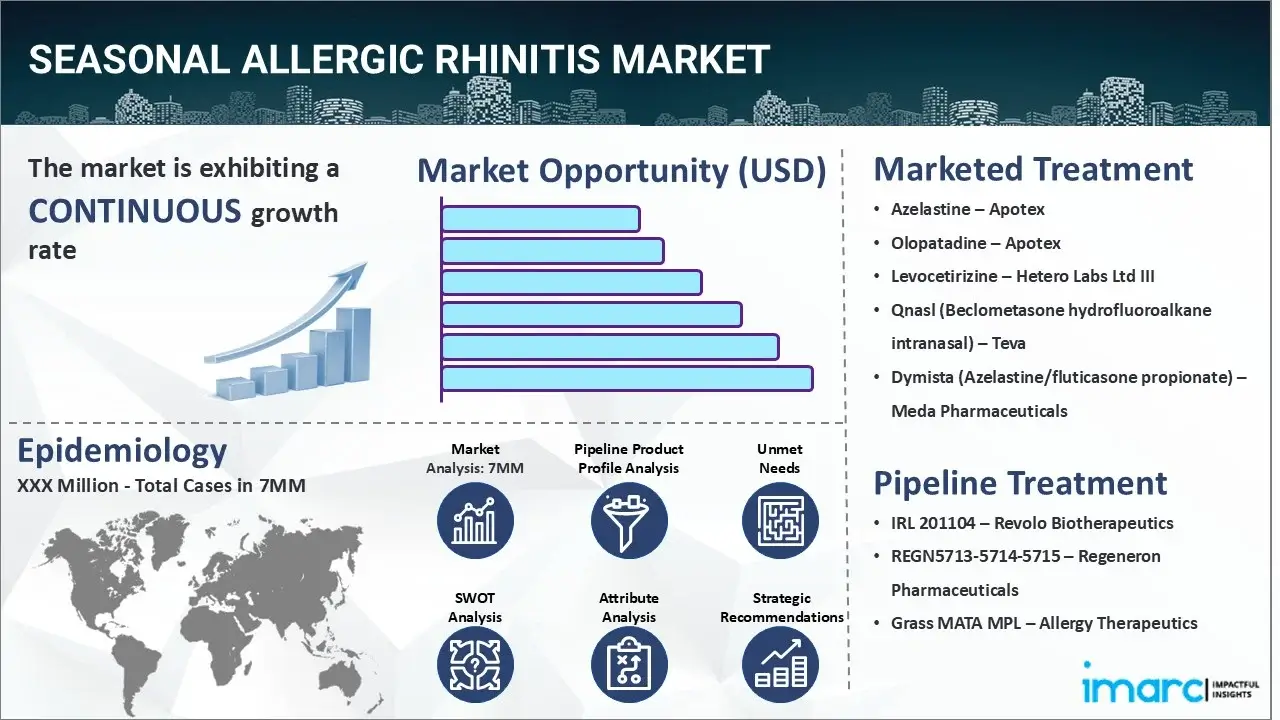

The seasonal allergic rhinitis market reached a value of USD 10.8 Billion across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 14.7 Billion by 2035, exhibiting a growth rate (CAGR) of 2.87% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 10.8 Billion |

|

Market Forecast in 2035

|

USD 14.7 Billion |

|

Market Growth Rate 2025-2035

|

2.87% |

The seasonal allergic rhinitis market has been comprehensively analyzed in IMARC's new report titled "Seasonal Allergic Rhinitis Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Seasonal allergic rhinitis, commonly called hay fever, refers to an allergic reaction that occurs in response to certain allergens present in the environment during specific seasons. It is characterized by inflammation of the nasal passages, resulting in various symptoms, such as sneezing, itching, a runny or stuffy nose, watery eyes, etc. Some individuals suffering from this ailment may also experience fatigue, coughing, sore throat, headache, nasal congestion, itchiness in the throat or ears, postnasal drip, impaired sleep cycle, etc. These symptoms can significantly impact daily activities and the overall quality of life. The diagnosis of seasonal allergic rhinitis is usually based on the patient's medical history, clinical signs, and physical examination. A healthcare provider may recommend skin prick tests to identify specific allergens that trigger the allergic reaction. Furthermore, radioallergosorbent testing is utilized to measure the amount of certain IgE antibodies in the blood that may be indicative of the disease. In some cases, a nasal provocation test is also required, which involves the introduction of a small amount of allergen directly into the nose to detect the cause of underlying symptoms.

To get more information on this market, Request Sample

The increasing cases of overactivation of the immune system, which results in the release of histamine and other chemicals, thereby leading to an allergic response, are primarily driving the seasonal allergic rhinitis market. Additionally, the rising incidences of exposure to pollen from grasses, trees, weeds, etc., which cause inflammation and irritation in the airways, are also creating a positive outlook for the market. Moreover, the widespread adoption of intranasal corticosteroids, including fluticasone, budesonide, mometasone, etc., to minimize the symptoms of the ailment is further bolstering the market growth. Apart from this, the escalating application of effective medications, like antihistamines, since they work by blocking the histamine receptors and reducing the swelling of blood vessels in the nasal passages to alleviate discomfort among patients, is acting as another significant growth-inducing factor. Additionally, the emerging popularity of allergy shots to treat this condition, owing to their several benefits, such as long-term relief, improved quality of life, and decreased need for other interventions, is expected to drive the seasonal allergic rhinitis market during the forecast period.

IMARC Group's new report provides an exhaustive analysis of the seasonal allergic rhinitis market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for seasonal allergic rhinitis and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the seasonal allergic rhinitis market in any manner.

Recent Developments:

- In February 2025, Allergy Therapeutics released the publication of comprehensive data from its pivotal G306 Phase III trial of Grass MATA MPL, the Group's innovative subcutaneous immunotherapy (SCIT) candidate designed to address the cause of symptoms of allergic rhinoconjunctivitis due to grass pollen.

Drugs:

Qnasl (beclometasone dipropionate hydrofluoroalkane) is a corticosteroid nasal spray developed by Teva for seasonal allergic rhinitis. It works by delivering beclometasone directly to the nasal mucosa, where it inhibits inflammatory cytokines and mediators like histamines and leukotrienes. This reduces local swelling, nasal congestion, itching, and sneezing. Its hydrofluoroalkane propellant ensures fine mist delivery without chlorofluorocarbons, providing effective symptom control with minimal systemic absorption.

IRL-201104 is an under-development immunomodulatory drug by Revolo Biotherapeutics for the treatment of seasonal allergic rhinitis. This therapeutic compound is a peptide derived from mycobacterium tuberculosis chaperonin 60.1 that reduces neutrophil invasion into the lung, thereby decreasing inflammation. It is administered through intravenous and subcutaneous routes to reset the immune response with the potential for inducing long-term disease remission.

REGN5713-5714-5715 is an investigational molecule to treat seasonal allergic rhinitis. The therapeutic substance consists of three human monoclonal antibodies, including REGN5713, REGN5714, and REGN5715. It is delivered via intravenous and subcutaneous routes. The medicinal agent works by addressing the pollen allergen Bet v 1 in patients.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the seasonal allergic rhinitis market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the seasonal allergic rhinitis market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current seasonal allergic rhinitis marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Azelastine | Apotex |

| Olopatadine | Apotex |

| Levocetirizine | Hetero Labs Ltd |

| Qnasl (Beclometasone hydrofluoroalkane) | Teva |

| Dymista (Azelastine/fluticasone propionate) | Meda Pharmaceuticals |

| IRL 201104 | Revolo Biotherapeutics |

| REGN5713-5714-5715 | Regeneron Pharmaceuticals |

| Grass MATA MPL | Allergy Therapeutics |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the seasonal allergic rhinitis market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the seasonal allergic rhinitis across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the seasonal allergic rhinitis across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of seasonal allergic rhinitis across the seven major markets?

- What is the number of prevalent cases (2019-2035) of seasonal allergic rhinitis by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of seasonal allergic rhinitis by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of seasonal allergic rhinitis by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with seasonal allergic rhinitis across the seven major markets?

- What is the size of the seasonal allergic rhinitis patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend seasonal allergic rhinitis of?

- What will be the growth rate of patients across the seven major markets?

Seasonal Allergic Rhinitis: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for seasonal allergic rhinitis drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the seasonal allergic rhinitis market?

- What are the key regulatory events related to the seasonal allergic rhinitis market?

- What is the structure of clinical trial landscape by status related to the seasonal allergic rhinitis market?

- What is the structure of clinical trial landscape by phase related to the seasonal allergic rhinitis market?

- What is the structure of clinical trial landscape by route of administration related to the seasonal allergic rhinitis market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)