Seafood Market Size, Share, Trends and Forecast by Type, Form, Distribution Channel, and Region, 2025-2033

Seafood Market 2024, Size and Trends:

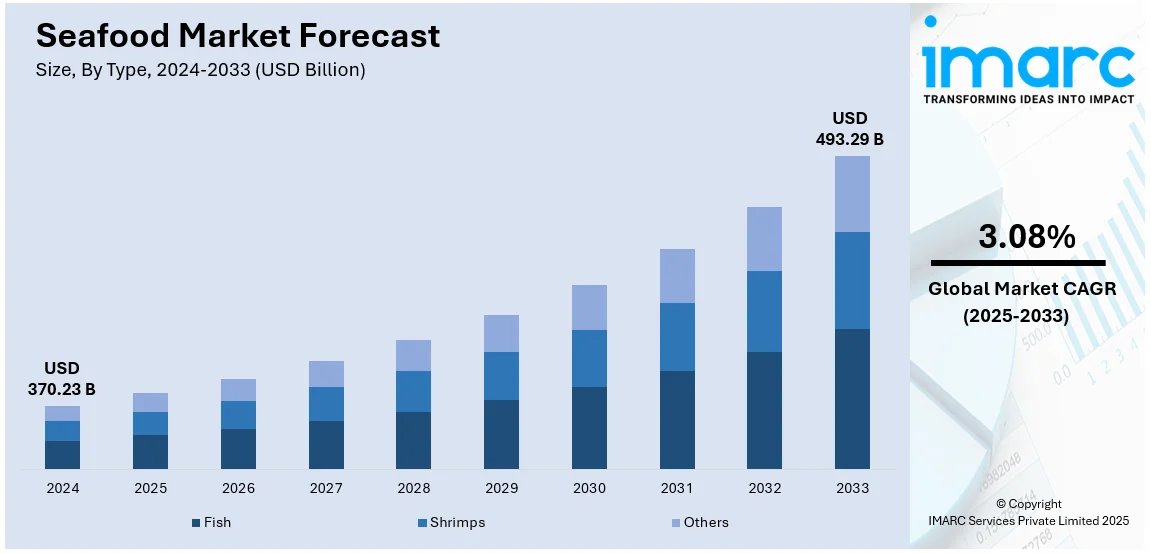

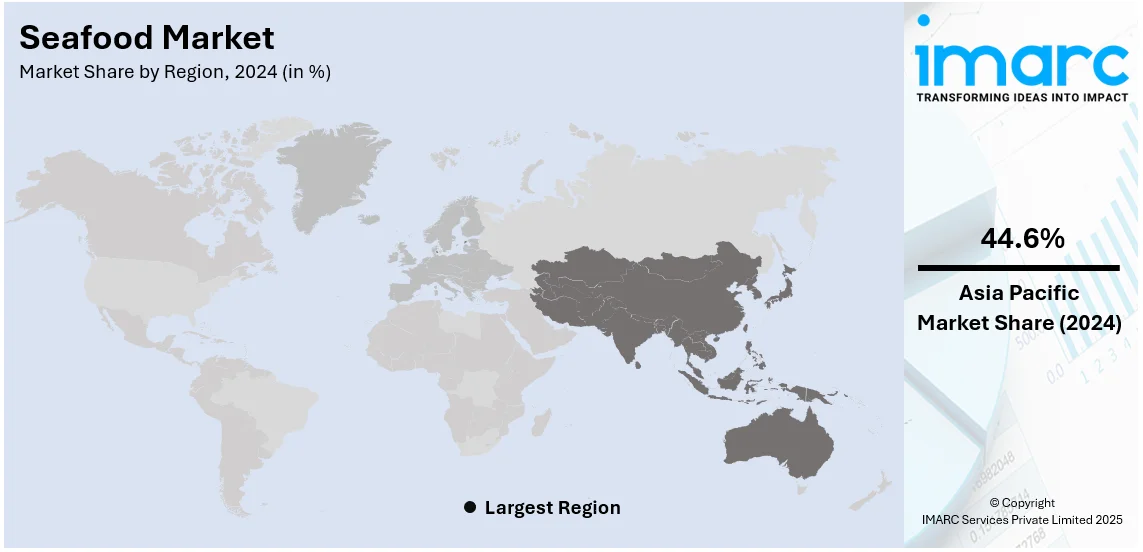

The global seafood market size was valued at USD 370.23 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 493.29 Billion by 2033, exhibiting a CAGR of 3.08% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of over 44.6% in 2024. The seafood market share is expanding, driven by the growing adoption of balanced diets, rising awareness about the benefits of protein consumption, and the increasing utilization of seafood in fine diners, restaurants, and fast food product chains.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 370.23 Billion |

| Market Forecast in 2033 | USD 493.29 Billion |

| Market Growth Rate (2025-2033) | 3.08% |

At present, the growing need for protein-rich food products is increasing seafood consumption, as it is considered a lean and nutritious option. As people focus more on health, fish and shellfish are popular choices due to their omega-3 fatty acids and other essential nutrients. Besides this, the rise of sustainable and eco-friendly eating habits also encourages the usage of responsibly sourced seafood items. Additionally, the popularity of worldwide cuisines like sushi and seafood-based dishes contributes to the market growth. Apart from this, the increasing adoption of plant-based and pescatarian diets, with more people becoming conscious about their wellness, is offering a favorable seafood market outlook. Moreover, innovations in seafood processing, such as frozen and ready-to-eat (RTE) options, make it easier for consumers to enjoy seafood without hassle.

The United States has emerged as a major region in the seafood market owing to many factors. Consumers have become more wellness-oriented, seeking lean protein options like fish and shellfish, which are rich in omega-3 fatty acids and other nutrients. Besides this, the growing interest in sustainable and responsibly sourced seafood items plays a big role, as more Americans opt for eco-friendly and traceable choices. Additionally, the rise of seafood-based cuisines, such as sushi and seafood dishes, drives its demand. Apart from this, the enhanced availability of flavorful frozen and ready-to-cook seafood products in retail channels makes it more convenient for consumers to enjoy seafood at home. In February 2024, ALDI, a well-known retailer based in Essen, Germany, offered promotions on various private-label seafood items and introduced pollock portions to US supermarkets for the first time. The items were offered as sandwiches in original and dill pickle savors under the Fremont Fish market brand.

Seafood Market Trends:

Rising Health Awareness

Seafood is a favorite staple of diets since it offers one of the richest nutritional profiles available nowadays, containing the all-important omega-3 fatty acids, superior quality proteins, vitamins, and minerals. In fact, increasing understanding about its benefits in health-protective, anti-inflammatory, and cognitive performances also enhances its consumption demand, more so by consumers concerned with wellness-oriented lifestyles. The FAO states that aquatic food items significantly contribute to worldwide nutrition, accounting for 15% of animal protein and 6% of total protein intake worldwide. In 2021, over 20% of the animal protein taken by 3.2 billion individuals came from seafood products, indicating its significant role in fulfilling protein needs. This catalyzes the demand for seafood items since producers innovate to meet the requirements of an increasing consumer base seeking more healthy foodstuffs.

Growing Demand for Processed and Ready-to-Cook Seafood

The rising demand for convenience food products brought about due to fast-paced lifestyles has greatly increased the need for processed, frozen, and ready-to-cook seafood items. These options cater to the requirements of time-constrained consumers who prefer a healthy meal and easy preparation time. Advancements in freezing and packaging technology have also allowed companies to maintain the quality of seafood and expand shelf life, guaranteeing availability and freshness for consumers. In 2020, per capita consumption of canned fishery products hit 4.1 pounds, representing a rise of 0.3 pounds compared to 2019, according to NOAA's data. Such a trend has indicated an increasing preference for more convenient seafood choices. Since time efficiency continues to be at the forefront for most consumers while compromising on no nutritional value, this is expected to stimulate further innovations in preservation and packaging technologies of processed and ready-to-cook seafood products.

Expansion of Aquaculture

As wild fish stock has been decreasing and the need for seafood items has been growing, aquaculture is seen as a vital and sustainable way to meet world demands. Advanced production in aquaculture through environment friendly farm techniques and modern feeding systems, which support higher levels of manufacturing, is propelling the seafood market growth. These changes add efficiency and sustainability, addressing both ecological concerns and the rising need for seafood. The FAO reported that global fisheries and aquaculture production reached 223.2 Million Tons in 2022, reflecting a 4.4% increase from the levels of 2020. This expansion is proof that aquaculture is playing an important role in catering to seafood items demand, as sustainable practice evolves.

Seafood Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global seafood market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, form, and distribution channel.

Analysis by Type:

- Fish

- Shrimps

- Others

Fish, accounting for 49.0%, leads the market. It is the most widely consumed and versatile seafood product. Fish is a primary source of protein for people all around the world, offering a range of options from salmon to tuna and tilapia. It is highly nutritious, providing essential nutrients like omega-3 fatty acids, vitamins, and minerals, which makes it a preferred choice for health-conscious consumers. Fish is also more inexpensive compared to other sorts of seafood like shellfish and crustaceans, making it accessible to a larger population. Its versatility in cooking and adaptability in various cuisines, such as sushi, grilled fish, and fish fillets, further increases its popularity. Additionally, fish farming, known as aquaculture, has grown significantly, ensuring a steady and sustainable supply, which keeps prices relatively stable. The rising focus on sustainable fishing practices and eco-friendly sourcing also makes fish a favored option in the market.

Analysis by Form:

- Fresh/Chilled

- Frozen/Canned

- Processed

Fresh/chilled leads the market as it is considered the highest quality and most desirable form by consumers. Fresh seafood retains its natural savors, texture, and nutrients, which makes it the liked choice for many. It is commonly seen as the most premium form of seafood item, often associated with the best taste and nutritional value. Restaurants and people who prioritize quality over convenience opt for fresh or chilled seafood. Additionally, many cuisines around the world, such as sushi in Japan or seafood platters in the West, require fresh seafood products for the best culinary experience. The rise in demand for healthier and natural food options also supports the preference for fresh seafood items, as it is perceived to be less processed. Fresh/chilled options remain the top choice for those seeking the finest and most flavorful seafood products, establishing its dominance in the market.

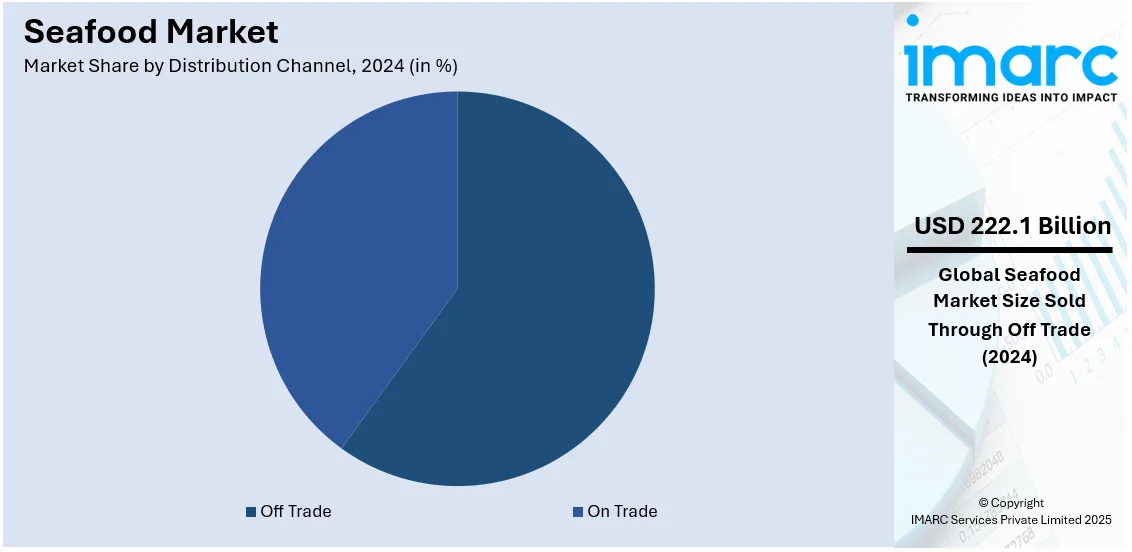

Analysis by Distribution Channel:

- Off Trade

- On Trade

According to the seafood market forecast, off trade accounts for 60.0% of the market share. It inculcates retail stores, supermarkets, and online platforms where individuals can buy seafood items for home consumption. This channel is expanding rapidly, as more people prefer to cook seafood products at home, especially with the rise of online grocery shopping. Supermarkets and grocery stores offer convenient access to a variety of seafood choices, including both fresh and frozen selections, to suit various tastes. Off-trade also allows consumers to choose seafood items based on quality, price, and sustainability, which has become important. The convenience of buying seafood products in stores or online, combined with the high trend of home-cooked meals has enhanced off-trade sales. Moreover, the growing awareness of the health advantages of seafood motivates more individuals to incorporate it into their meals. With more individuals looking to control what they eat and how it is prepared, off-trade continues to dominate the market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific enjoys the leading position in the market, accounting for 44.6%. The region has some of the world's largest seafood item manufacturers, including China, Japan, and India, due to its long coastlines and abundant marine resources. The extensive fishing activities in these countries meet both domestic and international demand. Additionally, this area leads in aquaculture production, which supports the high need for fish and shellfish. As populations in nations like China and India are growing, more individuals are turning to seafood products as a core source of protein. Moreover, the establishment of new facilities caters to the seafood market demand by increasing production capacity and improving processing efficiency, ensuring a steady supply of fresh and frozen items. In April 2024, Choice Canning, an Indian shrimp processor, intended to start shrimp production trials by the next month at a newly established factory in the Andhra Pradesh state. The facility can accommodate 70 Metric Tons of shrimp daily. These plants also support innovations in packaging and distribution, making seafood products more accessible to individuals. With modern processing techniques and an expanding export market, Asia-Pacific is well-positioned to maintain its dominance in the industry, serving worldwide consumers.

Key Regional Takeaways:

United States Seafood Market Analysis

The United States holds 75.00% share of North America. The US market has grown remarkably with per capita consumption of fish and shellfish increasing from 15.6 pounds in 2002 to 20.5 pounds in 2021, that is, by 31%, according to the United States Department of Commerce and NOAA. The enhanced demand is driven by the rising awareness among the masses about the health benefits of seafood items, such as high nutritional value and positive effects on heart health. Moreover, shifting dietary habits and a greater emphasis on sustainable and protein-based food products have catalyzed seafood demand. A contributing element to this improvement is the expansion of US seafood items imports, which has supported the high need by providing a consistent and diversified supply of seafood options. This trading growth has made it possible for the regional market to offer a greater variety of seafood products, making sure that people have access to fresh and quality seafood throughout the year. Taken together, these factors are positively influencing the market in this area.

Europe Seafood Market Analysis

Aquaculture farming has become the main growth driver in the European market. In 2022, aquaculture in the EU produced nearly 1.1 Million Tons of aquatic organisms and was valued at nearly Euro 4.8 billion (USD 5 billion), revealed the European Commission. This high manufacturing is shown to be further enhanced by an increase in demand for seafood items together with a problem in wild fishes' dwindling stocks. Advancements in aquaculture technologies. such as eco-friendly farming practices and sophisticated feeding systems are key factors that have improved yields and enabled the industry to be more efficient. In addition, the shift towards sustainability and traceability in the sector makes farmed seafood more attractive to green consumers. With customer preference now bent on eco-conscious and healthy food choices, the European aquaculture business is in a good position to tap these markets. Growth in aquaculture production will remain one of the leading dynamics in broadening the market appeal.

Asia-Pacific Seafood Market Analysis

The Asia-Pacific market is witnessing substantial expansion due to strategic governmental actions and strong exports. In 2022, China unveiled its 14th Five-Year Plan for National Fisheries Development (NFDP), targeting 69 million tons of aquatic products by 2025. This ambitious goal underlines the continued expansion of China's vast fishing activities and its vital role in meeting the region's increasing seafood demand. The growth rate of seafood export in India was at an astonishing 30.81% between 2019-20 and 2023-24, according to the PIB reports. Such enhanced exports have resulted from improved production capability, higher processing standards, and a high requirement for higher quality seafood items. In short, all these combined factors enable the region to broaden its ability to cater to domestic and foreign demands for seafood products. Therefore, the region is well-positioned to be one of the key drivers of global seafood supply and market growth.

Latin America Seafood Market Analysis

The Latin American market is witnessing robust growth, particularly in fish farming. In 2023, Brazil generated 887,029 Metric Tons of aquaculture fish, marking a 3.1% rise from 2022 and a notable 53.2% jump from the 578,800 Metric Tons produced ten years earlier, as reported by Seafood Source. This growth points to Brazil's expanding aquaculture industry, driven by advancements in farming techniques, sustainable practices, and high demand for seafood items at both domestic and international levels. Known to be one of the region's largest farmed fish producers, Brazil has been a significant contributor to the broadening of the area's participation in the market. Support from government agencies, innovative breakthroughs, and high export activities contribute to the market growth.

Middle East and Africa Seafood Market Analysis

Saudi Arabia has become a significant market for the seafood sector in the Middle East, representing a substantial portion in terms of value and volume. The demand driver for the area's seafood industry is the National Fisheries Development Program, which has been initiated under the Kingdom's Vision 2030. In 2022, Saudi Arabia managed to raise USD 4 Billion to improve the infrastructure and human resource required for the cultivation of inland fisheries, as per reports. This investment aims at increasing local seafood item production, reducing dependency on imports, and improving the capacity of the Kingdom to meet the growing requirement. Additionally, the focus of the government agencies on aquaculture development and sustainable practices positions Saudi Arabia as a major player in the regional market. With improved infrastructure, workforce training, and support for technological advancements, the program is expected to significantly expand the country's export capabilities.

Competitive Landscape:

Key players in the market work to ensure a steady supply of high-quality items. Major seafood producers and suppliers focus on sourcing sustainable and responsibly farmed or caught seafood options, meeting the high consumer demands. Big companies wager on advanced processing and distribution technologies to make seafood items more accessible, whether fresh, frozen, or RTE. They also collaborate with retailers and foodservice providers to expand their reach, making seafood available in stores, restaurants, and online platforms. By emphasizing product innovations and introducing convenient and value-added seafood options, key players tap into the rising need for quick and healthy meal choices. Moreover, they help to educate consumers about the nutritional benefits of seafood items, promoting its inclusion in everyday diets. These efforts assist in keeping the market competitive, thereby contributing to the growth in the industry. For instance, in October 2023, Nippon Suisan Kaisha Ltd intended to enter the realm of land-based white-leg shrimp farming and anticipated that by year’s end, its operations will generate approximately 100 Tons annually.

The report provides a comprehensive analysis of the competitive landscape in the seafood market with detailed profiles of all major companies, including:

- American Seafoods Company LLC

- Cermaq Group AS (Mitsubishi Corporation)

- Grieg Seafood

- Kangamiut Seafood A/S

- Lee Fishing Company

- Maruha Nichiro Corporation

- Mowi ASA

- Pacific Seafood

- Phillips Foods Inc.

- Royal Greenland A/S

- Sysco Corporation

- Thai Union Group PCL

- Trident Seafoods Corporation

Latest News and Developments:

- June 2024: The Sustainable Shrimp Partnership gained associate partner status in the worldwide sustainable seafood initiative, aiming to enhance better practices in the shrimp farming industry and promote the availability of eco-conscious options within the seafood sector. In this context, a specialized website has also been established to enhance interaction and facilitate exchanges in stakeholder discussions among leaders in the industry like traceability specialists, civil society members, and technology suppliers.

- January 2024: The Central Marine Fisheries Research Institute (CMFRI) collaborated with Neat Meatt to develop plant-based and cell-cultured alternatives for kingfish, pomfret, and several other types of marine fish. The purpose of the collaborative method is to replicate flavor, texture, and nutrition in novel products similar to those found in real fish.

Seafood Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fish, Shrimps, Others |

| Forms Covered | Fresh/Chilled, Frozen/Canned, Processed |

| Distribution Channels Covered | Off Trade, On Trade |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Seafoods Company LLC, Cermaq Group AS (Mitsubishi Corporation), Grieg Seafood, Kangamiut Seafood A/S, Lee Fishing Company, Maruha Nichiro Corporation, Mowi ASA, Pacific Seafood, Phillips Foods Inc., Royal Greenland A/S, Sysco Corporation, Thai Union Group PCL, Trident Seafoods Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the seafood market from 2019-2033

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global seafood market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the seafood industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The seafood market was valued at USD 370.23 Billion in 2024.

The seafood market is projected to exhibit a CAGR of 3.08% during 2025-2033, reaching a value of USD 493.29 Billion by 2033.

The rising need for sustainably sourced and eco-friendly seafood options, driven by environmental concerns, is impelling the market growth. The increasing disposable incomes, especially in developing regions, are also catalyzing the demand for seafood items. Moreover, the growing popularity of worldwide cuisines, such as sushi and seafood-based dishes, is contributing to the market growth.

Asia-Pacific currently dominates the seafood market, accounting for a share of 44.6% in 2024, driven by its extensive coastline, large-scale seafood production, and strong consumer demand. The region's advanced aquaculture activities, coupled with rising disposable incomes and a high preference for seafood items, fuel the market growth.

Some of the major players in the seafood market include American Seafoods Company LLC, Cermaq Group AS (Mitsubishi Corporation), Grieg Seafood, Kangamiut Seafood A/S, Lee Fishing Company, Maruha Nichiro Corporation, Mowi ASA, Pacific Seafood, Phillips Foods Inc., Royal Greenland A/S, Sysco Corporation, Thai Union Group PCL, Trident Seafoods Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)