Seafood Processing Equipment Market Size, Share, Trends and Forecast by Seafood Type, Equipment Type, Distribution Channel, and Region, 2025-2033

Seafood Processing Equipment Market Size and Share:

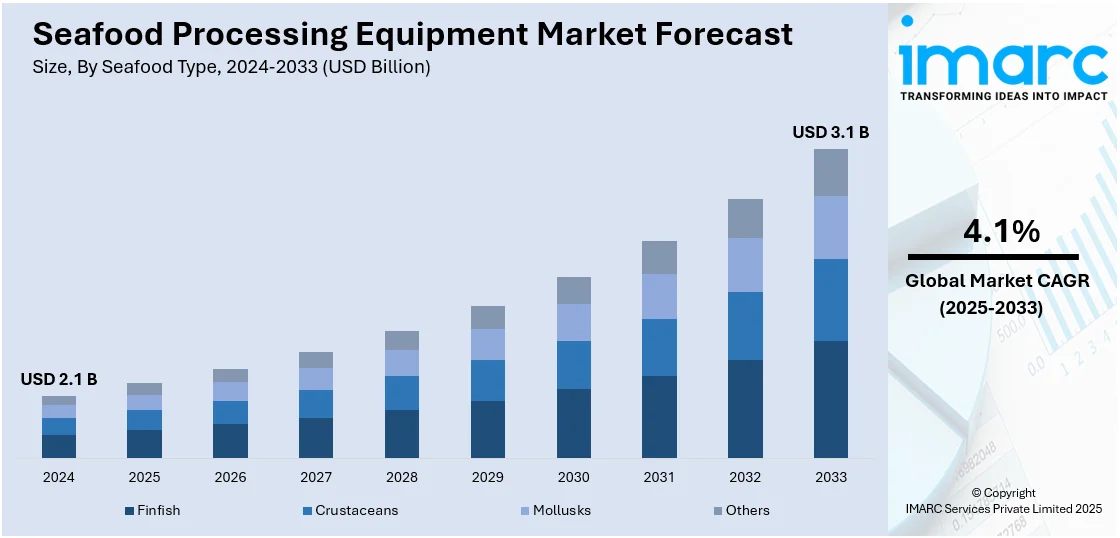

The global seafood processing equipment market size reached USD 2.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.1% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 42.5% in 2024. The rising seafood consumption, ongoing advancements in technology, increasing focus on food safety, growing demand for frozen and ready-to-eat (RTE) products, and the expansion of aquaculture practices to meet global protein needs are some of the key factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.1 Billion |

| Market Growth Rate (2025-2033) | 4.1% |

The market for seafood processing equipment is expanding rapidly worldwide. Higher disposable incomes and shifting dietary choices are contributing factors to consumers' growing interest in processed seafood, which is driving this increase. Due to the increased criteria for food safety, seafood processors are using more and more high-quality technology to improve efficiency and hygiene. Besides this, other technological advantages such as automation and high precision cutting tools, which help to boost industry production without increasing labor costs. Sophisticated processing equipment is becoming more and more in demand as aquaculture and fisheries continue to expand. An analysis by the IMARC Group projects that the worldwide aquaculture market would grow from 82.8 Million Tons in 2024 to 122.9 Million Tons in 2033, indicating a CAGR of 4.03% during 2025-2033.

The United States has emerged as a key regional market for seafood processing equipment. The United States seafood processing equipment market is driven by increasing consumer demand for convenience and ready-to-eat seafood products, aligned with changing lifestyles and dietary preferences. Rising awareness about sustainable seafood practices and regulatory compliance requirements has prompted processors to adopt advanced equipment for efficient and eco-friendly operations. Technological changes involved in automation and precision tools improve the productivity efficiency associated with processing while reducing wastes generated, driving market growth. In addition to that, aquaculture and domestic fish farming expansion is increasing the need for modern processing systems. As per a report published by the IMARC Group, the United States fish farming market size is expected to reach US$ 116.6 Billion by 2032, exhibiting a CAGR of 4.86% during 2024-2032. Other than that, the greater demands for frozen and packaged seafood along with a strong retail and e-commerce network are driving industry growth.

Seafood Processing Equipment Market Trends:

Rising Seafood Consumption

Increasing global awareness regarding the health benefits of seafood, combined with changing dietary preferences, has led to a rise in seafood consumption. According to the Food and Agriculture Organization of the United Nations, in 2021, the global apparent consumption of aquatic animal foods reached 162.5 Million Tonnes. This figure has increased at nearly twice the rate of the worldwide population since 1961, with global per capita yearly consumption rising from 9.1 kg in 1961 to 20.7 kg in 2022. Seafood is recognized for its high protein content, essential omega-3 fatty acids, and low saturated fats. It is hence one of the more popular products with health-conscious consumers. Aquatic meals also contain high-quality proteins, accounting for 15% of animal proteins and 6% of total proteins worldwide, as well as essential elements such as omega-3 fatty acids, minerals, and vitamins. In 2021, they accounted for at least 20% of the per capita protein supply from all animal sources for 3.2 billion people. Further, a growing global middle class is driving more increased disposable incomes and lifestyles that appreciate more diversified and healthier food intakes. This increased consumption of seafood is prompting processors to invest in more sophistic equipment that allow high efficiency in production and enhance quality of products such as fillet, frozen products, as well as value-added product, propelling overall market growth.

Technological Advancements

Technological innovations are transforming the seafood processing equipment market. Automation and novel processing technologies are gaining popularity as they enhance productivity and ensure consistent product quality. One such seafood processing technological development is employing High-Pressure Processing (HPP). HPP is widely used as a cold pasteurization process as it can easily neutralize harmful bacteria while still retaining the texture and nutrients of seafood through pressures as high as 87,000 psi. The method suits the preservation of perishable seafood products well since it significantly increases shelf life with no heat application at all. Equipment such as automatic filleting machines, high-speed freezing units, and advance packaging technologies are also being increasingly used. These are employed to cut labor costs and streamline operations. Smart technologies, including IoT applications, enable real-time monitoring and data analytics of operations, which also helps processors optimize their activities, minimize waste, and enhance traceability. These innovations are positively impacting the seafood processing equipment market outlook as they enhance the operating efficiency of companies and comply with strict food safety standards and regulations, answering consumers' needs regarding quality and safety.

Focus on Sustainability and Food Safety

The expanding emphasis on sustainability in the seafood processing industry is contributing substantially to market growth. The seafood industry is playing a vital role in achieving the United Nations’ 2030 Agenda for Sustainable Development. Multiple initiatives are being taken by governments and global organizations in this regard. For instance, the Sustainable Seafood Processing (SUSEAPRO) project by the European Union EIT Food is creating innovative processing techniques to increase the shelf life of seafood without the need for heat treatment or additives. This is addressing the issue of almost 35% of the world's seafood production being wasted each year as a result of spoiling. These technologies enhance food safety and consumer perception by increasing shelf life and inhibiting microbial growth. In addition to that, consumers and regulatory bodies are also seeking openness in sources and processing for assurance on the environment-friendliness of operations. This fact has heightened the focus toward sustainable fishing as well as eco-friendly modes of processing. Seafood processors today have begun to make investments that support sustainable practices. This consists of energy-efficient machinery along with equipment that can minimize waste. In addition, stringent food safety regulations following several outbreaks of foodborne illnesses linked to seafood consumption are bolstering the demand for equipment that aids hygiene, such as automatic cleaning systems and temperature-controlled processing lines, to reduce the risks and comply with regulatory standards.

Seafood Processing Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on seafood type, equipment type, and distribution channel.

Analysis by Seafood Type:

- Finfish

- Crustaceans

- Mollusks

- Others

Finfish leads the market with around 66.0% of market share in 2024. Finfish dominates the market due to its widespread consumption and commercial significance. Higher processing volumes due to the growing popularity of species such as tilapia, salmon, and tuna in a variety of culinary applications are strengthening the market demand. Investment in cutting-edge processing technologies to improve productivity, sustainability, and quality is also fostering market expansion. Furthermore, the growing popularity of ready-to-eat (RTE) and value-added finfish products, such as fillets and frozen meals is also supporting processing activities. Besides this, the rise of aquaculture has increased the supply of finfish, creating a need for specialized equipment to handle the unique requirements of finfish processing.

Analysis by Equipment Type:

- Gutting

- Scaling

- Skinning

- Deboning

- Filleting

- Others

Filleting leads the market globally. The demand for filleting equipment is propelled by the growing demand for ready-to-cook (RTC) and value-added fish products. As consumer preferences shift toward convenience and quality, the need for efficient filleting processes has intensified. Advanced filleting machines enhance precision and reduce waste, allowing processors to maximize yield and profitability. Moreover, automation in filleting operations minimizes labour costs and improves operational efficiency, making it an attractive investment for seafood processors. The rising demand for filleted fish due to the trend toward healthier eating and consumers' growing desire for lean protein options is also propelling the demand for high-quality processing equipment.

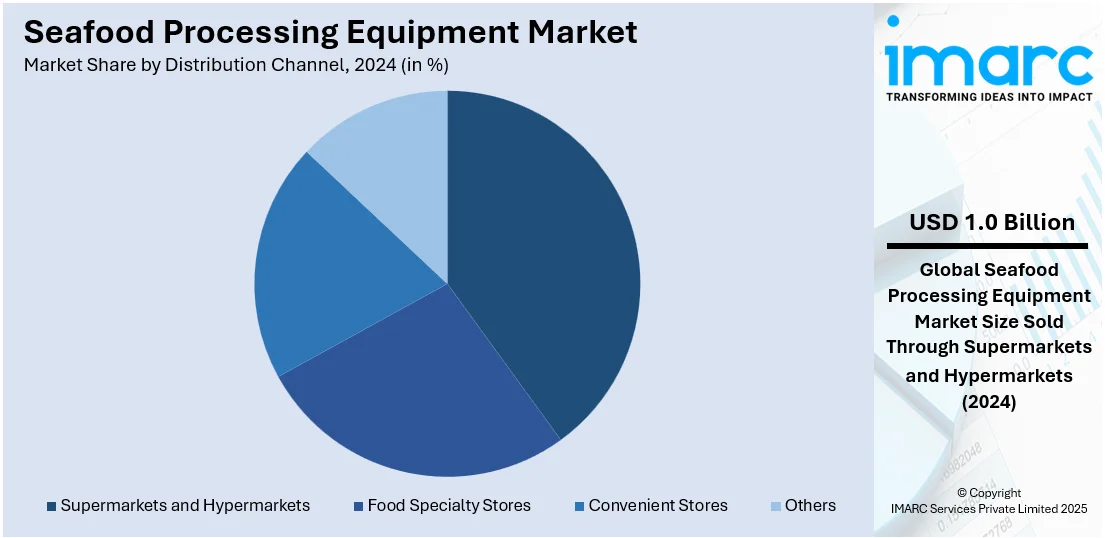

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Food Specialty Stores

- Convenient Stores

- Others

Supermarkets and hypermarkets lead the market with around 38.6% of market share in 2024. They are major distribution channels for seafood processing equipment, offering a wide range of products under one roof. These large retail spaces provide convenience and variety, attracting consumers seeking fresh and processed seafood. Their extensive supply chains and economies of scale enhance product availability and pricing competitiveness.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 42.5%. This is due to its robust seafood consumption and significant aquaculture production. Countries such as China, Japan, and India are major contributors, driven by rising demand for processed seafood products. The region's expanding middle class, combined with increasing health consciousness, fuels the preference for convenient and nutritious seafood options. Furthermore, advancements in technology and automation in processing facilities enhance operational efficiency and product quality. Apart from this, the growing trend of sustainable fishing practices and government support for modernizing seafood processing infrastructure are also impelling the market growth.

Key Regional Takeaways:

United States Seafood Processing Equipment Market Analysis

In 2024, the United States accounts for over 71.50% of the seafood processing equipment in North America. The growing demand for processed and value-added fish products is driving the seafood processing equipment market in the United States. According to the National Fisheries Institute's (NFI) newly revealed top ten list of seafood consumption in 2021, Americans consumed a record 20.5 pounds of seafood per capita, up 1.5 pounds from 2020. Consequently, the demand for sophisticated processing technology, such as automated filleting machines, grading systems, and freezing equipment, has increased due to the growing consumer preference for convenience and ready-to-eat foods. Additionally, the increased emphasis on food safety and quality requirements is another important motivator. Strict regulations on seafood processing are enforced by regulatory agencies such as the FDA and USDA, which propel producers to use contemporary machinery that guarantees compliance. Furthermore, according to the data by USDA, the United States exports a significant amount of seafood each year, valued at over USD 5 Billion, which calls for superior processing to satisfy global standards.

The market is also being impacted by sustainability trends. Numerous seafood businesses are using cutting-edge processing equipment to cut waste and boost productivity due to growing awareness about overfishing and environmental issues. The United States' marine wild-capture fisheries are scientifically monitored and regulated at the regional level. They are enforced under 10 national sustainability requirements established by the Magnuson-Stevens Act, which exceeds worldwide standards for eco-labelling seafood.

Europe Seafood Processing Equipment Market Analysis

The region's long-standing fish-eating customs and the growing need for processed seafood products are driving the European industry. The EU is the world’s largest seafood market for fish and seafood and has to import more than 60% to meet EU citizens’ annual demand. Among the biggest consumers of seafood in Europe are Spain, Norway, and the United Kingdom; Norway is also a major exporter of fish, notably salmon. Additionally, sustainability concerns are also very important, and many processors have made investments in environmentally friendly machinery that reduces waste and maximizes resource use. Besides this, one of the main drivers of growth is technological innovation in processing equipment. Automation is being increasingly used by European businesses to enhance productivity and lower labour costs, particularly in high-volume processing industries. Due to strict EU rules on food safety and cleanliness, there is a significant need for equipment such as automated skinning machines and quality control systems. Moreover, the price of seafood has gone up significantly in recent years due to rising inflation, which has an impact on both production and consumer costs. The European Market Observatory for Fisheries and Aquaculture found that since 2018, fish prices have increased by 10% due to inflation. Despite this, the affinity toward seafood in the region is expected to bolster the market growth.

Asia Pacific Seafood Processing Equipment Market Analysis

The Asia-Pacific region's role as a global seafood hub is the main factor driving the market for seafood processing equipment in this area. Seafood production and exports are dominated by nations such as Thailand, Vietnam, India, and China. According to the 2024 edition of The State of World Fisheries and Aquaculture (SOFIA), Asia accounted for 75% of global fisheries and aquaculture production in 2022. Additionally, Asia leads all regions producing 70% of global aquatic animals and 97% of global algae. Investments in innovative processing technology have also heightened due to the burgeoning middle class and increasing domestic demand for packaged and processed seafood. Furthermore, government programs assisting the seafood sector in nations such as Vietnam and India have promoted the use of contemporary machinery to boost export competitiveness and production efficiency. As seafood processors seek to save expenses and adhere to global standards, automation and energy-efficient solutions are becoming more popular.

Latin America Seafood Processing Equipment Market Analysis

The market for seafood processing equipment is developing in Latin America due to the region's abundant marine resources and burgeoning seafood export sector. Chile, Peru, and Argentina are among the leading producers of seafood, particularly fishmeal and aquaculture. Per capita seafood consumption in Latin America and the Caribbean, currently amounting to around 10 kilograms, could rise to 15 kilograms by 2030, as predicted by the FAO. Additionally, North American and European export demands have prompted processors to make investments in cutting-edge machinery in order to satisfy global safety and quality requirements. Furthermore, the growing demand for value-added seafood items in domestic markets has opened up markets for machinery such as freezing systems and filleting machines. Chile, a major producer of farmed salmon, is a vital market for cutting-edge processing technologies due to its expanding aquaculture industry. Investors are also encouraged to purchase contemporary equipment by government funding for sustainable fishing techniques.

Middle East and Africa Seafood Processing Equipment Market Analysis

Growing aquaculture operations and rising seafood consumption are driving growth in the Middle East and Africa's seafood processing equipment industry. To improve food security and decrease fish imports, Gulf nations such as Saudi Arabia and the United Arab Emirates are investing in aquaculture. The continent's abundant marine biodiversity and expanding exports to Asia and Europe are major factors. Moreover, sustainability is at the heart of Saudi Arabia’s fisheries transformation. The National Fisheries Development Program (NFDP), launched under MEWA, has been instrumental in setting strategic goals, coordinating efforts, and promoting sustainable fishing practices. In 2021-22, the program dedicated USD 0.35 Billion to various initiatives, including marine water aquaculture. With nearly 2,800 kilometres of coastline, Saudi Arabia has vast potential for aquaculture, and investments in this sector are growing rapidly. Besides this, infrastructure for seafood processing is being invested in by nations such as Morocco to achieve export grade criteria. Automated and energy-efficient processing equipment is also becoming increasingly popular as businesses want to cut expenses and boost output.

Competitive Landscape:

The competitive landscape is characterized by a mix of established global players and emerging regional manufacturers. Leading companies are dominating the market with their extensive product portfolios, advanced technologies, and strong distribution networks. These firms focus on innovation and sustainability, continually enhancing equipment efficiency and food safety features. Concurrently, smaller companies are utilizing niche technologies and localized services to gain market share, creating a diverse competitive environment. Collaboration with seafood processors to develop customized solutions is also a key strategy, as companies aim to meet specific client needs while adhering to regulatory standards. Furthermore, the market is witnessing increasing mergers and acquisitions as larger players seek to expand their technological capabilities and geographic presence. This dynamic competition drives advancements in equipment design and processing techniques, further enhancing the market's growth potential.

The report provides a comprehensive analysis of the competitive landscape in the seafood processing equipment market with detailed profiles of all major companies, including:

- BAADER

- Bettcher Industries Inc,

- CTB Inc. (Berkshire Hathaway Company)

- JBT Corporation

- KM Fish Machinery A/S

- Marel,

- Pisces Fish Machinery Inc.

- SEAC AB

- Seafood Technology Limited

- Subzero (Grimsby) Limited

- Uni-Food Technic A/S

Latest News and Developments:

- November 2024: The Global Seafood Alliance (GSA) has officially released version 6.0 of its Seafood Processing Standard (SPS), featuring a restructured modular framework with ten specific modules designed to enhance food safety for both farm-raised and wild-caught seafood. GSA will begin accepting applications for SPS 6.0 in mid-2025, with full implementation replacing the previous standard, aiming to improve audit efficiencies and provide better assurances to consumers globally.

- July 2024: Artisanal fishers in Seychelles launched a new seafood facility in Anse aux Pins, backed by a SCR 23.5 Million (USD 1.6 Million) investment from the European Union-Seychelles Sustainable Fisheries Partnership Agreement. The facility features a fish market, storage for equipment, and an ice plant to reduce post-harvest losses.

- February 2024: Marel, a leader in food processing systems, partnered with MMC First Process, specialists in fish handling and processing, to enhance sustainability and efficiency in the seafood industry. This collaboration aims to provide a comprehensive product offering across the value chain, including advanced software for data collection and tailored training for seamless operations. The partnership emphasizes low running costs and continuous support, promising to reshape seafood processing and deliver safer, traceable products to consumers.

- April 2023: Cretel, the Belgian manufacturer of food processing equipment launched its new F460M standalone fish skinner, replacing the proven 460VH model. The F460M is designed for efficient skinning of various fish and features a robust design with a safe 24-volt foot switch or fixed foot pedal.

Seafood Processing Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Seafood Types Covered | Finfish, Crustaceans, Mollusks, Others |

| Equipment Types Covered | Gutting, Scaling, Skinning, Deboning, Filleting, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Food Specialty Stores, Convenient Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BAADER, Bettcher Industries Inc, CTB Inc. (Berkshire Hathaway Company), JBT Corporation, KM Fish Machinery A/S, Marel, Pisces Fish Machinery Inc., SEAC AB, Seafood Technology Limited, Subzero (Grimsby) Limited, Uni-Food Technic A/S, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, seafood processing equipment market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global seafood processing equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the seafood processing equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Seafood processing equipment includes machinery and tools used to prepare, process, and package seafood products for consumption. This equipment performs tasks such as cleaning, filleting, scaling, deboning, freezing, and packaging. Designed to enhance efficiency, hygiene, and quality, it supports industries producing fresh, frozen, canned, or ready-to-eat seafood products.

The global seafood processing equipment market was valued at USD 2.1 Billion in 2024.

IMARC estimates the global seafood processing equipment market to exhibit a CAGR of 4.1% during 2025-2033.

The increasing consumer demand for processed seafood, advancements in automation and processing technology, growing aquaculture and fisheries industry, rising focus on food safety and hygiene standards, and the expansion of frozen and ready-to-eat seafood products are primarily driving the global seafood processing equipment market.

According to the report, finfish represented the largest segment by seafood type due to its high global consumption and diverse applications in fresh, frozen, and packaged products.

Filleting leads the market by equipment type owing as it is a critical process for enhancing product value and meeting consumer demand for ready-to-cook portions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global seafood processing equipment market include BAADER, Bettcher Industries Inc, CTB Inc. (Berkshire Hathaway Company), JBT Corporation, KM Fish Machinery A/S, Marel, Pisces Fish Machinery Inc., SEAC AB, Seafood Technology Limited, Subzero (Grimsby) Limited, Uni-Food Technic A/S, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)