Saw Blades Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Saw Blades Market Size and Share:

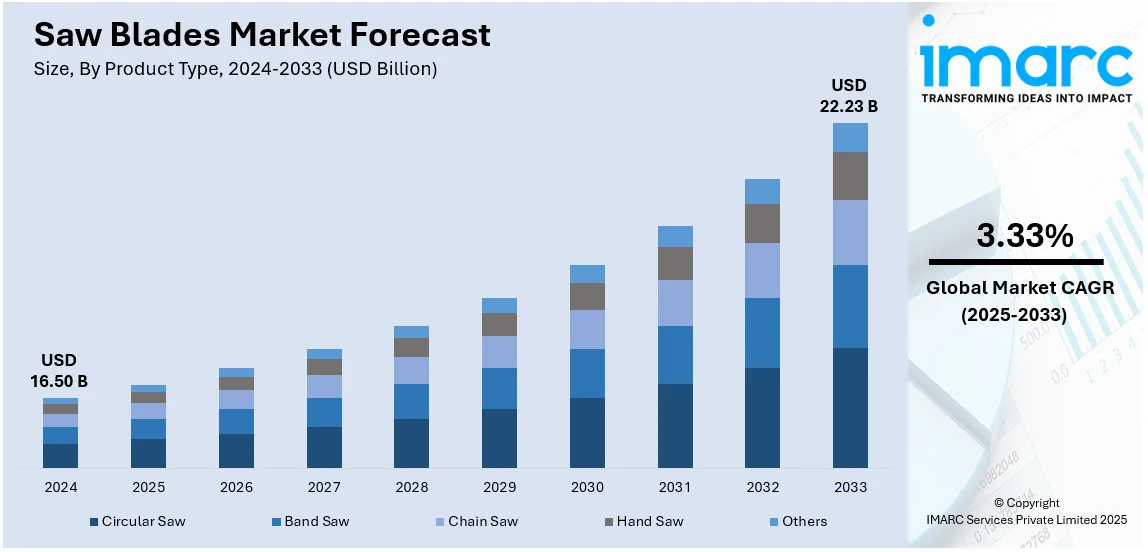

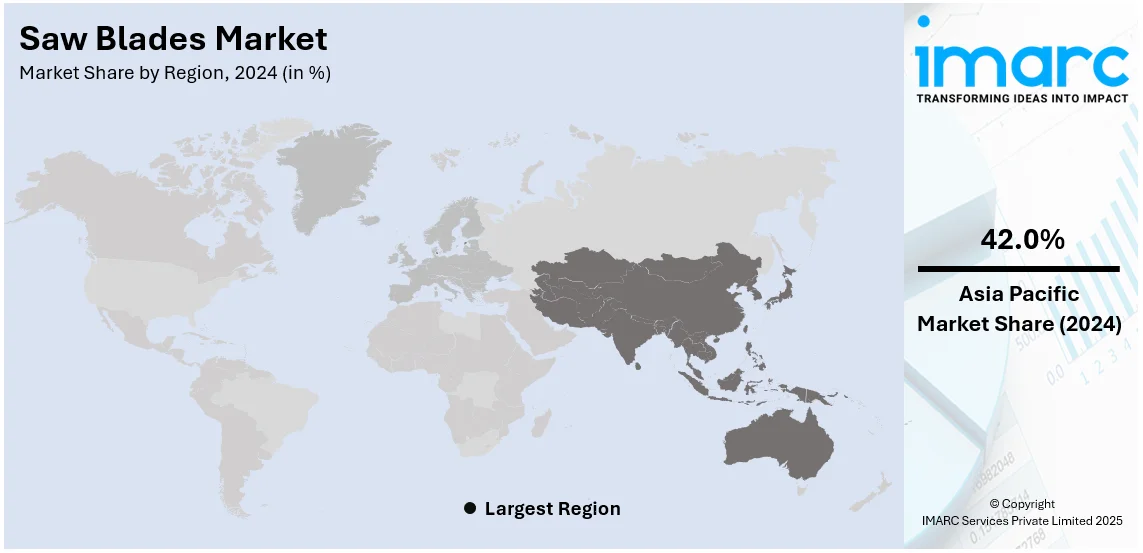

The global saw blades market size was valued at USD 16.50 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 22.23 Billion by 2033, exhibiting a CAGR of 3.33% during 2025-2033. Asia Pacific currently dominates the market holding a significant market share of over 42.0% in 2024. The growing construction and infrastructure development, increasing automation in woodworking and furniture making, and rising advancements in material technology to develop advanced composite materials that exhibit superior strength and heat tolerance are some of the major factors propelling the saw blades market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.50 Billion |

| Market Forecast in 2033 | USD 22.23 Billion |

| Market Growth Rate (2025-2033) | 3.33% |

The saw blades market outlook is influenced by the increasing need in industries including construction, manufacturing, woodworking, and metalworking. With expanding industries worldwide, the demand for effective and high-performance cutting equipment rises. Improvement in blade technology, including materials like carbide, diamond, and high-speed steel, has greatly improved precision, strength, and speed, fueling usage. Also, the increasing use of automation in manufacturing and construction industries spurs demand for high-quality, specialized saw blades that provide consistent and accurate outcomes in high-volume production settings. The move toward precision and tailored cutting solutions in automotive and aerospace industries also stimulates the market. Also, as sustainability gains prominence, environmentally friendly manufacturing processes and longer-lasting, energy-efficient saw blades are picking up momentum. Growing building and infrastructure construction globally further add to the growth of the market, making saw blades a necessary equipment in residential and industrial use.

The United States stands out as a key market disruptor, driven by its advanced manufacturing capabilities and technological innovations. As a leader in industrial and construction sectors, the US has a high demand for efficient, durable, and specialized saw blades. Key manufacturers in the country are continuously investing in research and development to produce high-performance blades with cutting-edge materials like carbide, diamond, and high-speed steel, which improve cutting precision and lifespan. The rise of automation and Industry 4.0 technologies further contributes to the demand for advanced saw blades designed for automated systems, improving production efficiency. Additionally, the US market emphasizes the development of custom-made blades for specific industries, including woodworking, metalworking, and automotive. Sustainability efforts are also influencing the market, with companies increasingly focusing on eco-friendly manufacturing processes and energy-efficient products. These factors position the US as a driving force and disruptor in shaping the future of the saw blades market globally.

Saw Blades Market Trends:

Growing construction and infrastructure development

The growing construction and infrastructure development are currently exerting a profoundly positive influence on the expansion of the saw blades market. The U.S. Census Bureau reports that construction spending in December 2024 was projected at a seasonally adjusted annual rate of USD 2,192.2 Billion, 0.5% higher than the revised November level of USD 2,180.3 Billion, further reflecting the industry's momentum. Besides this, as construction projects continue to increase, there is a rising demand for various types of saw blades. These blades are instrumental in cutting and shaping materials, such as metal, wood, and concrete, which are fundamental components in construction and infrastructure development. Additionally, manufacturers within the saw blades market are experiencing a sustained uptick in orders and production. Furthermore, the ongoing construction boom necessitates a diverse range of cutting tools and equipment, thereby fostering innovation within the saw blade industry. Manufacturers are increasingly investing in research operations to enhance the quality, durability, and efficiency of their products. This continuous improvement in saw blade technology ensures that construction professionals have access to cutting tools that are not only tailored to their specific needs but also capable of meeting the rigorous saw blades demand for modern construction and infrastructure projects.

Rising advancements in material technology

At present, the rising advancements in material technology are propelling the demand for saw blades. The U.S. Bureau of Labor Statistics estimates that employment of materials engineers will rise 5% from 2022 to 2032, a growth that indicates increasing demand for material innovation across industries. Besides this, there is an increase in the development of advanced composite materials that exhibit superior strength, wear resistance, and heat tolerance properties. These materials are being integrated into the production of saw blades, leading to increased cutting efficiency and longevity. Furthermore, ongoing research and development (R&D) efforts in the field of material science are continuously introducing new alloy compositions and surface coatings specifically tailored to address the diverse needs of various cutting applications. The present focus on optimizing the microstructure and hardness of saw blade materials is contributing to enhanced precision, reduced wear and tear, and extended service life.

Increasing automation in woodworking and furniture manufacturing

Presently, the increasing automation in woodworking and furniture manufacturing is bolstering the growth of the saw blades market. The wood products and furniture manufacturing sectors are two large parts of the Canadian economy, respectively earning revenues of USD 37.6 Billion and USD 12.6 Billion each year, according to the Business Development Bank of Canada. Besides this, the implementation of advanced automation technologies in woodworking and furniture manufacturing facilities is leading to a substantial enhancement in production efficiency. Machines equipped with state-of-the-art saw blades can operate continuously, with minimal downtime, thereby increasing overall output and reducing production costs. This continual optimization is contributing to the sustained expansion of the saw blade market. Furthermore, the adoption of automation is leading to higher precision and consistency in woodworking and furniture production processes. Automated systems, when paired with high-quality saw blades, can achieve intricate cuts and designs with unparalleled accuracy. This precision is essential in meeting the increasingly demanding quality standards of the market and fulfilling customized requirements from discerning consumers.

Saw Blades Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global saw blades market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and application.

Analysis by Product Type:

- Circular Saw

- Band Saw

- Chain Saw

- Hand Saw

- Others

Circular saw stands as the largest component with a market share of 26.2% in 2024. Circular saws can create a variety of cuts, including straight cuts, bevel cuts, and even plunge cuts, making them suitable for a wide range of tasks. They are efficient at cutting through materials quickly and cleanly, reducing the effort and time required for many projects. They are compact and portable, allowing users to easily move them to different job sites or around your workshop. They can also provide precise and accurate cuts, essential for many woodworking and construction tasks. They are relatively easy to operate, and with proper safety precautions, beginners can quickly learn how to use them effectively. Circular saws can be adjusted to make bevel cuts, which is useful for creating angled edges or joints in woodworking.

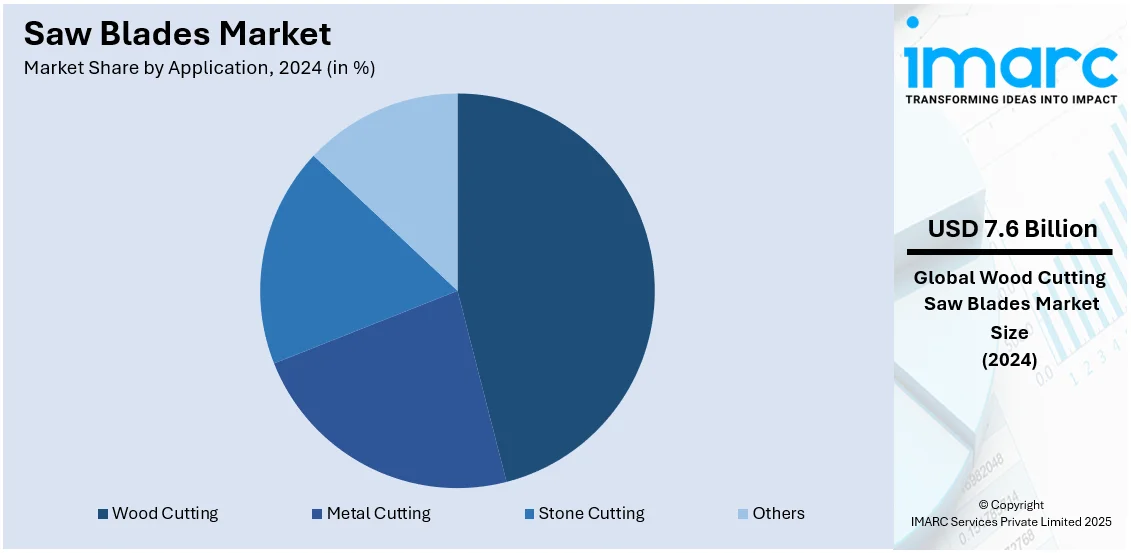

Analysis by Application:

- Wood Cutting

- Metal Cutting

- Stone Cutting

- Others

Wood cutting holds a market share of 45.8%. Saw blades for wood cutting are equipped with sharp teeth that have a specific geometry optimized for cutting through wood fibers. The teeth are usually designed to have a positive hook angle, which helps them engage with the wood and pull the blade into the material, making cutting easier. Saw blades are used in crosscutting, ripping, and notching or making small, precise cuts in wood.

Saw blades designed for metal cutting are used in portable circular saws and can be used to cut through various metal materials, including steel, aluminum, and copper. They are suitable for making straight cuts, and they come in different tooth configurations and materials to match the type of metal being cut.

Saw blades created for stone cutting are embedded with industrial-grade diamond particles that are extremely hard and can withstand the hardness of stone. They are designed to cut through granite, a hard and dense natural stone commonly used in countertops, monuments, and building materials.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 42.0%. Asia Pacific represents the largest geographical segment of the saw blades market, fueled by high industrialization, urbanization, and strong manufacturing industries in nations like China, India, Japan, and South Korea. The region has emerged as an international manufacturing base, playing an important role in the demand for quality saw blades in numerous sectors like construction, automotive, woodwork, and metalwork. With extensive infrastructure development, more construction activities, and a thriving automobile industry, the demand for effective and long-lasting saw blades has skyrocketed.

China, being the world's biggest manufacturing hub, is instrumental in this market, both producing and consuming saw blades. The increasing infrastructure developments and widening manufacturing base of India also add to the dominance of the region. Demand in the region is also being driven by growth in sophisticated technology uses in precision cutting and automation, with markets calling for blades with improved performance, durability, and affordability. Further, the increased use of saw blades across regional industries such as metalworking and woodworking continues to drive the growth of the market. The convergence of a growing industrial base, technological innovation, and rising demand for high-performance tools guarantees that Asia Pacific will remain at the forefront of the global saw blades market in the next few years.

Key Regional Takeaways:

United States Saw Blades Market Analysis

In 2024, the United States accounted for over 91.30% of the saw blades market in North America. The US blades market is expected to register significant growth due to rising demand for sophisticated cutting tools in various industries like manufacturing, construction, and automotive. Advances in saw blade materials such as carbide and diamond are improving performance and durability, fulfilling the growing demand for precision cutting. Moreover, the use of automated systems and machinery is growing market opportunities. The continuous boom in U.S. manufacturing investments further supports this trend. As of February 2024, the United States Congress Joint Economic Committee reported that almost USD 223 Billion was spent each year on inflation-adjusted U.S. manufacturing construction. This huge investment reflects the industrialization of the country, which has a direct impact on the demand for quality saw blades. With a competitive market fueled by incumbent manufacturers, the market keeps developing with advances in sustainability and efficiency. The demand for better product quality, combined with rising industrial activity, puts the saw blades market on track for continued growth in the next few years.

Europe Saw Blades Market Analysis

The European saw blade market is growing steadily, fueled by advances in blade materials and the growing need for high precision cutting tools. Major sectors like manufacturing, automotive, and construction are major drivers of market growth, with precision manufacturing and automation also driving demand for high-end saw blades. For instance, it is reported that a 4.1% increase in apparent steel consumption in the EU to 133 Million Tons in 2025 is expected according to industry reports. Furthermore, the market is influenced by an increasing emphasis on sustainable practices and the adoption of eco-friendly products. With leading manufacturers investing heavily in R&D, the European saw blades market is expected to see continued innovation and growth in the coming years.

Asia Pacific Saw Blades Market Analysis

The Asia Pacific saw blades market is poised for strong growth, fueled by increasing demand for cutting tools in the growing construction and manufacturing industries. China, Japan, India, South Korea, Australia, and Indonesia are key drivers of this growth, backed by industrialization, infrastructure development, and technological progress. The growing usage of automation on production lines and precision cutting processes further fuels the demand for robust and efficient saw blades. India is a major market player in this regard. The India Brand Equity Foundation (IBEF) states that India's manufacturing sector is likely to grow to USD 1 Trillion by 2025-26, which highlights the growing dependence on cutting-edge solutions. The cost-effectiveness of saw blades over conventional cutting techniques also promotes their market penetration, especially with small and medium-sized enterprises (SMEs). With increased demand for high-performance tools persisting, Asia Pacific is set to experience ongoing innovation and investment in the saw blades industry, promoting long-term market growth.

Latin America Saw Blades Market Analysis

The Latin American market for saw blades is expanding due to rising demand from the construction and automotive industries. Brazil and Mexico drive this growth largely, owing to their growing bases of industry and enhancing infrastructure projects. Urbanization gains and the growth in demand for cutting tools like saw blades are driven by big developments like that of the approval by the World Bank of a USD 150 Million project enhancing road infrastructure across Bahia in Brazil, which will help 2.35 Million inhabitants. This project is part of a broader USD 1.66 Billion program for enhancing infrastructure nationwide. There is a slow transition toward more sustainable and energy-efficient cutting technologies in the region. This trend is stimulating innovation within the saw blades market, with manufacturers looking to address the increasing demand for environmentally friendly solutions without sacrificing high performance for construction and automotive uses.

Middle East and Africa Saw Blades Market Analysis

The Middle East and Africa saw blades market is seeing growth, specifically driven by increased demand from the construction sector. The fast-paced growth of infrastructure projects in the region has generated a demand for effective cutting tools. The Saudi Arabian construction industry, for instance, has become a pioneer in the Middle East and North Africa, with an estimated size of USD 70.33 Billion in 2024 growing to USD 91.36 Billion by 2029, according to the International Trade Administration (ITA). This speedy growth also increases the demand for saw blades. The growth in industrialization and the use of state-of-the-art machinery throughout the country are also helping drive the demand for effective cutting solutions. The growing construction industry and modernization initiatives are fueling innovation and development in the saw blades industry.

Competitive Landscape:

Major players in the saw blades industry are pursuing several strategies to promote growth and innovation. One of the major initiatives is investing in research and development (R&D) to improve blade materials and coatings, enhance cutting efficiency, durability, and accuracy. Developments in materials like carbide, diamond, and high-speed steel play a vital role in addressing the increasing demand for high-performance saw blades. Manufacturers are also concentrating on the design of specialized blades for particular industries, including woodworking, metalworking, and construction, to meet specific cutting needs. Another great initiative lies in integrating newer technologies such as laser cutting and coating processes, which extend the life of the blades and lower maintenance expenses. To meet growing demand for automation, market leaders are launching automated cutting systems and blades to guarantee repeatable, high-quality outcomes. Strategic collaborations and partnerships are also being established with industries to provide tailored solutions and enhance supply chain efficiency. Sustainability is also emerging as a priority, with companies creating environmentally friendly, energy-efficient products to address increasing environmental issues. In addition, businesses are diversifying their product lines by acquiring businesses and focusing on emerging markets, specifically in Asia-Pacific, where industrialization is fueling the demand for cutting tools, thereby guaranteeing long-term market leadership. All these activities cumulatively determine the growth pattern of the saw blades market.

The report provides a comprehensive analysis of the competitive landscape in the saw blades market with detailed profiles of all major companies, including:

- AKE Knebel GmbH & Co. KG

- DoAll Company

- Freud America Inc.

- Kinkelder B.V.

- Ledermann GmbH & Co. KG

- Leuco Tool Corporation

- The M K Morse Company

- Pilana Knives A.S.

- Simonds International L.L.C. (BGR Saws Inc.)

- Stanley Black & Decker Inc.

Latest News and Developments:

- May 2024: M.K. Morse redesigned its recast saw blade product family, transitioning from name to application-based product families. The new nomenclature, rolled out on June 1, 2024, condensed the selection into four product families: Heavy Duty (HD), Professional (PRO), Professional Carbide (PRO-CT), and Specialty (SP). The transition improved inventory simplicity without sacrificing cutting performance in categories of materials.

- February 2025: DoAll launched the S-153 micro-benchtop saw, targeted at small workshops and on-the-go applications. At IMTS 2024, it boasted a compact, carry-anywhere form factor, up-to-60° miter capabilities, and adjustable band speeds. DoAll highlighted its accuracy and flexibility, aimed at contractors, machine shops, fabricators, and hobbyists.

- May 2024: LEUCO China inaugurated its new headquarters in Taicang, a milestone after 25 years of development. The new facility combines precision tool manufacturing, sharpening services, and administrative operations. With twice the production area, cutting-edge technology, and service centers across the country, LEUCO will improve efficiency and serve China's woodworking industry more effectively.

- October 2024: M.K. Morse introduced a spring-loaded Pin Drive Hole Saw Arbor, improving drilling efficiency with rapid blade change and a snug fit. Designed to last, it reduces wobble and makes installation easy. Research & Design Engineer Mike Lambert pointed out its better design, which makes it simpler for professionals. Morse keeps innovating cutting-edge solutions.

- May 2023: The M K Morse Company has introduced a new website that offers enhanced technical and product details for distributors and customers, assisting buyers in locating cutting solutions for various materials by searching through product categories, markets, or application types.

Saw Blades Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Circular Saw, Band Saw, Chain Saw, Hand Saw, Others |

| Applications Covered | Wood Cutting, Metal cutting, Stone Cutting, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AKE Knebel GmbH & Co. KG, DoAll Company, Freud America Inc., Kinkelder B.V., Ledermann GmbH & Co. KG, Leuco Tool Corporation, The M K Morse Company, Pilana Knives A.S., Simonds International L.L.C. (BGR Saws Inc.), Stanley Black & Decker Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the saw blades market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global saw blades market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the saw blades industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The saw blades market was valued at USD 16.50 Billion in 2024.

The saw blades market is projected to exhibit a CAGR of 3.33% during 2025-2033, reaching a value of USD 22.23 Billion by 2033.

The saw blades market is driven by increased demand across industries like construction, woodworking, and metalworking. Technological advancements in blade materials and coatings enhance performance, while rising construction and manufacturing activities globally boost the need for efficient cutting tools. Additionally, the trend toward automation and precision cutting fuels market growth.

Asia Pacific currently dominates the saw blades market share. The Asia Pacific saw blades market is driven by rapid industrialization, increased construction and infrastructure development, and growing demand from automotive, woodworking, and metalworking industries. Technological advancements, including precision cutting and automation, along with rising manufacturing activities in countries like China and India, further fuel the market's growth.

Some of the major players in the saw blades market include AKE Knebel GmbH & Co. KG, DoAll Company, Freud America Inc., Kinkelder B.V., Ledermann GmbH & Co. KG, Leuco Tool Corporation, The M K Morse Company, Pilana Knives A.S., Simonds International L.L.C. (BGR Saws Inc.), Stanley Black & Decker Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)