Scandinavia Frozen Food Market Size, Share, Trends and Forecast by Product, Type, Distribution Channel, and Country, 2025-2033

Market Overview:

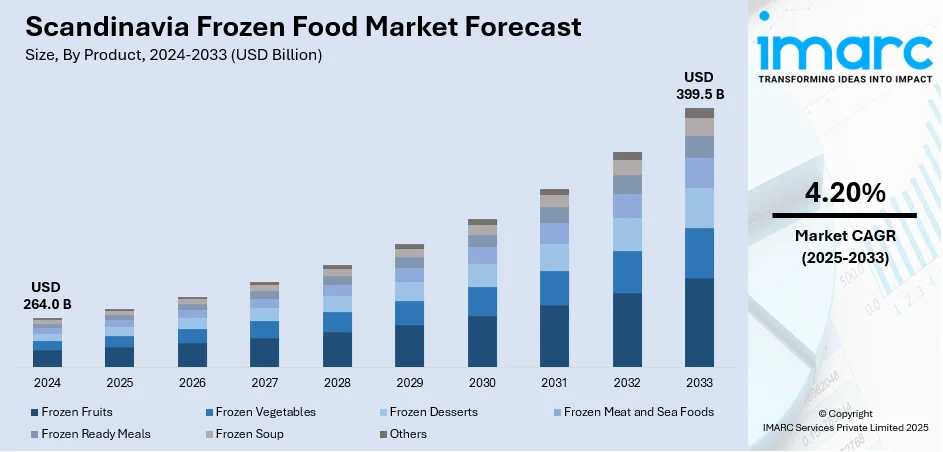

The Scandinavia frozen food market size reached USD 264.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 399.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 264.0 Billion |

| Market Forecast in 2033 | USD 399.5 Billion |

| Market Growth Rate (2025-2033) | 4.20% |

Frozen food includes a wide range of food products that are subjected to quick freezing for prolonged shelf life and easy storage. Some of the common product variants include frozen fruits, frozen vegetables, frozen snacks, frozen meat, frozen desserts, etc. These products offer high palatability along with better convenience and reduced cooking time in comparison with conventional home-cooked variants. Furthermore, frozen food products are extensively available throughout the year irrespective of seasons and geographical locations. In Scandinavia, the growing consumer preferences towards convenient food options based on hectic work schedules and sedentary lifestyles are augmenting the market growth.

To get more information on this market, Request Sample

The expanding food processing sector along with the wide availability of frozen food products, including fruits, meat, snacks, vegetables, etc., across numerous retail channels, is propelling the market in Scandinavia. Furthermore, the elevating levels of urbanization and the improving consumer living standards are also increasing the consumption of ready-to-eat food products in the region. Additionally, numerous foodservice companies rely upon frozen fruits and vegetables to reduce the need for washing, peeling, or chopping and minimizing the overall cooking time. Moreover, the emergence of e-commerce platforms is also driving the sales of frozen food products supported by numerous discount offers, doorstep delivery, secured payment gateways, etc. Besides this, the growing number of cold chain storage and transportation facilities in the region is also driving the market for frozen food products. Several facilities are deploying advanced techniques for preserving moisture content, preventing contamination, mitigating microbiological spoilage, etc. Furthermore, the emergence of numerous advanced technologies, including the integration of GPS tracking systems, IoT, and Bluetooth devices, for ensuring food safety and security will continue to bolster the market for frozen food in Scandinavia during the forecast period.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Scandinavia frozen food market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on product, type and distribution channel.

Breakup by Product:

- Frozen Fruits

- Frozen Vegetables

- Frozen Desserts

- Bakery Products

- Ice Cream

- Others

- Frozen Meat and Sea Foods

- Frozen Ready Meals

- Frozen Soup

- Others

Breakup by Type:

- Ready-to-Eat

- Ready-to-Cook

- Ready-to-Drink

- Others

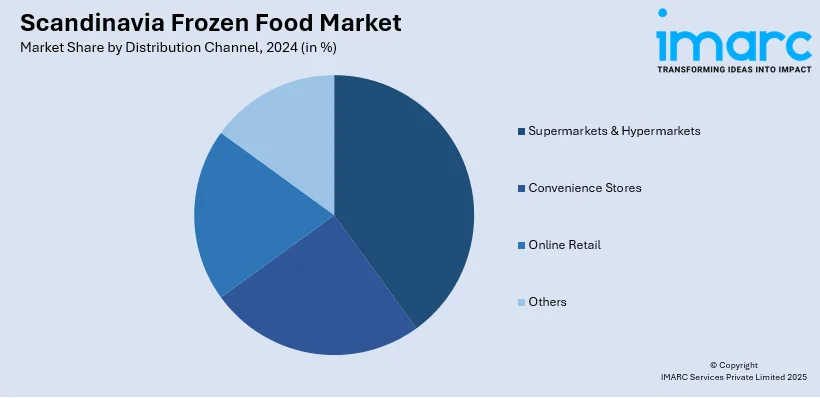

Breakup by Distribution Channel:

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Others

Breakup by Country:

- Denmark

- Norway

- Sweden

Competitive Landscape:

The industry's competitive landscape has also been examined, with some of the key players being Alimex Seafood A/S, Almondy AB, Ardo Ardooie, Berrifine A/S, Geia Food A/S, Lantmännen Unibake Denmark A/S, Lerøy Seafood Group ASA, Nomad Foods Limited, Orkla ASA and Prime Ocean A/S.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product, Type, Distribution Channel, Country |

| Countries Covered | Denmark, Norway, Sweden |

| Companies Covered | Alimex Seafood A/S, Almondy AB, Ardo Ardooie, Berrifine A/S, Geia Food A/S, Lantmännen Unibake Denmark A/S, Lerøy Seafood Group ASA, Nomad Foods Limited, Orkla ASA and Prime Ocean A/S |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Scandinavia frozen food market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Scandinavia frozen food market?

- What are the key regional markets?

- What is the breakup of the market based on the product?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the distribution channel?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the Scandinavia frozen food market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)