Seamless Pipe Market Size, Share, Trends and Forecast by Type, Material, Production Method, End Use, and Region, 2025-2033

Seamless Pipe Market Size and Share:

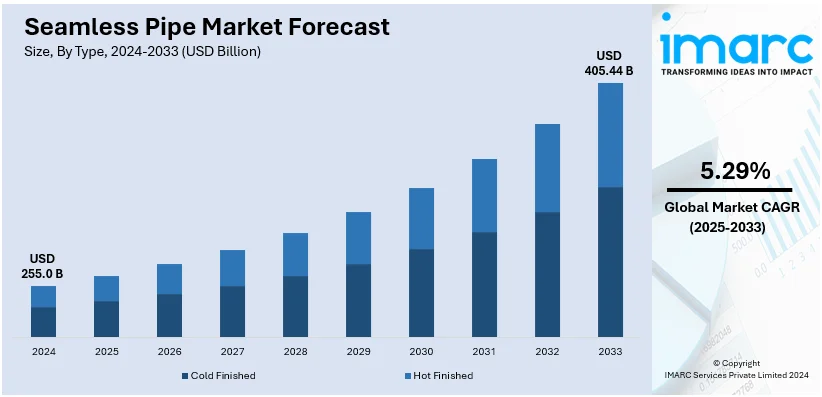

The global seamless pipe market size was valued at USD 255.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 405.44 Billion by 2033, exhibiting a CAGR of 5.29% from 2025-2033. North America currently dominates the market, due to the rapid expansion of the automotive industry, the increasing product demand in the construction industry, and the utilization of three-dimensional (3D) printing represent some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 255.0 Billion |

|

Market Forecast in 2033

|

USD 405.44 Billion |

| Market Growth Rate (2025-2033) | 5.29% |

One major driver in the seamless pipe market is the increasing demand from the oil and gas industry. As exploration and production activities expand, there is a rising need for high-strength, corrosion-resistant seamless pipes that can survive extreme pressures and harsh environments. Seamless pipes are ideal for applications in oil and gas pipelines, offshore drilling, and refineries due to their exceptional mechanical properties and durability. With the ongoing focus on energy exploration, infrastructure development, and the shift towards deep-water and unconventional resource extraction, the demand for seamless pipes is projected to remain strong in this sector.

In the U.S., the seamless pipe market is significantly driven by the oil and gas sector, with substantial investments in infrastructure expansion. For instance, Williams Cos plans to add 4.2 billion cubic feet per day (bcfd) of natural gas capacity through 12 projects between 2024 and 2027. This includes the 1.8-bcfd Louisiana Energy Gateway, expected by late 2025, and the 1.6-bcfd Southeast Supply Enhancement, slated for Q4 2027. These developments highlight the demand for high-quality seamless pipes, which are essential for extreme conditions in exploration, drilling, and energy transportation, further boosting growth in the construction and automotive industries.

Seamless Pipe Market Trends:

Oil and gas industry demand

The oil and gas sector are one of the primary drivers for the seamless pipe market. Seamless pipes are essential for transporting fluids under high pressure in exploration and production activities, especially in offshore and deep-water drilling. These pipes are preferred due to their high strength, corrosion resistance, and ability to endure extreme temperatures and pressures. As exploration moves toward deeper and more challenging reserves, such as shale oil and offshore fields, the demand for high-performance seamless pipes is increasing. The growing need for pipelines, refineries, and petrochemical plants further accelerates this demand, positioning the oil and gas industry as a key driver in the seamless pipe market.

Construction sector growth

The growing construction sector, particularly in emerging economies, plays a vital role in driving the seamless pipe market. Seamless pipes are widely used in construction applications, including plumbing, heating, and structural support. They are favored in high-rise buildings, bridges, and industrial facilities due to their ability to withstand high pressures and provide long-lasting durability. With urbanization and infrastructure development projects on the rise, there is an increasing need for reliable piping solutions. Government investments in infrastructure, particularly in developing countries, further bolster the market, driving demand for seamless pipes used in water supply systems, sewage treatment, and heating installations.

Automotive industry requirements

The automotive industry also significantly influences the seamless pipe market. Seamless pipes are used in manufacturing key components such as exhaust systems, chassis, and hydraulic systems due to their high strength, lightweight nature, and resistance to wear and corrosion. As the automotive industry shifts towards more fuel-efficient, electric, and environmentally friendly vehicles, the need for advanced materials that enhance vehicle performance and safety increases. Seamless pipes offer advantages in these applications, especially in high-performance and electric vehicles, which demand lightweight and durable materials. As global car production grows, so does the demand for seamless pipes in automotive manufacturing.

Seamless Pipe Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global seamless pipe market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, material, production method and end use.

Analysis by Type:

- Cold Finished

- Hot Finished

Hot finished stands as the largest component in 2024, due to their widespread use in industries that demand high strength and durability. Hot finishing involves heating the pipe to a high temperature, allowing for enhanced mechanical properties and a smooth surface finish. This process makes hot-finished pipes ideal for demanding applications in sectors such as oil and gas, petrochemical, and power generation, where pipes must withstand extreme pressure and temperature conditions. The increasing need for infrastructure development, coupled with the growth of oil and gas exploration, boosts the demand for hot-finished seamless pipes, positioning them as the leading segment in the market. Their superior performance and cost-effectiveness drive their dominance.

Analysis by Material:

- Steel and Alloys

- Nickel and Alloys

- Copper and Alloys

- Others

Steel and alloys lead the market in 2024 due to their superior mechanical properties, making them optimal for a wide range of industrial applications. Steel pipes, especially those made from carbon, alloy, and stainless steel, offer excellent strength, corrosion resistance, and durability, making them the preferred choice for sectors such as oil and gas, automotive, and construction. Alloys, including high-strength alloys and corrosion-resistant alloys, provide additional benefits, such as resistance to extreme temperatures and pressures, which are crucial in specialized applications like offshore drilling and power generation. The versatility, cost-effectiveness, and adaptability of steel and alloys in meeting diverse industry demands ensure their continued leadership in the seamless pipe market, with a focus on performance and longevity in harsh environments.

Analysis by Production Method:

- Pierce and Pilger Process

- Plug Rolling Process

- Continuous Rolling Process

In 2024, pierce and pilger process accounts for the majority of the market due to its efficiency in producing high-quality pipes with precise dimensions and superior mechanical properties. The piercing process involves creating a hollow billet, which is then elongated and reduced in diameter using the pilger process. This combination allows manufacturers to produce seamless pipes with excellent strength, uniformity, and surface finish, making them suitable for demanding applications in industries like oil and gas, petrochemical, and automotive. The ability to produce large quantities of seamless pipes with minimal material wastage and high consistency in properties makes the pierce and pilger process the dominant choice in the market for 2024.

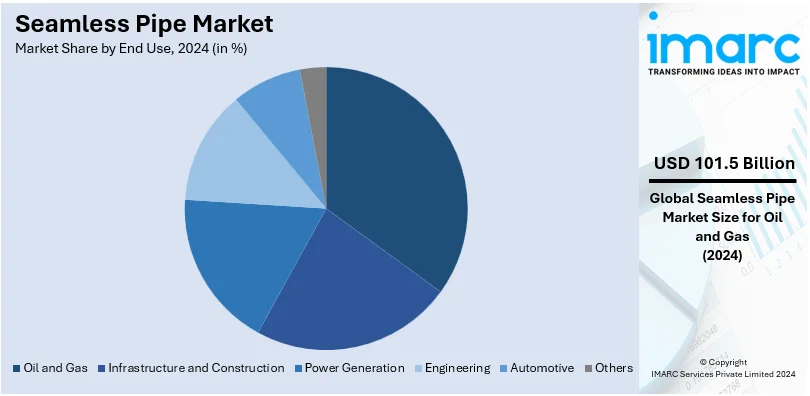

Analysis by End Use:

- Infrastructure and Construction

- Power Generation

- Oil and Gas

- Engineering

- Automotive

- Others

Oil and gas represented the leading market segment, due to the increasing demand for reliable and durable materials for exploration, production, and transportation. Seamless pipes are essential in the oil and gas industry as they can withstand extreme pressures, high temperatures, and corrosive environments, particularly in offshore drilling, pipeline transport, and refinery operations. With global energy demands rising and exploration expanding into more challenging environments, such as deep-water fields and shale reserves, the need for high-performance seamless pipes is escalating. These pipes are crucial for the safe and efficient transportation of oil and gas, driving their dominant position in the market. Their resistance to fatigue and corrosion further boosts their importance in this sector.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share driven by the region's robust oil and gas industry, infrastructure development, and manufacturing capabilities. The U.S. and Canada are major consumers of seamless pipes, particularly in oil and gas exploration, drilling, and pipeline construction, where high-strength, corrosion-resistant materials are essential. Besides this, the region’s significant automotive, construction, and power generation sectors further contribute to the demand for seamless pipes. Ongoing technological advancements in the manufacturing of seamless pipes, along with increased investments in energy infrastructure, ensure North America's dominance in the market. Furthermore, the region's regulatory framework and emphasis on quality standards support the growth of this segment.

Key Regional Takeaways:

United States Seamless Pipe Market Analysis

Seamless pipe demand is rising with expanding energy infrastructure projects and construction projects. According to reports, the United States' USD 1.2 Trillion infrastructure investment, with USD 550 Billion allocated for new projects, is driving the adoption of seamless pipes. These pipes are essential for traditional applications like energy transmission and water systems, as well as innovative infrastructure advancements. Rising demand underscores seamless pipe’s role in improving project efficiency and durability. The focus on modernizing energy facilities, including renewable and conventional energy plants, is creating a need for pipes that can withstand high pressure and extreme temperatures. Industries reliant on thermal and nuclear power facilities benefit from their durability, enabling efficient transport of steam, water, and gases. The availability of robust supply chains and advanced manufacturing hubs ensures production meets stringent safety and efficiency standards. Additionally, increasing investments in pipeline projects for energy distribution are fueling the requirement for high-performance piping solutions. Growing exploration of shale resources is enhancing operational efficiency in upstream and downstream sectors, promoting seamless pipe adoption across power plants and energy networks.

Europe Seamless Pipe Market Analysis

Seamless pipes play a critical role in Europe’s evolving power generation sector, particularly in renewable and nuclear energy projects. According to reports, the growing power generation sector, driven by a forecasted 2.3% rise in EU electricity demand from 2024 to 2026. Increased demand from electric vehicles, heat pumps, and data centres, which will account for half of the total growth, further accelerates this trend. The demand for pipes with high-pressure and corrosion-resistant properties is growing as new thermal and gas-based facilities emerge. Large-scale investments in infrastructure upgrades, especially within energy transmission pipelines, are further driving demand. Moreover, seamless pipes are integral to supporting carbon capture and storage systems within power plants, addressing sustainability goals. Growth in district heating systems across urban areas requires efficient piping networks capable of handling continuous thermal stress. The construction of advanced hydrogen production plants, fuelled by clean energy investments, relies on seamless pipes for efficient gas transportation. Overall, the region’s emphasis on energy diversification and infrastructure enhancement accelerates seamless pipe applications across multiple industries.

Asia Pacific Seamless Pipe Market Analysis

The region's booming automotive industry is fostering increasing demand for seamless pipes, particularly in manufacturing vehicle chassis, fuel injection systems, and exhaust components. For instance, India's automotive industry, targeting a USD 300 Billion milestone by 2026, is driving demand for seamless pipes, essential for vehicle efficiency and performance, amid rising production and urbanization. Strong FDI inflows and robust manufacturing further accelerate seamless pipe adoption in this growing automotive hub. Lightweight, high-strength pipes are critical to improving fuel efficiency and reducing emissions in compliance with strict environmental regulations. Ongoing developments in electric and hybrid vehicles are further driving the adoption of precision-engineered pipes. Growing investments in automotive production facilities are creating opportunities for seamless piping technologies that deliver durability and performance under demanding conditions. Additionally, the region’s industrial clusters emphasize large-scale manufacturing, where seamless pipes play a crucial role in machinery and tooling applications. Expanding export-oriented automotive production amplifies demand, as manufacturers prioritize superior-quality pipes to meet international standards. Infrastructure development supporting these industries enhances supply chains, facilitating seamless pipe adoption in high-growth automotive hubs.

Latin America Seamless Pipe Market Analysis

The seamless pipe market in Latin America is benefiting from growing urbanization and ongoing industrial infrastructure projects. According to reports, Latin America, the world’s most urbanized region, has seen its urban population surge from 40 percent in 1950 to 80 percent, with cities housing 260 Million people. Expanding housing developments, commercial spaces, and public infrastructure upgrades require efficient piping solutions, driving demand. The construction sector is adopting these pipes for their durability and resistance to pressure, while energy transmission projects increase the need for seamless pipes in utilities. Also, increasing investments in manufacturing and automotive sectors boost regional consumption. The shift towards modernizing aging water distribution systems and transportation networks further stimulates adoption. Urban expansion also fosters demand for seamless pipes in sewage and drainage systems, where reliable and long-lasting materials are preferred. Together, these developments create a favourable landscape for seamless pipe adoption across key infrastructure domains in the region.

Middle East and Africa Seamless Pipe Market Analysis

Seamless pipes are gaining acceptance in the Middle East and Africa as the oil and gas sector expands. For example, the hydrocarbons sector in the Middle East is growing fast, with ongoing oil and gas projects valued at over USD 300 Billion, according to MEED's latest update. Increasing upstream and downstream activities, such as exploration, drilling, and pipeline projects, require reliable pipes that will function well under extreme conditions. Refinery construction, petrochemical plants, and LNG facilities require durable piping systems. Infrastructure development in the form of urbanization is also growing; therefore, water treatment facilities and district cooling systems require seamless pipes to ensure longevity and efficiency. In addition, the region's commitment to diversifying its energy portfolio, including renewables, is pushing the adoption of advanced pipe materials for high-performance operations. With favourable industrial growth trends, the market is expected to continue expanding across critical energy and utility applications.

Competitive Landscape:

The seamless pipe market is highly competitive, with several key players leading the industry. Major global manufacturers lead the market through extensive product portfolios, strong distribution networks, and technological innovations. Manufacturers are focusing on giving high-quality, durable, and customized seamless pipes for application in the oil and gas, construction, and automotive sectors. The regional players also hold great market shares, especially in local markets where demand is driven by specific industrial requirements. Rising demand for high-performance seamless pipes is intensifying competition, which is compelling the companies to invest in R&D, manufacturing capabilities, and customer-specific solutions to stay competitive.

The report provides a comprehensive analysis of the competitive landscape in the seamless pipe market with detailed profiles of all major companies, including:

- American Piping Products Inc.

- ArcelorMittal S.A

- D.P. Jindal Group

- JFE Steel Corporation

- Nippon Steel Corporation

- Salzgitter AG

- Stahlrohr GmbH

- Sumitomo Corporation

- Tenaris S.A. (Techint Holdings S.àr.l.)

- Tianjin Pipe Corporation

- Zaffertec S.L

Latest News and Developments:

- In November 2024, AEP-IGI launched Southeast Asia's first seamless pipe plant through a joint initiative between PT Artas Energi Petrogas and PT Inerco Global International. The facility aims to meet the growing demand for high-quality seamless pipes in the region. This milestone marks a significant step in the region's industrial development. The plant is expected to enhance local production capabilities and supply to various industries.

- In October 2024, Viraj Profiles launched seamless stainless steel pipe production with a new piercer mill, marking a significant expansion in their manufacturing capabilities. This advancement will enhance their production efficiency and product range. The company aims to strengthen its position in the global market for high-quality stainless-steel products. The move is expected to cater to increasing demand across various industries, offering advanced solutions for seamless pipe production.

- In September 2024, PT Inerco Global International and PT Artas Energi Petrogas partnered to build Southeast Asia's first seamless pipe manufacturing facility in Cilegon, Banten. The plant will be located within the Krakatau Steel Industry Complex. With a production capacity of 250,000 tons annually, the facility aims to meet rising demand for seamless steel pipes in oil and gas sector in Indonesia.

- In June 2024, Japan's Nippon Steel and Sumitomo Corp secured orders from QatarEnergy for high-alloy seamless pipes to support carbon capture storage (CCS) projects. Nippon Steel has already shipped the first batch for Qatar's upcoming "blue" ammonia plant in Mesaieed. The facility aims to integrate CCS technology to reduce emissions. QatarEnergy's initiative marks a significant step in advancing clean energy production.

- In April 2024, Global Seamless Tubes & Pipes, a leading producer of carbon, alloy, and stainless-steel seamless tubes and pipes, will invest USD 35 Million to open its first U.S. production facility in northwest Louisiana. This expansion aims to boost domestic manufacturing capacity for cold-drawn and hot-finish seamless pipes. The new facility is expected to generate significant local employment opportunities. The investment marks a strategic move to strengthen the company’s presence in the U.S. market.

Seamless Pipe Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cold Finished, Hot Finished |

| Materials Covered | Steel and Alloys, Nickel and Alloys, Copper and Alloys, Others |

| Production Methods Covered | Pierce and Pilger Process, Plug Rolling Process, Continuous Rolling Process |

| End Uses Covered | Infrastructure and Construction, Power Generation, Oil and Gas, Engineering, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Piping Products Inc., ArcelorMittal S.A, D.P. Jindal Group, JFE Steel Corporation, Nippon Steel Corporation, Salzgitter AG, Stahlrohr GmbH, Sumitomo Corporation, Tenaris S.A. (Techint Holdings S.àr.l.), Tianjin Pipe Corporation, Zaffertec S.L, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the seamless pipe market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global seamless pipe market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the seamless pipe industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A seamless pipe is a type of pipe manufactured without any joints or seams, making it stronger and more durable. It is produced by extruding a solid billet through a mold, creating a continuous hollow tube. Seamless pipes are ideal for high-pressure and high-temperature applications, such as in the oil and gas industry.

The seamless pipe market was valued at USD 255.0 Billion in 2024.

IMARC estimates the global seamless pipe market to exhibit a CAGR of 5.29% during 2025-2033.

Key factors driving the global seamless pipe market include increasing demand in the energy, automotive, and construction sectors. Rising infrastructure investments, expanding oil and gas exploration, and the need for durable, high-performance materials in power generation and industrial applications are fueling market growth, along with advancements in manufacturing technologies.

In 2024, hot finished represented the largest segment by type, driven by their strength, durability, and ability to withstand high-temperature and pressure conditions.

Steel and alloys lead the market by material owing to their strength, durability, and resistance to high pressure and temperatures.

The pierce and pilger process is the leading segment by production method, driven by its efficiency in producing high-quality, precise pipes for various applications.

The oil and gas are the leading segment by end use, driven by high demand for durable pipes in exploration, drilling, and transmission.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global seamless pipe market include American Piping Products Inc., ArcelorMittal S.A, D.P. Jindal Group, JFE Steel Corporation, Nippon Steel Corporation, Salzgitter AG, Stahlrohr GmbH, Sumitomo Corporation, Tenaris S.A. (Techint Holdings S.àr.l.), Tianjin Pipe Corporation, Zaffertec S.L, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)