SCADA Market Size, Share, Trends and Forecast by Component, Architecture, End-User, and Region 2026-2034

SCADA Market Overview, Industry Size, Share & Growth Insights:

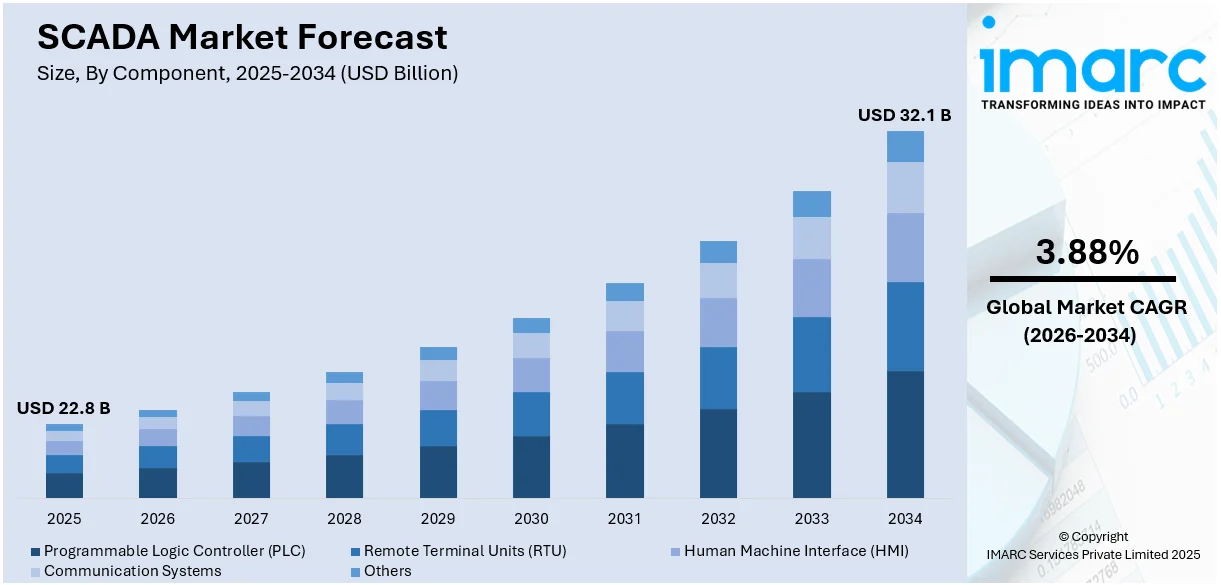

The global SCADA market size was valued at USD 22.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 32.1 Billion by 2034, exhibiting a CAGR of 3.88% from 2026-2034. Asia Pacific currently dominates the market, holding a significant share of 32.9% in 2025. The advent of Industry 4.0 and the Internet of Things (IoT), setting of rigid regulatory requirements upon industries, and the growing need to remotely monitor and manage devices, are some of the factors propelling the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 22.8 Billion |

|

Market Forecast in 2034

|

USD 32.1 Billion |

| Market Growth Rate 2026-2034 | 3.88% |

The SCADA market share is increasing due to the rising demand for industrial automation and real-time monitoring of almost all industries. SCADA systems support the optimization of operations in the oil and gas, power generation, water, and wastewater management sectors, so as to reduce costs and increase efficiencies. A push toward infrastructural modernization and building smart cities further supports increased product adoption. Integration of IoT and advanced analytics has expanded SCADA capabilities, enabling predictive maintenance and remote monitoring. Rising cybersecurity concerns and regulatory requirements for safe and efficient operations are compelling organizations to upgrade their SCADA systems. Additionally, the global transition toward renewable energy sources and smart grids creates new opportunities. Rapid industrialization in emerging economies, along with government investments in critical infrastructure, is accelerating market growth. The cloud-based SCADA solutions are also witnessing adoption by users due to their scalability and flexibility.

To get more information on this market Request Sample

The United States emerged as a key regional market for SCADA, due to industrial automation, energy infrastructure upgrades, and cybersecurity. More production of energy through renewable resources, such as solar energy and smart grid development has increased the demand for SCADA for effective generation, distribution, and storage of energy. Besides this, cyber security threats and regulation, specially from NERC-CIP, are further propelling the demand. Moreover, the incorporation of IoT, edge computing, and cloud-based technologies enhances the capabilities of SCADA with scalability, cost-effectiveness, and better insights into operations for different industries.

SCADA Market Trends:

Increasing Integration into IoT

The increasing incorporation of SCADA systems with IIoT is one of the significant factors influencing the SCADA market trend. According to a recent Microsoft survey, 87% of decision-makers within the manufacturing sector are for adoption with supply chain and logistics, plant safety & security, production planning & scheduling as main use cases, followed closely by industrial automation, quality, and compliance. In addition, several key companies, along with concerned government bodies, are working on promoting smart manufacturing. For example, the government authority of India has launched an initiative known as the Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0. The primary objectives of this initiative are to increase awareness among the Indian manufacturing industry regarding manufacturing 4.0 and assist the stakeholders in dealing with the challenges associated with smart manufacturing. Besides this, the increasing penetration of industry automation trends in several countries like South Korea, India, Singapore, etc. is driving the market. As per the National Bureau of Asian Research, in 2022, the GDP of South Korea comprised 42% of exports with semiconductors as the prime export item. This accounted for nearly 18.9% of total exports in 2022. In addition, the Korean regulatory authorities are focusing on smart manufacturing and are set to create nearly 30,000 fully automated manufacturing companies by 2025, using advanced automation, data exchange, and IoT technologies. Such implementations on adopting automation technologies will create demand for the SCADA market.

Implementation of strict regulatory requirements in industries

The implementation of stringent regulatory requirements is compelling industries to adhere to specific standards and protocols to ensure safety, operational integrity, and environmental responsibility. With this intent of regulatory standards, it is making the industries align themselves with the SCADA solution that ensures real-time monitoring, data collection, and reporting functions to support their compliance claims. For example, the Ubisense survey gives a clear view that, in 2023, 62% of manufacturers have already adopted IoT technologies in their manufacturing or assembly processes. Furthermore, the complexity of regulatory frameworks often demands tailored solutions suitable for specific industry needs. Many key market players respond to this demand by providing customizable and adaptable SCADA systems that can be seamlessly integrated into existing processes.

Growing emphasis on cybersecurity

The growing focus on cybersecurity is further increasing the SCADA demand. The elevating levels of digitization across various industries are leading to increased vulnerability of critical infrastructure to cyber threats. For instance, cybercrime is projected to cost the global economy USD 10.5 Trillion annually by 2025, highlighting the escalating threat to cybersecurity. Several key players are taking initiatives and investing in research and development activities to overcome this challenge. For example, Honeywell recently announced that it had acquired SCADA fence, a company specializing in solutions for cyber security monitoring of vast operational technology (OT) Internet of Things (IoT) networks, in July 2023. SCADA fence is known for its asset discovery, threat detection, and security governance, all of which are essential for cyber security in industrial and building management. Furthermore, the SCADA-fence product portfolio will become part of the Honeywell Forge Cybersecurity+ suite of Honeywell Connected Enterprise. This strategic move fits into Honeywell's digitalization, sustainability, and OT cyber security SaaS solutions. Moreover, since cyber security is one of the priorities for many organizations, there would be a demand for reliable and secure SCADA solutions, which will, therefore, drive the market in the coming years.

SCADA Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global SCADA market, along with forecast at the global and regional levels from 2026-2034. The market has been categorized based on component, architecture, and end-user.

Analysis by Component:

- Programmable Logic Controller (PLC)

- Remote Terminal Units (RTU)

- Human Machine Interface (HMI)

- Communication Systems

- Others

PLCs are implemented to perform tasks in real time and to direct processes in a real sense, by which they suit integrating with a SCADA system. Examples of integration with PLC, in manufacturing streams, with various automobile firms, such as improvement of productivity with efficiency at the manufacturing sites, are described below, ATS Applied Tech Systems Ltd developed an InTrack tracking and tracing airbag system through using InTouch and GE-Fanuc PLCs, which guaranteed full error-proofing, traceability. Similarly, in July 2023, Siemens launched a complete virtual programmable logic controller, Simatic S7-1500V. It expands the company's existing Simatic portfolio to special market requirements, including virtual hosting of PLC computing. Simatic S7-1500V is part of Industrial Operations X under which the company continuously focuses on the integration of IT and software capabilities into the automation landscape, the company says.

Analysis by Architecture:

- Hardware

- Software

- Services

Services represent the leading segment with a market share of 55.0%. SCADA systems are complex and need expertise in several domains like system integration, cybersecurity, and process optimization. SCADA service providers are providing specialized consultancy to help businesses choose the right SCADA solution for their specific needs. Besides this, several service providers are investing in research and development activities to enhance the capabilities of SCADA solutions. For example, in March 2021, GE Digital, which is headquartered in the US, announced CIMPLICITY and Tracker software services that are multi-industry HMI/SCADA and MES routing solutions. Tracker focuses on usage among high-volume manufacturers, such as auto manufacturers. CIMPLICITY is targeted at organizations that have remote operations centers across several locations. Furthermore, SCADA systems tend to be customized to a specific demand across a range of industries and applications. Service providers make SCADA solutions tailor-fit for specific operation needs such as data gathering, visualization, and strategies for control.

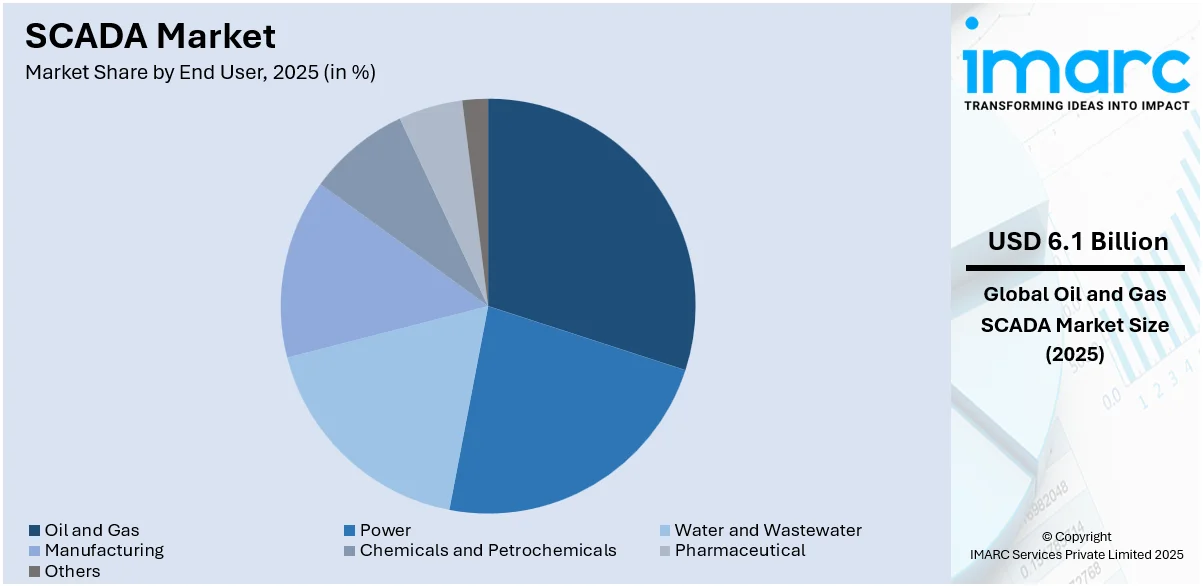

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Power

- Water and Wastewater

- Manufacturing

- Chemicals and Petrochemicals

- Pharmaceutical

- Others

The oil and gas industry leads the market with a share of 26.8% as they cover numerous and spread-out facilities ranging from drilling sites, refineries, and pipelines to distribution networks. SCADA systems play a pivotal role in the real-time monitoring and management of these large and geographically dispersed complex operations. Besides, the administration of different countries is prescribing regulations to the oil and gas companies for developing efficient management programs and risk assessment. For example, under the "Pipeline Safety Improvement Act" and the revised final rule, "Implementing Integrity Management" in natural gas transmission pipelines of the United States, it has been stated that operators of pipelines must develop an integrity management program, and it will also determine the integrity management program criteria. A SCADA system easily supports the data flow required to maintain and improve overall integrity. This is augmenting the adoption of SCADA solutions in the oil and gas industry and, thus, leading to market growth.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Asia Pacific dominates the market with a share of 32.9% as it represents some of the world's fastest-developing economies which includes China, India, and countries within Southeast Asia. Economic growth has speeded up industrialization through manifold levels, including, yet not limited to manufacturing, energy, automotive, and electronics sectors. As different industries increase in numbers at this phase, the need for innovative SCADA automation and control applications is increasing. As reported by IFR in March 2022, Japan is the world's largest industrial robot manufacturer, providing 45% of the global supply for robots around the globe. Such events will likely fuel the demand for automation, increasing the implementation of SCADA solutions in the region. In April 2023, Rockwell Automation revealed its plan to partner with Doosan Robotics, one of the leading global robotics companies. Signatures were witnessed by officials of both organizations and South Korea's Minister of Trade, Industry, and Energy, Lee Chang-Yang.

The SCADA market in North America is led by the rapid advancements of industrial automation, widespread adoption of IoT technologies, and a high dependency on smart systems for infrastructure management. Upgrades of critical infrastructure investments such as power grids, water processing facilities, and transportation systems are also responsible. The oil and gas industry continues to be an important driver, with SCADA systems helping optimize production and distribution. Operational safety, energy efficiency, and cybersecurity regulatory requirements force industries to modernize SCADA solutions. Increasing renewable energy projects and smart grid development are further fueling the market expansion.

Regulatory requirements for energy efficiency, environmental sustainability, and incorporation of renewable energy sources into the power grid create an ideal environment for SCADA solutions in Europe. The smart grid adoption and replacement of aging infrastructure are primary factors for the growth of the market. Utilities, manufacturing, and transport sectors are increasingly using SCADA for real-time monitoring and control. Smart city initiatives, as well as the growing shift toward green energy, create a demand for superior SCADA systems. Greater cybersecurity concerns and adherence to data protection standards make investors invest in secure and robust SCADA platforms.

Latin America SCADA market is driven due to industrial growth in key areas such as oil and gas, mining, and water management. Governments are investing in infrastructural development, especially in the energy and utility industries, where SCADA solutions improve operations and minimize losses. In the region, challenges of energy theft and water shortages open opportunities for SCADA deployment. Urbanization in the region and the increasing need to manage utilities improve demand. Emerging economies within the region are focusing on digital transformation, which pushes SCADA adoption.

The Middle East and Africa SCADA market is driven by large-scale investments in oil and gas and infrastructure developments. Thus, in this region, priority is given to energy projects, such as renewable energy and smart grids, and SCADA systems are used for effective resource management in arid regions due to water scarcity issues. Governments and private sectors are increasingly adopting SCADA for large-scale urban projects, including smart cities and transport networks. Cybersecurity and the need for resilient systems in critical infrastructure further spur market growth.

Key Regional Takeaways:

United States SCADA Market Analysis

In 2025, the United States accounts for over 88.90% of SCADA market in North America. This is due to the growing power sector and the increasing electricity demand. According to the U.S. Energy Information Administration, U.S. electricity consumption reached a record 4.07 Trillion kWh in 2022, which shows a high demand increase. This growing power sector requires SCDA solutions for effective energy management and efficiency. The rising need for efficient and reliable energy is increasingly being supported, especially in the integration of renewable energy, where SCADA systems play an essential role in ensuring real-time monitoring and control of power generation, distribution, and transmission networks. The key capability that meets these needs for the expanding population and industrial base includes enhancing the efficiency of operations, optimizing the usage of energy, and speeding up response to electrical grid imbalances. Adopting SCADA systems also further increases smart grid and renewable energy system integrations that are essential for making energy and a robust grid even more reliable and sustainable. Advances are not only occurring in technologies within SCADA, as developments including new techniques on analytics as well as predictive maintenance push for increased uses.

Europe SCADA Market Analysis

In Europe, the growth in demand for SCADA systems is attributed to the growing industrial and manufacturing industries. EU industrial production reportedly rose by 8.5% in 2021 and 0.4% in 2022, with expansions primarily attributed to manufacturing and the technology sectors. This upward trend aids SCDA acceptance due to the improved efficiency in operating these businesses and innovation within their domains. Advanced automation and control systems are needed for efficient production and energy consumption along with the quality of the product in these industries. SCADA technology enables industries to monitor and control processes, from raw material handling to final product manufacturing, in real time. The integration of SCADA systems helps manufacturers track performance, identify bottlenecks, and ensure compliance with strict regulatory standards. Additionally, the growing trend toward Industry 4.0 and smart factories has led to increased integration of SCADA systems with other technologies, such as IoT and data analytics platforms. This connectivity increases operational efficiency and reduces the downtime while also saving on the cost of maintenance. Considering this, the growth in SCADA systems will continue due to the need for competitiveness and sustainability has grown, making many sectors adopt it. These are the automotive, chemical, and food production sectors.

Asia Pacific SCADA Market Analysis

The adoption of SCADA systems within the Asia-Pacific region follows the expansion of water and wastewater treatment infrastructure. This is seen in India, with 306 water and wastewater management tech startups, from DrinkPrime to Ecozen Solutions, and others, whose investments are on the rise while boosting wastewater treatment solutions. This trend positively impacts SCDA adoption, driving the efficiency and sustainability of managing water. As urbanization accelerates and populations rise, the need for more efficient water management systems keeps growing. SCADA brings automation, real-time monitoring, and data analytics to enhance and improve water distribution, control quality, and wastewater treatment processes. With SCADA integrated into water utilities, operators may track water flow better, detect leaks quicker, optimize energy usage, and gain compliance with environmental regulations in place. These systems also contribute to better maintenance management, prolonging the operational life of infrastructure and minimizing costs. As governments and utilities in the region look to prioritize sustainable water practices, SCADA systems provide an all-inclusive solution to address water scarcity and enhance overall efficiency in water treatment facilities.

Latin America SCADA Market Analysis

Latin America's growth in the demand for SCADA systems is mainly caused by the increased mining sector activities. For example, Peru's mining sector, which accounts for 5% of the GDP and 60-68% of export revenue, is expected to reach US USD 73 Billion by 2024. A 9.7% increase in fiscal revenue to USD 3.7 Billion by September 2024 shows that the sector is important and SCDA adoption will increase. As mining operations continue to increase in scale to meet global demand, automated systems must be developed to monitor and control the mining process in real time. SCADA systems allow operators to optimize energy usage, improve safety protocols, and ensure efficient extraction and processing of minerals. They also give real-time data analytics for predicting equipment failures, scheduling maintenance efficiently, and keeping operational downtime at bay. SCADA systems also help in monitoring water usage, waste management, and emissions that ensure compliance with environmental regulations as the region focuses on efficiency in mining and reduction of environmental impact. The increase in complexity and scale of mining operations in the region continues to drive the adoption of SCADA systems, which enhance operational performance and contribute to sustainable practices.

Middle East and Africa SCADA Market Analysis

The growth of the oil and gas industry is the primary driver behind the adoption of SCADA systems in the Middle East and Africa. For example, the oil sector is predicted to drive GCC growth up to 4.5% in 2025, driven by new gas field discoveries. This expansion increases the opportunities for adopting SCDA, which in turn aids the energy sector in that region. As exploration and production activities increase, SCADA technology is important in monitoring and controlling the complex networks involved in oil and gas extraction, transportation, and processing. SCADA systems give real-time data on system performance, which allows operators to optimize production processes, reduce operational costs, and enhance safety standards. Moreover, these systems are integral in managing remote operations, ensuring the continuous flow of production even in challenging geographical locations. The region's drive toward automation and efficiency, coupled with greater safety and environmental surveillance demands, has increased dependence on SCADA systems. Proactive maintenance, better asset management, and detailed insights for the operation are therefore directly contributed by SCADA technology to the sustainable and efficient development of this region's oil and gas industry.

Top SCADA Market Leaders:

Key players in the business such as Siemens, Schneider Electric, and Rockwell Automation, are aiming at advancing their SCADA solutions in integrating advanced technologies such as the Industrial Internet of Things, artificial intelligence, and machine learning. These integrations allow for predictive analytics, real-time monitoring, and advanced diagnostics to improve operational efficiency, and reduce downtime. Additionally, many companies are expanding their offerings through cloud-based SCADA systems, which can be accessed remotely and offer scalable solutions with fewer operational costs. Customization and flexibility are also top priorities, with vendors offering custom solutions for the oil and gas, utilities, and manufacturing industries. Security is another focus area, which is increasing cyber threats to industrial control systems, firms are investing in robust cybersecurity capabilities to protect critical infrastructure. Joint ventures, mergers, and acquisitions are also common here as companies look to strengthen their position in the market and ability.

The report provides a comprehensive analysis of the competitive landscape in the SCADA market with detailed profiles of all major companies, including:

- ABB Ltd.

- Emerson Electric Co.

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Alstom

- General Electric Co.

- Honeywell International, Inc.

- Omron Corporation

- Yokogawa Electric Corporation

- Iconics Inc.

- Elynx Technologies, LLC

- Enbase LLC

- Globalogix

- Inductive Automation

Latest News and Developments:

- December 2024: TAQA Water Solutions has contracted a USD 25.8 Million project to develop an integrated SCADA system for its treatment infrastructure. The project, announced at the IDRA World Congress 2024, will involve a new central control facility to enhance environmental sustainability, improve operational efficiency, and increase wastewater treatment capacity by 20%.

- December 2024: Goodman Fielder is an Australian bakery firm, adding SCADA systems across its three factories, reversing the digitalization trend. Although Tyson Foods had a USD 1 Million revenue decrease during 2023, they maintain the investment of $1.3 Billion in new automation technologies in place through 2025 to bring up yields, lower the cost of labor, and have long-term savings.

- November 2024: SCADA International, has acquired NovoGrid Ltd., a leading provider of grid analytics software. The acquisition strengthens SCADA's grid modeling capabilities and supports facilitates the energy transition by streamlining optimizing the grid interconnection process. NovoGrid's GridScreen software offers automated, actionable insights for developers and asset owners, enhancing the speed and efficiency of grid connection assessments. This move accelerates the integration of critical energy infrastructure.

- March 2024: The UK's top national cybersecurity agency, the National Cyber Security Centre (NCSC), has published guidance designed to help organizations make a better-informed decision concerning whether to migrate their SCADA systems to the cloud. The NCSC should show organizations all the opportunities and those challenges that may be raised when migrating such deployments into the cloud.

- January 2024: DMRC signed a teaming agreement for the commercialization of Super-SCADA with Bharat Electronics Limited at its headquarters in Delhi yesterday. The Super-SCADA project is an endeavor of the 'Make in India' campaign to offer superior service to commuters through integrated fault management.

SCADA Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Programmable Logic Controller (PLC), Remote Terminal Units (RTU), Human Machine Interface (HMI), Communication Systems, Others |

| Architectures Covered | Hardware, Software, Services |

| End Users Covered | Oil and Gas, Power, Water and Wastewater, Manufacturing, Chemicals and Petrochemicals, Pharmaceutical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | ABB Ltd., Emerson Electric Co., Rockwell Automation, Inc., Schneider Electric SE, Siemens AG, Alstom, General Electric Co., Honeywell International, Inc., Omron Corporation, Yokogawa Electric Corporation, Iconics Inc., Elynx Technologies, LLC, Enbase LLC, Globalogix, Inductive Automation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the SCADA market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global SCADA market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the SCADA industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

SCADA, or Supervisory Control and Data Acquisition, is an industrial process monitoring and control system that collects real-time data from sensors and devices to help operators manage processes from remote locations, automate tasks, and ensure system efficiency, safety, and reliability in manufacturing, energy, and utility industries.

The global SCADA market was valued at USD 22.8 Billion in 2025.

IMARC estimates the global SCADA market to exhibit a CAGR of 3.88% during 2026-2034.

Some of the factors driving the market is the advent of Industry 4.0 and the Internet of Things, setting of rigid regulatory requirements upon industries, and the growing need to remotely monitor and manage devices.

In 2025, programmable logic controller represented the largest segment by component as they perform tasks in real time and to direct processes in a real sense.

Services leads the market by architecture as they provide specialized consultancy to help businesses choose the right SCADA solution for their specific needs.

Oil and gas are the leading segment for end users as they cover numerous and spread-out facilities ranging from drilling sites, refineries, and pipelines to distribution networks.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global SCADA market include ABB Ltd., Emerson Electric Co., Rockwell Automation, Inc., Schneider Electric SE, Siemens AG, Alstom, General Electric Co., Honeywell International, Inc., Omron Corporation, Yokogawa Electric Corporation, Iconics Inc., Elynx Technologies, LLC, Enbase LLC, Globalogix, Inductive Automation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)